Key Insights

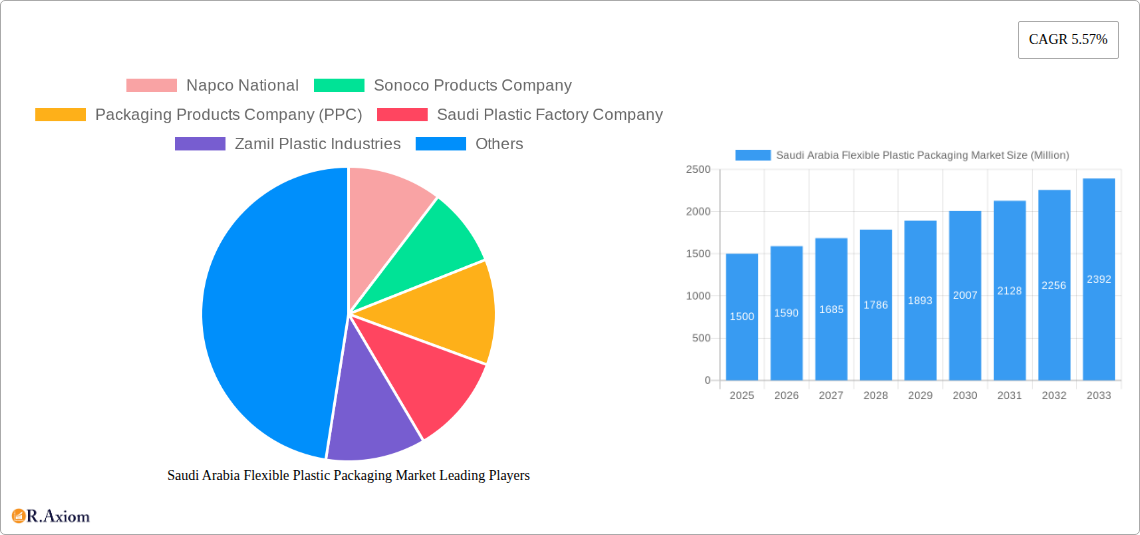

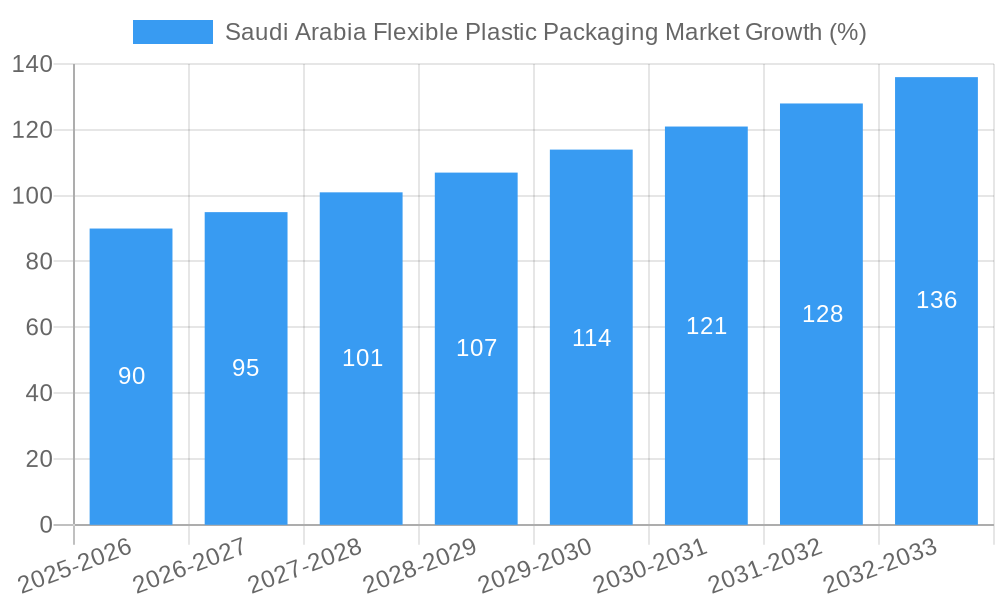

The Saudi Arabia flexible plastic packaging market is experiencing robust growth, driven by a burgeoning food and beverage sector, increasing e-commerce activities, and a rising demand for convenient and cost-effective packaging solutions. The market's Compound Annual Growth Rate (CAGR) of 5.57% from 2019 to 2024 indicates a consistently expanding market. This growth is further fueled by government initiatives promoting sustainable packaging practices, although this trend is balanced by environmental concerns related to plastic waste management. Key players such as Napco National, Sonoco Products Company, and Packaging Products Company (PPC) are actively shaping the market landscape through innovation in materials and designs, catering to the evolving needs of various industries. The segments within the market, while not explicitly defined, can be reasonably inferred to include food packaging, beverage packaging, consumer goods packaging, and industrial packaging. Each of these segments is influenced by factors specific to its application, such as shelf life requirements, transportation needs, and branding considerations. Competition is moderately intense among domestic and international companies, leading to continuous improvements in product offerings and pricing strategies.

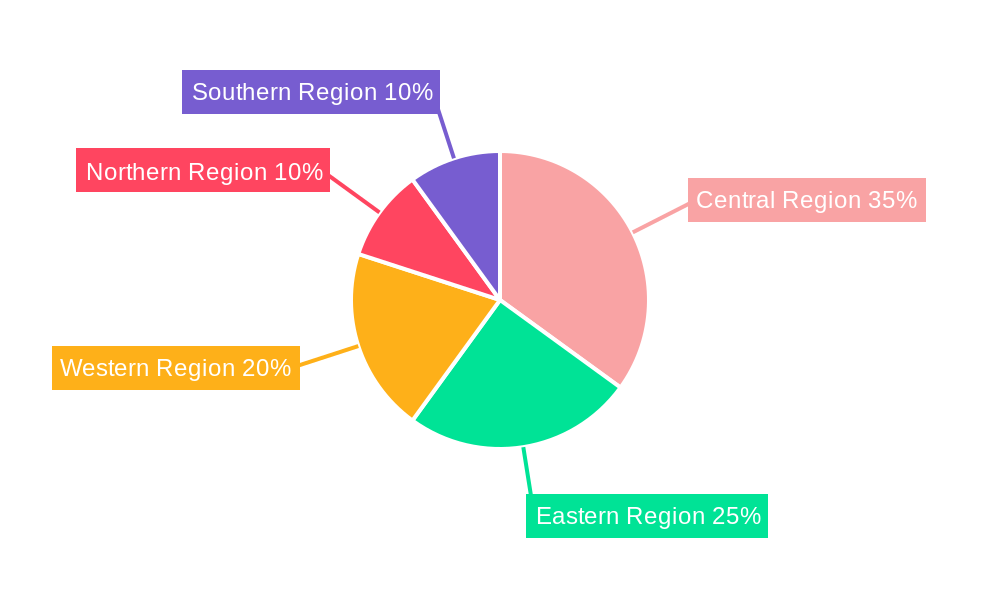

The forecast period from 2025 to 2033 projects continued expansion, fueled by sustained economic growth in Saudi Arabia and the expanding middle class driving consumption. However, regulatory pressures aiming to curb plastic waste and encourage recycling will likely influence material choices and packaging designs. Companies are expected to adapt by investing in research and development of biodegradable and recyclable alternatives. The geographical distribution of the market is likely concentrated in major urban centers and industrial zones, aligning with population density and manufacturing hubs. Expansion into smaller cities and towns is anticipated, driven by the growing accessibility of consumer goods and the widening distribution network. The overall market outlook remains positive, with opportunities for growth and innovation for companies that effectively navigate the evolving regulatory landscape and consumer preferences.

Saudi Arabia Flexible Plastic Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia flexible plastic packaging market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the base year 2025 and a forecast period extending to 2033. The report utilizes a robust methodology, including a 7-2 Heat Map Analysis, to deliver actionable intelligence on market dynamics, growth drivers, and emerging opportunities. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx%.

Saudi Arabia Flexible Plastic Packaging Market Concentration & Innovation

The Saudi Arabia flexible plastic packaging market exhibits a moderately concentrated landscape, with key players such as Napco National, Sonoco Products Company, Packaging Products Company (PPC), Saudi Plastic Factory Company, Zamil Plastic Industries, Arabian Plastic Industrial Company Limited (APICO), Takween Plastics Industries, NPF Advanced Plastic Solutions, and ENPI Group holding significant market share. Precise market share figures are unavailable but are estimated to vary substantially among these companies. The market is characterized by a dynamic interplay of innovation, regulatory frameworks, and evolving consumer preferences.

Market Concentration: While a few major players dominate, smaller regional players and specialized packaging firms contribute significantly to the market’s overall vibrancy. The Herfindahl-Hirschman Index (HHI) for the market is estimated to be xx, indicating a moderately concentrated market structure.

Innovation Drivers: Sustainability concerns are a major driver, with increased demand for eco-friendly materials like recycled plastics and biodegradable polymers. Technological advancements, such as improved barrier films and printing techniques, continue to fuel product innovation.

Regulatory Landscape: Government regulations concerning food safety, material composition, and waste management significantly impact the market. Stringent environmental regulations are pushing the adoption of sustainable packaging solutions.

Product Substitutes: Alternatives like paper-based packaging and glass containers exist, but the convenience, cost-effectiveness, and versatility of flexible plastic packaging maintain its dominance.

End-User Trends: The food and beverage sector is a key end-user, driving demand for various packaging types including pouches, films, and wraps. The growth of e-commerce is also contributing to the rising demand for flexible packaging suitable for online deliveries.

M&A Activities: While specific deal values are unavailable, the market has witnessed several mergers and acquisitions in recent years, aimed at expanding product portfolios, geographic reach, and technological capabilities. The overall value of M&A activity in the period 2019-2024 is estimated to be xx Million.

Saudi Arabia Flexible Plastic Packaging Market Industry Trends & Insights

The Saudi Arabian flexible plastic packaging market is experiencing robust growth, driven by several key factors. The country's expanding population, rising disposable incomes, and the growth of its food and beverage, consumer goods, and e-commerce sectors are all contributing to increased demand. Technological advancements are also shaping market trends, with a strong focus on sustainability and improved barrier properties.

The market is witnessing the adoption of advanced materials and manufacturing processes, leading to enhanced packaging performance and reduced environmental impact. The increasing adoption of flexible packaging in various sectors, coupled with the government's focus on improving infrastructure and logistics, is contributing to this market’s expansion. Consumer preferences for convenient and aesthetically appealing packaging solutions are also shaping the market’s trajectory. The competitive landscape is characterized by both domestic and international players, leading to price competitiveness and product innovation.

Dominant Markets & Segments in Saudi Arabia Flexible Plastic Packaging Market

The major cities in Saudi Arabia like Riyadh, Jeddah, and Dammam, represent dominant markets within the flexible packaging sector. This dominance is primarily due to higher population density, greater purchasing power, and established logistics networks.

- Key Drivers of Dominance:

- Higher Population Density: Concentrated populations in major urban centers translate to higher demand for packaged goods.

- Strong Retail Infrastructure: The presence of a large number of retail outlets and supermarkets drives the demand for diverse packaging solutions.

- Advanced Logistics Network: Efficient transportation networks facilitate the seamless movement of packaged goods across the country.

- Government Support: The Saudi Arabian government’s focus on economic diversification and infrastructure development has fostered a favorable environment for market expansion.

The food and beverage sector is the largest segment, followed by the consumer goods and industrial sectors. This is driven by the increasing demand for convenient and safe food packaging options, as well as the growth of the country's consumer goods industry.

Saudi Arabia Flexible Plastic Packaging Market Product Developments

Recent product developments focus on enhancing barrier properties, improving sustainability, and catering to specific end-user needs. There's a significant push toward eco-friendly solutions, incorporating recycled materials and biodegradable polymers. Advanced printing techniques are also improving the aesthetics and branding opportunities of flexible packaging. The introduction of innovative closure systems and improved material structures further enhances product shelf life and consumer convenience. This trend is aligned with global sustainability initiatives and caters to growing consumer demand for environmentally conscious products.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia flexible plastic packaging market by material type (polyethylene, polypropylene, etc.), packaging type (pouches, films, wraps, etc.), end-use industry (food & beverage, consumer goods, industrial, etc.), and region. Each segment's market size, growth projections, and competitive dynamics are analyzed in detail. The market is further segmented based on various factors influencing demand, providing a granular understanding of the market structure and its various segments. Growth projections are presented for each segment, incorporating various factors such as industry growth rates, consumption patterns, and pricing strategies.

Key Drivers of Saudi Arabia Flexible Plastic Packaging Market Growth

The market’s growth is propelled by several factors:

- Expanding Food & Beverage Sector: The rise in disposable incomes and a growing population fuel demand for packaged food and beverages.

- E-commerce Boom: The surge in online shopping necessitates efficient and protective packaging for goods.

- Government Initiatives: Investments in infrastructure and economic diversification support the growth of related industries.

- Technological Advancements: Innovations in materials and manufacturing techniques drive efficiency and sustainability.

Challenges in the Saudi Arabia Flexible Plastic Packaging Market Sector

The market faces some challenges:

- Fluctuating Raw Material Prices: Dependence on imported raw materials exposes the market to price volatility.

- Environmental Concerns: Growing awareness of plastic waste necessitates the adoption of sustainable alternatives.

- Stringent Regulations: Compliance with food safety and environmental regulations adds to operational costs.

- Competition: The presence of both domestic and international players creates a competitive landscape.

Emerging Opportunities in Saudi Arabia Flexible Plastic Packaging Market

Significant opportunities exist for growth:

- Sustainable Packaging Solutions: Demand for eco-friendly packaging is growing rapidly, presenting opportunities for innovative solutions.

- Specialized Packaging: Meeting the specific requirements of different end-use industries can create niche market opportunities.

- E-commerce Packaging Innovations: The growth of e-commerce requires development of specialized packaging solutions designed for online deliveries.

- Advanced Packaging Technologies: Integration of smart packaging technologies such as QR codes and RFID tracking systems presents significant opportunities.

Leading Players in the Saudi Arabia Flexible Plastic Packaging Market Market

- Napco National

- Sonoco Products Company

- Packaging Products Company (PPC)

- Saudi Plastic Factory Company

- Zamil Plastic Industries

- Arabian Plastic Industrial Company Limited (APICO)

- Takween Plastics Industries

- NPF Advanced Plastic Solutions

- ENPI Group

- *List Not Exhaustive

Key Developments in Saudi Arabia Flexible Plastic Packaging Market Industry

- June 2024: Arabian Plastic Industrial Co. Ltd (APICO) opened a new 34,000 square meter manufacturing facility in Al Kharj City, boosting its market position.

- April 2024: SABIC, Napco National, and FONTE collaborated to launch a new flexible packaging line for bakery items made from post-consumer recycled plastics, highlighting the growing emphasis on sustainability.

Strategic Outlook for Saudi Arabia Flexible Plastic Packaging Market Market

The Saudi Arabia flexible plastic packaging market is poised for continued growth driven by the country's economic diversification strategy, Vision 2030, and the flourishing consumer goods sector. The increasing emphasis on sustainability will drive innovation in eco-friendly packaging solutions. Strategic partnerships and investments in advanced technologies will be crucial for companies seeking to thrive in this dynamic market. Opportunities exist for companies focusing on sustainable and specialized packaging solutions, and those leveraging technological advancements to enhance efficiency and sustainability.

Saudi Arabia Flexible Plastic Packaging Market Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Bi-oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.6. Other Ma

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types (Blister Packs, Liners, etc)

-

3. End-User Industry

-

3.1. Food

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

- 3.2. Beverage

- 3.3. Medical and Pharmaceutical

- 3.4. Personal Care and Household Care

- 3.5. Other En

-

3.1. Food

Saudi Arabia Flexible Plastic Packaging Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Flexible Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Pharmaceutical Sector to Propel Demand for Flexible Plastic Packaging; Rising Demand for Cosmetic and Personal Care Products

- 3.3. Market Restrains

- 3.3.1. Growing Pharmaceutical Sector to Propel Demand for Flexible Plastic Packaging; Rising Demand for Cosmetic and Personal Care Products

- 3.4. Market Trends

- 3.4.1. The Polyethylene (PE) Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Flexible Plastic Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Bi-oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.6. Other Ma

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types (Blister Packs, Liners, etc)

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Food

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Beverage

- 5.3.3. Medical and Pharmaceutical

- 5.3.4. Personal Care and Household Care

- 5.3.5. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Napco National

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sonoco Products Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Packaging Products Company (PPC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saudi Plastic Factory Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Zamil Plastic Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arabian Plastic Industrial Company Limited (APICO)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Takween Plastics Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NPF Advanced Plastic Solutions

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ENPI Group*List Not Exhaustive 7 2 Heat Map Analysi

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Napco National

List of Figures

- Figure 1: Saudi Arabia Flexible Plastic Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Saudi Arabia Flexible Plastic Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 3: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 5: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 7: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 8: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 9: Saudi Arabia Flexible Plastic Packaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Flexible Plastic Packaging Market?

The projected CAGR is approximately 5.57%.

2. Which companies are prominent players in the Saudi Arabia Flexible Plastic Packaging Market?

Key companies in the market include Napco National, Sonoco Products Company, Packaging Products Company (PPC), Saudi Plastic Factory Company, Zamil Plastic Industries, Arabian Plastic Industrial Company Limited (APICO), Takween Plastics Industries, NPF Advanced Plastic Solutions, ENPI Group*List Not Exhaustive 7 2 Heat Map Analysi.

3. What are the main segments of the Saudi Arabia Flexible Plastic Packaging Market?

The market segments include Material Type, Product Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Pharmaceutical Sector to Propel Demand for Flexible Plastic Packaging; Rising Demand for Cosmetic and Personal Care Products.

6. What are the notable trends driving market growth?

The Polyethylene (PE) Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Pharmaceutical Sector to Propel Demand for Flexible Plastic Packaging; Rising Demand for Cosmetic and Personal Care Products.

8. Can you provide examples of recent developments in the market?

June 2024: Arabian Plastic Industrial Co. Ltd (APICO), headquartered in Saudi Arabia, unveiled its latest manufacturing facility in Al Kharj City, spanning 34,000 square meters. This strategic move is likely to bolster APICO's foothold in the Saudi Arabian market.April 2024: SABIC, a prominent chemical firm in Saudi Arabia, collaborated with Napco National and FONTE to introduce a new flexible packaging line for bakery items. These packages are exclusively crafted from post-consumer recycled plastics, underlining a strong commitment to sustainability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Flexible Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Flexible Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Flexible Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Flexible Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence