Key Insights

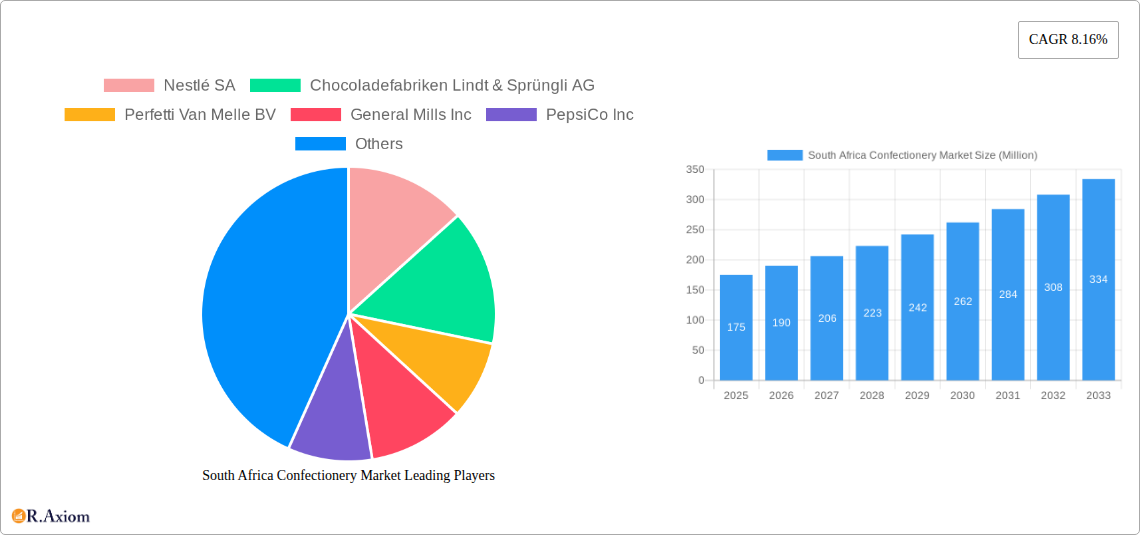

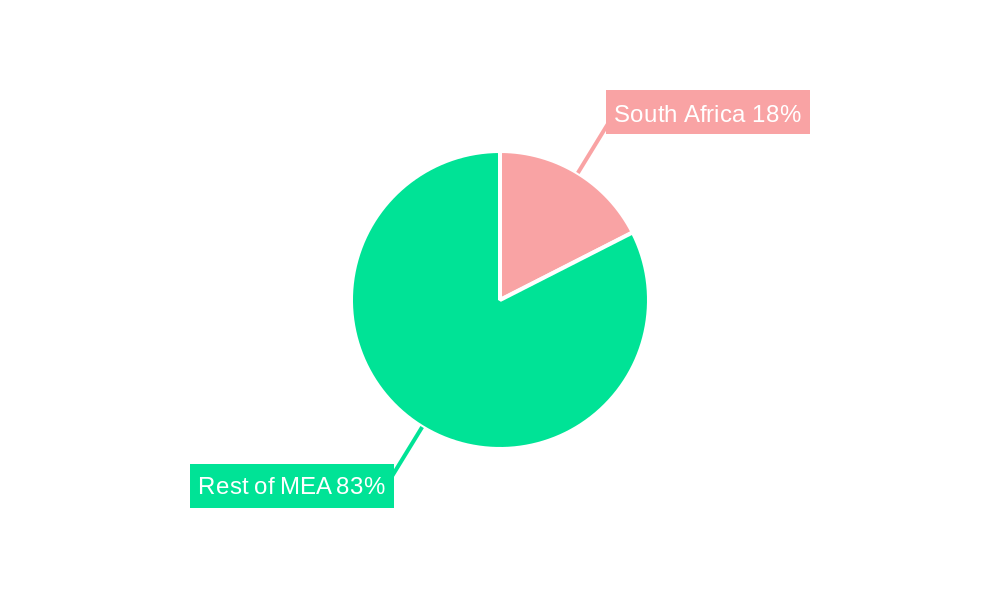

The South African confectionery market, a significant segment within the broader Middle East and Africa region, exhibits robust growth potential. While precise market size figures for South Africa are not provided, considering the overall MEA market size and applying a reasonable proportion based on South Africa's economic strength and population relative to other MEA nations (estimating South Africa's share at roughly 15-20% of the MEA market), we can project a 2025 market size in the range of $150-$200 million USD. This market is propelled by several key drivers, including rising disposable incomes, a growing urban population with changing lifestyles favoring convenient snacks, and the increasing popularity of various confectionery types beyond traditional chocolate, such as gummies, jellies, and sugar-free alternatives catering to health-conscious consumers. The convenience store distribution channel dominates, benefiting from its wide reach and impulse buying opportunities. Online retail is also growing rapidly, facilitated by increased internet penetration and e-commerce platforms. However, challenges remain. Economic fluctuations within South Africa can impact consumer spending on discretionary items like confectionery. Furthermore, increasing health concerns and awareness of sugar consumption might moderate growth in certain segments unless manufacturers adapt with healthier alternatives. The competitive landscape is characterized by a mix of international giants (Nestlé, Mars, Mondelez) and local players, creating a dynamic market environment. Growth strategies are likely to focus on product diversification, strategic partnerships, and targeted marketing campaigns.

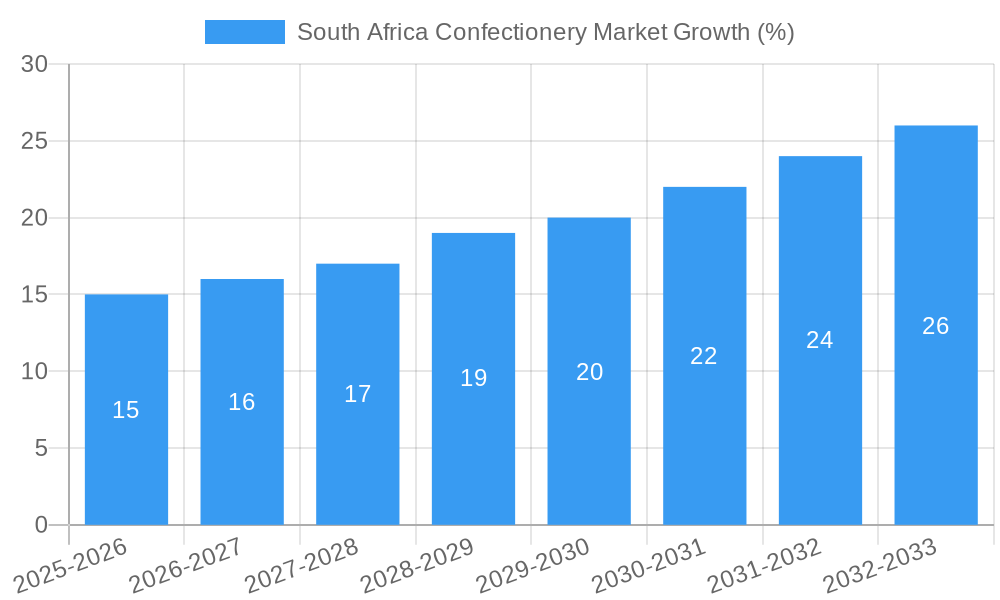

The forecast period (2025-2033) suggests continued expansion, driven by the factors mentioned above. The projected CAGR of 8.16% for the broader region provides a reasonable baseline, though the South African market's specific growth might vary slightly depending on the country's economic performance. Segmentation analysis reveals a significant presence of chocolate, but the "others" category (gummies, jellies etc.) is also expected to witness rapid growth reflecting changing consumer preferences. Strategic investments in online channels and the introduction of innovative, health-conscious confectionery products will be crucial for companies to capture increasing market share. Understanding the regional disparities within South Africa (urban vs. rural consumer behavior) will also be essential for effective market penetration.

South Africa Confectionery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South Africa confectionery market, offering valuable insights for businesses, investors, and stakeholders. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period of 2025-2033. The market is segmented by confectionery type (Chocolate, Others – including gummies, jellies, hard candies, and sugar-free options) and distribution channel (Convenience Stores, Online Retail Stores, Supermarket/Hypermarkets, and Others). Key players analyzed include Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, General Mills Inc, PepsiCo Inc, Tiger Brands, Premier Foods Pty, Abbott Laboratories, August Storck KG, Ferrero International SA, Mars Incorporated, Yıldız Holding AŞ, Arcor S.A.I.C., HARIBO Holding GmbH & Co KG, Mondelēz International Inc, The Hershey Company, and Kellogg Company. The report projects a market size of xx Million in 2025, experiencing a CAGR of xx% during the forecast period.

South Africa Confectionery Market Concentration & Innovation

The South African confectionery market exhibits a moderately concentrated structure, with a few multinational giants holding significant market share. Nestlé SA and Mondelēz International Inc. are expected to be among the leading players, holding approximately xx% and xx% market share respectively in 2025. Smaller local and regional players account for the remaining share, creating a competitive landscape.

Innovation Drivers:

- Growing demand for healthier confectionery options (sugar-free, low-calorie, and organic).

- Rising popularity of innovative flavors and product formats (e.g., vegan chocolates, protein bars).

- Increased adoption of sustainable packaging and sourcing practices.

Regulatory Framework:

The market is subject to food safety regulations and labeling requirements. Changes in these regulations can impact product development and pricing.

Product Substitutes:

Consumers have various alternatives, including fruits, nuts, and other snacks. Healthier confectionery options present a significant competitive threat.

End-User Trends:

- Shifting preferences towards premium and artisanal confectionery products.

- Growing demand for convenient and on-the-go snacking options.

- Increased emphasis on ethical and sustainable sourcing.

M&A Activities:

The past five years have witnessed a moderate level of M&A activity in the sector, primarily focused on expansion and portfolio diversification. The total value of M&A deals during 2019-2024 is estimated to be xx Million. Further consolidation is anticipated in the coming years.

South Africa Confectionery Market Industry Trends & Insights

The South African confectionery market is witnessing robust growth, driven by factors such as rising disposable incomes, increasing urbanization, and changing consumer lifestyles. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy growth rate during the forecast period (2025-2033). Market penetration for confectionery products is high, with a large proportion of the population regularly consuming these items.

Key growth drivers include:

- Rising Disposable Incomes: Increased purchasing power allows for higher spending on discretionary items like confectionery.

- Urbanization: Growing urban populations lead to higher demand for convenience foods, including confectionery products.

- Changing Consumer Lifestyles: Increased adoption of Westernized lifestyles contributes to elevated confectionery consumption.

- Product Innovation: The introduction of new flavors, formats, and healthier options enhances market appeal.

- Increased Online Retail Penetration: The expansion of e-commerce provides wider access to confectionery products.

Technological disruptions, such as advanced packaging and manufacturing techniques, are also playing a crucial role in enhancing the efficiency and production capacity of the industry.

Competitive dynamics remain intense, with both domestic and international players vying for market share through aggressive marketing strategies, new product launches, and distribution channel expansion.

Dominant Markets & Segments in South Africa Confectionery Market

The South African confectionery market is geographically diverse, with no single region exhibiting overwhelming dominance. However, urban areas and major metropolitan centers generally exhibit higher consumption rates due to higher population density and income levels.

Dominant Segments:

Chocolate: This segment remains the most significant contributor to overall market revenue, accounting for approximately xx% of the market in 2025. Growth is fueled by consumer preference for chocolate and the introduction of innovative products.

Others (Gummies, Jellies, Hard Candies, Sugar-Free Options): This segment demonstrates notable growth, driven by changing consumer preferences toward diverse flavors and healthier options. The market share of this segment is expected to reach xx% in 2025.

Distribution Channels: Supermarket/Hypermarkets maintain the largest market share in the distribution network, though online retail is growing rapidly.

Key Drivers:

- Economic policies: Government initiatives that support the growth of the food processing industry and the availability of credit.

- Infrastructure: Improved transportation and logistics networks facilitate efficient distribution of products across the country.

- Consumer preferences: Changing tastes and increased demand for convenience products.

South Africa Confectionery Market Product Developments

Recent years have witnessed significant product innovations within the South African confectionery market. The launch of vegan chocolate options by Lindt and the introduction of new flavors by Mondelēz highlight the industry's focus on meeting evolving consumer preferences. The growing health-consciousness is also driving the development of sugar-free and protein-enhanced confectionery. These developments reflect a greater focus on meeting consumer demands for healthier and more sustainable options. Technological trends, including advanced manufacturing processes and packaging solutions, are enhancing product quality, shelf life, and cost-effectiveness.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation of the South African confectionery market based on confectionery type and distribution channels.

Confectionery Type:

Chocolate: This segment includes various forms of chocolate, such as bars, candies, and cocoa products. The market size for chocolate is estimated at xx Million in 2025, with a projected CAGR of xx% during the forecast period. The market is characterized by intense competition amongst established players and new entrants.

Others (Gummies, Jellies, Hard Candies, Sugar-Free Options): This segment encompasses a wide range of confectionery products, with a projected market size of xx Million in 2025 and a CAGR of xx% during the forecast period. This segment reflects the rising demand for diversified tastes and healthier alternatives.

Distribution Channel:

Supermarket/Hypermarket: This remains the primary distribution channel, accounting for a majority of sales. Growth in this segment is projected to be xx% CAGR over the forecast period.

Convenience Stores: This channel plays a significant role in impulse purchases and is expected to grow at xx% CAGR over the forecast period.

Online Retail Stores: The e-commerce platform is rapidly expanding, with an expected CAGR of xx% over the forecast period, although its market share remains relatively small compared to traditional channels.

Others: This includes various other channels, such as vending machines and direct sales.

Key Drivers of South Africa Confectionery Market Growth

The South African confectionery market's growth is driven by a combination of factors, including:

- Rising disposable incomes and increasing urbanization, leading to higher discretionary spending.

- Evolving consumer preferences toward healthier options and innovative flavors, boosting demand for sugar-free and organic products.

- Effective marketing and branding strategies employed by leading players, attracting a wider consumer base.

- Government policies fostering business growth in the food and beverage sector.

Challenges in the South Africa Confectionery Market Sector

The South African confectionery market faces several challenges, including:

- Fluctuating raw material prices, significantly impacting production costs and profitability.

- Intense competition from both domestic and international players, requiring constant innovation and marketing efforts.

- Health concerns related to high sugar content, promoting a shift towards healthier alternatives.

- Economic downturns potentially reducing consumer spending on non-essential items like confectionery.

Emerging Opportunities in South Africa Confectionery Market

Emerging opportunities in the South African confectionery market include:

- Growing demand for premium and artisanal confectionery, opening doors for niche players.

- Expansion of e-commerce platforms creating potential for online sales growth.

- Increasing focus on health and wellness, driving the need for sugar-free and functional confectionery products.

- Exploring sustainable and ethically sourced ingredients to meet growing consumer expectations.

Leading Players in the South Africa Confectionery Market Market

- Nestlé SA

- Chocoladefabriken Lindt & Sprüngli AG

- Perfetti Van Melle BV

- General Mills Inc

- PepsiCo Inc

- Tiger Brands

- Premier Foods Pty

- Abbott Laboratories

- August Storck KG

- Ferrero International SA

- Mars Incorporated

- Yıldız Holding AŞ

- Arcor S.A.I.C.

- HARIBO Holding GmbH & Co KG

- Mondelēz International Inc

- The Hershey Company

- Kellogg Company

Key Developments in South Africa Confectionery Market Industry

July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa, expanding product offerings and catering to a growing consumer segment.

May 2023: Mondelēz International Inc. launched three new special edition Dairy Milk flavors, enhancing its product portfolio and driving consumer excitement.

April 2023: The Hershey Company launched a Peanut Butter & Jelly flavored protein bar under its ONE brand, tapping into health-conscious consumers and introducing a unique flavor combination. These developments show a trend towards innovation and catering to evolving consumer preferences in the South African confectionery market.

Strategic Outlook for South Africa Confectionery Market Market

The South African confectionery market presents significant growth potential over the forecast period. Continued innovation in product offerings, expanding distribution channels, and adapting to evolving consumer preferences will be crucial for success. Health-conscious consumers will continue to drive demand for healthier options, while premiumization and unique flavor profiles will also attract a significant segment of the market. Companies that adapt to these trends and effectively leverage emerging opportunities are well-positioned for strong growth in the years to come.

South Africa Confectionery Market Segmentation

-

1. Confections

-

1.1. Chocolate

-

1.1.1. By Confectionery Variant

- 1.1.1.1. Dark Chocolate

- 1.1.1.2. Milk and White Chocolate

-

1.1.1. By Confectionery Variant

-

1.2. Gums

- 1.2.1. Bubble Gum

-

1.2.2. Chewing Gum

-

1.2.2.1. By Sugar Content

- 1.2.2.1.1. Sugar Chewing Gum

- 1.2.2.1.2. Sugar-free Chewing Gum

-

1.2.2.1. By Sugar Content

-

1.3. Snack Bar

- 1.3.1. Cereal Bar

- 1.3.2. Fruit & Nut Bar

- 1.3.3. Protein Bar

-

1.4. Sugar Confectionery

- 1.4.1. Hard Candy

- 1.4.2. Lollipops

- 1.4.3. Mints

- 1.4.4. Pastilles, Gummies, and Jellies

- 1.4.5. Toffees and Nougats

- 1.4.6. Others

-

1.1. Chocolate

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

South Africa Confectionery Market Segmentation By Geography

- 1. South Africa

South Africa Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.16% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population

- 3.3. Market Restrains

- 3.3.1. Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 5.1.1. Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.1.1.1. Dark Chocolate

- 5.1.1.1.2. Milk and White Chocolate

- 5.1.1.1. By Confectionery Variant

- 5.1.2. Gums

- 5.1.2.1. Bubble Gum

- 5.1.2.2. Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.2.2.1.1. Sugar Chewing Gum

- 5.1.2.2.1.2. Sugar-free Chewing Gum

- 5.1.2.2.1. By Sugar Content

- 5.1.3. Snack Bar

- 5.1.3.1. Cereal Bar

- 5.1.3.2. Fruit & Nut Bar

- 5.1.3.3. Protein Bar

- 5.1.4. Sugar Confectionery

- 5.1.4.1. Hard Candy

- 5.1.4.2. Lollipops

- 5.1.4.3. Mints

- 5.1.4.4. Pastilles, Gummies, and Jellies

- 5.1.4.5. Toffees and Nougats

- 5.1.4.6. Others

- 5.1.1. Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Confections

- 6. UAE South Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. South Africa South Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia South Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA South Africa Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nestlé SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Chocoladefabriken Lindt & Sprüngli AG

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Perfetti Van Melle BV

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 General Mills Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PepsiCo Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Tiger Brands

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Premier Foods Pty

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Abbott Laboratories

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 August Storck KG

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Ferrero International SA

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Mars Incorporated

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Yıldız Holding A

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Arcor S A I C

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 HARIBO Holding GmbH & Co KG

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Mondelēz International Inc

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.16 The Hershey Company

- 10.2.16.1. Overview

- 10.2.16.2. Products

- 10.2.16.3. SWOT Analysis

- 10.2.16.4. Recent Developments

- 10.2.16.5. Financials (Based on Availability)

- 10.2.17 Kellogg Company

- 10.2.17.1. Overview

- 10.2.17.2. Products

- 10.2.17.3. SWOT Analysis

- 10.2.17.4. Recent Developments

- 10.2.17.5. Financials (Based on Availability)

- 10.2.1 Nestlé SA

List of Figures

- Figure 1: South Africa Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Confectionery Market Revenue Million Forecast, by Confections 2019 & 2032

- Table 3: South Africa Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South Africa Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE South Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa South Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia South Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA South Africa Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Confectionery Market Revenue Million Forecast, by Confections 2019 & 2032

- Table 11: South Africa Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South Africa Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Confectionery Market?

The projected CAGR is approximately 8.16%.

2. Which companies are prominent players in the South Africa Confectionery Market?

Key companies in the market include Nestlé SA, Chocoladefabriken Lindt & Sprüngli AG, Perfetti Van Melle BV, General Mills Inc, PepsiCo Inc, Tiger Brands, Premier Foods Pty, Abbott Laboratories, August Storck KG, Ferrero International SA, Mars Incorporated, Yıldız Holding A, Arcor S A I C, HARIBO Holding GmbH & Co KG, Mondelēz International Inc, The Hershey Company, Kellogg Company.

3. What are the main segments of the South Africa Confectionery Market?

The market segments include Confections, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Focus on Maintaining Health and Well-Being; Launching Supplements For Specific Purposes and Targeted Population.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Supplement Consumption and Their Side-effects; Inclination Towards Substitute Products.

8. Can you provide examples of recent developments in the market?

July 2023: Chocoladefabriken Lindt & Sprüngli AG launched a vegan chocolate range in South Africa. The products are available in two vegan flavors – Lindt Vegan Smooth Chocolate (made with oats and almonds to deliver a smooth, creamy texture) and Lindt Vegan Hazelnut Chocolate (made with roasted hazelnuts and premium vegan chocolate for a nutty flavor).May 2023: Under its brand, Mondelēz International Inc. launched three new special edition flavors that deliver indulgence with much-loved flavor combinations. The 150 g slabs include Dairy Milk Fudge Cookie Crumble, Fudge Mint Crisp, and Dream Coconut & Hazelnut Bliss.April 2023: Under the ONE brand, The Hershey Company launched the Peanut Butter & Jelly Flavored Protein Bar. The ONE Limited Edition Peanut Butter & Jelly flavored bars are packed with 20 g of protein, 1 g of sugar, and the familiar taste of peanut butter and strawberry jelly flavors.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Confectionery Market?

To stay informed about further developments, trends, and reports in the South Africa Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence