Key Insights

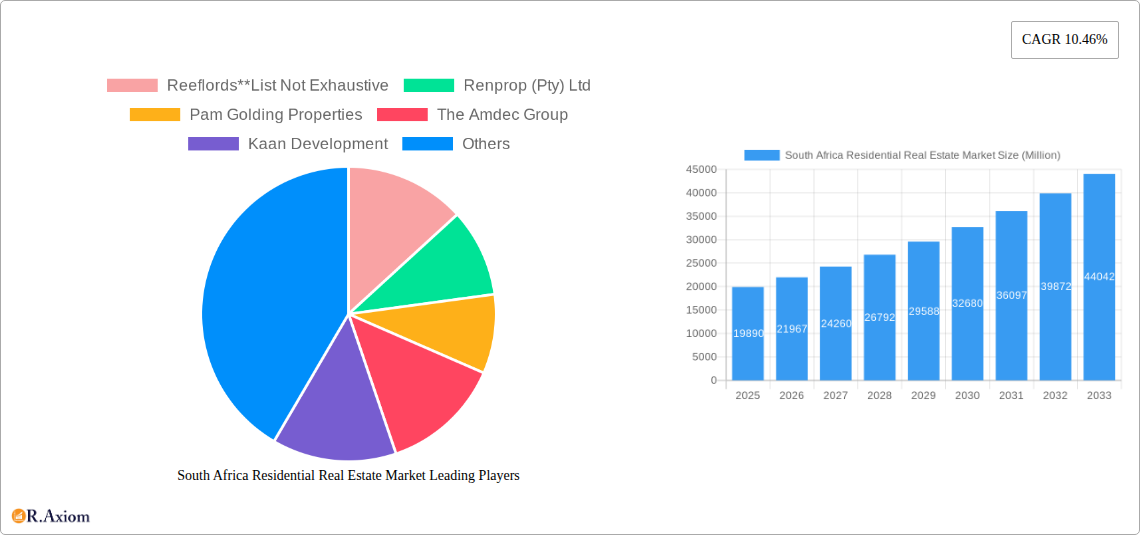

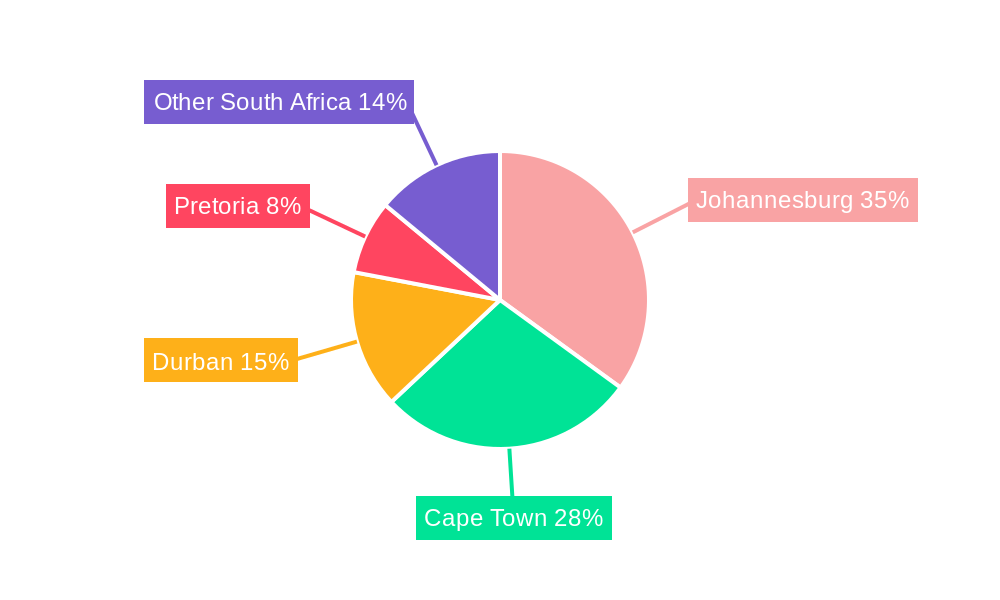

The South African residential real estate market, valued at $19.89 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 10.46% from 2025 to 2033. This expansion is driven by several key factors. A burgeoning middle class, coupled with increasing urbanization and a demand for improved housing infrastructure, fuels consistent demand. Government initiatives aimed at affordable housing and infrastructure development further contribute to market momentum. Furthermore, the popularity of specific locations like Johannesburg, Cape Town, and Durban, combined with a diverse range of housing types including villas, apartments, and condominiums, caters to a broad spectrum of buyer preferences, fueling market dynamism. The presence of significant players like Reeflords, Renprop, Pam Golding Properties, and Amdec Group underscores the market's maturity and potential for further growth. While challenges like fluctuating interest rates and economic volatility exist, the long-term outlook remains positive, anticipating substantial market expansion throughout the forecast period.

The segmentation of the market into key cities and property types provides valuable insights into regional disparities and consumer preferences. Johannesburg, Cape Town, and Durban, as major metropolitan areas, naturally command larger market shares. However, growth in secondary cities like Pretoria and Bloemfontein reflects the expanding reach of the market beyond traditional urban centers. The preference for specific property types, like villas and landed houses versus condominiums and apartments, is expected to shift in response to changing demographics and lifestyle preferences, influencing investment strategies and development plans within the sector. Competition among developers and real estate firms remains intense, driving innovation in design, construction, and marketing strategies. This competitive landscape ensures the delivery of quality homes at various price points, accommodating diverse buyer needs and furthering market expansion.

South Africa Residential Real Estate Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the South African residential real estate market, covering the period 2019-2033, with a focus on 2025. It examines market dynamics, key players, emerging trends, and future growth prospects, offering valuable insights for industry stakeholders, investors, and policymakers. The report segments the market by key cities (Johannesburg, Cape Town, Durban, Port Elizabeth, Bloemfontein, Pretoria, and Rest of South Africa) and property type (Villas and Landed Houses, Condominiums and Apartments).

South Africa Residential Real Estate Market Concentration & Innovation

This section analyzes the market concentration, highlighting the leading players and their market share. We examine innovation drivers, including technological advancements and sustainable building practices. The regulatory framework impacting the sector, the presence of product substitutes, prevailing end-user trends, and recent M&A activities are also discussed. We estimate that the top 5 players hold approximately xx% of the market share in 2025. M&A activity in the period 2019-2024 totaled approximately Rxx Million, with an average deal value of Rxx Million.

- Market Concentration: Highly fragmented market with a few dominant players.

- Innovation Drivers: Green building technologies, smart home integration, and demand for sustainable housing.

- Regulatory Framework: Analysis of existing regulations and their impact on market growth.

- Product Substitutes: Limited direct substitutes, but competition from alternative housing options.

- End-User Trends: Growing demand for secure estates, sustainable housing, and proximity to amenities.

- M&A Activities: Overview of significant mergers and acquisitions in the recent past.

South Africa Residential Real Estate Market Industry Trends & Insights

This section delves into the key trends shaping the South African residential real estate market. We analyze market growth drivers, such as population growth, urbanization, and economic development. We also explore technological disruptions, shifting consumer preferences (e.g., increased demand for eco-friendly homes), and the competitive landscape, analyzing the strategies employed by leading players. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration for green building technologies is expected to reach xx% by 2033.

Dominant Markets & Segments in South Africa Residential Real Estate Market

This section identifies the dominant segments within the South African residential real estate market. Both geographical and property type segments are analyzed.

By Key Cities: Johannesburg and Cape Town are expected to remain the dominant markets due to strong economic activity and infrastructure development.

By Type: Villas and landed houses continue to be the most popular choice, although the condominium and apartment market is growing rapidly, driven by urbanization and affordability concerns.

Detailed analysis of each city and property type will be provided, including specific drivers (economic policies, infrastructure investment etc.) and factors contributing to market dominance.

South Africa Residential Real Estate Market Product Developments

This section examines recent product innovations and advancements in the South African residential real estate market. We discuss technological trends like the integration of smart home technology and sustainable building materials, focusing on how these developments enhance the functionality, sustainability, and appeal of residential properties. The market is witnessing increased adoption of prefabricated housing and modular construction methods which offer shorter construction times and cost savings.

Report Scope & Segmentation Analysis

This report segments the South African residential real estate market by key cities (Johannesburg, Cape Town, Durban, Port Elizabeth, Bloemfontein, Pretoria, and Rest of South Africa) and property types (Villas and Landed Houses, Condominiums and Apartments). Each segment will have its specific growth projections, market size estimations (in Millions), and competitive dynamics detailed.

By Key Cities: Each city's market size, growth projections, and competitive landscape will be analyzed.

By Property Type: Growth projections, market size breakdowns, and competitive dynamics will be detailed for villas, landed houses, condominiums, and apartments.

Key Drivers of South Africa Residential Real Estate Market Growth

The growth of the South African residential real estate market is driven by several factors including: increasing urbanization, population growth, government initiatives to improve access to housing, and the growth of the middle class. Further contributing factors include favorable interest rates and investment in infrastructure, particularly in major cities.

Challenges in the South Africa Residential Real Estate Market Sector

Challenges facing the sector include high construction costs, land scarcity, and infrastructure deficits, particularly in peri-urban areas. Furthermore, strict regulations and bureaucratic hurdles can slow down projects, while fluctuating economic conditions impact consumer confidence and investment.

Emerging Opportunities in South Africa Residential Real Estate Market

Emerging opportunities include increasing investment in affordable housing, the development of eco-friendly housing solutions, and the growth of the rental market. Furthermore, the use of technology (e.g., proptech solutions) presents opportunities for efficiency gains and process improvement. Growth potential exists in developing secondary cities and providing housing solutions to the growing middle class.

Leading Players in the South Africa Residential Real Estate Market Market

- Reeflords

- Renprop (Pty) Ltd

- Pam Golding Properties

- The Amdec Group

- Kaan Development

- Pipilo Projects

- Devmark Property Group

- RDC Properties

- Harcourts International Ltd

- Legaro Property Development

Key Developments in South Africa Residential Real Estate Market Industry

- June 2022: Construction of Rubik, a new mixed-use building with luxury apartments, commenced in Cape Town's CBD.

- July 2022: IFC announced investment in Alleyroads, to build over 1,000 rental apartments in Johannesburg, focusing on affordable and sustainable housing.

Strategic Outlook for South Africa Residential Real Estate Market Market

The South African residential real estate market exhibits strong long-term growth potential. Continued urbanization, population growth, and government initiatives aimed at improving housing affordability will be key drivers of future growth. Opportunities lie in the development of innovative, sustainable housing solutions and strategic partnerships to address the housing shortage, particularly in affordable segments.

South Africa Residential Real Estate Market Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Condominiums and Apartments

-

2. Key Cities

- 2.1. Johannesburg

- 2.2. Cape Town

- 2.3. Durban

- 2.4. Port Elizabeth

- 2.5. Bloemfontein

- 2.6. Pretoria

- 2.7. Rest of South Africa

South Africa Residential Real Estate Market Segmentation By Geography

- 1. South Africa

South Africa Residential Real Estate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water

- 3.2.2 energy

- 3.2.3 transportation

- 3.2.4 and communications

- 3.3. Market Restrains

- 3.3.1. 4.; Lack of quality and quantity of infrastructure

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sectional Title Living in South Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Condominiums and Apartments

- 5.2. Market Analysis, Insights and Forecast - by Key Cities

- 5.2.1. Johannesburg

- 5.2.2. Cape Town

- 5.2.3. Durban

- 5.2.4. Port Elizabeth

- 5.2.5. Bloemfontein

- 5.2.6. Pretoria

- 5.2.7. Rest of South Africa

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. South Africa South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 7. Sudan South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 8. Uganda South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 9. Tanzania South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 10. Kenya South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 11. Rest of Africa South Africa Residential Real Estate Market Analysis, Insights and Forecast, 2019-2031

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Reeflords**List Not Exhaustive

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Renprop (Pty) Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Pam Golding Properties

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 The Amdec Group

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kaan Development

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Pipilo Projects

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Devmark Property Group

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 RDC Properties

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Harcourts International Ltd

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Legaro Property Development

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Reeflords**List Not Exhaustive

List of Figures

- Figure 1: South Africa Residential Real Estate Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Residential Real Estate Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: South Africa Residential Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 4: South Africa Residential Real Estate Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Africa South Africa Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Sudan South Africa Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Uganda South Africa Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Tanzania South Africa Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Kenya South Africa Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Rest of Africa South Africa Residential Real Estate Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: South Africa Residential Real Estate Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: South Africa Residential Real Estate Market Revenue Million Forecast, by Key Cities 2019 & 2032

- Table 14: South Africa Residential Real Estate Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Residential Real Estate Market?

The projected CAGR is approximately 10.46%.

2. Which companies are prominent players in the South Africa Residential Real Estate Market?

Key companies in the market include Reeflords**List Not Exhaustive, Renprop (Pty) Ltd, Pam Golding Properties, The Amdec Group, Kaan Development, Pipilo Projects, Devmark Property Group, RDC Properties, Harcourts International Ltd, Legaro Property Development.

3. What are the main segments of the South Africa Residential Real Estate Market?

The market segments include Type, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.89 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing urbanisation in the countries4.; Increasing support of private sector to meet infrastructural growth in various sectors such as water. energy. transportation. and communications.

6. What are the notable trends driving market growth?

Increasing Demand for Sectional Title Living in South Africa.

7. Are there any restraints impacting market growth?

4.; Lack of quality and quantity of infrastructure.

8. Can you provide examples of recent developments in the market?

July 2022- To improve access to affordable and sustainable housing in South Africa, IFC (International Finance Corporation) announced an investment to help South African residential property developer Alleyroads build over 1,000 rental apartments in the Johannesburg area.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Residential Real Estate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Residential Real Estate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Residential Real Estate Market?

To stay informed about further developments, trends, and reports in the South Africa Residential Real Estate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence