Key Insights

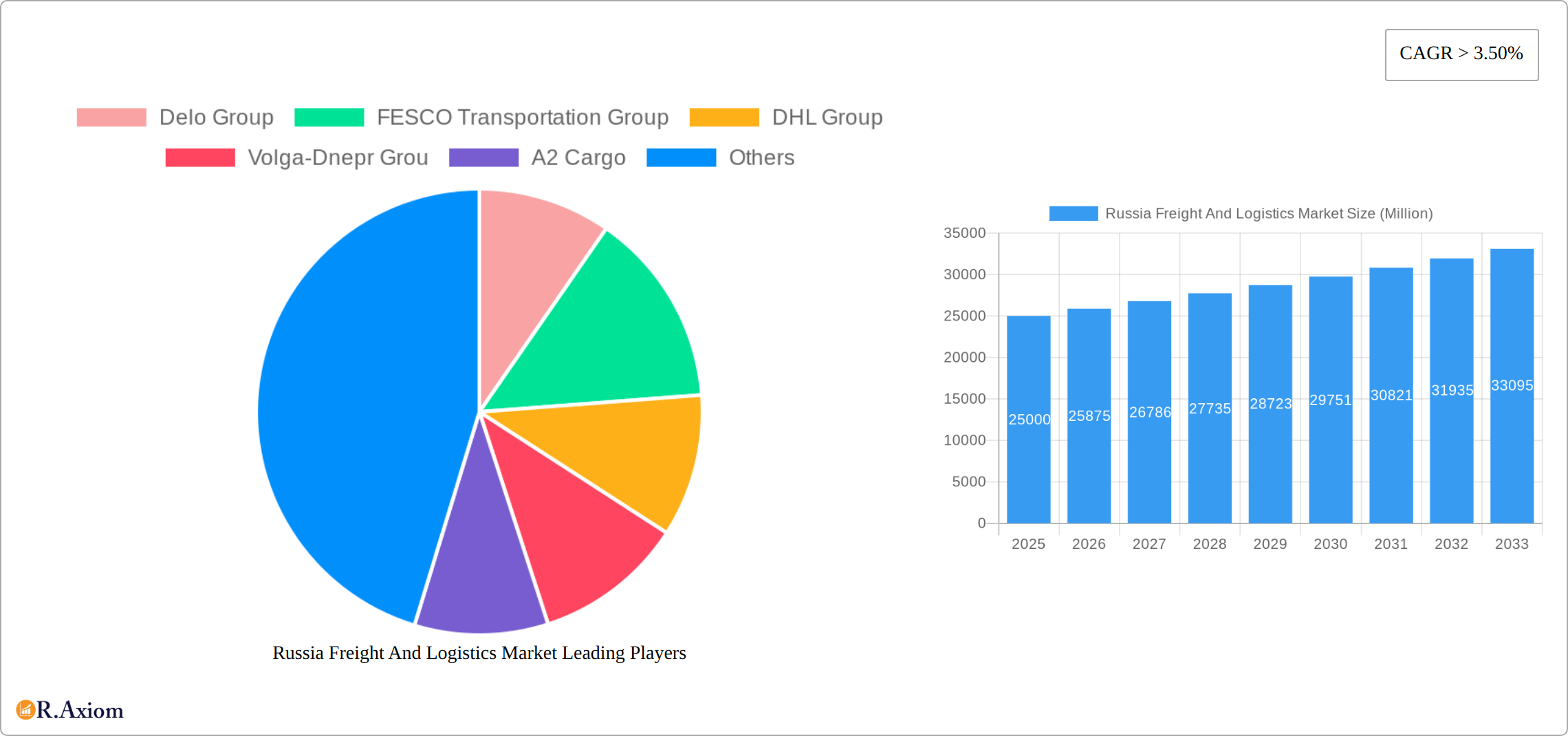

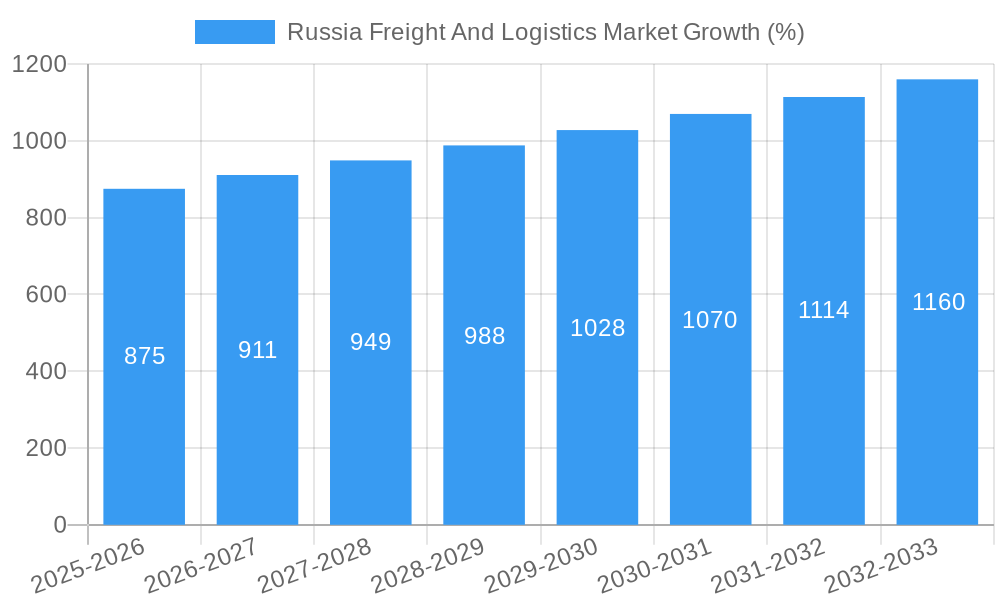

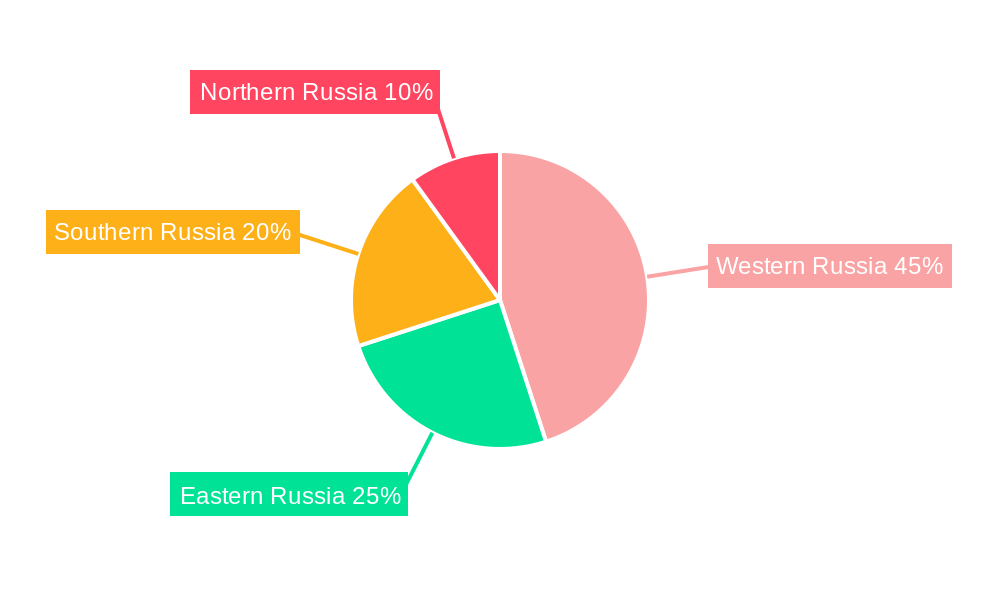

The Russia freight and logistics market, valued at approximately $XX million in 2025 (assuming a reasonable market size based on global trends and the provided CAGR), is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 3.50% from 2025 to 2033. Several key drivers fuel this expansion. The burgeoning e-commerce sector necessitates efficient and reliable delivery networks, stimulating demand for freight and logistics services. Furthermore, ongoing infrastructure development projects within Russia, particularly improvements to road, rail, and port facilities, are streamlining transportation and reducing transit times, contributing to market growth. Growth is also spurred by the increasing adoption of advanced technologies such as GPS tracking, route optimization software, and real-time shipment monitoring, enhancing efficiency and transparency within the supply chain. However, the market faces challenges. Geopolitical uncertainties and sanctions can disrupt trade flows and negatively impact logistical operations. Fluctuations in fuel prices and driver shortages also pose significant restraints to sustainable growth. The market is segmented by temperature-controlled services, general freight, and various end-user industries, including agriculture, construction, manufacturing, oil & gas, mining, and retail, with significant activity in courier, express, and parcel (CEP) logistics. Major players like Delo Group, FESCO Transportation Group, DHL Group, and Volga-Dnepr Group dominate the market, leveraging their extensive networks and expertise. Regional variations exist, with Western Russia likely holding the largest market share due to higher economic activity and infrastructure development.

The forecast period (2025-2033) anticipates continued growth, driven by expanding domestic and international trade. However, sustained growth depends on addressing the existing challenges. Government initiatives promoting logistics infrastructure development and fostering a more favorable regulatory environment will be crucial in optimizing the market's potential. Furthermore, the increasing adoption of sustainable practices within the logistics sector, such as using alternative fuels and optimizing delivery routes, will shape future market dynamics. The competitive landscape will likely remain dynamic, with existing players consolidating their market share and new entrants vying for opportunities. The interplay of these factors will determine the precise trajectory of the Russia freight and logistics market's growth over the next decade.

Russia Freight and Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Russia Freight and Logistics Market, covering the period 2019-2033. It offers crucial insights for stakeholders, including market size estimations, segment analysis, competitive landscape assessments, and future growth projections. The report leverages extensive primary and secondary research to deliver actionable intelligence. The Base Year is 2025, with an Estimated Year of 2025 and a Forecast Period of 2025-2033. The Historical Period covered is 2019-2024.

Russia Freight and Logistics Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the Russian freight and logistics sector. We examine the market share of key players like Delo Group, FESCO Transportation Group, DHL Group, and Volga-Dnepr Group, identifying the degree of market consolidation and the presence of any dominant players. The analysis incorporates an assessment of innovation drivers, including technological advancements in transportation management systems (TMS), the adoption of automation and robotics, and the increasing demand for sustainable logistics solutions. We also consider the influence of regulatory frameworks, including transportation regulations and customs procedures, as well as the impact of substitute products and services, such as alternative transportation modes. Furthermore, the report examines end-user trends, including shifting demand patterns across various sectors, and evaluates the impact of mergers and acquisitions (M&A) activities on market structure and competitiveness. We analyze the value and implications of significant M&A deals involving Russian freight and logistics companies, estimating deal values to be in the range of xx Million. The xx Million represents a conservative estimate based on industry trends and observed M&A activity in comparable markets.

- Market Share Analysis: Delo Group, FESCO, and DHL are projected to hold the largest market shares in 2025, with estimates ranging from xx% to xx%, respectively. Smaller players like A2 Cargo and STS Logistics collectively contribute a significant percentage, further shaping the competitive landscape.

- M&A Activity: The report analyzes the recent M&A activity, pinpointing key deals and their implications on market consolidation and strategic positioning of major players. The total M&A value in the reviewed period is conservatively estimated to be xx Million.

- Innovation Drivers: Technological advancements in digitalization, automation, and sustainable practices are major drivers of innovation, influencing operational efficiency and service offerings.

Russia Freight and Logistics Market Industry Trends & Insights

This section delves into the key trends shaping the Russian freight and logistics market. The analysis focuses on market growth drivers, such as rising e-commerce, infrastructure development, and increasing cross-border trade. We also explore technological disruptions, including the integration of AI and big data analytics, and the impact of these technological advancements on operational efficiency and service quality. The evolving consumer preferences, particularly the increasing demand for faster and more reliable delivery services, are also evaluated. The competitive dynamics are analyzed, with a focus on pricing strategies, service differentiation, and the strategic responses of major players to market changes. The report projects a CAGR of xx% for the forecast period (2025-2033), with market penetration in key segments showing significant growth. Detailed insights into consumer preferences, including expectations for transparency and traceability in supply chains, will be included.

Dominant Markets & Segments in Russia Freight and Logistics Market

This section identifies the leading segments within the Russian freight and logistics market. This includes a regional analysis, highlighting the most dynamic regions based on factors like economic activity, infrastructure development, and regulatory environment. We examine the dominance of key segments – Temperature Controlled, Other Services – by analyzing their market size, growth trajectories, and key drivers. The leading end-user industries – Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others – are analyzed based on their contribution to overall market demand. Finally, the dominance within Logistics Functions (Courier, Express, and Parcel (CEP)) will be assessed.

- Key Drivers for Dominant Segments:

- Temperature Controlled: Growth is driven by increased demand for perishable goods and stringent quality control requirements.

- Oil and Gas: This sector consistently drives high volume freight due to its extensive operations across the country.

- Wholesale and Retail Trade: The expanding e-commerce sector fuels this segment's rapid growth.

- Courier, Express, and Parcel (CEP): Rapid growth of e-commerce and individual consumer demand are major contributors.

- Dominance Analysis: The report provides a detailed analysis of the factors contributing to the dominance of specific regions, segments, and end-user industries, considering factors like infrastructure, regulatory policies, and economic conditions.

Russia Freight and Logistics Market Product Developments

Recent product innovations have focused on improving efficiency and sustainability. Technological advancements, such as advanced tracking systems and optimized routing software, are being incorporated into logistics solutions. These innovations enhance transparency and enable real-time monitoring of shipments, leading to improved delivery times and reduced costs. The market is witnessing a growing trend towards sustainable practices, with companies adopting eco-friendly vehicles and optimizing transportation routes to minimize environmental impact. These developments are shaping the competitive landscape, creating advantages for companies that effectively integrate these advancements into their operations.

Report Scope & Segmentation Analysis

This report segments the Russia Freight and Logistics Market based on several key parameters: Temperature Controlled, Other Services, Logistics Function (Courier, Express, and Parcel (CEP)), and End-User Industry (Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The projected market size for each segment for 2025 and beyond is presented, along with analysis of competitive landscapes and growth potential.

- Temperature Controlled: This segment is expected to see strong growth, driven by rising demand for temperature-sensitive goods across various industries.

- Other Services: This segment encompasses a wide range of services and will experience moderate growth.

- End-User Industries: Each industry’s contribution to market growth varies based on economic performance, investment trends, and regulatory changes.

- Logistics Function (CEP): This fast-growing segment is expected to witness significant growth, boosted by the expansion of e-commerce.

Key Drivers of Russia Freight and Logistics Market Growth

Several factors contribute to the growth of the Russia Freight and Logistics Market. These include:

- Increased E-commerce Activity: The surging popularity of online shopping is driving demand for efficient and reliable delivery services.

- Government Initiatives: Infrastructure development and favorable regulatory policies facilitate logistics operations.

- Rising Foreign Investment: Investments in the sector enhance operational capabilities and technological advancements.

- Technological Advancements: The implementation of technologies such as AI and IoT optimizes operations and improves efficiency.

Challenges in the Russia Freight and Logistics Market Sector

The Russian freight and logistics sector faces several challenges:

- Infrastructure Limitations: Inadequate infrastructure in certain regions can hinder efficient transportation. This results in increased transit times and higher costs, impacting overall market efficiency by an estimated xx%.

- Geopolitical Uncertainty: Geopolitical instability and sanctions can disrupt supply chains and impact market stability.

- Seasonal Fluctuations: Weather conditions can significantly impact transportation efficiency and reliability, especially for road and rail transport.

- Regulatory Complexity: Navigating complex regulations can add bureaucratic hurdles and increase operational costs.

Emerging Opportunities in Russia Freight and Logistics Market

Emerging opportunities exist in:

- Sustainable Logistics: Growing environmental concerns create an opportunity for businesses that embrace eco-friendly practices.

- Technology Integration: Further adoption of AI, IoT, and blockchain technologies offers significant potential for efficiency improvements.

- Last-Mile Delivery Solutions: Innovative solutions for efficient last-mile delivery are in high demand due to expanding e-commerce.

- Cross-Border Trade Facilitation: Streamlining processes for cross-border trade can unlock new growth avenues.

Leading Players in the Russia Freight and Logistics Market Market

- Delo Group

- FESCO Transportation Group

- DHL Group

- Volga-Dnepr Group

- A2 Cargo

- Sovtransavto Group

- Volga Shipping

- Eurosib Group

- Delko

- STS Logistics

Key Developments in Russia Freight and Logistics Market Industry

- November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract for transport logistics. This signifies growing collaborations within the industry and increased reliance on specialized logistics providers.

- November 2022: DHL extended its partnership with the German Bobsleigh, Luge, and Skeleton Federation. This highlights DHL’s commitment to the market and their branding efforts.

- February 2023: DHL Global Forwarding implemented sustainable logistics solutions for Grundfos. This exemplifies the growing focus on sustainability within the logistics industry.

Strategic Outlook for Russia Freight and Logistics Market Market

The future of the Russia Freight and Logistics Market appears promising, driven by continued e-commerce growth, technological advancements, and increasing government support for infrastructure development. Companies focusing on innovation, sustainable practices, and efficient operations will be best positioned to capitalize on emerging opportunities. The market is expected to see sustained growth over the forecast period, presenting significant potential for both domestic and international players.

Russia Freight And Logistics Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Logistics Function

-

2.1. Courier, Express, and Parcel (CEP)

-

2.1.1. By Destination Type

- 2.1.1.1. Domestic

- 2.1.1.2. International

-

2.1.1. By Destination Type

-

2.2. Freight Forwarding

-

2.2.1. By Mode Of Transport

- 2.2.1.1. Air

- 2.2.1.2. Sea and Inland Waterways

- 2.2.1.3. Others

-

2.2.1. By Mode Of Transport

-

2.3. Freight Transport

- 2.3.1. Pipelines

- 2.3.2. Rail

- 2.3.3. Road

-

2.4. Warehousing and Storage

-

2.4.1. By Temperature Control

- 2.4.1.1. Non-Temperature Controlled

-

2.4.1. By Temperature Control

- 2.5. Other Services

-

2.1. Courier, Express, and Parcel (CEP)

Russia Freight And Logistics Market Segmentation By Geography

- 1. Russia

Russia Freight And Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing volume of international trade4.; The rise of trade agreements between nations

- 3.3. Market Restrains

- 3.3.1. 4.; Surge in fuel costs affecting the market4.; Increasing trade tension

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Logistics Function

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.2.1.1. By Destination Type

- 5.2.1.1.1. Domestic

- 5.2.1.1.2. International

- 5.2.1.1. By Destination Type

- 5.2.2. Freight Forwarding

- 5.2.2.1. By Mode Of Transport

- 5.2.2.1.1. Air

- 5.2.2.1.2. Sea and Inland Waterways

- 5.2.2.1.3. Others

- 5.2.2.1. By Mode Of Transport

- 5.2.3. Freight Transport

- 5.2.3.1. Pipelines

- 5.2.3.2. Rail

- 5.2.3.3. Road

- 5.2.4. Warehousing and Storage

- 5.2.4.1. By Temperature Control

- 5.2.4.1.1. Non-Temperature Controlled

- 5.2.4.1. By Temperature Control

- 5.2.5. Other Services

- 5.2.1. Courier, Express, and Parcel (CEP)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Western Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Freight And Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Delo Group

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 FESCO Transportation Group

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DHL Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Volga-Dnepr Grou

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 A2 Cargo

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Sovtransavto Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Volga Shipping

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eurosib Group

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Delko

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 STS Logistics

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Delo Group

List of Figures

- Figure 1: Russia Freight And Logistics Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Freight And Logistics Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Russia Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 4: Russia Freight And Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Russia Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Western Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Eastern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern Russia Russia Freight And Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Russia Freight And Logistics Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 11: Russia Freight And Logistics Market Revenue Million Forecast, by Logistics Function 2019 & 2032

- Table 12: Russia Freight And Logistics Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Freight And Logistics Market?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Russia Freight And Logistics Market?

Key companies in the market include Delo Group, FESCO Transportation Group, DHL Group, Volga-Dnepr Grou, A2 Cargo, Sovtransavto Group, Volga Shipping, Eurosib Group, Delko, STS Logistics.

3. What are the main segments of the Russia Freight And Logistics Market?

The market segments include End User Industry, Logistics Function.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing volume of international trade4.; The rise of trade agreements between nations.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; Surge in fuel costs affecting the market4.; Increasing trade tension.

8. Can you provide examples of recent developments in the market?

February 2023: DHL Global Forwarding, the air and ocean freight specialist division of Deutsche Post DHL Group, successfully implemented sustainable logistics solutions for its customer Grundfos.November 2022: DHL prolonged its partnership with the German Bobsleigh, Luge, and Skeleton Federation (BSD) for another four years. The premium and logistics partnership has been in place since the 2014-2015 winter season, and it includes logistics for all equipment during the seasons, along with the branding of sports equipment and clothing of athletes.November 2022: Eurosib Group and EFKO-Cascade CRC LLC signed a service contract to provide transport logistics to enterprises belonging to the EFKO Group of Companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Freight And Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Freight And Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Freight And Logistics Market?

To stay informed about further developments, trends, and reports in the Russia Freight And Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence