Key Insights

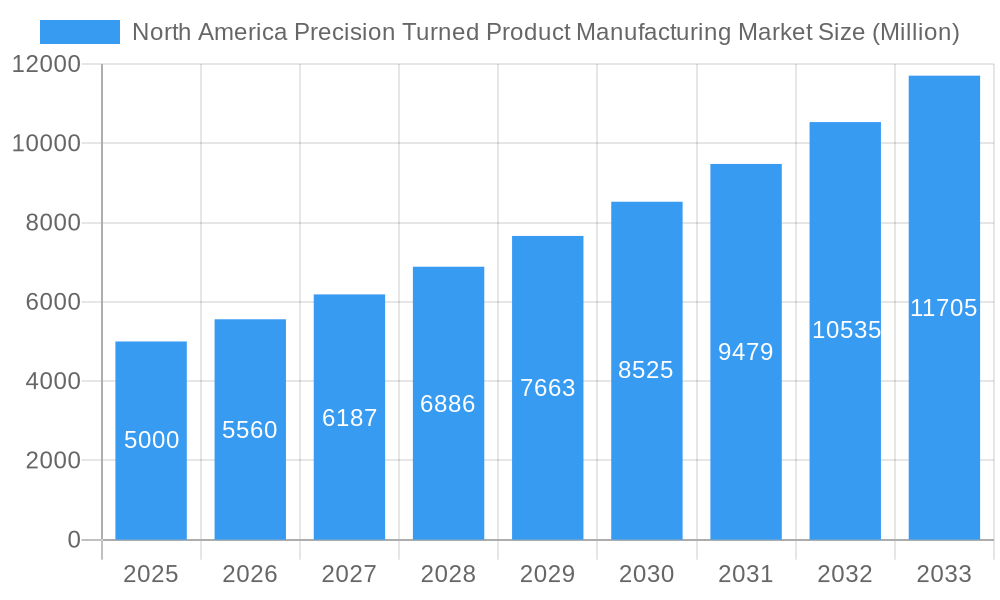

The North America precision turned product manufacturing market is poised for significant expansion, propelled by escalating demand across the automotive, aerospace, and medical device sectors. With a projected Compound Annual Growth Rate (CAGR) of 6.7%, the market is anticipated to reach 110.33 billion by 2033, building upon a strong foundation in the 2025 base year. Key growth catalysts include the increasing adoption of advanced materials, advancements in CNC machining and automation, and the imperative for high-precision components in sophisticated end-products. The trend towards miniaturization and lightweighting in various industries further fuels the demand for precision turned parts. Despite challenges such as supply chain volatility and raw material price fluctuations, the market's outlook remains robust, offering considerable opportunities for innovation and product portfolio expansion. The market is segmented by product type, material, and end-use industry, with key players differentiating on precision, quality, delivery, and technological capabilities. Ongoing investments in research and development within the precision machining industry will continue to enhance efficiency and broaden application possibilities.

North America Precision Turned Product Manufacturing Market Market Size (In Billion)

The North American precision turned parts market is distinguished by its high degree of specialization and a diverse manufacturer base catering to specific niche requirements. The competitive environment features both large multinational corporations and specialized smaller enterprises. Success hinges on leveraging advanced technologies, efficient manufacturing processes, and cultivating strong customer relationships. Future growth will be driven by the adoption of Industry 4.0 technologies, including AI-driven quality control, predictive maintenance, and digital twin technology for process optimization and enhanced productivity. Government initiatives supporting advanced manufacturing and domestic production of critical components will also stimulate market expansion. Continued innovation in materials science, leading to lighter, stronger, and more durable parts, represents another pivotal growth driver for the industry.

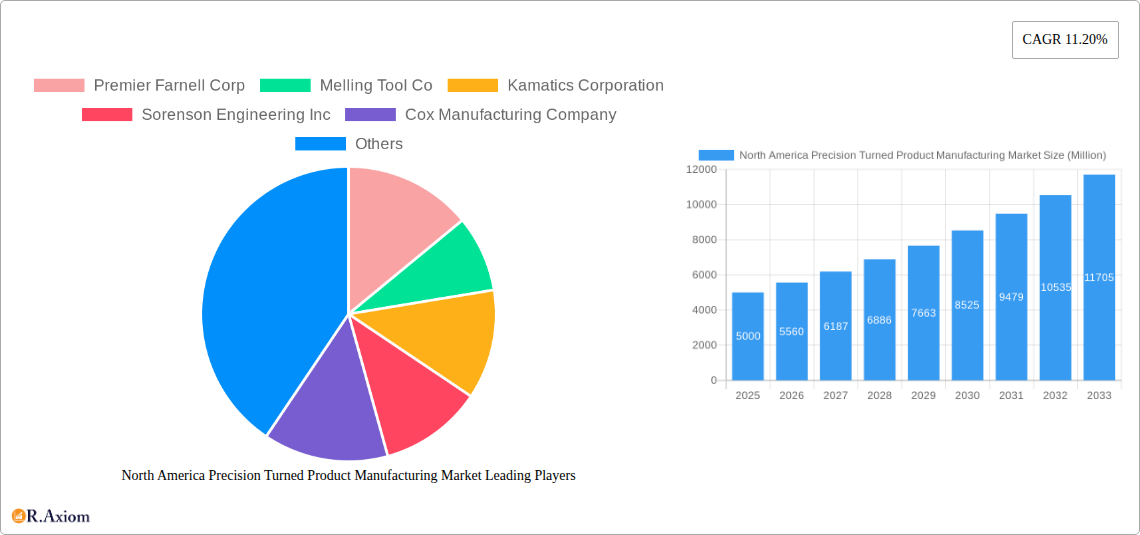

North America Precision Turned Product Manufacturing Market Company Market Share

North America Precision Turned Product Manufacturing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America precision turned product manufacturing market, covering the period from 2019 to 2033. It offers invaluable insights into market dynamics, competitive landscape, growth drivers, and emerging opportunities, enabling stakeholders to make informed strategic decisions. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to forecast market trends until 2033.

North America Precision Turned Product Manufacturing Market Concentration & Innovation

This section analyzes the market's competitive landscape, focusing on market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The market is characterized by a moderately concentrated structure with several key players holding significant market share. However, the presence of numerous smaller companies indicates a competitive environment.

- Market Concentration: The top 5 players account for approximately xx% of the total market share in 2025, indicating a moderately concentrated market. Further analysis reveals that smaller players collectively constitute the remaining xx% and are actively contributing to market innovation.

- Innovation Drivers: Technological advancements, including automation and advanced materials, are driving innovation. The demand for higher precision, efficiency, and customization is also a key factor.

- Regulatory Framework: Compliance with industry-specific regulations and environmental standards plays a crucial role. Stringent quality and safety standards, along with evolving environmental regulations, influence manufacturing processes and product development.

- Product Substitutes: The market faces competition from alternative manufacturing processes like 3D printing and casting, presenting potential challenges to traditional turned products. However, the precision and quality provided by turned products still maintain a considerable edge in several applications.

- End-User Trends: Growing demand for precision components across diverse industries like automotive, aerospace, medical devices, and electronics drives market growth. The increasing focus on lightweighting and miniaturization further fuels the demand for precision turned products.

- M&A Activities: Recent M&A activity, such as One Equity Partners' acquisition of Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group in November 2022, and Plansee Group's acquisition of Mi-Tech Tungsten Metals in December 2021, demonstrate the ongoing consolidation within the industry. These deals, with a combined value of approximately xx Million, highlight the strategic importance of expanding capabilities and market reach.

North America Precision Turned Product Manufacturing Market Industry Trends & Insights

This section explores key industry trends and insights, providing a detailed analysis of market growth drivers, technological disruptions, consumer preferences, and competitive dynamics.

The North American precision turned product manufacturing market is experiencing a steady growth trajectory, driven by robust demand from various end-use sectors. Technological advancements, such as the adoption of CNC machining and automation, are significantly enhancing production efficiency and precision. This has led to improved quality control and reduced production costs, creating a favourable environment for market expansion. The increasing adoption of additive manufacturing technologies, particularly 3D printing, is presenting both opportunities and challenges. While 3D printing is emerging as a potential substitute for some applications, its current limitations in terms of precision and material properties ensure that traditional turning remains crucial in high-precision applications. Consumer preferences are shifting towards customized and high-performance products, creating new avenues for growth within niche markets. The market is also witnessing growing competition from foreign manufacturers, requiring North American players to constantly innovate and improve their cost competitiveness. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx Million by 2033. Market penetration is expected to increase significantly, particularly in high-growth sectors such as medical devices and renewable energy.

Dominant Markets & Segments in North America Precision Turned Product Manufacturing Market

This section identifies the leading regions, countries, or segments within the North American precision turned product manufacturing market.

- Dominant Region/Country: The [Insert Dominant Region, e.g., Midwest] region of North America is projected to dominate the market due to [Insert Key Reasons, e.g., high concentration of manufacturing facilities, strong automotive industry, access to skilled labor].

- Key Drivers:

- Strong industrial base and established manufacturing infrastructure

- Presence of major automotive and aerospace clusters

- Supportive government policies and incentives for advanced manufacturing

- Availability of skilled labor and specialized expertise

The dominance of this region stems from the concentration of automotive and aerospace industries, which are significant consumers of precision turned components. The region benefits from robust infrastructure, a skilled workforce, and supportive government policies that promote advanced manufacturing. Government initiatives aimed at boosting domestic manufacturing and attracting foreign investment contribute further to its leading position. Other regions, while showing growth, lag behind in terms of market size and concentration of key players.

North America Precision Turned Product Manufacturing Market Product Developments

Recent product innovations focus on materials with higher strength-to-weight ratios, improved surface finishes, and enhanced dimensional accuracy. This is driven by the growing demand for lightweight and high-performance components in industries such as aerospace and automotive. The integration of smart sensors and data analytics into manufacturing processes allows for real-time monitoring and optimization, enhancing overall efficiency and product quality. These technological advancements are improving the market fit by addressing the evolving needs of end-users for improved performance, reliability, and cost-effectiveness.

Report Scope & Segmentation Analysis

This report segments the North America precision turned product manufacturing market based on several key parameters, providing a granular view of the market dynamics.

By Material: This segment includes steel, aluminum, brass, titanium, and other materials. Each material type exhibits distinct properties and applications, resulting in varying growth rates and competitive dynamics. Steel remains dominant due to its versatility and cost-effectiveness, while specialized materials like titanium show significant growth in high-performance applications.

By Product Type: This segment categorizes products based on their shape, size, and application, including shafts, pins, bushings, and other components. Each product type exhibits unique characteristics, requiring specialized manufacturing techniques and impacting market growth. The high precision demanded by certain applications is driving innovation and higher manufacturing costs for certain product types.

By End-User Industry: This segment covers diverse industries like automotive, aerospace, medical devices, electronics, and industrial machinery. Growth projections for each segment are influenced by their unique market drivers, technological advancements, and economic conditions. The automotive and aerospace industries, requiring high-precision components, show strong growth potential.

Key Drivers of North America Precision Turned Product Manufacturing Market Growth

Several factors are driving the growth of the North American precision turned product manufacturing market. These include technological advancements like automation and CNC machining, which improve efficiency and precision. Rising demand from key end-user industries, especially automotive and aerospace, is a major contributor. Government support for advanced manufacturing, as well as favorable economic conditions, provide further impetus for growth. Finally, the increasing need for lightweight and high-performance components pushes innovation and fuels market expansion.

Challenges in the North America Precision Turned Product Manufacturing Market Sector

The market faces challenges such as increasing labor costs, intensifying competition from low-cost manufacturers, and the need for continuous technological upgrades. Supply chain disruptions and the volatility of raw material prices add to these challenges. These factors can affect profitability and create pressure on companies to innovate and improve their operational efficiency to maintain competitiveness. Meeting increasingly stringent environmental regulations also necessitates investments in sustainable manufacturing practices. Furthermore, the rise of additive manufacturing poses a long-term challenge by offering an alternative production method for some applications.

Emerging Opportunities in North America Precision Turned Product Manufacturing Market

Several emerging opportunities exist for growth within the North American precision turned product manufacturing market. The increasing demand for precision components in new markets such as renewable energy and medical devices offers promising prospects. Advancements in materials science, leading to the development of high-performance materials with enhanced properties, provide opportunities for innovation. The integration of Industry 4.0 technologies, such as AI and machine learning, can greatly improve efficiency and productivity, leading to cost savings and enhanced product quality.

Leading Players in the North America Precision Turned Product Manufacturing Market Market

- Premier Farnell Corp

- Melling Tool Co

- Kamatics Corporation

- Sorenson Engineering Inc

- Cox Manufacturing Company

- Nook Industries LLC

- Creed-Monarch Inc

- Camcraft Inc

- M & W Industries Inc

- Greystone of Lincoln Inc

- Swagelok Hy-Level Company

- Herker Industries Inc

- Supreme Screw Products Inc

- List Not Exhaustive

Key Developments in North America Precision Turned Product Manufacturing Market Industry

- November 2022: One Equity Partners' acquisition of Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group signifies industry consolidation and expansion of capabilities within the metal manufacturing services sector.

- December 2021: Plansee Group's acquisition of Mi-Tech Tungsten Metals strengthens its position in the North American tungsten market, indicating increased competition and focus on strategic acquisitions to expand market share.

Strategic Outlook for North America Precision Turned Product Manufacturing Market Market

The North American precision turned product manufacturing market exhibits strong growth potential driven by ongoing technological advancements, increasing demand from diverse end-use sectors, and supportive government policies. Companies focused on innovation, operational efficiency, and strategic acquisitions are best positioned to capitalize on the market opportunities. Continued investments in automation, advanced materials, and sustainable manufacturing practices will be crucial for long-term success. The market is expected to witness significant growth in the coming years, driven by the factors mentioned above.

North America Precision Turned Product Manufacturing Market Segmentation

-

1. Operation

- 1.1. Manual Operation

- 1.2. CNC Operation

-

2. Machine Types

- 2.1. Automatic Screw Machines

- 2.2. Rotary Transfer Machines

- 2.3. Computer Numerically Controlled (CNC)

- 2.4. Lathes or Turning Centers

-

3. Material Type

- 3.1. Plastic

- 3.2. Steel

- 3.3. Other Material Types

-

4. End Use

- 4.1. Automobile

- 4.2. Electronics

- 4.3. Defense

- 4.4. Healthcare

North America Precision Turned Product Manufacturing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Precision Turned Product Manufacturing Market Regional Market Share

Geographic Coverage of North America Precision Turned Product Manufacturing Market

North America Precision Turned Product Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT)

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Precision Turned Product Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 5.1.1. Manual Operation

- 5.1.2. CNC Operation

- 5.2. Market Analysis, Insights and Forecast - by Machine Types

- 5.2.1. Automatic Screw Machines

- 5.2.2. Rotary Transfer Machines

- 5.2.3. Computer Numerically Controlled (CNC)

- 5.2.4. Lathes or Turning Centers

- 5.3. Market Analysis, Insights and Forecast - by Material Type

- 5.3.1. Plastic

- 5.3.2. Steel

- 5.3.3. Other Material Types

- 5.4. Market Analysis, Insights and Forecast - by End Use

- 5.4.1. Automobile

- 5.4.2. Electronics

- 5.4.3. Defense

- 5.4.4. Healthcare

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Operation

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Premier Farnell Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Melling Tool Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kamatics Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sorenson Engineering Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cox Manufacturing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nook Industries LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Creed-Monarch Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Camcraft Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M & W Industries Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Greystone of Lincoln Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Swagelok Hy-Level Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Herker Industries Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Supreme Screw Products Inc **List Not Exhaustive

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Premier Farnell Corp

List of Figures

- Figure 1: North America Precision Turned Product Manufacturing Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Precision Turned Product Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 2: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 3: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 4: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 5: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Operation 2020 & 2033

- Table 7: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Machine Types 2020 & 2033

- Table 8: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 9: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by End Use 2020 & 2033

- Table 10: North America Precision Turned Product Manufacturing Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: United States North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Mexico North America Precision Turned Product Manufacturing Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Precision Turned Product Manufacturing Market?

The projected CAGR is approximately 6.7%.

2. Which companies are prominent players in the North America Precision Turned Product Manufacturing Market?

Key companies in the market include Premier Farnell Corp, Melling Tool Co, Kamatics Corporation, Sorenson Engineering Inc, Cox Manufacturing Company, Nook Industries LLC, Creed-Monarch Inc, Camcraft Inc, M & W Industries Inc, Greystone of Lincoln Inc, Swagelok Hy-Level Company, Herker Industries Inc, Supreme Screw Products Inc **List Not Exhaustive.

3. What are the main segments of the North America Precision Turned Product Manufacturing Market?

The market segments include Operation, Machine Types, Material Type, End Use .

4. Can you provide details about the market size?

The market size is estimated to be USD 110.33 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Sector is Being Transformed by the Internet Of Things (IoT).

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

November 2022: Middle market private equity firm One Equity Partners announced the acquisition of precision machining service providers Evans Industries Inc. and Little Enterprises LLC by Momentum Manufacturing Group, a leading North American metal manufacturing services provider. The purchases will extend Momentum's capabilities, increase the company's exposure to mission-critical end markets, and add close to 160 qualified team members.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Precision Turned Product Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Precision Turned Product Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Precision Turned Product Manufacturing Market?

To stay informed about further developments, trends, and reports in the North America Precision Turned Product Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence