Key Insights

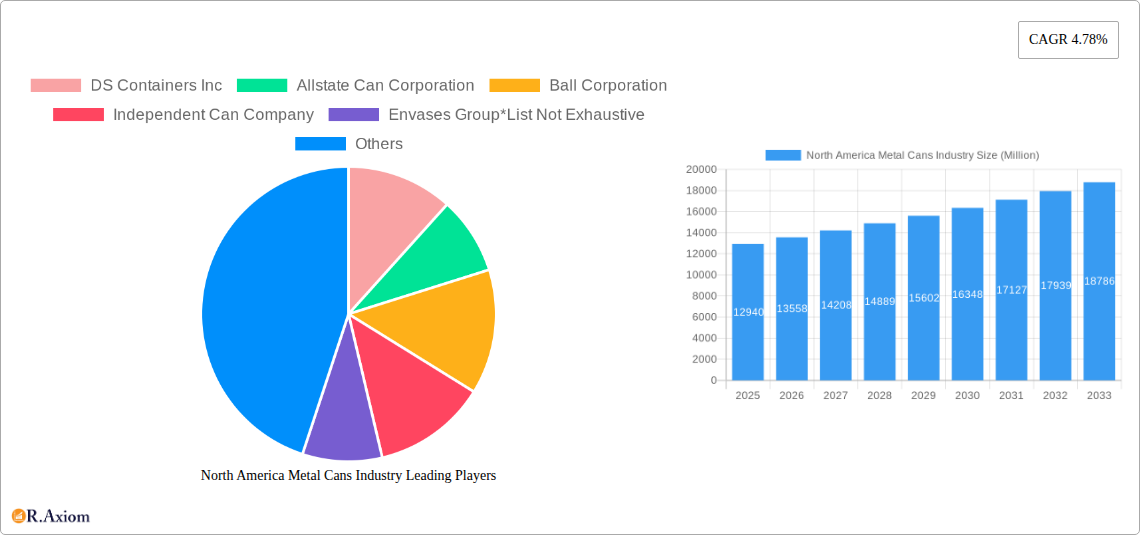

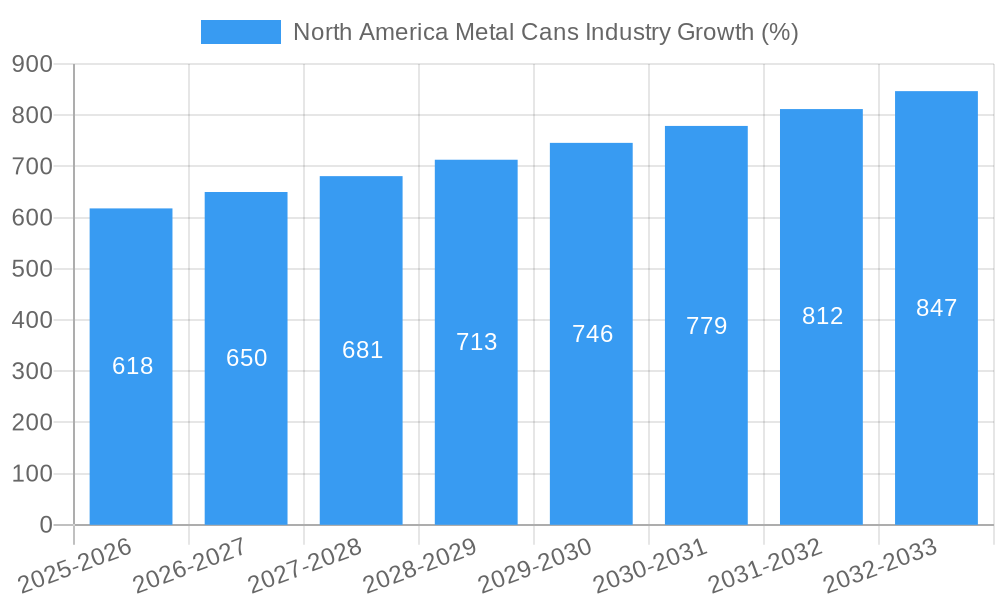

The North American metal cans industry, valued at $12.94 billion in 2025, is projected to experience steady growth, driven by a robust CAGR of 4.78% from 2025 to 2033. This expansion is fueled by several key factors. The increasing demand for convenient and shelf-stable food and beverage products is a major catalyst. The pharmaceutical and cosmetic sectors also contribute significantly, utilizing metal cans for their protective properties and tamper-evident features. Furthermore, sustainability initiatives focusing on recyclable packaging materials are bolstering the industry's appeal. Aluminum and steel, the primary materials used, benefit from established recycling infrastructure, contributing to a positive environmental image. Growth within the North American market is further supported by the established presence of major players like Ball Corporation, Crown Holdings Inc., and Silgan Containers LLC, all of whom contribute to innovation and production capacity. Regional variations exist, with the United States likely holding the largest market share, followed by Canada and Mexico. While potential restraints could include fluctuating raw material prices and environmental regulations, the overall outlook for the North American metal cans market remains positive, driven by its inherent advantages in terms of protection, convenience, and sustainability.

The forecast period from 2025 to 2033 anticipates continued growth, though the rate may fluctuate slightly year-over-year depending on macroeconomic conditions and consumer spending patterns. Specific end-user segments, such as the food and beverage industry, are expected to exhibit above-average growth due to continuous innovation in product packaging and the rise of e-commerce, which necessitates robust and transportable packaging. The industry’s focus on improved manufacturing processes, lightweighting of cans, and exploring new alloys for enhanced performance and cost-effectiveness will further influence its trajectory. Competition remains significant, but the consolidated nature of the market with several large players allows for ongoing investment in technological advancements and market penetration strategies. Ultimately, the North American metal cans market is poised for sustained growth, driven by a confluence of factors ranging from consumer preferences to environmental concerns.

North America Metal Cans Industry: A Comprehensive Market Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the North America metal cans industry, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Key players analyzed include DS Containers Inc, Allstate Can Corporation, Ball Corporation, Independent Can Company, Envases Group, Crown Holdings Inc, Silgan Containers LLC, Can-Pack SA, Ardagh Group S A, CCL Container Inc, Mauser Packaging Solutions, and Technocap Group. This list is not exhaustive.

North America Metal Cans Industry Market Concentration & Innovation

The North American metal cans industry exhibits a moderately concentrated market structure, with a few dominant players holding significant market share. Ball Corporation, Crown Holdings Inc, and Silgan Containers LLC are among the leading companies, collectively accounting for an estimated xx% of the market in 2025. Market concentration is influenced by factors such as economies of scale, technological capabilities, and brand recognition. Innovation within the industry is driven by the need to enhance sustainability, improve efficiency, and meet evolving consumer preferences. This includes the development of lightweight cans, improved printing technologies (like digital printing showcased by Hart Print’s acquisition), and the exploration of new materials. Regulatory frameworks concerning recyclability and material sourcing significantly impact industry practices. The industry faces competition from alternative packaging solutions like plastics and flexible pouches, but the inherent advantages of metal cans—namely recyclability, barrier properties, and durability—continue to sustain demand. Mergers and acquisitions (M&A) activities play a significant role in shaping the competitive landscape. Recent deals, such as Ardagh Group's acquisition of Hart Print (detailed further below), illustrate the ongoing consolidation trend and the increasing focus on digital printing capabilities. The total value of M&A deals in the sector from 2019-2024 is estimated at $xx Million.

North America Metal Cans Industry Industry Trends & Insights

The North American metal cans industry is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key trends: a growing preference for convenient and shelf-stable packaging, particularly in the food and beverage sectors; rising consumer demand for sustainable and recyclable packaging options, pushing for improved recyclability rates of metal cans; increasing adoption of innovative printing technologies to enhance product appeal and brand visibility; and the continued expansion of the e-commerce sector, driving demand for robust and easily shippable packaging. Technological disruptions are impacting production efficiency and product innovation, leading to lighter weight cans that reduce material costs and environmental footprint. Consumer preferences shift towards healthier, sustainably packaged goods, positively influencing demand. The competitive landscape is intense, with companies focusing on differentiation through product innovation, improved sustainability initiatives, and enhanced supply chain capabilities. Market penetration is highest in established sectors like food and beverages and is anticipated to increase steadily in personal care and pharmaceuticals. Overall, the industry shows considerable resilience, adaptability, and promise for continued growth.

Dominant Markets & Segments in North America Metal Cans Industry

- By Material Type: Steel cans currently dominate the North American market due to their cost-effectiveness and suitability for various applications. However, aluminum cans are witnessing significant growth, driven by their lightweight properties and superior recyclability.

- By End-user Vertical: The food and beverage sectors represent the largest end-use segments, driven by the high demand for canned foods and beverages. However, increasing demand for metal cans in the pharmaceuticals and cosmetic and personal care sectors represents promising avenues for industry growth. Pharmaceuticals are increasingly utilizing cans for their security, protection, and shelf-life qualities.

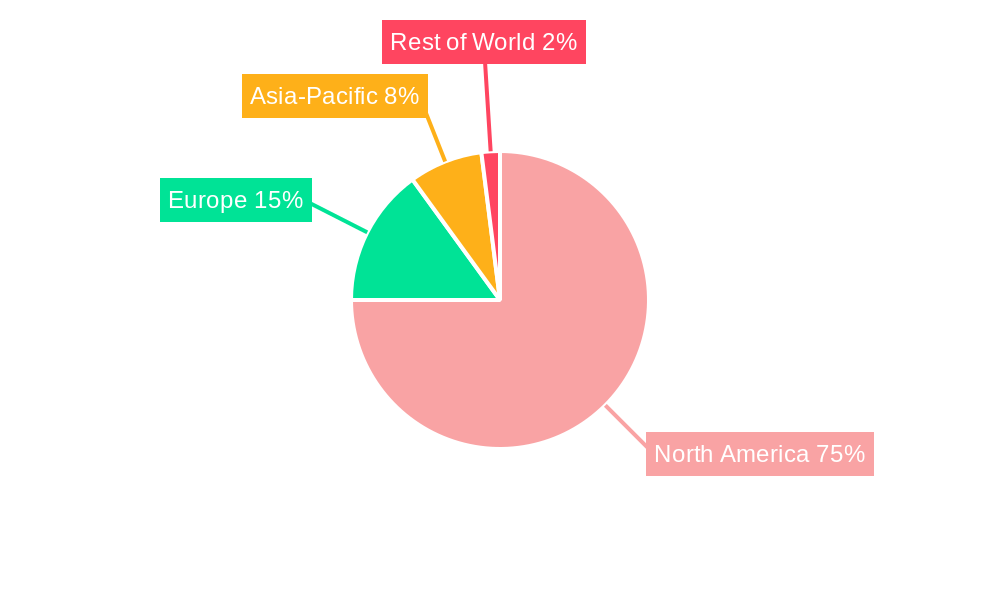

- By Country: The United States represents the largest market, owing to its significant manufacturing base, high per capita consumption, and large population base. Canada, while smaller, is witnessing growth in line with overall economic activity and demand from various end-use segments.

- Key Drivers: Robust manufacturing infrastructure in the US fuels industry growth; favorable economic conditions in both countries support consumer spending; and supportive government regulations on recycling and sustainable packaging are encouraging adoption of environmentally friendly practices.

The dominance of the food and beverage segments are driven by the convenience and shelf stability provided by metal cans, enabling longer shelf life and efficient transportation.

North America Metal Cans Industry Product Developments

Recent product innovations focus on enhancing sustainability through lightweighting, improved recyclability, and the use of recycled materials. Advances in printing technology, such as digital printing, enable greater design flexibility and brand customization, boosting product appeal and brand recognition. These innovations translate into enhanced consumer engagement, increased shelf impact, and greater brand recognition within a competitive market, offering improved value to brand owners. The focus remains on producing cans that are environmentally friendly, cost-effective, and meet the evolving needs of diverse end-user verticals.

Report Scope & Segmentation Analysis

This report segments the North American metal cans market by material type (aluminum and steel), end-user vertical (food, beverage, pharmaceuticals, cosmetic and personal care, and other end-user verticals), and geography (United States and Canada). Each segment's growth projections, market size, and competitive dynamics are comprehensively analyzed. For example, the food and beverage segment is expected to grow by xx% by 2033 due to increased demand for ready-to-eat meals and canned drinks. The aluminum can segment is forecasted to show accelerated growth due to increasing demand for lighter weight, more sustainable packaging options. The US market is projected to maintain its leading position, with steady growth expected in Canada. Competitive dynamics within each segment are influenced by factors such as technological capabilities, pricing strategies, and market share.

Key Drivers of North America Metal Cans Industry Growth

Several factors contribute to the growth of the North American metal cans industry. Technological advancements, such as improved printing and manufacturing processes, enhance efficiency and reduce costs. Steady economic growth in North America fuels consumer spending and demand for packaged goods. Finally, government regulations promoting sustainable packaging practices drive the adoption of recyclable metal cans, furthering market growth. These factors combined contribute to a positive outlook for the industry.

Challenges in the North America Metal Cans Industry Sector

The North America metal cans industry faces several challenges. Fluctuations in raw material prices (aluminum and steel) impact production costs and profitability. Competition from alternative packaging materials, such as plastics and flexible pouches, necessitates constant product innovation and cost optimization. Stringent environmental regulations require continuous improvements in recyclability and sustainable manufacturing processes. These challenges collectively influence profitability and necessitate strategic adaptation. The estimated impact of these challenges on the industry’s overall profitability is a xx% reduction.

Emerging Opportunities in North America Metal Cans Industry

The industry is witnessing several emerging opportunities. Growing demand for sustainable and recyclable packaging presents a significant growth avenue. Innovation in printing technology allows for enhanced customization and brand differentiation. The expansion of e-commerce necessitates robust and shippable packaging, creating demand for cans. These opportunities showcase significant growth potential for the industry.

Leading Players in the North America Metal Cans Industry Market

- DS Containers Inc

- Allstate Can Corporation

- Ball Corporation

- Independent Can Company

- Envases Group

- Crown Holdings Inc

- Silgan Containers LLC

- Can-Pack SA

- Ardagh Group S A

- CCL Container Inc

- Mauser Packaging Solutions

- Technocap Group

Key Developments in North America Metal Cans Industry Industry

- October 2021: Ball Metalpack added a new two-piece food can production line at its Milwaukee plant, enhancing its production capacity and bolstering its position in the food can market.

- November 2021: Ardagh Metal Packaging (AMP) acquired Hart Print, a Canadian digital printing cans provider, expanding its capabilities in offering customized and high-quality printed cans to the beverage sector, thus enhancing market competitiveness and product offerings.

Strategic Outlook for North America Metal Cans Industry Market

The North American metal cans industry is poised for continued growth, driven by the inherent advantages of metal cans and ongoing innovations to enhance sustainability and product appeal. Focus on lightweighting, improved recyclability, and advanced printing technologies will shape the future of the industry, providing opportunities for both established players and new entrants. The growing demand for convenient, sustainable, and aesthetically pleasing packaging will continue to drive market expansion throughout the forecast period.

North America Metal Cans Industry Segmentation

-

1. Material Type

- 1.1. Aluminum

- 1.2. Steel

-

2. End-user Vertical

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceuticals

- 2.4. Cosmetic and Personal Care

- 2.5. Other End-user Verticals

North America Metal Cans Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Metal Cans Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.78% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Recyclability Rates of Metal Packaging; Convenience and Lower Price Offered by Canned Food

- 3.3. Market Restrains

- 3.3.1. Presence of Alternate Packaging Solutions

- 3.4. Market Trends

- 3.4.1. Beverage is Expected to Account For Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Metal Cans Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Aluminum

- 5.1.2. Steel

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceuticals

- 5.2.4. Cosmetic and Personal Care

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. United States North America Metal Cans Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Metal Cans Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Metal Cans Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Metal Cans Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 DS Containers Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Allstate Can Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Ball Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Independent Can Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Envases Group*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Crown Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Silgan Containers LLC

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Can-Pack SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Ardagh Group S A

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CCL Container Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mauser Packaging Solutions

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Technocap Group

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 DS Containers Inc

List of Figures

- Figure 1: North America Metal Cans Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Metal Cans Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Metal Cans Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Metal Cans Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: North America Metal Cans Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: North America Metal Cans Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: North America Metal Cans Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States North America Metal Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada North America Metal Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico North America Metal Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of North America North America Metal Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: North America Metal Cans Industry Revenue Million Forecast, by Material Type 2019 & 2032

- Table 11: North America Metal Cans Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 12: North America Metal Cans Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: United States North America Metal Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Metal Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Metal Cans Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Metal Cans Industry?

The projected CAGR is approximately 4.78%.

2. Which companies are prominent players in the North America Metal Cans Industry?

Key companies in the market include DS Containers Inc, Allstate Can Corporation, Ball Corporation, Independent Can Company, Envases Group*List Not Exhaustive, Crown Holdings Inc, Silgan Containers LLC, Can-Pack SA, Ardagh Group S A, CCL Container Inc, Mauser Packaging Solutions, Technocap Group.

3. What are the main segments of the North America Metal Cans Industry?

The market segments include Material Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.94 Million as of 2022.

5. What are some drivers contributing to market growth?

High Recyclability Rates of Metal Packaging; Convenience and Lower Price Offered by Canned Food.

6. What are the notable trends driving market growth?

Beverage is Expected to Account For Significant Market Share.

7. Are there any restraints impacting market growth?

Presence of Alternate Packaging Solutions.

8. Can you provide examples of recent developments in the market?

November 2021 - Ardagh Metal Packaging (AMP), a subsidiary of Ardagh Group, acquired Canada-based digital printed cans provider Hart Print. Hart Print was established in 2018 and is based in Quebec, offering flexible digital printing solutions to customers serving the beverage market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Metal Cans Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Metal Cans Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Metal Cans Industry?

To stay informed about further developments, trends, and reports in the North America Metal Cans Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence