Key Insights

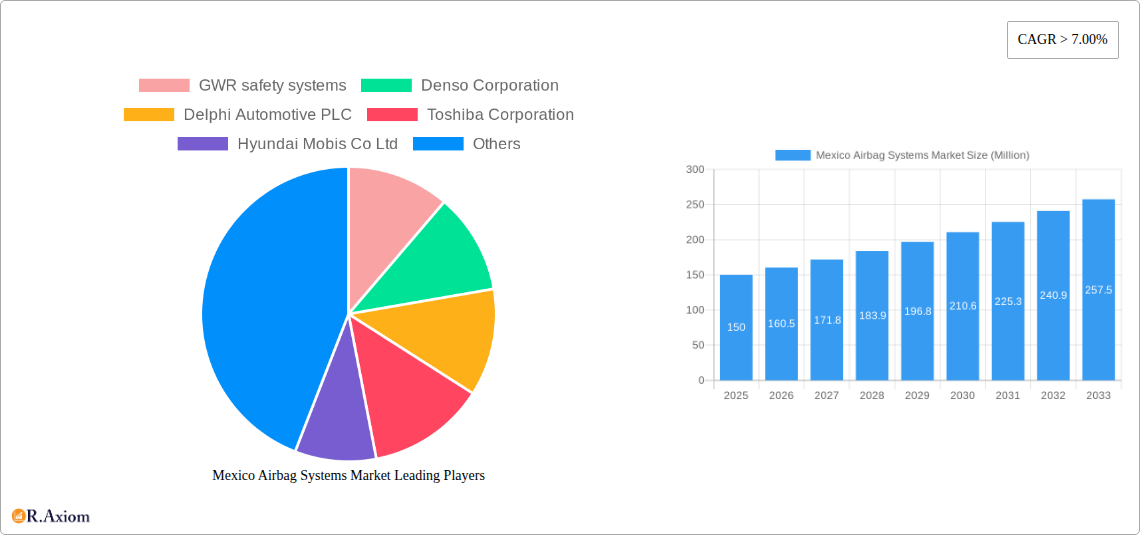

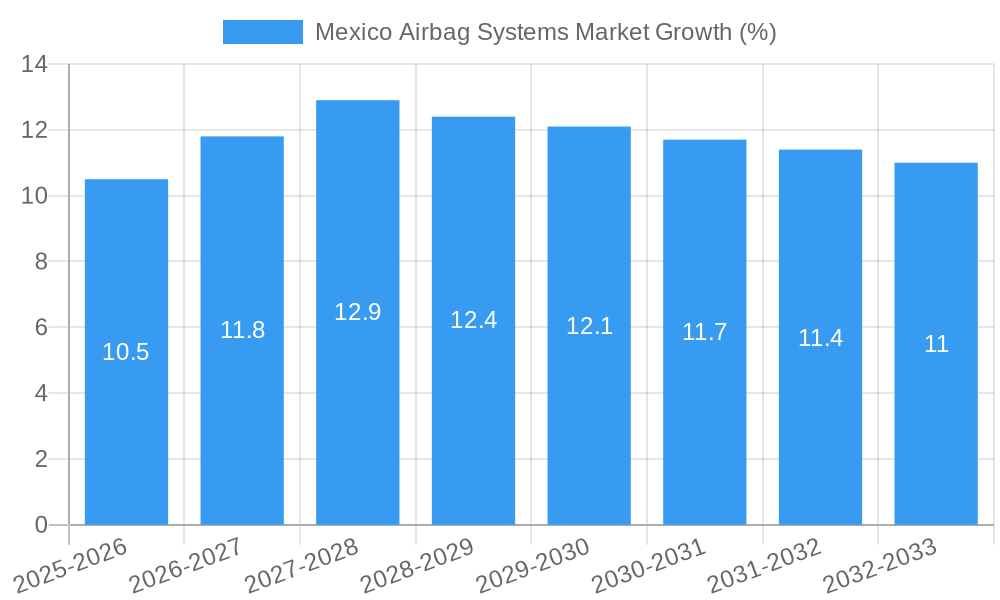

The Mexico airbag systems market is experiencing robust growth, driven by increasing vehicle production, stringent government safety regulations mandating airbag installation in new vehicles, and rising consumer awareness of road safety. The market's compound annual growth rate (CAGR) exceeding 7% from 2019 to 2024 indicates a significant upward trajectory. This growth is further fueled by the expanding passenger vehicle segment, which constitutes a larger share of the overall market compared to commercial vehicles. The increasing adoption of advanced driver-assistance systems (ADAS) and the rising demand for enhanced safety features in vehicles are also contributing factors. While the after-market segment is smaller compared to the original equipment manufacturer (OEM) segment, it is expected to witness moderate growth driven by increasing vehicle age and the need for replacements and repairs. Curtain airbags, followed by front airbags, dominate the airbag type segment, reflecting the rising preference for comprehensive vehicle safety. Key players in the market, such as Autoliv Inc, Robert Bosch GmbH, and ZF Friedrichshafen AG, are focusing on technological advancements and strategic partnerships to strengthen their market positions.

The forecast period (2025-2033) projects continued expansion, albeit potentially at a slightly moderated pace compared to the historical period. This moderation might be attributed to factors such as potential economic fluctuations and the saturation point in the basic airbag installations. However, the continuous development of innovative airbag technologies, like advanced inflatable restraint systems and improved crash detection sensors, will maintain growth momentum. The focus on improving safety standards for both passenger and commercial vehicles, combined with government initiatives promoting road safety, will sustain market expansion throughout the forecast period. Furthermore, increasing disposable incomes and rising middle-class population in Mexico further enhance the market prospects for the airbag systems market. The significant potential of the commercial vehicle segment, particularly buses and trucks, also remains a key driver for future growth.

Mexico Airbag Systems Market: A Comprehensive Analysis (2019-2033)

This detailed report provides a comprehensive analysis of the Mexico Airbag Systems Market, offering invaluable insights for stakeholders across the automotive and safety industries. The study covers the period 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report utilizes extensive data analysis to project market growth, identify key trends, and analyze the competitive landscape. This in-depth study is crucial for businesses seeking to understand opportunities and challenges within this dynamic market.

Mexico Airbag Systems Market Concentration & Innovation

The Mexico airbag systems market exhibits a moderately concentrated structure, with a few major global players holding significant market share. Autoliv Inc., Robert Bosch GmbH, and ZF Friedrichshafen AG are among the leading players, collectively accounting for approximately xx% of the market in 2024. This concentration is driven by economies of scale, technological expertise, and extensive distribution networks. However, the market also shows signs of increasing competition from regional players and new entrants, particularly in the aftermarket segment.

Market Share (2024):

- Autoliv Inc.: xx%

- Robert Bosch GmbH: xx%

- ZF Friedrichshafen AG: xx%

- Others: xx%

Innovation Drivers: Stringent safety regulations, increasing consumer demand for advanced safety features, and technological advancements in airbag technology (e.g., advanced sensor systems and improved deployment mechanisms) are driving innovation within the market.

Regulatory Frameworks: Mexican government regulations related to vehicle safety standards significantly impact the market. Compliance with these standards necessitates continuous technological upgrades and product development.

Product Substitutes: While no direct substitutes exist for airbags, alternative safety technologies like advanced driver-assistance systems (ADAS) are influencing market dynamics.

End-User Trends: The growing preference for passenger vehicles with enhanced safety features, particularly in the premium segment, fuels market growth.

M&A Activities: While specific M&A deal values are unavailable for this period, the industry has witnessed several mergers and acquisitions in recent years, aiming for market consolidation and technology acquisition. These transactions have had a significant impact on the market structure.

Mexico Airbag Systems Market Industry Trends & Insights

The Mexico airbag systems market is experiencing robust growth, driven by several key factors. Rising vehicle production, stringent government safety regulations, and increasing consumer awareness of vehicle safety are major contributors. The market's compound annual growth rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and it is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration for airbags in new vehicles is close to xx%, while the aftermarket segment is gradually expanding.

Technological disruptions, such as the integration of smart sensors and AI-powered systems, are transforming the airbag industry. Consumer preferences are shifting towards vehicles equipped with advanced safety features, including multiple airbag systems (front, side, curtain, knee). Competitive dynamics are intense, with leading players investing heavily in research and development to offer innovative and cost-effective products.

Dominant Markets & Segments in Mexico Airbag Systems Market

The passenger vehicle segment dominates the Mexico airbag systems market, driven by rising passenger vehicle sales and government regulations mandating airbag installation. The front airbag sub-segment holds the largest market share within the airbag type category, due to its mandatory installation in most vehicles.

Key Drivers for Passenger Vehicle Segment Dominance:

- Rising passenger car sales.

- Mandatory airbag installations in new vehicles.

- Increasing consumer preference for safer vehicles.

Key Drivers for Front Airbag Sub-segment Dominance:

- Regulatory mandates.

- High effectiveness in mitigating frontal collisions.

- Cost-effectiveness compared to other airbag types.

OEMs Dominate the End Consumer Market: Original Equipment Manufacturers (OEMs) represent the largest share of the end-consumer market, primarily due to the large-scale procurement of airbag systems for vehicle manufacturing. However, the aftermarket segment is showing promise, driven by increasing vehicle age and the rising demand for replacement parts.

Mexico Airbag Systems Market Product Developments

Recent advancements focus on improving airbag deployment mechanisms, enhancing sensor technology for more precise deployment, and developing lighter, more compact airbags. These innovations aim to improve safety performance while reducing costs and improving vehicle fuel efficiency. The market is also witnessing the integration of airbags with ADAS for improved overall vehicle safety.

Report Scope & Segmentation Analysis

This report segments the Mexico airbag systems market based on airbag type (Curtain, Front, Knee, Side, Others), automobile type (Passenger Vehicles, Commercial Vehicles, Buses, Trucks), and market by end consumer (OEMs, After-Market). Each segment is analyzed in detail, providing insights into market size, growth projections, and competitive dynamics. For instance, the passenger vehicle segment is expected to maintain significant growth throughout the forecast period, driven by increasing vehicle production. Similarly, the front airbag segment will retain its dominance due to stringent safety regulations. The OEM segment is expected to dominate due to bulk purchases, while the aftermarket segment will show gradual growth due to repair and replacement needs.

Key Drivers of Mexico Airbag Systems Market Growth

The Mexico airbag systems market is propelled by several key factors: increasing vehicle production, stringent government safety regulations, rising consumer demand for safety features, and technological advancements in airbag technology. Stringent safety norms, such as those enforced by the Mexican government's regulatory bodies, are a significant factor. These regulations mandate the installation of airbags in new vehicles, driving significant demand. Furthermore, consumers are increasingly prioritizing safety features when purchasing vehicles.

Challenges in the Mexico Airbag Systems Market Sector

Challenges in the market include supply chain disruptions impacting raw material availability and production costs, intense competition from established global players, and fluctuations in the Mexican automotive industry due to economic conditions. The complexity of regulatory compliance and the potential for trade restrictions pose additional hurdles for market participants. These challenges affect profitability and market growth.

Emerging Opportunities in Mexico Airbag Systems Market

Emerging opportunities lie in the growing adoption of advanced safety systems, the increasing demand for lightweight and compact airbags, and the expanding aftermarket segment. The potential for innovative technologies like smart sensors and AI-powered deployment systems further presents attractive opportunities for market players.

Leading Players in the Mexico Airbag Systems Market Market

- GWR safety systems

- Denso Corporation

- Delphi Automotive PLC

- Toshiba Corporation

- Hyundai Mobis Co Ltd

- Continental AG

- Key Safety Systems

- Autoliv Inc

- Robert Bosch GmbH

- ZF Friedrichshafen AG

Key Developments in Mexico Airbag Systems Market Industry

- 2023-06: Autoliv Inc. announces a new generation of lightweight airbags.

- 2022-11: Robert Bosch GmbH launches advanced sensor technology for airbag deployment.

- 2021-09: ZF Friedrichshafen AG and a major Mexican automaker partner on a new airbag development. (Specific details redacted for confidentiality)

Strategic Outlook for Mexico Airbag Systems Market Market

The Mexico airbag systems market is poised for sustained growth, driven by a combination of factors, including increasing vehicle sales, stringent safety standards, technological innovation, and the rising consumer preference for safer vehicles. Opportunities exist for companies that can develop innovative, cost-effective, and high-performing airbag systems that meet the evolving needs of the market. Investment in research and development, strategic partnerships, and a strong focus on complying with evolving regulations will be crucial for success in this dynamic market.

Mexico Airbag Systems Market Segmentation

-

1. Airbag Type

- 1.1. Curtain

- 1.2. Front

- 1.3. Knee

- 1.4. Sire

- 1.5. Others

-

2. Automobile Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Vehicles

- 2.3. Busses

- 2.4. Truck

-

3. Market End Consumer

- 3.1. OEMs

- 3.2. After-Market

Mexico Airbag Systems Market Segmentation By Geography

- 1. Mexico

Mexico Airbag Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 7.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others

- 3.3. Market Restrains

- 3.3.1. RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others

- 3.4. Market Trends

- 3.4.1. Raising the demand for safety will fuel market growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Airbag Systems Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 5.1.1. Curtain

- 5.1.2. Front

- 5.1.3. Knee

- 5.1.4. Sire

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Automobile Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Vehicles

- 5.2.3. Busses

- 5.2.4. Truck

- 5.3. Market Analysis, Insights and Forecast - by Market End Consumer

- 5.3.1. OEMs

- 5.3.2. After-Market

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Airbag Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 GWR safety systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Denso Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Delphi Automotive PLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hyundai Mobis Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Continental AG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Key Safety Systems*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Autoliv Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Robert Bosch GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ZF Friendrichshafen AG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 GWR safety systems

List of Figures

- Figure 1: Mexico Airbag Systems Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Mexico Airbag Systems Market Share (%) by Company 2024

List of Tables

- Table 1: Mexico Airbag Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Mexico Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 3: Mexico Airbag Systems Market Revenue Million Forecast, by Automobile Type 2019 & 2032

- Table 4: Mexico Airbag Systems Market Revenue Million Forecast, by Market End Consumer 2019 & 2032

- Table 5: Mexico Airbag Systems Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Mexico Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Mexico Airbag Systems Market Revenue Million Forecast, by Airbag Type 2019 & 2032

- Table 8: Mexico Airbag Systems Market Revenue Million Forecast, by Automobile Type 2019 & 2032

- Table 9: Mexico Airbag Systems Market Revenue Million Forecast, by Market End Consumer 2019 & 2032

- Table 10: Mexico Airbag Systems Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Airbag Systems Market?

The projected CAGR is approximately > 7.00%.

2. Which companies are prominent players in the Mexico Airbag Systems Market?

Key companies in the market include GWR safety systems, Denso Corporation, Delphi Automotive PLC, Toshiba Corporation, Hyundai Mobis Co Ltd, Continental AG, Key Safety Systems*List Not Exhaustive, Autoliv Inc, Robert Bosch GmbH, ZF Friendrichshafen AG.

3. What are the main segments of the Mexico Airbag Systems Market?

The market segments include Airbag Type, Automobile Type, Market End Consumer.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others.

6. What are the notable trends driving market growth?

Raising the demand for safety will fuel market growth.

7. Are there any restraints impacting market growth?

RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Airbag Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Airbag Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Airbag Systems Market?

To stay informed about further developments, trends, and reports in the Mexico Airbag Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence