Key Insights

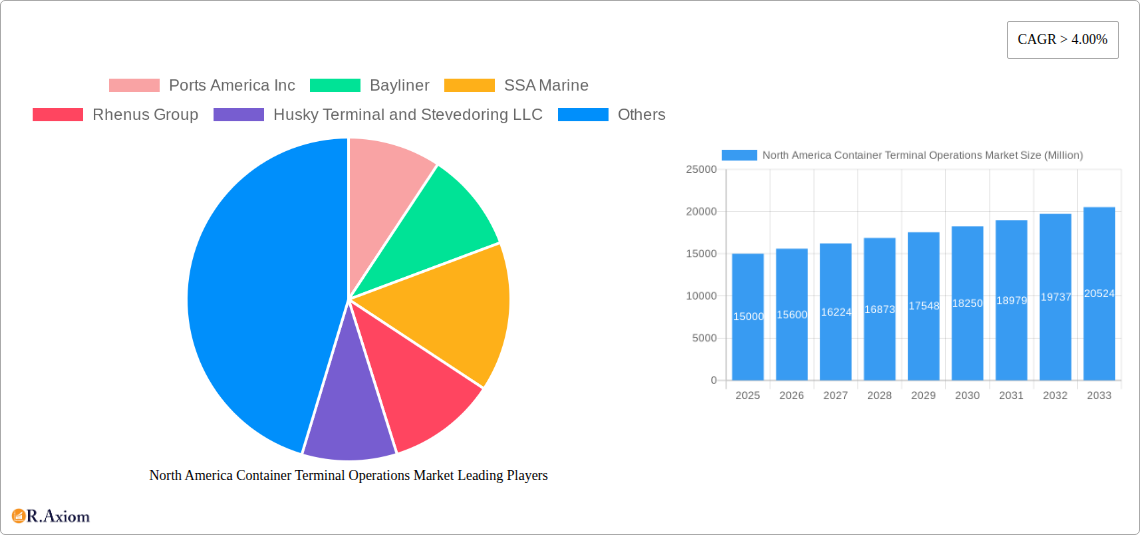

The North American Container Terminal Operations market is experiencing robust expansion, projected with a Compound Annual Growth Rate (CAGR) of 4.5%. In the base year of 2025, the market size is estimated at $213.38 billion. This growth is propelled by increasing global trade, the expansion of e-commerce, and advancements in logistics and port infrastructure. Key drivers include the rise in manufacturing and import/export activities, alongside technological innovations such as automated container handling and enhanced data analytics. Significant challenges include port congestion, labor shortages, and the need for substantial infrastructure investment. The market is primarily segmented by crude oil and dry cargo transport, with stevedoring and cargo handling as core service segments. Competition is intense, featuring global players and regional specialists. Future growth hinges on strategic investments in automation, infrastructure, and workforce development.

North America Container Terminal Operations Market Market Size (In Billion)

The forecast period of 2025-2033 anticipates sustained market growth, driven by economic stability and escalating global trade volumes. Regional variations in market activity are expected, with major port hubs on the US West and East Coasts leading the expansion. Evolving supply chain management strategies and the adoption of sustainable practices will further influence market development. Companies must embrace technological advancements and optimize operational efficiency to maintain competitiveness. The market offers significant opportunities for providers of port infrastructure, technology, and logistics services, requiring a deep understanding of evolving dynamics and a proactive approach to challenges.

North America Container Terminal Operations Market Company Market Share

This report delivers a comprehensive analysis of the North America Container Terminal Operations market from 2019 to 2033, with a detailed focus on 2025. It offers critical insights into market dynamics, growth drivers, challenges, and opportunities for stakeholders, investors, and industry professionals.

North America Container Terminal Operations Market Market Concentration & Innovation

The North America container terminal operations market exhibits moderate concentration, with several major players controlling significant market share. Ports America Inc., SSA Marine, and Mediterranean Shipping Company S.A. are among the leading operators, collectively holding an estimated xx% of the market share in 2025. However, a significant number of smaller, regional players also contribute to the overall market landscape. Innovation is driven by the need for increased efficiency, automation, and sustainability. The adoption of technologies like AI-powered terminal operating systems, automated guided vehicles (AGVs), and improved data analytics are key innovations. Regulatory frameworks, such as those related to environmental protection and port security, significantly impact market operations. Product substitutes, while limited, include alternative transportation modes like rail and trucking. However, the dominance of maritime container shipping remains robust. End-user trends towards faster delivery times and greater supply chain transparency exert significant pressure for innovation within the terminal operations sector. M&A activity in the sector has been relatively moderate in recent years, with deal values averaging around xx Million in the period 2019-2024. Consolidation is expected to continue, driven by the search for economies of scale and enhanced operational efficiency.

North America Container Terminal Operations Market Industry Trends & Insights

The North America container terminal operations market is experiencing robust growth, fueled by expanding global trade volumes and increasing e-commerce activities. The market is expected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, particularly the adoption of automation and digitization, are fundamentally reshaping terminal operations. Consumer preferences for faster and more reliable delivery times are driving demand for efficient and technologically advanced terminal services. The competitive landscape is characterized by both intense competition among established players and the emergence of new entrants offering innovative solutions. Market penetration of automated systems is growing steadily, with an estimated xx% of terminals incorporating automated technologies by 2033. The increasing focus on sustainability and reducing carbon emissions is also shaping industry trends, leading to investments in greener technologies and practices.

Dominant Markets & Segments in North America Container Terminal Operations Market

The East Coast of the United States, particularly the ports of New York/New Jersey and Savannah, represent the dominant regions within the North America container terminal operations market. These locations benefit from established infrastructure, strong economic activity, and proximity to major consumer markets.

Key Drivers for Dominance:

- Robust Economic Activity: Strong economic growth in the surrounding regions fuels high import/export volumes.

- Established Infrastructure: Well-developed port facilities and efficient hinterland connectivity are crucial.

- Government Support: Favorable government policies and investments in port infrastructure further enhance competitiveness.

Segment Dominance Analysis:

- By Cargo Type: Dry cargo consistently represents the largest segment due to the high volume of manufactured goods and consumer products shipped across North America. Crude oil and other liquid cargo segments show moderate growth influenced by fluctuating energy prices and demand.

- By Service: Stevedoring services constitute the most significant revenue generator, while cargo handling and transportation are closely intertwined and crucial segments of this market, showing a high correlation with overall market growth. 'Others' include ancillary services such as warehousing and customs brokerage.

North America Container Terminal Operations Market Product Developments

Recent product innovations focus on enhancing efficiency and automation within terminal operations. This includes the deployment of AI-powered systems for optimizing cargo flow, the use of AGVs to automate container handling, and the integration of blockchain technology to enhance supply chain transparency and security. These advancements provide significant competitive advantages by reducing operational costs, improving throughput, and enhancing overall efficiency. The market fit for these innovations is strong, driven by industry demand for greater productivity and operational excellence.

Report Scope & Segmentation Analysis

This report segments the North America container terminal operations market by cargo type (Crude Oil, Dry Cargo, Other Liquid Cargo) and by service (Stevedoring, Cargo and handling transportation, Others). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The Dry Cargo segment is projected to experience the highest growth rate, driven by increasing global trade. Stevedoring services represent the largest segment by revenue, while the “Others” segment is expected to see moderate growth fueled by increasing demand for value-added services like warehousing and customs brokerage.

Key Drivers of North America Container Terminal Operations Market Growth

Several factors drive market growth. Increased global trade volumes, particularly between Asia and North America, fuel demand for efficient terminal operations. Technological advancements, such as automation and digitization, boost efficiency and productivity. Government investments in port infrastructure and supportive regulatory frameworks create a favorable environment for market expansion. Furthermore, the rising e-commerce sector and the associated need for faster delivery times further contribute to market growth.

Challenges in the North America Container Terminal Operations Market Sector

Significant challenges hinder market growth. Congestion at major ports, leading to delays and increased costs, is a significant concern. Supply chain disruptions caused by geopolitical events and pandemics also pose risks. Intense competition among terminal operators necessitates continuous investment in infrastructure and technology to maintain market share. Environmental regulations, while necessary, also add to operational costs. These factors collectively impact profitability and efficiency within the sector. The total impact of these factors has been estimated to reduce the market growth rate by approximately xx% over the forecast period.

Emerging Opportunities in North America Container Terminal Operations Market

Emerging opportunities exist in the growing adoption of automation and digitization, creating demand for advanced technologies and services. The development of greener and more sustainable terminal operations presents significant opportunities for businesses adopting environmentally friendly technologies and practices. Expanding e-commerce activities necessitate efficient and scalable solutions for handling increased cargo volumes, providing further market expansion opportunities. Further expansion into smaller ports and inland terminals presents opportunities for diversification and growth.

Leading Players in the North America Container Terminal Operations Market Market

- Ports America Inc. www.portsamerica.com

- Bayliner

- SSA Marine www.ssamarine.com

- Rhenus Group www.rhenus.com

- Husky Terminal and Stevedoring LLC

- Viking Line www.vikingline.com

- Indiana Port Commission www.indianaports.com

- MEYER WERFT GmbH & Co KG www.meyerwerft.com

- Mississippi State Port Authority at Gulfport www.gulfportms.com/port

- Mediterranean Shipping Company S.A. www.msc.com

Key Developments in North America Container Terminal Operations Market Industry

- 2022 Q3: Ports America Inc. announced a significant investment in automated container handling equipment.

- 2023 Q1: SSA Marine partnered with a technology provider to implement an AI-powered terminal operating system.

- 2024 Q2: A major merger between two regional terminal operators consolidated market share in the Gulf Coast region. (Further details regarding merger are not available)

Strategic Outlook for North America Container Terminal Operations Market Market

The North America container terminal operations market is poised for continued growth driven by expanding global trade, technological advancements, and investments in port infrastructure. Opportunities exist in automation, sustainability, and the expansion into new markets. Companies adopting innovative technologies and strategies to enhance efficiency and operational excellence will be best positioned for success in this dynamic and competitive market. Continued investment in automation and intelligent technologies will be a key factor determining market leadership in the years to come.

North America Container Terminal Operations Market Segmentation

-

1. Service

- 1.1. Stevedoring

- 1.2. Cargo and handling transportation

- 1.3. Others

-

2. Cargo Type

- 2.1. Crude Oil

- 2.2. Dry Cargo

- 2.3. Other Liquid Cargo

- 3. US

- 4. Canada

North America Container Terminal Operations Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

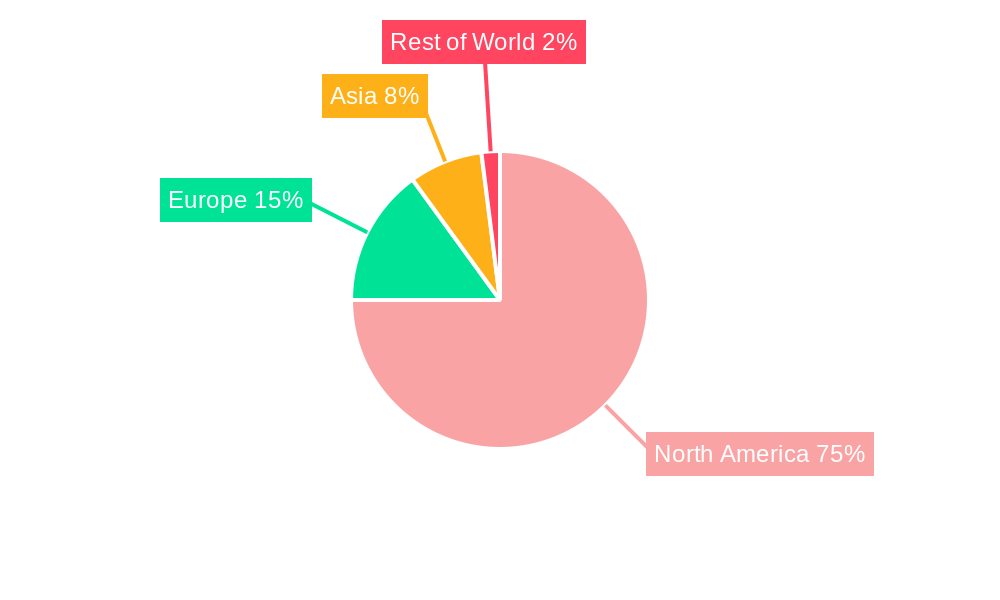

North America Container Terminal Operations Market Regional Market Share

Geographic Coverage of North America Container Terminal Operations Market

North America Container Terminal Operations Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing global trade activities; Infrastructure Development is on rise

- 3.3. Market Restrains

- 3.3.1. Manufacturers' lack of control over logistics services and also increasing logistical costs

- 3.4. Market Trends

- 3.4.1. Initiatives towards Greener Industrial Port Activities

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Container Terminal Operations Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Stevedoring

- 5.1.2. Cargo and handling transportation

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Cargo Type

- 5.2.1. Crude Oil

- 5.2.2. Dry Cargo

- 5.2.3. Other Liquid Cargo

- 5.3. Market Analysis, Insights and Forecast - by US

- 5.4. Market Analysis, Insights and Forecast - by Canada

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ports America Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayliner

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SSA Marine

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Rhenus Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Husky Terminal and Stevedoring LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Viking Line

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Indiana Port Commission

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MEYER WERFT GmbH & Co KG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mississippi State Port Authority at Gulfport**List Not Exhaustive

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Mediterranean Shipping Company S A

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ports America Inc

List of Figures

- Figure 1: North America Container Terminal Operations Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Container Terminal Operations Market Share (%) by Company 2025

List of Tables

- Table 1: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 3: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 4: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 5: North America Container Terminal Operations Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Container Terminal Operations Market Revenue billion Forecast, by Service 2020 & 2033

- Table 7: North America Container Terminal Operations Market Revenue billion Forecast, by Cargo Type 2020 & 2033

- Table 8: North America Container Terminal Operations Market Revenue billion Forecast, by US 2020 & 2033

- Table 9: North America Container Terminal Operations Market Revenue billion Forecast, by Canada 2020 & 2033

- Table 10: North America Container Terminal Operations Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Container Terminal Operations Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Container Terminal Operations Market?

The projected CAGR is approximately 4.5%.

2. Which companies are prominent players in the North America Container Terminal Operations Market?

Key companies in the market include Ports America Inc, Bayliner, SSA Marine, Rhenus Group, Husky Terminal and Stevedoring LLC, Viking Line, Indiana Port Commission, MEYER WERFT GmbH & Co KG, Mississippi State Port Authority at Gulfport**List Not Exhaustive, Mediterranean Shipping Company S A.

3. What are the main segments of the North America Container Terminal Operations Market?

The market segments include Service, Cargo Type, US, Canada.

4. Can you provide details about the market size?

The market size is estimated to be USD 213.38 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing global trade activities; Infrastructure Development is on rise.

6. What are the notable trends driving market growth?

Initiatives towards Greener Industrial Port Activities.

7. Are there any restraints impacting market growth?

Manufacturers' lack of control over logistics services and also increasing logistical costs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Container Terminal Operations Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Container Terminal Operations Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Container Terminal Operations Market?

To stay informed about further developments, trends, and reports in the North America Container Terminal Operations Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence