Key Insights

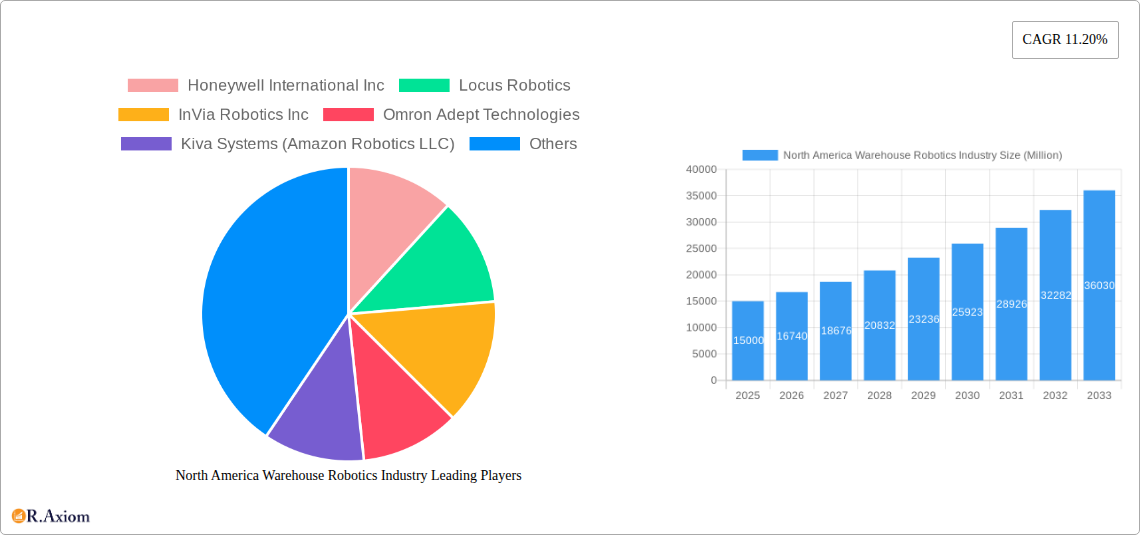

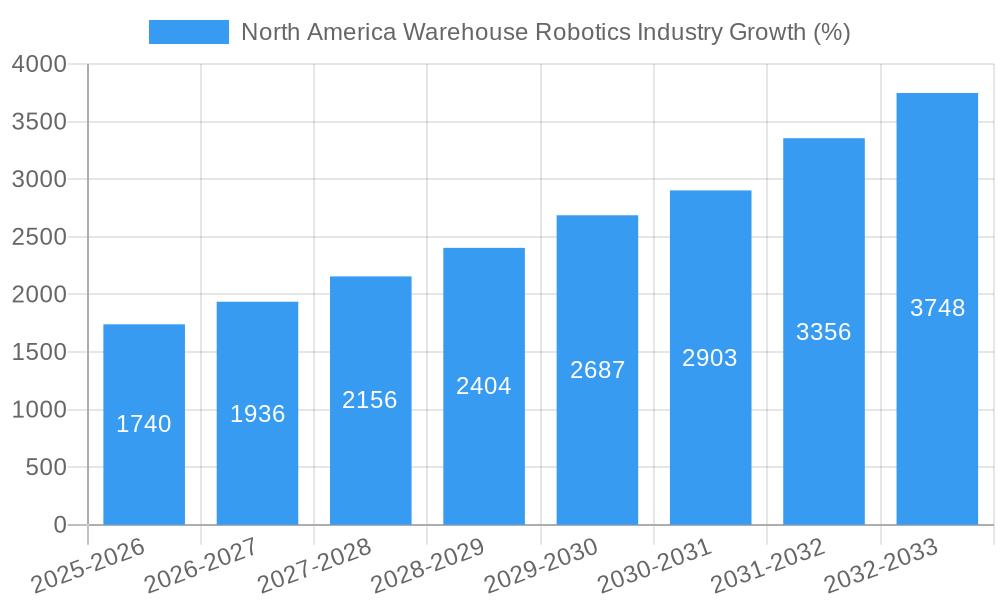

The North American warehouse robotics market is experiencing robust growth, driven by the escalating demand for efficient and automated warehouse operations across various sectors. The market, valued at approximately $X billion in 2025 (assuming a logical extrapolation based on the provided CAGR of 11.20% and a starting point derived from common market size estimations for related sectors), is projected to reach $Y billion by 2033. This significant expansion is fueled by several key factors. E-commerce's relentless growth necessitates faster order fulfillment and delivery times, pushing businesses to adopt automated solutions. Labor shortages and increasing labor costs further incentivize automation, while advancements in robotics technology—including improved sensor capabilities, AI-powered navigation, and collaborative robots (cobots)—enhance efficiency and versatility. The increasing prevalence of omnichannel strategies and the demand for faster delivery options like same-day and next-day shipping are also contributing significantly to market growth.

Growth is further segmented across diverse applications. Industrial robots, automated storage and retrieval systems (ASRS), and mobile robots (AGVs and AMRs) are experiencing particularly strong demand, driven by their effectiveness in tasks such as order picking, packing, and material handling. The food and beverage, automotive, and e-commerce sectors are significant end-users, with substantial investment in warehouse automation to optimize their supply chains. While initial investment costs can be substantial, the long-term return on investment (ROI) through increased efficiency, reduced labor costs, and improved order fulfillment makes warehouse robotics a compelling proposition. However, challenges remain, including the need for skilled labor to integrate and maintain these systems and concerns about the potential displacement of human workers. Addressing these concerns through workforce retraining initiatives and focusing on human-robot collaboration will be crucial for continued, sustainable market growth.

North America Warehouse Robotics Industry: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the North America warehouse robotics industry, covering the period 2019-2033. It offers actionable insights into market trends, competitive dynamics, and growth opportunities for industry stakeholders. The report leverages extensive data analysis to forecast market size and growth, providing a valuable resource for strategic decision-making. The base year for this analysis is 2025, with an estimated year of 2025 and a forecast period of 2025-2033. The historical period covered is 2019-2024.

North America Warehouse Robotics Industry Market Concentration & Innovation

This section analyzes the level of market concentration, identifying key players and their respective market shares. We explore the innovative drivers shaping the industry, including technological advancements, automation needs, and evolving end-user preferences. The report examines the regulatory landscape, potential product substitutes, and the impact of mergers and acquisitions (M&A) activities on market dynamics. We analyze historical and projected M&A deal values, providing context for industry consolidation and investment trends. For instance, the acquisition of Kiva Systems by Amazon significantly altered the competitive landscape. While precise market share data for each player is proprietary, we estimate that the top 5 players control approximately xx% of the market in 2025, with a projected increase to xx% by 2033. The average M&A deal value in the period 2019-2024 was approximately $xx Million, with expectations of an increase to $xx Million during the forecast period due to increased investment in automation technologies. The impact of regulatory frameworks like OSHA regulations on safety and worker displacement is also assessed. Finally, the report analyzes trends in end-user demand, including the growing adoption of robotics in e-commerce fulfillment and the increasing prevalence of automation in various sectors.

North America Warehouse Robotics Industry Industry Trends & Insights

This section delves into the key trends driving growth in the North America warehouse robotics market. We examine factors such as the escalating demand for efficient warehouse operations, the rising adoption of e-commerce, and the increasing need for automation to improve productivity and reduce labor costs. The report explores the impact of technological disruptions, including advancements in artificial intelligence (AI), machine learning (ML), and computer vision, on the industry’s trajectory. It further analyzes changing consumer preferences and their influence on warehouse automation requirements. The competitive landscape is thoroughly examined, assessing the strategies employed by leading players to maintain market share and drive innovation. The compound annual growth rate (CAGR) for the North America warehouse robotics industry is projected at xx% during the forecast period (2025-2033), driven primarily by the rising adoption of mobile robots (AMRs and AGVs) and the increasing demand for automated storage and retrieval systems (ASRS). The market penetration of warehouse robotics is expected to increase from xx% in 2025 to xx% by 2033.

Dominant Markets & Segments in North America Warehouse Robotics Industry

This section identifies the dominant markets and segments within the North America warehouse robotics industry.

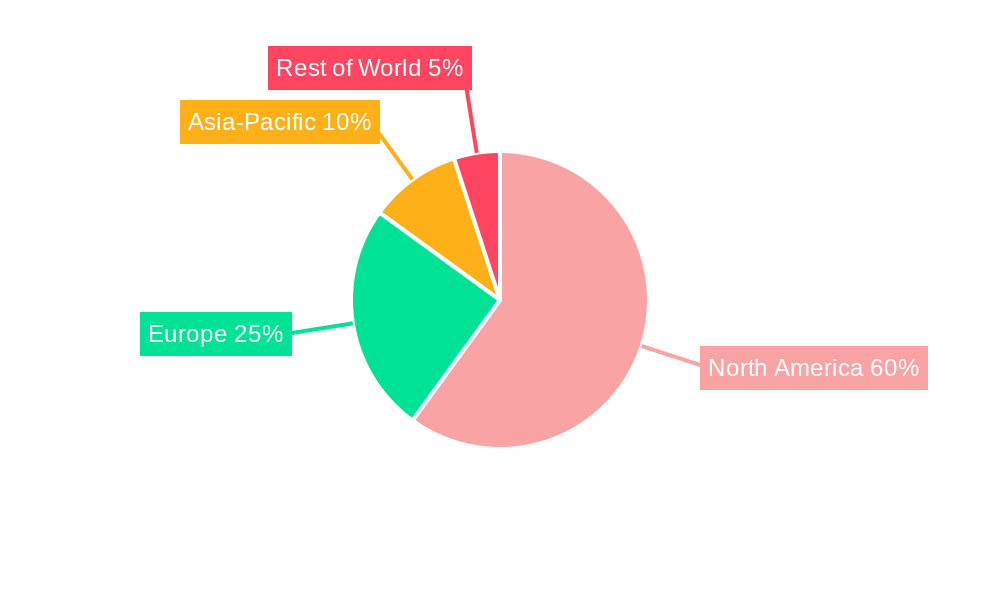

Leading Region/Country: The United States dominates the North American warehouse robotics market due to its large e-commerce sector, robust manufacturing base, and significant investments in automation technologies. Canada also exhibits substantial growth, albeit at a smaller scale.

Dominant Type Segments: Mobile Robots (AGVs and AMRs) are projected to hold the largest market share due to their flexibility and adaptability to various warehouse operations. Automated Storage and Retrieval Systems (ASRS) also represent a significant segment, driven by the need for high-density storage and efficient order fulfillment.

Dominant Function Segments: Storage and Packaging are the dominant function segments, reflecting the critical role of robotics in managing inventory and preparing goods for shipment.

Dominant End-User Segments: The Food and Beverage, and E-commerce sectors are prominent end-users, owing to the high volume of goods handled and the demand for efficient order fulfillment. The Automotive sector is also substantial, with a notable growth trajectory driven by automation needs in its supply chain.

Key Drivers: Several factors contribute to the dominance of these segments. For the United States, the well-developed logistics infrastructure and supportive government policies encouraging automation play a significant role. In both countries, the growing e-commerce sector fuels the demand for efficient warehouse operations.

North America Warehouse Robotics Industry Product Developments

Recent product innovations focus on enhancing the capabilities of existing technologies and developing new solutions. This includes advancements in AI-powered navigation for mobile robots, improved sensor technologies for enhanced object recognition and manipulation, and the integration of cloud-based platforms for real-time data analysis and remote monitoring. These innovations are geared toward improving efficiency, reducing operational costs, and enhancing the overall flexibility and scalability of warehouse operations. The market is witnessing a shift towards collaborative robots (cobots) designed to work safely alongside human workers, addressing safety concerns and expanding the applications of warehouse robotics.

Report Scope & Segmentation Analysis

This report comprehensively segments the North America warehouse robotics market based on type (Industrial Robots, Sortation Systems, Conveyors, Palletizers, ASRS, Mobile Robots), function (Storage, Plastic Bottles, Packaging, Trans-shipments, Other Functions), end-user (Food and Beverage, Automotive, Retail, Electrical and Electronics, Pharmaceutical, Other End Users), and country (United States, Canada). Each segment is analyzed based on its growth projections, market size, and competitive dynamics. For example, the Mobile Robots segment is projected to experience a CAGR of xx% driven by increasing adoption of AMRs. The Food and Beverage sector's segment growth is linked to the increasing demand for automation in food processing and distribution.

Key Drivers of North America Warehouse Robotics Industry Growth

Several factors are driving the growth of the North America warehouse robotics industry. Technological advancements, including AI and machine learning, are enhancing the capabilities of robots and creating new applications. The increasing demand for e-commerce fulfillment and the rising labor costs are compelling businesses to automate warehouse operations. Supportive government policies and initiatives promoting automation are also contributing to market growth. Furthermore, the need for improved supply chain efficiency and resilience is a key factor in the expanding adoption of warehouse robotics.

Challenges in the North America Warehouse Robotics Industry Sector

Despite the growth potential, several challenges hinder the widespread adoption of warehouse robotics. High initial investment costs and the complexity of implementation can be significant barriers for smaller businesses. Concerns about job displacement and the need for skilled labor to operate and maintain robotic systems also pose challenges. Regulatory compliance and safety standards add to the complexity. Supply chain disruptions can also impact the availability of components and hinder the timely delivery of robotic systems. The competitive landscape, characterized by both established players and emerging startups, can create price pressures and limit profit margins.

Emerging Opportunities in North America Warehouse Robotics Industry

The North American warehouse robotics market presents several emerging opportunities. The growing demand for automation in various industries beyond e-commerce, such as healthcare and pharmaceuticals, creates new market avenues. Advancements in AI and machine learning are opening doors for more sophisticated and adaptable robotic systems. The increasing adoption of cloud-based solutions provides opportunities for data-driven optimization and remote management of robotic systems. The focus on sustainability and energy efficiency presents opportunities for the development of eco-friendly robotics solutions.

Leading Players in the North America Warehouse Robotics Industry Market

- Honeywell International Inc

- Locus Robotics

- InVia Robotics Inc

- Omron Adept Technologies

- Kiva Systems (Amazon Robotics LLC)

- Fetch Robotics Inc

- List Not Exhaustive

Key Developments in North America Warehouse Robotics Industry Industry

- 2023 Q3: Honeywell International Inc. launched a new generation of autonomous mobile robots with enhanced AI capabilities.

- 2022 Q4: Locus Robotics announced a strategic partnership with a major e-commerce retailer to expand its market reach.

- 2021 Q2: Amazon Robotics expanded its fulfillment center automation initiatives with the deployment of new robotic systems.

- Further developments will be detailed in the full report.

Strategic Outlook for North America Warehouse Robotics Industry Market

The future of the North America warehouse robotics market is bright. Continued technological advancements, coupled with the rising demand for automation in various sectors, are poised to drive significant growth. The increasing adoption of AI, machine learning, and cloud-based solutions will lead to more sophisticated and efficient robotic systems. Opportunities exist for companies that can offer innovative solutions addressing the challenges of scalability, cost-effectiveness, and worker safety. The market will likely consolidate further, with larger players acquiring smaller companies to expand their capabilities and market share. The overall market potential is substantial, with continued growth expected throughout the forecast period.

North America Warehouse Robotics Industry Segmentation

-

1. Type

- 1.1. Industrial Robots

- 1.2. Sortation Systems

- 1.3. Conveyors

- 1.4. Palletizers

- 1.5. Automated Storage and Retrieval System (ASRS)

- 1.6. Mobile Robots (AGVs and AMRs)

-

2. Function

- 2.1. Storage

- 2.2. Plastic Bottles

- 2.3. Packaging

- 2.4. Trans-shipments

- 2.5. Other Functions

-

3. End User

- 3.1. Food and Beverage

- 3.2. Automotive

- 3.3. Retail

- 3.4. Electrical and Electronics

- 3.5. Pharmaceutical

- 3.6. Other End Users

North America Warehouse Robotics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Warehouse Robotics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number of SKUs; Growth of E-commerce in Developing Countries

- 3.3. Market Restrains

- 3.3.1. ; Lack of Awareness and Budget to Deploy INS in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Growth of E-commerce in Developing Countries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Industrial Robots

- 5.1.2. Sortation Systems

- 5.1.3. Conveyors

- 5.1.4. Palletizers

- 5.1.5. Automated Storage and Retrieval System (ASRS)

- 5.1.6. Mobile Robots (AGVs and AMRs)

- 5.2. Market Analysis, Insights and Forecast - by Function

- 5.2.1. Storage

- 5.2.2. Plastic Bottles

- 5.2.3. Packaging

- 5.2.4. Trans-shipments

- 5.2.5. Other Functions

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Food and Beverage

- 5.3.2. Automotive

- 5.3.3. Retail

- 5.3.4. Electrical and Electronics

- 5.3.5. Pharmaceutical

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Warehouse Robotics Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Honeywell International Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Locus Robotics

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 InVia Robotics Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Omron Adept Technologies

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kiva Systems (Amazon Robotics LLC)

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Fetch Robotics Inc *List Not Exhaustive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Honeywell International Inc

List of Figures

- Figure 1: North America Warehouse Robotics Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Warehouse Robotics Industry Share (%) by Company 2024

List of Tables

- Table 1: North America Warehouse Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Warehouse Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: North America Warehouse Robotics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 4: North America Warehouse Robotics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 5: North America Warehouse Robotics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: North America Warehouse Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: United States North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Rest of North America North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: North America Warehouse Robotics Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 12: North America Warehouse Robotics Industry Revenue Million Forecast, by Function 2019 & 2032

- Table 13: North America Warehouse Robotics Industry Revenue Million Forecast, by End User 2019 & 2032

- Table 14: North America Warehouse Robotics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: United States North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Mexico North America Warehouse Robotics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Warehouse Robotics Industry?

The projected CAGR is approximately 11.20%.

2. Which companies are prominent players in the North America Warehouse Robotics Industry?

Key companies in the market include Honeywell International Inc, Locus Robotics, InVia Robotics Inc, Omron Adept Technologies, Kiva Systems (Amazon Robotics LLC), Fetch Robotics Inc *List Not Exhaustive.

3. What are the main segments of the North America Warehouse Robotics Industry?

The market segments include Type, Function, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number of SKUs; Growth of E-commerce in Developing Countries.

6. What are the notable trends driving market growth?

Growth of E-commerce in Developing Countries.

7. Are there any restraints impacting market growth?

; Lack of Awareness and Budget to Deploy INS in Emerging Economies.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Warehouse Robotics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Warehouse Robotics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Warehouse Robotics Industry?

To stay informed about further developments, trends, and reports in the North America Warehouse Robotics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence