Key Insights

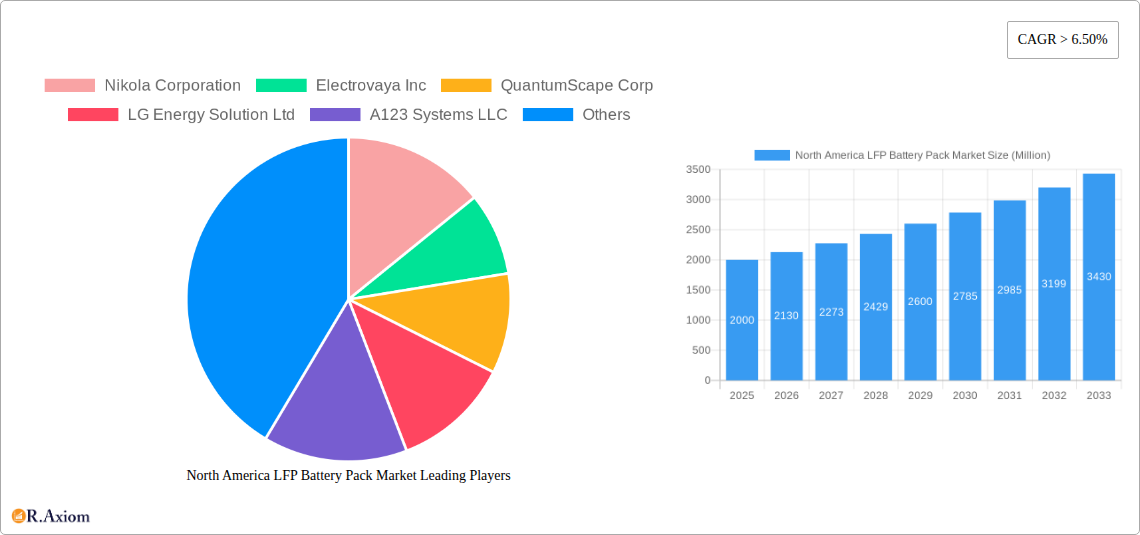

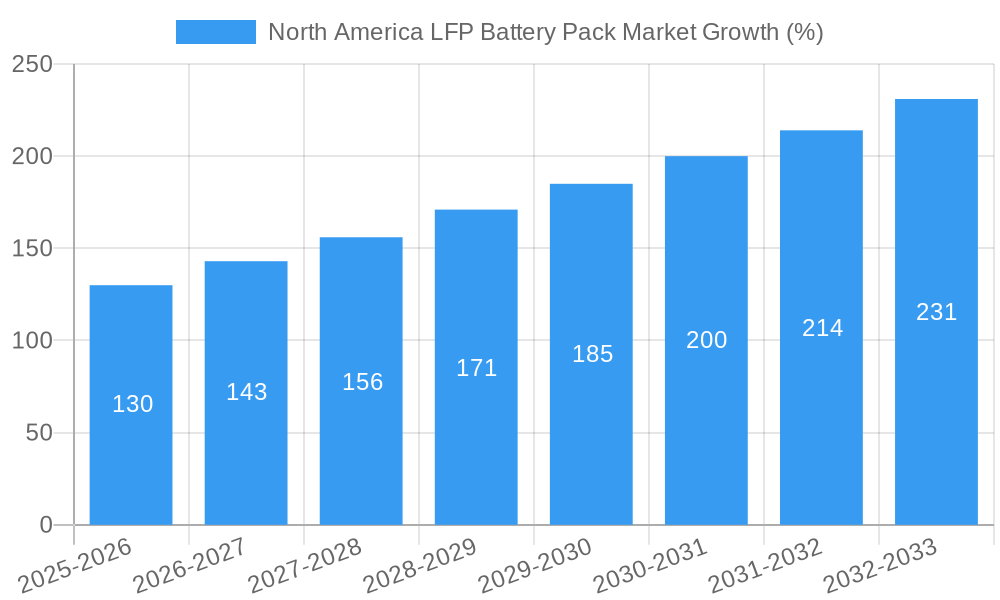

The North American Lithium Iron Phosphate (LFP) battery pack market is experiencing robust growth, fueled by increasing electric vehicle (EV) adoption and the inherent cost-effectiveness and safety advantages of LFP technology. The market's compound annual growth rate (CAGR) exceeding 6.50% from 2019 to 2024 indicates significant momentum. While precise market size figures for 2025 are unavailable, projecting from the historical data and considering the strong EV market growth in North America, a conservative estimate places the 2025 market value at approximately $2 billion. This substantial value is driven by the increasing demand for LFP battery packs across various vehicle segments, including passenger cars, light commercial vehicles (LCVs), medium and heavy-duty trucks (M&HDTs), and buses. The prevalence of LFP battery packs is also likely boosted by government incentives promoting EV adoption and a growing focus on sustainable transportation solutions. Further growth drivers include advancements in LFP battery technology leading to improved energy density and performance, coupled with a stable supply chain for crucial raw materials like lithium, iron phosphate, and graphite, although potential supply chain disruptions remain a monitoring point.

Segment-wise, the passenger car segment is expected to dominate the market share, followed by LCVs and M&HDTs. Within battery form factors, prismatic and cylindrical cells likely maintain significant shares due to their established manufacturing processes and suitability for various applications. While the market shows strong promise, challenges such as potential raw material price fluctuations and ongoing technological advancements in competing battery chemistries could influence market dynamics in the coming years. The forecast period (2025-2033) anticipates continued expansion, driven by the factors mentioned above, though careful consideration of geopolitical factors and evolving consumer preferences remains crucial for accurate long-term projections. The North American market, particularly the US and Canada, will remain key regions due to significant EV manufacturing and robust government support for sustainable transportation.

North America LFP Battery Pack Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the North America LFP (Lithium Iron Phosphate) battery pack market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period covers 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The historical period analyzed is 2019-2024. The report segments the market across various crucial parameters, offering granular data and future projections. The market size is expressed in Millions.

North America LFP Battery Pack Market Concentration & Innovation

This section analyzes the competitive landscape of the North American LFP battery pack market, examining market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities. The market is characterized by a mix of established players and emerging entrants, resulting in a moderately concentrated market. Key metrics such as market share held by leading players and the total value of M&A deals within the studied period are presented to illustrate the competitive dynamics.

- Market Concentration: The top 5 players collectively hold approximately xx% of the market share in 2025, indicating a moderately consolidated market. This is expected to slightly decrease to xx% by 2033 due to the entry of new players and increased competition.

- Innovation Drivers: Stringent emission regulations, increasing demand for electric vehicles (EVs), and advancements in battery technology are driving innovation in LFP battery pack design and manufacturing. Focus areas include improved energy density, enhanced safety features, and reduced costs.

- Regulatory Landscape: Government incentives and policies promoting EV adoption significantly impact market growth. However, evolving regulations related to battery safety and recyclability present both opportunities and challenges.

- Product Substitutes: While LFP batteries are increasingly competitive, other battery chemistries like NMC (Nickel Manganese Cobalt) and NCA (Nickel Cobalt Aluminum) remain key substitutes, particularly in high-performance applications. The report analyzes the competitive advantages and limitations of each.

- End-User Trends: The increasing popularity of EVs across various segments (passenger cars, buses, LCVs) is a primary driver of demand for LFP battery packs. Consumer preferences for longer range, faster charging, and improved safety are shaping product development.

- M&A Activities: The report details significant M&A activities within the period, including the value and strategic implications of key deals. These activities often aim to expand market share, access new technologies, or secure crucial supply chains. The total value of M&A deals during 2019-2024 is estimated at xx Million.

North America LFP Battery Pack Market Industry Trends & Insights

This section delves into the key industry trends and insights shaping the North America LFP battery pack market. It examines market growth drivers, technological disruptions, consumer preferences, and competitive dynamics, providing a detailed analysis of market evolution and future projections. The report projects a CAGR of xx% during the forecast period (2025-2033), driven by factors such as increasing demand for electric vehicles and stringent emission regulations. Market penetration of LFP battery packs in the North American EV market is also analyzed and projected to increase from xx% in 2025 to xx% by 2033.

The substantial growth is primarily attributed to factors such as government incentives promoting EV adoption, technological advancements leading to improved battery performance and cost reduction, and the rising consumer preference for eco-friendly transportation solutions. Competitive dynamics are influenced by factors such as economies of scale, technological innovation, and strategic partnerships.

Dominant Markets & Segments in North America LFP Battery Pack Market

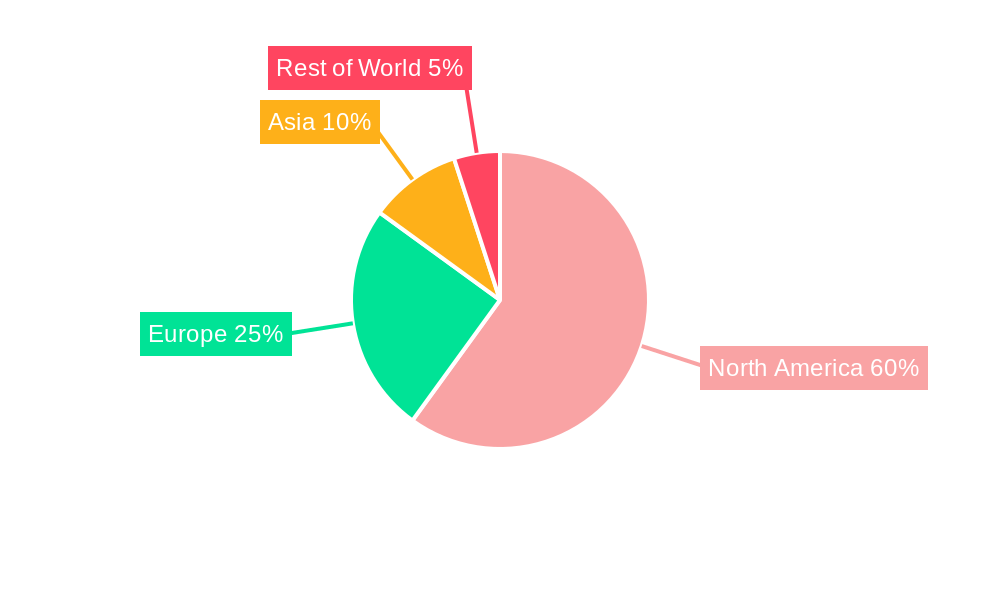

This section identifies the leading regions, countries, and market segments within the North America LFP battery pack market. The analysis is conducted across various parameters:

- By Country: The US dominates the North American LFP battery pack market due to a large EV market and robust government support for EV adoption. Canada follows as a significant market, but with a smaller market share compared to the US.

- By Material Type: Lithium and Phosphate are the dominant materials in LFP batteries, while the contributions of Cobalt, Manganese, and Nickel are less significant. Other materials comprise a small portion of the market.

- By Body Type: The passenger car segment is projected to maintain its dominance throughout the forecast period, driven by rising consumer demand for electric passenger vehicles. However, significant growth is anticipated in the LCV and Bus segments, driven by fleet electrification initiatives.

- By Propulsion Type: BEV (Battery Electric Vehicles) accounts for the majority of LFP battery pack demand, while PHEV (Plug-in Hybrid Electric Vehicles) contributes to a smaller yet growing segment.

- By Capacity: The 40 kWh to 80 kWh capacity segment is projected to dominate, reflecting the growing demand for vehicles with longer driving ranges. However, other capacity segments also exhibit growth, catering to diverse vehicle types and applications.

- By Battery Form: Prismatic battery form factor is projected to dominate due to cost-effectiveness and suitability for large-scale production. However, cylindrical and pouch cells will also contribute significantly.

- By Method: Wire bonding method holds the significant market share for LFP battery pack manufacturing. Laser welding is gaining popularity for its advantages in high-volume manufacturing.

- By Component: The anode, cathode, electrolyte, and separator components are crucial elements of LFP battery packs. The report analyzes the market for each individual component.

Key Drivers:

- Strong government support for electric vehicle adoption through tax credits, subsidies, and other incentives.

- Growing consumer preference for electric vehicles driven by environmental concerns and fuel efficiency.

- Advancements in battery technology, leading to higher energy density and lower costs.

- Development of charging infrastructure to support the expanding EV market.

North America LFP Battery Pack Market Product Developments

Recent years have witnessed significant advancements in LFP battery pack technology, focusing on enhanced energy density, faster charging times, improved safety features, and cost reduction. Innovations in cell chemistry, thermal management, and packaging are driving the development of more efficient and reliable LFP battery packs, better suited for various vehicle applications. This includes incorporating advanced materials to improve energy density and lifespan, as well as adopting innovative manufacturing techniques for efficient production and cost reduction. These improvements enhance the market fit for LFP battery packs in various segments, particularly for those requiring a balance of cost-effectiveness and performance.

Report Scope & Segmentation Analysis

This report comprehensively segments the North American LFP battery pack market across several parameters, including Material Type (Cobalt, Lithium, Manganese, Natural Graphite, Nickel, Other Materials), Country (Canada, US), Body Type (Bus, LCV, M&HDT, Passenger Car), Propulsion Type (BEV, PHEV), Capacity (Less than 15 kWh, 15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), Battery Form (Cylindrical, Pouch, Prismatic), Method (Laser, Wire), and Component (Anode, Cathode, Electrolyte, Separator). Each segment's growth projections, market sizes, and competitive dynamics are thoroughly analyzed to provide a complete market picture.

Key Drivers of North America LFP Battery Pack Market Growth

The growth of the North America LFP battery pack market is driven by several key factors. Firstly, stringent government regulations aimed at reducing carbon emissions are pushing for the adoption of electric vehicles, significantly increasing the demand for LFP battery packs. Secondly, advances in battery technology have resulted in improved energy density, longer lifespan, and lower costs, making LFP batteries more attractive. Finally, substantial investments in charging infrastructure are enhancing the convenience and practicality of electric vehicles, further accelerating market growth.

Challenges in the North America LFP Battery Pack Market Sector

The North American LFP battery pack market faces several challenges. The primary concern is the dependence on raw materials, particularly lithium, creating supply chain vulnerabilities and price volatility. Furthermore, the manufacturing process is energy-intensive and poses environmental concerns. Finally, intense competition from established battery manufacturers and the emergence of new players requires continuous innovation and cost optimization.

Emerging Opportunities in North America LFP Battery Pack Market

Significant opportunities exist in the North American LFP battery pack market. The growing demand for electric vehicles across various segments presents a considerable growth opportunity. Furthermore, advancements in fast-charging technology and improvements in energy density are expanding the applications of LFP batteries beyond electric vehicles. Developing innovative solutions for battery recycling and sustainable sourcing of raw materials will create significant new market opportunities.

Leading Players in the North America LFP Battery Pack Market Market

- Nikola Corporation

- Electrovaya Inc

- QuantumScape Corp

- LG Energy Solution Ltd

- A123 Systems LLC

- American Battery Solutions Inc

- Primearth EV Energy Co Ltd

- Contemporary Amperex Technology Co Ltd (CATL)

- Clarios International Inc

- Envision AESC Japan Co Ltd

- ACDELCO (Subsidiary Of General Motors)

Key Developments in North America LFP Battery Pack Market Industry

- 2024-Q4: LG Energy Solution announced a significant expansion of its LFP battery production capacity in North America.

- 2023-Q3: Several major automotive manufacturers announced partnerships with LFP battery suppliers to secure long-term supply.

- 2023-Q1: A significant investment was made in developing a new LFP battery recycling facility in the US.

- 2022-Q4: New government regulations in California mandate a certain percentage of EVs use LFP batteries.

Strategic Outlook for North America LFP Battery Pack Market Market

The North American LFP battery pack market exhibits significant growth potential, driven by increasing EV adoption, technological advancements, and supportive government policies. The market is expected to witness sustained growth in the coming years, offering lucrative opportunities for both established players and new entrants. Strategic focus should be placed on technological innovation, supply chain optimization, and meeting the evolving needs of the automotive industry, including enhanced energy density, rapid charging capabilities, and improved safety.

North America LFP Battery Pack Market Segmentation

-

1. Body Type

- 1.1. Bus

- 1.2. LCV

- 1.3. M&HDT

- 1.4. Passenger Car

-

2. Propulsion Type

- 2.1. BEV

- 2.2. PHEV

-

3. Capacity

- 3.1. 15 kWh to 40 kWh

- 3.2. 40 kWh to 80 kWh

- 3.3. Above 80 kWh

- 3.4. Less than 15 kWh

-

4. Battery Form

- 4.1. Cylindrical

- 4.2. Pouch

- 4.3. Prismatic

-

5. Method

- 5.1. Laser

- 5.2. Wire

-

6. Component

- 6.1. Anode

- 6.2. Cathode

- 6.3. Electrolyte

- 6.4. Separator

-

7. Material Type

- 7.1. Cobalt

- 7.2. Lithium

- 7.3. Manganese

- 7.4. Natural Graphite

- 7.5. Nickel

- 7.6. Other Materials

North America LFP Battery Pack Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America LFP Battery Pack Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems

- 3.3. Market Restrains

- 3.3.1. Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America LFP Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 5.1.1. Bus

- 5.1.2. LCV

- 5.1.3. M&HDT

- 5.1.4. Passenger Car

- 5.2. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.2.1. BEV

- 5.2.2. PHEV

- 5.3. Market Analysis, Insights and Forecast - by Capacity

- 5.3.1. 15 kWh to 40 kWh

- 5.3.2. 40 kWh to 80 kWh

- 5.3.3. Above 80 kWh

- 5.3.4. Less than 15 kWh

- 5.4. Market Analysis, Insights and Forecast - by Battery Form

- 5.4.1. Cylindrical

- 5.4.2. Pouch

- 5.4.3. Prismatic

- 5.5. Market Analysis, Insights and Forecast - by Method

- 5.5.1. Laser

- 5.5.2. Wire

- 5.6. Market Analysis, Insights and Forecast - by Component

- 5.6.1. Anode

- 5.6.2. Cathode

- 5.6.3. Electrolyte

- 5.6.4. Separator

- 5.7. Market Analysis, Insights and Forecast - by Material Type

- 5.7.1. Cobalt

- 5.7.2. Lithium

- 5.7.3. Manganese

- 5.7.4. Natural Graphite

- 5.7.5. Nickel

- 5.7.6. Other Materials

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Body Type

- 6. United States North America LFP Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America LFP Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America LFP Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America LFP Battery Pack Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nikola Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Electrovaya Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 QuantumScape Corp

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 LG Energy Solution Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 A123 Systems LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 American Battery Solutions Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Primearth EV Energy Co Ltd

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Contemporary Amperex Technology Co Ltd (CATL)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Clarios International Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Envision AESC Japan Co Ltd

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 ACDELCO (Subsidiary Of General Motors)

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Nikola Corporation

List of Figures

- Figure 1: North America LFP Battery Pack Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America LFP Battery Pack Market Share (%) by Company 2024

List of Tables

- Table 1: North America LFP Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America LFP Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 3: North America LFP Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 4: North America LFP Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 5: North America LFP Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 6: North America LFP Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 7: North America LFP Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 8: North America LFP Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 9: North America LFP Battery Pack Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: North America LFP Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States North America LFP Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada North America LFP Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico North America LFP Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of North America North America LFP Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: North America LFP Battery Pack Market Revenue Million Forecast, by Body Type 2019 & 2032

- Table 16: North America LFP Battery Pack Market Revenue Million Forecast, by Propulsion Type 2019 & 2032

- Table 17: North America LFP Battery Pack Market Revenue Million Forecast, by Capacity 2019 & 2032

- Table 18: North America LFP Battery Pack Market Revenue Million Forecast, by Battery Form 2019 & 2032

- Table 19: North America LFP Battery Pack Market Revenue Million Forecast, by Method 2019 & 2032

- Table 20: North America LFP Battery Pack Market Revenue Million Forecast, by Component 2019 & 2032

- Table 21: North America LFP Battery Pack Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 22: North America LFP Battery Pack Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: United States North America LFP Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Canada North America LFP Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Mexico North America LFP Battery Pack Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America LFP Battery Pack Market?

The projected CAGR is approximately > 6.50%.

2. Which companies are prominent players in the North America LFP Battery Pack Market?

Key companies in the market include Nikola Corporation, Electrovaya Inc, QuantumScape Corp, LG Energy Solution Ltd, A123 Systems LLC, American Battery Solutions Inc, Primearth EV Energy Co Ltd, Contemporary Amperex Technology Co Ltd (CATL), Clarios International Inc, Envision AESC Japan Co Ltd, ACDELCO (Subsidiary Of General Motors).

3. What are the main segments of the North America LFP Battery Pack Market?

The market segments include Body Type, Propulsion Type, Capacity, Battery Form, Method, Component, Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand and Sales of Commercial Vehicles is Driving the Market for Hydraulic Systems.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Replacement of Conventional Hydraulic Systems with Fully-electric Hydraulic Systems Acts as a Restraint.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America LFP Battery Pack Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America LFP Battery Pack Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America LFP Battery Pack Market?

To stay informed about further developments, trends, and reports in the North America LFP Battery Pack Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence