Key Insights

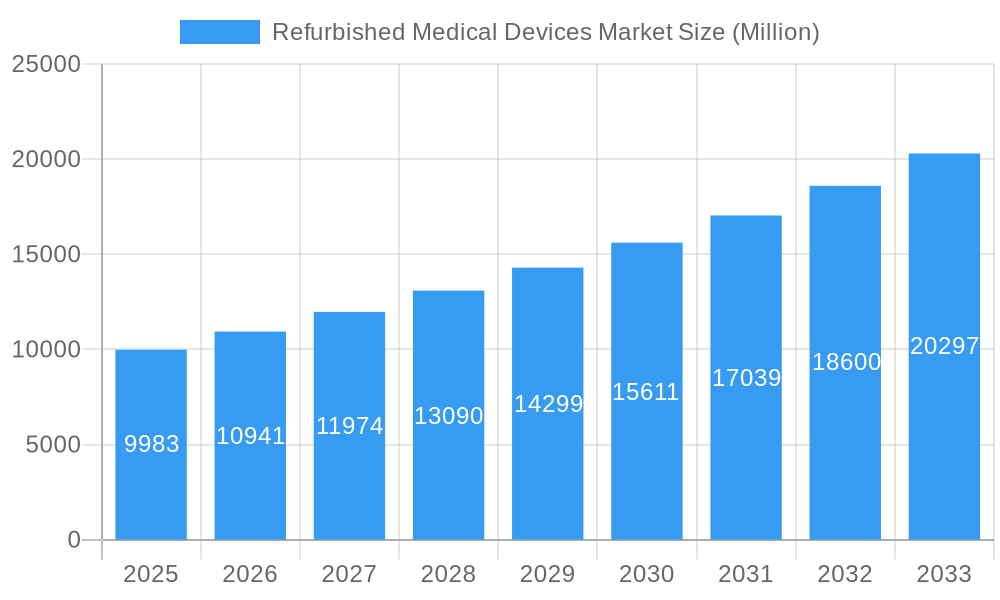

The global Refurbished Medical Devices Market is poised for significant expansion, projected to reach USD 9,983 million in 2025, with a robust CAGR of 9.6% anticipated over the forecast period. This growth is primarily fueled by the escalating demand for cost-effective medical solutions, particularly in emerging economies and for healthcare providers facing budget constraints. The increasing prevalence of chronic diseases and the aging global population necessitate advanced medical equipment, and refurbished devices offer a compelling alternative to new purchases, providing comparable quality and performance at a fraction of the cost. Furthermore, growing environmental consciousness and the drive towards a circular economy are promoting the adoption of refurbished medical equipment as a sustainable choice, reducing electronic waste and conserving resources. Key market drivers include advancements in refurbishment technologies, stringent quality control measures ensuring product reliability, and supportive government initiatives promoting the use of pre-owned medical equipment.

Refurbished Medical Devices Market Market Size (In Billion)

The market is segmented across a diverse range of product categories, with Medical Imaging Equipment, including X-ray machines, ultrasound systems, MRI machines, and CT scanners, expected to dominate due to their high cost and continued demand. Operating Room and Surgical Equipment, Patient Monitors, Cardiovascular and Cardiology Equipment, and Neurology Equipment also represent significant segments. North America and Europe are anticipated to hold substantial market shares, driven by established healthcare infrastructures and a mature market for refurbished medical devices. However, the Asia Pacific region is expected to witness the fastest growth, propelled by increasing healthcare expenditure, a rising middle class, and a growing need for accessible medical technology. Key players in this dynamic market include GE Healthcare, Siemens Healthcare Systems, Koninklijke Philips NV, Canon Medical Systems, and Johnson & Johnson, actively investing in expanding their refurbished device portfolios and global reach.

Refurbished Medical Devices Market Company Market Share

This detailed market research report provides an in-depth analysis of the global Refurbished Medical Devices Market, offering critical insights and actionable intelligence for stakeholders. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report delves into market dynamics, key trends, leading players, and future growth opportunities. The report is designed for medical device manufacturers, distributors, healthcare providers, investors, and regulatory bodies seeking to understand the evolving landscape of refurbished medical equipment.

Refurbished Medical Devices Market Market Concentration & Innovation

The Refurbished Medical Devices Market is characterized by a moderate level of market concentration, with a mix of large, established players and numerous smaller, specialized refurbishers. Innovation is primarily driven by advancements in diagnostic imaging technology, demanding sophisticated refurbishment processes to maintain performance. Regulatory frameworks, such as FDA guidelines and ISO certifications, play a crucial role in ensuring the safety and efficacy of refurbished devices, influencing product quality and market access. Product substitutes, such as new, lower-cost models or different diagnostic modalities, present a continuous challenge, necessitating competitive pricing and superior service offerings for refurbished equipment. End-user trends indicate a growing demand for cost-effective healthcare solutions, particularly in emerging economies and resource-constrained healthcare settings, fueling the adoption of refurbished devices. Mergers and acquisitions (M&A) activities are a significant factor in market consolidation, with deal values expected to reach several hundred million dollars annually. Notable M&A activities include strategic acquisitions aimed at expanding service capabilities and market reach. For instance, in December 2021, Block Imaging acquired Reliable Healthcare Imaging, significantly enhancing their repair and reprocessing capabilities for high-value CT scanner components. The market share distribution sees key players like GE Healthcare, Siemens Healthcare Systems, and Koninklijke Philips NV holding substantial portions, alongside specialized refurbishers focusing on specific equipment categories.

Refurbished Medical Devices Market Industry Trends & Insights

The Refurbished Medical Devices Market is poised for substantial growth, driven by an escalating global demand for affordable healthcare solutions and the increasing cost of new medical equipment. The projected Compound Annual Growth Rate (CAGR) for the forecast period is approximately 8.5%, with the market size estimated to surpass $45,000 million by 2033. Key growth drivers include the tightening healthcare budgets in developed economies and the burgeoning need for advanced medical technologies in developing nations. Technological advancements in original equipment manufacturing (OEM) continuously create opportunities for the refurbishment sector as older, yet highly functional, equipment becomes available. This creates a continuous cycle of innovation and cost-efficiency. Consumer preferences are increasingly shifting towards value-driven healthcare, making refurbished devices an attractive alternative for hospitals and clinics seeking to optimize capital expenditure without compromising on quality. The competitive dynamics are intense, with established OEMs increasingly participating in their own remarketing and refurbishment programs, alongside independent third-party refurbishers. Market penetration of refurbished devices is steadily increasing across various segments, particularly in medical imaging and patient monitoring. The aging global population also contributes significantly to the demand for medical devices, and refurbished options provide a more accessible pathway to acquiring necessary equipment for an expanding patient base. Furthermore, the growing awareness of sustainability and the circular economy principles is encouraging the adoption of refurbished medical equipment as a more environmentally conscious choice. The ability of refurbishers to offer comprehensive service packages, including warranties and maintenance, further enhances the appeal of these devices, bridging the gap between cost savings and reliable performance.

Dominant Markets & Segments in Refurbished Medical Devices Market

The Medical Imaging Equipment segment is the undisputed leader in the Refurbished Medical Devices Market, projected to account for over 35% of the total market revenue by 2033, estimated at $15,750 million. Within this segment, CT Scanners and MRI Machines represent the highest value sub-segments, driven by their high cost of new acquisition and ongoing demand for diagnostic imaging services. The dominance of this segment is fueled by several key drivers:

- High Capital Expenditure for New Equipment: New medical imaging systems can cost millions of dollars, making refurbished options an economically viable alternative for many healthcare facilities, especially smaller clinics and hospitals in emerging markets.

- Technological Advancements Leading to Equipment Obsolescence: Rapid innovation in imaging technology leads to frequent upgrades of new equipment, making previously state-of-the-art refurbished machines readily available in the secondary market.

- Extended Lifespan of Sophisticated Equipment: Medical imaging devices are built for durability, allowing them to maintain high performance standards after rigorous refurbishment processes.

- Increasing Prevalence of Chronic Diseases: The rising incidence of conditions requiring diagnostic imaging, such as cancer, cardiovascular diseases, and neurological disorders, directly translates to a higher demand for imaging equipment.

Other significant segments include:

- Operating Room and Surgical Equipment: Valued at approximately $8,100 million by 2033, this segment is driven by the constant need for functional and reliable surgical tools.

- Key Drivers: The need for cost-effective surgical solutions in outpatient settings and developing countries, alongside the continuous replacement cycles for high-wear surgical instruments. Anesthesia Machines and Electrosurgical Units are particularly strong sub-segments.

- Patient Monitors: Expected to reach $6,300 million by 2033, this segment is crucial for critical care and continuous patient observation.

- Key Drivers: The expanding critical care infrastructure, the increasing number of hospital beds globally, and the demand for essential monitoring devices in remote and underserved areas. Multiparameter Monitors are the most prominent in this segment.

Geographically, North America is anticipated to remain the largest market, accounting for over 30% of the global revenue, estimated at $13,500 million by 2033. This dominance is attributed to its robust healthcare infrastructure, high disposable income, and a strong regulatory framework that supports the refurbished medical device market. However, the Asia-Pacific region is projected to exhibit the fastest growth rate, driven by increasing healthcare investments, a growing middle class, and a substantial unmet demand for advanced medical technologies. Economic policies in these regions, aimed at improving healthcare accessibility and affordability, further bolster the demand for refurbished medical devices.

Refurbished Medical Devices Market Product Developments

Product developments in the Refurbished Medical Devices Market are focused on enhancing the capabilities and lifespan of existing technologies. Refurbishers are investing in advanced diagnostic software upgrades, ensuring refurbished equipment meets current imaging standards. The competitive advantage lies in providing certified pre-owned equipment that offers near-new performance at a fraction of the cost. Key technological trends include the integration of AI-powered diagnostic tools into refurbished imaging systems and the development of modular refurbishment processes that allow for faster turnaround times and greater customization. This ensures refurbished devices remain relevant and competitive in the dynamic healthcare landscape, appealing to a wider range of healthcare providers.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Refurbished Medical Devices Market across various product categories and geographical regions. The market is segmented into Medical Imaging Equipment, Operating Room and Surgical Equipment, Patient Monitors, Cardiovascular and Cardiology Equipment, Neurology Equipment, Endoscopy Equipment, Intensive Care Units, and Other Medical Equipment. The Medical Imaging Equipment segment, including X-ray Machines, Ultrasound Systems, MRI Machines, CT Scanners, and Nuclear Imaging Systems, is projected to lead the market with a significant share of over 35% by 2033, estimated at $15,750 million. The Operating Room and Surgical Equipment segment, encompassing Anesthesia Machines, Microscopes, and Electrosurgical Units, is expected to grow substantially, reaching approximately $8,100 million by 2033. Patient Monitors, particularly Multiparameter Monitors and ECG devices, are also key contributors, with an estimated market size of $6,300 million by 2033. The competitive dynamics within each segment vary, with some categories exhibiting higher refurbishment volumes and greater price sensitivity than others.

Key Drivers of Refurbished Medical Devices Market Growth

The growth of the Refurbished Medical Devices Market is propelled by a confluence of compelling factors.

- Cost-Effectiveness: The primary driver is the significant cost savings offered by refurbished devices compared to new ones, making advanced medical technology accessible to a broader spectrum of healthcare providers, particularly small and medium-sized hospitals, clinics, and those in emerging economies.

- Increasing Healthcare Demand: The aging global population and the rising prevalence of chronic diseases are escalating the demand for medical equipment across all specialties. Refurbished devices provide a crucial solution to meet this growing need within budget constraints.

- Technological Advancements: Rapid innovation in medical technology leads to a faster obsolescence cycle for new equipment, creating a steady supply of high-quality used machines for the refurbishment market.

- Environmental Consciousness: A growing emphasis on sustainability and the circular economy is promoting the adoption of refurbished products as an eco-friendly alternative.

Challenges in the Refurbished Medical Devices Market Sector

Despite its robust growth, the Refurbished Medical Devices Market faces several challenges.

- Regulatory Scrutiny: Stringent regulations regarding the quality, safety, and re-certification of refurbished medical devices can be complex and costly to navigate, posing a barrier to entry for some refurbishers and increasing operational expenses.

- Perception and Trust: Some healthcare providers still harbor concerns about the reliability and performance of refurbished equipment compared to new devices, necessitating significant efforts in marketing and customer education.

- Supply Chain Volatility: The availability and quality of used medical equipment can be subject to market fluctuations and supply chain disruptions, impacting the consistent availability of high-demand items.

- Rapid Technological Evolution: The continuous pace of technological advancement can quickly render even recently refurbished equipment outdated, requiring ongoing investment in re-skilling and component upgrades.

Emerging Opportunities in Refurbished Medical Devices Market

The Refurbished Medical Devices Market is ripe with emerging opportunities.

- Emerging Markets: The burgeoning healthcare sectors in Asia-Pacific, Latin America, and Africa present significant untapped potential for refurbished medical equipment, driven by rapid economic development and a growing need for accessible healthcare.

- Specialized Refurbishment: There is an increasing demand for specialized refurbishment services for niche or high-complexity equipment, such as advanced radiotherapy systems or specialized surgical robots, where expertise is paramount.

- Extended Service Contracts: Offering comprehensive warranties, maintenance, and upgrade services alongside refurbished equipment can create a strong value proposition and foster long-term customer loyalty.

- Digital Integration: Integrating refurbished devices with newer digital health platforms and AI-powered diagnostic tools presents an opportunity to enhance their functionality and market appeal.

Leading Players in the Refurbished Medical Devices Market Market

- Soma Technology

- Agito Medical AS

- GE Healthcare

- Cambridge Scientific Products

- Avante Health Solutions

- Hilditch Group

- Radio Oncology Systems Inc

- Koninklijke Philips NV

- Integrity Medical Systems Inc

- Johnson & Johnson

- Block Imaging International Inc

- Siemens Healthcare Systems

- Master Medical Equipment

- Everx Pvt Ltd

- Canon Medical Systems

Key Developments in Refurbished Medical Devices Market Industry

- December 2021: Block Imaging acquired Reliable Healthcare Imaging to establish a new repair and reprocessing facility for CT scanner tubes and HV tanks, enhancing their service capabilities for critical imaging components.

- May 2021: Hermes Medical Solutions and Radiology Oncology Systems entered into an agreement to deliver cost-efficient and innovative solutions, including refurbished medical devices, to Medical Imaging and Radiotherapy Departments in the US, underscoring strategic partnerships for market expansion.

Strategic Outlook for Refurbished Medical Devices Market Market

The strategic outlook for the Refurbished Medical Devices Market is overwhelmingly positive, fueled by its inherent value proposition in an increasingly cost-conscious global healthcare environment. The market will continue to benefit from the growing demand for advanced medical technologies in both developed and developing economies, where affordability is a key consideration. Strategic partnerships between refurbishers and original equipment manufacturers, as well as healthcare providers, will become more prevalent, ensuring quality control and expanding market reach. Investments in advanced refurbishment techniques, quality assurance protocols, and extended service offerings will be critical for sustained growth. Furthermore, the increasing emphasis on sustainability and the circular economy will drive greater acceptance and adoption of refurbished medical equipment. The market is expected to witness continued consolidation through mergers and acquisitions as larger players seek to expand their product portfolios and geographical presence. Innovations in diagnostics and treatment modalities will also create new opportunities for the refurbishment sector to provide cost-effective access to these technologies.

Refurbished Medical Devices Market Segmentation

-

1. Product

-

1.1. Medical Imaging Equipment

- 1.1.1. X-ray Machines

- 1.1.2. Ultrasound Systems

- 1.1.3. MRI Machines

- 1.1.4. CT Scanners

- 1.1.5. Nuclear Imaging Systems (Pet, Spect, and Pet/CT)

- 1.1.6. Other Medical Imaging Equipment

-

1.2. Operating Room and Surgical Equipment

- 1.2.1. Anesthesia Machines

- 1.2.2. CO2 and Agent Monitors

- 1.2.3. Microscopes

- 1.2.4. Electrosurgical Units

- 1.2.5. Other Operating Room and Surgical Equipment

-

1.3. Patient Monitors

- 1.3.1. Multiparameter Monitors

- 1.3.2. Electrocardiography Devices (ECG)

- 1.3.3. Non-invasive Blood Pressure Monitors

- 1.4. Cardiovascular and Cardiology Equipment

- 1.5. Neurology Equipment

- 1.6. Endoscopy Equipment

- 1.7. Intensive Care Units

- 1.8. Other Medical Equipment

-

1.1. Medical Imaging Equipment

Refurbished Medical Devices Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Refurbished Medical Devices Market Regional Market Share

Geographic Coverage of Refurbished Medical Devices Market

Refurbished Medical Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Cost Containment Pressure on Healthcare Organizations; Large Inventory of Old or Used Medical Devices; Growing Rate of Private Healthcare Institutions

- 3.3. Market Restrains

- 3.3.1. Quality Issues of Refurbished Medical Equipment among End Users; Reluctance to Purchase Refurbished Medical Equipment Among Healthcare Providers

- 3.4. Market Trends

- 3.4.1. Medical Imaging Equipment is Expected to hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Refurbished Medical Devices Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Medical Imaging Equipment

- 5.1.1.1. X-ray Machines

- 5.1.1.2. Ultrasound Systems

- 5.1.1.3. MRI Machines

- 5.1.1.4. CT Scanners

- 5.1.1.5. Nuclear Imaging Systems (Pet, Spect, and Pet/CT)

- 5.1.1.6. Other Medical Imaging Equipment

- 5.1.2. Operating Room and Surgical Equipment

- 5.1.2.1. Anesthesia Machines

- 5.1.2.2. CO2 and Agent Monitors

- 5.1.2.3. Microscopes

- 5.1.2.4. Electrosurgical Units

- 5.1.2.5. Other Operating Room and Surgical Equipment

- 5.1.3. Patient Monitors

- 5.1.3.1. Multiparameter Monitors

- 5.1.3.2. Electrocardiography Devices (ECG)

- 5.1.3.3. Non-invasive Blood Pressure Monitors

- 5.1.4. Cardiovascular and Cardiology Equipment

- 5.1.5. Neurology Equipment

- 5.1.6. Endoscopy Equipment

- 5.1.7. Intensive Care Units

- 5.1.8. Other Medical Equipment

- 5.1.1. Medical Imaging Equipment

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Refurbished Medical Devices Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Medical Imaging Equipment

- 6.1.1.1. X-ray Machines

- 6.1.1.2. Ultrasound Systems

- 6.1.1.3. MRI Machines

- 6.1.1.4. CT Scanners

- 6.1.1.5. Nuclear Imaging Systems (Pet, Spect, and Pet/CT)

- 6.1.1.6. Other Medical Imaging Equipment

- 6.1.2. Operating Room and Surgical Equipment

- 6.1.2.1. Anesthesia Machines

- 6.1.2.2. CO2 and Agent Monitors

- 6.1.2.3. Microscopes

- 6.1.2.4. Electrosurgical Units

- 6.1.2.5. Other Operating Room and Surgical Equipment

- 6.1.3. Patient Monitors

- 6.1.3.1. Multiparameter Monitors

- 6.1.3.2. Electrocardiography Devices (ECG)

- 6.1.3.3. Non-invasive Blood Pressure Monitors

- 6.1.4. Cardiovascular and Cardiology Equipment

- 6.1.5. Neurology Equipment

- 6.1.6. Endoscopy Equipment

- 6.1.7. Intensive Care Units

- 6.1.8. Other Medical Equipment

- 6.1.1. Medical Imaging Equipment

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Refurbished Medical Devices Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Medical Imaging Equipment

- 7.1.1.1. X-ray Machines

- 7.1.1.2. Ultrasound Systems

- 7.1.1.3. MRI Machines

- 7.1.1.4. CT Scanners

- 7.1.1.5. Nuclear Imaging Systems (Pet, Spect, and Pet/CT)

- 7.1.1.6. Other Medical Imaging Equipment

- 7.1.2. Operating Room and Surgical Equipment

- 7.1.2.1. Anesthesia Machines

- 7.1.2.2. CO2 and Agent Monitors

- 7.1.2.3. Microscopes

- 7.1.2.4. Electrosurgical Units

- 7.1.2.5. Other Operating Room and Surgical Equipment

- 7.1.3. Patient Monitors

- 7.1.3.1. Multiparameter Monitors

- 7.1.3.2. Electrocardiography Devices (ECG)

- 7.1.3.3. Non-invasive Blood Pressure Monitors

- 7.1.4. Cardiovascular and Cardiology Equipment

- 7.1.5. Neurology Equipment

- 7.1.6. Endoscopy Equipment

- 7.1.7. Intensive Care Units

- 7.1.8. Other Medical Equipment

- 7.1.1. Medical Imaging Equipment

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Refurbished Medical Devices Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Medical Imaging Equipment

- 8.1.1.1. X-ray Machines

- 8.1.1.2. Ultrasound Systems

- 8.1.1.3. MRI Machines

- 8.1.1.4. CT Scanners

- 8.1.1.5. Nuclear Imaging Systems (Pet, Spect, and Pet/CT)

- 8.1.1.6. Other Medical Imaging Equipment

- 8.1.2. Operating Room and Surgical Equipment

- 8.1.2.1. Anesthesia Machines

- 8.1.2.2. CO2 and Agent Monitors

- 8.1.2.3. Microscopes

- 8.1.2.4. Electrosurgical Units

- 8.1.2.5. Other Operating Room and Surgical Equipment

- 8.1.3. Patient Monitors

- 8.1.3.1. Multiparameter Monitors

- 8.1.3.2. Electrocardiography Devices (ECG)

- 8.1.3.3. Non-invasive Blood Pressure Monitors

- 8.1.4. Cardiovascular and Cardiology Equipment

- 8.1.5. Neurology Equipment

- 8.1.6. Endoscopy Equipment

- 8.1.7. Intensive Care Units

- 8.1.8. Other Medical Equipment

- 8.1.1. Medical Imaging Equipment

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Refurbished Medical Devices Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Medical Imaging Equipment

- 9.1.1.1. X-ray Machines

- 9.1.1.2. Ultrasound Systems

- 9.1.1.3. MRI Machines

- 9.1.1.4. CT Scanners

- 9.1.1.5. Nuclear Imaging Systems (Pet, Spect, and Pet/CT)

- 9.1.1.6. Other Medical Imaging Equipment

- 9.1.2. Operating Room and Surgical Equipment

- 9.1.2.1. Anesthesia Machines

- 9.1.2.2. CO2 and Agent Monitors

- 9.1.2.3. Microscopes

- 9.1.2.4. Electrosurgical Units

- 9.1.2.5. Other Operating Room and Surgical Equipment

- 9.1.3. Patient Monitors

- 9.1.3.1. Multiparameter Monitors

- 9.1.3.2. Electrocardiography Devices (ECG)

- 9.1.3.3. Non-invasive Blood Pressure Monitors

- 9.1.4. Cardiovascular and Cardiology Equipment

- 9.1.5. Neurology Equipment

- 9.1.6. Endoscopy Equipment

- 9.1.7. Intensive Care Units

- 9.1.8. Other Medical Equipment

- 9.1.1. Medical Imaging Equipment

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Refurbished Medical Devices Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Medical Imaging Equipment

- 10.1.1.1. X-ray Machines

- 10.1.1.2. Ultrasound Systems

- 10.1.1.3. MRI Machines

- 10.1.1.4. CT Scanners

- 10.1.1.5. Nuclear Imaging Systems (Pet, Spect, and Pet/CT)

- 10.1.1.6. Other Medical Imaging Equipment

- 10.1.2. Operating Room and Surgical Equipment

- 10.1.2.1. Anesthesia Machines

- 10.1.2.2. CO2 and Agent Monitors

- 10.1.2.3. Microscopes

- 10.1.2.4. Electrosurgical Units

- 10.1.2.5. Other Operating Room and Surgical Equipment

- 10.1.3. Patient Monitors

- 10.1.3.1. Multiparameter Monitors

- 10.1.3.2. Electrocardiography Devices (ECG)

- 10.1.3.3. Non-invasive Blood Pressure Monitors

- 10.1.4. Cardiovascular and Cardiology Equipment

- 10.1.5. Neurology Equipment

- 10.1.6. Endoscopy Equipment

- 10.1.7. Intensive Care Units

- 10.1.8. Other Medical Equipment

- 10.1.1. Medical Imaging Equipment

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Soma Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Agito Medical AS

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 GE Healthcare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Cambridge Scientific Products

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Avante Health Solutions

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hilditch Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Radio Oncology Systems Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Koninklijke Philips NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Integrity Medical Systems Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Johnson & Johnson

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Block Imaging International Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Siemens Healthcare Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Master Medical Equipment

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Everx Pvt Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Canon Medical Systems

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Soma Technology

List of Figures

- Figure 1: Global Refurbished Medical Devices Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Refurbished Medical Devices Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Refurbished Medical Devices Market Revenue (undefined), by Product 2025 & 2033

- Figure 4: North America Refurbished Medical Devices Market Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Refurbished Medical Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Refurbished Medical Devices Market Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Refurbished Medical Devices Market Revenue (undefined), by Country 2025 & 2033

- Figure 8: North America Refurbished Medical Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America Refurbished Medical Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Refurbished Medical Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Refurbished Medical Devices Market Revenue (undefined), by Product 2025 & 2033

- Figure 12: Europe Refurbished Medical Devices Market Volume (K Unit), by Product 2025 & 2033

- Figure 13: Europe Refurbished Medical Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 14: Europe Refurbished Medical Devices Market Volume Share (%), by Product 2025 & 2033

- Figure 15: Europe Refurbished Medical Devices Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: Europe Refurbished Medical Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe Refurbished Medical Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Refurbished Medical Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Refurbished Medical Devices Market Revenue (undefined), by Product 2025 & 2033

- Figure 20: Asia Pacific Refurbished Medical Devices Market Volume (K Unit), by Product 2025 & 2033

- Figure 21: Asia Pacific Refurbished Medical Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Asia Pacific Refurbished Medical Devices Market Volume Share (%), by Product 2025 & 2033

- Figure 23: Asia Pacific Refurbished Medical Devices Market Revenue (undefined), by Country 2025 & 2033

- Figure 24: Asia Pacific Refurbished Medical Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific Refurbished Medical Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Refurbished Medical Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Middle East and Africa Refurbished Medical Devices Market Revenue (undefined), by Product 2025 & 2033

- Figure 28: Middle East and Africa Refurbished Medical Devices Market Volume (K Unit), by Product 2025 & 2033

- Figure 29: Middle East and Africa Refurbished Medical Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 30: Middle East and Africa Refurbished Medical Devices Market Volume Share (%), by Product 2025 & 2033

- Figure 31: Middle East and Africa Refurbished Medical Devices Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: Middle East and Africa Refurbished Medical Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Middle East and Africa Refurbished Medical Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Refurbished Medical Devices Market Volume Share (%), by Country 2025 & 2033

- Figure 35: South America Refurbished Medical Devices Market Revenue (undefined), by Product 2025 & 2033

- Figure 36: South America Refurbished Medical Devices Market Volume (K Unit), by Product 2025 & 2033

- Figure 37: South America Refurbished Medical Devices Market Revenue Share (%), by Product 2025 & 2033

- Figure 38: South America Refurbished Medical Devices Market Volume Share (%), by Product 2025 & 2033

- Figure 39: South America Refurbished Medical Devices Market Revenue (undefined), by Country 2025 & 2033

- Figure 40: South America Refurbished Medical Devices Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: South America Refurbished Medical Devices Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: South America Refurbished Medical Devices Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 6: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 7: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: United States Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Canada Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Mexico Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 16: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 17: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 18: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Germany Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: United Kingdom Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: France Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: France Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Italy Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Italy Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Spain Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Spain Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: Rest of Europe Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 32: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 33: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 35: China Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: China Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Japan Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Japan Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: India Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: India Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Australia Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Australia Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: South Korea Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: South Korea Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Asia Pacific Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 48: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 49: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: GCC Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: GCC Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: South Africa Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: South Africa Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Rest of Middle East and Africa Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Rest of Middle East and Africa Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 58: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 59: Global Refurbished Medical Devices Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Refurbished Medical Devices Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Brazil Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Brazil Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Argentina Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Argentina Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of South America Refurbished Medical Devices Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of South America Refurbished Medical Devices Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Refurbished Medical Devices Market?

The projected CAGR is approximately 9.6%.

2. Which companies are prominent players in the Refurbished Medical Devices Market?

Key companies in the market include Soma Technology, Agito Medical AS, GE Healthcare, Cambridge Scientific Products, Avante Health Solutions, Hilditch Group, Radio Oncology Systems Inc, Koninklijke Philips NV, Integrity Medical Systems Inc, Johnson & Johnson, Block Imaging International Inc, Siemens Healthcare Systems, Master Medical Equipment, Everx Pvt Ltd, Canon Medical Systems.

3. What are the main segments of the Refurbished Medical Devices Market?

The market segments include Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Cost Containment Pressure on Healthcare Organizations; Large Inventory of Old or Used Medical Devices; Growing Rate of Private Healthcare Institutions.

6. What are the notable trends driving market growth?

Medical Imaging Equipment is Expected to hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Quality Issues of Refurbished Medical Equipment among End Users; Reluctance to Purchase Refurbished Medical Equipment Among Healthcare Providers.

8. Can you provide examples of recent developments in the market?

In December 2021, Block Imaging acquired Reliable Healthcare Imaging to open a new repair and reprocessing facility for CT scanner tubes and HV tanks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Refurbished Medical Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Refurbished Medical Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Refurbished Medical Devices Market?

To stay informed about further developments, trends, and reports in the Refurbished Medical Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence