Key Insights

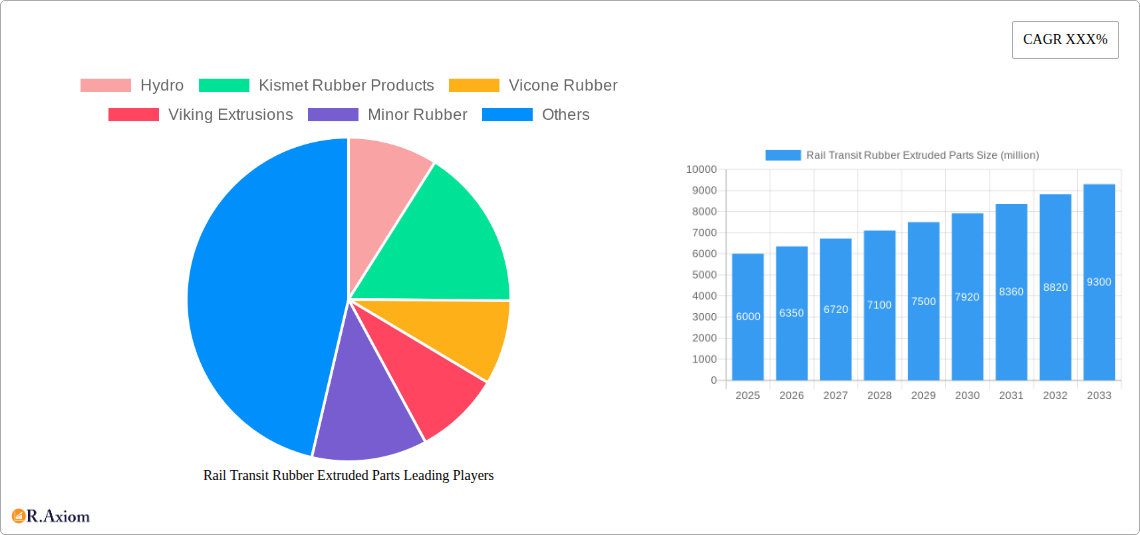

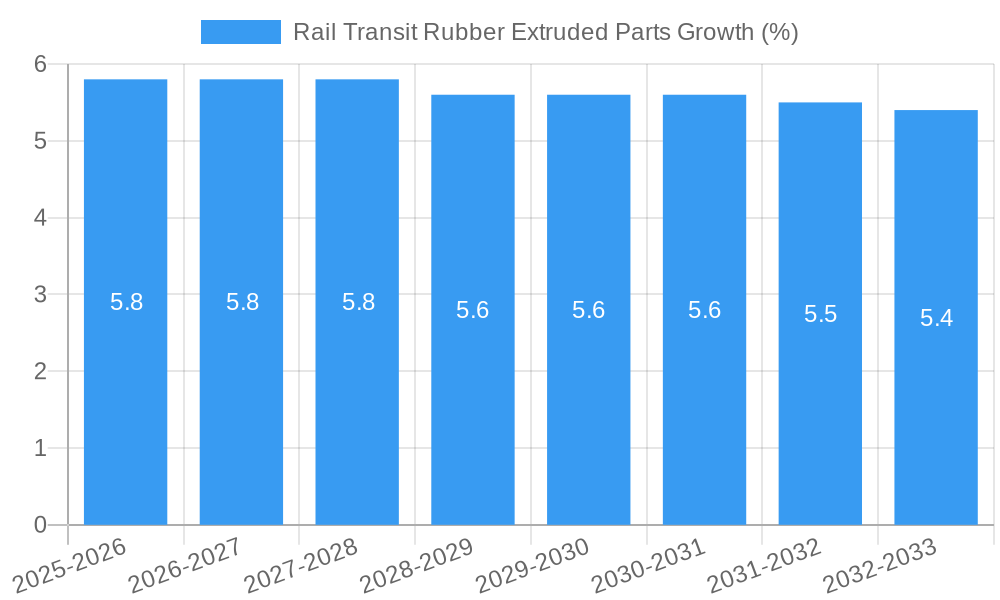

The global market for Rail Transit Rubber Extruded Parts is poised for significant expansion, projected to reach an estimated market size of approximately $6,000 million by 2025, growing at a robust Compound Annual Growth Rate (CAGR) of around 5.8% through 2033. This upward trajectory is primarily fueled by the escalating investments in new rail infrastructure development and the ongoing modernization of existing railway networks across the globe. The increasing demand for high-speed rail, light rail, and urban subway systems, particularly in emerging economies, acts as a major growth driver. These parts are indispensable for ensuring the safety, comfort, and operational efficiency of rail transport, providing crucial functions like vibration dampening, noise reduction, and sealing against environmental elements. The market's expansion is also bolstered by stringent safety regulations and performance standards within the rail industry, necessitating the use of high-quality, durable rubber extruded components.

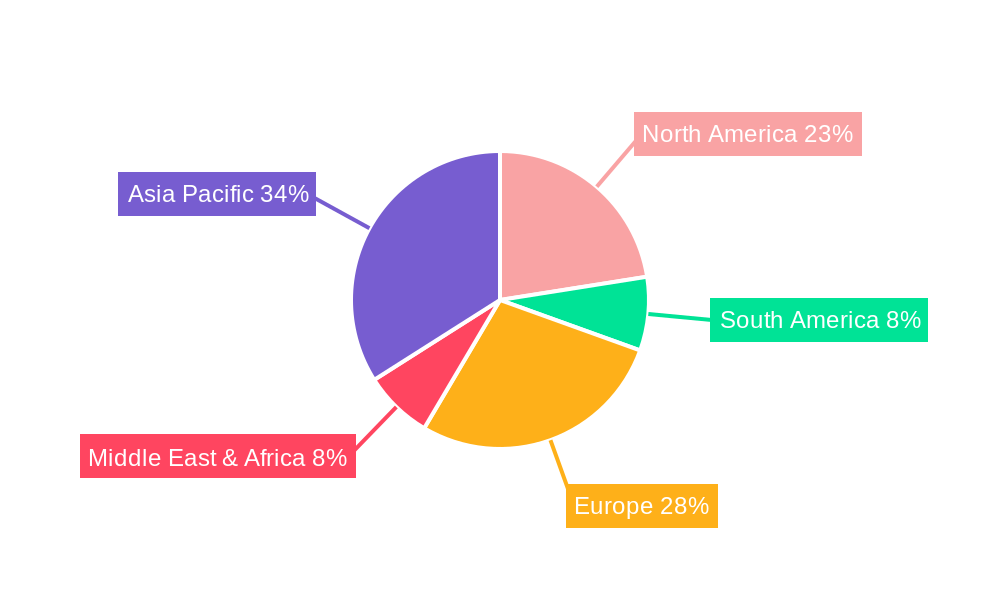

The market segmentation reveals diverse application and type categories, with "Application" segments like Subway and Light Rail expected to exhibit substantial growth due to rapid urbanization and the increasing adoption of sustainable public transportation. The "Type" segment for Seals and Shock Absorbing Parts are anticipated to dominate the market owing to their critical role in passenger safety and vehicle longevity. Key players such as Hydro, Kismet Rubber Products, and Viking Extrusions are actively innovating and expanding their product portfolios to meet evolving industry demands. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as a dominant force in market growth, driven by extensive infrastructure projects. Conversely, established markets in North America and Europe will continue to represent significant revenue streams, with a focus on advanced technology and upgrade projects. However, the market may face challenges related to fluctuating raw material prices and intense competition among manufacturers.

This in-depth report provides a comprehensive analysis of the global Rail Transit Rubber Extruded Parts market, covering the historical period (2019-2024), base year (2025), and an extensive forecast period (2025-2033). The study examines critical aspects including market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and strategic mergers and acquisitions. We dissect industry trends, market dynamics, and key insights, offering actionable intelligence for stakeholders seeking to navigate this dynamic sector. Detailed segmentation by application – including Subway, Light Rail, Regional Trains, High-speed Rail, and Others – and by type – encompassing Seals, Shock Absorbing Parts, Sound Insulation, Insulation Parts, and Others – provides granular market understanding. The report highlights dominant markets and segments, product developments, and identifies key growth drivers, challenges, and emerging opportunities. Featuring an exhaustive list of leading players and pivotal industry developments, this report serves as an indispensable resource for manufacturers, suppliers, investors, and researchers within the rail transit rubber extruded parts ecosystem.

Rail Transit Rubber Extruded Parts Market Concentration & Innovation

The global Rail Transit Rubber Extruded Parts market exhibits a moderate to high concentration, with a significant portion of the market share held by a few key players. Leading companies like Hydro, Kismet Rubber Products, Vicone Rubber, Viking Extrusions, Minor Rubber, Ames Rubber Manufacturing, Hebei Shida Seal Group, Boss Polymer, Denver Rubber Company, Elasto Proxy, Fournier Rubber & Supply Co, and Vip Rubber Co. have established strong footholds through continuous product innovation and strategic market positioning. Innovation is primarily driven by the increasing demand for enhanced safety, comfort, and operational efficiency in rail transportation. This includes the development of advanced rubber compounds offering superior durability, fire resistance, and environmental performance. Regulatory frameworks, particularly those concerning safety standards and emissions, play a crucial role in shaping product development and market access. For instance, stringent fire and smoke regulations necessitate specialized flame-retardant rubber materials. Product substitutes, such as advanced polymers and composites, pose a potential challenge but are often outcompeted by the cost-effectiveness and versatility of rubber extruded parts in specific applications. End-user trends are leaning towards lightweight, high-performance components that reduce maintenance costs and improve passenger experience. Mergers and acquisition (M&A) activities, with estimated deal values in the hundreds of millions of dollars, are prevalent as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For example, a recent acquisition in the forecast period could bolster a company's market share by an estimated 15% and introduce new product lines valued at over $50 million.

Rail Transit Rubber Extruded Parts Industry Trends & Insights

The Rail Transit Rubber Extruded Parts industry is experiencing robust growth, driven by several interconnected trends. A significant market growth driver is the escalating global investment in rail infrastructure development and modernization. Governments worldwide are prioritizing sustainable and efficient public transportation, leading to increased demand for new rail lines and upgrades to existing ones. This translates directly into a substantial need for high-quality rubber extruded parts across various segments. Technological disruptions are also playing a pivotal role. Advancements in material science are enabling the development of specialized rubber compounds with enhanced properties such as extreme temperature resistance, vibration damping, and extended lifespan. For example, the adoption of self-healing rubber materials, while still nascent, promises to revolutionize maintenance cycles and reduce downtime. Consumer preferences are increasingly focused on passenger comfort and safety. This translates into a demand for superior sound insulation to reduce noise pollution within carriages, effective shock-absorbing parts to ensure a smooth ride, and advanced sealing solutions to prevent water ingress and drafts. The competitive dynamics within the market are characterized by a blend of global players and specialized regional manufacturers. Intense competition necessitates continuous innovation and cost optimization. Key players are investing heavily in research and development to stay ahead of the curve, with an estimated annual R&D expenditure of over $10 million for leading firms. The market penetration of specialized, high-performance rubber extruded parts is projected to increase by an estimated 20% over the forecast period. The Compound Annual Growth Rate (CAGR) for the global Rail Transit Rubber Extruded Parts market is projected to be a healthy 6.5% from 2025 to 2033, with an estimated market size of over $8,000 million by the end of the forecast period.

Dominant Markets & Segments in Rail Transit Rubber Extruded Parts

The dominance within the Rail Transit Rubber Extruded Parts market is clearly defined by geographical regions and specific applications, driven by robust economic policies and extensive infrastructure development. Asia-Pacific, particularly China, is emerging as a dominant market due to its massive investments in high-speed rail networks and urban subway systems. Government initiatives promoting public transportation and the development of large-scale rail projects fuel this dominance.

- Dominant Region: Asia-Pacific, with an estimated market share exceeding 40% of the global market.

- Key Drivers: Government policies supporting high-speed rail expansion, rapid urbanization, and significant infrastructure spending. The sheer volume of new rail projects in countries like China and India is a primary catalyst.

- Dominant Application Segment: Subway systems represent the largest application segment, accounting for an estimated 35% of the market revenue.

- Key Drivers: Continuous expansion of urban metro networks globally to combat traffic congestion and promote sustainable commuting. The high frequency of operation and passenger volume in subways necessitates durable and reliable sealing, sound insulation, and shock-absorbing parts.

- Dominant Type Segment: Seals constitute the most significant product type segment, holding an estimated 45% of the market share.

- Key Drivers: Essential for maintaining cabin integrity, preventing environmental ingress (water, dust, noise), and ensuring passenger comfort and safety. The diverse requirements across different rail types necessitate a wide range of specialized sealing solutions, from door seals to window seals and undercarriage seals.

The dominance of these segments is further amplified by technological advancements in rubber extrusion that allow for the production of complex profiles and specialized compounds tailored to the stringent demands of rail applications. For instance, the development of weather-resistant and UV-stable rubber seals for subway cars operating in varied climates contributes significantly to their market penetration. High-speed rail, while a smaller segment by volume currently, is experiencing rapid growth and presents significant future potential, driving innovation in lightweight and high-performance shock-absorbing parts. Regional trains also contribute significantly, particularly in developed economies with extensive intercity rail networks requiring robust and long-lasting components.

Rail Transit Rubber Extruded Parts Product Developments

Product developments in the Rail Transit Rubber Extruded Parts market are centered on enhancing performance, durability, and sustainability. Innovations include the introduction of advanced EPDM (ethylene propylene diene monomer) rubber compounds offering superior resistance to ozone, UV radiation, and extreme temperatures, crucial for outdoor rail applications. Fire-retardant and low-smoke formulations are increasingly being adopted to meet stringent safety regulations. Furthermore, the development of self-lubricating or low-friction rubber seals is improving operational efficiency and reducing wear. These advancements provide competitive advantages by enabling longer service life, reducing maintenance costs, and enhancing passenger safety and comfort, aligning perfectly with market demands for resilient and efficient rail components.

Report Scope & Segmentation Analysis

This report encompasses a detailed segmentation of the global Rail Transit Rubber Extruded Parts market, providing granular insights into various sub-segments.

Application Segments:

- Subway: This segment, projected to grow at a CAGR of 7.0% from 2025-2033, is driven by rapid urbanization and extensive metro network expansion worldwide. The market size is estimated to reach over $3,500 million by 2033, driven by the constant need for seals, sound insulation, and shock absorbers.

- Light Rail: Expected to experience a CAGR of 6.2%, this segment benefits from the increasing adoption of light rail systems in mid-sized cities. Its market size is forecast to reach approximately $1,500 million by 2033.

- Regional Trains: With a projected CAGR of 5.8%, this segment caters to intercity and commuter rail services, requiring durable and reliable components. The market is estimated to be around $2,000 million by 2033.

- High-speed Rail: Anticipated to grow at a CAGR of 8.5%, this segment is characterized by demand for high-performance, lightweight materials for seals and vibration damping. The market is projected to reach $1,200 million by 2033.

- Others: This includes specialized rail applications and niche markets, expected to grow at a CAGR of 5.5% and reach approximately $800 million by 2033.

Type Segments:

- Seals: This dominant segment, projected for continued strong growth, is driven by the fundamental need for protection against environmental factors and the maintenance of cabin integrity.

- Shock Absorbing Parts: Essential for passenger comfort and ride quality, this segment is seeing increased demand, particularly for high-speed rail applications.

- Sound Insulation: Crucial for enhancing passenger experience, this segment is growing as noise reduction becomes a key design consideration in modern rail vehicles.

- Insulation Parts: These components are vital for electrical and thermal insulation, ensuring safe and efficient operation of rail systems.

- Others: Encompasses a variety of specialized extruded rubber parts designed for specific functionalities.

Key Drivers of Rail Transit Rubber Extruded Parts Growth

The growth of the Rail Transit Rubber Extruded Parts market is propelled by several interconnected factors. A primary driver is the continuous global expansion and modernization of rail infrastructure, fueled by government investments aimed at enhancing public transportation systems and promoting sustainable mobility. This includes the development of new subway lines, light rail networks, and high-speed rail corridors. Technological advancements in material science are enabling the creation of rubber compounds with superior performance characteristics, such as enhanced durability, fire resistance, and extreme temperature tolerance, meeting the stringent safety and performance requirements of the rail industry. Furthermore, increasing passenger demand for comfort and safety is driving the adoption of advanced sound insulation, vibration damping, and effective sealing solutions. Regulatory mandates for safety and environmental compliance also play a significant role, pushing manufacturers to develop and utilize high-quality, certified rubber components.

Challenges in the Rail Transit Rubber Extruded Parts Sector

The Rail Transit Rubber Extruded Parts sector faces several challenges that can impede growth and profitability. Stringent and evolving regulatory requirements related to fire safety, emissions, and material performance necessitate significant investment in research and development and compliance testing, adding to production costs. Supply chain disruptions, particularly for specialized raw materials like high-grade synthetic rubber, can lead to price volatility and production delays, impacting timely project delivery. Intense competition among established players and emerging manufacturers, especially from regions with lower manufacturing costs, puts pressure on profit margins. Moreover, the development and adoption of alternative materials, such as advanced polymers and composites, pose a long-term threat, although rubber often retains its cost-effectiveness and versatility for many applications. Economic downturns and budget constraints in government infrastructure spending can also lead to project delays or cancellations, directly affecting demand for rubber extruded parts.

Emerging Opportunities in Rail Transit Rubber Extruded Parts

The Rail Transit Rubber Extruded Parts market presents several promising emerging opportunities for growth and innovation. The increasing focus on sustainable transportation and "green" rail initiatives is driving demand for eco-friendly rubber compounds with reduced environmental impact and longer lifespans. The expansion of urban metro systems in developing economies, coupled with the modernization of existing infrastructure in developed nations, offers a substantial avenue for market penetration. Furthermore, the development of "smart" rubber components embedded with sensors for condition monitoring and predictive maintenance represents a significant technological frontier. The burgeoning sector of autonomous rail systems and the increasing need for advanced vibration damping and sealing solutions in these applications also present new avenues for product development and market expansion. The demand for personalized and customized rubber solutions for specific rail models and operating conditions is also a growing opportunity.

Leading Players in the Rail Transit Rubber Extruded Parts Market

- Hydro

- Kismet Rubber Products

- Vicone Rubber

- Viking Extrusions

- Minor Rubber

- Ames Rubber Manufacturing

- Hebei Shida Seal Group

- Boss Polymer

- Denver Rubber Company

- Elasto Proxy

- Fournier Rubber & Supply Co

- Vip Rubber Co

Key Developments in Rail Transit Rubber Extruded Parts Industry

- 2023: Launch of advanced EPDM compounds with enhanced UV and ozone resistance for high-speed rail exterior seals.

- 2023: Increased M&A activity, with an estimated $250 million in deals focused on expanding product portfolios and geographical reach.

- 2024: Introduction of new fire-retardant and low-smoke rubber formulations meeting the latest international safety standards.

- 2024: Significant investments in R&D for self-healing rubber materials for extended component lifespan.

- 2024: Growing adoption of advanced extrusion techniques for producing complex rubber profiles for specialized applications.

Strategic Outlook for Rail Transit Rubber Extruded Parts Market

The strategic outlook for the Rail Transit Rubber Extruded Parts market remains exceptionally positive, fueled by sustained global investment in rail infrastructure and the ongoing demand for advanced transportation solutions. The trend towards urbanization and the imperative for sustainable mobility will continue to drive the expansion of subway and light rail systems, creating a consistent need for high-quality rubber components. Innovations in material science, particularly in developing more durable, environmentally friendly, and high-performance rubber compounds, will be crucial for companies to maintain a competitive edge. Furthermore, strategic partnerships and acquisitions will likely continue as market players seek to consolidate their positions, expand their technological capabilities, and broaden their market access. The increasing focus on passenger comfort and safety will also drive the demand for specialized solutions like enhanced sound insulation and vibration damping. The market is poised for robust and sustained growth, presenting significant opportunities for stakeholders who can effectively address evolving industry demands and technological advancements.

Rail Transit Rubber Extruded Parts Segmentation

-

1. Application

- 1.1. Subway

- 1.2. Light Rail

- 1.3. Regional Trains

- 1.4. High-speed Rail

- 1.5. Others

-

2. Type

- 2.1. Seals

- 2.2. Shock Absorbing Parts

- 2.3. Sound Insulation

- 2.4. Insulation Parts

- 2.5. Others

Rail Transit Rubber Extruded Parts Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Rail Transit Rubber Extruded Parts REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Rail Transit Rubber Extruded Parts Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Subway

- 5.1.2. Light Rail

- 5.1.3. Regional Trains

- 5.1.4. High-speed Rail

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Seals

- 5.2.2. Shock Absorbing Parts

- 5.2.3. Sound Insulation

- 5.2.4. Insulation Parts

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Rail Transit Rubber Extruded Parts Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Subway

- 6.1.2. Light Rail

- 6.1.3. Regional Trains

- 6.1.4. High-speed Rail

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Seals

- 6.2.2. Shock Absorbing Parts

- 6.2.3. Sound Insulation

- 6.2.4. Insulation Parts

- 6.2.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Rail Transit Rubber Extruded Parts Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Subway

- 7.1.2. Light Rail

- 7.1.3. Regional Trains

- 7.1.4. High-speed Rail

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Seals

- 7.2.2. Shock Absorbing Parts

- 7.2.3. Sound Insulation

- 7.2.4. Insulation Parts

- 7.2.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Rail Transit Rubber Extruded Parts Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Subway

- 8.1.2. Light Rail

- 8.1.3. Regional Trains

- 8.1.4. High-speed Rail

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Seals

- 8.2.2. Shock Absorbing Parts

- 8.2.3. Sound Insulation

- 8.2.4. Insulation Parts

- 8.2.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Rail Transit Rubber Extruded Parts Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Subway

- 9.1.2. Light Rail

- 9.1.3. Regional Trains

- 9.1.4. High-speed Rail

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Seals

- 9.2.2. Shock Absorbing Parts

- 9.2.3. Sound Insulation

- 9.2.4. Insulation Parts

- 9.2.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Rail Transit Rubber Extruded Parts Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Subway

- 10.1.2. Light Rail

- 10.1.3. Regional Trains

- 10.1.4. High-speed Rail

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Seals

- 10.2.2. Shock Absorbing Parts

- 10.2.3. Sound Insulation

- 10.2.4. Insulation Parts

- 10.2.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Hydro

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Kismet Rubber Products

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vicone Rubber

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Viking Extrusions

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Minor Rubber

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ames Rubber Manufacturing

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hebei Shida Seal Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boss Polymer

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Denver Rubber Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Elasto Proxy

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Fournier Rubber & Supply Co

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Vip Rubber Co

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Hydro

List of Figures

- Figure 1: Global Rail Transit Rubber Extruded Parts Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Rail Transit Rubber Extruded Parts Revenue (million), by Application 2024 & 2032

- Figure 3: North America Rail Transit Rubber Extruded Parts Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Rail Transit Rubber Extruded Parts Revenue (million), by Type 2024 & 2032

- Figure 5: North America Rail Transit Rubber Extruded Parts Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Rail Transit Rubber Extruded Parts Revenue (million), by Country 2024 & 2032

- Figure 7: North America Rail Transit Rubber Extruded Parts Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Rail Transit Rubber Extruded Parts Revenue (million), by Application 2024 & 2032

- Figure 9: South America Rail Transit Rubber Extruded Parts Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Rail Transit Rubber Extruded Parts Revenue (million), by Type 2024 & 2032

- Figure 11: South America Rail Transit Rubber Extruded Parts Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Rail Transit Rubber Extruded Parts Revenue (million), by Country 2024 & 2032

- Figure 13: South America Rail Transit Rubber Extruded Parts Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Rail Transit Rubber Extruded Parts Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Rail Transit Rubber Extruded Parts Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Rail Transit Rubber Extruded Parts Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Rail Transit Rubber Extruded Parts Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Rail Transit Rubber Extruded Parts Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Rail Transit Rubber Extruded Parts Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Rail Transit Rubber Extruded Parts Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Rail Transit Rubber Extruded Parts Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Rail Transit Rubber Extruded Parts Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Rail Transit Rubber Extruded Parts Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Rail Transit Rubber Extruded Parts Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Rail Transit Rubber Extruded Parts Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Rail Transit Rubber Extruded Parts Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Rail Transit Rubber Extruded Parts Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Rail Transit Rubber Extruded Parts Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Rail Transit Rubber Extruded Parts Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Rail Transit Rubber Extruded Parts Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Rail Transit Rubber Extruded Parts Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Rail Transit Rubber Extruded Parts Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Rail Transit Rubber Extruded Parts Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Rail Transit Rubber Extruded Parts?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Rail Transit Rubber Extruded Parts?

Key companies in the market include Hydro, Kismet Rubber Products, Vicone Rubber, Viking Extrusions, Minor Rubber, Ames Rubber Manufacturing, Hebei Shida Seal Group, Boss Polymer, Denver Rubber Company, Elasto Proxy, Fournier Rubber & Supply Co, Vip Rubber Co.

3. What are the main segments of the Rail Transit Rubber Extruded Parts?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Rail Transit Rubber Extruded Parts," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Rail Transit Rubber Extruded Parts report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Rail Transit Rubber Extruded Parts?

To stay informed about further developments, trends, and reports in the Rail Transit Rubber Extruded Parts, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence