Key Insights

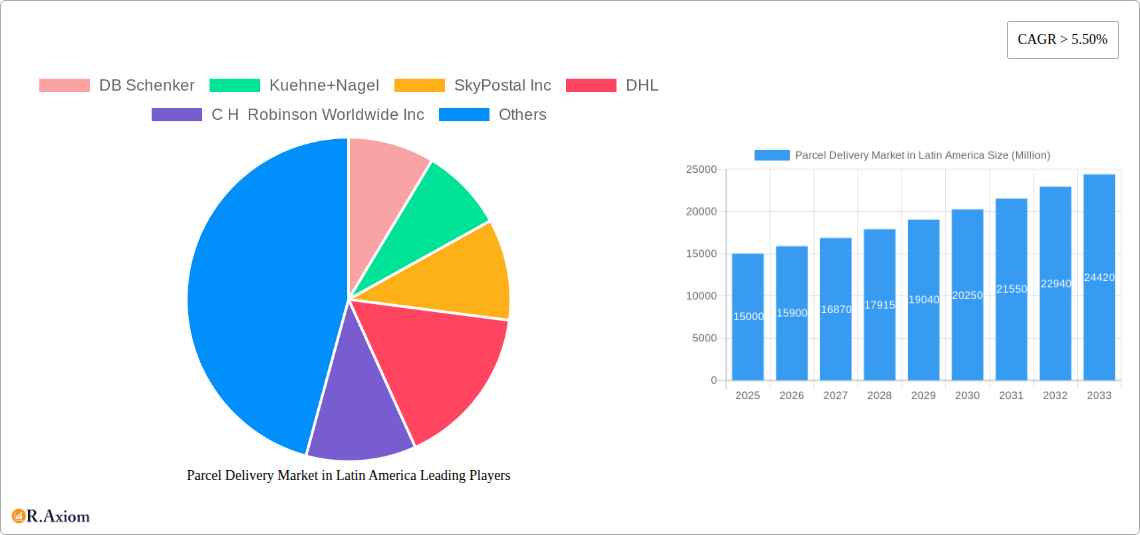

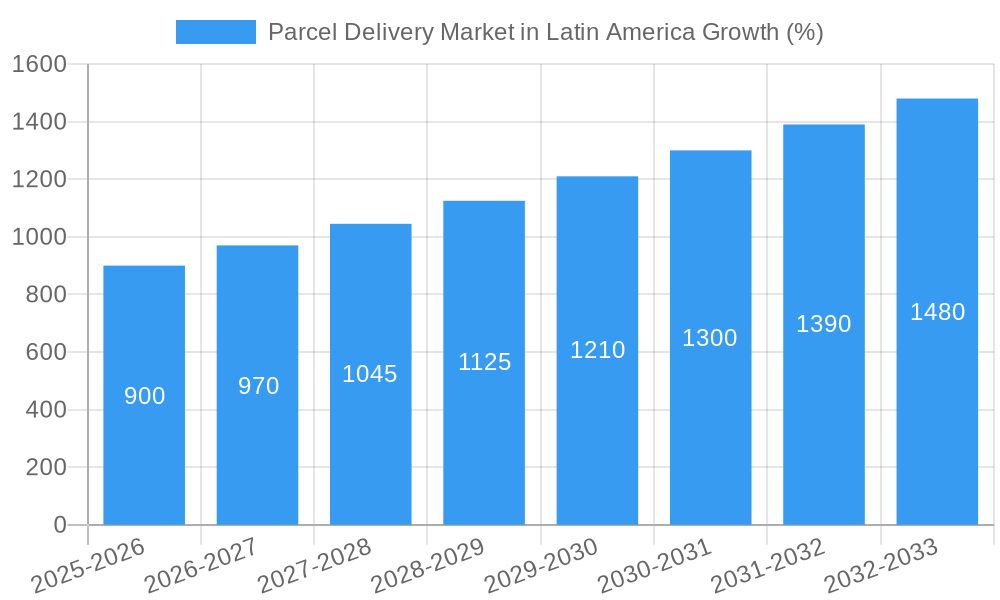

The Latin American parcel delivery market, currently valued at approximately $XX million (assuming a reasonable market size based on the provided CAGR and regional economic indicators), is experiencing robust growth, exceeding a compound annual growth rate (CAGR) of 5.5%. This expansion is fueled by several key factors. The burgeoning e-commerce sector across Brazil, Mexico, and other Latin American countries is a primary driver, with consumers increasingly relying on online shopping for a wide range of goods. Furthermore, improvements in logistics infrastructure, including expanded delivery networks and technological advancements in tracking and delivery management, are streamlining operations and enhancing efficiency. The rise of B2C and C2C parcel delivery, alongside robust growth in B2B services, contributes significantly to overall market volume. Significant growth is projected across segments, with Brazil, Mexico, and Colombia leading the charge due to their larger economies and higher online penetration rates. While challenges exist, such as inconsistent infrastructure in some areas and fluctuating currency exchange rates, the overall outlook for the market remains positive, promising continued expansion over the forecast period (2025-2033).

However, certain restraints impact market growth. These include the need for further infrastructure development in less accessible regions, particularly in smaller cities and rural areas. Addressing this requires investment in transportation networks, warehousing facilities, and advanced tracking technologies. Moreover, regulatory hurdles and customs procedures in some Latin American countries can create inefficiencies and delays, affecting delivery timelines and increasing costs. Competition among established players like DHL, FedEx, and local carriers such as Loggi is fierce, driving innovation and price optimization. Nevertheless, the potential for market expansion, fueled by the rising middle class and increasing digitalization, overshadows these limitations. The market segmentation across end-users (services, retail, healthcare, manufacturing), business models (B2B, B2C, C2C), and delivery types (e-commerce, non-e-commerce) offers various opportunities for market participants to target specific niches and leverage their strengths to capture market share.

Parcel Delivery Market in Latin America: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin American parcel delivery market, covering market size, segmentation, growth drivers, challenges, and key players. The study period spans 2019-2033, with 2025 as the base and estimated year, and a forecast period of 2025-2033. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders.

Parcel Delivery Market in Latin America: Market Concentration & Innovation

The Latin American parcel delivery market exhibits a moderately concentrated landscape, dominated by global giants like DHL, FedEx, and UPS, alongside regional players such as Loggi and Brazil Post. These established players command significant market share, estimated at xx% collectively in 2025. However, the market is witnessing increased competition from smaller, specialized companies focusing on niche segments like e-commerce delivery.

Market share dynamics are significantly influenced by:

- Technological Innovation: Investments in automation, AI-powered route optimization, and last-mile delivery solutions are shaping competitive advantages. Companies are also investing in tracking and delivery management systems.

- Regulatory Frameworks: Varying regulations across Latin American countries impact operational efficiency and cross-border shipping. Harmonization efforts are gradually improving the ease of doing business.

- Product Substitutes: The emergence of alternative delivery models, such as drone deliveries and crowdsourced logistics, presents potential disruption, although their market penetration remains limited currently (estimated at xx% in 2025).

- End-User Trends: The rise of e-commerce is a major driver, fueling demand for faster and more reliable delivery services. The increasing adoption of omnichannel strategies by businesses is also contributing to market growth.

- M&A Activities: Consolidation through mergers and acquisitions is expected to increase in the coming years. While specific deal values are difficult to ascertain publicly, there is ongoing activity aimed at expanding market reach and service capabilities.

Parcel Delivery Market in Latin America: Industry Trends & Insights

The Latin American parcel delivery market is experiencing robust growth, driven by several key factors. The expanding e-commerce sector is a primary driver, with online retail sales witnessing a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024). This high CAGR is expected to continue in the forecast period, albeit at a slightly moderated pace. Market penetration of e-commerce remains relatively low compared to developed markets, presenting considerable untapped potential.

Technological disruptions are profoundly impacting the industry. The adoption of technologies such as automated sorting facilities, real-time tracking systems, and delivery optimization software significantly improves efficiency and reduces operational costs. Changing consumer preferences toward faster and more convenient delivery options, such as same-day and next-day delivery, are also influencing market trends. Intense competition among established players and new entrants is driving innovation and service improvement, leading to a more dynamic and customer-centric market. This competition manifests through price wars, expansion into new markets, and diversification of services.

Dominant Markets & Segments in Parcel Delivery Market in Latin America

Dominant Regions and Segments:

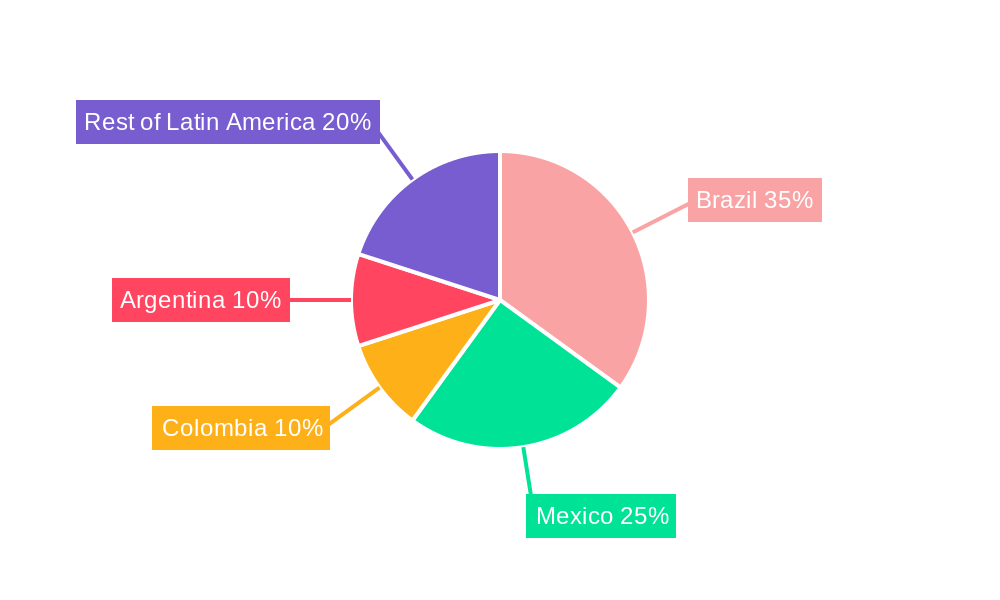

- By Country: Brazil holds the largest market share due to its large population and expanding economy. Mexico follows as the second largest market.

- By End User: The Wholesale and Retail Trade segment is the largest, followed by the e-commerce segment. Growth in the healthcare and industrial manufacturing segments is expected to accelerate in the coming years.

- By Business Model: B2C (Business-to-Customer) transactions currently dominate, driven by the growth of e-commerce. However, B2B (Business-to-Business) is also growing significantly.

- By Type: The e-commerce segment is the fastest growing, exhibiting a much higher CAGR than the non-e-commerce segment.

Key Drivers of Dominance:

- Brazil: Strong economic growth, a large consumer base, and expanding e-commerce sector.

- Mexico: Proximity to the US market, growing industrial sector, and increasing cross-border trade.

- Wholesale and Retail Trade: High volume of goods movement related to both online and offline retail activities.

- E-commerce: Rapid adoption of online shopping and increased demand for fast and reliable delivery.

Detailed Dominance Analysis: Brazil's dominance stems from its large population and rapidly expanding e-commerce market. Mexico benefits from its proximity to the US, facilitating cross-border trade. The dominance of the Wholesale and Retail Trade segment reflects the significant volume of goods movement in traditional commerce, complemented by the rapid growth in e-commerce.

Parcel Delivery Market in Latin America: Product Developments

The parcel delivery market in Latin America is witnessing significant product innovation, driven by technological advancements and evolving customer expectations. Companies are investing in improved tracking systems, providing real-time updates on package location and delivery status. Advanced route optimization software and the integration of AI are improving delivery efficiency and reducing costs. The development of specialized delivery solutions for temperature-sensitive goods and high-value items caters to specific market needs, enhancing service differentiation and attracting new customer segments.

Report Scope & Segmentation Analysis

This report offers an in-depth analysis and comprehensive segmentation of the Latin American parcel delivery market, providing granular insights across several critical dimensions:

By End User: The market is segmented by end-user industries including Services, Wholesale and Retail Trade, Healthcare, Industrial Manufacturing, and Other End Users. Each segment presents distinct growth patterns and competitive landscapes. The Wholesale and Retail Trade segment continues to command the highest volume of parcels, largely fueled by robust consumer demand. Simultaneously, the Healthcare sector is emerging as a high-growth area, driven by increasing demand for medical supplies and pharmaceuticals delivery.

By Country: Key countries analyzed include Brazil, Mexico, Colombia, Argentina, and the Rest of Latin America. Market sizes, growth rates, and operational complexities are found to vary substantially across these nations, influenced by prevailing economic conditions, regulatory frameworks, and the maturity of infrastructure development. Brazil and Mexico represent the largest and most dynamic markets, while significant growth potential is also observed within the combined markets of the Rest of Latin America.

By Business Model: The market is further dissected by business model: Business-to-Business (B2B), Business-to-Customer (B2C), and Customer-to-Customer (C2C). The B2C segment currently holds a dominant position, primarily propelled by the relentless expansion of e-commerce activities. However, the B2B segment is also experiencing substantial and sustained growth, indicating a broadening demand for specialized logistics solutions across various industries.

By Type: Classification by parcel type includes E-commerce and Non-Ecommerce shipments. The E-commerce segment is exhibiting the most aggressive growth rates, profoundly reshaping the competitive dynamics and operational strategies within the broader parcel delivery ecosystem.

Key Drivers of Parcel Delivery Market in Latin America Growth

The burgeoning growth of the Latin American parcel delivery market is underpinned by a confluence of powerful and interconnected factors:

- E-commerce Surge: The accelerated and widespread adoption of e-commerce platforms is creating an unprecedented and continuously increasing demand for swift, dependable, and efficient parcel delivery services across the region.

- Infrastructure Modernization: Significant and ongoing investments in transportation and logistics infrastructure are systematically improving network efficiency, reducing transit times, and enhancing the overall reliability of delivery operations.

- Technological Innovation: The integration of advanced technologies such as sophisticated automation, ubiquitous real-time tracking systems, and intelligent route optimization algorithms is revolutionizing operational efficiency, minimizing costs, and elevating customer satisfaction levels.

- Expanding Middle Class and Disposable Income: The growth of the middle class and the corresponding rise in disposable income are directly fueling consumer spending, which in turn is driving sustained demand for a wide array of goods and services delivered through efficient parcel networks.

- Cross-Border E-commerce: The increasing popularity of cross-border online shopping within Latin America is adding another significant layer of demand for international parcel delivery services, requiring specialized customs and logistics expertise.

- Logistics as a Service (LaaS) Adoption: Businesses are increasingly outsourcing their logistics operations to specialized providers, recognizing the benefits of efficiency, cost savings, and access to advanced technology, thereby boosting the demand for integrated parcel delivery solutions.

Challenges in the Parcel Delivery Market in Latin America Sector

The Latin American parcel delivery market faces several challenges:

- Infrastructure limitations: Inconsistent road networks and inadequate last-mile delivery infrastructure in certain areas hinder operational efficiency and increase costs. This results in increased delivery times and higher operational costs, estimated to impact profitability by xx% in some regions.

- Regulatory hurdles: Inconsistent and complex regulations across different countries add complexity and increase operational costs for companies operating in multiple markets.

- Security concerns: Package theft and loss are significant issues impacting customer satisfaction and operational costs. Insurance and enhanced security measures are increasing operational expenses for businesses.

- Competition: Intense competition among established players and new entrants puts pressure on pricing and profitability margins.

Emerging Opportunities in Parcel Delivery Market in Latin America

Several opportunities exist for growth in the Latin American parcel delivery market:

- Expansion into underserved regions: Reaching rural and remote areas with reliable parcel delivery services presents significant growth potential.

- Technological innovation: Adoption of new technologies such as drones and autonomous vehicles can enhance efficiency and reduce costs.

- Specialized services: Catering to niche segments such as temperature-sensitive goods and high-value items presents lucrative opportunities.

- Cross-border e-commerce: Facilitating cross-border e-commerce can unlock significant growth, particularly given increased regional trade agreements.

Leading Players in the Parcel Delivery Market in Latin America Market

- DB Schenker

- Kuehne+Nagel

- SkyPostal Inc

- DHL

- C H Robinson Worldwide Inc

- Nippon Express Co Ltd

- FedEx

- CEVA Logistics

- GEFCO

- KERRY LOGISTICS NETWORK LIMITED

- Loggi

- Brazil Post

- United Parcel Service of America Inc

- SF International

Key Developments in Parcel Delivery Market in Latin America Industry

- 2022 Q4: DHL launched an expanded same-day delivery service in major Brazilian cities.

- 2023 Q1: Loggi acquired a smaller regional delivery company, expanding its footprint in Colombia.

- 2023 Q3: FedEx invested in a new sorting facility in Mexico City to increase capacity.

- 2024 Q2: Several companies announced partnerships with fintech companies to improve payment options for online transactions and deliveries.

Strategic Outlook for Parcel Delivery Market in Latin America Market

The Latin American parcel delivery market is poised for significant growth in the coming years, driven by the continued expansion of e-commerce, improvements in infrastructure, and technological advancements. Opportunities exist for both established players and new entrants to capitalize on this growth. Strategic investments in technology, infrastructure, and service diversification will be crucial for companies to gain a competitive edge. Further expansion into underserved areas and catering to niche market segments will present lucrative opportunities for the expansion and diversification of this market.

Parcel Delivery Market in Latin America Segmentation

-

1. Business

- 1.1. Business-to-Business (B2B)

- 1.2. Business-to-Customer (B2C)

- 1.3. Customer-to-Customer (C2C)

-

2. Type

- 2.1. Ecommerce

- 2.2. Non-E-commerce

-

3. End User

- 3.1. Services

- 3.2. Wholesale and Retail Trade

- 3.3. Healthcare

- 3.4. Industrial Manufacturing

- 3.5. Other End Users

Parcel Delivery Market in Latin America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Parcel Delivery Market in Latin America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing demand for Perishable Goods; Expanding E-commerce Market

- 3.3. Market Restrains

- 3.3.1. Infrastructure Limitations; Skilled Labor Shortage

- 3.4. Market Trends

- 3.4.1. Cross Border E-Commerce Driving the CEP Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Business

- 5.1.1. Business-to-Business (B2B)

- 5.1.2. Business-to-Customer (B2C)

- 5.1.3. Customer-to-Customer (C2C)

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Ecommerce

- 5.2.2. Non-E-commerce

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Services

- 5.3.2. Wholesale and Retail Trade

- 5.3.3. Healthcare

- 5.3.4. Industrial Manufacturing

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Business

- 6. North America Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Business

- 6.1.1. Business-to-Business (B2B)

- 6.1.2. Business-to-Customer (B2C)

- 6.1.3. Customer-to-Customer (C2C)

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Ecommerce

- 6.2.2. Non-E-commerce

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Services

- 6.3.2. Wholesale and Retail Trade

- 6.3.3. Healthcare

- 6.3.4. Industrial Manufacturing

- 6.3.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Business

- 7. South America Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Business

- 7.1.1. Business-to-Business (B2B)

- 7.1.2. Business-to-Customer (B2C)

- 7.1.3. Customer-to-Customer (C2C)

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Ecommerce

- 7.2.2. Non-E-commerce

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Services

- 7.3.2. Wholesale and Retail Trade

- 7.3.3. Healthcare

- 7.3.4. Industrial Manufacturing

- 7.3.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Business

- 8. Europe Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Business

- 8.1.1. Business-to-Business (B2B)

- 8.1.2. Business-to-Customer (B2C)

- 8.1.3. Customer-to-Customer (C2C)

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Ecommerce

- 8.2.2. Non-E-commerce

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Services

- 8.3.2. Wholesale and Retail Trade

- 8.3.3. Healthcare

- 8.3.4. Industrial Manufacturing

- 8.3.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Business

- 9. Middle East & Africa Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Business

- 9.1.1. Business-to-Business (B2B)

- 9.1.2. Business-to-Customer (B2C)

- 9.1.3. Customer-to-Customer (C2C)

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Ecommerce

- 9.2.2. Non-E-commerce

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Services

- 9.3.2. Wholesale and Retail Trade

- 9.3.3. Healthcare

- 9.3.4. Industrial Manufacturing

- 9.3.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Business

- 10. Asia Pacific Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Business

- 10.1.1. Business-to-Business (B2B)

- 10.1.2. Business-to-Customer (B2C)

- 10.1.3. Customer-to-Customer (C2C)

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Ecommerce

- 10.2.2. Non-E-commerce

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Services

- 10.3.2. Wholesale and Retail Trade

- 10.3.3. Healthcare

- 10.3.4. Industrial Manufacturing

- 10.3.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Business

- 11. Brazil Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 12. Argentina Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 13. Mexico Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 14. Peru Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 15. Chile Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 16. Rest of Latin America Parcel Delivery Market in Latin America Analysis, Insights and Forecast, 2019-2031

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 DB Schenker

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Kuehne+Nagel

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 SkyPostal Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 DHL

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 C H Robinson Worldwide Inc

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Nippon Express Co Ltd

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 FedEx

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 CEVA Logistics

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 GEFCO

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 KERRY LOGISTICS NETWORK LIMITED

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Loggi**List Not Exhaustive

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 Brazil Post

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 United Parcel Service of America Inc

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 SF International

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.1 DB Schenker

List of Figures

- Figure 1: Global Parcel Delivery Market in Latin America Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Latin America Parcel Delivery Market in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 3: Latin America Parcel Delivery Market in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Parcel Delivery Market in Latin America Revenue (Million), by Business 2024 & 2032

- Figure 5: North America Parcel Delivery Market in Latin America Revenue Share (%), by Business 2024 & 2032

- Figure 6: North America Parcel Delivery Market in Latin America Revenue (Million), by Type 2024 & 2032

- Figure 7: North America Parcel Delivery Market in Latin America Revenue Share (%), by Type 2024 & 2032

- Figure 8: North America Parcel Delivery Market in Latin America Revenue (Million), by End User 2024 & 2032

- Figure 9: North America Parcel Delivery Market in Latin America Revenue Share (%), by End User 2024 & 2032

- Figure 10: North America Parcel Delivery Market in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Parcel Delivery Market in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America Parcel Delivery Market in Latin America Revenue (Million), by Business 2024 & 2032

- Figure 13: South America Parcel Delivery Market in Latin America Revenue Share (%), by Business 2024 & 2032

- Figure 14: South America Parcel Delivery Market in Latin America Revenue (Million), by Type 2024 & 2032

- Figure 15: South America Parcel Delivery Market in Latin America Revenue Share (%), by Type 2024 & 2032

- Figure 16: South America Parcel Delivery Market in Latin America Revenue (Million), by End User 2024 & 2032

- Figure 17: South America Parcel Delivery Market in Latin America Revenue Share (%), by End User 2024 & 2032

- Figure 18: South America Parcel Delivery Market in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 19: South America Parcel Delivery Market in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Parcel Delivery Market in Latin America Revenue (Million), by Business 2024 & 2032

- Figure 21: Europe Parcel Delivery Market in Latin America Revenue Share (%), by Business 2024 & 2032

- Figure 22: Europe Parcel Delivery Market in Latin America Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Parcel Delivery Market in Latin America Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Parcel Delivery Market in Latin America Revenue (Million), by End User 2024 & 2032

- Figure 25: Europe Parcel Delivery Market in Latin America Revenue Share (%), by End User 2024 & 2032

- Figure 26: Europe Parcel Delivery Market in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Parcel Delivery Market in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa Parcel Delivery Market in Latin America Revenue (Million), by Business 2024 & 2032

- Figure 29: Middle East & Africa Parcel Delivery Market in Latin America Revenue Share (%), by Business 2024 & 2032

- Figure 30: Middle East & Africa Parcel Delivery Market in Latin America Revenue (Million), by Type 2024 & 2032

- Figure 31: Middle East & Africa Parcel Delivery Market in Latin America Revenue Share (%), by Type 2024 & 2032

- Figure 32: Middle East & Africa Parcel Delivery Market in Latin America Revenue (Million), by End User 2024 & 2032

- Figure 33: Middle East & Africa Parcel Delivery Market in Latin America Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East & Africa Parcel Delivery Market in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa Parcel Delivery Market in Latin America Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Parcel Delivery Market in Latin America Revenue (Million), by Business 2024 & 2032

- Figure 37: Asia Pacific Parcel Delivery Market in Latin America Revenue Share (%), by Business 2024 & 2032

- Figure 38: Asia Pacific Parcel Delivery Market in Latin America Revenue (Million), by Type 2024 & 2032

- Figure 39: Asia Pacific Parcel Delivery Market in Latin America Revenue Share (%), by Type 2024 & 2032

- Figure 40: Asia Pacific Parcel Delivery Market in Latin America Revenue (Million), by End User 2024 & 2032

- Figure 41: Asia Pacific Parcel Delivery Market in Latin America Revenue Share (%), by End User 2024 & 2032

- Figure 42: Asia Pacific Parcel Delivery Market in Latin America Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific Parcel Delivery Market in Latin America Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Business 2019 & 2032

- Table 3: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by End User 2019 & 2032

- Table 5: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Brazil Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Argentina Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Mexico Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Peru Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Chile Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Latin America Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Business 2019 & 2032

- Table 14: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Business 2019 & 2032

- Table 21: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by End User 2019 & 2032

- Table 23: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Brazil Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Argentina Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Business 2019 & 2032

- Table 28: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 29: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by End User 2019 & 2032

- Table 30: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 31: United Kingdom Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Germany Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: France Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Italy Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Spain Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Russia Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Benelux Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Nordics Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Business 2019 & 2032

- Table 41: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 42: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by End User 2019 & 2032

- Table 43: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Turkey Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Israel Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: GCC Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: North Africa Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East & Africa Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Business 2019 & 2032

- Table 51: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by End User 2019 & 2032

- Table 53: Global Parcel Delivery Market in Latin America Revenue Million Forecast, by Country 2019 & 2032

- Table 54: China Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: India Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Japan Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Korea Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: ASEAN Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Oceania Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Asia Pacific Parcel Delivery Market in Latin America Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Parcel Delivery Market in Latin America?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the Parcel Delivery Market in Latin America?

Key companies in the market include DB Schenker, Kuehne+Nagel, SkyPostal Inc, DHL, C H Robinson Worldwide Inc, Nippon Express Co Ltd, FedEx, CEVA Logistics, GEFCO, KERRY LOGISTICS NETWORK LIMITED, Loggi**List Not Exhaustive, Brazil Post, United Parcel Service of America Inc, SF International.

3. What are the main segments of the Parcel Delivery Market in Latin America?

The market segments include Business, Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing demand for Perishable Goods; Expanding E-commerce Market.

6. What are the notable trends driving market growth?

Cross Border E-Commerce Driving the CEP Market.

7. Are there any restraints impacting market growth?

Infrastructure Limitations; Skilled Labor Shortage.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Parcel Delivery Market in Latin America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Parcel Delivery Market in Latin America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Parcel Delivery Market in Latin America?

To stay informed about further developments, trends, and reports in the Parcel Delivery Market in Latin America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence