Key Insights

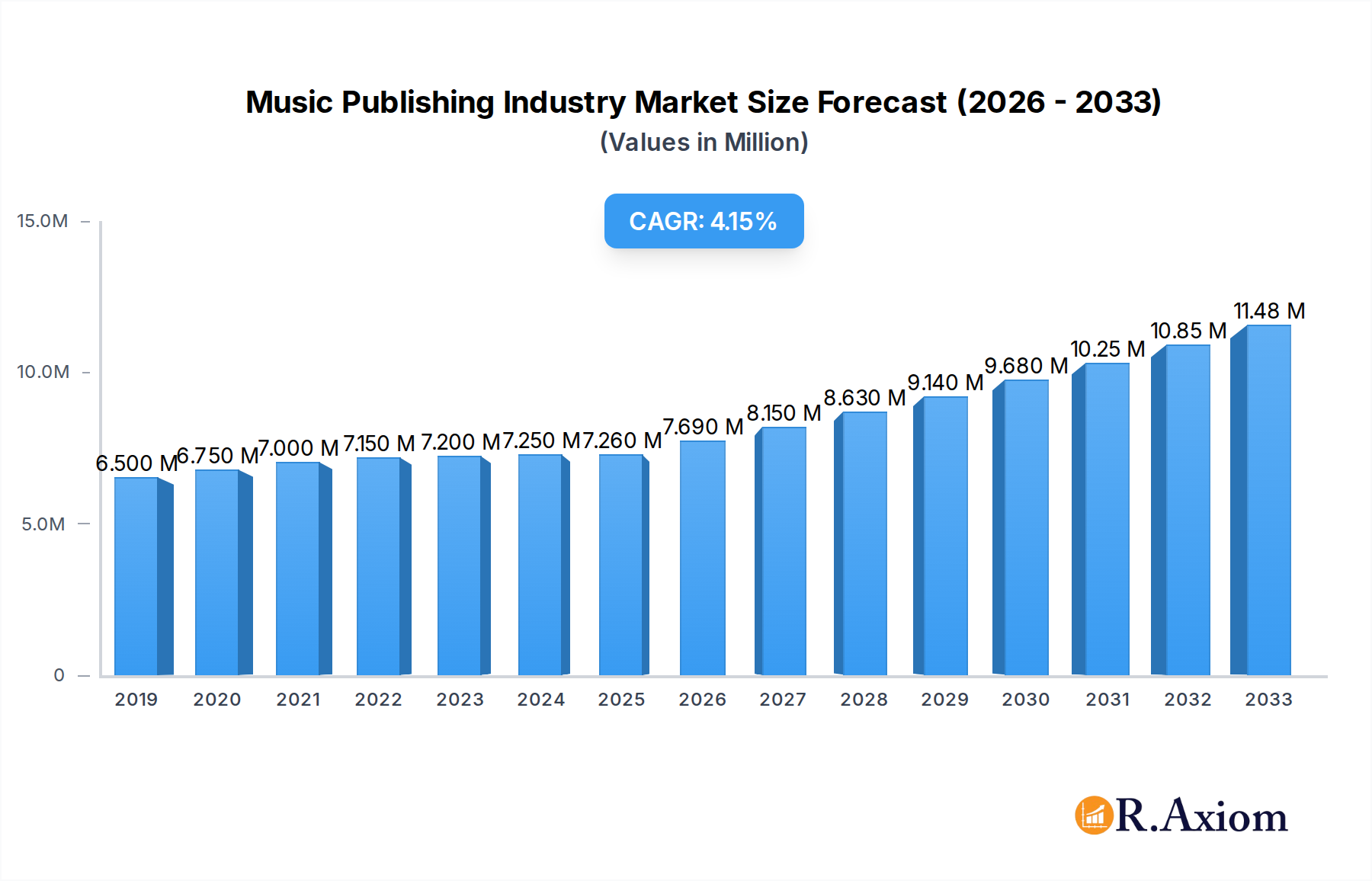

The global Music Publishing Industry is experiencing robust expansion, currently valued at $7.26 million and projected to grow at a Compound Annual Growth Rate (CAGR) of 5.87% from 2019 to 2033. This sustained growth is propelled by a dynamic interplay of evolving revenue streams and an expanding global music consumption landscape. Digital revenue, encompassing streaming and downloads, continues to be a dominant force, reflecting listeners' preference for accessible and on-demand music. Synchronization licensing, which involves the use of music in films, television, advertisements, and video games, also presents a significant growth avenue as content creation across various media platforms flourishes. Physical revenue, while traditionally a cornerstone, is adapting to niche markets and collector demand, contributing to the overall stability of the industry. Emerging markets are increasingly contributing to the industry's expansion, driven by growing internet penetration and a burgeoning middle class with a greater disposable income for entertainment. The industry's resilience is further underscored by its ability to adapt to technological advancements and changing consumer behaviors, ensuring continued relevance and profitability.

Music Publishing Industry Market Size (In Million)

The music publishing sector is actively navigating key trends and challenges that shape its future trajectory. The increasing proliferation of short-form video content and social media platforms has opened up new avenues for music discovery and usage, driving demand for synchronization licenses. Furthermore, the rise of independent artists and DIY music creation tools democratizes the music ecosystem, creating new opportunities for publishers to discover and monetize talent. However, challenges such as piracy and the complexities of global royalty collection in a fragmented digital landscape persist, necessitating ongoing innovation in licensing and rights management technologies. The market is segmented into performance royalties, synchronization, digital revenue, and physical revenue, with each segment exhibiting unique growth dynamics. Major players like Disney Music Group, Universal Music Publishing Group, Sony Music Publishing, and Warner Chappell Music Inc. are at the forefront, actively investing in technology and talent to capitalize on these evolving market conditions. The industry's ability to foster innovation, adapt to regulatory changes, and effectively monetize diverse revenue streams will be crucial for sustained success.

Music Publishing Industry Company Market Share

This in-depth report offers a panoramic view of the global Music Publishing Industry, meticulously analyzing its landscape from 2019 to 2033. With a base year of 2025 and a forecast period extending to 2033, this study provides critical insights into market concentration, innovation, industry trends, dominant segments, product developments, growth drivers, challenges, emerging opportunities, and key players. Leveraging high-traffic keywords such as "music royalties," "synchronization licensing," "digital music revenue," "performance royalties," and "music catalog acquisition," this report is an indispensable resource for publishers, artists, investors, and industry stakeholders seeking to navigate the dynamic and evolving world of music publishing. We delve into the intricate workings of royalty streams, explore transformative industry developments, and pinpoint strategic imperatives for sustained growth.

Music Publishing Industry Market Concentration & Innovation

The Music Publishing Industry is characterized by a significant level of market concentration, with a few major players holding substantial market share, estimated at over 70% of global publishing revenues. Innovation within the sector is primarily driven by technological advancements in digital distribution, data analytics for royalty tracking, and the increasing demand for synchronization licenses in film, television, and advertising. Regulatory frameworks, while evolving to address digital complexities, continue to shape how rights are managed and revenue is distributed. Product substitutes, such as user-generated content platforms and direct artist-to-fan distribution, pose a growing challenge, necessitating continuous adaptation by traditional publishing models. End-user trends highlight a preference for diverse music consumption, fueling demand for a wider range of catalog exploitation. Mergers and Acquisitions (M&A) activity is a significant indicator of market dynamics, with estimated deal values in the catalog acquisition space reaching billions of dollars. Key M&A activities often involve the consolidation of significant song catalogs, enhancing the competitive advantage of acquiring entities.

- Market Share Concentration: Top 5 publishers hold over 70% of global revenue.

- Innovation Drivers: Digital platforms, AI in music creation & discovery, data analytics.

- Regulatory Impact: Copyright law evolution, digital licensing reforms.

- Product Substitutes: Streaming platforms' user-generated content, direct-to-fan models.

- M&A Deal Value: Catalog acquisitions exceeding $1 Billion annually.

Music Publishing Industry Industry Trends & Insights

The Music Publishing Industry is poised for substantial growth, with projected Compound Annual Growth Rates (CAGRs) in the range of 8-12% over the forecast period. This expansion is fueled by several key market growth drivers. The proliferation of digital streaming services globally continues to be a primary revenue generator, with increasing subscriber numbers and per-stream rates contributing significantly to digital revenue. Technological disruptions, including advancements in blockchain for transparent rights management and AI for catalog curation and discovery, are reshaping operational efficiencies and monetization strategies. Consumer preferences are increasingly leaning towards personalized music experiences and the discovery of niche genres, creating opportunities for diverse catalog exploitation. The competitive dynamics within the industry are intensifying, marked by aggressive catalog acquisitions, strategic partnerships, and a global race for emerging talent. Market penetration of digital music services is estimated to reach over 85% globally by 2028, underscoring the importance of digital strategy for all industry players.

- Digital Streaming Dominance: Continued growth in subscribers and ad-supported revenue.

- Technological Integration: AI for A&R and royalty optimization, blockchain for transparency.

- Consumer Preference Shifts: Demand for diverse genres and personalized playlists.

- Competitive Landscape: Increased M&A, focus on catalog value and new signings.

- Market Penetration: High digital adoption driving revenue streams.

Dominant Markets & Segments in Music Publishing Industry

The Music Publishing Industry's revenue streams are diversified across several key segments, with Digital Revenue currently being the dominant force. This segment's dominance is driven by the ubiquitous nature of global streaming platforms, the expanding reach of emerging markets, and the increasing consumption of music through various digital channels. The market size for digital revenue is projected to surpass $10 Billion by 2028.

- Digital Revenue: This segment, encompassing revenue from streaming services (interactive and non-interactive), digital downloads, and digital licensing for online content, is the largest contributor to the global music publishing market.

- Key Drivers:

- Global Internet Penetration: Increasing access to high-speed internet worldwide.

- Smartphone Adoption: Ubiquitous devices for music consumption.

- Subscription Models: Recurring revenue from premium streaming services.

- Emerging Market Growth: Rapidly expanding user bases in Asia, Latin America, and Africa.

- Platform Innovation: New features and integrations by streaming services to enhance user engagement.

- Key Drivers:

Following closely is Performance Revenue, generated from the public performance of music in venues like radio, television, live concerts, and businesses. While traditionally strong, its growth is steadily paced by the continuous expansion of digital platforms and the inherent monetization potential they offer.

- Performance Revenue: Revenue from public performances via broadcast radio, terrestrial radio, live music venues, and businesses.

- Key Drivers:

- Live Entertainment Resurgence: Post-pandemic recovery and continued demand for live music experiences.

- Global Media Landscape: Ongoing use of music in television, film, and radio broadcasts.

- Economic Policies: Factors influencing consumer spending on entertainment.

- Infrastructure Development: Growth in venues and broadcasting networks in developing regions.

- Key Drivers:

Synchronization Revenue, derived from licensing music for use in films, television shows, advertisements, and video games, represents a significant and growing segment, often yielding high per-use fees. Its growth is directly tied to the booming production of visual content across all media.

- Synchronization Revenue: Licensing fees for the use of musical compositions in visual media.

- Key Drivers:

- Increased Content Production: Proliferation of streaming services and demand for original content.

- Advertising Spend: Continuous investment in music for brand campaigns.

- Gaming Industry Growth: Expansion of music licensing in video games.

- Global Film & TV Production: Robust production activity worldwide.

- Key Drivers:

Physical Revenue, comprising sales of CDs, vinyl, and other physical formats, while declining in overall market share, still holds a dedicated niche, particularly among audiophiles and collectors, and remains a stable, albeit smaller, revenue stream.

- Physical Revenue: Sales from physical music formats like CDs and vinyl records.

- Key Drivers:

- Collector Market: Dedicated fan base for physical media.

- Nostalgia & Authenticity: Appeal of tangible music formats.

- Special Edition Releases: Limited edition vinyl and deluxe CD sets.

- Record Store Day Initiatives: Events promoting physical music sales.

- Key Drivers:

Music Publishing Industry Product Developments

Product developments in the music publishing industry are increasingly centered around leveraging technology for enhanced rights management and royalty collection. Innovations include AI-powered catalog analysis for identifying untapped licensing opportunities, blockchain-based platforms for transparent royalty distribution, and sophisticated data analytics tools that provide publishers with deeper insights into consumption patterns and emerging trends. These developments offer competitive advantages by streamlining operations, maximizing revenue, and enabling more targeted marketing of song catalogs. The market fit for these innovations is driven by the industry's growing reliance on digital infrastructure and the need for greater efficiency and accuracy in managing complex global licensing.

Report Scope & Segmentation Analysis

This report segments the Music Publishing Industry by key revenue streams: Royalties: Performance, Synchronization, Digital Revenue, and Physical Revenue. The study period spans from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, built upon historical data from 2019–2024. Digital Revenue is expected to continue its dominant trajectory, projected to reach over $12 Billion by 2030, driven by increasing global internet access and subscription growth. Performance royalties are anticipated to see steady growth, estimated at over $5 Billion by 2030, bolstered by live music's recovery and broadcast media's continued reliance on music. Synchronization revenue is forecast to exceed $3 Billion by 2030, propelled by the insatiable demand for content in film, TV, and gaming. Physical revenue, while smaller, is expected to maintain its niche, with projected revenues around $1 Billion by 2030, supported by collector markets.

Key Drivers of Music Publishing Industry Growth

The Music Publishing Industry's growth is propelled by a confluence of technological advancements, economic resilience, and evolving regulatory landscapes. The relentless expansion of digital streaming platforms worldwide, coupled with increasing global internet and smartphone penetration, forms the bedrock of digital revenue growth. Economically, the sustained consumer spending on entertainment, particularly in emerging markets, fuels demand across all royalty segments. Regulatory frameworks that adapt to digital realities, such as improved global copyright enforcement and fairer digital licensing, are crucial for ensuring fair compensation for creators and rights holders. Technological innovations like AI for catalog analysis and blockchain for transparency further optimize revenue streams and operational efficiencies.

- Technological Drivers: Global streaming service expansion, AI for A&R and rights management, blockchain for transparency.

- Economic Drivers: Rising disposable incomes in emerging markets, sustained consumer spending on entertainment.

- Regulatory Drivers: Evolving copyright laws for the digital age, international licensing agreements.

Challenges in the Music Publishing Industry Sector

Despite robust growth, the Music Publishing Industry faces significant challenges. The complex and often fragmented nature of digital licensing across various platforms and territories can lead to revenue leakage and delayed payments. Piracy and unauthorized usage of copyrighted material, though evolving in form, continue to pose a threat to revenue streams. Navigating diverse international copyright laws and enforcement mechanisms presents ongoing regulatory hurdles. The intense competition for new talent and catalog acquisitions, driven by a desire for market share, can inflate acquisition costs and intensify operational pressures. Furthermore, the industry grapples with the equitable distribution of revenue in an increasingly digital ecosystem, ensuring fair compensation for songwriters and composers.

- Regulatory Hurdles: International copyright complexity, enforcement inconsistencies.

- Piracy & Unauthorized Use: Persistent threats to revenue integrity.

- Competitive Pressures: High catalog acquisition costs, talent war.

- Revenue Distribution: Ensuring fair compensation in digital economy.

Emerging Opportunities in Music Publishing Industry

Emerging opportunities within the Music Publishing Industry are abundant, driven by new technologies and evolving consumer behaviors. The metaverse and Web3 technologies present novel avenues for music licensing, virtual performances, and fan engagement through NFTs. The growing demand for AI-generated music and sound design in various media opens up new licensing possibilities. Furthermore, the increasing globalization of music consumption creates fertile ground for exploring untapped markets and licensing catalogs to diverse audiences. The resurgence of vinyl and the ongoing demand for unique physical music experiences offer continued revenue potential. Additionally, the focus on catalog acquisitions continues to present opportunities for strategic investment and portfolio expansion.

- New Technologies: Metaverse, Web3, AI in music creation and licensing.

- Untapped Markets: Expansion into emerging economies with growing music consumption.

- Niche Content Licensing: Soundtracks for gaming, podcasts, and emerging digital media.

- Catalog Monetization: Innovative ways to exploit existing song libraries.

Leading Players in the Music Publishing Industry Market

- Disney Music Group

- Universal Music Publishing Group

- Pulse Recordings

- Sony Music Publishing

- Big Deal Music LLC

- Big Yellow Dog Music LLC

- Kobalt Music Group Ltd

- Black River Entertainment

- BMG Rights Management GmbH

- Reach Music Publishing Inc

- Round Hill Music

- Warner Chappell Music Inc

Key Developments in Music Publishing Industry Industry

- May 2022: Sony Music Publishing UK announced a global publishing deal for rising singer-songwriter Kal Lavelle, highlighting her emergence as a prominent hitmaker due to collaborations with Ed Sheeran.

- February 2022: Universal Music Group (UMG), through Universal Music Publishing Group (UMPG), fully acquired the historic song catalog of Neil Diamond, unifying his recorded music and publishing assets under UMG's global umbrella.

- February 2022: Influence Media Partners, in partnership with funds managed by BlackRock Alternative Investors and Warner Music Group (WMG), announced the formation of a music rights platform to finance and oversee significant works by renowned composers.

Strategic Outlook for Music Publishing Industry Market

The strategic outlook for the Music Publishing Industry remains exceptionally positive, driven by sustained digital transformation and increasing demand for music content across a myriad of platforms. Publishers who prioritize data-driven decision-making, embrace emerging technologies like AI and blockchain, and strategically expand their global reach will be best positioned for future success. The continued growth of streaming, coupled with innovative licensing opportunities in the digital realm and the metaverse, presents a significant runway for revenue expansion. Strategic catalog acquisitions and a robust A&R strategy to identify and nurture new talent will remain crucial for maintaining competitive advantage and ensuring long-term value creation in this dynamic industry.

Music Publishing Industry Segmentation

-

1. Royalties

- 1.1. Performance

- 1.2. Synchronization

- 1.3. Digital Revenue

- 1.4. Physical Revenue

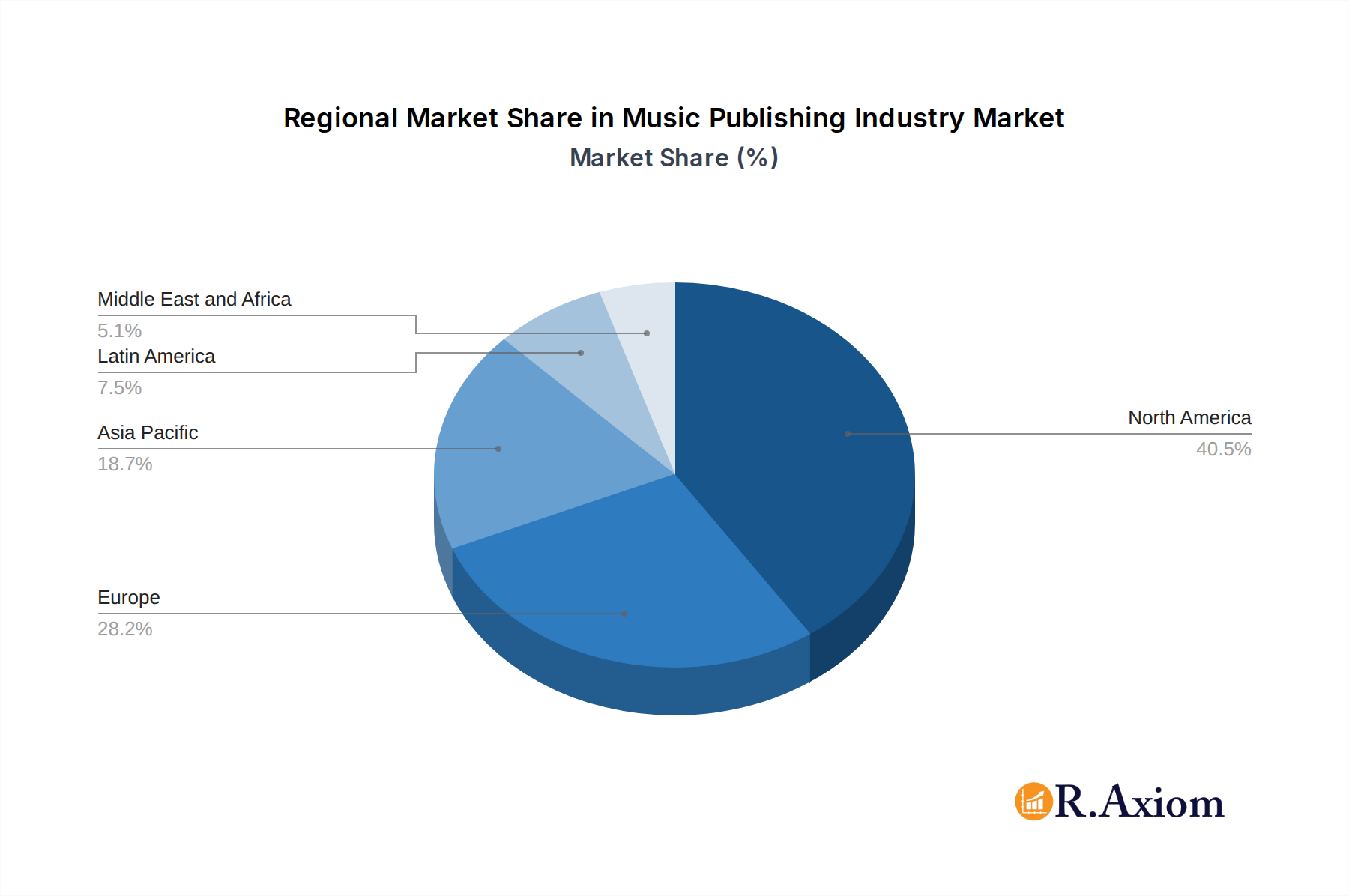

Music Publishing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Music Publishing Industry Regional Market Share

Geographic Coverage of Music Publishing Industry

Music Publishing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.87% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Music Streaming Services; Increasing Live Concerts and Performances; Growing Adoption of Digital Music

- 3.3. Market Restrains

- 3.3.1. Privacy Issues; Decline in Physical Volume Sales

- 3.4. Market Trends

- 3.4.1. Digital Revenue has the Largest Growth in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Royalties

- 5.1.1. Performance

- 5.1.2. Synchronization

- 5.1.3. Digital Revenue

- 5.1.4. Physical Revenue

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Royalties

- 6. North America Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Royalties

- 6.1.1. Performance

- 6.1.2. Synchronization

- 6.1.3. Digital Revenue

- 6.1.4. Physical Revenue

- 6.1. Market Analysis, Insights and Forecast - by Royalties

- 7. Europe Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Royalties

- 7.1.1. Performance

- 7.1.2. Synchronization

- 7.1.3. Digital Revenue

- 7.1.4. Physical Revenue

- 7.1. Market Analysis, Insights and Forecast - by Royalties

- 8. Asia Pacific Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Royalties

- 8.1.1. Performance

- 8.1.2. Synchronization

- 8.1.3. Digital Revenue

- 8.1.4. Physical Revenue

- 8.1. Market Analysis, Insights and Forecast - by Royalties

- 9. Latin America Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Royalties

- 9.1.1. Performance

- 9.1.2. Synchronization

- 9.1.3. Digital Revenue

- 9.1.4. Physical Revenue

- 9.1. Market Analysis, Insights and Forecast - by Royalties

- 10. Middle East and Africa Music Publishing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Royalties

- 10.1.1. Performance

- 10.1.2. Synchronization

- 10.1.3. Digital Revenue

- 10.1.4. Physical Revenue

- 10.1. Market Analysis, Insights and Forecast - by Royalties

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Disney Music Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Universal Music Publishing Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Pulse Recordings

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sony Music Publishing

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Big Deal Music LLC*List Not Exhaustive

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Big Yellow Dog Music LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Kobalt Music Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Black River Entertainment

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BMG Rights Management GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Reach Music Publishing Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Round Hill Music

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Warner Chappell Music Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Disney Music Group

List of Figures

- Figure 1: Global Music Publishing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 3: North America Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 4: North America Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 7: Europe Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 8: Europe Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 11: Asia Pacific Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 12: Asia Pacific Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 15: Latin America Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 16: Latin America Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa Music Publishing Industry Revenue (Million), by Royalties 2025 & 2033

- Figure 19: Middle East and Africa Music Publishing Industry Revenue Share (%), by Royalties 2025 & 2033

- Figure 20: Middle East and Africa Music Publishing Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa Music Publishing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 2: Global Music Publishing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 4: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 6: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 8: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 10: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Music Publishing Industry Revenue Million Forecast, by Royalties 2020 & 2033

- Table 12: Global Music Publishing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Publishing Industry?

The projected CAGR is approximately 5.87%.

2. Which companies are prominent players in the Music Publishing Industry?

Key companies in the market include Disney Music Group, Universal Music Publishing Group, Pulse Recordings, Sony Music Publishing, Big Deal Music LLC*List Not Exhaustive, Big Yellow Dog Music LLC, Kobalt Music Group Ltd, Black River Entertainment, BMG Rights Management GmbH, Reach Music Publishing Inc, Round Hill Music, Warner Chappell Music Inc.

3. What are the main segments of the Music Publishing Industry?

The market segments include Royalties.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Music Streaming Services; Increasing Live Concerts and Performances; Growing Adoption of Digital Music.

6. What are the notable trends driving market growth?

Digital Revenue has the Largest Growth in the Market.

7. Are there any restraints impacting market growth?

Privacy Issues; Decline in Physical Volume Sales.

8. Can you provide examples of recent developments in the market?

May 2022 - A global publishing deal was signed by rising singer-songwriter Kal Lavelle, according to Sony Music Publishing United Kingdom. Due to her collaborations with Ed Sheeran, Irish-born singer-songwriter Kal Lavelle has quickly emerged as one of the genre's most promising hitmakers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Music Publishing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Music Publishing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Music Publishing Industry?

To stay informed about further developments, trends, and reports in the Music Publishing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence