Key Insights

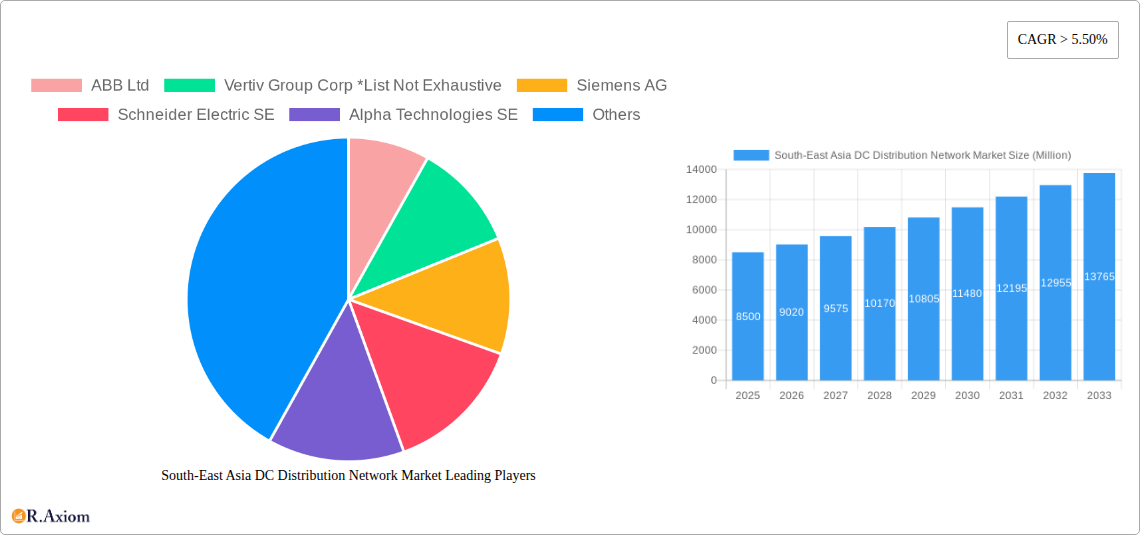

The South-East Asia DC Distribution Network Market is poised for substantial growth, driven by the escalating demand for efficient and reliable power distribution solutions across a diverse range of critical infrastructure. With a projected market size of approximately USD 8,500 million, the region is expected to witness a Compound Annual Growth Rate (CAGR) exceeding 5.50% from 2025 to 2033. This robust expansion is underpinned by several key drivers, including the rapid digitalization and increasing adoption of cloud computing, which necessitate more powerful and energy-efficient data centers. Furthermore, the burgeoning telecommunications sector, particularly the ongoing rollout of 5G networks, requires extensive deployment of remote cell towers that benefit significantly from DC distribution solutions for enhanced reliability and reduced energy loss. The growing emphasis on renewable energy integration and the electrification of transportation, especially the expansion of EV fast-charging infrastructure, also presents a significant opportunity for DC distribution networks to optimize power flow and charging efficiency.

South-East Asia DC Distribution Network Market Market Size (In Billion)

The market is segmented into crucial end-user applications, with Commercial Buildings, Remote Cell Towers, Data Centers, Military Applications, and EV Fast Charging Stations forming the primary demand centers. The geographical landscape is dominated by key economies like Thailand, Malaysia, and Indonesia, alongside the broader Rest of Southeast Asia, all actively investing in their power infrastructure to support economic development and technological advancement. Leading global players such as ABB Ltd, Vertiv Group Corp, Siemens AG, Schneider Electric SE, and Eaton Corporation Plc are actively participating in this dynamic market, offering innovative solutions and driving technological progress. Emerging trends point towards the increasing adoption of smart grid technologies, the development of more sophisticated microgrid solutions, and a strong focus on energy efficiency and sustainability within DC distribution networks, further fueling market expansion and innovation.

South-East Asia DC Distribution Network Market Company Market Share

South-East Asia DC Distribution Network Market Market Concentration & Innovation

The South-East Asia DC Distribution Network Market exhibits a moderately concentrated landscape, with key players like Siemens AG, Schneider Electric SE, and Vertiv Group Corp holding significant market share. Innovation is a crucial differentiator, driven by the burgeoning demand for efficient and reliable DC power solutions in data centers, commercial buildings, and remote cell towers. Companies are investing heavily in R&D to develop advanced technologies such as smart grid integration, energy storage solutions, and high-density power distribution units. Regulatory frameworks, while evolving, generally support the adoption of advanced DC distribution technologies, especially in countries with ambitious digital transformation agendas. Product substitutes, primarily AC distribution systems, are facing increasing competition from DC solutions due to their superior energy efficiency and suitability for modern electronic loads. End-user trends favor scalable, robust, and sustainable power infrastructure, pushing for DC solutions that minimize energy losses and enhance operational uptime. Merger and acquisition (M&A) activities are anticipated to rise as larger players seek to consolidate their market position and acquire innovative technologies. Recent M&A deals in the broader energy infrastructure space suggest a growing appetite for strategic acquisitions within the DC distribution network sector.

South-East Asia DC Distribution Network Market Industry Trends & Insights

The South-East Asia DC Distribution Network Market is experiencing robust growth, fueled by a confluence of technological advancements, expanding digital infrastructure, and increasing demand for energy efficiency. The region's rapid economic development and digital transformation initiatives are primary growth drivers, leading to a surge in data center construction, the deployment of 5G networks, and the electrification of transportation, all of which heavily rely on sophisticated DC distribution networks. Technological disruptions, such as the integration of AI and IoT in power management systems, are enhancing the intelligence and efficiency of DC distribution networks. These advancements enable predictive maintenance, real-time monitoring, and optimized energy consumption, leading to reduced operational costs and improved reliability. Consumer preferences are shifting towards sustainable and energy-efficient solutions, making DC distribution networks, with their inherent lower energy losses compared to AC counterparts, a more attractive option. The growing awareness of climate change and the push for greener energy solutions further bolster the adoption of DC power systems. Competitive dynamics are characterized by intense innovation and strategic partnerships among established global players and emerging regional vendors. The market penetration of advanced DC distribution solutions is steadily increasing across various end-use segments, driven by the need for higher power densities, reduced footprint, and enhanced flexibility in power delivery. The projected Compound Annual Growth Rate (CAGR) for the South-East Asia DC Distribution Network Market is robust, reflecting the region's dynamic economic landscape and its commitment to technological advancement. Key industry trends include the increasing modularity and scalability of DC power solutions, the growing importance of cybersecurity in power infrastructure, and the integration of renewable energy sources with DC grids. The demand for high-availability and fault-tolerant systems is paramount, especially in mission-critical applications like data centers and telecommunications infrastructure. The market is also witnessing a trend towards customized DC distribution solutions tailored to the specific needs of different end-users, from large hyperscale data centers to smaller enterprise facilities and remote infrastructure. The adoption of advanced cooling technologies alongside DC power distribution is also a significant trend, as both contribute to the overall efficiency and performance of IT infrastructure. Furthermore, the increasing adoption of electric vehicles (EVs) and the subsequent need for widespread EV fast-charging infrastructure are creating substantial new demand for reliable and high-capacity DC power distribution networks. Governments across the region are actively promoting the development of smart cities and digital economies, which directly translates into increased investment in the underlying power infrastructure, including advanced DC distribution networks.

Dominant Markets & Segments in South-East Asia DC Distribution Network Market

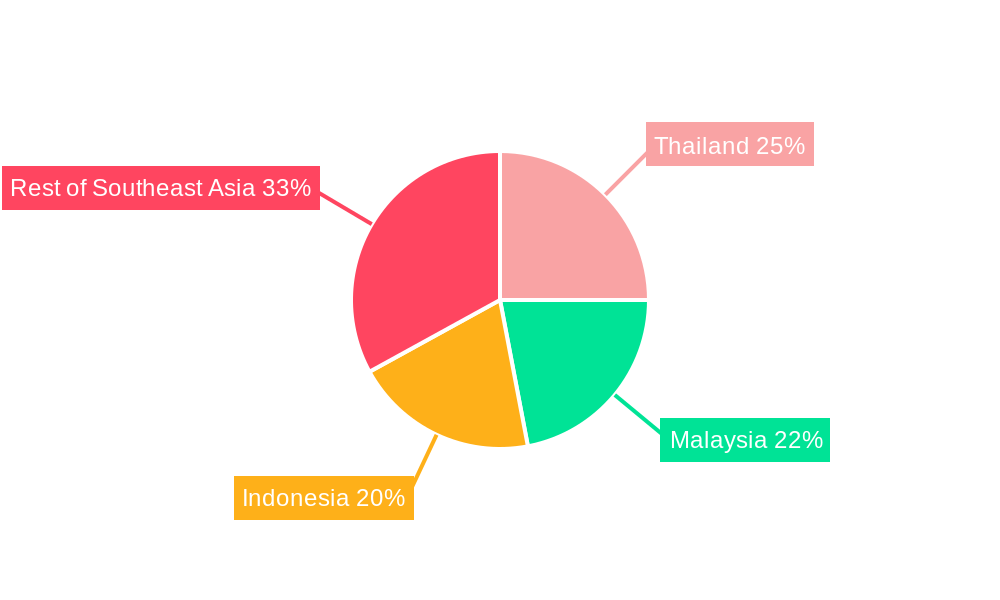

The South-East Asia DC Distribution Network Market is characterized by the dominance of certain geographies and end-user segments, driven by economic policies, existing infrastructure, and specific industry demands.

Leading Regions and Countries:

- Malaysia: Emerging as a significant hub for data center development and technological innovation, Malaysia presents a strong demand for advanced DC distribution networks. Government initiatives promoting digital economy growth and foreign direct investment in the tech sector are key drivers. The presence of established technology companies and a skilled workforce further bolsters its position.

- Indonesia: With its vast population and rapidly expanding digital economy, Indonesia is a key growth market. The country's ongoing digital transformation efforts, including the expansion of internet connectivity and the development of new data centers, are creating substantial opportunities for DC distribution network providers. Economic policies aimed at attracting tech investments are also influential.

- Thailand: Thailand's focus on developing its digital infrastructure and becoming a regional technology leader is fueling demand for efficient power solutions. The government's "Thailand 4.0" initiative emphasizes innovation and digital connectivity, necessitating robust DC distribution networks for its burgeoning IT sector.

- Rest of Southeast Asia: This segment, encompassing countries like Vietnam, Singapore, the Philippines, and Cambodia, represents a diverse and dynamic market. Vietnam, in particular, is seeing significant investment in data centers, as evidenced by recent announcements from state-run telecom groups. Singapore continues to be a mature market for data center infrastructure, while other nations are progressively investing in their digital capabilities, thereby increasing the demand for DC distribution networks.

Dominant End-User Segments:

- Data Centers: This is unequivocally the largest and most influential segment. The exponential growth of cloud computing, big data analytics, and the digital economy across South-East Asia is driving unprecedented demand for new data center facilities. These facilities require highly reliable, efficient, and scalable DC distribution networks to power their critical IT infrastructure, minimize energy losses, and ensure continuous operations. The need for higher power densities and improved energy efficiency makes DC distribution the preferred choice.

- Commercial Buildings: As buildings become smarter and incorporate more advanced building management systems, IoT devices, and energy-efficient lighting and HVAC, the demand for integrated and efficient power distribution solutions grows. DC distribution offers advantages in terms of energy savings and simplified integration of renewable energy sources for these modern commercial spaces.

- Remote Cell Towers: With the ongoing expansion of mobile networks, particularly 4G and the rollout of 5G, the need for reliable power at remote cell tower locations is critical. DC distribution networks provide an efficient and often more cost-effective solution for powering these distributed infrastructure nodes, especially when integrated with local renewable energy sources like solar power.

- EV Fast Charging Stations: The rapid adoption of electric vehicles across South-East Asia necessitates a robust and scalable charging infrastructure. High-power DC fast charging stations require significant DC power input, making advanced DC distribution networks essential for their deployment and operation. Government incentives and targets for EV adoption are driving this segment's growth.

- Military Applications: The defense sector relies on highly secure and reliable power systems for command centers, communication hubs, and operational bases. DC distribution networks offer inherent advantages in terms of efficiency, reduced electromagnetic interference, and potential for greater survivability in challenging environments.

- Other End Users: This category encompasses a wide range of applications, including industrial automation, telecommunications infrastructure beyond cell towers, and critical IT operations in various other sectors, all of which benefit from the efficiency and reliability offered by DC distribution networks.

South-East Asia DC Distribution Network Market Product Developments

Product developments in the South-East Asia DC Distribution Network Market are focused on enhancing efficiency, reliability, and scalability. Innovations include modular DC power systems that allow for easier expansion, intelligent power distribution units (PDUs) with advanced monitoring and control capabilities, and integrated solutions that combine power distribution with battery storage and renewable energy management. Companies are also developing high-density power solutions to reduce the physical footprint of equipment, crucial for space-constrained data centers. The competitive advantage lies in offering solutions that minimize energy losses, improve uptime, and facilitate seamless integration with existing and future IT infrastructure.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the South-East Asia DC Distribution Network Market, segmented by end-user and geography.

- End-User Segmentation: The market is analyzed across Commercial Buildings, Remote Cell Towers, Data Centers, Military Applications, EV Fast Charging Stations, and Other End Users. Each segment is evaluated based on its current market size, projected growth rates, and key demand drivers, considering the specific power requirements and operational priorities of each end-user.

- Geographical Segmentation: The report covers Thailand, Malaysia, Indonesia, and the Rest of Southeast Asia. Detailed market sizes and growth projections are provided for each of these key geographical regions, taking into account their unique economic landscapes, regulatory environments, and levels of digital infrastructure development.

Key Drivers of South-East Asia DC Distribution Network Market Growth

The growth of the South-East Asia DC Distribution Network Market is propelled by several key factors. The escalating demand for data centers, driven by cloud computing and digital transformation, is a primary catalyst. The widespread rollout of 5G networks requires efficient power solutions for a denser infrastructure of cell towers. Furthermore, the increasing adoption of electric vehicles is spurring the development of high-power DC charging infrastructure. Government initiatives promoting digitalization and smart city development, alongside a growing emphasis on energy efficiency and sustainability, also significantly contribute to market expansion.

Challenges in the South-East Asia DC Distribution Network Market Sector

Despite its robust growth, the South-East Asia DC Distribution Network Market faces several challenges. The initial capital investment for advanced DC distribution systems can be a barrier for some smaller enterprises. Ensuring interoperability and standardization across different vendors' products can be complex. Skilled labor shortages for the installation and maintenance of sophisticated DC power infrastructure pose another hurdle. Furthermore, evolving regulatory landscapes and the need for robust cybersecurity measures to protect critical power infrastructure add to the complexity of market adoption.

Emerging Opportunities in South-East Asia DC Distribution Network Market

Emerging opportunities in the South-East Asia DC Distribution Network Market are abundant. The burgeoning e-commerce sector and the increasing adoption of IoT devices are creating sustained demand for data center expansion. The electrification of transportation presents a significant growth avenue with the expansion of EV charging networks. Opportunities also lie in developing smart grid solutions that integrate DC distribution with renewable energy sources, enhancing grid resilience and sustainability. Furthermore, the growing focus on edge computing and decentralized data processing will necessitate localized and efficient DC power solutions.

Leading Players in the South-East Asia DC Distribution Network Market Market

- ABB Ltd

- Vertiv Group Corp

- Siemens AG

- Schneider Electric SE

- Alpha Technologies SE

- SGA SA

- EPE Malaysia

- Eaton Corporation Plc

Key Developments in South-East Asia DC Distribution Network Market Industry

- April 2022: The state-run telecom group, Viettel, announced plans to build a new data center in Ho Chi Minh, Vietnam. The company has earmarked an investment of around USD 261 million for the project, indicating significant investment in data infrastructure and a corresponding need for advanced DC distribution networks in the region.

South-East Asia DC Distribution Network Market Segmentation

-

1. End User

- 1.1. Commercial Buildings

- 1.2. Remote Cell Towers

- 1.3. Data Centers

- 1.4. Military Applications

- 1.5. EV Fast Charging Stations

- 1.6. Other End Users

-

2. Geography

- 2.1. Thailand

- 2.2. Malaysia

- 2.3. Indonesia

- 2.4. Rest of Southeast Asia

South-East Asia DC Distribution Network Market Segmentation By Geography

- 1. Thailand

- 2. Malaysia

- 3. Indonesia

- 4. Rest of Southeast Asia

South-East Asia DC Distribution Network Market Regional Market Share

Geographic Coverage of South-East Asia DC Distribution Network Market

South-East Asia DC Distribution Network Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Several Government Plans for the Energy Transition in the Region

- 3.3. Market Restrains

- 3.3.1. 4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors

- 3.4. Market Trends

- 3.4.1. Data Centers Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End User

- 5.1.1. Commercial Buildings

- 5.1.2. Remote Cell Towers

- 5.1.3. Data Centers

- 5.1.4. Military Applications

- 5.1.5. EV Fast Charging Stations

- 5.1.6. Other End Users

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Thailand

- 5.2.2. Malaysia

- 5.2.3. Indonesia

- 5.2.4. Rest of Southeast Asia

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.3.2. Malaysia

- 5.3.3. Indonesia

- 5.3.4. Rest of Southeast Asia

- 5.1. Market Analysis, Insights and Forecast - by End User

- 6. Thailand South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End User

- 6.1.1. Commercial Buildings

- 6.1.2. Remote Cell Towers

- 6.1.3. Data Centers

- 6.1.4. Military Applications

- 6.1.5. EV Fast Charging Stations

- 6.1.6. Other End Users

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Thailand

- 6.2.2. Malaysia

- 6.2.3. Indonesia

- 6.2.4. Rest of Southeast Asia

- 6.1. Market Analysis, Insights and Forecast - by End User

- 7. Malaysia South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End User

- 7.1.1. Commercial Buildings

- 7.1.2. Remote Cell Towers

- 7.1.3. Data Centers

- 7.1.4. Military Applications

- 7.1.5. EV Fast Charging Stations

- 7.1.6. Other End Users

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Thailand

- 7.2.2. Malaysia

- 7.2.3. Indonesia

- 7.2.4. Rest of Southeast Asia

- 7.1. Market Analysis, Insights and Forecast - by End User

- 8. Indonesia South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End User

- 8.1.1. Commercial Buildings

- 8.1.2. Remote Cell Towers

- 8.1.3. Data Centers

- 8.1.4. Military Applications

- 8.1.5. EV Fast Charging Stations

- 8.1.6. Other End Users

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Thailand

- 8.2.2. Malaysia

- 8.2.3. Indonesia

- 8.2.4. Rest of Southeast Asia

- 8.1. Market Analysis, Insights and Forecast - by End User

- 9. Rest of Southeast Asia South-East Asia DC Distribution Network Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End User

- 9.1.1. Commercial Buildings

- 9.1.2. Remote Cell Towers

- 9.1.3. Data Centers

- 9.1.4. Military Applications

- 9.1.5. EV Fast Charging Stations

- 9.1.6. Other End Users

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Thailand

- 9.2.2. Malaysia

- 9.2.3. Indonesia

- 9.2.4. Rest of Southeast Asia

- 9.1. Market Analysis, Insights and Forecast - by End User

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ABB Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Vertiv Group Corp *List Not Exhaustive

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Siemens AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Schneider Electric SE

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Alpha Technologies SE

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 SGA SA

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 EPE Malaysia

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Eaton Corporation Plc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.1 ABB Ltd

List of Figures

- Figure 1: South-East Asia DC Distribution Network Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South-East Asia DC Distribution Network Market Share (%) by Company 2025

List of Tables

- Table 1: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 2: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 5: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 11: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: South-East Asia DC Distribution Network Market Revenue Million Forecast, by End User 2020 & 2033

- Table 14: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: South-East Asia DC Distribution Network Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South-East Asia DC Distribution Network Market?

The projected CAGR is approximately > 5.50%.

2. Which companies are prominent players in the South-East Asia DC Distribution Network Market?

Key companies in the market include ABB Ltd, Vertiv Group Corp *List Not Exhaustive, Siemens AG, Schneider Electric SE, Alpha Technologies SE, SGA SA, EPE Malaysia, Eaton Corporation Plc.

3. What are the main segments of the South-East Asia DC Distribution Network Market?

The market segments include End User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Several Government Plans for the Energy Transition in the Region.

6. What are the notable trends driving market growth?

Data Centers Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

4.; Increasing Adoption of Self-generated Renewable Power in the Residential and Commercial Sectors.

8. Can you provide examples of recent developments in the market?

April 2022: The state-run telecom group, Viettel, announced plans to build a new data center in Ho Chi Minh, Vietnam. The company has earmarked an investment of around USD 261 million for the project.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South-East Asia DC Distribution Network Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South-East Asia DC Distribution Network Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South-East Asia DC Distribution Network Market?

To stay informed about further developments, trends, and reports in the South-East Asia DC Distribution Network Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence