Key Insights

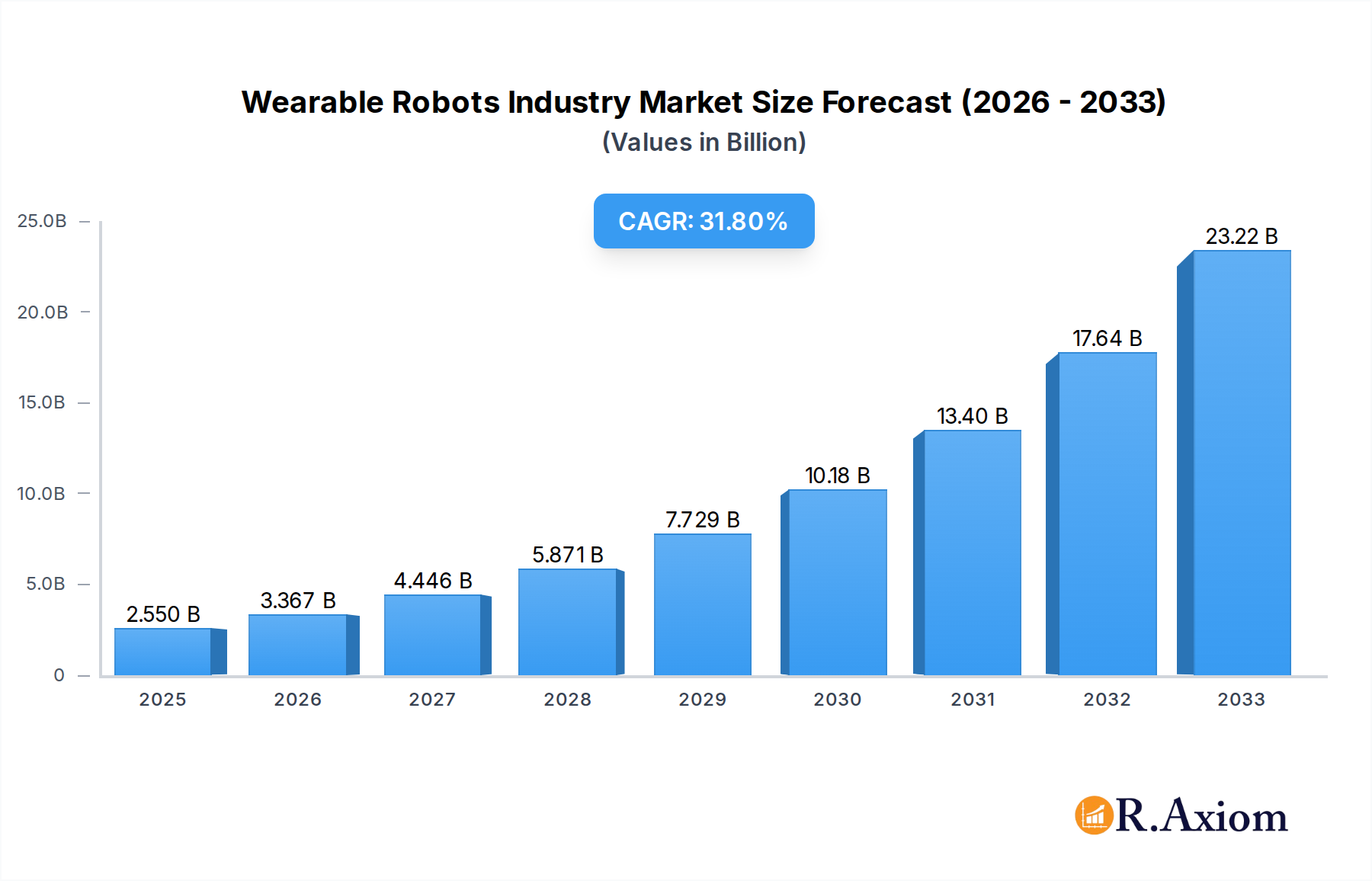

The global Wearable Robots industry is poised for substantial expansion, with a current market size of approximately $2.55 Billion and a projected Compound Annual Growth Rate (CAGR) of 32.05%. This robust growth trajectory, spanning from 2019 to 2033 with a base year of 2025, underscores the increasing adoption and innovation within the sector. Key drivers fueling this market surge include advancements in robotics and artificial intelligence, the growing demand for assistive technologies in healthcare, and the imperative to enhance human capabilities in industrial and defense applications. The rising prevalence of age-related conditions and the need for rehabilitation solutions are significantly boosting the healthcare segment, while the military's focus on improving soldier performance and reducing physical strain is a major catalyst for defense applications. Furthermore, industrial sectors are increasingly leveraging wearable robots to enhance worker safety, productivity, and ergonomics, particularly in manufacturing and logistics.

Wearable Robots Industry Market Size (In Billion)

The market is segmented into Powered Exoskeletons and Passive Exoskeletons, with powered solutions demonstrating higher growth potential due to their advanced functionalities. End-user industries are diverse, with Healthcare and Military & Defense emerging as dominant segments, followed by the Industrial sector. Emerging trends include the development of lighter, more intuitive, and more affordable exoskeleton technologies, alongside the integration of advanced sensors and AI for adaptive control. Challenges such as high initial investment costs and regulatory hurdles for widespread adoption are being addressed through technological innovation and increased market awareness. Leading companies like Lockheed Martin Corporation, Hocoma AG, Sarcos Corporation, and Ekso Bionics Holdings Inc. are at the forefront of this innovation, driving the market's evolution. The Asia Pacific region is anticipated to witness significant growth due to expanding healthcare infrastructure and government initiatives supporting technological adoption.

Wearable Robots Industry Company Market Share

Wearable Robots Industry Market Concentration & Innovation

The wearable robots industry, a dynamic sector poised for significant expansion, exhibits a moderately concentrated market landscape. Key players are investing heavily in research and development, driving innovation in areas such as advanced robotics, artificial intelligence integration, and user-centric design. Regulatory frameworks, particularly within the healthcare and military sectors, are evolving to accommodate these advanced technologies, creating both opportunities and challenges. Product substitutes, while present in the form of traditional assistive devices, are increasingly being outpaced by the superior functionality and rehabilitative capabilities of wearable robots. End-user trends clearly point towards a growing demand for solutions that enhance human capabilities, improve quality of life, and increase operational efficiency across various industries. Mergers and acquisitions (M&A) are a notable feature, with strategic consolidations aimed at acquiring specialized technologies and expanding market reach. For instance, the acquisition of smaller, innovative startups by larger corporations is a recurring theme, with estimated M&A deal values in the tens of millions of dollars. The market share of leading companies is gradually increasing as they solidify their positions through product innovation and strategic partnerships.

- Market Concentration: Moderately concentrated with a few key dominant players.

- Innovation Drivers: AI integration, advanced robotics, human-machine interface development, miniaturization of components.

- Regulatory Frameworks: Evolving, with a focus on safety, efficacy, and ethical considerations in healthcare and defense.

- Product Substitutes: Traditional orthotics, manual lifting aids, conventional prosthetics.

- End-User Trends: Increasing demand for rehabilitation, worker augmentation, and support for mobility impairments.

- M&A Activities: Strategic acquisitions of innovative startups and technology integration.

Wearable Robots Industry Industry Trends & Insights

The wearable robots industry is experiencing an unprecedented surge, driven by a confluence of technological advancements, shifting consumer preferences, and a growing recognition of the potential for these devices to revolutionize human capabilities. The market is projected to witness robust growth throughout the forecast period of 2025–2033, with an estimated Compound Annual Growth Rate (CAGR) of approximately 25%. This impressive expansion is fueled by escalating investments in research and development, particularly in powered exoskeletons designed for medical rehabilitation, industrial augmentation, and military applications. Technological disruptions are at the forefront of this growth, with advancements in battery technology leading to lighter, more powerful, and longer-lasting devices. The integration of artificial intelligence (AI) and machine learning (ML) is enabling more intuitive control, adaptive assistance, and personalized user experiences. Consumers, both individuals seeking to overcome physical limitations and industries aiming to enhance worker safety and productivity, are increasingly aware of and demanding these sophisticated solutions. The competitive dynamics within the industry are intensifying, characterized by strategic partnerships, product differentiation, and a race to capture significant market share. The penetration of wearable robots is expected to rise substantially across various end-user industries, moving beyond niche applications to become integral components of daily life and professional environments. For example, in the healthcare sector, the adoption of exoskeletons for stroke rehabilitation and spinal cord injury recovery is accelerating, driven by their proven efficacy in improving patient outcomes and reducing long-term care costs. Similarly, in the industrial sector, wearable robots are being deployed to reduce musculoskeletal injuries among workers engaged in physically demanding tasks, leading to significant cost savings for businesses in terms of worker's compensation and lost productivity. The military and defense segment continues to be a significant adopter, with a focus on enhancing soldier performance and survivability on the battlefield. This sustained demand, coupled with ongoing innovation, paints a very promising picture for the future of the wearable robots market.

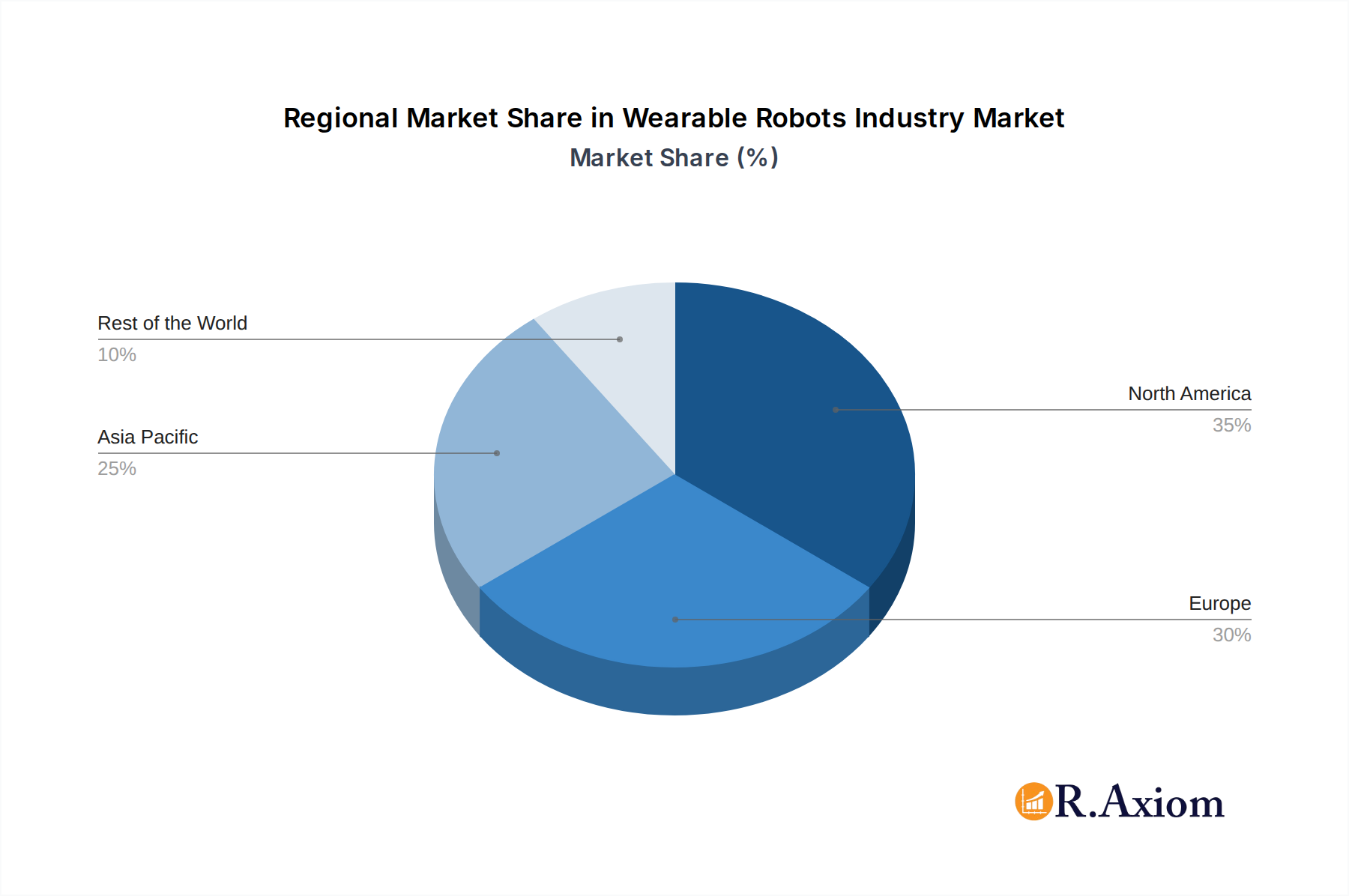

Dominant Markets & Segments in Wearable Robots Industry

The wearable robots industry is characterized by distinct regional dominance and segment preferences, reflecting varying levels of technological adoption, investment, and specific end-user needs. North America, particularly the United States, currently holds a leading position in the market, driven by substantial government funding for defense and healthcare research, a highly developed technological infrastructure, and a strong presence of key industry players. Economic policies encouraging innovation and the rapid adoption of advanced technologies further bolster its dominance.

Type: Powered Exoskeletons

- Dominance: Powered exoskeletons represent the largest and fastest-growing segment within the wearable robots market. Their advanced capabilities, offering active assistance and rehabilitation, make them highly sought after in healthcare and military applications.

- Key Drivers:

- Healthcare: Increasing incidence of neurological disorders, aging populations, and a growing demand for advanced rehabilitation solutions. The ability of powered exoskeletons to restore mobility and improve the quality of life for individuals with paralysis, stroke, and other mobility impairments is a significant driver.

- Military & Defense: The need to enhance soldier strength, endurance, and load-carrying capacity on the battlefield. These exoskeletons are crucial for reducing fatigue and preventing injuries in demanding combat environments.

- Technological Advancements: Continuous improvements in actuator technology, battery life, control systems, and sensor integration are making powered exoskeletons more effective, user-friendly, and affordable.

End-user Industry: Healthcare

- Dominance: The healthcare sector is a primary driver of growth and adoption for wearable robots. The therapeutic benefits and potential for patient recovery are immense, making it a focal point for innovation and investment.

- Key Drivers:

- Rehabilitation: Wearable robots are transforming rehabilitation for individuals with spinal cord injuries, stroke, traumatic brain injuries, and other neurological conditions. They provide consistent, controlled movements, aiding in motor relearning and functional recovery.

- Assistive Devices: For individuals with chronic mobility issues, these robots offer a means of regaining independence and participating more fully in daily life.

- Cost-Effectiveness: While initial costs can be high, the long-term benefits of improved patient outcomes and reduced reliance on human caregivers can lead to significant cost savings in healthcare systems.

- Technological Integration: The seamless integration of wearable robots with other healthcare technologies, such as diagnostic tools and therapeutic software, further enhances their value.

The industrial segment is also experiencing significant growth, driven by the need to improve worker safety and reduce workplace injuries. Powered exoskeletons designed for industrial use can assist workers in lifting heavy loads, performing repetitive tasks, and maintaining awkward postures, thereby minimizing the risk of musculoskeletal disorders. The military and defense sector is a consistent adopter, focusing on enhancing soldier performance and resilience. Other end-user industries, including logistics and manufacturing, are exploring the potential of wearable robots for augmenting human capabilities and increasing operational efficiency.

Wearable Robots Industry Product Developments

The wearable robots industry is abuzz with innovation, continually pushing the boundaries of human augmentation and assistive technology. Recent product developments focus on enhancing the user experience through lighter, more flexible designs, improved battery life, and intuitive AI-powered control systems. Companies are developing specialized exoskeletons for a wider range of applications, from precise surgical assistance to robust load-carrying for industrial workers. The integration of advanced sensors and feedback mechanisms allows for a more natural and responsive interaction between the user and the robot, making these devices increasingly effective and user-friendly. Competitive advantages are being built through superior ergonomic design, enhanced mobility, and tailored solutions for specific end-user needs, ensuring greater market adoption and impact.

Report Scope & Segmentation Analysis

This report meticulously analyzes the global wearable robots market, segmenting it based on critical parameters to provide a comprehensive understanding of its landscape.

Type: The market is divided into Powered Exoskeletons, which actively assist movement through powered actuators, and Passive Exoskeletons, which provide support and reduce load without active propulsion. Powered exoskeletons are projected to dominate due to their advanced capabilities, while passive versions cater to specific needs for support and fatigue reduction, exhibiting steady growth.

End-user Industry: Key segments include Healthcare, where wearable robots are revolutionizing rehabilitation and assistive care; Military and Defense, focusing on soldier augmentation and operational enhancement; Industrial, addressing worker safety and productivity in manufacturing and logistics; and Other End-user Industries, encompassing fields like entertainment and personal assistance. Healthcare is anticipated to be the largest and fastest-growing segment, followed closely by industrial applications.

Key Drivers of Wearable Robots Industry Growth

The growth of the wearable robots industry is propelled by several interconnected factors. Technological advancements, particularly in artificial intelligence, robotics, and materials science, are enabling the development of more sophisticated, lighter, and user-friendly devices. The increasing prevalence of age-related mobility issues and neurological conditions globally fuels demand for rehabilitative and assistive exoskeletons in the healthcare sector. Furthermore, the imperative to enhance worker safety and productivity in physically demanding industries, coupled with stringent regulations aimed at preventing workplace injuries, is driving adoption in the industrial sector. Government initiatives and funding, especially in defense and healthcare research, also play a crucial role in fostering innovation and market expansion.

Challenges in the Wearable Robots Industry Sector

Despite the promising growth trajectory, the wearable robots industry faces several significant challenges. High manufacturing costs and the initial purchase price of sophisticated exoskeletons can be prohibitive for many individuals and smaller organizations, impacting market penetration. Regulatory hurdles, particularly in the medical device sector, require extensive testing and approval processes, which can be time-consuming and costly. Public perception and user acceptance, especially concerning comfort, aesthetics, and the perceived "cyborg-like" nature of some devices, can also pose barriers to widespread adoption. Furthermore, ensuring the long-term reliability, durability, and ease of maintenance of these complex systems remains an ongoing concern for manufacturers and end-users alike.

Emerging Opportunities in Wearable Robots Industry

The wearable robots industry is ripe with emerging opportunities driven by continuous innovation and expanding applications. The integration of advanced AI and machine learning algorithms is paving the way for highly personalized and adaptive robotic assistance, tailored to individual user needs and environmental conditions. Growth in remote healthcare and telemedicine presents a significant opportunity for wearable robots to facilitate home-based rehabilitation and remote patient monitoring. Furthermore, the exploration of new markets, such as the development of exoskeletons for rehabilitation in emerging economies and the integration of wearable robotics in augmented reality experiences, offers substantial untapped potential. Consumer demand for solutions that enhance personal well-being and physical capabilities is also a growing area of opportunity.

Leading Players in the Wearable Robots Industry Market

- Lockheed Martin Corporation

- Hocoma AG (DIH International Ltd)

- Sarcos Corporation

- Ekso Bionics Holdings Inc

- Technaid S L

- Cyberdyne Inc

- Skelex

- ATOUN Inc

- Honda Motor Co Ltd

- ReWalk Robotics Inc

Key Developments in Wearable Robots Industry Industry

- November 2021: ReWalk Robotics Ltd received a 'Breakthrough Designation' from the FDA for its ReBoot, battery-powered orthotic exo-suit, designed to assist ambulatory functions in individuals with reduced ankle function related to neurological injuries, such as stroke. It is intended for home and community use.

- March 2021: DIH International Limited, the parent company of Hocomo, partnered with Reha technology to distribute the rehabilitation robotics products developed by the latter in Switzerland, Germany, and the United States. The products are end-effector-based gait therapy devices for lower extremities rehabilitation.

Strategic Outlook for Wearable Robots Industry Market

The strategic outlook for the wearable robots industry is overwhelmingly positive, characterized by sustained innovation, increasing market penetration, and expanding application areas. Continued investment in research and development, particularly in AI-driven control systems and advanced materials, will be crucial for unlocking new functionalities and enhancing user experience. Strategic partnerships and collaborations between technology developers, healthcare providers, and industrial end-users will further accelerate market adoption. The growing awareness of the benefits of wearable robots in improving human capabilities and quality of life, coupled with favorable economic and regulatory environments, positions the industry for significant long-term growth and transformative impact across multiple sectors.

Wearable Robots Industry Segmentation

-

1. Type

- 1.1. Powered Exoskeletons

- 1.2. Passive Exoskeletons

-

2. End-user Industry

- 2.1. Healthcare

- 2.2. Military and Defense

- 2.3. Industrial

- 2.4. Other End-user Industries

Wearable Robots Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Wearable Robots Industry Regional Market Share

Geographic Coverage of Wearable Robots Industry

Wearable Robots Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 32.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Robotic Rehabilitation in Healthcare Industry; Growing Investment in the Development of the Exoskeleton Technology

- 3.3. Market Restrains

- 3.3.1. High Cost of the Equipment

- 3.4. Market Trends

- 3.4.1. Healthcare is Expected to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Powered Exoskeletons

- 5.1.2. Passive Exoskeletons

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Healthcare

- 5.2.2. Military and Defense

- 5.2.3. Industrial

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Powered Exoskeletons

- 6.1.2. Passive Exoskeletons

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Healthcare

- 6.2.2. Military and Defense

- 6.2.3. Industrial

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Powered Exoskeletons

- 7.1.2. Passive Exoskeletons

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Healthcare

- 7.2.2. Military and Defense

- 7.2.3. Industrial

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Powered Exoskeletons

- 8.1.2. Passive Exoskeletons

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Healthcare

- 8.2.2. Military and Defense

- 8.2.3. Industrial

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Wearable Robots Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Powered Exoskeletons

- 9.1.2. Passive Exoskeletons

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Healthcare

- 9.2.2. Military and Defense

- 9.2.3. Industrial

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Lockheed Martin Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hocoma AG (DIH International Ltd )

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sarcos Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ekso Bionics Holdings Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Technaid S L

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Cyberdyne Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Skelex

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ATOUN Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Honda Motor Co Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 ReWalk Robotics Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Lockheed Martin Corporation

List of Figures

- Figure 1: Global Wearable Robots Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Wearable Robots Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Wearable Robots Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Wearable Robots Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Rest of the World Wearable Robots Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Rest of the World Wearable Robots Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Wearable Robots Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Wearable Robots Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Wearable Robots Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Wearable Robots Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Wearable Robots Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wearable Robots Industry?

The projected CAGR is approximately 32.05%.

2. Which companies are prominent players in the Wearable Robots Industry?

Key companies in the market include Lockheed Martin Corporation, Hocoma AG (DIH International Ltd ), Sarcos Corporation, Ekso Bionics Holdings Inc, Technaid S L, Cyberdyne Inc, Skelex, ATOUN Inc, Honda Motor Co Ltd, ReWalk Robotics Inc.

3. What are the main segments of the Wearable Robots Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Robotic Rehabilitation in Healthcare Industry; Growing Investment in the Development of the Exoskeleton Technology.

6. What are the notable trends driving market growth?

Healthcare is Expected to Hold a Significant Share.

7. Are there any restraints impacting market growth?

High Cost of the Equipment.

8. Can you provide examples of recent developments in the market?

November 2021 - Rewalk Robotics Ltd received a 'Breakthrough Designation' from the FDA for its ReBoot, battery-powered orthotic exo-suit, designed to assist ambulatory functions in individuals with reduced ankle function related to neurological injuries, such as stroke. It is intended for home and community use.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wearable Robots Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wearable Robots Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wearable Robots Industry?

To stay informed about further developments, trends, and reports in the Wearable Robots Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence