Key Insights

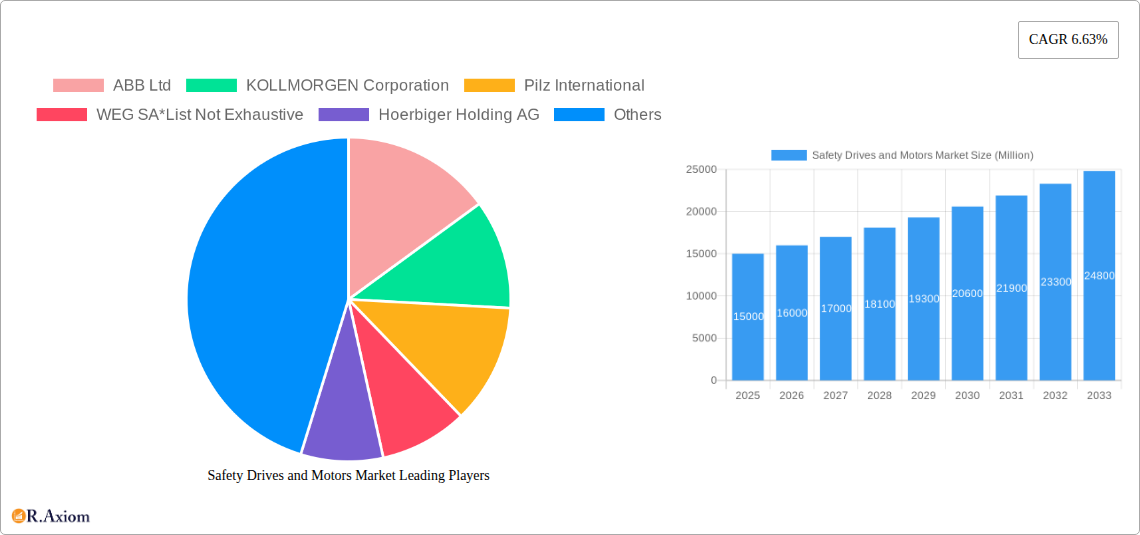

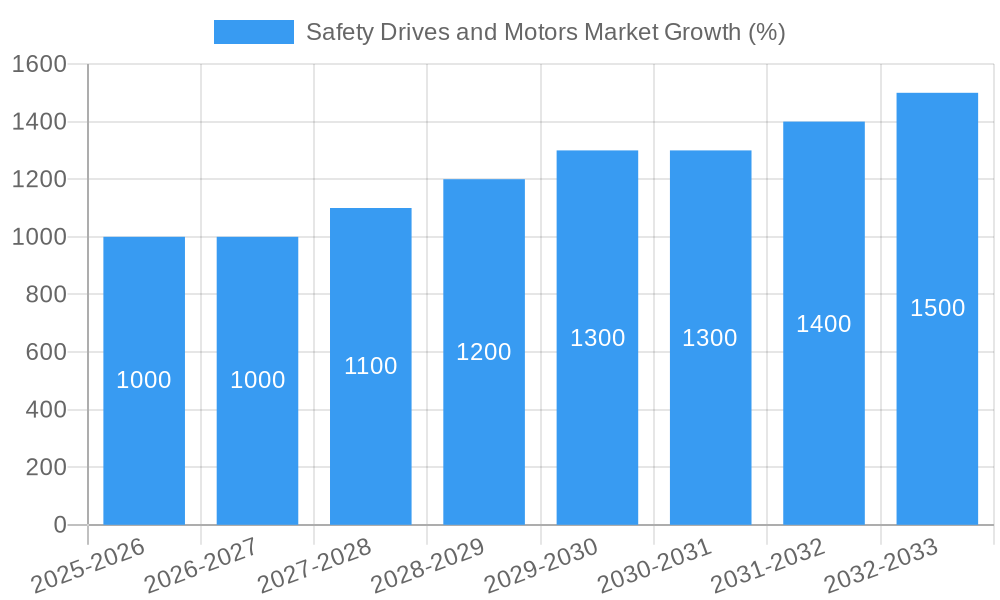

The global Safety Drives and Motors Market is experiencing robust growth, projected to reach a substantial size driven by increasing automation across various industries. The market's 6.63% CAGR from 2019 to 2024 indicates a consistent upward trajectory, fueled by several key factors. Stringent safety regulations across sectors like manufacturing, energy, and mining are mandating the adoption of advanced safety mechanisms, directly boosting the demand for safety drives and motors. Furthermore, the growing emphasis on worker safety and the reduction of workplace accidents are significantly impacting market growth. The rising adoption of Industry 4.0 technologies, including the integration of smart sensors and advanced control systems, further contributes to this expanding market. Specific end-user verticals, such as energy and power (due to the increasing complexity and safety requirements in power generation and distribution) and manufacturing (driven by the need for automation and process optimization), are exhibiting particularly strong growth. Technological advancements, such as the development of more compact, energy-efficient, and reliable safety drives and motors, also contribute to the market's expansion.

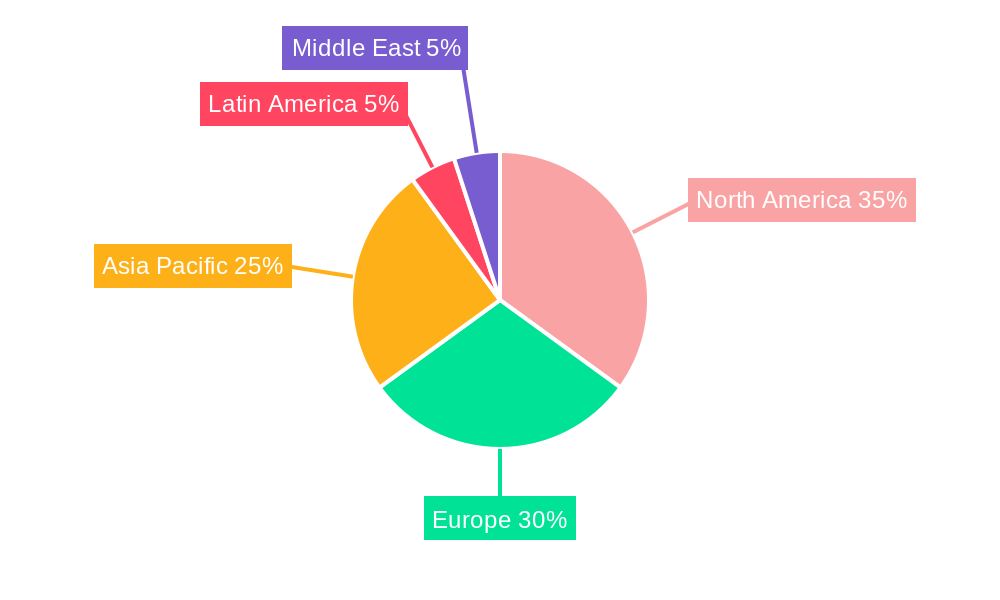

The market segmentation reveals a significant share held by AC drives, owing to their superior performance characteristics and adaptability to various applications. The manufacturing sector represents a major end-user segment due to its extensive use of automated machinery. Major players like ABB, Siemens, and Rockwell Automation are actively engaged in product innovation and strategic partnerships to maintain their market dominance. While geographical distribution is not detailed, it is reasonable to assume that North America and Europe, with their advanced manufacturing infrastructure and stringent safety standards, hold significant market shares. The Asia Pacific region is also likely to witness significant growth due to its rapid industrialization and increasing adoption of automation technologies. However, the market faces challenges such as high initial investment costs associated with advanced safety systems, which could restrain growth to some extent in price-sensitive markets.

Safety Drives and Motors Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Safety Drives and Motors Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages rigorous research methodologies to deliver accurate market sizing, growth projections, and competitive landscape analysis. It incorporates detailed segmentations by type (Drives, DC Motors) and end-user vertical (Energy and Power, Manufacturing, Mining, Oil and Gas, Chemical and Petrochemical, Construction, Other End-user Verticals), providing granular insights into market dynamics.

Safety Drives and Motors Market Market Concentration & Innovation

The Safety Drives and Motors market exhibits a moderately concentrated landscape, with several key players holding significant market share. ABB Ltd, KOLLMORGEN Corporation, Pilz International, and Siemens AG are prominent examples, though the market also includes a number of smaller, specialized companies. Market share analysis reveals that the top five players collectively account for approximately xx% of the market, indicating room for both consolidation and innovation by smaller entrants. The average M&A deal value in the sector during the historical period (2019-2024) was approximately $xx Million, reflecting a growing interest in strategic acquisitions to bolster market positioning.

- Market Concentration: Top 5 players hold xx% market share (2024).

- Innovation Drivers: Stringent safety regulations, demand for automation in hazardous environments, and advancements in sensor technologies are key innovation drivers.

- Regulatory Frameworks: Compliance with global safety standards (e.g., IEC 61508, ISO 13849) is paramount, shaping product development and market access.

- Product Substitutes: Limited direct substitutes exist; however, alternative safety mechanisms and control systems pose indirect competition.

- End-User Trends: Growing adoption of Industry 4.0 and digitalization drives demand for advanced safety solutions.

- M&A Activities: Strategic acquisitions focused on technological integration and geographic expansion are observed. The average deal value between 2019 and 2024 was approximately $xx Million.

Safety Drives and Motors Market Industry Trends & Insights

The Safety Drives and Motors market is experiencing robust growth, driven by increasing automation across various industries, coupled with a rising focus on workplace safety. The market is projected to witness a CAGR of xx% during the forecast period (2025-2033). Technological advancements, such as the integration of artificial intelligence (AI) and machine learning (ML) in safety systems, are accelerating market penetration. Consumer preferences are shifting towards sophisticated, reliable, and easily integrable safety solutions. Intense competitive dynamics are forcing companies to invest heavily in R&D and strategic partnerships to maintain their market positions. The manufacturing sector is currently the leading end-user vertical, accounting for xx% of the market in 2024, followed by the energy and power sector at xx%.

Dominant Markets & Segments in Safety Drives and Motors Market

The manufacturing sector represents the largest segment within the Safety Drives and Motors market, driven by the extensive adoption of automation technologies across various manufacturing processes. Geographically, North America currently leads the market in terms of revenue generation, followed by Europe and Asia-Pacific.

- By Type: Drives segment dominates due to wider applicability across diverse industries.

- By End-user Vertical:

- Manufacturing: High adoption of automation and stringent safety standards fuel demand. Key drivers include increasing production volumes, growing complexity of machinery, and government regulations promoting workplace safety.

- Energy and Power: Demand is propelled by the need for safe operation in power generation and distribution facilities.

- Mining: The sector necessitates robust safety systems for hazardous operations, driving demand for specialized safety drives and motors.

- Oil and Gas: Stringent safety regulations and the inherent risks associated with oil and gas extraction necessitate advanced safety solutions.

- Chemical and Petrochemical: The highly regulated nature of the chemical industry requires sophisticated safety mechanisms.

- Construction: Increased focus on worker safety and prevention of accidents leads to higher adoption rates.

- Other End-user Verticals: These include sectors like food and beverage, transportation, and pharmaceuticals.

Safety Drives and Motors Market Product Developments

Recent product innovations include the integration of advanced sensor technologies, improved communication protocols, and enhanced diagnostic capabilities in safety drives and motors. These advancements enable more precise safety control, improved system reliability, and predictive maintenance capabilities. The focus is on developing compact, energy-efficient, and easily configurable solutions that cater to the diverse needs of various industries. This improves system uptime and reduces overall operational costs, providing a strong competitive advantage.

Report Scope & Segmentation Analysis

This report segments the Safety Drives and Motors market by Type (Drives, DC Motors) and by End-user Vertical (Energy and Power, Manufacturing, Mining, Oil and Gas, Chemical and Petrochemical, Construction, Other End-user Verticals). Each segment is analyzed in terms of market size, growth projections, and competitive dynamics. The Drives segment is projected to experience a CAGR of xx% during the forecast period, while the DC Motors segment is expected to grow at a CAGR of xx%. The manufacturing vertical is anticipated to maintain its dominance, with a projected CAGR of xx%.

Key Drivers of Safety Drives and Motors Market Growth

The market's growth is fueled by several factors: rising demand for automation in hazardous environments, stringent safety regulations across various industries, technological advancements leading to improved safety features and functionality, increasing industrial output and infrastructural developments across several economies, and the growing adoption of Industry 4.0 principles.

Challenges in the Safety Drives and Motors Market Sector

The market faces challenges including high initial investment costs for safety systems, complexity in integrating various safety components, the need for specialized expertise for installation and maintenance, supply chain disruptions impacting the availability of components, and intense competition among established players.

Emerging Opportunities in Safety Drives and Motors Market

Emerging opportunities include the integration of AI and ML for predictive maintenance and enhanced safety control, the development of modular and customizable safety solutions, and expanding into new markets with growing industrialization and automation needs, particularly in developing economies.

Leading Players in the Safety Drives and Motors Market Market

- ABB Ltd

- KOLLMORGEN Corporation

- Pilz International

- WEG SA

- Hoerbiger Holding AG

- Siemens AG

- KEBA Corporation

- Beckhoff Automation GmbH

- Rockwell Automation Inc

- SIGMATEK Safety Systems

Key Developments in Safety Drives and Motors Market Industry

- January 2023: ABB Ltd launched a new range of safety drives with enhanced communication protocols.

- April 2022: Siemens AG acquired a smaller safety technology company, expanding its product portfolio.

- October 2021: KOLLMORGEN Corporation introduced a new generation of safe servo motors with improved diagnostic capabilities.

- (Further developments can be added here with specific dates and impact)

Strategic Outlook for Safety Drives and Motors Market Market

The Safety Drives and Motors market presents significant growth potential, driven by increasing industrial automation, robust safety regulations, and continuous technological advancements. Companies focusing on innovation, strategic partnerships, and expansion into emerging markets are well-positioned to capitalize on the market's future opportunities. The market is likely to witness further consolidation through mergers and acquisitions, as companies seek to broaden their product portfolios and enhance their market share.

Safety Drives and Motors Market Segmentation

-

1. Type

-

1.1. Drives

- 1.1.1. AC

- 1.1.2. DC

- 1.2. Motors

-

1.1. Drives

-

2. End-user Vertical

- 2.1. Energy and Power

- 2.2. Manufacturing

- 2.3. Mining

- 2.4. Oil and Gas

- 2.5. Chemical and Petrochemical

- 2.6. Construction

- 2.7. Other End-user Verticals

Safety Drives and Motors Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Safety Drives and Motors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Growing Adoption of automation has Created a Need for Accurate Control of Industrial Machinery

- 3.2.2 thus Helping in Market Growth

- 3.3. Market Restrains

- 3.3.1. ; Considerable Slowdown in Mining Industry due to Regulatory Constraints is Challenging the Market Growth

- 3.4. Market Trends

- 3.4.1. Oil & Gas to Occupy the Maximum Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Drives

- 5.1.1.1. AC

- 5.1.1.2. DC

- 5.1.2. Motors

- 5.1.1. Drives

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Energy and Power

- 5.2.2. Manufacturing

- 5.2.3. Mining

- 5.2.4. Oil and Gas

- 5.2.5. Chemical and Petrochemical

- 5.2.6. Construction

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Drives

- 6.1.1.1. AC

- 6.1.1.2. DC

- 6.1.2. Motors

- 6.1.1. Drives

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Energy and Power

- 6.2.2. Manufacturing

- 6.2.3. Mining

- 6.2.4. Oil and Gas

- 6.2.5. Chemical and Petrochemical

- 6.2.6. Construction

- 6.2.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Drives

- 7.1.1.1. AC

- 7.1.1.2. DC

- 7.1.2. Motors

- 7.1.1. Drives

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Energy and Power

- 7.2.2. Manufacturing

- 7.2.3. Mining

- 7.2.4. Oil and Gas

- 7.2.5. Chemical and Petrochemical

- 7.2.6. Construction

- 7.2.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Drives

- 8.1.1.1. AC

- 8.1.1.2. DC

- 8.1.2. Motors

- 8.1.1. Drives

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Energy and Power

- 8.2.2. Manufacturing

- 8.2.3. Mining

- 8.2.4. Oil and Gas

- 8.2.5. Chemical and Petrochemical

- 8.2.6. Construction

- 8.2.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Drives

- 9.1.1.1. AC

- 9.1.1.2. DC

- 9.1.2. Motors

- 9.1.1. Drives

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Energy and Power

- 9.2.2. Manufacturing

- 9.2.3. Mining

- 9.2.4. Oil and Gas

- 9.2.5. Chemical and Petrochemical

- 9.2.6. Construction

- 9.2.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Drives

- 10.1.1.1. AC

- 10.1.1.2. DC

- 10.1.2. Motors

- 10.1.1. Drives

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Energy and Power

- 10.2.2. Manufacturing

- 10.2.3. Mining

- 10.2.4. Oil and Gas

- 10.2.5. Chemical and Petrochemical

- 10.2.6. Construction

- 10.2.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East Safety Drives and Motors Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 ABB Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 KOLLMORGEN Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Pilz International

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 WEG SA*List Not Exhaustive

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Hoerbiger Holding AG

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Siemens AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 KEBA Corporation

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Beckhoff Automation GmbH

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Rockwell Automation Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 SIGMATEK Safety Systems

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 ABB Ltd

List of Figures

- Figure 1: Safety Drives and Motors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Safety Drives and Motors Market Share (%) by Company 2024

List of Tables

- Table 1: Safety Drives and Motors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Safety Drives and Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Safety Drives and Motors Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Safety Drives and Motors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Safety Drives and Motors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Safety Drives and Motors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Safety Drives and Motors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Safety Drives and Motors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Safety Drives and Motors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Safety Drives and Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Safety Drives and Motors Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Safety Drives and Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Safety Drives and Motors Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Safety Drives and Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Safety Drives and Motors Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Safety Drives and Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Safety Drives and Motors Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Safety Drives and Motors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Safety Drives and Motors Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Safety Drives and Motors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Safety Drives and Motors Market?

The projected CAGR is approximately 6.63%.

2. Which companies are prominent players in the Safety Drives and Motors Market?

Key companies in the market include ABB Ltd, KOLLMORGEN Corporation, Pilz International, WEG SA*List Not Exhaustive, Hoerbiger Holding AG, Siemens AG, KEBA Corporation, Beckhoff Automation GmbH, Rockwell Automation Inc, SIGMATEK Safety Systems.

3. What are the main segments of the Safety Drives and Motors Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Adoption of automation has Created a Need for Accurate Control of Industrial Machinery. thus Helping in Market Growth.

6. What are the notable trends driving market growth?

Oil & Gas to Occupy the Maximum Market Share.

7. Are there any restraints impacting market growth?

; Considerable Slowdown in Mining Industry due to Regulatory Constraints is Challenging the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Safety Drives and Motors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Safety Drives and Motors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Safety Drives and Motors Market?

To stay informed about further developments, trends, and reports in the Safety Drives and Motors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence