Key Insights

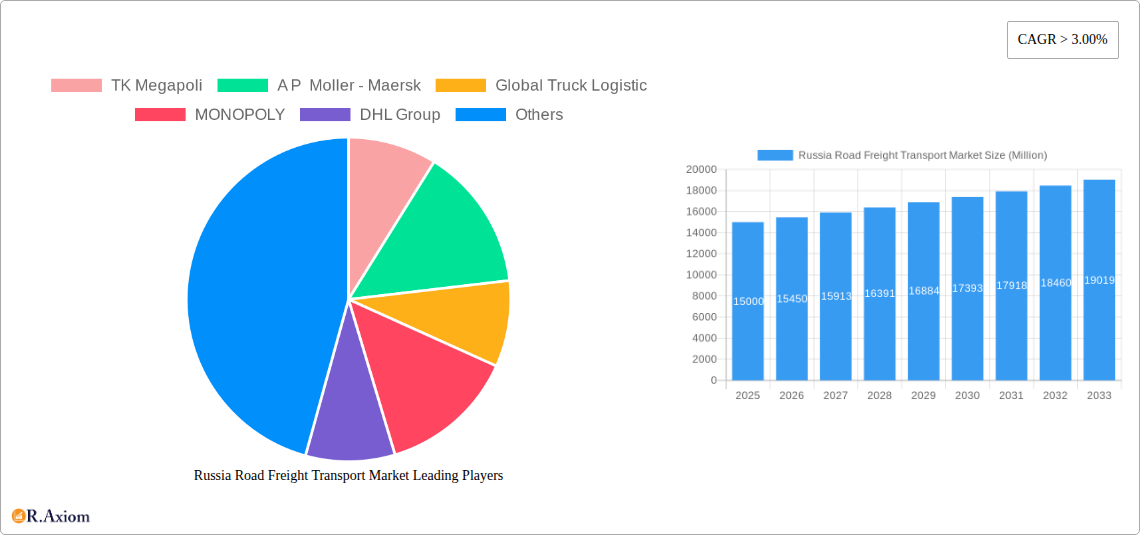

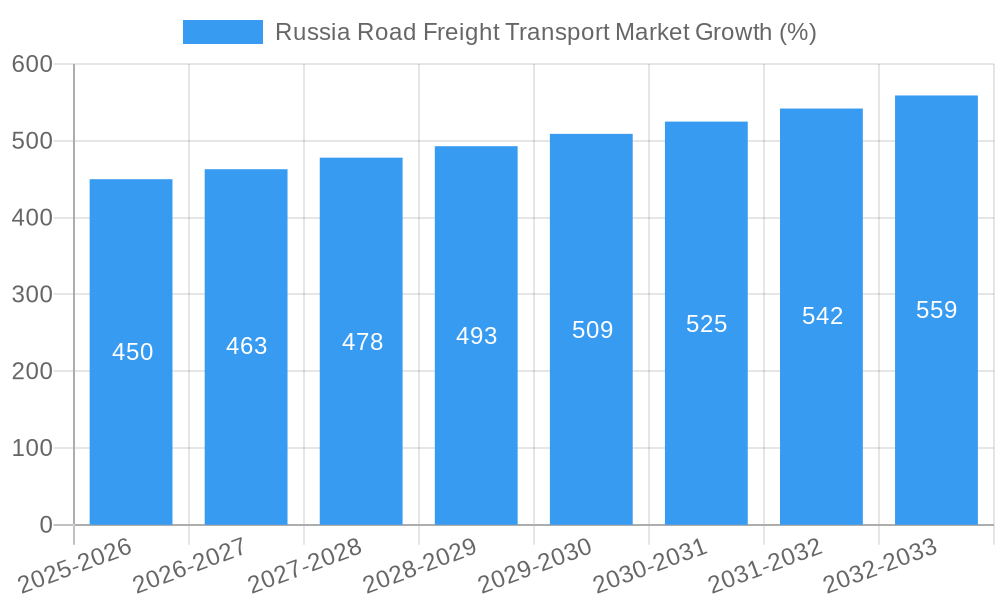

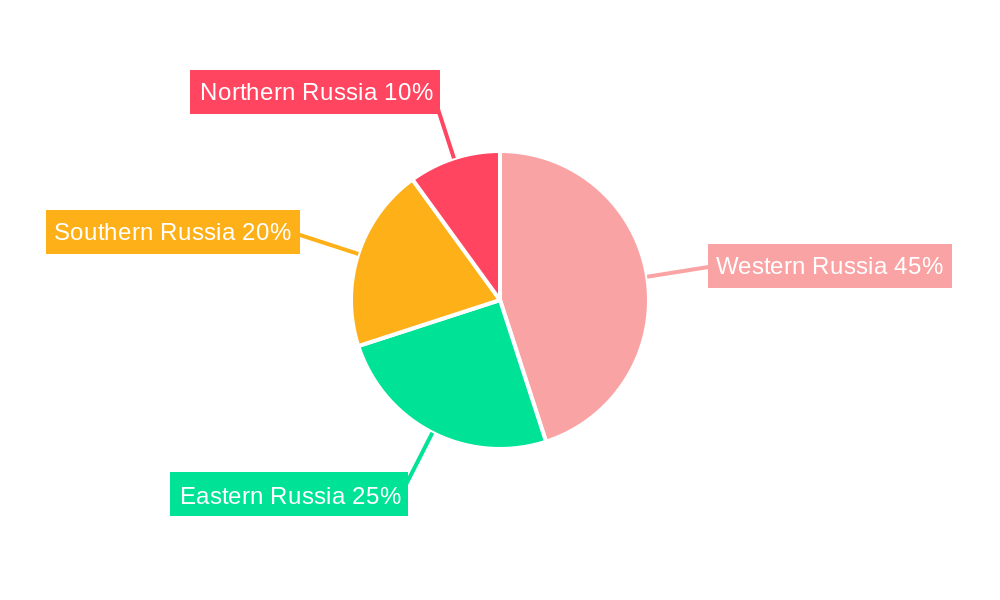

The Russia Road Freight Transport Market is experiencing robust growth, fueled by a burgeoning e-commerce sector, expanding industrial activity, and increasing cross-border trade. The market's Compound Annual Growth Rate (CAGR) exceeding 3.00% indicates a consistently upward trajectory, projected to continue throughout the forecast period (2025-2033). Key drivers include improvements in Russia's road infrastructure, the rising adoption of technological solutions such as GPS tracking and fleet management systems, and a growing demand for efficient and reliable logistics solutions across diverse sectors. While geopolitical factors and economic fluctuations may present some restraints, the overall market outlook remains positive. Segmentation analysis reveals significant opportunities within the full-truckload (FTL) segment, driven by the need for large-scale transportation of goods across long distances. The temperature-controlled segment is also witnessing considerable growth, propelled by the increasing demand for the transportation of perishable goods in the food and pharmaceutical industries. Geographically, Western Russia currently commands the largest market share due to its higher concentration of industrial and commercial activity, but Eastern Russia is anticipated to show strong growth potential. Major players like TK Megapoli, Maersk, and DHL are strategically investing in expanding their operations and enhancing service offerings to capitalize on this thriving market.

The market's growth is further influenced by shifts in goods configuration, with a rising preference for containerized transport offering improved security and efficiency. The diverse end-user industries, encompassing agriculture, manufacturing, and oil & gas, contribute to the market's breadth and resilience. While the short-haul segment currently dominates in terms of volume, the long-haul segment is witnessing faster growth, driven by the increasing inter-regional trade. The market is predicted to witness further consolidation in the coming years, with larger players acquiring smaller companies to enhance their market reach and service capabilities. This dynamic interplay of factors underscores the complexities and opportunities present within the Russia Road Freight Transport Market, presenting a promising investment landscape for both established and emerging players.

This detailed report provides a comprehensive analysis of the Russia road freight transport market, covering market size, segmentation, key players, growth drivers, challenges, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. This report is an indispensable resource for industry stakeholders, investors, and strategic decision-makers seeking to navigate the complexities of this dynamic market.

Russia Road Freight Transport Market Concentration & Innovation

The Russia road freight transport market exhibits a moderately concentrated structure, with several large players holding significant market share. TK Megapoli, A.P. Moller-Maersk, and DHL Group are among the leading companies, although precise market share data remains unavailable for certain players due to data limitations (xx%). The market is characterized by a mix of established multinational corporations and smaller, regional operators. Innovation is driven by several factors, including:

- Technological advancements: The adoption of telematics, GPS tracking, and advanced route optimization software is enhancing efficiency and reducing costs. The introduction of electric, Bio-LNG, CNG, and HVO trucks reflects a push towards sustainable transportation.

- Regulatory frameworks: Government regulations related to safety, environmental protection, and driver hours influence market dynamics. Changes in these regulations can present both challenges and opportunities for market players.

- Product substitutes: While road freight remains dominant, competition exists from rail and air freight, particularly for long-haul transportation. The cost-effectiveness of road transport remains a key competitive advantage.

- End-user trends: The growing e-commerce sector fuels demand for faster and more reliable delivery services, driving the need for enhanced logistics capabilities. Increasing demand from various end-user industries like manufacturing and wholesale/retail trade also impacts the market.

- M&A Activities: Consolidation activity in the sector is moderate. While precise deal values are unavailable (xx Million), several smaller acquisitions have occurred in recent years to improve market positioning and network expansion.

Russia Road Freight Transport Market Industry Trends & Insights

The Russia road freight transport market has experienced fluctuating growth in recent years, influenced by economic conditions, geopolitical factors, and infrastructure limitations. The CAGR (Compound Annual Growth Rate) for the historical period (2019-2024) is estimated at xx%, with fluctuations due to sanctions and geopolitical instability. Market penetration of technology such as telematics is increasing, but remains relatively low (xx%) compared to more developed markets. Market growth is largely driven by:

- Expansion of e-commerce: The surge in online shopping is boosting demand for last-mile delivery solutions.

- Growth in manufacturing and retail: The increase in production and consumption fuels the need for efficient freight transportation.

- Government investments in infrastructure: While improvements have been made, further infrastructure development is crucial for enhancing market efficiency.

- Competitive dynamics: The market is experiencing increased competition from new entrants and existing players expanding their services.

- Technological disruptions: Innovations such as autonomous vehicles and drone deliveries hold long-term potential, though adoption faces technological and regulatory hurdles.

Dominant Markets & Segments in Russia Road Freight Transport Market

The domestic market segment is considerably larger than the international segment, driven by robust internal trade. Within the truckload specification, Full-Truck-Load (FTL) dominates owing to cost-effectiveness for large shipments. Containerized freight is also significant, though non-containerized transport remains prevalent, particularly for bulk and specialized goods. Long-haul transport holds a greater market share compared to short-haul, reflecting the vast distances across Russia. Solid goods dominate the goods configuration, with the manufacturing and wholesale/retail trade sectors representing the largest end-user industries.

- Key Drivers for Domestic Market Dominance: Strong internal trade, relatively lower costs compared to international transport.

- Key Drivers for FTL Dominance: Cost efficiency for large shipments, ease of logistics.

- Key Drivers for Solid Goods Dominance: Higher volume of manufactured and retail goods.

- Key Drivers for Long-haul Dominance: The expansive geographical distances within Russia.

Detailed dominance analysis based on specific regional breakdown within Russia requires more granular data.

Russia Road Freight Transport Market Product Developments

Recent product innovations focus on enhancing efficiency, sustainability, and safety. Telematics systems provide real-time tracking and route optimization. The adoption of environmentally friendly vehicles, including electric and alternative fuel trucks, is gaining momentum. These innovations are aimed at improving operational efficiency, reducing environmental impact, and meeting evolving customer demands for enhanced transparency and sustainability.

Report Scope & Segmentation Analysis

This report segments the Russia road freight transport market across multiple dimensions:

- Destination: Domestic and International

- Truckload Specification: Full-Truck-Load (FTL) and Less-than-Truck-Load (LTL)

- Containerization: Containerized and Non-Containerized

- Distance: Long Haul and Short Haul

- Goods Configuration: Fluid Goods and Solid Goods

- Temperature Control: Non-Temperature Controlled and Temperature Controlled

- End User Industry: Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; and Others

Each segment's growth projection, market size (xx Million for each), and competitive dynamics are analyzed within the full report.

Key Drivers of Russia Road Freight Transport Market Growth

Several factors are driving market growth, including increasing e-commerce activity, expansion of manufacturing and retail sectors, government investments in infrastructure development (though limited in some areas), and the growing adoption of technology to enhance efficiency and optimize logistics. The need for improved cross-border trade connections and modernization of existing infrastructure represents significant long-term growth opportunities.

Challenges in the Russia Road Freight Transport Market Sector

The Russia road freight transport market faces several challenges, including infrastructural limitations, particularly in remote areas, seasonal variations impacting road conditions, fuel price volatility significantly impacting operating costs, and regulatory hurdles that increase operational complexities and compliance costs. Geopolitical factors and sanctions also significantly impact market stability and cross-border trade. These factors contribute to higher transportation costs and operational inefficiencies.

Emerging Opportunities in Russia Road Freight Transport Market

Emerging opportunities lie in the expansion of e-commerce logistics, the development of specialized transport solutions for temperature-sensitive goods, the adoption of sustainable transportation technologies, and the increasing demand for greater transparency and traceability in supply chains. Furthermore, expanding into new markets and regions within Russia offers considerable potential for growth.

Leading Players in the Russia Road Freight Transport Market Market

- TK Megapoli

- A.P. Moller - Maersk

- Global Truck Logistic

- MONOPOLY

- DHL Group

- ITECO Corporation

- PEK OOO

- DL-TRANS LTD

- DPD Group

Key Developments in Russia Road Freight Transport Market Industry

- October 2022: DHL Freight introduces GoGreen Plus service to reduce CO2 emissions.

- August 2022: PEK, OOO opens a new branch in Dubna, near Moscow.

- August 2022: DL-TRANS Ltd launches prefabricated container transportation from Turkey to Russia.

Strategic Outlook for Russia Road Freight Transport Market Market

The Russia road freight transport market holds significant long-term growth potential, driven by the ongoing expansion of e-commerce, industrial growth, and the increasing adoption of technology. Addressing infrastructural challenges and navigating geopolitical complexities will be crucial for realizing this potential. Companies that invest in sustainable solutions and leverage technological advancements to enhance efficiency and transparency will be well-positioned for success in this dynamic market.

Russia Road Freight Transport Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

-

3. Truckload Specification

- 3.1. Full-Truck-Load (FTL)

- 3.2. Less than-Truck-Load (LTL)

-

4. Containerization

- 4.1. Containerized

- 4.2. Non-Containerized

-

5. Distance

- 5.1. Long Haul

- 5.2. Short Haul

-

6. Goods Configuration

- 6.1. Fluid Goods

- 6.2. Solid Goods

-

7. Temperature Control

- 7.1. Non-Temperature Controlled

Russia Road Freight Transport Market Segmentation By Geography

- 1. Russia

Russia Road Freight Transport Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation

- 3.3. Market Restrains

- 3.3.1 4.; South Korea's logistics infrastructure

- 3.3.2 while generally well-developed

- 3.3.3 can experience congestion in key areas

- 3.3.4 such as ports and highways4.; Like many other countries

- 3.3.5 South Korea faced issues related to labor shortages in the logistics sector.

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russia Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Truckload Specification

- 5.3.1. Full-Truck-Load (FTL)

- 5.3.2. Less than-Truck-Load (LTL)

- 5.4. Market Analysis, Insights and Forecast - by Containerization

- 5.4.1. Containerized

- 5.4.2. Non-Containerized

- 5.5. Market Analysis, Insights and Forecast - by Distance

- 5.5.1. Long Haul

- 5.5.2. Short Haul

- 5.6. Market Analysis, Insights and Forecast - by Goods Configuration

- 5.6.1. Fluid Goods

- 5.6.2. Solid Goods

- 5.7. Market Analysis, Insights and Forecast - by Temperature Control

- 5.7.1. Non-Temperature Controlled

- 5.8. Market Analysis, Insights and Forecast - by Region

- 5.8.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. Western Russia Russia Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 7. Eastern Russia Russia Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 8. Southern Russia Russia Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern Russia Russia Road Freight Transport Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 TK Megapoli

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 A P Moller - Maersk

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Global Truck Logistic

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 MONOPOLY

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 DHL Group

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 ITECO Corporation

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 PEK OOO

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DL-TRANS LTD

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 DPD Group

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 TK Megapoli

List of Figures

- Figure 1: Russia Road Freight Transport Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Russia Road Freight Transport Market Share (%) by Company 2024

List of Tables

- Table 1: Russia Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Russia Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Russia Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Russia Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 5: Russia Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 6: Russia Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 7: Russia Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 8: Russia Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 9: Russia Road Freight Transport Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Russia Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Western Russia Russia Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Eastern Russia Russia Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Southern Russia Russia Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Northern Russia Russia Road Freight Transport Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Russia Road Freight Transport Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 16: Russia Road Freight Transport Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 17: Russia Road Freight Transport Market Revenue Million Forecast, by Truckload Specification 2019 & 2032

- Table 18: Russia Road Freight Transport Market Revenue Million Forecast, by Containerization 2019 & 2032

- Table 19: Russia Road Freight Transport Market Revenue Million Forecast, by Distance 2019 & 2032

- Table 20: Russia Road Freight Transport Market Revenue Million Forecast, by Goods Configuration 2019 & 2032

- Table 21: Russia Road Freight Transport Market Revenue Million Forecast, by Temperature Control 2019 & 2032

- Table 22: Russia Road Freight Transport Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russia Road Freight Transport Market?

The projected CAGR is approximately > 3.00%.

2. Which companies are prominent players in the Russia Road Freight Transport Market?

Key companies in the market include TK Megapoli, A P Moller - Maersk, Global Truck Logistic, MONOPOLY, DHL Group, ITECO Corporation, PEK OOO, DL-TRANS LTD, DPD Group.

3. What are the main segments of the Russia Road Freight Transport Market?

The market segments include End User Industry, Destination, Truckload Specification, Containerization, Distance, Goods Configuration, Temperature Control.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Global Trade and Export-Oriented Economy boosting the market4.; Investment in Robotics and Automation.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

4.; South Korea's logistics infrastructure. while generally well-developed. can experience congestion in key areas. such as ports and highways4.; Like many other countries. South Korea faced issues related to labor shortages in the logistics sector..

8. Can you provide examples of recent developments in the market?

October 2022: DHL Freight is introducing the GoGreen Plus service to reduce CO2 emissions for road transport. In recent years, DHL Freight has already pioneered numerous green road freight projects by introducing electric, Bio-LNG or –CNG, and HVO trucks to the fleet. The GoGreen Plus service is part of Deutsche Post DHL Group's sustainability goal of achieving net-zero emissions by 2050.August 2022: PEK, OOO announced the beginning of its work in new branch in Dubna, near MoscowAugust 2022: DL-TRANS Ltd announced the launch of the business of prefabricated container transportation from Turkey to Russia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russia Road Freight Transport Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russia Road Freight Transport Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russia Road Freight Transport Market?

To stay informed about further developments, trends, and reports in the Russia Road Freight Transport Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence