Key Insights

The North America textile fabrics industry, valued at $99.82 billion in 2025, is projected to experience steady growth, with a Compound Annual Growth Rate (CAGR) of 3.85% from 2025 to 2033. This growth is driven by several key factors. Firstly, the increasing demand for comfortable and functional clothing, coupled with evolving fashion trends, fuels consistent demand for diverse textile fabrics. Secondly, the burgeoning e-commerce sector and the rise of fast fashion contribute to increased production and consumption. Furthermore, innovations in textile technology, including the development of sustainable and performance-enhancing fabrics, are driving market expansion. Major players like Nike, Levi Strauss & Co., and Hennes & Mauritz AB significantly influence market trends through their product innovations and extensive distribution networks. However, challenges remain. Fluctuations in raw material prices, particularly cotton, can impact profitability. Furthermore, increasing labor costs and growing competition from overseas manufacturers present ongoing hurdles for industry growth. The industry's segmentation likely reflects various fabric types (e.g., cotton, synthetic, blends) and end-use applications (e.g., apparel, home furnishings, industrial textiles), offering opportunities for targeted market penetration.

North America Textile Fabrics Industry Market Size (In Billion)

The forecast period (2025-2033) anticipates continued growth, albeit at a potentially moderated pace towards the latter half of the decade due to potential economic shifts and evolving consumer preferences. The industry's resilience will depend on its ability to adapt to shifting consumer demands, embrace sustainable manufacturing practices, and leverage technological advancements to enhance efficiency and reduce costs. A focus on innovation in materials science and design will be crucial in maintaining market competitiveness and driving long-term growth. The successful players will be those who can balance affordability with quality, sustainability, and unique product offerings.

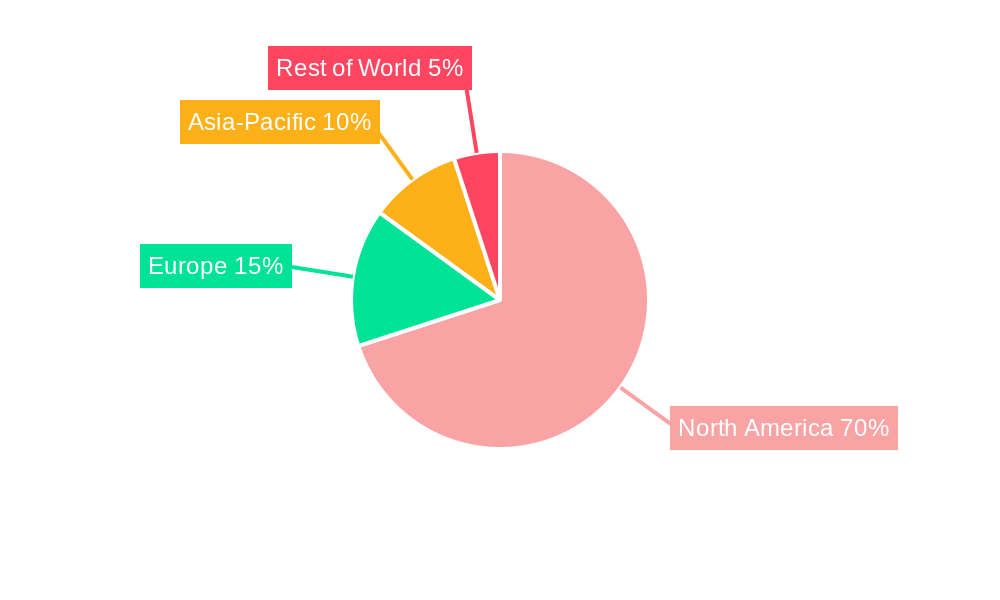

North America Textile Fabrics Industry Company Market Share

North America Textile Fabrics Industry: A Comprehensive Market Report (2019-2033)

This detailed report provides a comprehensive analysis of the North America textile fabrics industry, encompassing market size, segmentation, growth drivers, challenges, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. The forecast period spans 2025-2033, and the historical period covers 2019-2024. This report is essential for industry stakeholders, investors, and businesses seeking to understand the current market landscape and future trends in this dynamic sector.

North America Textile Fabrics Industry Market Concentration & Innovation

The North American textile fabrics industry exhibits a moderately concentrated market structure, with a few dominant players and a large number of smaller firms. Major companies such as Nike Inc, The Dixie Group Inc, American Eagle Outfitters Inc, Guilford Mills Inc, DuPont de Nemours Inc, Levi Strauss & Co, Hennes & Mauritz AB, WestPoint Home Inc, Welspun India Ltd, Standard Textile Co Inc, Mohawk Industries Inc, and Elevate Textiles Inc hold significant market share, although the exact figures vary across segments. The industry is characterized by ongoing innovation driven by consumer demand for sustainable, high-performance fabrics, technological advancements in fiber production, and evolving fashion trends. Regulatory frameworks, particularly those related to environmental sustainability and labor practices, significantly influence industry operations. The presence of substitute materials, such as synthetic fabrics and plant-based alternatives, exerts competitive pressure. Furthermore, M&A activities, exemplified by the USD 593 Million acquisition of Huntsman Corporation's Textile Effects division by Archroma in 2023, reshape the competitive landscape and drive consolidation. The average deal value for M&A transactions within the last five years is estimated at USD xx Million. End-user trends, such as increased demand for athleisure and eco-friendly apparel, further shape the industry's trajectory.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Innovation Drivers: Sustainable materials, high-performance fabrics, technological advancements.

- Regulatory Framework: Environmental sustainability and labor practices.

- Product Substitutes: Synthetic fabrics, plant-based alternatives.

- M&A Activity: Significant consolidation through mergers and acquisitions (e.g., Huntsman/Archroma deal).

- End-User Trends: Growing demand for athleisure and sustainable apparel.

North America Textile Fabrics Industry Industry Trends & Insights

The North American textile fabrics industry is experiencing a period of significant transformation, driven by several key trends. The market is witnessing robust growth, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Technological disruptions, particularly in areas like 3D printing and smart fabrics, are creating new possibilities and disrupting traditional manufacturing processes. Consumer preferences are shifting towards sustainable, ethically sourced, and functional fabrics, influencing material choices and production methods. Market penetration of sustainable fabrics is growing rapidly, currently estimated at xx% and projected to reach xx% by 2033. The competitive dynamics are intensifying, with companies focusing on innovation, brand building, and supply chain optimization to gain a competitive edge. These factors collectively contribute to the industry's dynamic and evolving nature. Specific growth drivers include increasing consumer spending on apparel and home furnishings, advancements in textile technology, and a growing focus on sustainability.

Dominant Markets & Segments in North America Textile Fabrics Industry

The United States represents the dominant market within North America for textile fabrics, driven by its large consumer base, robust apparel and home furnishings industries, and established textile manufacturing infrastructure. Within the US market, the apparel segment holds a significant share, fueled by consumer demand for clothing and athletic wear.

- Key Drivers of US Market Dominance:

- Large consumer base and disposable income.

- Robust domestic apparel and home furnishings industries.

- Well-established textile manufacturing infrastructure.

- Favorable economic policies and regulations.

The dominance of the US market is further solidified by factors such as established retail networks, strong consumer spending, and access to advanced technologies. Other segments within the broader textile industry, including industrial textiles, also contribute significantly to the overall market size.

North America Textile Fabrics Industry Product Developments

Recent product innovations have focused on developing sustainable and high-performance fabrics. Technological advancements in fiber production, including the use of recycled materials and innovative bio-based fibers, are driving the creation of environmentally friendly fabrics. The integration of smart technologies into textiles, such as sensors and conductive materials, is creating new applications in areas like sportswear and healthcare. These innovations cater to the evolving needs and preferences of consumers, who are increasingly seeking both sustainability and high-performance attributes. The competitive advantage hinges on the ability to provide innovative, sustainable, and high-quality fabrics that meet specific end-user needs.

Report Scope & Segmentation Analysis

This report segments the North America textile fabrics industry based on fiber type (natural, synthetic, blended), fabric type (woven, knitted, non-woven), application (apparel, home furnishings, industrial), and region (United States, Canada, Mexico). Each segment presents unique growth projections, market sizes, and competitive dynamics. The apparel segment is anticipated to exhibit strong growth throughout the forecast period, followed by the home furnishings sector. The competitive landscape varies across segments, with some dominated by a few large players, while others are more fragmented.

Key Drivers of North America Textile Fabrics Industry Growth

The growth of the North America textile fabrics industry is fueled by several key factors. Technological advancements in fiber production and fabric manufacturing are leading to the development of innovative and high-performance textiles. The growing consumer demand for sustainable and ethical products is pushing manufacturers to adopt eco-friendly practices. Furthermore, favorable economic conditions and government policies supporting the textile industry contribute to market expansion. Increased disposable income and consumer spending on apparel and home furnishings further fuel demand.

Challenges in the North America Textile Fabrics Industry Sector

The North American textile fabrics industry faces several challenges, including rising raw material costs, increasing labor costs, and intense competition from overseas manufacturers. Supply chain disruptions, exacerbated by geopolitical events, pose a significant risk. Stringent environmental regulations and consumer pressure for sustainable practices add to operational costs. These factors collectively constrain profit margins and necessitate efficient operations and innovative solutions for sustainable growth.

Emerging Opportunities in North America Textile Fabrics Industry

Emerging opportunities lie in the development and adoption of sustainable and high-performance fabrics, particularly in areas like recycled materials, bio-based fibers, and smart textiles. The growing demand for functional apparel and home furnishings offers significant potential for growth. Expansion into new markets and the development of niche products catered to specific consumer segments also presents promising avenues for business development. Technological advancements will unlock further possibilities, opening doors for new products and improved efficiency.

Leading Players in the North America Textile Fabrics Industry Market

- Nike Inc

- The Dixie Group Inc

- American Eagle Outfitters Inc

- Guilford Mills Inc

- DuPont de Nemours Inc

- Levi Strauss & Co

- Hennes & Mauritz AB

- WestPoint Home Inc

- Welspun India Ltd

- Standard Textile Co Inc

- Mohawk Industries Inc

- Elevate Textiles Inc

Key Developments in North America Textile Fabrics Industry Industry

- August 2022: Huntsman Corporation announced that Archroma would acquire its Textile Effects business.

- December 2022: India and Canada negotiated a free trade agreement, potentially impacting textile trade.

- February 2023: Huntsman Corporation completed the sale of its Textile Effects division to Archroma for USD 593 Million.

Strategic Outlook for North America Textile Fabrics Industry Market

The North America textile fabrics industry is poised for continued growth, driven by technological innovation, consumer demand for sustainable and functional fabrics, and expanding applications across various sectors. Companies that prioritize sustainability, invest in research and development, and adapt to evolving consumer preferences are well-positioned to capture significant market share in the years to come. The future success will depend on embracing innovative technologies, sustainable practices, and adapting to the evolving needs of consumers.

North America Textile Fabrics Industry Segmentation

-

1. Application

- 1.1. Clothing

- 1.2. Industrial/Technical Applications

- 1.3. Household Applications

-

2. Material Type

- 2.1. Cotton

- 2.2. Jute

- 2.3. Silk

- 2.4. Synthetics

- 2.5. Wool

-

3. Process

- 3.1. Woven

- 3.2. Non-woven

North America Textile Fabrics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Textile Fabrics Industry Regional Market Share

Geographic Coverage of North America Textile Fabrics Industry

North America Textile Fabrics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.3. Market Restrains

- 3.3.1. Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers

- 3.4. Market Trends

- 3.4.1. Increasing demand for North America's apparels driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Textile Fabrics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Clothing

- 5.1.2. Industrial/Technical Applications

- 5.1.3. Household Applications

- 5.2. Market Analysis, Insights and Forecast - by Material Type

- 5.2.1. Cotton

- 5.2.2. Jute

- 5.2.3. Silk

- 5.2.4. Synthetics

- 5.2.5. Wool

- 5.3. Market Analysis, Insights and Forecast - by Process

- 5.3.1. Woven

- 5.3.2. Non-woven

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Nike Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Dixie Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 American Eagle Outfitters Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Guilford Mills Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 DuPont de Nemours Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Levi Strauss & Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hennes & Mauritz AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WestPoint Home Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Welspun India Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Standard Textile Co Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Mohawk Industries Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Elevate Textiles Inc **List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Nike Inc

List of Figures

- Figure 1: North America Textile Fabrics Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Textile Fabrics Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 2: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 3: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 5: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 6: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 7: North America Textile Fabrics Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 8: North America Textile Fabrics Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 9: North America Textile Fabrics Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Textile Fabrics Industry Volume Billion Forecast, by Application 2020 & 2033

- Table 11: North America Textile Fabrics Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 12: North America Textile Fabrics Industry Volume Billion Forecast, by Material Type 2020 & 2033

- Table 13: North America Textile Fabrics Industry Revenue Million Forecast, by Process 2020 & 2033

- Table 14: North America Textile Fabrics Industry Volume Billion Forecast, by Process 2020 & 2033

- Table 15: North America Textile Fabrics Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Textile Fabrics Industry Volume Billion Forecast, by Country 2020 & 2033

- Table 17: United States North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Canada North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico North America Textile Fabrics Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico North America Textile Fabrics Industry Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Textile Fabrics Industry?

The projected CAGR is approximately 3.85%.

2. Which companies are prominent players in the North America Textile Fabrics Industry?

Key companies in the market include Nike Inc, The Dixie Group Inc, American Eagle Outfitters Inc, Guilford Mills Inc, DuPont de Nemours Inc, Levi Strauss & Co, Hennes & Mauritz AB, WestPoint Home Inc, Welspun India Ltd, Standard Textile Co Inc, Mohawk Industries Inc, Elevate Textiles Inc **List Not Exhaustive.

3. What are the main segments of the North America Textile Fabrics Industry?

The market segments include Application, Material Type, Process.

4. Can you provide details about the market size?

The market size is estimated to be USD 99.82 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

6. What are the notable trends driving market growth?

Increasing demand for North America's apparels driving the market.

7. Are there any restraints impacting market growth?

Increasing demand for clothing and accessories; Availability of raw materials at low prices for textile manufacturers.

8. Can you provide examples of recent developments in the market?

February 2023: Huntsman Corporation (NYSE: HUN) announced that it has completed the sale of its Textile Effects division to Archroma, a portfolio company of SK Capital Partners. The agreed purchase price was USD 593 million in cash plus assumed pension liabilities. Huntsman expects the net after-tax cash proceeds to be approximately USD 540 million before customary post-closing adjustments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Textile Fabrics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Textile Fabrics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Textile Fabrics Industry?

To stay informed about further developments, trends, and reports in the North America Textile Fabrics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence