Key Insights

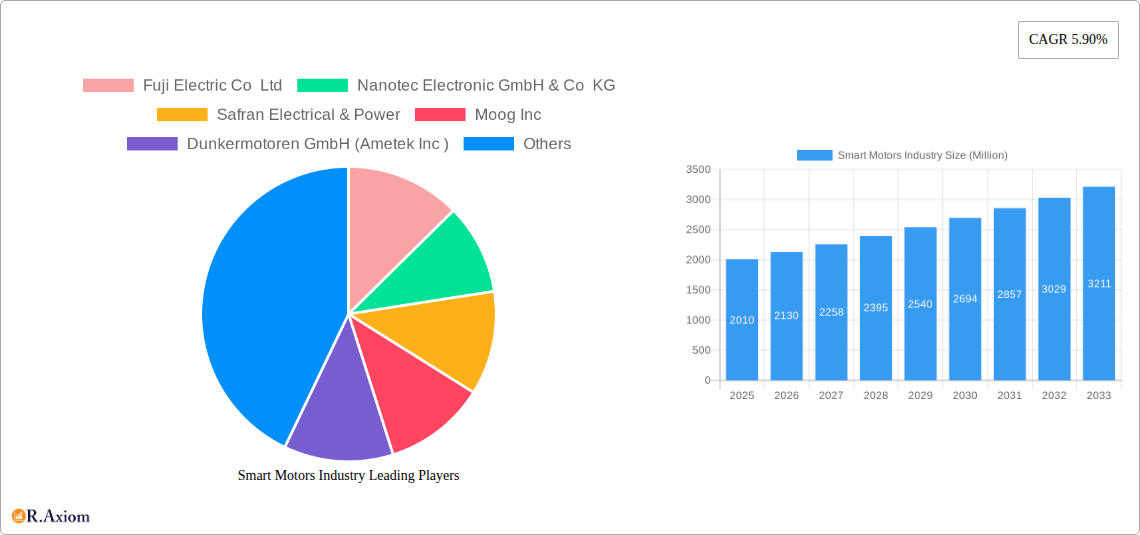

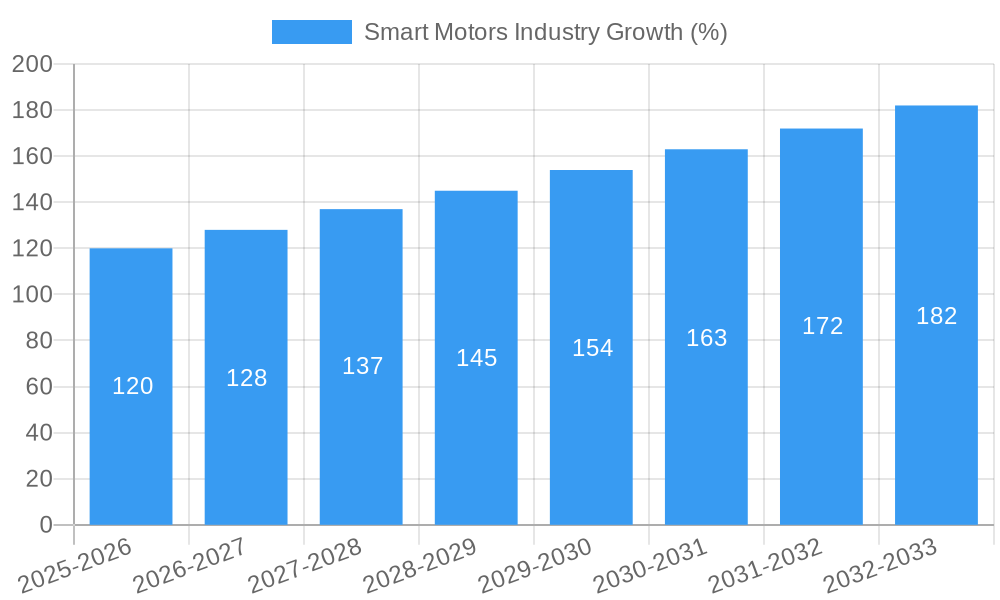

The global smart motors market, valued at approximately $2.01 billion in 2025, is poised for significant growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.90% from 2025 to 2033. This expansion is driven by several key factors. Increasing automation across diverse industries like manufacturing, automotive, and renewable energy is a major catalyst. The demand for energy-efficient and precise motor control systems is escalating, pushing the adoption of smart motors equipped with advanced features like integrated sensors, connectivity, and intelligent control algorithms. Furthermore, stringent government regulations promoting energy conservation and industrial automation are further fueling market growth. The industrial sector currently dominates the application segment, followed by commercial and automotive sectors. However, burgeoning renewable energy and aerospace & defense sectors are expected to witness rapid growth in smart motor adoption during the forecast period. Key players like Fuji Electric, Siemens, and Nidec are driving innovation through continuous product development and strategic partnerships, contributing to market competitiveness.

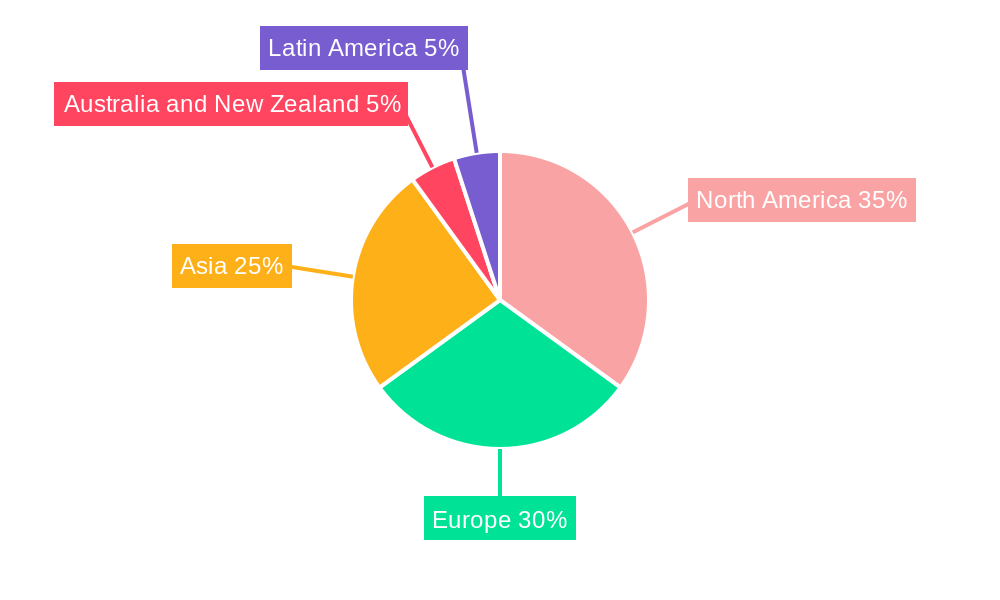

The market segmentation reveals significant opportunities across various components (Variable Speed Drives and Motors) and applications. While variable speed drives offer enhanced efficiency and control, the increasing sophistication of motors themselves is also a significant growth area. Regional analysis suggests a strong presence in North America and Europe, driven by early adoption and established industrial infrastructure. However, Asia-Pacific is anticipated to experience the fastest growth due to its rapidly expanding manufacturing base and increasing investments in smart infrastructure. Growth restraints include high initial investment costs for smart motor technology and the need for specialized technical expertise for implementation and maintenance. Nevertheless, the long-term cost savings and enhanced operational efficiency offered by smart motors are expected to overcome these challenges and sustain market expansion throughout the forecast period.

Smart Motors Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Smart Motors Industry, offering actionable insights for industry stakeholders. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report analyzes market trends, key players, and future growth opportunities. The global market is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Smart Motors Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the smart motors market, encompassing market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities.

The market is moderately concentrated, with several key players holding significant market share. While precise market share data requires proprietary research, we can estimate that the top 5 players (Siemens AG, Nidec Motion Control, Schneider Electric SE, Moog Inc, and Fuji Electric Co Ltd) collectively hold approximately xx% of the global market. M&A activity has been moderate, with deal values averaging approximately xx Million in recent years. Notable transactions include [Insert specific example of an M&A deal if available, otherwise state "Specific details of recent M&A activities are not publicly available at this time, but the market has experienced a moderate level of consolidation."].

- Innovation Drivers: Increased demand for energy efficiency, advancements in sensor technology, and the rise of Industry 4.0 are key drivers of innovation.

- Regulatory Frameworks: Stringent environmental regulations and safety standards are shaping product development and adoption.

- Product Substitutes: While no direct substitutes exist, advancements in alternative technologies (e.g., hydraulic systems) pose indirect competitive pressures.

- End-User Trends: Growing adoption of automation and smart technologies across various industries is fueling market growth.

Smart Motors Industry Industry Trends & Insights

The smart motors market is experiencing significant growth driven by several factors. The increasing demand for automation across diverse sectors, such as industrial automation, automotive, and renewable energy, is a major driver. Technological advancements, particularly in areas like power electronics and digital control systems, are enhancing the efficiency and capabilities of smart motors, leading to wider adoption. Consumer preferences are shifting toward energy-efficient and sustainable solutions, aligning perfectly with the environmental benefits of smart motors. The competitive dynamics are characterized by intense rivalry among established players and the emergence of innovative startups, leading to continuous improvements in product offerings and pricing. This results in a market where product differentiation and technological leadership play crucial roles. The market penetration rate for smart motors is currently at approximately xx%, and it is projected to increase to xx% by 2033.

Dominant Markets & Segments in Smart Motors Industry

The industrial sector currently dominates the smart motors market, accounting for approximately xx% of global revenue. This is followed by the automotive sector with approximately xx% of the market share.

Key Drivers by Segment:

- Industrial: Growing automation initiatives, increasing demand for energy-efficient solutions, and the rising adoption of Industry 4.0.

- Automotive: The shift towards electric and hybrid vehicles, enhanced safety features, and the increasing complexity of vehicle systems.

- Variable Speed Drives: Higher efficiency and precise control capabilities compared to traditional motors.

- Motors: Continuous advancements in motor design and materials lead to smaller, more powerful, and efficient motors.

Dominance Analysis: The dominance of the industrial sector stems from its high adoption rate of automation and smart technologies. The automotive sector's growth is driven by the global trend towards electric vehicles.

Smart Motors Industry Product Developments

Recent product developments in the smart motors market highlight the focus on increased efficiency, enhanced connectivity, and improved control capabilities. Manufacturers are integrating advanced sensors, sophisticated algorithms, and cloud-based connectivity to create more intelligent and adaptable motor systems. These innovations allow for predictive maintenance, real-time monitoring, and optimization of motor performance, resulting in reduced operational costs and improved reliability. The market trend is towards modular designs that allow for customization and flexible integration into various applications, meeting the growing demand for tailored solutions.

Report Scope & Segmentation Analysis

This report segments the smart motors market based on components (variable speed drives and motors) and applications (industrial, commercial, automotive, aerospace and defense, oil and gas, metal and mining, water and wastewater, and other applications).

By Component: The variable speed drive segment is projected to exhibit a CAGR of xx% during the forecast period, driven by its energy-saving capabilities and enhanced control precision. The motor segment is anticipated to grow at a CAGR of xx%, driven by technological advancements in motor design and materials. Competitive dynamics are characterized by both innovation and price competition.

By Application: Each application segment shows unique growth trajectories. The industrial sector's growth will continue to be influenced by automation, while the automotive sector's development depends on the transition to electric vehicles. Other application segments, such as aerospace and defense, will exhibit steady growth but at potentially lower rates compared to the industrial and automotive segments. Market size for each segment is extensively detailed within the complete report.

Key Drivers of Smart Motors Industry Growth

The smart motors industry's growth is propelled by several key factors:

- Technological advancements: Innovations in power electronics, digital control systems, and sensor technology are continuously improving motor efficiency and functionality.

- Government regulations: Policies promoting energy efficiency and reducing carbon emissions are driving the adoption of smart motors.

- Economic growth: Expansion in manufacturing and industrial sectors creates a higher demand for automation solutions incorporating smart motors.

Challenges in the Smart Motors Industry Sector

The smart motors sector faces several significant challenges:

- High initial investment costs: The high price of smart motors can be a barrier to adoption for some businesses.

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of components, affecting production and market dynamics.

- Competition: Intense competition among established players and new entrants is putting pressure on pricing and profitability.

Emerging Opportunities in Smart Motors Industry

The smart motors industry presents several exciting opportunities:

- New applications: Smart motors are finding increasing applications in emerging fields such as robotics, renewable energy, and smart grids.

- Technological advancements: Continuous innovation in areas such as artificial intelligence (AI) and machine learning (ML) will create new opportunities for enhanced motor control and performance.

- Emerging markets: Growth in developing economies will create new market segments for smart motor solutions.

Leading Players in the Smart Motors Industry Market

- Fuji Electric Co Ltd

- Nanotec Electronic GmbH & Co KG

- Safran Electrical & Power

- Moog Inc

- Dunkermotoren GmbH (Ametek Inc)

- Siemens AG

- Nidec Motion Control (Nidec Corporation)

- Schneider Electric SE

- Shanghai Moons' Electric Co Lt

- Turntide Technologies Inc

Key Developments in Smart Motors Industry Industry

- August 2023: Torqeedo partnered with c.technology to develop intelligent motors and innovative software systems for electric boating, integrating cloud technology for enhanced sustainability and user experience.

- June 2023: Moog Animatics' SmartMotor (SM23165DT) replaced stepper motors in Kelch's products, improving efficiency, reducing space, and enhancing worker safety.

Strategic Outlook for Smart Motors Industry Market

The smart motors market is poised for substantial growth, driven by technological innovation, increasing automation across various industries, and the growing focus on energy efficiency and sustainability. The market's future success hinges on continuous technological advancements, strategic partnerships, and the ability of companies to meet evolving customer demands for smarter, more efficient, and reliable motor solutions. The ongoing shift towards Industry 4.0 and the rise of electric vehicles will continue to be major growth catalysts in the years to come.

Smart Motors Industry Segmentation

-

1. Component

- 1.1. Variable Speed Drive

- 1.2. Motor

-

2. Application

- 2.1. Industrial

- 2.2. Commercial

- 2.3. Automotive

- 2.4. Aerospace and Defense

- 2.5. Oil and Gas

- 2.6. Metal and Mining

- 2.7. Water and Wastewater

- 2.8. Other Applications

Smart Motors Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

Smart Motors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Emphasis on Reducing Capex With Gaining Effectiveness of the Equipment; Growing Integration of IIoT Services for Enabling Services Such as Predictive Maintenance

- 3.2.2 Superior Machine Control

- 3.3. Market Restrains

- 3.3.1. Low Rate of Implementation; High Switching Cost Along with Alternate VFD Solutions

- 3.4. Market Trends

- 3.4.1. Industrial Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Variable Speed Drive

- 5.1.2. Motor

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Industrial

- 5.2.2. Commercial

- 5.2.3. Automotive

- 5.2.4. Aerospace and Defense

- 5.2.5. Oil and Gas

- 5.2.6. Metal and Mining

- 5.2.7. Water and Wastewater

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Variable Speed Drive

- 6.1.2. Motor

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Industrial

- 6.2.2. Commercial

- 6.2.3. Automotive

- 6.2.4. Aerospace and Defense

- 6.2.5. Oil and Gas

- 6.2.6. Metal and Mining

- 6.2.7. Water and Wastewater

- 6.2.8. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Variable Speed Drive

- 7.1.2. Motor

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Industrial

- 7.2.2. Commercial

- 7.2.3. Automotive

- 7.2.4. Aerospace and Defense

- 7.2.5. Oil and Gas

- 7.2.6. Metal and Mining

- 7.2.7. Water and Wastewater

- 7.2.8. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Variable Speed Drive

- 8.1.2. Motor

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Industrial

- 8.2.2. Commercial

- 8.2.3. Automotive

- 8.2.4. Aerospace and Defense

- 8.2.5. Oil and Gas

- 8.2.6. Metal and Mining

- 8.2.7. Water and Wastewater

- 8.2.8. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Australia and New Zealand Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Variable Speed Drive

- 9.1.2. Motor

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Industrial

- 9.2.2. Commercial

- 9.2.3. Automotive

- 9.2.4. Aerospace and Defense

- 9.2.5. Oil and Gas

- 9.2.6. Metal and Mining

- 9.2.7. Water and Wastewater

- 9.2.8. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Latin America Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Variable Speed Drive

- 10.1.2. Motor

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Industrial

- 10.2.2. Commercial

- 10.2.3. Automotive

- 10.2.4. Aerospace and Defense

- 10.2.5. Oil and Gas

- 10.2.6. Metal and Mining

- 10.2.7. Water and Wastewater

- 10.2.8. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Australia and New Zealand Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Latin America Smart Motors Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Fuji Electric Co Ltd

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Nanotec Electronic GmbH & Co KG

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Safran Electrical & Power

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Moog Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Dunkermotoren GmbH (Ametek Inc )

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Siemens AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Nidec Motion Control (Nidec Corporation)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Schneider Electric SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Shanghai Moons' Electric Co Lt

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Turntide Technologies Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Fuji Electric Co Ltd

List of Figures

- Figure 1: Global Smart Motors Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Australia and New Zealand Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Australia and New Zealand Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Latin America Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Latin America Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Smart Motors Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America Smart Motors Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America Smart Motors Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Smart Motors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Smart Motors Industry Revenue (Million), by Component 2024 & 2032

- Figure 19: Europe Smart Motors Industry Revenue Share (%), by Component 2024 & 2032

- Figure 20: Europe Smart Motors Industry Revenue (Million), by Application 2024 & 2032

- Figure 21: Europe Smart Motors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 22: Europe Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Smart Motors Industry Revenue (Million), by Component 2024 & 2032

- Figure 25: Asia Smart Motors Industry Revenue Share (%), by Component 2024 & 2032

- Figure 26: Asia Smart Motors Industry Revenue (Million), by Application 2024 & 2032

- Figure 27: Asia Smart Motors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Australia and New Zealand Smart Motors Industry Revenue (Million), by Component 2024 & 2032

- Figure 31: Australia and New Zealand Smart Motors Industry Revenue Share (%), by Component 2024 & 2032

- Figure 32: Australia and New Zealand Smart Motors Industry Revenue (Million), by Application 2024 & 2032

- Figure 33: Australia and New Zealand Smart Motors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 34: Australia and New Zealand Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Australia and New Zealand Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Smart Motors Industry Revenue (Million), by Component 2024 & 2032

- Figure 37: Latin America Smart Motors Industry Revenue Share (%), by Component 2024 & 2032

- Figure 38: Latin America Smart Motors Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Latin America Smart Motors Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Latin America Smart Motors Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Latin America Smart Motors Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Motors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Motors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Smart Motors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Global Smart Motors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Smart Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Smart Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Smart Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Smart Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Smart Motors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Smart Motors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 16: Global Smart Motors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Smart Motors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 19: Global Smart Motors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 20: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Smart Motors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 22: Global Smart Motors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 23: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Smart Motors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 25: Global Smart Motors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 26: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Smart Motors Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 28: Global Smart Motors Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Smart Motors Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Motors Industry?

The projected CAGR is approximately 5.90%.

2. Which companies are prominent players in the Smart Motors Industry?

Key companies in the market include Fuji Electric Co Ltd, Nanotec Electronic GmbH & Co KG, Safran Electrical & Power, Moog Inc, Dunkermotoren GmbH (Ametek Inc ), Siemens AG, Nidec Motion Control (Nidec Corporation), Schneider Electric SE, Shanghai Moons' Electric Co Lt, Turntide Technologies Inc.

3. What are the main segments of the Smart Motors Industry?

The market segments include Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.01 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Emphasis on Reducing Capex With Gaining Effectiveness of the Equipment; Growing Integration of IIoT Services for Enabling Services Such as Predictive Maintenance. Superior Machine Control.

6. What are the notable trends driving market growth?

Industrial Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Low Rate of Implementation; High Switching Cost Along with Alternate VFD Solutions.

8. Can you provide examples of recent developments in the market?

August 2023 - Torqeedo, a leading player in electric boating, partnered with c.technology, a cutting-edge SaaS cloud infrastructure provider for power sport vehicles. This collaboration aims to develop intelligent motors and introduce an innovative software system. By integrating cloud technology into its electric boating products, Torqeedo continues its commitment to enhancing sustainability and user experience.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Motors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Motors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Motors Industry?

To stay informed about further developments, trends, and reports in the Smart Motors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence