Key Insights

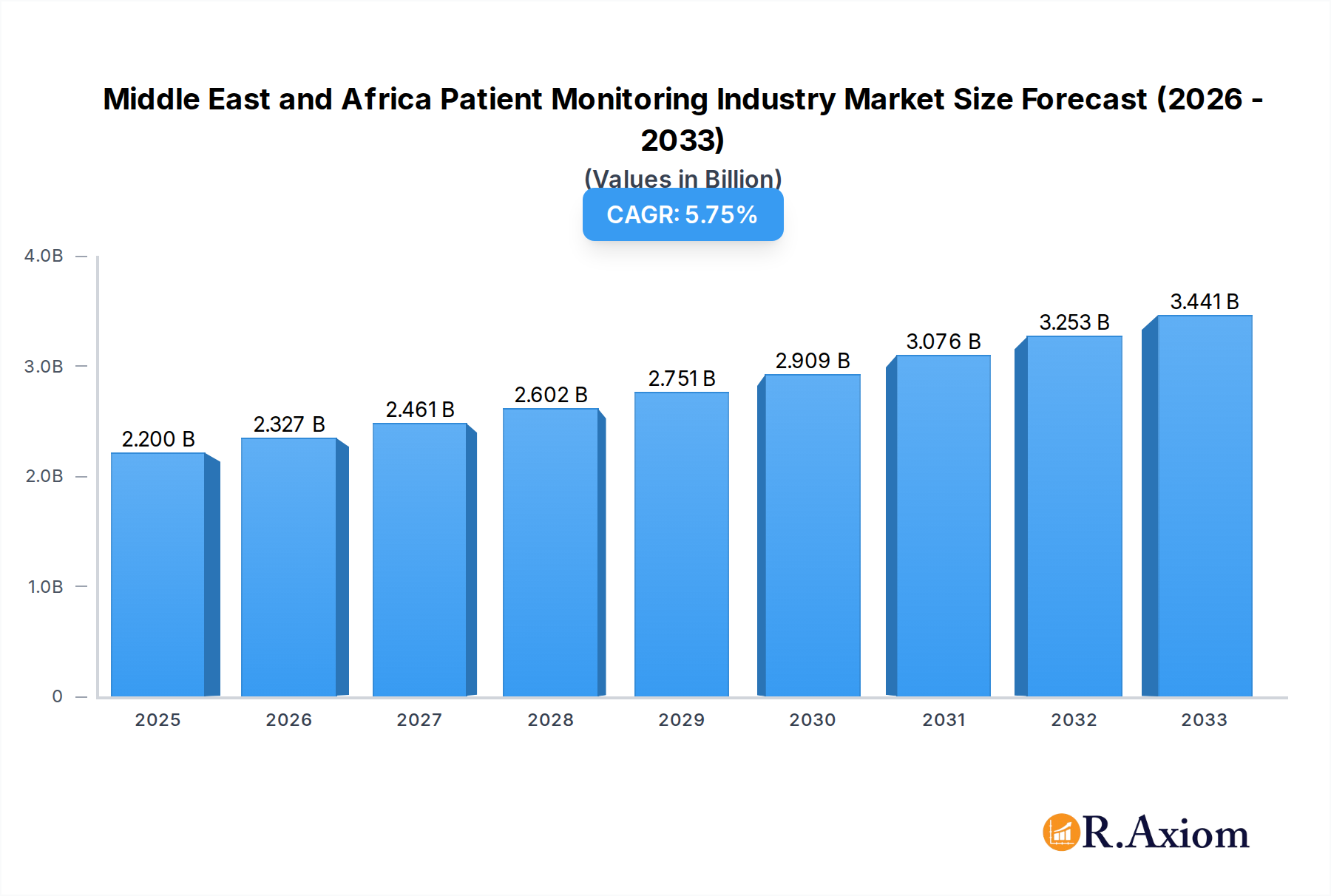

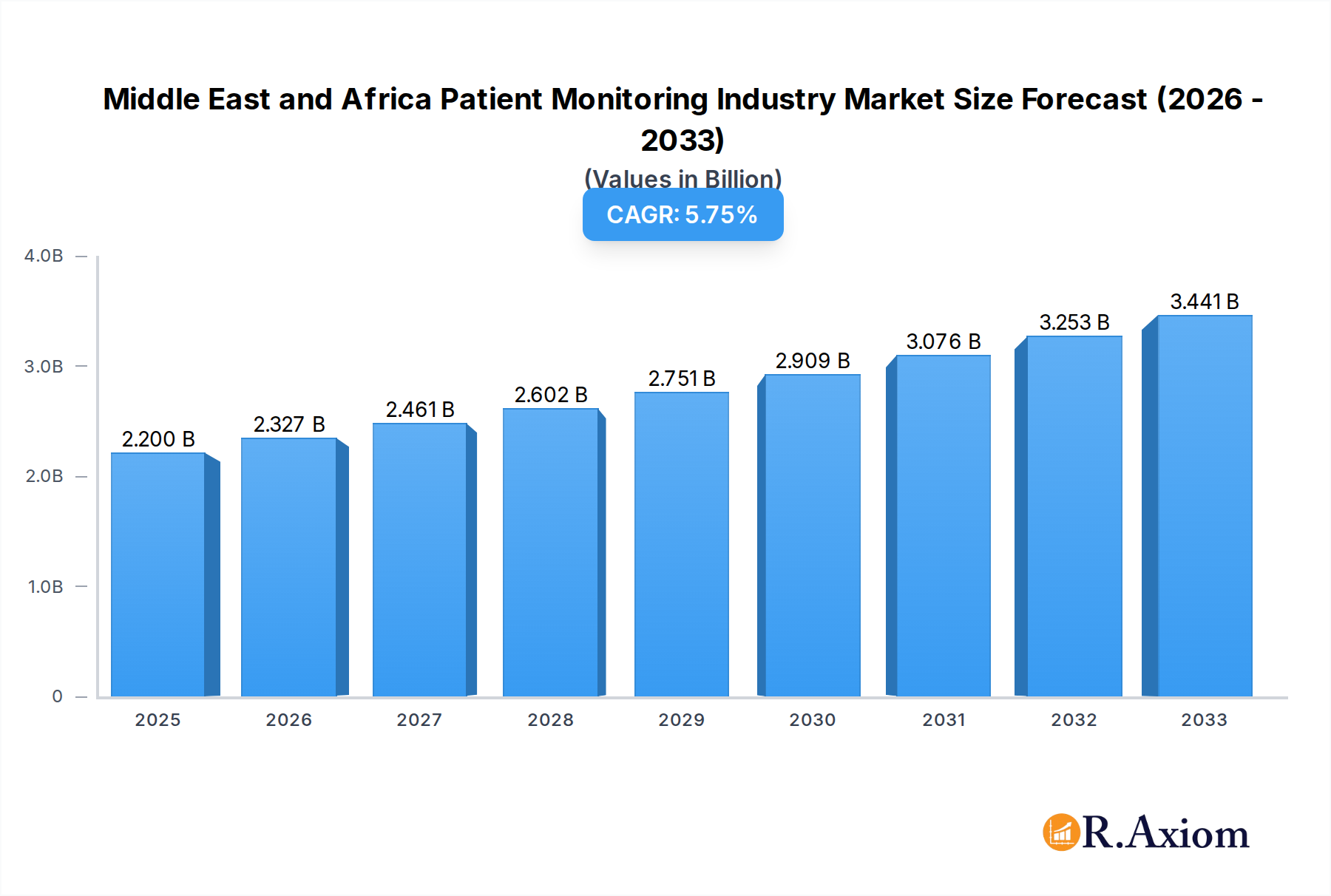

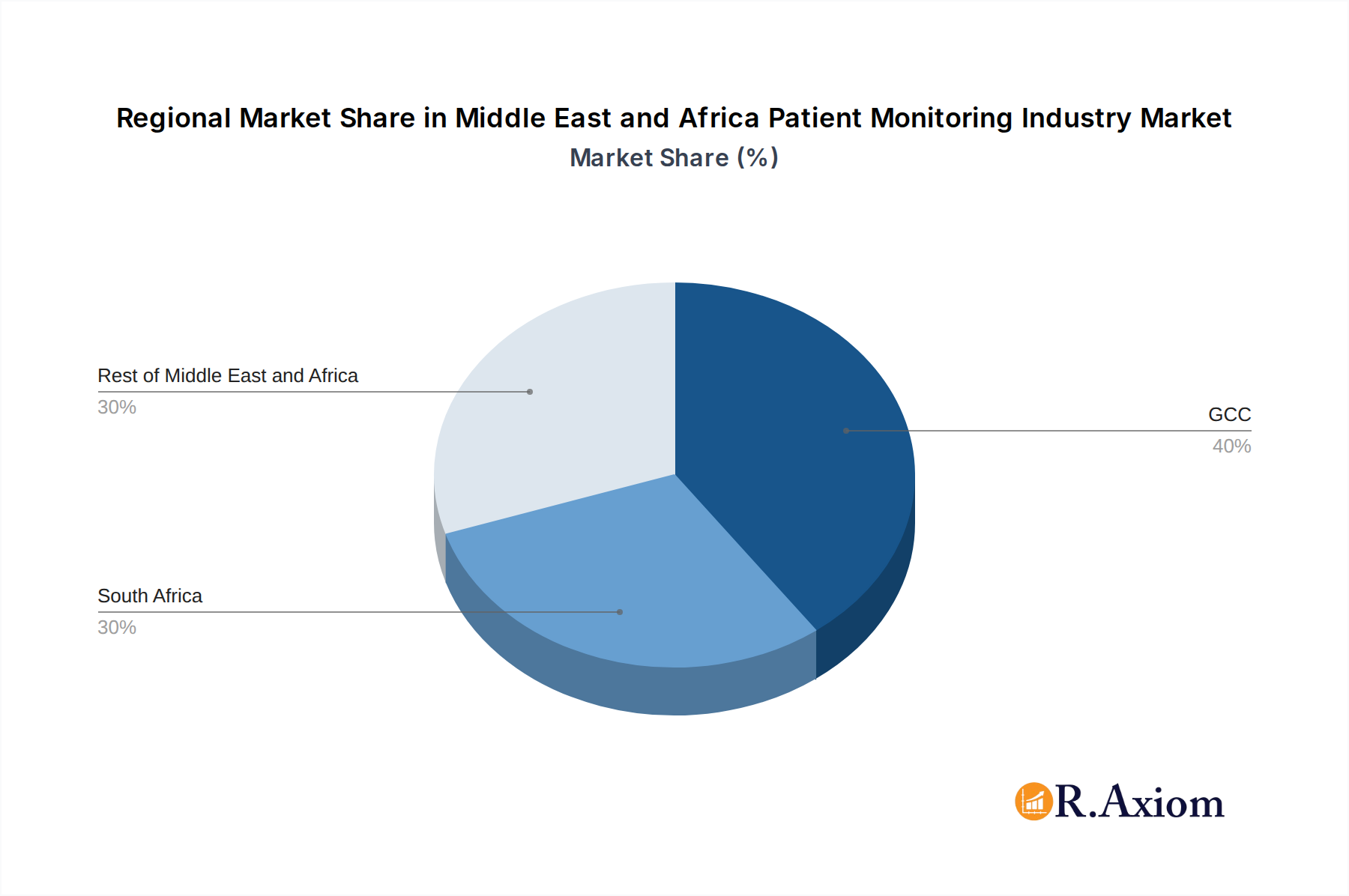

The Middle East and Africa (MEA) Patient Monitoring Industry is poised for significant expansion, driven by increasing healthcare infrastructure development, a rising prevalence of chronic diseases, and a growing demand for advanced medical technologies. The market is valued at $2.20 billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of 5.80% through 2033. Key drivers for this growth include the expanding reach of home healthcare solutions, the integration of sophisticated neuromonitoring and cardiac monitoring devices, and the increasing adoption of multi-parameter monitors in both hospital and clinic settings. The surge in respiratory illnesses and the critical need for effective fetal and neonatal monitoring also contribute to market dynamism. Geographically, the GCC region is expected to lead due to substantial investments in healthcare, followed by South Africa and the rest of the MEA, where a gradual but steady adoption of modern patient monitoring systems is anticipated.

Middle East and Africa Patient Monitoring Industry Market Size (In Billion)

The competitive landscape features established global players such as Becton Dickinson and Company, Abbott Laboratories, Siemens Healthcare GmbH, General Electric Company (GE Healthcare), Koninklijke Philips NV, Medtronic Plc, Johnson & Johnson, and Boston Scientific Corporation, who are instrumental in introducing innovative solutions and expanding market reach. Restraints, such as the high cost of advanced devices and varying levels of healthcare affordability across the region, are being addressed through strategic pricing, increasing government initiatives for healthcare access, and the growing preference for integrated and cost-effective patient monitoring solutions. The industry is witnessing a trend towards remote patient monitoring, wearable devices, and AI-powered analytics, which will further fuel market penetration and improve patient outcomes across diverse applications like cardiology, neurology, and general patient care.

Middle East and Africa Patient Monitoring Industry Company Market Share

This in-depth report provides a thorough examination of the Middle East and Africa (MEA) Patient Monitoring Industry, a rapidly evolving sector poised for significant expansion. Spanning from 2019 to 2033, with a base year of 2025, this study leverages historical data (2019-2024) and forecasts future trends (2025-2033) to offer unparalleled strategic insights. We delve into market dynamics, technological advancements, competitive landscapes, and emerging opportunities, equipping industry stakeholders with the knowledge to navigate and capitalize on this lucrative market. High-traffic keywords such as "MEA patient monitoring market," "remote patient monitoring Africa," "cardiac monitoring solutions Middle East," and "neuromonitoring devices GCC" are integrated to maximize search visibility.

Middle East and Africa Patient Monitoring Industry Market Concentration & Innovation

The MEA patient monitoring industry exhibits a moderate level of market concentration, with a few key global players like Becton Dickinson and Company, Abbott Laboratories, Siemens Healthcare GmbH, General Electric Company (GE Healthcare), Koninklijke Philips NV, Medtronic Plc, Johnson & Johnson, and Boston Scientific Corporation holding substantial market share. Innovation in this region is primarily driven by the increasing adoption of advanced technologies such as AI-powered diagnostics, IoT-enabled devices, and wearable sensors. The growing demand for remote patient monitoring solutions, fueled by rising chronic disease prevalence and the need for accessible healthcare in underserved areas, is a significant innovation catalyst. Regulatory frameworks across MEA are progressively aligning with global standards, encouraging the development and deployment of sophisticated patient monitoring systems. However, challenges remain in harmonizing regulations across different countries. Product substitutes, such as traditional diagnostic methods, are gradually being phased out by more efficient and data-driven monitoring solutions. End-user trends are shifting towards a greater preference for home-based care and telehealth services, pushing innovation towards user-friendly and portable devices. Merger and acquisition (M&A) activities, though not extensively documented with precise deal values in every instance, are anticipated to increase as larger companies seek to expand their geographic reach and technological capabilities within the MEA region.

Middle East and Africa Patient Monitoring Industry Industry Trends & Insights

The MEA patient monitoring industry is experiencing robust growth, projected to achieve a compound annual growth rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This expansion is underpinned by several critical trends. The escalating burden of chronic diseases, including cardiovascular conditions, respiratory ailments, and neurological disorders, is a primary growth driver, necessitating continuous and accurate patient monitoring. Technological disruptions, such as the integration of artificial intelligence (AI) for predictive analytics and the proliferation of the Internet of Things (IoT) in healthcare devices, are revolutionizing how patient data is collected, analyzed, and acted upon. The burgeoning adoption of remote patient monitoring (RPM) solutions is a significant trend, driven by the desire for improved patient outcomes, reduced healthcare costs, and enhanced convenience. Consumer preferences are increasingly leaning towards personalized and proactive healthcare, encouraging the development of user-friendly, wearable, and connected patient monitoring devices. The competitive dynamics within the MEA market are intensifying, with both established global players and emerging regional companies vying for market share. Market penetration of advanced patient monitoring technologies is steadily increasing, particularly in urban centers and more developed economies within the GCC. The development of robust telehealth infrastructure and government initiatives to promote digital health are further accelerating market penetration. The shift towards value-based healthcare models also favors the adoption of patient monitoring solutions that demonstrate improved patient outcomes and cost-effectiveness.

Dominant Markets & Segments in Middle East and Africa Patient Monitoring Industry

The GCC (Gulf Cooperation Council) region stands out as a dominant market within the MEA patient monitoring industry, driven by its robust economic growth, high disposable incomes, and significant investments in healthcare infrastructure. Countries like Saudi Arabia, the UAE, and Qatar are at the forefront of adopting advanced medical technologies.

Type of Device:

- Multi-parameter Monitors are currently the leading segment, essential for comprehensive patient assessment in critical care settings and general hospital wards. Their dominance is attributed to their versatility in tracking vital signs such as blood pressure, heart rate, SpO2, and temperature simultaneously.

- Cardiac Monitoring Devices are witnessing rapid growth due to the high prevalence of cardiovascular diseases across the MEA region. This includes ECG monitors, Holter monitors, and implantable cardiac monitoring devices.

- Hemodynamic Monitoring Devices are crucial in intensive care units for managing critically ill patients, and their adoption is increasing with the expansion of critical care facilities.

- Neuromonitoring Devices are gaining traction with the rising incidence of neurological disorders and advancements in neurosurgery.

- Other Types of Devices, including pulse oximeters and temperature monitors, also contribute significantly to the market.

Application:

- Cardiology is the largest application segment, directly correlating with the high burden of heart-related diseases. Advanced cardiac monitoring solutions are in high demand.

- Respiratory applications are also significant, driven by the increasing prevalence of chronic obstructive pulmonary disease (COPD) and asthma, necessitating devices like pulse oximeters and ventilators.

- Neurology is a growing segment, with a rising demand for neuromonitoring devices used in epilepsy, stroke, and sleep disorder management.

- Fetal and Neonatal monitoring remains a critical area, with continuous demand for devices ensuring the health of mothers and newborns.

- Others, encompassing critical care, general medicine, and post-operative recovery, contribute to the diverse application landscape.

End User:

- Hospitals and Clinics represent the largest end-user segment. These institutions are the primary purchasers of advanced patient monitoring equipment due to their need for comprehensive patient care and diagnostic capabilities. Government initiatives to upgrade public healthcare facilities and the growth of private healthcare providers are key drivers.

- Home Healthcare is an emerging and rapidly growing segment. The increasing preference for in-home care, driven by an aging population and the convenience of remote monitoring, is fueling demand for user-friendly and portable devices.

- Other End Users, including long-term care facilities and diagnostic centers, also contribute to market demand.

Middle East and Africa Patient Monitoring Industry Product Developments

Product developments in the MEA patient monitoring industry are characterized by a strong focus on miniaturization, connectivity, and AI-driven analytics. Innovations are geared towards enhancing remote patient monitoring capabilities, enabling continuous data collection, and providing clinicians with actionable insights. For instance, the development of non-invasive sensors, wearable devices with extended battery life, and secure cloud-based data platforms are key trends. Companies are also focusing on creating integrated systems that can seamlessly communicate with electronic health records (EHRs), improving workflow efficiency and reducing manual data entry errors. Competitive advantages are being gained through enhanced accuracy, ease of use, and the ability to detect subtle physiological changes that might otherwise go unnoticed.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Middle East and Africa Patient Monitoring Industry across several key segmentation axes.

Type of Device: The market is segmented into Hemodynamic Monitoring Devices, Neuromonitoring Devices, Cardiac Monitoring Devices, Multi-parameter Monitors, and Other Types of Devices. Each segment is analyzed for its market size, growth projections, and competitive dynamics, with multi-parameter and cardiac monitoring devices expected to lead in market value due to high prevalence of associated conditions and critical care needs.

Application: The segmentation includes Cardiology, Neurology, Respiratory, Fetal and Neonatal, and Others. Cardiology and Respiratory applications are projected to exhibit substantial growth, driven by chronic disease burdens. Neuromonitoring is a burgeoning area with significant future potential.

End User: This segmentation comprises Home Healthcare, Hospitals and Clinics, and Other End Users. Hospitals and Clinics currently dominate, but Home Healthcare is poised for significant expansion, reflecting a global trend in personalized and decentralized care.

Geography: The report categorizes the market into GCC, South Africa, and Rest of Middle East and Africa. The GCC region is anticipated to exhibit the highest market growth and adoption rates due to its economic strength and healthcare investments, followed by South Africa with its expanding healthcare infrastructure.

Key Drivers of Middle East and Africa Patient Monitoring Industry Growth

The growth of the MEA patient monitoring industry is propelled by a confluence of factors. The increasing prevalence of chronic diseases such as cardiovascular, respiratory, and neurological disorders is a primary driver, creating a sustained demand for continuous patient oversight. Technological advancements, including the proliferation of AI, IoT, and wearable devices, are enabling more sophisticated and accessible monitoring solutions. Government initiatives promoting digital health adoption and the expansion of healthcare infrastructure, particularly in the GCC, are creating a conducive environment for market growth. Furthermore, a growing patient awareness and preference for personalized, home-based care are augmenting the demand for remote patient monitoring (RPM) solutions.

Challenges in the Middle East and Africa Patient Monitoring Industry Sector

Despite its promising growth trajectory, the MEA patient monitoring industry faces several challenges. Inconsistent regulatory frameworks across different countries can hinder market entry and adoption of new technologies. The high cost of advanced patient monitoring devices can be a barrier, especially in less economically developed regions. Limited digital literacy and infrastructure in certain areas pose challenges for the widespread adoption of connected monitoring solutions. Moreover, cybersecurity concerns related to sensitive patient data collected through connected devices require robust solutions to ensure patient privacy and data integrity. The availability of skilled healthcare professionals to operate and interpret data from complex monitoring systems also presents a bottleneck in some markets.

Emerging Opportunities in Middle East and Africa Patient Monitoring Industry

Emerging opportunities within the MEA patient monitoring industry are abundant. The expansion of telehealth services and the growing demand for remote patient monitoring (RPM) present a significant avenue for growth, particularly for chronic disease management and post-operative care. The increasing focus on preventive healthcare and wellness is driving the adoption of wearable health trackers and consumer-grade monitoring devices. The development of AI-powered predictive analytics for early disease detection and intervention holds immense potential. Furthermore, strategic collaborations between technology providers and local healthcare organizations can unlock new markets and tailor solutions to specific regional needs. The increasing investment in healthcare infrastructure across many MEA nations also creates opportunities for suppliers of advanced patient monitoring equipment.

Leading Players in the Middle East and Africa Patient Monitoring Industry Market

- Becton Dickinson and Company

- Abbott Laboratories

- Siemens Healthcare GmbH

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- Medtronic Plc

- Johnson & Johnson

- Boston Scientific Corporation

Key Developments in Middle East and Africa Patient Monitoring Industry Industry

- March 2022: BioIntelliSense Inc collaborated with Mubadala Health, the integrated healthcare network of Mubadala Investment company. This collaboration incorporated BioIntelluSense's innovative remote care technologies with Mubadala Health's continuous care model to drive clinical workflow efficiencies.

- March 2022: Cardo Health launched the telemedicine app Kena Health in South Africa. Kena Health targets the millions of uninsured citizens who are dependent on stressed public health systems using a B2C freemium business model.

Strategic Outlook for Middle East and Africa Patient Monitoring Industry Market

The strategic outlook for the MEA patient monitoring industry is exceptionally positive, driven by sustained demand for advanced healthcare solutions. Future growth will be fueled by the continued expansion of remote patient monitoring, increasing adoption of AI and IoT technologies, and a growing emphasis on preventive and personalized healthcare. Investments in healthcare infrastructure and supportive government policies will further accelerate market penetration. Companies that focus on developing user-friendly, cost-effective, and interoperable patient monitoring solutions, particularly those tailored for chronic disease management and home healthcare, are well-positioned for success. Strategic partnerships and a keen understanding of local market nuances will be crucial for navigating the diverse landscape of the Middle East and Africa.

Middle East and Africa Patient Monitoring Industry Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Multi-parameter Monitors

- 1.5. Other Types of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Others

-

3. End User

- 3.1. Home Healthcare

- 3.2. Hospitals and Clinics

- 3.3. Other End Users

-

4. Geography

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

Middle East and Africa Patient Monitoring Industry Segmentation By Geography

- 1. GCC

- 2. South Africa

- 3. Rest of Middle East and Africa

Middle East and Africa Patient Monitoring Industry Regional Market Share

Geographic Coverage of Middle East and Africa Patient Monitoring Industry

Middle East and Africa Patient Monitoring Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. Resistance from Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; High Cost of Technology

- 3.4. Market Trends

- 3.4.1. Hemodynamic Monitoring Devices Segment is Expected to Grow Fastest Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Patient Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Multi-parameter Monitors

- 5.1.5. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals and Clinics

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. GCC

- 5.4.2. South Africa

- 5.4.3. Rest of Middle East and Africa

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. GCC

- 5.5.2. South Africa

- 5.5.3. Rest of Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. GCC Middle East and Africa Patient Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Hemodynamic Monitoring Devices

- 6.1.2. Neuromonitoring Devices

- 6.1.3. Cardiac Monitoring Devices

- 6.1.4. Multi-parameter Monitors

- 6.1.5. Other Types of Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiology

- 6.2.2. Neurology

- 6.2.3. Respiratory

- 6.2.4. Fetal and Neonatal

- 6.2.5. Others

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Home Healthcare

- 6.3.2. Hospitals and Clinics

- 6.3.3. Other End Users

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. GCC

- 6.4.2. South Africa

- 6.4.3. Rest of Middle East and Africa

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. South Africa Middle East and Africa Patient Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Hemodynamic Monitoring Devices

- 7.1.2. Neuromonitoring Devices

- 7.1.3. Cardiac Monitoring Devices

- 7.1.4. Multi-parameter Monitors

- 7.1.5. Other Types of Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiology

- 7.2.2. Neurology

- 7.2.3. Respiratory

- 7.2.4. Fetal and Neonatal

- 7.2.5. Others

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Home Healthcare

- 7.3.2. Hospitals and Clinics

- 7.3.3. Other End Users

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. GCC

- 7.4.2. South Africa

- 7.4.3. Rest of Middle East and Africa

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Rest of Middle East and Africa Middle East and Africa Patient Monitoring Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Hemodynamic Monitoring Devices

- 8.1.2. Neuromonitoring Devices

- 8.1.3. Cardiac Monitoring Devices

- 8.1.4. Multi-parameter Monitors

- 8.1.5. Other Types of Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiology

- 8.2.2. Neurology

- 8.2.3. Respiratory

- 8.2.4. Fetal and Neonatal

- 8.2.5. Others

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Home Healthcare

- 8.3.2. Hospitals and Clinics

- 8.3.3. Other End Users

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. GCC

- 8.4.2. South Africa

- 8.4.3. Rest of Middle East and Africa

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Becton Dickinson and Company

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Abbott Laboratories

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Siemens Healthcare GmbH

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 General Electric Company (GE Healthcare)

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Koninklijke Philips NV

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Medtronic Plc

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Johnson & Johnson

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Boston Scientific Corporation

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Middle East and Africa Patient Monitoring Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Patient Monitoring Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 2: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 3: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 8: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 12: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 13: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 15: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 16: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 17: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 22: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 23: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 24: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 25: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 26: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 27: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 28: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Type of Device 2020 & 2033

- Table 32: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Type of Device 2020 & 2033

- Table 33: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 35: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 36: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by End User 2020 & 2033

- Table 37: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Geography 2020 & 2033

- Table 38: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Middle East and Africa Patient Monitoring Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 40: Middle East and Africa Patient Monitoring Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Patient Monitoring Industry?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Middle East and Africa Patient Monitoring Industry?

Key companies in the market include Becton Dickinson and Company, Abbott Laboratories, Siemens Healthcare GmbH, General Electric Company (GE Healthcare), Koninklijke Philips NV, Medtronic Plc, Johnson & Johnson, Boston Scientific Corporation.

3. What are the main segments of the Middle East and Africa Patient Monitoring Industry?

The market segments include Type of Device, Application, End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

Hemodynamic Monitoring Devices Segment is Expected to Grow Fastest Over the Forecast Period.

7. Are there any restraints impacting market growth?

Resistance from Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; High Cost of Technology.

8. Can you provide examples of recent developments in the market?

In March 2022, BioIntelliSense Inc collaborated with Mubadala Health, the integrated healthcare network of Mubadala Investment company. This collaboration incorporated BioIntelluSense's innovative remote care technologies with Mubadala BiointelliSense's innovative remote care technologies with Mubadala Health's continuous care model to drive clinical workflow efficiencies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Patient Monitoring Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Patient Monitoring Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Patient Monitoring Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Patient Monitoring Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence