Key Insights

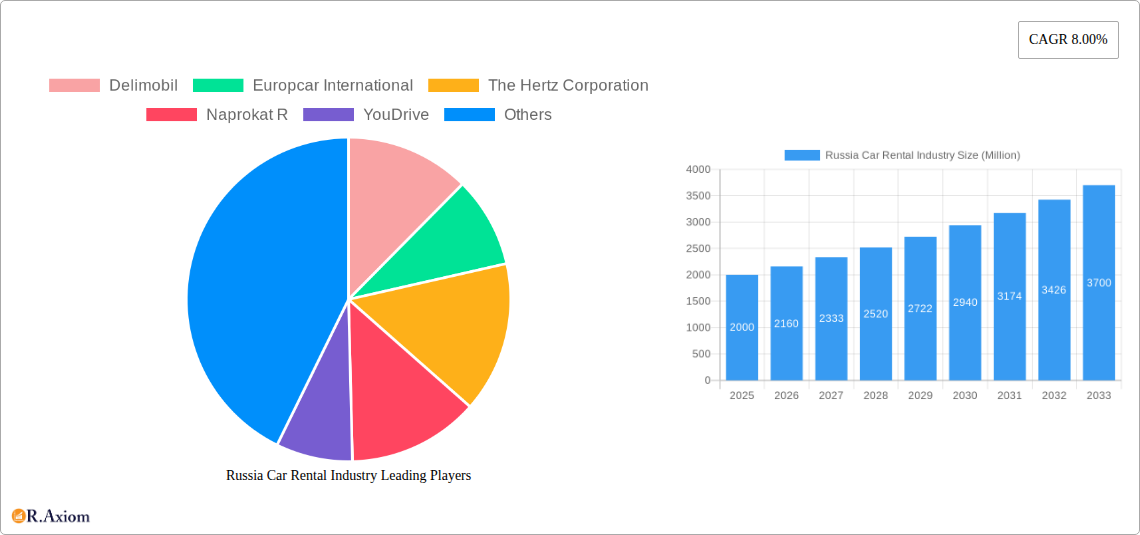

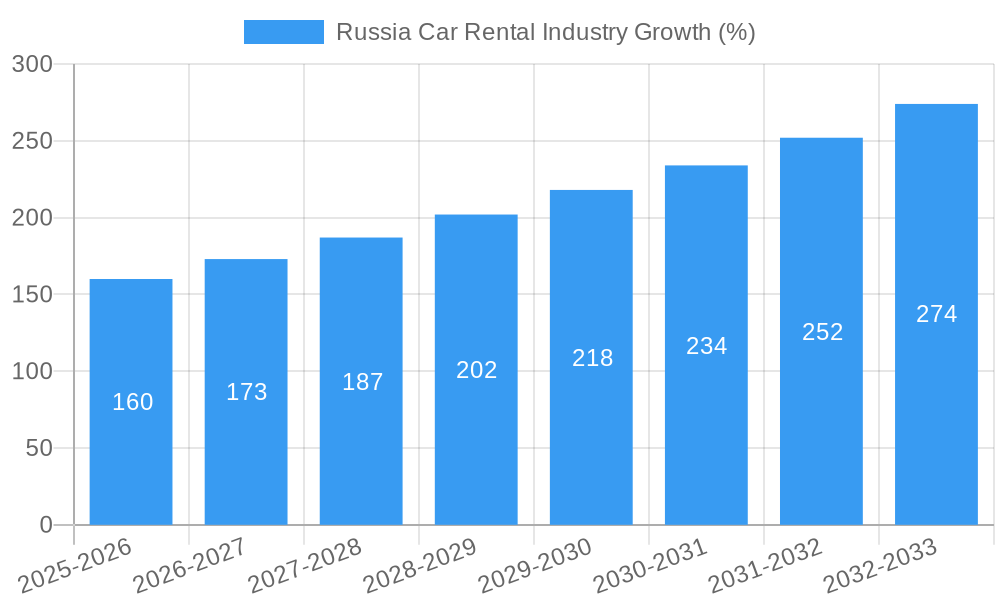

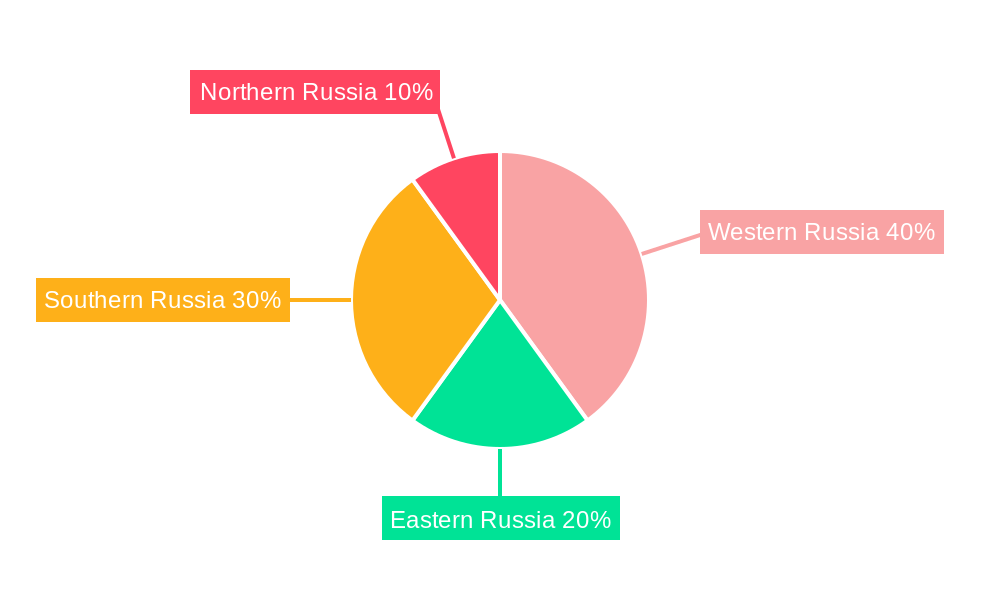

The Russian car rental market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 8.00% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning tourism sector, particularly in Western and Southern Russia, contributes significantly to increased demand for short-term rentals. Furthermore, the growing business travel segment, especially in major cities like Moscow and St. Petersburg, fuels demand for long-term car rentals. Increasing disposable incomes and a preference for convenient transportation options further bolster market growth. However, the market faces certain constraints, including fluctuating fuel prices, seasonal variations in demand, and the ongoing development of public transportation infrastructure in some regions. The market is segmented by booking type (online vs. offline), car type (hatchback, sedan, SUV), rental length (short-term vs. long-term), and application (leisure/tourism vs. business). Online bookings are gaining traction, mirroring global trends. The SUV segment is anticipated to witness strong growth, driven by increasing family sizes and a preference for spacious vehicles. Key players like Delimobil, Europcar International, Hertz, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget, Avis, and Enterprise are actively competing in this dynamic market, employing various strategies to capture market share. Regional variations exist, with Western and Southern Russia expected to dominate due to higher tourism and business activity.

The forecast period (2025-2033) anticipates consistent growth, although the rate may fluctuate slightly year-on-year due to macroeconomic factors and potential policy changes. The historical period (2019-2024) likely reflected slower growth, influenced by external economic conditions and perhaps the pandemic. Long-term prospects remain positive, predicated on continued economic development in Russia and the sustained appeal of car rentals as a flexible and convenient mode of transportation. Market participants are focusing on technological advancements, improving customer service, and expanding their fleet to cater to evolving consumer preferences to maintain competitiveness and maximize their share of this expanding market.

Russia Car Rental Industry: 2019-2033 Market Report

This comprehensive report provides a detailed analysis of the Russia car rental industry, covering the period from 2019 to 2033. It offers invaluable insights into market size, segmentation, key players, emerging trends, and future growth prospects, making it an essential resource for industry stakeholders, investors, and strategic decision-makers. The report leverages extensive data analysis and incorporates real-world examples to paint a clear picture of the dynamic Russian car rental landscape. The study period covers 2019-2033, with 2025 as the base and estimated year.

Russia Car Rental Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the Russian car rental market, examining market concentration, innovation drivers, regulatory frameworks, and key industry developments. The report details market share held by major players such as Delimobil, Europcar International, The Hertz Corporation, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget Rent a Car System Inc, Avis, and Enterprise Holding Inc. It also assesses the impact of mergers and acquisitions (M&A) activities on market dynamics, providing analysis of deal values (in Millions) where available, and highlighting the influence of technological innovation on market structure. The influence of regulatory frameworks, substitute products (e.g., ride-sharing services), and shifting end-user trends will also be considered to paint a holistic picture of market concentration and its evolution throughout the study period. We will explore the impact of factors like increasing smartphone penetration and evolving consumer preferences on the market's competitive intensity and the overall concentration level. An analysis of innovation drivers such as technological advancements in vehicle sharing platforms and fleet management systems will also be included.

- Market Share Analysis: Detailed breakdown of market share for key players (xx% for Delimobil, xx% for Europcar, etc.)

- M&A Activity: Analysis of significant M&A deals, including deal values (xx Million) and their impact on market consolidation.

- Innovation Drivers: Assessment of the role of technology, changing consumer behavior, and government policies.

- Regulatory Framework: Evaluation of existing regulations and their impact on market participants.

Russia Car Rental Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the Russian car rental market. It explores market growth drivers (e.g., rising disposable incomes, tourism growth, business travel), technological disruptions (e.g., the adoption of mobile apps, the rise of car-sharing services), changing consumer preferences (e.g., demand for specific car types, rental durations), and the intense competitive dynamics. This section will present the CAGR (Compound Annual Growth Rate) for the market during the historical and forecast periods, providing a clear indication of the industry's trajectory. Market penetration of online booking systems, car-sharing platforms, and subscription services will also be analyzed. The analysis will consider the impact of macroeconomic factors, such as economic growth and fluctuations in fuel prices, on the overall industry growth.

Dominant Markets & Segments in Russia Car Rental Industry

This section identifies the leading segments within the Russian car rental market across various parameters. A detailed analysis will be provided for each of the segments, highlighting their key drivers and factors contributing to their dominance.

By Booking Type:

- Online Booking: This segment’s growth is driven by increased internet penetration and the convenience offered by online platforms.

- Offline Booking: Traditional booking methods maintain relevance due to certain consumer preferences and geographical factors.

By Car Type:

- Hatchback: Dominance influenced by affordability, fuel efficiency, and suitability for urban areas.

- Sedan: Popularity for business travel and families seeking comfort.

- SUV: Growing demand driven by consumer preference for spaciousness, especially in rural areas.

By Rental Length:

- Short Term: This segment benefits from tourist travel and spontaneous rental needs.

- Long Term: Growth influenced by corporate rentals and individuals seeking long-term car usage.

By Application:

- Leisure/Tourism: Significant contributor, driven by inbound and domestic tourism.

- Business: Corporate rentals remain a substantial segment, dependent on economic conditions.

Dominance Analysis: This section will analyze the factors behind the dominance of specific segments (e.g., economic policies, infrastructure development, tourism trends).

Russia Car Rental Industry Product Developments

This section showcases the innovation within the industry. Recent technological advancements have led to the introduction of minute-based rentals (Mercedes-Benz and BMW AG), fully digital booking services (MINI Russia's EASY2DRIVE), premium subscription services (Audi Drive), and sophisticated fleet management platforms (Yandex Drive). These developments reflect a move towards enhanced customer convenience, optimized fleet management, and data-driven decision-making. The report assesses how these innovations cater to evolving customer needs and enhance competitive advantages.

Report Scope & Segmentation Analysis

This report provides a comprehensive segmentation analysis of the Russia car rental market, covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033). The market is segmented by booking type (online, offline), car type (hatchback, sedan, SUV), rental length (short-term, long-term), and application (leisure/tourism, business). Growth projections, market sizes (in Millions), and competitive dynamics will be detailed for each segment.

Key Drivers of Russia Car Rental Industry Growth

The growth of the Russian car rental industry is fueled by several key factors. Increased disposable incomes among the population are leading to higher tourism and leisure spending, driving demand for rental cars. Technological advancements, such as mobile apps and online booking platforms, have enhanced convenience and accessibility. Government initiatives supporting tourism and infrastructure development further contribute to industry expansion.

Challenges in the Russia Car Rental Industry Sector

The Russian car rental market faces several challenges, including fluctuating fuel prices impacting operational costs, seasonality in tourism affecting demand, and stringent regulatory requirements. Supply chain disruptions and economic volatility pose additional risks. The competitive landscape, with established players and emerging car-sharing services, necessitates continuous innovation and adaptation. These challenges can impact profitability and overall market growth.

Emerging Opportunities in Russia Car Rental Industry

The Russian car rental industry presents several promising opportunities. The expanding middle class, increasing domestic and international tourism, and ongoing digitalization create a favorable environment for growth. The potential for strategic partnerships with technology companies to enhance fleet management and customer service, together with the development of specialized rental services for niche markets, offers considerable upside.

Leading Players in the Russia Car Rental Industry Market

- Delimobil

- Europcar International

- The Hertz Corporation

- Naprokat R

- YouDrive

- Yandex Drive

- Belka Car

- Budget Rent a Car System Inc

- Avis

- Enterprise Holding Inc

Key Developments in Russia Car Rental Industry Industry

- June 2021: Yandex Drive launched a fleet management platform.

- March 2021: Audi Russia launched the Audi Drive subscription service.

- October 2021: MINI Russia launched the EASY2DRIVE app.

- May 2022: Mercedes-Benz and BMW AG introduced a minute-based car rental service.

Strategic Outlook for Russia Car Rental Industry Market

The Russian car rental market is poised for continued growth, driven by increasing consumer demand, technological advancements, and supportive government policies. The focus on innovative services, efficient fleet management, and customer-centric strategies will be crucial for success in this dynamic market. The long-term outlook is positive, with opportunities for expansion into new regions and segments.

Russia Car Rental Industry Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Car Type

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. SUV

-

3. Rental Length

- 3.1. Short Term

- 3.2. Long Term

-

4. Application

- 4.1. Leisure/Tourism

- 4.2. Business

Russia Car Rental Industry Segmentation By Geography

- 1. Russia

Russia Car Rental Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Online Booking Segment Likely to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Car Type

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. SUV

- 5.3. Market Analysis, Insights and Forecast - by Rental Length

- 5.3.1. Short Term

- 5.3.2. Long Term

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Leisure/Tourism

- 5.4.2. Business

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Western Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Car Rental Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Delimobil

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Europcar International

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 The Hertz Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Naprokat R

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 YouDrive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Yandex Drive

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Belka Car

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Budget Rent a Car System Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Avis

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Enterprise Holding Inc

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Delimobil

List of Figures

- Figure 1: Russia Car Rental Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Car Rental Industry Share (%) by Company 2024

List of Tables

- Table 1: Russia Car Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Car Rental Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 3: Russia Car Rental Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 4: Russia Car Rental Industry Revenue Million Forecast, by Rental Length 2019 & 2032

- Table 5: Russia Car Rental Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Russia Car Rental Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Russia Car Rental Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Western Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Eastern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Northern Russia Russia Car Rental Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Car Rental Industry Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 13: Russia Car Rental Industry Revenue Million Forecast, by Car Type 2019 & 2032

- Table 14: Russia Car Rental Industry Revenue Million Forecast, by Rental Length 2019 & 2032

- Table 15: Russia Car Rental Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Russia Car Rental Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Car Rental Industry?

The projected CAGR is approximately 8.00%.

2. Which companies are prominent players in the Russia Car Rental Industry?

Key companies in the market include Delimobil, Europcar International, The Hertz Corporation, Naprokat R, YouDrive, Yandex Drive, Belka Car, Budget Rent a Car System Inc, Avis, Enterprise Holding Inc.

3. What are the main segments of the Russia Car Rental Industry?

The market segments include Booking Type, Car Type, Rental Length, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Online Booking Segment Likely to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In May 2022, Mercedes Benz and BMW AG jointly introduced a car rental service in Russia. The service allows the user to rent a car by the minute. The vehicles were booked over a smartphone application and can be returned anywhere in the business area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Car Rental Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Car Rental Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Car Rental Industry?

To stay informed about further developments, trends, and reports in the Russia Car Rental Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence