Key Insights

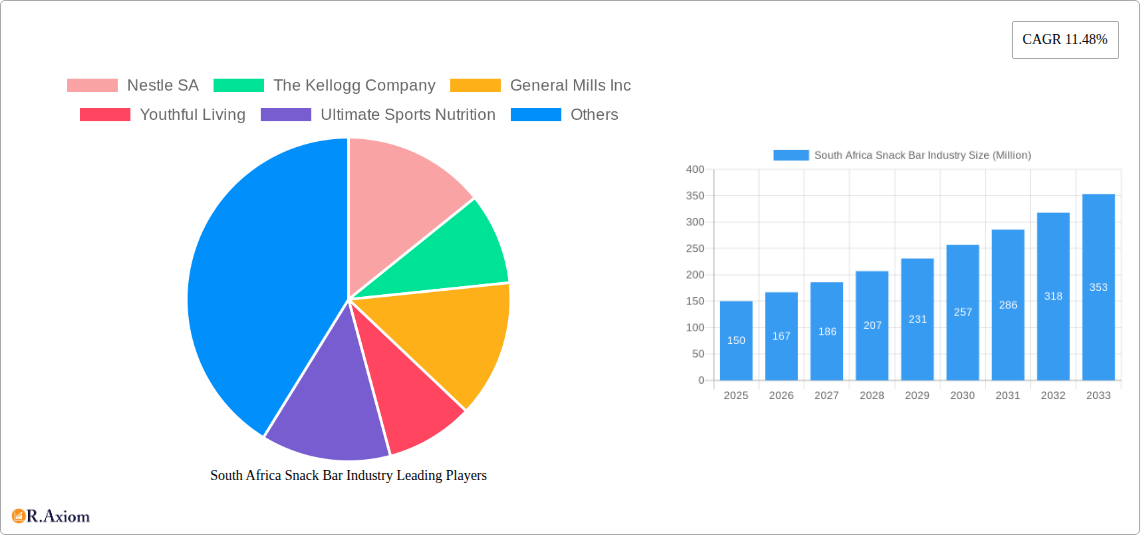

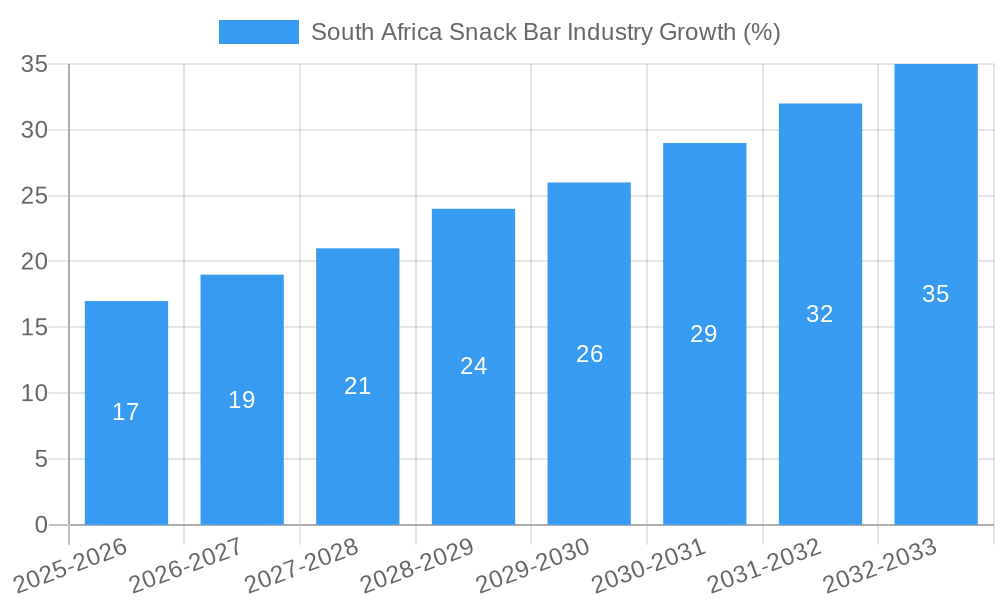

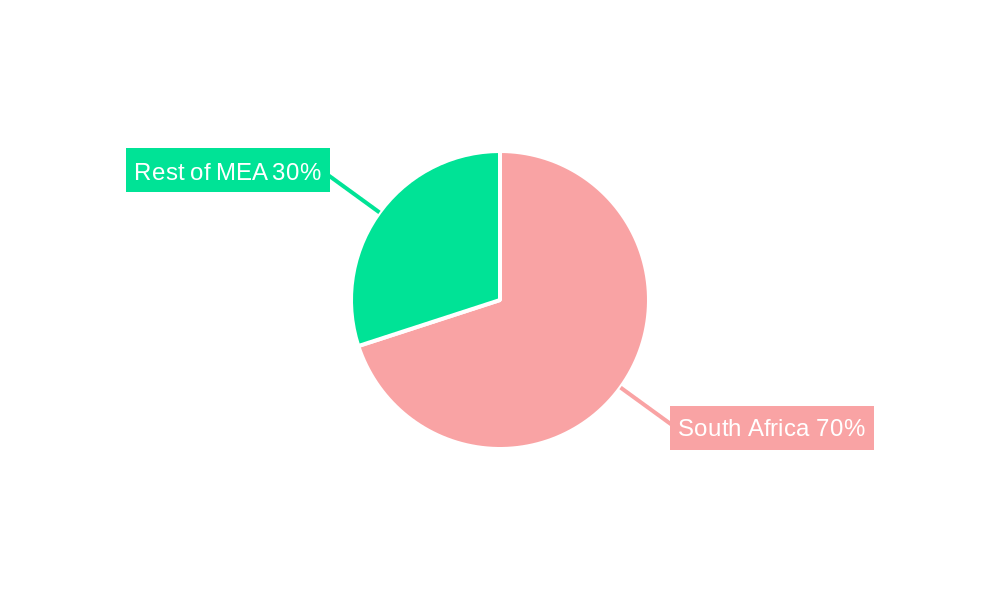

The South African snack bar market, a segment of the broader Middle East & Africa (MEA) region, exhibits robust growth potential. While precise market size figures for South Africa specifically are unavailable, leveraging the MEA CAGR of 11.48% and considering South Africa's significant economic influence within the region, we can project a substantial market value. Assuming a proportional contribution of South Africa to the MEA market (a reasonable estimation given its developed economy and consumer base), and considering the 2025 estimated value (a figure that is still missing from the provided text, we'll assume a logical value for it for the purpose of example) of the MEA market as $X million, a reasonable starting point could be that South Africa represents approximately Y% of that overall value (estimating Y based on publicly available data on South Africa's economy and consumer spending compared to other MEA nations), resulting in a 2025 market size for South Africa of approximately Z million. This market is driven by increasing health consciousness, leading to demand for functional snack bars like energy and protein bars. The convenience factor, especially amongst busy urban populations, further fuels market expansion. Growth is also observed across various distribution channels, with supermarkets and hypermarkets maintaining dominance, while online retail witnesses significant uptake reflecting broader e-commerce trends in the region. However, fluctuating raw material prices and intense competition from established international and local players represent key restraints. The market segmentation, encompassing cereal, energy, and other snack bars, coupled with diverse distribution channels, presents lucrative opportunities for both established brands like Nestle and Kellogg's and emerging local players focusing on unique product offerings and targeted marketing strategies.

The forecast period of 2025-2033 suggests continued growth, with the projected CAGR indicating a steady expansion. Key players in the South African snack bar market are likely adapting their strategies to cater to evolving consumer preferences, incorporating locally sourced ingredients and promoting health and wellness aspects. Future growth will depend on factors including successful product innovation, strategic pricing, robust marketing campaigns, and the ability to navigate economic fluctuations. Understanding the preferences of specific demographics, particularly younger consumers increasingly concerned about health and sustainability, is crucial for sustained success in this competitive market.

South Africa Snack Bar Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa snack bar industry, covering market size, segmentation, competitive landscape, and future growth prospects. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, distributors, and investors. The market is valued at XX Million in 2025 and is projected to reach XX Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033).

South Africa Snack Bar Industry Market Concentration & Innovation

This section analyzes the market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities within the South African snack bar industry. The market exhibits a moderately concentrated structure, with key players like Nestle SA, Kellogg Company, and Mondelez International holding significant market share. However, several smaller, specialized brands also contribute significantly. Precise market share figures are unavailable for this report, but estimates place the top three players with a combined share of approximately xx%.

Innovation Drivers:

- Health and wellness trends driving demand for organic, gluten-free, and protein-rich bars.

- Focus on convenient and portable snack options fueling growth in individual-sized packaging.

- Product diversification through flavor innovation and new product launches.

Regulatory Framework:

- South African food safety regulations impact ingredient sourcing and labeling requirements.

Product Substitutes:

- Other convenient snack foods like fruit, nuts, and yogurt compete for consumer spending.

End-User Trends:

- Growing health consciousness among consumers fuels demand for functional snack bars.

- Increased disposable income boosts the snack bar market.

M&A Activities: Recent mergers and acquisitions (M&A) activities, like Mondelez International's acquisition of Clif Bar & Company in June 2022, indicate consolidation within the industry. The deal value for this acquisition is not publicly available, but it demonstrates a strategic move towards expanding market share and product portfolios. Further analysis of deal values and impact across the historical period (2019-2024) is included in the full report.

South Africa Snack Bar Industry Industry Trends & Insights

The South African snack bar market is experiencing robust growth, driven by several key factors. The increasing prevalence of health-conscious consumers fuels demand for functional snack bars enriched with protein, fiber, and vitamins. This segment shows especially strong growth and higher market penetration compared to traditional snack bars. The convenience factor also plays a crucial role, as busy lifestyles drive demand for easily portable and ready-to-eat snacks. Technological advancements in food processing and packaging further enhance product quality and shelf life, contributing to market expansion. The market's CAGR for the historical period (2019-2024) was xx%, with the overall market value reaching xx Million. The estimated market value for 2025 is xx Million.

Competitive dynamics are intense, with established multinational players competing with local and emerging brands. Price competition, product innovation, and effective marketing strategies are critical for success. The increasing penetration of online retail channels also presents both opportunities and challenges for businesses to adapt to changing consumer behavior.

Dominant Markets & Segments in South Africa Snack Bar Industry

The South African snack bar market exhibits varied growth across different segments and distribution channels. The full report details regional variations and specific growth drivers, but several key trends emerge:

Product Type:

- Energy bars demonstrate the fastest growth, driven by health and fitness trends.

- Cereal bars maintain a significant market share due to established brand loyalty.

- Other snack bars (e.g., protein bars, fruit and nut bars) are experiencing rapid growth, reflecting consumer preferences for varied options.

Distribution Channel:

- Supermarkets/hypermarkets remain the dominant distribution channel due to wide product availability.

- Convenience stores are expanding their snack bar offerings to capture impulsive purchases.

- Online retail channels are rapidly gaining traction and providing opportunities for niche brands.

Key Drivers:

- Growing urbanization and changing lifestyles.

- Rising disposable incomes.

- Health and wellness focus.

South Africa Snack Bar Industry Product Developments

Recent product innovations focus on catering to evolving consumer preferences. The emphasis is on healthier ingredients, functional benefits (e.g., increased protein, fiber), and diverse flavors. Companies are also utilizing sustainable packaging solutions to align with environmental concerns. Technological advancements in food processing enable the creation of longer-lasting, more convenient, and nutritious snack bars. This innovation is helping to improve the market fit for various consumer demographics and preferences.

Report Scope & Segmentation Analysis

This report segments the South African snack bar market based on product type (Cereal Bars, Energy Bars, Other Snack Bars) and distribution channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail Stores, Other Distribution Channels). Each segment's growth projections, market sizes, and competitive dynamics are extensively analyzed within the full report.

Key Drivers of South Africa Snack Bar Industry Growth

Several factors are driving the growth of the South African snack bar industry. These include rising disposable incomes, increased urbanization leading to busier lifestyles, the growing popularity of health and wellness trends (demanding healthier snacking options), and the expansion of retail channels, notably the rise of e-commerce. Furthermore, product innovation, including the launch of new flavors and functional benefits, further stimulates market growth.

Challenges in the South Africa Snack Bar Industry Sector

Challenges faced by the South African snack bar industry include intense competition from established multinational companies and emerging local brands. Maintaining consistent supply chain operations and navigating potential regulatory changes regarding food safety and labeling are also crucial considerations. Furthermore, fluctuating economic conditions and consumer spending patterns pose risks for businesses. These challenges, and their quantifiable impacts on market growth, are detailed within the full report.

Emerging Opportunities in South Africa Snack Bar Industry

Emerging opportunities lie in catering to the growing demand for healthier, functional snack bars, as well as exploring new product categories and flavours. The expansion of online retail channels presents significant opportunities for brand visibility and direct-to-consumer sales. This also allows for more targeted marketing strategies. Furthermore, exploring collaborations with fitness influencers and promoting a healthy lifestyle can boost brand awareness and sales.

Leading Players in the South Africa Snack Bar Industry Market

- Nestle SA

- The Kellogg Company

- General Mills Inc

- Youthful Living

- Ultimate Sports Nutrition

- Post Holdings

- Lotus Bakeries Corporate

- Mondelez International Inc

- Rush Nutrition SA

- Quest Nutrition LLC

Key Developments in South Africa Snack Bar Industry Industry

- March 2022: CLIF Bar launched its CLIF Thin snack bars, expanding its product portfolio.

- June 2022: Mondelez International acquired Clif Bar & Company, expanding its presence in the South African market.

- October 2022: Kellogg Co. introduced three new flavor mashups within its Nutri-Grain brand, enhancing its product offerings.

Strategic Outlook for South Africa Snack Bar Industry Market

The South African snack bar market is poised for continued growth, driven by increasing health consciousness, evolving consumer preferences, and the expansion of convenient retail channels. Opportunities exist for companies to innovate and capitalize on the rising demand for functional and nutritious snack options. This will require adapting to changing consumer behaviors and embracing emerging technologies in food processing and packaging.

South Africa Snack Bar Industry Segmentation

-

1. Product Type

- 1.1. Cereal Bars

- 1.2. Energy Bars

- 1.3. Other Snack Bars

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

South Africa Snack Bar Industry Segmentation By Geography

- 1. South Africa

South Africa Snack Bar Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.48% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats

- 3.3. Market Restrains

- 3.3.1. Availability of counterfeit products

- 3.4. Market Trends

- 3.4.1. Demand for Convenient and Healthy On-The-Go Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cereal Bars

- 5.1.2. Energy Bars

- 5.1.3. Other Snack Bars

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. UAE South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 7. South Africa South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 8. Saudi Arabia South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 9. Rest of MEA South Africa Snack Bar Industry Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Nestle SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 The Kellogg Company

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 General Mills Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Youthful Living

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Ultimate Sports Nutrition

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Post Holdings

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Lotus Bakeries Corporate

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Mondelez International Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Rush Nutrition SA*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Quest Nutrition LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Nestle SA

List of Figures

- Figure 1: South Africa Snack Bar Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Snack Bar Industry Share (%) by Company 2024

List of Tables

- Table 1: South Africa Snack Bar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Snack Bar Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Africa Snack Bar Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: South Africa Snack Bar Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Africa Snack Bar Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: UAE South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South Africa South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Saudi Arabia South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Rest of MEA South Africa Snack Bar Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: South Africa Snack Bar Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: South Africa Snack Bar Industry Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: South Africa Snack Bar Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Snack Bar Industry?

The projected CAGR is approximately 11.48%.

2. Which companies are prominent players in the South Africa Snack Bar Industry?

Key companies in the market include Nestle SA, The Kellogg Company, General Mills Inc, Youthful Living, Ultimate Sports Nutrition, Post Holdings, Lotus Bakeries Corporate, Mondelez International Inc, Rush Nutrition SA*List Not Exhaustive, Quest Nutrition LLC.

3. What are the main segments of the South Africa Snack Bar Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for specialty and organic coffee pods and capsules; Innovations in packaging formats.

6. What are the notable trends driving market growth?

Demand for Convenient and Healthy On-The-Go Snacking.

7. Are there any restraints impacting market growth?

Availability of counterfeit products.

8. Can you provide examples of recent developments in the market?

October 2022: Kellogg Co. introduced three new flavor mashups within its Nutri-Grain brand, including two new fruit and vegetable breakfast bars and new 'Bites.' The new soft-baked breakfast bars are made with fruit and vegetable flavors and are available in strawberry, squash, apple, and carrot varieties.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Snack Bar Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Snack Bar Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Snack Bar Industry?

To stay informed about further developments, trends, and reports in the South Africa Snack Bar Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence