Key Insights

The Saudi Arabia real estate brokerage market exhibits robust growth potential, projected at a Compound Annual Growth Rate (CAGR) of 6.80% from 2025 to 2033. With a market size of $8.14 billion in 2025, this sector is driven by several key factors. Significant government investments in infrastructure development, including Vision 2030 initiatives focused on diversifying the economy and expanding urban areas, are fueling demand. The influx of foreign investment and a burgeoning population contribute to increased property transactions, creating a favorable environment for brokerage services. Furthermore, the rising adoption of technology within the real estate sector, including online platforms and property management software, enhances efficiency and transparency, attracting more clients and driving market expansion. The competitive landscape involves both international players like JLL, CBRE, and Colliers International, and prominent local firms such as Ewaan Global Residential Company and Tamkeen Real Estate. These companies are vying for market share, leading to innovation and enhanced service offerings.

Saudi Arabia Real Estate Brokerage Market Market Size (In Billion)

However, the market faces certain challenges. Regulatory changes and fluctuating interest rates can impact investment decisions and transaction volumes. Furthermore, maintaining high ethical standards and addressing potential price volatility are crucial for sustained growth. Segment analysis, while not provided in the original data, is crucial to understand specific niches within the market, such as residential, commercial, and industrial properties. A deeper dive into regional variations across Saudi Arabia would also provide valuable insights, highlighting growth opportunities in specific areas. Analyzing these factors is key for effective market penetration and strategic decision-making for both established and emerging players. Further research into specific market segments and regional breakdowns will refine market projections and highlight key opportunities for investors and businesses operating in this dynamic sector.

Saudi Arabia Real Estate Brokerage Market Company Market Share

Saudi Arabia Real Estate Brokerage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Saudi Arabia real estate brokerage market, covering market size, growth drivers, challenges, key players, and future prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic market. The report leverages extensive data analysis from the historical period (2019-2024) to project future market trends.

Saudi Arabia Real Estate Brokerage Market Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory landscape, and competitive dynamics within the Saudi Arabia real estate brokerage sector. We examine the market share of key players, including Jones Lang LaSalle (JLL), CBRE Group, Colliers International, Savills, Knight Frank, Ewaan Global Residential Company, Al Andalusia Real Estate, Tamkeen Real Estate, Rafal Real Estate Development, and Sakan Real Estate Solutions, along with 73 other companies. The analysis considers the impact of mergers and acquisitions (M&A) activities, evaluating deal values and their influence on market consolidation. We delve into the innovative technologies adopted by brokerage firms, assessing their impact on efficiency and client experience. Regulatory frameworks, such as the recently enacted Real Estate Brokerage Law, are examined for their effect on market structure and competition. Furthermore, the report identifies emerging product substitutes and analyzes evolving end-user trends to project future market dynamics. We estimate that the market share of the top 5 players is approximately xx% in 2025, with the total M&A deal value in the sector reaching approximately xx Million during the historical period.

Saudi Arabia Real Estate Brokerage Market Industry Trends & Insights

This section explores the key industry trends shaping the Saudi Arabian real estate brokerage market. We analyze the Compound Annual Growth Rate (CAGR) of the market during the historical period and project the CAGR for the forecast period (2025-2033), estimating it to be xx%. Market penetration rates for various brokerage services are examined, along with a detailed analysis of market growth drivers, such as government initiatives promoting real estate investment, population growth, and urbanization. The influence of technological disruptions, particularly the adoption of PropTech solutions and digital platforms, is assessed. Consumer preferences are analyzed, focusing on the evolving demands of both residential and commercial property buyers and sellers. Competitive dynamics are evaluated, focusing on strategies employed by key players to maintain their market positions and attract new clients. The impact of fluctuating oil prices and overall economic conditions on market growth is also considered.

Dominant Markets & Segments in Saudi Arabia Real Estate Brokerage Market

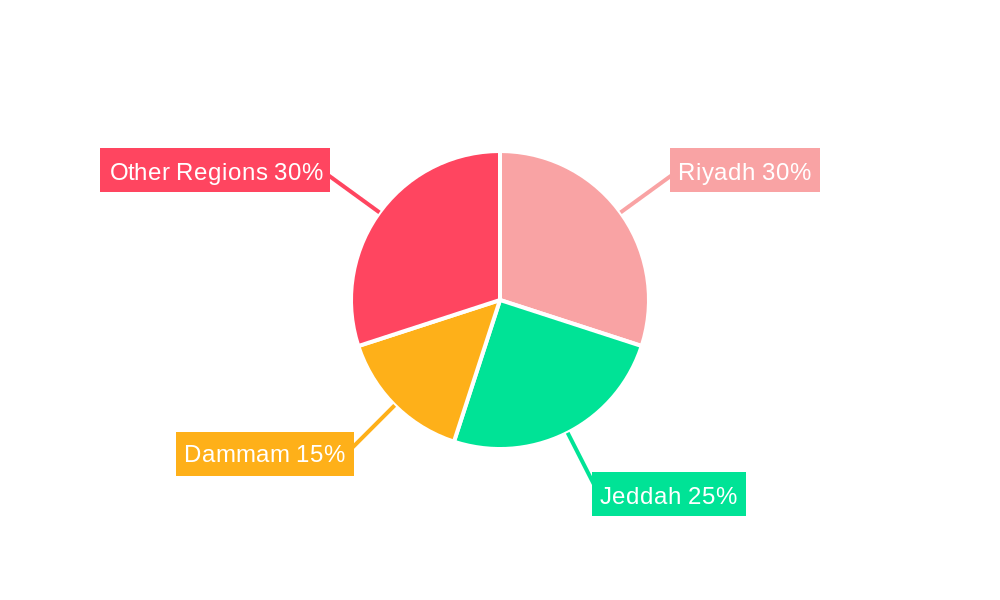

This section pinpoints the leading regions and segments within the Saudi Arabian real estate brokerage market. A detailed dominance analysis is conducted, focusing on factors contributing to the success of specific areas.

- Key Drivers for Dominant Segments:

- Favorable government policies incentivizing real estate investment.

- Robust infrastructure development in key regions.

- High population density and urbanization rates.

- Strong demand for residential and commercial properties.

The analysis identifies Riyadh and Jeddah as the dominant markets, accounting for approximately xx% of the total market value in 2025. The report provides granular insights into the factors driving their dominance, including infrastructure development, government initiatives, and economic activity. We also explore the relative importance of various segments, such as residential, commercial, and industrial real estate brokerage. The report projects the continued dominance of these leading markets and segments through the forecast period, fueled by ongoing economic growth and infrastructural developments.

Saudi Arabia Real Estate Brokerage Market Product Developments

Recent product innovations in the Saudi Arabian real estate brokerage market focus on enhancing digital capabilities and offering clients more sophisticated services. The integration of virtual reality (VR) and augmented reality (AR) technologies for property viewings, coupled with AI-driven property valuation and search tools, are transforming client engagement and operational efficiency. These advancements, alongside the wider adoption of cloud-based management systems, provide competitive advantages for brokerage firms that embrace technological innovation, better meeting client demands and market needs.

Report Scope & Segmentation Analysis

This report segments the Saudi Arabia real estate brokerage market based on several factors:

- By Property Type: Residential, Commercial, Industrial, and Land. Each segment’s projected growth, market size, and competitive dynamics are individually analyzed.

- By Service Type: Sales, Leasing, and Property Management. Growth projections and market sizes are provided for each service type. The competitive intensity within each segment is also discussed.

- By Geographic Location: Key regions within Saudi Arabia, with specific growth forecasts provided. The competitive landscape in each region is discussed.

Key Drivers of Saudi Arabia Real Estate Brokerage Market Growth

Several factors drive the growth of the Saudi Arabia real estate brokerage market:

- Government Initiatives: Supportive policies and regulations, including the Real Estate Brokerage Law, are boosting investor confidence and facilitating market expansion.

- Economic Growth: The nation's economic diversification efforts are creating a more robust and stable real estate sector.

- Technological Advancements: PropTech adoption is improving efficiency and client experience, driving market growth.

Challenges in the Saudi Arabia Real Estate Brokerage Market Sector

Challenges facing the Saudi Arabia real estate brokerage market include:

- Regulatory Hurdles: While recent regulations are positive, implementation and enforcement remain crucial.

- Competition: The market is becoming increasingly competitive, requiring firms to innovate and differentiate.

- Economic Fluctuations: Global economic uncertainty can impact real estate investment and market stability.

Emerging Opportunities in Saudi Arabia Real Estate Brokerage Market

Emerging opportunities exist in:

- PropTech Integration: Further adoption of innovative technologies can enhance efficiency and client experience.

- Market Expansion: Growth in underserved regions presents expansion opportunities for brokerage firms.

- Specialized Services: Catering to niche markets, such as luxury properties or sustainable developments, offers potential for growth.

Leading Players in the Saudi Arabia Real Estate Brokerage Market Market

- Jones Lang LaSalle (JLL)

- CBRE Group

- Colliers International

- Savills

- Knight Frank

- Ewaan Global Residential Company

- Al Andalusia Real Estate

- Tamkeen Real Estate

- Rafal Real Estate Development

- Sakan Real Estate Solutions

- 73 Other Companies

Key Developments in Saudi Arabia Real Estate Brokerage Market Industry

- June 2024: Announcement of inaugural facility management legislation by REGA, enhancing industry reliability and investment appeal.

- January 2023: Over 89,000 license requests received for the new Real Estate Brokerage Law within two days of enactment, with over 72,000 licenses granted to individuals and 17,100 to establishments.

Strategic Outlook for Saudi Arabia Real Estate Brokerage Market Market

The Saudi Arabia real estate brokerage market presents significant growth potential driven by ongoing economic diversification, government support, and technological advancements. Firms that successfully adapt to changing market dynamics and embrace innovation will be best positioned to capitalize on future opportunities, contributing to the sustained expansion of the sector in the coming years.

Saudi Arabia Real Estate Brokerage Market Segmentation

-

1. Type

- 1.1. Residential

- 1.2. Non-residential

-

2. Services

- 2.1. Sales

- 2.2. Rental

Saudi Arabia Real Estate Brokerage Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Real Estate Brokerage Market Regional Market Share

Geographic Coverage of Saudi Arabia Real Estate Brokerage Market

Saudi Arabia Real Estate Brokerage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Diversification Efforts; Regulatory Reforms and Foreign Investment

- 3.3. Market Restrains

- 3.3.1. Economic Diversification Efforts; Regulatory Reforms and Foreign Investment

- 3.4. Market Trends

- 3.4.1. Government-led Initiatives Driving the Saudi Arabian Real Estate Brokerage Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Real Estate Brokerage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Residential

- 5.1.2. Non-residential

- 5.2. Market Analysis, Insights and Forecast - by Services

- 5.2.1. Sales

- 5.2.2. Rental

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Jones Lang LaSalle (JLL)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CBRE Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Colliers International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Savills

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Knight Frank

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ewaan Global Residential Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al Andalusia Real Estate

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tamkeen Real Estate

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Rafal Real Estate Development

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sakan Real Estate Solutions**List Not Exhaustive 7 3 Other Companie

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Jones Lang LaSalle (JLL)

List of Figures

- Figure 1: Saudi Arabia Real Estate Brokerage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Real Estate Brokerage Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 5: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Services 2020 & 2033

- Table 10: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Services 2020 & 2033

- Table 11: Saudi Arabia Real Estate Brokerage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Real Estate Brokerage Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Real Estate Brokerage Market?

The projected CAGR is approximately 6.80%.

2. Which companies are prominent players in the Saudi Arabia Real Estate Brokerage Market?

Key companies in the market include Jones Lang LaSalle (JLL), CBRE Group, Colliers International, Savills, Knight Frank, Ewaan Global Residential Company, Al Andalusia Real Estate, Tamkeen Real Estate, Rafal Real Estate Development, Sakan Real Estate Solutions**List Not Exhaustive 7 3 Other Companie.

3. What are the main segments of the Saudi Arabia Real Estate Brokerage Market?

The market segments include Type, Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.14 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Diversification Efforts; Regulatory Reforms and Foreign Investment.

6. What are the notable trends driving market growth?

Government-led Initiatives Driving the Saudi Arabian Real Estate Brokerage Market.

7. Are there any restraints impacting market growth?

Economic Diversification Efforts; Regulatory Reforms and Foreign Investment.

8. Can you provide examples of recent developments in the market?

June 2024: Abdullah Al-Hammad, CEO of the Real Estate General Authority (REGA), announced that Saudi Arabia was set to unveil its inaugural legislation for facility management within the real estate industry in Q1 of 2024. This legislation enhances the industry's reliability and investment appeal by establishing clear regulations. Al-Hammad emphasized the pivotal role of the Real Estate Brokerage Law in advancing the industry. He highlighted its functions in modernizing operations, enhancing governance, and positioning real estate as a transparent and reliable investment avenue.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Real Estate Brokerage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Real Estate Brokerage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Real Estate Brokerage Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Real Estate Brokerage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence