Key Insights

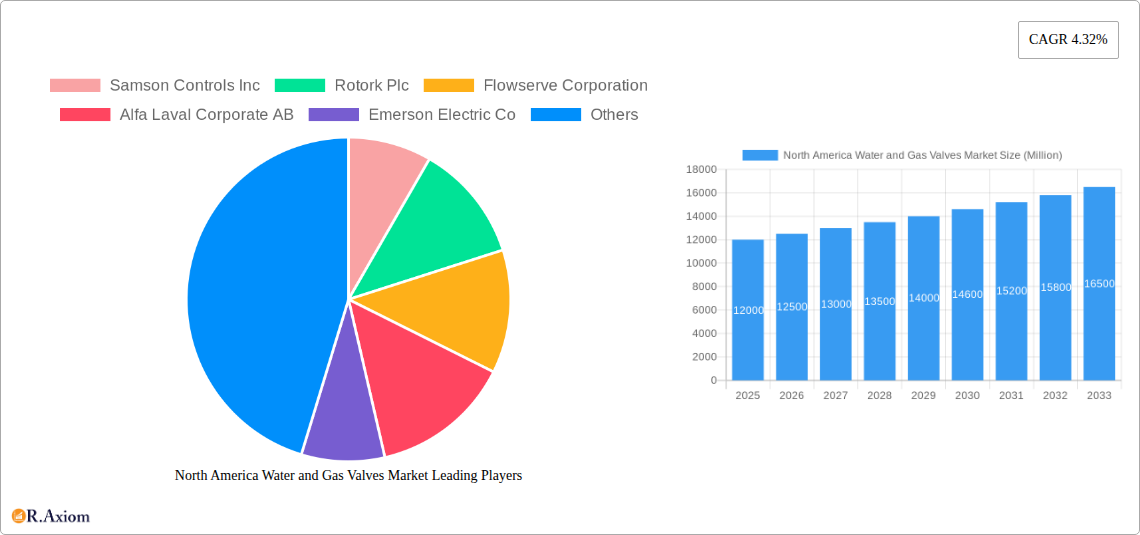

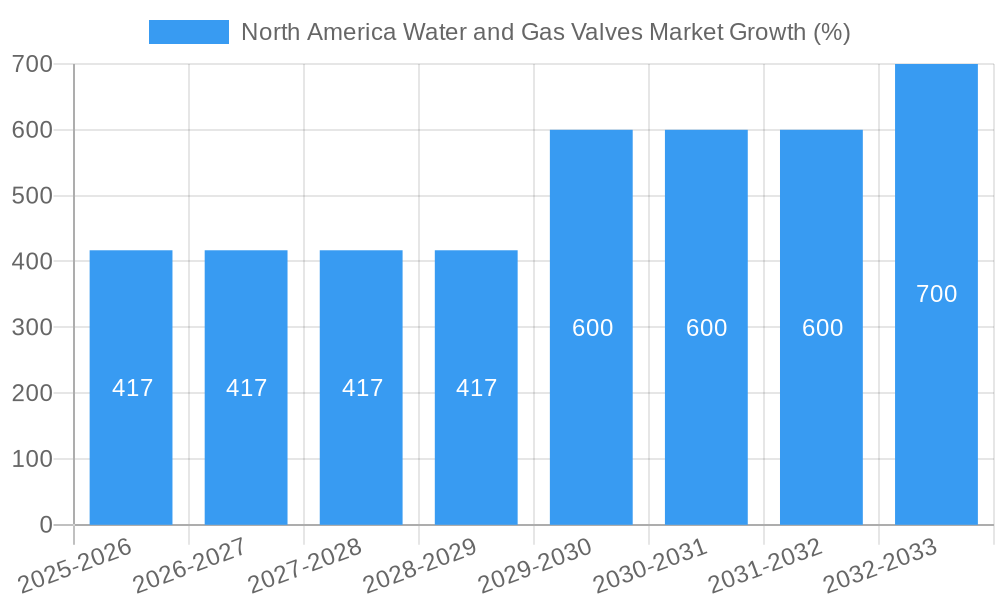

The North American water and gas valves market, encompassing the United States and Canada, is experiencing steady growth, driven by increasing investments in water infrastructure modernization and expansion of the oil and gas sector. The market's expansion is fueled by aging infrastructure requiring upgrades and replacements, stringent environmental regulations promoting efficient water management, and the burgeoning demand for natural gas as a cleaner energy source. The prevalence of ball valves, owing to their ease of operation and cost-effectiveness, significantly contributes to market volume. However, the market faces challenges including fluctuating commodity prices, particularly for metals used in valve manufacturing, and potential supply chain disruptions. The oil and gas segment remains a dominant end-user vertical, followed by the water and wastewater treatment sector, reflecting the significant investments in both industries. Growth is expected to be particularly strong in areas undergoing significant infrastructure development, with smart city initiatives and renewable energy projects driving adoption of technologically advanced valves. The market is characterized by a mix of established global players and regional manufacturers, creating a competitive landscape that fosters innovation and price competition. While precise figures are not provided, based on the 4.32% CAGR and a market size of XX million (assumed to be in 2025), reasonable estimations place the market size in the range of $10-15 Billion in 2025, projecting further growth to $12-18 Billion by 2033.

The competitive landscape includes major players like Samson Controls, Rotork, Flowserve, Alfa Laval, Emerson Electric, and others, competing on factors such as technological innovation, product quality, pricing strategies, and service offerings. Within the segment breakdown, gate, globe, and check valves are expected to maintain significant market share due to their wide applicability in diverse applications. The ongoing development of advanced materials and automation technologies, such as smart valves with remote monitoring capabilities, is further shaping the market trajectory and enhancing operational efficiency for end-users. Future growth prospects are underpinned by continuous investments in pipeline infrastructure, increased demand for water-efficient technologies, and the rising adoption of advanced control systems in both water and gas distribution networks.

North America Water and Gas Valves Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America water and gas valves market, covering the period from 2019 to 2033. It offers valuable insights into market dynamics, growth drivers, challenges, and future opportunities, empowering stakeholders to make informed strategic decisions. The report segments the market by type (Ball, Butterfly, Gate/Globe/Check, Plug, Control, Other Types), end-user vertical (Oil and Gas, Power Generation, Chemical, Water and Wastewater, Mining, Other End User Verticals), and country (United States, Canada). Key players analyzed include Samson Controls Inc, Rotork Plc, Flowserve Corporation, Alfa Laval Corporate AB, Emerson Electric Co, IMI Critical Engineering, Crane Co, Valmet Oyj, Schlumberger Limited, and KITZ Corporation. The base year for this report is 2025, with an estimated year of 2025 and a forecast period spanning 2025-2033. The historical period covered is 2019-2024.

North America Water and Gas Valves Market Concentration & Innovation

The North American water and gas valves market exhibits a moderately concentrated landscape, with a handful of multinational corporations holding significant market share. The top ten players collectively account for approximately xx% of the market in 2025. Market share dynamics are influenced by factors like technological innovation, mergers and acquisitions (M&A), and regulatory compliance. M&A activity in the sector has been relatively robust in recent years, with deals primarily driven by the desire to expand product portfolios, geographic reach, and technological capabilities. For example, while precise deal values are confidential in many cases, the combined market capitalization of the major players suggests a substantial value in M&A transactions over the past five years exceeding xx Million. Innovation is a key driver, with companies investing heavily in developing advanced materials, smart valve technologies, and improved control systems. Stringent environmental regulations further stimulate innovation, pushing for more energy-efficient and sustainable valve solutions. Product substitution is a factor, with newer, more efficient valve types gradually replacing older technologies. End-user trends, especially towards automation and digitalization in water and gas infrastructure, are reshaping market demands.

- Market Concentration: Top 10 players hold approximately xx% market share (2025).

- M&A Activity: Significant activity in recent years, with deal values exceeding xx Million.

- Innovation Drivers: Advanced materials, smart valve technologies, and environmental regulations.

- Product Substitution: Newer valve types gradually replacing older technologies.

- End-User Trends: Increasing demand for automation and digitalization.

North America Water and Gas Valves Market Industry Trends & Insights

The North America water and gas valves market is projected to witness robust growth, with a CAGR of xx% during the forecast period (2025-2033). This growth is primarily fueled by the expansion of water and gas infrastructure, increasing demand for energy-efficient solutions, and the rising adoption of smart technologies. Technological disruptions, particularly in areas such as remote monitoring and predictive maintenance, are transforming market dynamics. The market penetration of smart valves is steadily increasing, driven by their ability to enhance operational efficiency and reduce maintenance costs. Consumer preferences are shifting towards advanced valve solutions that offer improved reliability, durability, and ease of maintenance. Competitive dynamics are intense, with established players focusing on innovation, strategic partnerships, and acquisitions to maintain their market positions. The market exhibits a trend towards vertical integration, with some companies expanding their operations to encompass the entire value chain, from design and manufacturing to installation and maintenance. Overall, the market is characterized by a dynamic interplay of technological advancement, regulatory changes, and evolving consumer demands.

Dominant Markets & Segments in North America Water and Gas Valves Market

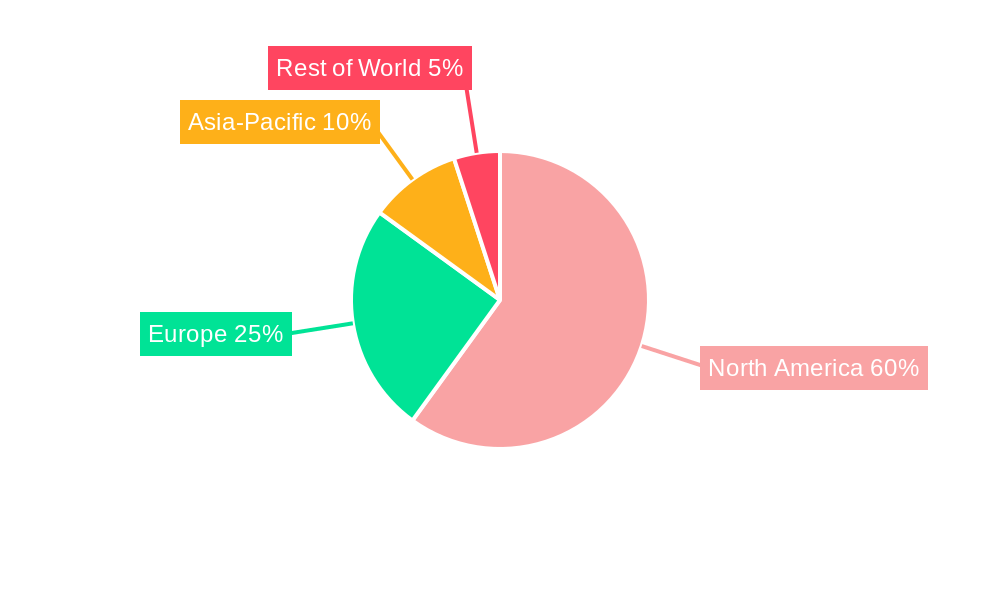

The United States represents the largest market for water and gas valves in North America, owing to its extensive infrastructure, robust industrial sector, and ongoing investments in modernization projects. Within the product type segment, the ball valve segment holds the largest market share due to its versatility, ease of operation, and cost-effectiveness. The oil and gas end-user vertical dominates the market, driven by high demand from upstream and downstream operations.

- United States Dominance: Driven by extensive infrastructure, industrial activity, and modernization investments.

- Ball Valve Segment Leadership: Versatility, ease of operation, and cost-effectiveness.

- Oil and Gas End-User Dominance: High demand from upstream and downstream operations.

- Key Drivers (United States): Robust industrial activity, significant investments in infrastructure modernization, and stringent environmental regulations.

- Key Drivers (Canada): Energy sector investments (oil sands, hydropower), growing urbanization, and government initiatives promoting water infrastructure development.

North America Water and Gas Valves Market Product Developments

Recent product innovations have focused on enhancing valve performance, efficiency, and smart capabilities. The introduction of smart valves with integrated sensors and communication protocols allows for remote monitoring, predictive maintenance, and improved control. These innovations offer significant competitive advantages, such as reduced downtime, optimized energy consumption, and enhanced safety. Technological trends point toward greater integration of digital technologies, advanced materials, and automation features. The market fit for these advancements is strong, driven by increasing demands for efficiency, reliability, and data-driven decision-making in water and gas management.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the North America water and gas valves market, segmented by type, end-user vertical, and geography.

By Type: Ball, Butterfly, Gate/Globe/Check, Plug, Control, and Other Types. Each segment's growth projections and competitive dynamics are analyzed, revealing market size variations and growth potential.

By End-User Vertical: Oil and Gas, Power Generation, Chemical, Water and Wastewater, Mining, and Other End-User Verticals. The report assesses the unique characteristics of each sector, highlighting growth drivers and competitive intensity.

By Geography: United States and Canada. Country-specific market dynamics are examined, focusing on infrastructure investments, regulatory landscape, and economic growth factors.

Key Drivers of North America Water and Gas Valves Market Growth

The North America water and gas valves market's growth is driven by several factors. The expansion of existing and the development of new water and gas infrastructure projects across both the United States and Canada is a significant factor. Moreover, increasing government regulations focused on efficient water management and reducing environmental impact fuel innovation and growth within the market. Further, technological advancements, such as the adoption of smart valves with remote monitoring capabilities, contribute to improved efficiency and reduced operational costs, driving market expansion.

Challenges in the North America Water and Gas Valves Market Sector

The North American water and gas valves market faces various challenges, including supply chain disruptions impacting material availability and production timelines. These disruptions can lead to increased costs and delays in project completion. Furthermore, intense competition among established and emerging players requires companies to continuously innovate and improve offerings to remain competitive. Fluctuations in raw material prices, especially for metals used in valve manufacturing, create cost volatility.

Emerging Opportunities in North America Water and Gas Valves Market

Emerging opportunities lie in the increasing adoption of smart and digital technologies, such as IoT-enabled valves and predictive maintenance systems, for enhanced efficiency and data-driven decision-making. Further, the expansion of renewable energy sources creates demand for valves in new applications, while investments in water infrastructure modernization present growth opportunities.

Leading Players in the North America Water and Gas Valves Market Market

- Samson Controls Inc

- Rotork Plc

- Flowserve Corporation

- Alfa Laval Corporate AB

- Emerson Electric Co

- IMI Critical Engineering

- Crane Co

- Valmet Oyj

- Schlumberger Limited

- KITZ Corporation

Key Developments in North America Water and Gas Valves Market Industry

- April 2022: Emerson launched the TopWorx™ PD Series Smart Valve Positioner, enhancing valve control intelligence and expanding its TopWorx product line.

- June 2021: ValvTechnologies and Severn Glocon collaborated, combining expertise in high-end, severe service valves.

Strategic Outlook for North America Water and Gas Valves Market Market

The North America water and gas valves market exhibits strong growth potential, driven by ongoing infrastructure development, technological advancements, and increasing demand for efficient and reliable valve solutions. Companies should prioritize strategic investments in R&D, focusing on smart valve technologies, advanced materials, and digital solutions to capture market share. Strategic partnerships and acquisitions can be instrumental in expanding market reach and enhancing technological capabilities. The focus on sustainability and environmental compliance will shape future market developments.

North America Water and Gas Valves Market Segmentation

-

1. Type

- 1.1. Ball

- 1.2. Butterfly

- 1.3. Gate/Globe/Check

- 1.4. Plug

- 1.5. Control

- 1.6. Other Types

-

2. End-User Vertical

- 2.1. Oil and Gas

- 2.2. Power Generation

- 2.3. Chemical

- 2.4. Water and Wastewater

- 2.5. Mining

- 2.6. Other End User Verticals

North America Water and Gas Valves Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Water and Gas Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.32% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising adoption of automation technologies in process industries; Expansion of refineries and petrochemical plants; Need for replacement of outdated valves and adoption of smart valves

- 3.3. Market Restrains

- 3.3.1. Lack of standardized policies

- 3.4. Market Trends

- 3.4.1. Water and Wastewater is Expected to Grow at Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ball

- 5.1.2. Butterfly

- 5.1.3. Gate/Globe/Check

- 5.1.4. Plug

- 5.1.5. Control

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.2.1. Oil and Gas

- 5.2.2. Power Generation

- 5.2.3. Chemical

- 5.2.4. Water and Wastewater

- 5.2.5. Mining

- 5.2.6. Other End User Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. United States North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Water and Gas Valves Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Samson Controls Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Rotork Plc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Flowserve Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Alfa Laval Corporate AB

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Emerson Electric Co

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IMI Critical Engineering

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Crane Co

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Valmet Oyj

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Schlumberger Limited

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 KITZ Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Samson Controls Inc

List of Figures

- Figure 1: North America Water and Gas Valves Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Water and Gas Valves Market Share (%) by Company 2024

List of Tables

- Table 1: North America Water and Gas Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Water and Gas Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Water and Gas Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: North America Water and Gas Valves Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: North America Water and Gas Valves Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 6: North America Water and Gas Valves Market Volume K Unit Forecast, by End-User Vertical 2019 & 2032

- Table 7: North America Water and Gas Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Water and Gas Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Water and Gas Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Water and Gas Valves Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Water and Gas Valves Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: North America Water and Gas Valves Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 21: North America Water and Gas Valves Market Revenue Million Forecast, by End-User Vertical 2019 & 2032

- Table 22: North America Water and Gas Valves Market Volume K Unit Forecast, by End-User Vertical 2019 & 2032

- Table 23: North America Water and Gas Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Water and Gas Valves Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Water and Gas Valves Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Water and Gas Valves Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Water and Gas Valves Market?

The projected CAGR is approximately 4.32%.

2. Which companies are prominent players in the North America Water and Gas Valves Market?

Key companies in the market include Samson Controls Inc, Rotork Plc, Flowserve Corporation, Alfa Laval Corporate AB, Emerson Electric Co, IMI Critical Engineering, Crane Co, Valmet Oyj, Schlumberger Limited, KITZ Corporation.

3. What are the main segments of the North America Water and Gas Valves Market?

The market segments include Type, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising adoption of automation technologies in process industries; Expansion of refineries and petrochemical plants; Need for replacement of outdated valves and adoption of smart valves.

6. What are the notable trends driving market growth?

Water and Wastewater is Expected to Grow at Significant Rate.

7. Are there any restraints impacting market growth?

Lack of standardized policies.

8. Can you provide examples of recent developments in the market?

April 2022 - Emerson launched the TopWorxTM PD Series Smart Valve Positioner. The PD Series adds intelligence, dependability, and versatility to valve control, expanding Emerson's current line of TopWorx sensing and control devices. The PD Series improves the current TopWorx range of discrete valve controllers by integrating communication through a 4-20 mA loop signal and HART protocols, enabling complete control over valve position.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Water and Gas Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Water and Gas Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Water and Gas Valves Market?

To stay informed about further developments, trends, and reports in the North America Water and Gas Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence