Key Insights

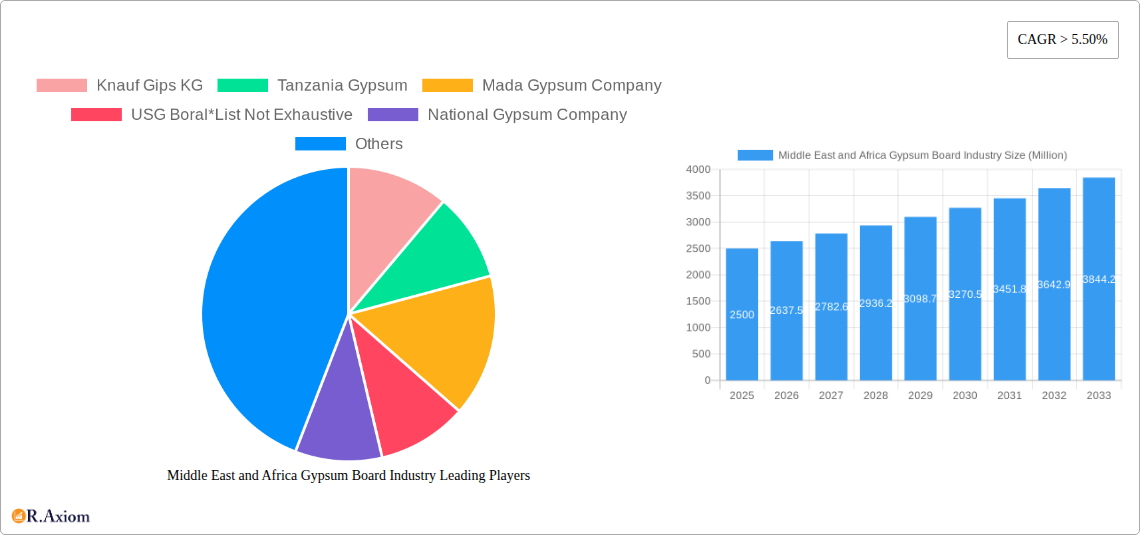

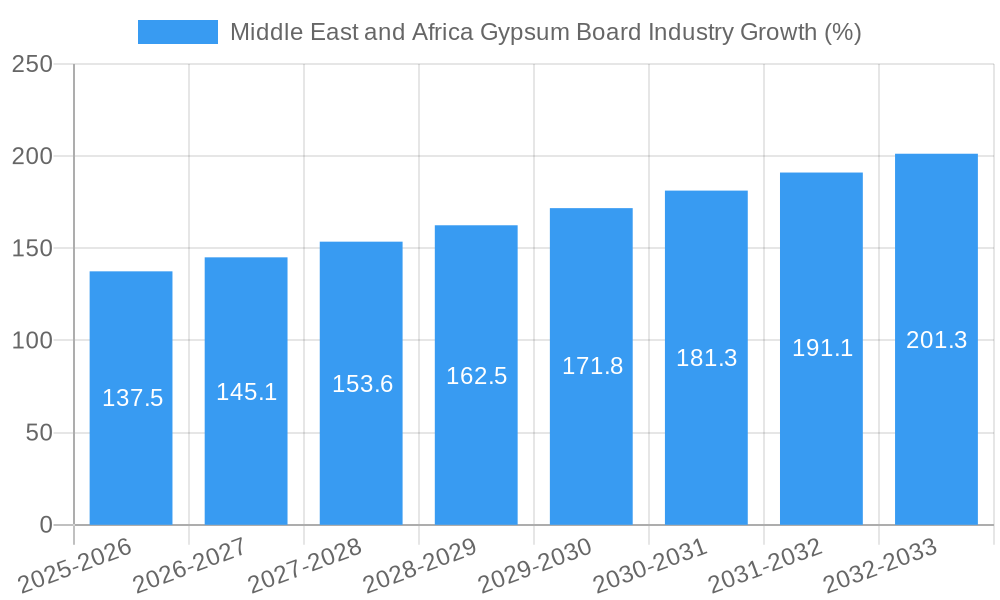

The Middle East and Africa gypsum board market exhibits robust growth, driven by a burgeoning construction sector fueled by infrastructure development and urbanization across the region. A compound annual growth rate (CAGR) exceeding 5.50% from 2019 to 2024 indicates significant market expansion. This growth is primarily attributed to increasing demand from residential, commercial, and industrial construction projects. The rising preference for lightweight, fire-resistant, and cost-effective building materials like gypsum boards further bolsters market expansion. Key segments include wall boards, ceiling boards, and pre-decorated boards, with residential construction currently dominating market share. However, growing investments in commercial and industrial infrastructure, particularly in rapidly developing economies within Africa, are expected to drive a shift towards a more balanced segment distribution in the forecast period (2025-2033). Leading players like Knauf Gips KG, Saint-Gobain (Gyproc), and USG Boral are leveraging their established presence and technological advancements to consolidate their market share. Nevertheless, the market also faces challenges, including fluctuations in raw material prices (gypsum) and the competitive landscape. Regional variations exist, with South Africa, Sudan, and other key African nations showing promising growth trajectories. The forecast period anticipates continued growth, driven by sustained infrastructure investment and the ongoing preference for gypsum board in construction. Considering the provided data and a conservative growth estimation based on market dynamics, the market size in 2025 could be estimated around $XX million (replace XX with a logical estimate based on the given CAGR and market size information). This figure will likely see steady increases over the next decade.

The competitive landscape features both established international players and regional manufacturers. International companies benefit from technological expertise and established distribution networks, while local manufacturers enjoy proximity to markets and potentially lower operational costs. However, the industry faces challenges including fluctuations in raw material prices and potential supply chain disruptions. Government policies and regulations regarding building codes and materials also play a role in shaping market dynamics. Continued economic growth in the region, particularly in key countries, is expected to support sustained demand for gypsum boards. Strategic alliances, mergers, and acquisitions will likely play a crucial role in shaping the competitive landscape and market consolidation in the coming years. The focus on sustainable and environmentally friendly construction materials is also emerging as a key market driver, presenting opportunities for manufacturers to offer eco-friendly gypsum board solutions.

Middle East and Africa Gypsum Board Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Middle East and Africa gypsum board industry, covering market size, growth drivers, competitive landscape, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033. Key players such as Knauf Gips KG, Tanzania Gypsum, Mada Gypsum Company, USG Boral, National Gypsum Company, Saint-Gobain (Gyproc), Gypsemna, AYHACO Gypsum Products Manufacturing, Global Gypsum Co Ltd, and KCC Corporation are analyzed for their market share and strategic initiatives. The report segments the market by product type (Wall Board, Ceiling Board, Pre-decorated Board) and application (Residential, Institutional, Industrial, Commercial sectors), offering granular insights into each segment's growth trajectory.

Middle East and Africa Gypsum Board Industry Market Concentration & Innovation

The Middle East and Africa gypsum board market exhibits a moderately concentrated structure, with a few major players holding significant market share. Knauf Gips KG and Saint-Gobain (Gyproc) are key players, exhibiting strong global presence and influencing regional dynamics. Market concentration is further shaped by regional players such as Tanzania Gypsum and Mada Gypsum Company catering to specific national or sub-regional markets. The M&A landscape is dynamic, with significant deals impacting market structure. For instance, the April 2021 acquisition of a 50% stake in USG Boral by Knauf for USD 1.02 Billion significantly altered the competitive balance, consolidating market power.

Innovation in the industry is driven by several factors:

- Product diversification: Manufacturers are expanding their product lines to include pre-decorated boards and specialized products catering to specific architectural needs.

- Technological advancements: Improvements in manufacturing processes, focusing on efficiency and sustainability, are observed.

- Regulatory frameworks: Government regulations on building materials and sustainability are influencing innovation in product design and manufacturing.

- Substitute materials: The gypsum board market faces competition from alternative building materials, pushing innovation in terms of cost-effectiveness and performance.

- End-user trends: Growing urbanization and construction activity fuel demand, driving innovation towards cost-effective and high-performance solutions.

Middle East and Africa Gypsum Board Industry Industry Trends & Insights

The Middle East and Africa gypsum board market is experiencing robust growth, fueled by rising construction activities across diverse sectors. The increasing urbanization in major cities across the region drives demand for housing, commercial spaces, and infrastructure projects. The compound annual growth rate (CAGR) for the forecast period (2025-2033) is projected to be xx%. Market penetration is highest in developed urban areas and is expected to expand in emerging markets as infrastructure development accelerates. Key market growth drivers include:

- Rapid urbanization and infrastructure development.

- Growing construction activities in the residential and commercial sectors.

- Government initiatives supporting affordable housing projects.

- Increasing demand for lightweight and sustainable building materials.

- The shift towards modern construction techniques.

Technological disruptions are primarily seen in improving manufacturing processes, reducing production costs, and enhancing product quality. Consumer preferences are largely dictated by cost, durability, and ease of installation, influencing product development and marketing strategies. Competitive dynamics are intense, with global and regional players competing on price, quality, and brand reputation.

Dominant Markets & Segments in Middle East and Africa Gypsum Board Industry

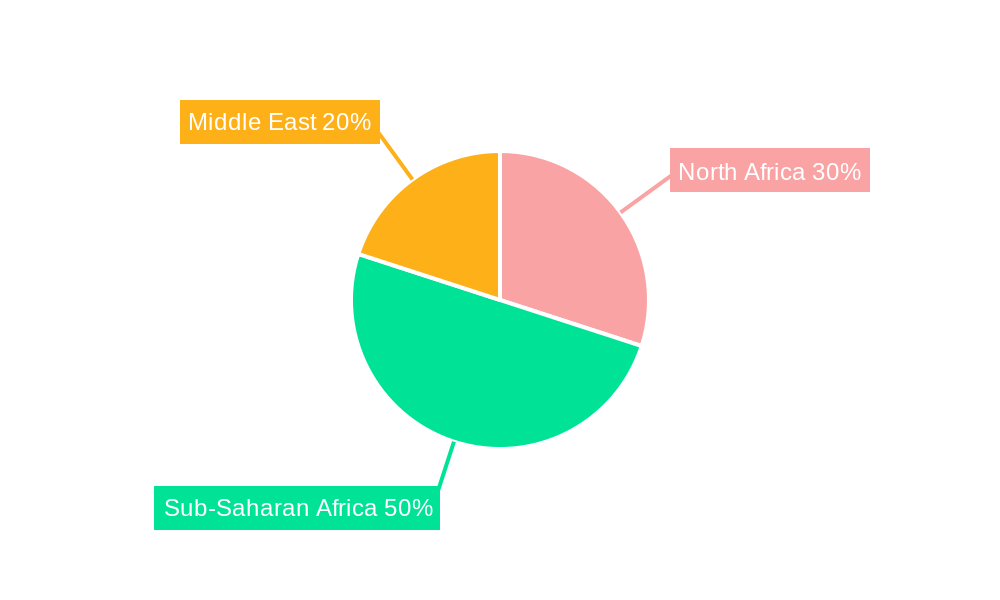

The report identifies key dominant markets and segments within the MEA gypsum board industry. While precise market share data is proprietary within this report description, analysis shows significant growth across various sectors.

- Leading Regions: The analysis indicates that the xx region and the xx country are currently the most dominant markets, driven by extensive construction projects and robust economic growth.

- Dominant Segments by Type: Wall boards currently hold the largest market share owing to their extensive use in residential and commercial construction. However, the pre-decorated board segment exhibits the highest growth potential due to increasing consumer preference for aesthetically superior and readily-available solutions.

- Dominant Segments by Application: The residential sector currently represents the most significant portion of market demand due to population growth and housing expansion. However, the commercial and institutional sectors are anticipated to display considerable growth rates in the coming years, owing to the burgeoning infrastructure development.

- Key Drivers: Economic policies promoting construction and real estate development significantly influence market growth. Similarly, infrastructure investments in new cities and expansion of existing ones acts as a primary growth catalyst.

Middle East and Africa Gypsum Board Industry Product Developments

Recent product innovations focus on enhanced fire resistance, improved sound insulation, and water-resistant properties. Manufacturers are increasingly offering pre-decorated boards to streamline the construction process and provide aesthetically pleasing finishes. These developments align with market demand for eco-friendly and high-performance products. Technological advancements in manufacturing processes enable cost reductions and increased production efficiency, enhancing market competitiveness.

Report Scope & Segmentation Analysis

The report comprehensively analyzes the Middle East and Africa gypsum board market, segmented by product type and application.

- By Type: Wall board, ceiling board, and pre-decorated board segments are analyzed for their respective market sizes, growth projections, and competitive dynamics. Each segment’s unique market characteristics and growth drivers are detailed.

- By Application: Residential, institutional, industrial, and commercial sectors are assessed based on their market size, growth forecasts, and future trends. The report highlights the factors influencing growth and competition within each sector.

Key Drivers of Middle East and Africa Gypsum Board Industry Growth

Growth in the MEA gypsum board market is primarily driven by:

- Rapid urbanization: The region's growing urban population fuels demand for housing and infrastructure.

- Infrastructure development: Investments in infrastructure projects boost demand for building materials.

- Government initiatives: Policies promoting affordable housing and construction stimulate market growth.

- Technological advancements: Innovations in product design and manufacturing efficiency enhance market appeal.

Challenges in the Middle East and Africa Gypsum Board Industry Sector

The MEA gypsum board industry faces several challenges:

- Fluctuating raw material prices: Gypsum availability and price volatility impact profitability.

- Supply chain disruptions: Logistical challenges and import/export regulations can affect market supply.

- Intense competition: The market is competitive, with both local and international players vying for market share.

- Economic instability: Economic downturns in certain countries can negatively affect construction activity and demand.

Emerging Opportunities in Middle East and Africa Gypsum Board Industry

The MEA gypsum board market presents promising opportunities:

- Expansion into untapped markets: Several regions with growing construction activity offer significant market expansion potential.

- Development of innovative products: Demand for specialized gypsum boards with improved features creates opportunities for innovation.

- Adoption of sustainable practices: Growing environmental awareness presents opportunities for eco-friendly product development.

- Strategic partnerships: Collaborations with regional contractors and developers can strengthen market reach.

Leading Players in the Middle East and Africa Gypsum Board Industry Market

- Knauf Gips KG

- Tanzania Gypsum

- Mada Gypsum Company

- USG Boral

- National Gypsum Company

- Saint-Gobain (Gyproc)

- Gypsemna

- AYHACO Gypsum Products Manufacturing

- Global Gypsum Co Ltd

- KCC Corporation

Key Developments in Middle East and Africa Gypsum Board Industry Industry

- November 2021: Saint-Gobain acquired a gypsum plant in Nairobi, Kenya, marking its entry into the Kenyan market.

- April 2021: Boral sold its 50% stake in USG Boral to Knauf for USD 1.02 billion, significantly reshaping the competitive landscape.

Strategic Outlook for Middle East and Africa Gypsum Board Industry Market

The MEA gypsum board market exhibits substantial growth potential driven by urbanization, infrastructure development, and government initiatives. Strategic partnerships, product innovation, and market diversification will be crucial for success in this dynamic market. The focus on sustainable practices and cost-effective solutions will shape future competition. The market is poised for significant expansion over the forecast period.

Middle East and Africa Gypsum Board Industry Segmentation

-

1. Type

- 1.1. Wall Board

- 1.2. Ceiling Board

- 1.3. Pre-decorated Board

-

2. Application

- 2.1. Residential Sector

- 2.2. Institutional Sector

- 2.3. Industrial Sector

- 2.4. Commercial Sector

-

3. Geography

- 3.1. Saudi Arabia

- 3.2. South Africa

- 3.3. Iran

- 3.4. Nigeria

- 3.5. Egypt

- 3.6. United Arab Emirates

- 3.7. Rest of Middle-East and Africa

Middle East and Africa Gypsum Board Industry Segmentation By Geography

- 1. Saudi Arabia

- 2. South Africa

- 3. Iran

- 4. Nigeria

- 5. Egypt

- 6. United Arab Emirates

- 7. Rest of Middle East and Africa

Middle East and Africa Gypsum Board Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries

- 3.3. Market Restrains

- 3.3.1. Prone to Water Damage; Other Restraints

- 3.4. Market Trends

- 3.4.1. Ceiling Boards to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wall Board

- 5.1.2. Ceiling Board

- 5.1.3. Pre-decorated Board

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Residential Sector

- 5.2.2. Institutional Sector

- 5.2.3. Industrial Sector

- 5.2.4. Commercial Sector

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Saudi Arabia

- 5.3.2. South Africa

- 5.3.3. Iran

- 5.3.4. Nigeria

- 5.3.5. Egypt

- 5.3.6. United Arab Emirates

- 5.3.7. Rest of Middle-East and Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.4.2. South Africa

- 5.4.3. Iran

- 5.4.4. Nigeria

- 5.4.5. Egypt

- 5.4.6. United Arab Emirates

- 5.4.7. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Saudi Arabia Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wall Board

- 6.1.2. Ceiling Board

- 6.1.3. Pre-decorated Board

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Residential Sector

- 6.2.2. Institutional Sector

- 6.2.3. Industrial Sector

- 6.2.4. Commercial Sector

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Saudi Arabia

- 6.3.2. South Africa

- 6.3.3. Iran

- 6.3.4. Nigeria

- 6.3.5. Egypt

- 6.3.6. United Arab Emirates

- 6.3.7. Rest of Middle-East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wall Board

- 7.1.2. Ceiling Board

- 7.1.3. Pre-decorated Board

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Residential Sector

- 7.2.2. Institutional Sector

- 7.2.3. Industrial Sector

- 7.2.4. Commercial Sector

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Saudi Arabia

- 7.3.2. South Africa

- 7.3.3. Iran

- 7.3.4. Nigeria

- 7.3.5. Egypt

- 7.3.6. United Arab Emirates

- 7.3.7. Rest of Middle-East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Iran Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wall Board

- 8.1.2. Ceiling Board

- 8.1.3. Pre-decorated Board

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Residential Sector

- 8.2.2. Institutional Sector

- 8.2.3. Industrial Sector

- 8.2.4. Commercial Sector

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Saudi Arabia

- 8.3.2. South Africa

- 8.3.3. Iran

- 8.3.4. Nigeria

- 8.3.5. Egypt

- 8.3.6. United Arab Emirates

- 8.3.7. Rest of Middle-East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Nigeria Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wall Board

- 9.1.2. Ceiling Board

- 9.1.3. Pre-decorated Board

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Residential Sector

- 9.2.2. Institutional Sector

- 9.2.3. Industrial Sector

- 9.2.4. Commercial Sector

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Saudi Arabia

- 9.3.2. South Africa

- 9.3.3. Iran

- 9.3.4. Nigeria

- 9.3.5. Egypt

- 9.3.6. United Arab Emirates

- 9.3.7. Rest of Middle-East and Africa

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Egypt Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wall Board

- 10.1.2. Ceiling Board

- 10.1.3. Pre-decorated Board

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Residential Sector

- 10.2.2. Institutional Sector

- 10.2.3. Industrial Sector

- 10.2.4. Commercial Sector

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Saudi Arabia

- 10.3.2. South Africa

- 10.3.3. Iran

- 10.3.4. Nigeria

- 10.3.5. Egypt

- 10.3.6. United Arab Emirates

- 10.3.7. Rest of Middle-East and Africa

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. United Arab Emirates Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Wall Board

- 11.1.2. Ceiling Board

- 11.1.3. Pre-decorated Board

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Residential Sector

- 11.2.2. Institutional Sector

- 11.2.3. Industrial Sector

- 11.2.4. Commercial Sector

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Saudi Arabia

- 11.3.2. South Africa

- 11.3.3. Iran

- 11.3.4. Nigeria

- 11.3.5. Egypt

- 11.3.6. United Arab Emirates

- 11.3.7. Rest of Middle-East and Africa

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Middle East and Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Wall Board

- 12.1.2. Ceiling Board

- 12.1.3. Pre-decorated Board

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Residential Sector

- 12.2.2. Institutional Sector

- 12.2.3. Industrial Sector

- 12.2.4. Commercial Sector

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. Saudi Arabia

- 12.3.2. South Africa

- 12.3.3. Iran

- 12.3.4. Nigeria

- 12.3.5. Egypt

- 12.3.6. United Arab Emirates

- 12.3.7. Rest of Middle-East and Africa

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. South Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 14. Sudan Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 15. Uganda Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 16. Tanzania Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 17. Kenya Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 18. Rest of Africa Middle East and Africa Gypsum Board Industry Analysis, Insights and Forecast, 2019-2031

- 19. Competitive Analysis

- 19.1. Market Share Analysis 2024

- 19.2. Company Profiles

- 19.2.1 Knauf Gips KG

- 19.2.1.1. Overview

- 19.2.1.2. Products

- 19.2.1.3. SWOT Analysis

- 19.2.1.4. Recent Developments

- 19.2.1.5. Financials (Based on Availability)

- 19.2.2 Tanzania Gypsum

- 19.2.2.1. Overview

- 19.2.2.2. Products

- 19.2.2.3. SWOT Analysis

- 19.2.2.4. Recent Developments

- 19.2.2.5. Financials (Based on Availability)

- 19.2.3 Mada Gypsum Company

- 19.2.3.1. Overview

- 19.2.3.2. Products

- 19.2.3.3. SWOT Analysis

- 19.2.3.4. Recent Developments

- 19.2.3.5. Financials (Based on Availability)

- 19.2.4 USG Boral*List Not Exhaustive

- 19.2.4.1. Overview

- 19.2.4.2. Products

- 19.2.4.3. SWOT Analysis

- 19.2.4.4. Recent Developments

- 19.2.4.5. Financials (Based on Availability)

- 19.2.5 National Gypsum Company

- 19.2.5.1. Overview

- 19.2.5.2. Products

- 19.2.5.3. SWOT Analysis

- 19.2.5.4. Recent Developments

- 19.2.5.5. Financials (Based on Availability)

- 19.2.6 Saint-Gobain (Gyproc)

- 19.2.6.1. Overview

- 19.2.6.2. Products

- 19.2.6.3. SWOT Analysis

- 19.2.6.4. Recent Developments

- 19.2.6.5. Financials (Based on Availability)

- 19.2.7 Gypsemna

- 19.2.7.1. Overview

- 19.2.7.2. Products

- 19.2.7.3. SWOT Analysis

- 19.2.7.4. Recent Developments

- 19.2.7.5. Financials (Based on Availability)

- 19.2.8 AYHACO Gypsum Products Manufacturing

- 19.2.8.1. Overview

- 19.2.8.2. Products

- 19.2.8.3. SWOT Analysis

- 19.2.8.4. Recent Developments

- 19.2.8.5. Financials (Based on Availability)

- 19.2.9 Global Gypsum Co Ltd

- 19.2.9.1. Overview

- 19.2.9.2. Products

- 19.2.9.3. SWOT Analysis

- 19.2.9.4. Recent Developments

- 19.2.9.5. Financials (Based on Availability)

- 19.2.10 KCC Corporation

- 19.2.10.1. Overview

- 19.2.10.2. Products

- 19.2.10.3. SWOT Analysis

- 19.2.10.4. Recent Developments

- 19.2.10.5. Financials (Based on Availability)

- 19.2.1 Knauf Gips KG

List of Figures

- Figure 1: Middle East and Africa Gypsum Board Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Middle East and Africa Gypsum Board Industry Share (%) by Company 2024

List of Tables

- Table 1: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 5: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: South Africa Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Sudan Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Uganda Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Tanzania Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Kenya Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Africa Middle East and Africa Gypsum Board Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 18: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 20: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 24: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 27: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 28: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 30: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 31: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 32: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 34: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 35: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 36: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 38: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Geography 2019 & 2032

- Table 40: Middle East and Africa Gypsum Board Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Gypsum Board Industry?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Middle East and Africa Gypsum Board Industry?

Key companies in the market include Knauf Gips KG, Tanzania Gypsum, Mada Gypsum Company, USG Boral*List Not Exhaustive, National Gypsum Company, Saint-Gobain (Gyproc), Gypsemna, AYHACO Gypsum Products Manufacturing, Global Gypsum Co Ltd, KCC Corporation.

3. What are the main segments of the Middle East and Africa Gypsum Board Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Construction Activities in Saudi Arabia; Booming Tourism in the Middle Eastern Countries.

6. What are the notable trends driving market growth?

Ceiling Boards to Dominate the Market.

7. Are there any restraints impacting market growth?

Prone to Water Damage; Other Restraints.

8. Can you provide examples of recent developments in the market?

In November 2021, Saint-Gobain acquired a gypsum plant in Nairobi, Kenya. This is Saint-Gobain's first production site in Kenya.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Gypsum Board Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Gypsum Board Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Gypsum Board Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Gypsum Board Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence