Key Insights

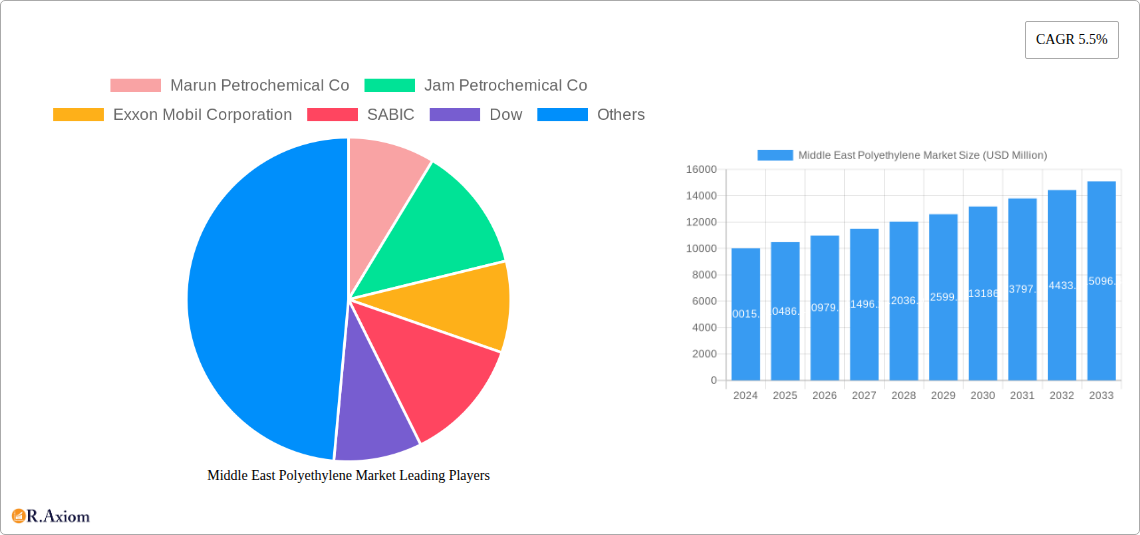

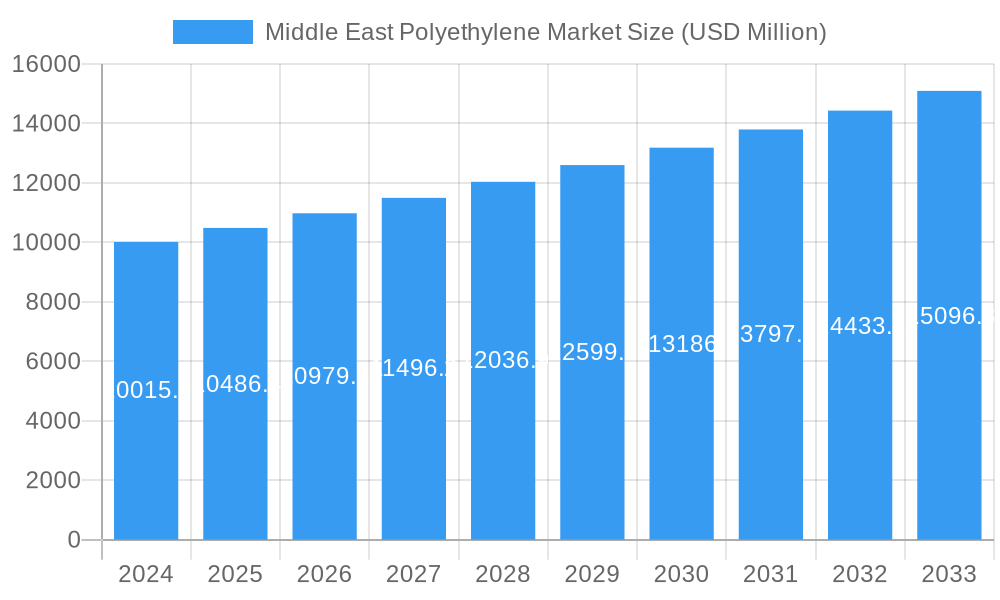

The Middle East Polyethylene Market is poised for significant expansion, currently valued at an estimated $10,015.9 million in 2024. This robust growth is propelled by a compound annual growth rate (CAGR) of 4.7% through the forecast period, indicating sustained demand and development. Key market drivers include the escalating consumption in the packaging sector, particularly for flexible packaging solutions and rigid containers, and the burgeoning construction industry's need for durable polyethylene pipes and conduit. Furthermore, the expanding automotive and transportation sectors are increasingly adopting lightweight polyethylene components to improve fuel efficiency. Emerging trends such as the growing preference for recyclable and sustainable polyethylene grades, driven by environmental regulations and consumer awareness, will shape market dynamics. Innovations in additive technologies and polymer processing are also contributing to enhanced product performance and wider application possibilities.

Middle East Polyethylene Market Market Size (In Billion)

Despite this positive outlook, the market faces certain restraints. Fluctuations in crude oil prices, the primary feedstock for polyethylene production, can impact manufacturing costs and, consequently, market pricing. While the Middle East region possesses significant feedstock advantages, geopolitical instability in certain areas could pose supply chain challenges. The increasing regulatory scrutiny surrounding plastic waste and the drive towards circular economy initiatives necessitate a focus on enhanced recycling infrastructure and the development of biodegradable alternatives. Nevertheless, the inherent versatility and cost-effectiveness of polyethylene across diverse applications, coupled with ongoing investments in production capacity and technological advancements by major players like SABIC, Dow, and LyondellBasell, are expected to overcome these challenges and ensure continued market prosperity. The dominance of HDPE and LDPE within product segments, alongside widespread adoption in Blow Molding, Films and Sheets, and Injection Molding applications, underscores the foundational role of these materials in the region's industrial landscape.

Middle East Polyethylene Market Company Market Share

Middle East Polyethylene Market Market Concentration & Innovation

The Middle East polyethylene market, valued at an estimated $XX million in 2025, exhibits a moderate to high level of concentration, with key players like SABIC, Exxon Mobil Corporation, and Dow holding significant market shares. Innovation in this sector is primarily driven by advancements in catalyst technology, leading to the development of specialized polyethylene grades with enhanced properties. For instance, the development of high-performance PE resins for pressure pipes, as demonstrated by SABIC's September 2021 initiative, signifies a push towards material science innovation. Regulatory frameworks, largely influenced by environmental concerns and product safety standards, are progressively shaping manufacturing processes and product development. While direct product substitutes for polyethylene in its diverse applications are limited, the industry faces indirect competition from alternative materials in specific niches. End-user trends, particularly the growing demand for sustainable packaging solutions and lightweight materials in transportation, are powerful innovation catalysts. Mergers and acquisitions (M&A) activities, though not extensively detailed in public records, are crucial for market consolidation and strategic expansion, with deal values typically ranging from $XX million to $XX million, enhancing competitive advantages and expanding product portfolios.

Middle East Polyethylene Market Industry Trends & Insights

The Middle East polyethylene market is poised for robust growth, driven by a confluence of economic, technological, and consumer-driven factors. The region's abundant feedstock availability, particularly natural gas, provides a significant cost advantage for polyethylene production, fostering strong export capabilities. The projected Compound Annual Growth Rate (CAGR) for the market is approximately X.XX% during the forecast period of 2025–2033. Technological disruptions, including the refinement of metallocene and Ziegler-Natta catalyst systems, are enabling the production of polyethylene grades with superior mechanical properties, heat resistance, and processability. These advancements are directly addressing evolving consumer preferences for durable, lightweight, and eco-friendly products.

Key market growth drivers include the burgeoning packaging industry, which accounts for a substantial portion of polyethylene consumption due to its versatility, cost-effectiveness, and protective qualities. The demand for flexible packaging films, rigid containers, and specialized packaging for food and beverages continues to fuel market expansion. Furthermore, the transportation sector's increasing adoption of lightweight polyethylene components to improve fuel efficiency and reduce emissions is a significant trend. The electrical and electronics industry benefits from polyethylene's excellent insulation properties, driving demand for wires and cables. The building and construction sector also relies on polyethylene for pipes, geomembranes, and insulation materials, particularly in infrastructure development projects across the region. Agriculture utilizes polyethylene for films, irrigation pipes, and greenhouse coverings, contributing to enhanced crop yields and water conservation.

Competitive dynamics within the Middle East polyethylene market are characterized by intense competition among major global and regional players. These companies are continuously investing in capacity expansions, technological upgrades, and strategic partnerships to maintain and enhance their market positions. The increasing focus on sustainability is also shaping competitive strategies, with companies exploring recycled polyethylene and bio-based alternatives. Market penetration is expected to deepen across various end-user industries as economic development progresses and urbanization continues in the region.

Dominant Markets & Segments in Middle East Polyethylene Market

The Middle East polyethylene market is dominated by several key segments, each driven by distinct economic and infrastructural factors.

Dominant Region/Country: While the entire Middle East region is a significant producer and consumer, Saudi Arabia stands out as a dominant force, propelled by its substantial petrochemical infrastructure, government support for downstream industries, and access to competitive feedstock. Economic diversification initiatives, such as Saudi Vision 2030, further bolster the demand for polyethylene in various manufacturing sectors.

Dominant Product Type:

- HDPE (High-Density Polyethylene): This segment holds a significant market share due to its excellent strength, rigidity, and chemical resistance.

- Key Drivers: Growing demand in the packaging sector for bottles, containers, and films; extensive use in pipes and conduit for water and gas distribution infrastructure; applications in toys and household goods.

- LLDPE (Linear Low-Density Polyethylene): LLDPE is a strong contender, particularly valued for its flexibility and toughness.

- Key Drivers: Dominance in the flexible packaging films market, including food packaging and stretch wrap; use in agricultural films for greenhouses and mulching; essential for producing bags and sacks.

- LDPE (Low-Density Polyethylene): Though facing competition, LDPE remains crucial for specific applications.

- Key Drivers: Applications in shrink film, plastic bags, and squeeze bottles; use in coatings for paper and cardboard packaging; demand in the electrical and electronics sector for insulation.

Dominant Application:

- Packaging: This is the largest and most significant application segment, encompassing a wide array of uses.

- Key Drivers: Rapid growth in the food and beverage industry; increasing consumerism and demand for convenience products; expansion of e-commerce requiring robust packaging solutions.

- Films and Sheets: This sub-segment within packaging and other applications is critical.

- Key Drivers: Widespread use in flexible packaging, agricultural films, geomembranes, and industrial wrapping.

- Pipes and Conduit: Essential for infrastructure development.

- Key Drivers: Government investments in water management, sewage systems, and oil & gas pipelines; growing urbanization necessitates extensive piping networks.

Dominant End-user Industry:

- Packaging: As highlighted, this is the leading end-user industry, driving substantial demand across all polyethylene types and applications.

- Key Drivers: Population growth, rising disposable incomes, and the demand for safe and convenient product delivery.

- Building and Construction: This sector's reliance on durable and cost-effective materials makes it a key consumer.

- Key Drivers: Ambitious infrastructure projects across the region, including residential, commercial, and industrial construction.

- Electrical and Electronics: Polyethylene's insulating properties are vital.

- Key Drivers: Expanding telecommunications networks, growing demand for consumer electronics, and renewable energy infrastructure development.

Middle East Polyethylene Market Product Developments

Recent product developments in the Middle East polyethylene market are centered on enhancing material performance and sustainability. Innovations in catalyst technology have led to the creation of specialized HDPE, LDPE, and LLDPE grades with improved tensile strength, impact resistance, and thermal stability, catering to demanding applications in packaging, automotive, and construction. For example, SABIC's September 2021 advancement in PE and PP resins for pressure pipes demonstrates a focus on durability and longevity in critical infrastructure. Competitive advantages are being gained through the development of lighter, yet stronger, polyethylene materials that reduce raw material consumption and transportation costs, appealing to environmentally conscious industries.

Report Scope & Segmentation Analysis

This comprehensive report provides an in-depth analysis of the Middle East Polyethylene Market, segmented across key areas to offer actionable insights. The Product Type segmentation includes High-Density Polyethylene (HDPE), Low-Density Polyethylene (LDPE), Linear Low-Density Polyethylene (LLDPE), and Other Product Types. The Application segmentation covers Blow Molding, Films and Sheets, Injection Molding, Pipes and Conduit, Wires and Cables, and Other Applications. Furthermore, the End-user Industry segmentation encompasses Packaging, Transportation, Electrical and Electronics, Building and Construction, Agriculture, and Other End-user Industries. Each segment is analyzed for market size, growth projections, and competitive dynamics. For instance, the Packaging segment is projected to grow at an estimated CAGR of X.XX%, reaching a market size of $XX million by 2033.

Key Drivers of Middle East Polyethylene Market Growth

The Middle East polyethylene market growth is propelled by several interconnected drivers. The region's significant petrochemical production capacity, fueled by abundant and competitively priced feedstock like natural gas, provides a fundamental cost advantage. Government initiatives focused on economic diversification and the development of downstream industries, such as Saudi Vision 2030, are creating robust demand for polyethylene in manufacturing and construction. Technological advancements in catalyst technology are enabling the production of higher-performance polyethylene grades, meeting the evolving needs of industries like packaging and automotive. Furthermore, increasing urbanization and a growing population are driving demand for essential goods and infrastructure, where polyethylene plays a vital role in packaging, piping, and construction materials.

Challenges in the Middle East Polyethylene Market Sector

Despite its strong growth trajectory, the Middle East polyethylene market faces several challenges. Fluctuations in global oil and gas prices can impact feedstock costs and the overall competitiveness of the region's petrochemical industry. Increasing global environmental regulations and growing consumer awareness regarding plastic waste are pressuring manufacturers to adopt more sustainable practices, including the development of recycled and bio-based polyethylene, which requires significant investment and technological innovation. Intense global competition from other major polyethylene-producing regions, particularly Asia, necessitates continuous improvement in efficiency and product differentiation. Supply chain disruptions, as evidenced by global events, can also pose risks to production and distribution.

Emerging Opportunities in Middle East Polyethylene Market

Emerging opportunities in the Middle East polyethylene market lie in the growing demand for specialized and high-performance polyethylene grades. The trend towards sustainable packaging solutions presents significant opportunities for companies developing recyclable and compostable polyethylene materials, as well as those investing in advanced recycling technologies. The expansion of renewable energy infrastructure, such as solar farms, requires specialized polyethylene components for insulation and protective coverings. Furthermore, the ongoing infrastructure development projects across the region, particularly in water management and transportation, will continue to drive demand for durable polyethylene pipes and conduit. The potential for increased penetration of polyethylene in advanced manufacturing sectors, such as 3D printing and lightweight automotive components, also represents a promising avenue for growth.

Leading Players in the Middle East Polyethylene Market Market

- Marun Petrochemical Co

- Jam Petrochemical Co

- Exxon Mobil Corporation

- SABIC

- Dow

- Saudi Polymers Company (Chevron & SABIC)

- Amir Kabir Petrochemical Co (AKPC)

- Ilam Petrochemical

- Saudi Ethylene and Polyethylene Co (Tasnee)

- Sharq - Eastern Petrochemical Co (SDPC)

- LyondellBasell Industries Holdings BV

Key Developments in Middle East Polyethylene Market Industry

- November 2022: SABIC partnered with Guangdong Jinming Machinery Co. Ltd, a plastic packaging equipment manufacturer, and Bolsas de los Altos, a leading plastic film and packaging converter. The agreement will allow SABIC polyolefin resin products, as well as polyethylene resin offers from Gulf Coast Growth Ventures (GCGV) and TRUCIRCLETM, to be tested and validated, indicating a focus on product application and market validation.

- September 2021: SABIC announced the development of a new technology and range of dedicated polyethylene (PE) and polypropylene (PP) resins that represent a substantial advancement in the performance profile of polyolefin pressure pipes. The technique is being developed from concept to reality in collaboration with Tecnomatic and aquatherm, two key specialists in pipe manufacture, highlighting innovation in material science for infrastructure applications.

Strategic Outlook for Middle East Polyethylene Market Market

The strategic outlook for the Middle East polyethylene market is characterized by a strong emphasis on innovation, sustainability, and strategic partnerships. The region's inherent advantage in feedstock availability will continue to be a cornerstone of its competitive strength. Future growth will be significantly influenced by investments in advanced catalyst technologies to produce higher-value, specialized polyethylene grades catering to evolving end-user demands, particularly in sectors like advanced packaging, automotive lightweighting, and infrastructure development. The imperative to address environmental concerns will drive greater adoption of circular economy principles, including the development and commercialization of recycled and bio-based polyethylene solutions. Strategic collaborations with downstream converters and equipment manufacturers, similar to SABIC's initiatives, will be crucial for market penetration and validating new product applications, ensuring sustained growth and market leadership in the coming years.

Middle East Polyethylene Market Segmentation

-

1. Product Type

- 1.1. HDPE

- 1.2. LDPE

- 1.3. LLDPE

- 1.4. Other Product Types

-

2. Application

- 2.1. Blow Molding

- 2.2. Films and Sheets

- 2.3. Injection Molding

- 2.4. Pipes and Conduit

- 2.5. Wires and Cables

- 2.6. Other Applications

-

3. End-user Industry

- 3.1. Packaging

- 3.2. Transportation

- 3.3. Electrical and Electronics

- 3.4. Building and Construction

- 3.5. Agriculture

- 3.6. Other End-user Industries

Middle East Polyethylene Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East Polyethylene Market Regional Market Share

Geographic Coverage of Middle East Polyethylene Market

Middle East Polyethylene Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand from a Diverse Range of End-user Industries; Growth in Industrial Applications such as Primarily Packing Automotive and Electrical Replacement Part

- 3.3. Market Restrains

- 3.3.1. Availability of Substitutes such as Polypropylene and Polyethylene Terephthalate Products; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand in the Building and Construction Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East Polyethylene Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. HDPE

- 5.1.2. LDPE

- 5.1.3. LLDPE

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Blow Molding

- 5.2.2. Films and Sheets

- 5.2.3. Injection Molding

- 5.2.4. Pipes and Conduit

- 5.2.5. Wires and Cables

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Packaging

- 5.3.2. Transportation

- 5.3.3. Electrical and Electronics

- 5.3.4. Building and Construction

- 5.3.5. Agriculture

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Marun Petrochemical Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jam Petrochemical Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Exxon Mobil Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SABIC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dow

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Polymers Company (Chevron & SABIC)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amir Kabir Petrochemical Co (AKPC)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Ilam Petrochemical

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Ethylene and Polyethylene Co (Tasnee)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sharq - Eastern Petrochemical Co (SDPC)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LyondellBasell Industries Holdings BV

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Marun Petrochemical Co

List of Figures

- Figure 1: Middle East Polyethylene Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Middle East Polyethylene Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East Polyethylene Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Middle East Polyethylene Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: Middle East Polyethylene Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Middle East Polyethylene Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Middle East Polyethylene Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Middle East Polyethylene Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 7: Middle East Polyethylene Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Middle East Polyethylene Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: Middle East Polyethylene Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Middle East Polyethylene Market Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: Middle East Polyethylene Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Middle East Polyethylene Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 13: Middle East Polyethylene Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Middle East Polyethylene Market Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 15: Middle East Polyethylene Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Middle East Polyethylene Market Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: Saudi Arabia Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Saudi Arabia Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 19: United Arab Emirates Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: United Arab Emirates Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 21: Israel Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Israel Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 23: Qatar Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Qatar Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 25: Kuwait Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Kuwait Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 27: Oman Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Oman Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 29: Bahrain Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Bahrain Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 31: Jordan Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Jordan Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

- Table 33: Lebanon Middle East Polyethylene Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Lebanon Middle East Polyethylene Market Volume (K Tons) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East Polyethylene Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Middle East Polyethylene Market?

Key companies in the market include Marun Petrochemical Co, Jam Petrochemical Co, Exxon Mobil Corporation, SABIC, Dow, Saudi Polymers Company (Chevron & SABIC), Amir Kabir Petrochemical Co (AKPC), Ilam Petrochemical, Saudi Ethylene and Polyethylene Co (Tasnee), Sharq - Eastern Petrochemical Co (SDPC), LyondellBasell Industries Holdings BV.

3. What are the main segments of the Middle East Polyethylene Market?

The market segments include Product Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from a Diverse Range of End-user Industries; Growth in Industrial Applications such as Primarily Packing Automotive and Electrical Replacement Part.

6. What are the notable trends driving market growth?

Increasing Demand in the Building and Construction Industry.

7. Are there any restraints impacting market growth?

Availability of Substitutes such as Polypropylene and Polyethylene Terephthalate Products; Other Restraints.

8. Can you provide examples of recent developments in the market?

November 2022: SABIC partnered with Guangdong Jinming Machinery Co. Ltd, a plastic packaging equipment manufacturer, and Bolsas de los Altos, a leading plastic film and packaging converter. The agreement will allow SABIC polyolefin resin products, as well as polyethylene resin offers from Gulf Coast Growth Ventures (GCGV) and TRUCIRCLETM, to be tested and validated.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East Polyethylene Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East Polyethylene Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East Polyethylene Market?

To stay informed about further developments, trends, and reports in the Middle East Polyethylene Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence