Key Insights

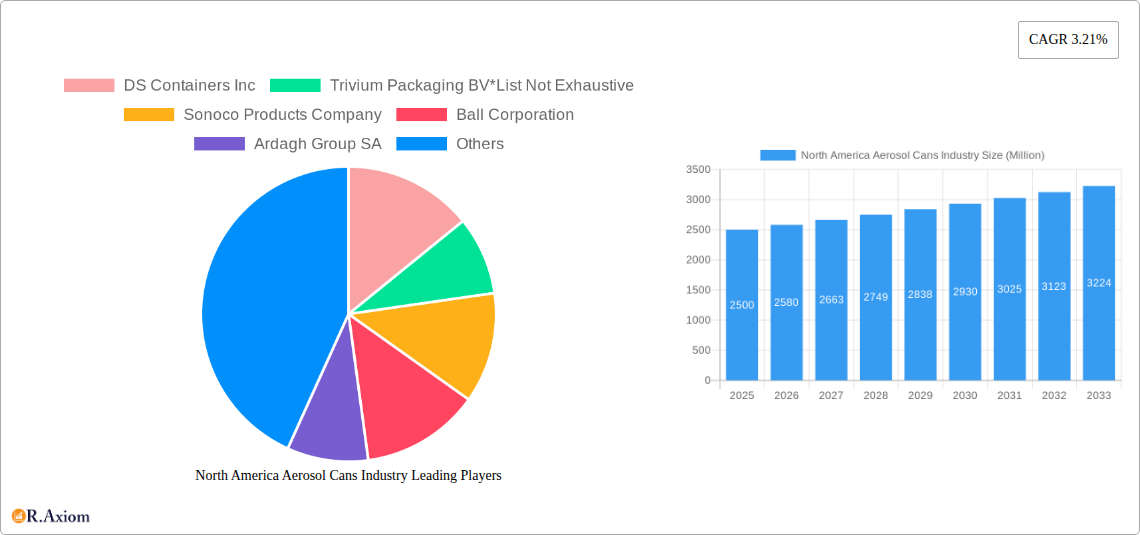

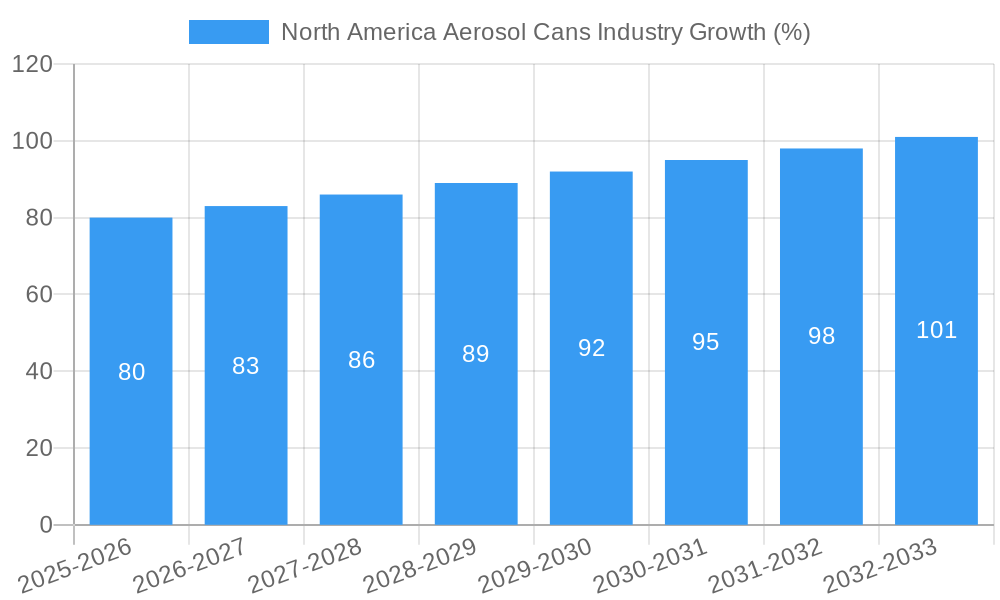

The North American aerosol can market, valued at approximately $XX million in 2025, is projected to experience steady growth, driven by increasing demand across diverse end-use industries. The 3.21% CAGR indicates a consistent expansion, primarily fueled by the robust cosmetic and personal care sector, encompassing deodorants, hairsprays, and other aerosol products. The rise in consumer preference for convenient and efficient packaging formats further boosts market demand. Growth in the pharmaceutical/veterinary and automotive/industrial segments also contributes to the overall market expansion. While the specific market size for 2019-2024 is unavailable, the provided data suggests consistent growth within this period, leading to the 2025 valuation. Geographic concentration within North America, specifically the United States and Canada, signifies a significant market opportunity in this region. The preference for aluminum and steel-tinplate materials underscores the material selection considerations influencing market dynamics. Competitive intensity is evident with key players like Ball Corporation, Crown Holdings Inc., and others vying for market share. However, potential restraints, such as environmental concerns related to aerosol propellants and increasing raw material costs, could influence future growth trajectory. Nevertheless, innovations in sustainable packaging materials and propellants may mitigate these challenges and sustain the market's positive growth outlook.

The forecast period (2025-2033) anticipates continued growth, albeit at a pace influenced by macroeconomic factors and industry-specific trends. The dominance of the United States and Canada within the North American market suggests a strong focus on these key regions for manufacturers. Further segmentation analysis, possibly by considering specific product types within each end-user industry and a detailed breakdown of material usage, would provide a more granular understanding of market dynamics. Analyzing consumer behavior and preferences related to eco-friendly packaging options would also contribute towards a more nuanced market outlook. Companies should focus on strategic partnerships, product diversification, and investment in sustainable technologies to maintain a competitive edge in this evolving market landscape.

This detailed report provides a comprehensive analysis of the North America aerosol cans industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors.

North America Aerosol Cans Industry Market Concentration & Innovation

The North American aerosol cans market exhibits a moderately concentrated landscape, with several major players commanding significant market share. While precise market share figures for each company are proprietary data, we can estimate that the top 10 players account for approximately xx% of the total market value (2025). This concentration is driven by significant economies of scale, substantial investments in R&D, and extensive distribution networks. However, the market is not without competition, with smaller niche players focusing on specialized applications or sustainable materials gaining traction.

Key factors influencing market concentration and innovation:

- Mergers & Acquisitions (M&A): The industry has witnessed several significant M&A activities in recent years, with deal values ranging from xx Million to xx Million, further shaping the competitive landscape and driving consolidation.

- Regulatory Frameworks: Environmental regulations concerning propellant gases and material recyclability significantly impact innovation and manufacturing processes. Compliance costs and the need to adapt to stringent rules are driving innovation in sustainable materials and production technologies.

- Product Substitutes: While aerosol cans remain the dominant packaging format for many products, alternatives like pump sprays, pouches, and sticks are exerting competitive pressure, especially in segments focused on eco-friendly alternatives.

- End-User Trends: The growing demand for convenient and portable packaging, coupled with consumer preferences for sustainable and recyclable options, presents both opportunities and challenges for manufacturers.

- Technological Advancements: Developments in can design, manufacturing processes, and propellant technology are constantly enhancing the functionality, performance, and sustainability of aerosol cans.

North America Aerosol Cans Industry Industry Trends & Insights

The North American aerosol cans market is poised for steady growth throughout the forecast period (2025-2033), driven by robust demand across various end-use industries. The Compound Annual Growth Rate (CAGR) is estimated to be xx% during this period. This growth is fueled by several key factors:

- Expanding Cosmetic and Personal Care Sector: Increased consumer spending on beauty and personal care products is a primary driver, with aerosol packaging being favored for its convenient dispensing of hairsprays, deodorants, and other products. Market penetration in this segment is already high, but growth is expected from premiumization and the introduction of innovative formulations.

- Technological Disruptions: The development and adoption of sustainable materials (e.g., recycled aluminum and steel), along with improvements in manufacturing processes, are boosting the industry's efficiency and reducing environmental impact. These advancements are influencing consumer choices, particularly amongst environmentally conscious segments.

- Consumer Preferences: The demand for convenient and portable packaging continues to drive sales. This is reinforced by trends like on-the-go lifestyles and increased participation in outdoor activities. A shift towards premium and specialty aerosol products is also observed, driving value growth.

- Competitive Dynamics: The market remains competitive, with established players constantly innovating to maintain their market share and new entrants focusing on niche segments. This competitive landscape pushes for better product quality, innovation, and sustainable practices.

Dominant Markets & Segments in North America Aerosol Cans Industry

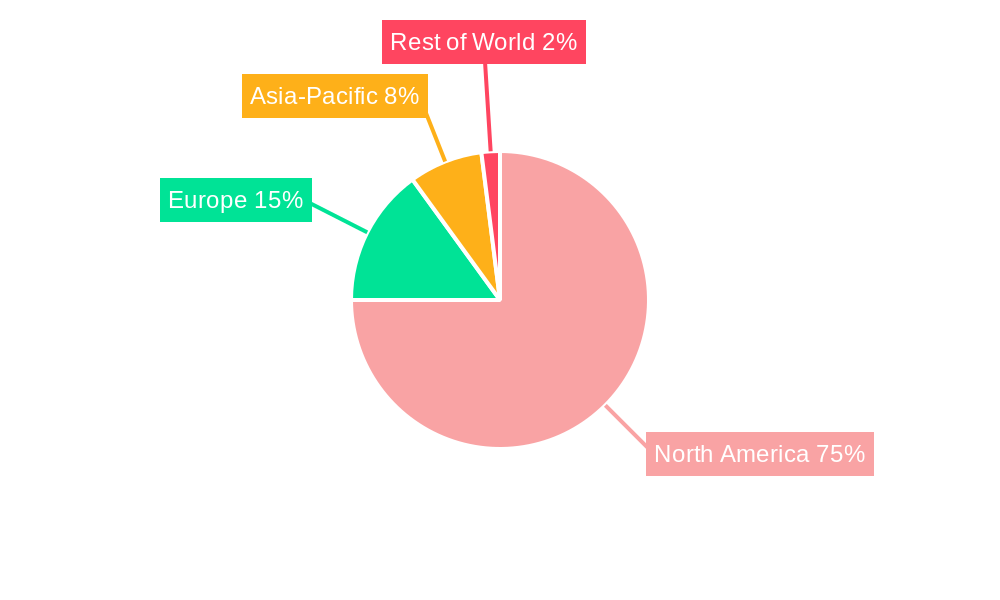

The United States dominates the North American aerosol cans market, accounting for a significantly larger share than Canada. This dominance is largely due to the larger population, higher per capita consumption of aerosol products, and a more developed manufacturing base.

Dominance Factors:

United States: Strong consumer demand, well-established supply chains, and a larger base of manufacturers contribute to US market dominance. Further growth is expected from the expansion of e-commerce and personalized product offerings.

Canada: While smaller in overall market size, the Canadian market is characterized by a growing preference for sustainable and eco-friendly aerosol products, driving demand for innovative packaging solutions.

Leading End-User Segments:

Cosmetic and Personal Care: This segment remains the largest, accounting for approximately xx% of the market value due to the extensive use of aerosol cans in hairsprays, deodorants, and other personal care items.

Paints and Varnishes: This segment also displays significant growth potential, driven by the construction and DIY sectors.

Household: The household segment shows steady growth driven by the increased adoption of cleaning sprays and air fresheners in aerosol cans.

Material Dominance:

- Aluminum continues to dominate as the primary material due to its lightweight, malleability, and recyclability. Steel-tinplate maintains a significant presence, particularly in segments where strength and durability are crucial.

North America Aerosol Cans Industry Product Developments

Recent product innovations focus on sustainability, enhanced functionality, and improved user experience. Examples include the introduction of aerosol cans made from recycled materials, cans with integrated dispensing systems, and improved propellant technologies minimizing environmental impact. These innovations are designed to meet evolving consumer preferences and stricter environmental regulations. The integration of smart technologies for monitoring inventory or track & trace capabilities is also beginning to emerge.

Report Scope & Segmentation Analysis

This report segments the North American aerosol cans market by end-user industry (Cosmetic and Personal Care, Household, Pharmaceutical/Veterinary, Paints and Varnishes, Automotive/Industrial), by country (United States, Canada), and by material (Aluminum, Steel-Tinplate). Each segment's growth projections, market sizes, and competitive dynamics are analyzed in detail. Market size for each segment is estimated at xx Million for 2025, with specific forecasts provided for each segment up to 2033.

Key Drivers of North America Aerosol Cans Industry Growth

Several key factors are driving the growth of the North American aerosol cans industry. These include:

- Technological advancements in can design, manufacturing, and propellant technologies, enhancing efficiency, sustainability, and functionality.

- Strong consumer demand across various end-use segments, particularly in the cosmetic and personal care sector.

- Favorable economic conditions in North America, supporting consumer spending and business investment.

- Government policies promoting the use of sustainable materials and environmentally friendly manufacturing practices.

Challenges in the North America Aerosol Cans Industry Sector

Despite significant growth potential, the industry faces some challenges, such as:

- Stringent environmental regulations requiring manufacturers to adopt sustainable practices and reduce their environmental footprint.

- Fluctuations in raw material prices (aluminum, steel, and propellants) impacting profitability.

- Intense competition among established players and new entrants, resulting in pricing pressure and the need for continuous innovation.

Emerging Opportunities in North America Aerosol Cans Industry

The North American aerosol cans industry offers exciting opportunities, including:

- Growth in emerging markets: Increased demand for aerosol products in developing regions within North America provides growth opportunities.

- Innovation in sustainable packaging: Developments in recyclable and biodegradable materials offer significant market potential.

- Expansion into new applications: Aerosol technology is continuously finding new uses in various industries, broadening the market.

Leading Players in the North America Aerosol Cans Industry Market

- DS Containers Inc

- Trivium Packaging BV

- Sonoco Products Company

- Ball Corporation

- Ardagh Group SA

- ITW Sexton (Illinois Tool Works Inc)

- CCL Container Inc (CCL Industries Inc)

- Crown Holdings Inc

- Mauser Packaging Solutions (Bway Holding Company)

- Graham Packaging Company Inc

Key Developments in North America Aerosol Cans Industry Industry

November 2023: Kano Laboratories launched an innovative 13-ounce aerosol spray can with an integrated straw for its Aerokroil penetrant line. This improves product usability and enhances market competitiveness.

September 2023: Aptar introduced a new range of aerosol actuators eliminating overcaps, enhancing convenience and reducing leakage. This innovation addresses consumer preferences for ease of use and product safety.

Strategic Outlook for North America Aerosol Cans Industry Market

The North American aerosol cans market is expected to experience continued growth, driven by technological advancements, evolving consumer preferences, and increasing demand across various end-use sectors. The focus on sustainability, innovation in product design and functionality, and strategic acquisitions will be key factors determining future market success. The market's future growth will depend on companies' abilities to adapt to environmental regulations and meet the evolving demands of environmentally conscious consumers.

North America Aerosol Cans Industry Segmentation

-

1. Material

- 1.1. Aluminium

- 1.2. Steel-Tinplate

-

2. End-user Industry

- 2.1. Cosmetic

- 2.2. Household

- 2.3. Pharmaceutical/Veterinary

- 2.4. Paints and Varnishes

- 2.5. Automotive/Industrial

North America Aerosol Cans Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Aerosol Cans Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.21% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand from Cosmetics Sector; Growth in Use of Automotive Lubricants

- 3.3. Market Restrains

- 3.3.1. ; Higher initial setup cost

- 3.4. Market Trends

- 3.4.1. The Automotive/Industrial Segment to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Aerosol Cans Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Aluminium

- 5.1.2. Steel-Tinplate

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Cosmetic

- 5.2.2. Household

- 5.2.3. Pharmaceutical/Veterinary

- 5.2.4. Paints and Varnishes

- 5.2.5. Automotive/Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. United States North America Aerosol Cans Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Aerosol Cans Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Aerosol Cans Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Aerosol Cans Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 DS Containers Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Trivium Packaging BV*List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Sonoco Products Company

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Ball Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ardagh Group SA

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ITW Sexton (Illinois Tool Works Inc )

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 CCL Container Inc (CCL Industries Inc )

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Crown Holdings Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Mauser Packaging Solutions (Bway Holding Company)

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Graham Packaging Company Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 DS Containers Inc

List of Figures

- Figure 1: North America Aerosol Cans Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Aerosol Cans Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Aerosol Cans Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Aerosol Cans Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 3: North America Aerosol Cans Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 4: North America Aerosol Cans Industry Volume Billion Forecast, by Material 2019 & 2032

- Table 5: North America Aerosol Cans Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: North America Aerosol Cans Industry Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: North America Aerosol Cans Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Aerosol Cans Industry Volume Billion Forecast, by Region 2019 & 2032

- Table 9: North America Aerosol Cans Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Aerosol Cans Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 11: United States North America Aerosol Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Aerosol Cans Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Aerosol Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Aerosol Cans Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Aerosol Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Aerosol Cans Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Aerosol Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Aerosol Cans Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: North America Aerosol Cans Industry Revenue Million Forecast, by Material 2019 & 2032

- Table 20: North America Aerosol Cans Industry Volume Billion Forecast, by Material 2019 & 2032

- Table 21: North America Aerosol Cans Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: North America Aerosol Cans Industry Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 23: North America Aerosol Cans Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Aerosol Cans Industry Volume Billion Forecast, by Country 2019 & 2032

- Table 25: United States North America Aerosol Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Aerosol Cans Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Aerosol Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Aerosol Cans Industry Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Aerosol Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Aerosol Cans Industry Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Aerosol Cans Industry?

The projected CAGR is approximately 3.21%.

2. Which companies are prominent players in the North America Aerosol Cans Industry?

Key companies in the market include DS Containers Inc, Trivium Packaging BV*List Not Exhaustive, Sonoco Products Company, Ball Corporation, Ardagh Group SA, ITW Sexton (Illinois Tool Works Inc ), CCL Container Inc (CCL Industries Inc ), Crown Holdings Inc, Mauser Packaging Solutions (Bway Holding Company), Graham Packaging Company Inc.

3. What are the main segments of the North America Aerosol Cans Industry?

The market segments include Material, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand from Cosmetics Sector; Growth in Use of Automotive Lubricants.

6. What are the notable trends driving market growth?

The Automotive/Industrial Segment to Drive the Market.

7. Are there any restraints impacting market growth?

; Higher initial setup cost.

8. Can you provide examples of recent developments in the market?

November 2023: Kano Laboratories, a major manufacturer of industrial specialty chemicals based in the United States, launched an innovative design for its line of industrial-strength penetrants Aerokroil with SprayTech. The new 13-ounce aerosol spray can is designed with an integrated straw, which can spray in any direction to loosen frozen and rusted metal parts quickly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Aerosol Cans Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Aerosol Cans Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Aerosol Cans Industry?

To stay informed about further developments, trends, and reports in the North America Aerosol Cans Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence