Key Insights

The South American primary battery market, encompassing alkaline, NiCd, NiMH, and other battery types, is projected for sustained expansion. Key growth drivers include increasing urbanization, industrialization, and the rising adoption of consumer electronics across Brazil, Argentina, and the wider region. The market is estimated to reach $5.3 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 6.6%. Demand is robust across consumer electronics, healthcare, and industrial sectors, with a growing preference for disposable power sources in areas with limited grid access. Alkaline batteries currently dominate the market due to cost-effectiveness, while NiMH batteries are anticipated to exhibit higher growth driven by environmental concerns and demand for rechargeable solutions.

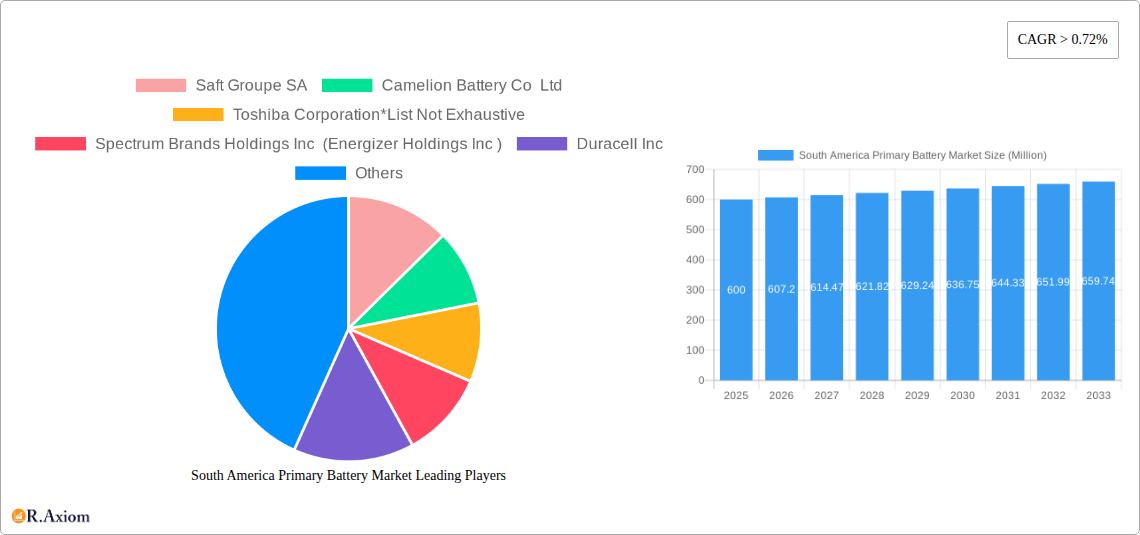

South America Primary Battery Market Market Size (In Billion)

Market challenges include raw material price volatility, stringent environmental regulations, and competition from rechargeable alternatives. Leading players such as Saft Groupe SA, Camelion Battery Co Ltd, Toshiba Corporation, Energizer Holdings Inc, Duracell Inc, and Panasonic Corporation are actively engaged in product innovation, strategic alliances, and regional expansion. Future market performance will be influenced by regional economic growth, technological advancements, and government policies supporting sustainable energy.

South America Primary Battery Market Company Market Share

This comprehensive report analyzes the South America Primary Battery Market, offering critical insights for stakeholders, investors, and decision-makers. The forecast period is 2025-2033, with 2024 serving as the base year. Key market segments include Primary Alkaline Battery, Nickel-cadmium (NiCD) Battery, Nickel-metal Hydride (NiMH) Battery, and Other Types. The competitive landscape features detailed profiles of major players, including Saft Groupe SA, Camelion Battery Co Ltd, Toshiba Corporation, Spectrum Brands Holdings Inc (Energizer Holdings Inc), Duracell Inc, and Panasonic Corporation.

South America Primary Battery Market Concentration & Innovation

The South America primary battery market exhibits a moderately concentrated landscape, with a few major players holding significant market share. However, the presence of numerous regional and smaller players fosters competition. Market share data for 2024 indicates that the top 5 players collectively hold approximately xx% of the market, with the remaining share distributed amongst smaller players. Innovation is driven by the demand for higher energy density, longer lifespan batteries, and improved safety features. Regulatory frameworks, including environmental regulations concerning battery disposal and raw material sourcing, significantly impact the industry. Product substitutes, such as rechargeable batteries, pose a competitive threat, influencing market growth. End-user trends, especially within consumer electronics and industrial applications, are shaping demand. M&A activities have been relatively limited in recent years; however, predicted deal values for 2025 are estimated at xx Million, primarily focused on strengthening supply chains and expanding product portfolios.

South America Primary Battery Market Industry Trends & Insights

The South America primary battery market is experiencing steady growth, driven by increasing demand across various sectors. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at xx%. Market penetration of primary batteries remains high, particularly in regions with limited access to reliable electricity grids. Technological disruptions, such as advancements in battery chemistry and improved manufacturing processes, are gradually enhancing battery performance and reducing costs. Consumer preferences are shifting towards higher-capacity and longer-lasting batteries. Competitive dynamics are shaped by pricing strategies, product differentiation, and brand recognition. The market is also influenced by fluctuations in raw material prices and geopolitical factors.

Dominant Markets & Segments in South America Primary Battery Market

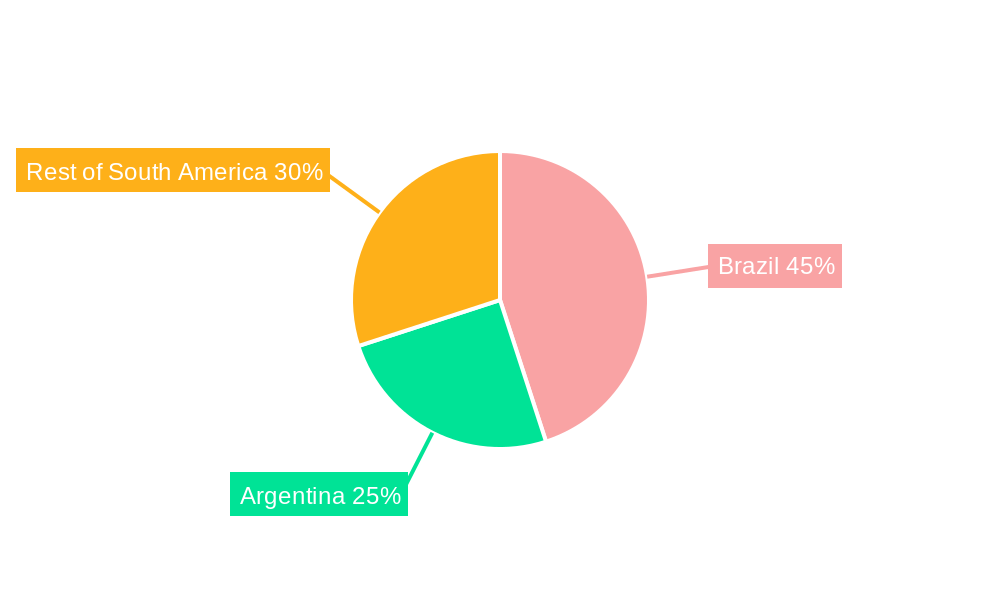

Dominant Region: Brazil holds the largest market share in South America, driven by its large population and diverse industrial base.

Dominant Country: Brazil's dominance stems from factors like robust economic growth, expanding industrial activity (especially in automotive and consumer electronics), and a well-established distribution network. Other countries, including Argentina and Colombia, exhibit significant, albeit smaller, market shares.

Dominant Segment (Type): Primary alkaline batteries dominate the market, owing to their relatively low cost and wide applicability. However, the market share of other types like NiMH batteries is showing gradual growth, influenced by rising environmental awareness and the need for more sustainable solutions.

Key Drivers:

- Economic Growth: Strong GDP growth in several South American countries fuels demand across various sectors.

- Infrastructure Development: Investments in infrastructure projects increase the demand for primary batteries in industrial applications.

- Consumer Electronics Penetration: Rising penetration of consumer electronics fuels the need for primary batteries for powering various devices.

- Government Policies: Supportive government policies promoting sustainable energy solutions and industrial growth further influence market dynamics.

South America Primary Battery Market Product Developments

Recent product innovations have focused on improving energy density, extending battery life, and enhancing safety features. These advancements aim to improve market fit and cater to the evolving needs of various applications. The industry is witnessing a gradual shift towards more environmentally friendly battery chemistries. Competitive advantages are derived from factors such as advanced manufacturing processes, superior battery performance, and strong brand recognition. Technological trends like improved material science and miniaturization are driving product development.

Report Scope & Segmentation Analysis

This report segments the South America primary battery market by type:

Primary Alkaline Battery: This segment holds the largest market share due to its cost-effectiveness. Growth is projected at xx% CAGR during the forecast period. Competition is intense, with several major players vying for market share.

Nickel-cadmium (NiCD) Battery: This segment shows a relatively modest market share compared to alkaline batteries. However, it is expected to witness slow but steady growth driven by its niche applications.

Nickel-metal Hydride (NiMH) Battery: The NiMH segment is experiencing growth, albeit slowly, driven by its higher energy density compared to NiCd batteries.

Other Types: This segment encompasses other less commonly used primary battery types, and its market share is relatively small.

Key Drivers of South America Primary Battery Market Growth

Several factors fuel the growth of the South America primary battery market: increasing demand from consumer electronics, the expanding industrial sector, and the rising adoption of portable devices. Furthermore, government initiatives promoting sustainable energy solutions and industrial development further stimulate growth. Technological advancements in battery chemistry and manufacturing processes also contribute significantly. Economic growth in various South American countries is another major driver.

Challenges in the South America Primary Battery Market Sector

The South American primary battery market faces several challenges. Fluctuating raw material prices significantly impact production costs. Supply chain disruptions can lead to shortages and price volatility. Intense competition from established players and the emergence of new entrants pose a significant challenge. Stringent environmental regulations related to battery disposal and waste management add to operational complexities and costs.

Emerging Opportunities in South America Primary Battery Market

The South American primary battery market presents numerous opportunities. The growing demand for energy storage solutions in renewable energy applications presents a significant growth prospect. The increasing adoption of electric vehicles (EVs) is anticipated to create a substantial demand for batteries in the long term. The rising focus on sustainable and environmentally friendly battery technologies opens up opportunities for companies offering eco-friendly solutions. Expansion into untapped markets and regions within South America also presents growth prospects.

Leading Players in the South America Primary Battery Market Market

- Saft Groupe SA

- Camelion Battery Co Ltd

- Toshiba Corporation

- Spectrum Brands Holdings Inc (Energizer Holdings Inc)

- Duracell Inc

- Energizer Holdings Inc

- Panasonic Corporation

Key Developments in South America Primary Battery Market Industry

November 2022: Argentina launched its first lithium battery plant in La Plata, marking a significant step towards domestic lithium-ion battery production. This development is expected to reduce reliance on imports and stimulate the domestic battery industry.

December 2022: Argentina's Y-TEC YPF announced plans for a lithium battery manufacturing plant in Catamarca, further bolstering the country's position in the lithium-ion battery value chain. This initiative will contribute to the growth of the lithium-ion segment within the broader primary battery market.

Strategic Outlook for South America Primary Battery Market Market

The South American primary battery market is poised for continued growth, driven by robust economic growth, rising consumer spending, and expanding industrialization. The growing focus on sustainable energy solutions and technological advancements present significant opportunities for market players. Companies focusing on innovation, cost optimization, and sustainable practices are expected to thrive in this evolving market. The long-term outlook is positive, with significant potential for expansion and market penetration.

South America Primary Battery Market Segmentation

-

1. Type

- 1.1. Primary Alkaline Battery

- 1.2. Nickel-cadmium (NiCD) Battery

- 1.3. Nickel-metal Hydride (NiMH) Battery

- 1.4. Other Types

-

2. Geography

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Colombia

- 2.4. Rest of South America

South America Primary Battery Market Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Colombia

- 4. Rest of South America

South America Primary Battery Market Regional Market Share

Geographic Coverage of South America Primary Battery Market

South America Primary Battery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure

- 3.3. Market Restrains

- 3.3.1. Limited Investments to Support Medium-voltage Transmission Network

- 3.4. Market Trends

- 3.4.1. Primary Alkaline Battery to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary Alkaline Battery

- 5.1.2. Nickel-cadmium (NiCD) Battery

- 5.1.3. Nickel-metal Hydride (NiMH) Battery

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Brazil

- 5.2.2. Argentina

- 5.2.3. Colombia

- 5.2.4. Rest of South America

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Colombia

- 5.3.4. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Brazil South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Primary Alkaline Battery

- 6.1.2. Nickel-cadmium (NiCD) Battery

- 6.1.3. Nickel-metal Hydride (NiMH) Battery

- 6.1.4. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Brazil

- 6.2.2. Argentina

- 6.2.3. Colombia

- 6.2.4. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Argentina South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Primary Alkaline Battery

- 7.1.2. Nickel-cadmium (NiCD) Battery

- 7.1.3. Nickel-metal Hydride (NiMH) Battery

- 7.1.4. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Brazil

- 7.2.2. Argentina

- 7.2.3. Colombia

- 7.2.4. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Colombia South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Primary Alkaline Battery

- 8.1.2. Nickel-cadmium (NiCD) Battery

- 8.1.3. Nickel-metal Hydride (NiMH) Battery

- 8.1.4. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Brazil

- 8.2.2. Argentina

- 8.2.3. Colombia

- 8.2.4. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of South America South America Primary Battery Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Primary Alkaline Battery

- 9.1.2. Nickel-cadmium (NiCD) Battery

- 9.1.3. Nickel-metal Hydride (NiMH) Battery

- 9.1.4. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Brazil

- 9.2.2. Argentina

- 9.2.3. Colombia

- 9.2.4. Rest of South America

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Saft Groupe SA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Camelion Battery Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Toshiba Corporation*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Spectrum Brands Holdings Inc (Energizer Holdings Inc )

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Duracell Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Energizer Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Panasonic Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.1 Saft Groupe SA

List of Figures

- Figure 1: South America Primary Battery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Primary Battery Market Share (%) by Company 2025

List of Tables

- Table 1: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 5: South America Primary Battery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: South America Primary Battery Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 11: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 14: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 15: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 17: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 18: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 20: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 21: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 23: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: South America Primary Battery Market Revenue billion Forecast, by Type 2020 & 2033

- Table 26: South America Primary Battery Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: South America Primary Battery Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: South America Primary Battery Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: South America Primary Battery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: South America Primary Battery Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Primary Battery Market?

The projected CAGR is approximately 6.6%.

2. Which companies are prominent players in the South America Primary Battery Market?

Key companies in the market include Saft Groupe SA, Camelion Battery Co Ltd, Toshiba Corporation*List Not Exhaustive, Spectrum Brands Holdings Inc (Energizer Holdings Inc ), Duracell Inc, Energizer Holdings Inc, Panasonic Corporation.

3. What are the main segments of the South America Primary Battery Market?

The market segments include Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Increase in Electricity Propelled by Growing Industrialization and Urbanization4.; Aging Power Sector Infrastructure.

6. What are the notable trends driving market growth?

Primary Alkaline Battery to Dominate the Market.

7. Are there any restraints impacting market growth?

Limited Investments to Support Medium-voltage Transmission Network.

8. Can you provide examples of recent developments in the market?

December 2022: Argentina's state-run Y-TEC YPF announced its plans to install a lithium battery manufacturing plant in the Catamarca. According to the deal signed, the company will produce cells, lithium-ion batteries, and active materials to add to the current work by the provincial mining company CAMYEN in Fiambal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Primary Battery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Primary Battery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Primary Battery Market?

To stay informed about further developments, trends, and reports in the South America Primary Battery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence