Key Insights

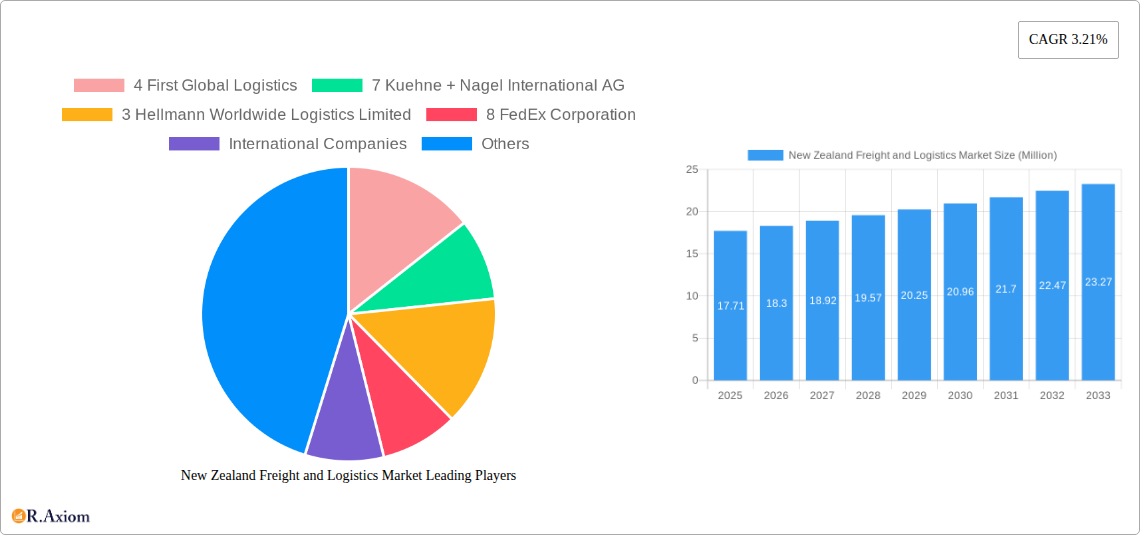

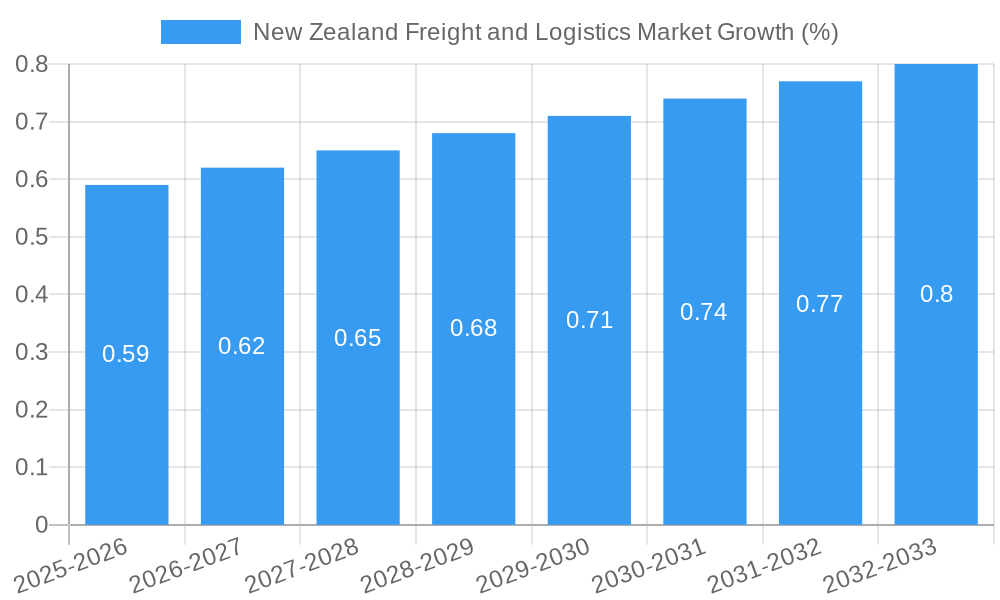

The New Zealand freight and logistics market, valued at $17.71 million in 2025, is projected to experience steady growth, driven by a Compound Annual Growth Rate (CAGR) of 3.21% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning e-commerce sector significantly contributes to increased demand for efficient delivery and warehousing solutions. Furthermore, growth in key sectors like manufacturing, automotive, and construction fuels the need for robust logistics networks. The increasing focus on supply chain optimization and the adoption of advanced technologies like automation and data analytics are also major drivers. While the market faces some constraints, such as infrastructure limitations in certain regions and labor shortages, these are expected to be mitigated by ongoing investments in infrastructure development and the implementation of innovative solutions. The market is segmented by function (freight transport, freight forwarding, warehousing, value-added services) and end-user (manufacturing, automotive, oil and gas, agriculture, construction, distributive trade, and others). Leading players include both international giants like DHL and Kuehne + Nagel, and established local companies like Mainfreight and Toll Group, fostering a competitive landscape that further drives innovation and service enhancement. The forecast period of 2025-2033 suggests a continued upward trajectory for the market, with potential for accelerated growth depending on government policy, technological advancements, and overall economic conditions.

The competitive landscape involves a mix of global logistics giants and strong domestic players. This dynamic interplay ensures that New Zealand businesses have access to a wide range of services, from sophisticated global supply chain management solutions to specialized local expertise. The diversification of the end-user segments suggests a relatively resilient market, less vulnerable to shocks impacting single sectors. However, understanding the specific growth rates within each segment will be critical for strategic business planning. Further analysis should focus on the interplay between technological advancements (such as autonomous vehicles and drone delivery) and regulatory frameworks to better assess the market's long-term potential and associated risks. The continued focus on sustainability and environmentally friendly practices within the logistics industry will also shape future market dynamics.

New Zealand Freight and Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the New Zealand freight and logistics market, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report is essential for industry stakeholders, investors, and anyone seeking a detailed understanding of this dynamic market.

New Zealand Freight and Logistics Market Market Concentration & Innovation

The New Zealand freight and logistics market exhibits a moderately concentrated structure, with a mix of large multinational corporations and smaller, locally established players. While precise market share data for individual companies fluctuates yearly, Mainfreight Limited consistently holds a significant share, followed by Freightways Ltd and other international giants like FedEx Corporation and DSV. Smaller players like Carrolls Cartage Limited and Online Distribution Ltd cater to niche segments. The market’s concentration ratio (CR) for the top 5 players is estimated at approximately xx% in 2025.

Innovation within the sector is driven by several factors:

- Technological advancements: Adoption of automation (robotics, AI), telematics, and blockchain technology for improved efficiency and tracking.

- E-commerce boom: Increased demand for last-mile delivery solutions and efficient warehousing capabilities.

- Sustainability concerns: Growing emphasis on green logistics solutions, including electric vehicles and optimized routing.

Regulatory frameworks, such as those related to road transport and safety, significantly influence market operations. Product substitutes, primarily focused on improving efficiency and reducing costs, are constantly emerging. End-user trends shift towards greater supply chain transparency and reliability.

Mergers and acquisitions (M&A) activity is noteworthy. Recent transactions, such as Qube Holding's acquisition of Kalari (May 2023) and Lineage Logistics’ acquisition of Grupo Fuentes and CNS (August 2022), demonstrate a consolidation trend within the industry. The total value of M&A deals in the New Zealand freight and logistics market during 2019-2024 is estimated at approximately $xx Million, with an average deal size of $xx Million.

New Zealand Freight and Logistics Market Industry Trends & Insights

The New Zealand freight and logistics market is experiencing robust growth, driven by several key trends. The increasing volume of e-commerce shipments fuels demand for efficient last-mile delivery solutions, while the country's geographically dispersed population necessitates strong warehousing and transportation networks. The CAGR for the market from 2019-2024 is estimated at xx%, projected to reach xx% from 2025 to 2033. This growth is influenced by several factors:

- Economic expansion: Continued growth in key sectors like manufacturing and agriculture contributes to increased freight volumes.

- Infrastructure development: Investments in port infrastructure and road networks enhance logistics capabilities.

- Technological disruptions: Adoption of automation and data analytics improves efficiency and reduces costs.

- Rising consumer expectations: Demands for faster and more reliable delivery services push innovation within the industry.

- Government policies: Initiatives promoting sustainable transport and efficient supply chains influence market dynamics.

Competitive dynamics are shaped by the presence of both large multinational players and smaller, specialized companies. Larger firms leverage economies of scale, while smaller players focus on niche markets and personalized service. Market penetration of technological advancements varies across segments. For example, the adoption rate of automated warehousing solutions is high in the FMCG segment.

Dominant Markets & Segments in New Zealand Freight and Logistics Market

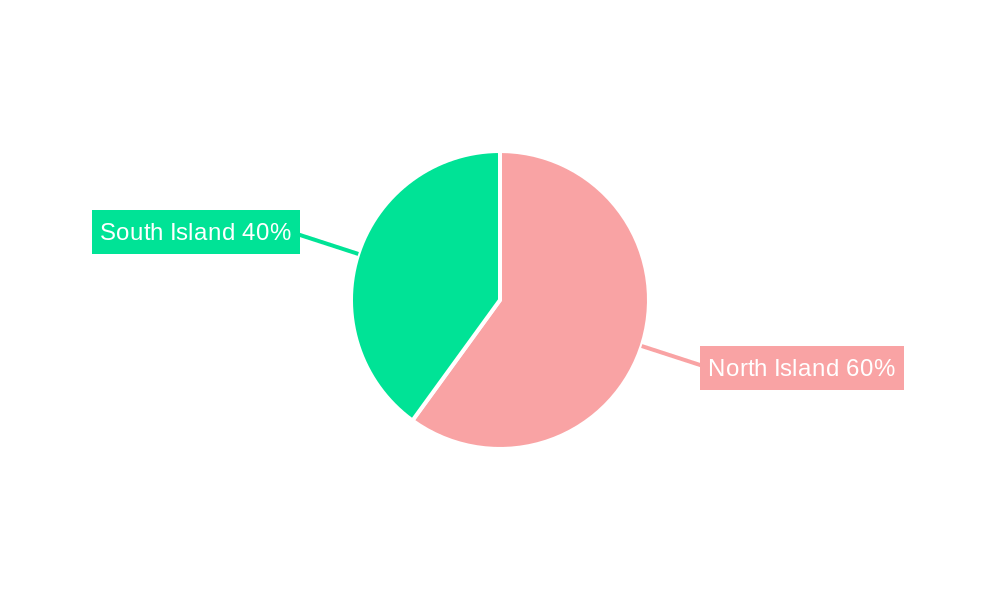

The New Zealand freight and logistics market is geographically diversified but presents specific segmental dominance:

Dominant Function: Freight Transport remains the most substantial segment, followed by warehousing. Freight forwarding is also substantial, driven by international trade. Value-added services are witnessing growth with rising demand for specialized logistics solutions.

Dominant End-User: The distributive trade (wholesale and retail, including FMCG) is the dominant end-user segment, largely due to e-commerce growth. This segment's substantial contribution to GDP drives consistent demand. The manufacturing and automotive segments also show significant contributions.

Key Drivers for Dominance:

- Economic policies: Government support for infrastructure development and export promotion fuels growth across multiple segments.

- Infrastructure: Investments in ports, airports, and road networks directly impact freight transport and warehousing.

- Consumer behavior: Changing consumer preferences (e.g., increased online shopping) shape demand for specific services.

- Regional development: Growth in specific regions directly correlates to demand for logistics services within those areas.

New Zealand Freight and Logistics Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and customer experience. This includes the introduction of sophisticated warehouse management systems (WMS), route optimization software, and environmentally friendly transportation options. Companies compete by offering tailored solutions to specific industry needs, using technology to achieve competitive advantage through speed, tracking, and cost-effectiveness. The integration of AI and machine learning is becoming a significant differentiator, enabling predictive analytics and optimized resource allocation.

Report Scope & Segmentation Analysis

This report segments the New Zealand freight and logistics market based on function (Freight Transport, Rail, Freight Forwarding, Warehousing, Value-added Services, and Other Functions) and end-user (Manufacturing and Automotive, Oil and Gas, Mining and Quarrying, Agriculture, Fishing and Forestry, Construction, Distributive Trade (including FMCG), and Other End-Users). Each segment's growth projections, market size, and competitive dynamics are analyzed separately. Market sizes for each segment are provided for the historical period (2019-2024), the estimated year (2025), and the forecast period (2025-2033), with growth rates projected based on current trends. Competitive analysis includes the assessment of key players' strategies, market shares, and competitive advantages within each segment.

Key Drivers of New Zealand Freight and Logistics Market Growth

Several factors contribute to the growth of the New Zealand freight and logistics market:

- E-commerce expansion: The rapid growth of online retail requires efficient last-mile delivery solutions, driving market expansion.

- Infrastructure improvements: Investments in port and road infrastructure enhance transportation efficiency.

- Technological advancements: Automation and digitalization improve operational efficiency and reduce costs.

- Government regulations: Policies promoting sustainable logistics practices encourage innovation and market growth.

- Economic diversification: Growth across multiple sectors leads to increased demand for logistics services.

Challenges in the New Zealand Freight and Logistics Market Sector

The industry faces several challenges:

- Infrastructure limitations: Existing infrastructure, especially in certain regions, sometimes struggles to keep pace with demand. This leads to increased costs and delays.

- Skills shortage: A lack of skilled labor in certain areas of logistics operations poses constraints on industry growth.

- Supply chain disruptions: Global events such as the COVID-19 pandemic highlight the vulnerability of supply chains and the need for greater resilience.

- Regulatory complexity: Navigating various regulations across different modes of transport can prove complex and increase costs for operators.

Emerging Opportunities in New Zealand Freight and Logistics Market

Significant opportunities exist for businesses in the New Zealand freight and logistics market:

- Sustainable logistics: Growing focus on reducing the environmental impact of transportation presents opportunities for green logistics solutions.

- Technology adoption: Further investment in automation, AI, and data analytics offers considerable potential for efficiency improvements.

- Specialized services: Catering to niche industries or providing value-added services offers market differentiation.

- Cross-border e-commerce: The expansion of e-commerce across borders presents opportunities for companies specializing in international shipping and logistics.

Leading Players in the New Zealand Freight and Logistics Market Market

- First Global Logistics

- Kuehne + Nagel International AG

- Hellmann Worldwide Logistics Limited

- FedEx Corporation

- DSV

- Freightways Ltd

- Online Distribution Ltd

- Mainfreight Limited

- Agility Logistics Pvt Ltd

- New Zealand Post Ltd

- Carrolls Cartage Limited

- Cardinal Logistics

- TIL Logistics Group Limited

- Deutsche Post DHL Group

- Bollore Logistics

- Nexus Logistics

- Goddards Cartage

- March Logistics (NZ) Ltd

- PBT

- Mondiale Freight Services Ltd

- Owens Transport Ltd

- Fliway Group Ltd

- Scales Logistics

- Crown Worldwide

- BPW Transport

- Efficiency NZ Ltd

- Champion Freight

- Central Transport Limited

- Charter Transport

- Rohlig New Zealand Limited

- Malcolm Total Logistics

- Burnard International Limited

- Alderson Bulk Lines Limited

- DB Schenker

- Toll Group

- K&S Corporation Limited

- Linfox Pty Ltd

- CEVA Logistics

- Yusen Logistics Co Ltd

Key Developments in New Zealand Freight and Logistics Market Industry

- May 2023: Qube Holdings acquired a 50% stake in Pinnacle Corporation and 100% of Kalari, significantly impacting the mining and resources logistics sector.

- August 2022: Lineage Logistics' acquisition of Grupo Fuentes and CNS expanded its cold chain presence in New Zealand, impacting the food and beverage logistics.

Strategic Outlook for New Zealand Freight and Logistics Market Market

The New Zealand freight and logistics market holds significant future potential. Continued e-commerce growth, infrastructure investments, and technological advancements will drive market expansion. Companies that effectively adapt to changing consumer demands, embrace sustainable practices, and leverage technological innovations will be best positioned for success. The focus on improving supply chain resilience and efficiency will be crucial for sustained growth.

New Zealand Freight and Logistics Market Segmentation

-

1. Function

-

1.1. Freight Transport

- 1.1.1. Road

- 1.1.2. Shipping and Inland Water

- 1.1.3. Air

- 1.1.4. Rail

- 1.2. Freight Forwarding

- 1.3. Warehousing

- 1.4. Value-added Services and Other Functions

-

1.1. Freight Transport

-

2. End-User

- 2.1. Manufacturing and Automotive

- 2.2. Oil and Gas, Mining, and Quarrying

- 2.3. Agriculture, Fishing, and Forestry

- 2.4. Construction

- 2.5. Distribu

- 2.6. Other En

New Zealand Freight and Logistics Market Segmentation By Geography

- 1. New Zealand

New Zealand Freight and Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in global trade activites; Increase in infrastrustrure and construction

- 3.3. Market Restrains

- 3.3.1. Long distances and sometimes difficult terrain can contribute to increased transportation costs

- 3.4. Market Trends

- 3.4.1. Increase in cross-border trade driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. New Zealand Freight and Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Function

- 5.1.1. Freight Transport

- 5.1.1.1. Road

- 5.1.1.2. Shipping and Inland Water

- 5.1.1.3. Air

- 5.1.1.4. Rail

- 5.1.2. Freight Forwarding

- 5.1.3. Warehousing

- 5.1.4. Value-added Services and Other Functions

- 5.1.1. Freight Transport

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Oil and Gas, Mining, and Quarrying

- 5.2.3. Agriculture, Fishing, and Forestry

- 5.2.4. Construction

- 5.2.5. Distribu

- 5.2.6. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Function

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 4 First Global Logistics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 7 Kuehne + Nagel International AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 3 Hellmann Worldwide Logistics Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 8 FedEx Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 International Companies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 10 DSV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 9 Freightways Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 8 Online Distribution Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 1 Mainfreight Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 5 Agility Logistics Pvt Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 10 New Zealand Post Ltd *

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3 Carrolls Cartage Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Other Companies (Key Information/Overview)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 2 Cardinal Logistics

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 5 TIL Logistics Group Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 1 Deutsche Post DHL Group

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 1 Bollore Logistics Nexus Logistics Goddards Cartage March Logistics (NZ) Ltd PBT Mondiale Freight Services Ltd Owens Transport Ltd Fliway Group Ltd Scales Logistics Crown Worldwide BPW Transport Efficiency NZ Ltd Champion Freight Central Transport Limited Charter Transport Rohlig New Zealand Limited Malcolm Total Logistics Burnard International Limited Alderson Bulk Lines Limited*List Not Exhaustive

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 9 DB Schenker

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 6 Toll Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 7 K&S Corporation Limited

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 6 Linfox Pty Ltd

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Local Companies

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 4 CEVA Logistics

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 2 Yusen Logistics Co Ltd

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.1 4 First Global Logistics

List of Figures

- Figure 1: New Zealand Freight and Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: New Zealand Freight and Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: New Zealand Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: New Zealand Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 3: New Zealand Freight and Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: New Zealand Freight and Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: New Zealand Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: New Zealand Freight and Logistics Market Revenue Million Forecast, by Function 2019 & 2032

- Table 7: New Zealand Freight and Logistics Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: New Zealand Freight and Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the New Zealand Freight and Logistics Market?

The projected CAGR is approximately 3.21%.

2. Which companies are prominent players in the New Zealand Freight and Logistics Market?

Key companies in the market include 4 First Global Logistics, 7 Kuehne + Nagel International AG, 3 Hellmann Worldwide Logistics Limited, 8 FedEx Corporation, International Companies, 10 DSV, 9 Freightways Ltd, 8 Online Distribution Ltd, 1 Mainfreight Limited, 5 Agility Logistics Pvt Ltd, 10 New Zealand Post Ltd *, 3 Carrolls Cartage Limited, Other Companies (Key Information/Overview), 2 Cardinal Logistics, 5 TIL Logistics Group Limited, 1 Deutsche Post DHL Group, 1 Bollore Logistics Nexus Logistics Goddards Cartage March Logistics (NZ) Ltd PBT Mondiale Freight Services Ltd Owens Transport Ltd Fliway Group Ltd Scales Logistics Crown Worldwide BPW Transport Efficiency NZ Ltd Champion Freight Central Transport Limited Charter Transport Rohlig New Zealand Limited Malcolm Total Logistics Burnard International Limited Alderson Bulk Lines Limited*List Not Exhaustive, 9 DB Schenker, 6 Toll Group, 7 K&S Corporation Limited, 6 Linfox Pty Ltd, Local Companies, 4 CEVA Logistics, 2 Yusen Logistics Co Ltd.

3. What are the main segments of the New Zealand Freight and Logistics Market?

The market segments include Function, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in global trade activites; Increase in infrastrustrure and construction.

6. What are the notable trends driving market growth?

Increase in cross-border trade driving the market.

7. Are there any restraints impacting market growth?

Long distances and sometimes difficult terrain can contribute to increased transportation costs.

8. Can you provide examples of recent developments in the market?

May 2023: Australia-based logistics company Qube Holdings acquired a 50% stake in New Zealand’s Pinnacle Corporation and 100% of Kalari. Qube acquired Kalari from Swire Investments (Australia). Kalari is a leading logistics provider to the Australian mining and resources industry, specializing in on-road and remote bulk haulage through a fleet of predominantly performance-based standards vehicles, materials handling, and supply chain optimization.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "New Zealand Freight and Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the New Zealand Freight and Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the New Zealand Freight and Logistics Market?

To stay informed about further developments, trends, and reports in the New Zealand Freight and Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence