Key Insights

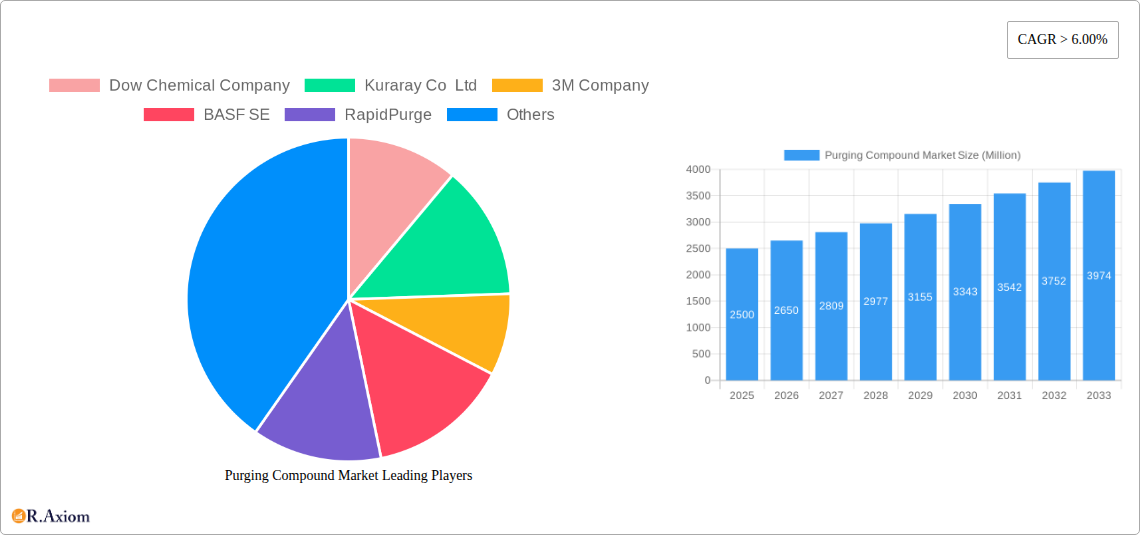

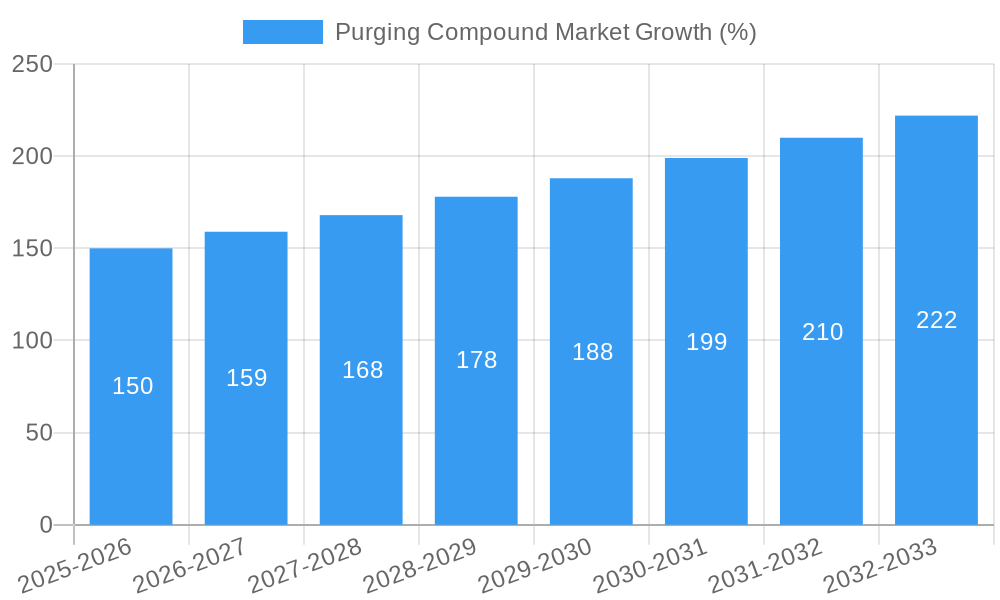

The purging compound market is experiencing robust growth, driven by increasing demand across various industries. The market's compound annual growth rate (CAGR) exceeding 6% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by several factors, including the rising adoption of automation in manufacturing processes, the growing need for efficient cleaning and maintenance of processing equipment, and the increasing focus on improving product quality and reducing waste. Specific applications like plastics processing, rubber manufacturing, and the food and beverage industries are key contributors to this growth. The demand for high-performance purging compounds that minimize downtime, enhance cleaning efficiency, and ensure consistent product quality is also driving market expansion. Leading players like Dow Chemical Company, BASF SE, and 3M Company are investing heavily in research and development to introduce innovative purging compounds with improved properties and broader applications. This competitive landscape further fuels innovation and market growth.

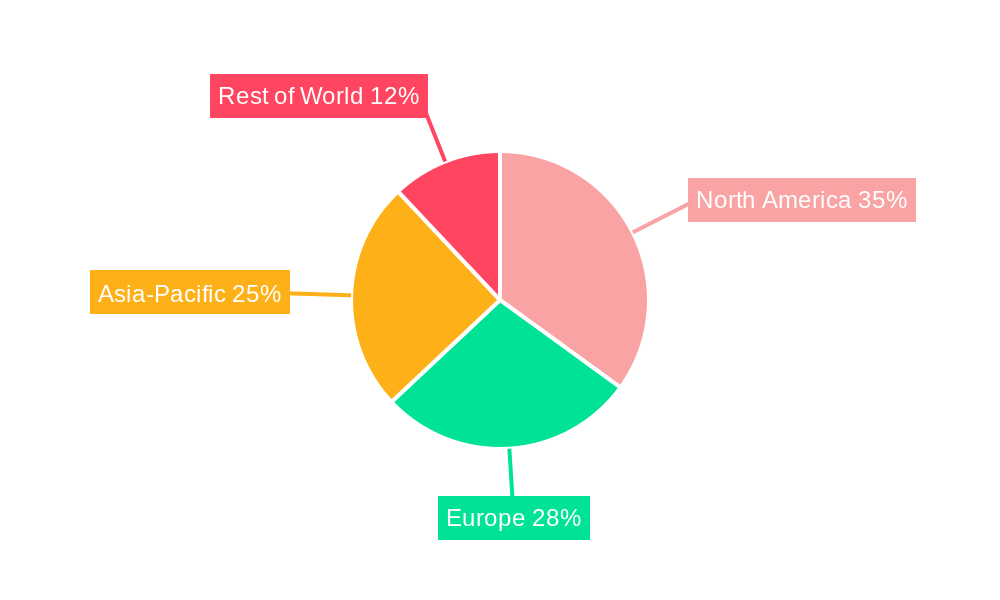

Looking ahead to 2033, the market is projected to maintain a healthy growth trajectory, driven by continuous advancements in material science and the expanding applications of purging compounds in diverse industries. The market segmentation, while not explicitly detailed, likely includes various types of purging compounds based on material composition (e.g., polymer-based, chemical-based), application (e.g., plastics, rubber, coatings), and end-use industry. Regional variations in growth rates will probably reflect differences in industrial activity and adoption rates of advanced manufacturing technologies. The market's continued expansion hinges on factors such as technological innovation, regulatory changes regarding waste management and environmental concerns, and the overall health of related manufacturing sectors. Future market analysis will benefit from granular data on market segmentation and regional breakdowns to accurately model future performance.

Purging Compound Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the Purging Compound Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive market research, incorporating key industry developments and competitive landscapes to forecast market growth and identify lucrative opportunities. The total market value is projected to reach xx Million by 2033.

Purging Compound Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, product substitutes, end-user trends, and mergers and acquisitions (M&A) activities within the purging compound market. The market exhibits a moderately concentrated structure, with key players holding significant market share. However, the presence of several smaller, specialized players contributes to competitive dynamics.

Market Share (2024 Estimates):

- Dow Chemical Company: xx%

- Kuraray Co Ltd: xx%

- 3M Company: xx%

- BASF SE: xx%

- Other Players: xx%

Innovation Drivers:

- Demand for high-performance purging compounds tailored to specific resin types and processing techniques.

- Growing focus on sustainability and environmentally friendly purging solutions.

- Advancements in material science leading to enhanced cleaning efficiency and reduced downtime.

Regulatory Frameworks:

- Stringent environmental regulations influencing the development of biodegradable and less toxic purging compounds.

- Safety standards governing the handling and disposal of purging compounds.

Product Substitutes:

- Limited viable substitutes currently exist, making purging compounds essential for efficient processing in various industries.

End-User Trends:

- Increasing adoption of high-performance plastics and demanding processing techniques drive demand for sophisticated purging compounds.

M&A Activities:

While specific M&A deal values are unavailable (xx Million), several smaller acquisitions have been observed, primarily focused on expanding product portfolios and geographical reach.

Purging Compound Market Industry Trends & Insights

The purging compound market is experiencing robust growth, driven by several key factors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is estimated at xx%. This growth is fueled by increased demand from various end-use industries, including plastics processing, automotive, packaging, and healthcare. Technological advancements are also playing a crucial role, with the development of specialized purging compounds for advanced materials like high-temperature engineering resins. Market penetration is currently at xx% and projected to reach xx% by 2033. Competitive dynamics are intense, with established players constantly innovating and launching new products to maintain market share. Consumer preferences are shifting towards sustainable and environmentally friendly options, influencing product development strategies.

Dominant Markets & Segments in Purging Compound Market

The [Region/Country - e.g., North America/United States] currently dominates the purging compound market, owing to its large plastics processing industry and high adoption of advanced manufacturing technologies.

Key Drivers for Dominance:

- Strong economic growth and industrial development.

- Well-established infrastructure and robust supply chain networks.

- Favorable government policies and regulations promoting industrial expansion.

The detailed dominance analysis shows a strong correlation between high plastics production and demand for effective purging compounds. Other regions, such as [Region/Country - e.g., Asia-Pacific/China], are showing rapid growth potential, driven by increasing industrialization and expanding manufacturing sectors. However, regulatory frameworks and infrastructure developments in these regions will play a crucial role in influencing market growth.

Purging Compound Market Product Developments

Recent product innovations include the launch of heat-activated purging compounds designed to seamlessly integrate with various resins while providing exceptional cleaning power (Asahi Kasei Asaclean Plus Grade concentrate, June 2021). Another significant development is the introduction of high-temperature purging compounds specifically formulated for engineering resins like PEEK and PPS (Slide Products, April 2021). These advancements showcase a clear trend towards specialized purging compounds tailored to meet the demands of increasingly complex plastic processing techniques. This reflects a strong focus on improving cleaning efficiency and reducing production downtime, thereby enhancing overall process economics.

Report Scope & Segmentation Analysis

This report segments the purging compound market based on several factors. These include:

By Type: [List types, e.g., Chemical, Mechanical] with projected market sizes and growth rates for each. Competitive dynamics vary across each type, with some types experiencing higher growth due to specific applications.

By Application: [List applications, e.g., Injection Molding, Extrusion] The application segment provides insights into the market share held by each application and their respective growth projections. Competitive intensity varies across these applications.

By Resin Type: [List resin types, e.g., Polyolefins, Engineering Plastics] Analysis includes market size forecasts and competitive landscape dynamics.

Key Drivers of Purging Compound Market Growth

The growth of the purging compound market is propelled by several factors:

- The increasing use of plastics in various industries fuels demand for efficient cleaning solutions.

- Technological advancements lead to more effective and specialized purging compounds.

- Stringent environmental regulations necessitate the development of eco-friendly purging agents.

Challenges in the Purging Compound Market Sector

Despite its growth trajectory, the purging compound market faces several challenges:

- Fluctuations in raw material prices affect production costs and profitability. (Quantifiable impact: xx% price volatility leading to xx% cost fluctuation).

- Intense competition among established players and new entrants.

- Meeting stringent environmental regulations without compromising performance.

Emerging Opportunities in Purging Compound Market

Emerging opportunities exist in several areas:

- Development of biodegradable and sustainable purging compounds to cater to increasing environmental concerns.

- Expansion into new applications, such as 3D printing and additive manufacturing.

- Focus on developing specialized purging compounds for high-performance polymers used in advanced technologies.

Leading Players in the Purging Compound Market Market

- Dow Chemical Company

- Kuraray Co Ltd

- 3M Company

- BASF SE

- RapidPurge

- Daicel Corporation

- VELOX GmbH (IMCD Group)

- Calsak Corporation

- ChemTrend LP

- Dyna-Purge

- Formosa Plastics Corporation

- Ultra System SA

- Purge Right

- Clariant AG

Key Developments in Purging Compound Market Industry

June 2021: Asahi Kasei Asaclean America launched its newest purging compound, Asaclean Plus Grade concentrate, offering invisible blending with production resins while maintaining high cleaning performance. This development caters to the demands of processors requiring efficient and high-quality purging solutions.

April 2021: Slide Products introduced a purge compound for high-temperature applications, specifically designed for engineering resins such as polyphenylene sulfide (PPS), polyetheretherketone (PEEK), polyethylene terephthalate (PET), polyetherimide (PEI), and liquid crystal polymer (LCP). This launch addresses the need for effective cleaning in processing these demanding materials.

Strategic Outlook for Purging Compound Market Market

The purging compound market is poised for continued growth, driven by increasing demand from various industries and ongoing technological advancements. Opportunities exist in developing specialized solutions for emerging materials and processes, as well as in expanding into new geographical markets. A focus on sustainability and environmentally friendly solutions will also be crucial for long-term success in this dynamic market. The strategic outlook suggests a positive trajectory, with significant growth potential in the coming years.

Purging Compound Market Segmentation

-

1. Type

- 1.1. Mechanical Purge

- 1.2. Chemical Purge

- 1.3. Liquid Purge

-

2. Process

- 2.1. Injection Molding

- 2.2. Extrusion

- 2.3. Blow Molding

- 2.4. Other Processes

-

3. Application

- 3.1. Automotive

- 3.2. Construction

- 3.3. Industrial machinery

- 3.4. Polymers

- 3.5. Thermoplastic Processing

- 3.6. Other Applications

Purging Compound Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. France

- 3.4. Italy

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Purging Compound Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Purging Compound from Thermoplastic Industry in Global Market; Growing Demand as Effective Removal Solutions to Control Corrosion in Chemical Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. Increasing Demand of Purging Compound from Thermoplastic Industry in Global Market; Growing Demand as Effective Removal Solutions to Control Corrosion in Chemical Industry; Other Drivers

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Purging Compound from Thermoplastic Processing Industry in Global Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Purging Compound Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mechanical Purge

- 5.1.2. Chemical Purge

- 5.1.3. Liquid Purge

- 5.2. Market Analysis, Insights and Forecast - by Process

- 5.2.1. Injection Molding

- 5.2.2. Extrusion

- 5.2.3. Blow Molding

- 5.2.4. Other Processes

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Automotive

- 5.3.2. Construction

- 5.3.3. Industrial machinery

- 5.3.4. Polymers

- 5.3.5. Thermoplastic Processing

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Asia Pacific Purging Compound Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mechanical Purge

- 6.1.2. Chemical Purge

- 6.1.3. Liquid Purge

- 6.2. Market Analysis, Insights and Forecast - by Process

- 6.2.1. Injection Molding

- 6.2.2. Extrusion

- 6.2.3. Blow Molding

- 6.2.4. Other Processes

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Automotive

- 6.3.2. Construction

- 6.3.3. Industrial machinery

- 6.3.4. Polymers

- 6.3.5. Thermoplastic Processing

- 6.3.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. North America Purging Compound Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mechanical Purge

- 7.1.2. Chemical Purge

- 7.1.3. Liquid Purge

- 7.2. Market Analysis, Insights and Forecast - by Process

- 7.2.1. Injection Molding

- 7.2.2. Extrusion

- 7.2.3. Blow Molding

- 7.2.4. Other Processes

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Automotive

- 7.3.2. Construction

- 7.3.3. Industrial machinery

- 7.3.4. Polymers

- 7.3.5. Thermoplastic Processing

- 7.3.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe Purging Compound Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mechanical Purge

- 8.1.2. Chemical Purge

- 8.1.3. Liquid Purge

- 8.2. Market Analysis, Insights and Forecast - by Process

- 8.2.1. Injection Molding

- 8.2.2. Extrusion

- 8.2.3. Blow Molding

- 8.2.4. Other Processes

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Automotive

- 8.3.2. Construction

- 8.3.3. Industrial machinery

- 8.3.4. Polymers

- 8.3.5. Thermoplastic Processing

- 8.3.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Purging Compound Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mechanical Purge

- 9.1.2. Chemical Purge

- 9.1.3. Liquid Purge

- 9.2. Market Analysis, Insights and Forecast - by Process

- 9.2.1. Injection Molding

- 9.2.2. Extrusion

- 9.2.3. Blow Molding

- 9.2.4. Other Processes

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Automotive

- 9.3.2. Construction

- 9.3.3. Industrial machinery

- 9.3.4. Polymers

- 9.3.5. Thermoplastic Processing

- 9.3.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Purging Compound Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mechanical Purge

- 10.1.2. Chemical Purge

- 10.1.3. Liquid Purge

- 10.2. Market Analysis, Insights and Forecast - by Process

- 10.2.1. Injection Molding

- 10.2.2. Extrusion

- 10.2.3. Blow Molding

- 10.2.4. Other Processes

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Automotive

- 10.3.2. Construction

- 10.3.3. Industrial machinery

- 10.3.4. Polymers

- 10.3.5. Thermoplastic Processing

- 10.3.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Dow Chemical Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kuraray Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 3M Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BASF SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 RapidPurge

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Daicel Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 VELOX GmbH (IMCD Group)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Calsak Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ChemTrend LP

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Dyna-Purge

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Formosa Plastics Corporation

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ultra System SA

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Purge Right

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Clariant AG*List Not Exhaustive

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Dow Chemical Company

List of Figures

- Figure 1: Global Purging Compound Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific Purging Compound Market Revenue (Million), by Type 2024 & 2032

- Figure 3: Asia Pacific Purging Compound Market Revenue Share (%), by Type 2024 & 2032

- Figure 4: Asia Pacific Purging Compound Market Revenue (Million), by Process 2024 & 2032

- Figure 5: Asia Pacific Purging Compound Market Revenue Share (%), by Process 2024 & 2032

- Figure 6: Asia Pacific Purging Compound Market Revenue (Million), by Application 2024 & 2032

- Figure 7: Asia Pacific Purging Compound Market Revenue Share (%), by Application 2024 & 2032

- Figure 8: Asia Pacific Purging Compound Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Asia Pacific Purging Compound Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Purging Compound Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America Purging Compound Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America Purging Compound Market Revenue (Million), by Process 2024 & 2032

- Figure 13: North America Purging Compound Market Revenue Share (%), by Process 2024 & 2032

- Figure 14: North America Purging Compound Market Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Purging Compound Market Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Purging Compound Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Purging Compound Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Purging Compound Market Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Purging Compound Market Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Purging Compound Market Revenue (Million), by Process 2024 & 2032

- Figure 21: Europe Purging Compound Market Revenue Share (%), by Process 2024 & 2032

- Figure 22: Europe Purging Compound Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Purging Compound Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Purging Compound Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Purging Compound Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Purging Compound Market Revenue (Million), by Type 2024 & 2032

- Figure 27: South America Purging Compound Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: South America Purging Compound Market Revenue (Million), by Process 2024 & 2032

- Figure 29: South America Purging Compound Market Revenue Share (%), by Process 2024 & 2032

- Figure 30: South America Purging Compound Market Revenue (Million), by Application 2024 & 2032

- Figure 31: South America Purging Compound Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: South America Purging Compound Market Revenue (Million), by Country 2024 & 2032

- Figure 33: South America Purging Compound Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Middle East and Africa Purging Compound Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Middle East and Africa Purging Compound Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Middle East and Africa Purging Compound Market Revenue (Million), by Process 2024 & 2032

- Figure 37: Middle East and Africa Purging Compound Market Revenue Share (%), by Process 2024 & 2032

- Figure 38: Middle East and Africa Purging Compound Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Middle East and Africa Purging Compound Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Middle East and Africa Purging Compound Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Purging Compound Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Purging Compound Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Purging Compound Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Purging Compound Market Revenue Million Forecast, by Process 2019 & 2032

- Table 4: Global Purging Compound Market Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Purging Compound Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Purging Compound Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global Purging Compound Market Revenue Million Forecast, by Process 2019 & 2032

- Table 8: Global Purging Compound Market Revenue Million Forecast, by Application 2019 & 2032

- Table 9: Global Purging Compound Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: China Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: India Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Japan Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: South Korea Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Asia Pacific Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Purging Compound Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Purging Compound Market Revenue Million Forecast, by Process 2019 & 2032

- Table 17: Global Purging Compound Market Revenue Million Forecast, by Application 2019 & 2032

- Table 18: Global Purging Compound Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: United States Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Canada Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Mexico Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Purging Compound Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Purging Compound Market Revenue Million Forecast, by Process 2019 & 2032

- Table 24: Global Purging Compound Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Purging Compound Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Germany Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: United Kingdom Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Rest of Europe Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Purging Compound Market Revenue Million Forecast, by Type 2019 & 2032

- Table 32: Global Purging Compound Market Revenue Million Forecast, by Process 2019 & 2032

- Table 33: Global Purging Compound Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global Purging Compound Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Brazil Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of South America Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Purging Compound Market Revenue Million Forecast, by Type 2019 & 2032

- Table 39: Global Purging Compound Market Revenue Million Forecast, by Process 2019 & 2032

- Table 40: Global Purging Compound Market Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Purging Compound Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Saudi Arabia Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: South Africa Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Rest of Middle East and Africa Purging Compound Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Purging Compound Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the Purging Compound Market?

Key companies in the market include Dow Chemical Company, Kuraray Co Ltd, 3M Company, BASF SE, RapidPurge, Daicel Corporation, VELOX GmbH (IMCD Group), Calsak Corporation, ChemTrend LP, Dyna-Purge, Formosa Plastics Corporation, Ultra System SA, Purge Right, Clariant AG*List Not Exhaustive.

3. What are the main segments of the Purging Compound Market?

The market segments include Type, Process, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Purging Compound from Thermoplastic Industry in Global Market; Growing Demand as Effective Removal Solutions to Control Corrosion in Chemical Industry; Other Drivers.

6. What are the notable trends driving market growth?

Increasing Demand of Purging Compound from Thermoplastic Processing Industry in Global Market.

7. Are there any restraints impacting market growth?

Increasing Demand of Purging Compound from Thermoplastic Industry in Global Market; Growing Demand as Effective Removal Solutions to Control Corrosion in Chemical Industry; Other Drivers.

8. Can you provide examples of recent developments in the market?

June 2021: Asahi Kasei Asaclean America's newest purging compound blends invisibly with a processor's own production resins while providing the same performance and cleaning power as the company's other purging compounds. Processors' most demanding uses were in mind when developing the new heat-activated Asaclean Plus Grade concentrate.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Purging Compound Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Purging Compound Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Purging Compound Market?

To stay informed about further developments, trends, and reports in the Purging Compound Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence