Key Insights

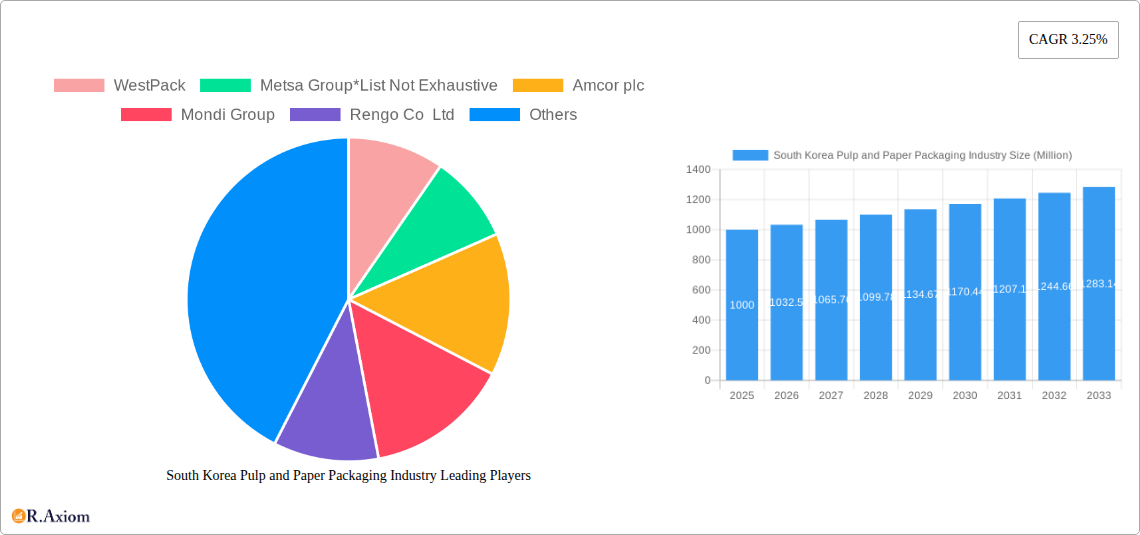

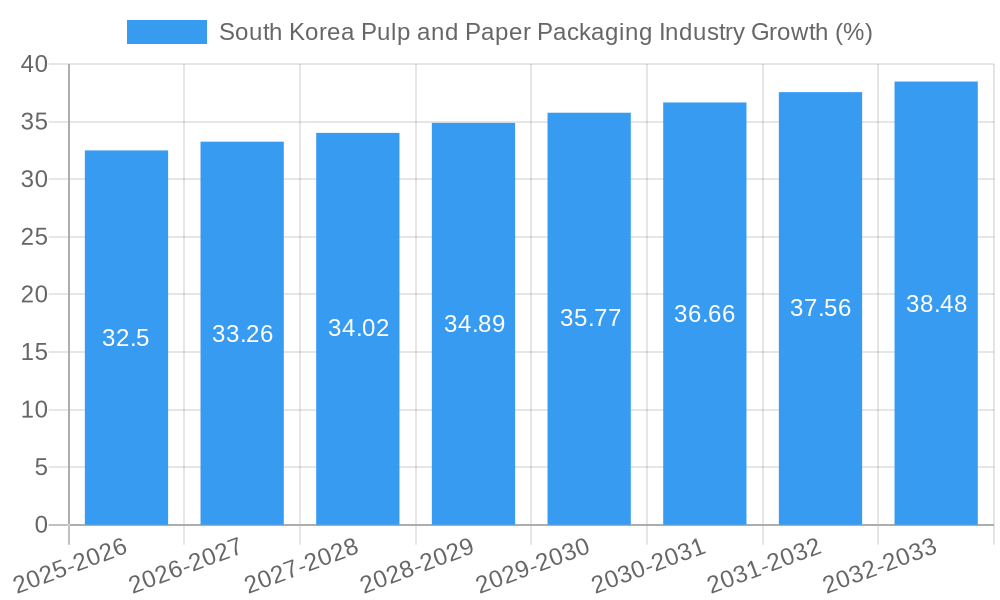

The South Korean pulp and paper packaging industry, valued at approximately $X million in 2025 (assuming a logical estimation based on the provided CAGR and market size), is projected to experience steady growth, driven primarily by the expanding food and beverage sector, the increasing demand for convenient and sustainable packaging solutions, and the growth of e-commerce fueling demand for corrugated boxes. The market's segmentation reveals a strong preference for folding cartons and corrugated boxes, while other product types like flexible paper packaging and liquid cartons are experiencing moderate growth, reflecting a shift towards diverse packaging needs across various industries. Key players like Amcor plc, Mondi Group, and Smurfit Kappa Group PLC are strategically positioned to capitalize on these trends, though competition is fierce. The 3.25% CAGR indicates a consistent expansion, although potential restraints include fluctuations in raw material prices (pulp) and increasing environmental regulations pushing for sustainable packaging solutions. The industry will need to adapt and innovate to meet these demands, focusing on eco-friendly materials and optimized packaging designs.

The forecast period (2025-2033) suggests continued expansion, with growth primarily fueled by increased consumer spending and industrial production. The food and beverage segment is expected to remain the largest revenue contributor, driven by the increasing demand for processed food and beverages. However, healthcare and personal care segments are poised for significant growth due to rising health consciousness and increased demand for hygiene products. The industry is expected to see a further diversification in product types, with an increasing focus on sustainable and innovative packaging solutions. Technological advancements in manufacturing processes and the adoption of automation will be crucial for maintaining competitiveness and optimizing production efficiency. The South Korean government's policies promoting sustainable practices and waste reduction will also significantly influence the industry's trajectory.

South Korea Pulp and Paper Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South Korea pulp and paper packaging industry, covering market size, growth drivers, challenges, and future opportunities. The study period spans from 2019 to 2033, with 2025 serving as both the base and estimated year. The report offers actionable insights for industry stakeholders, including manufacturers, investors, and policymakers. The forecast period extends from 2025 to 2033, while the historical period covers 2019-2024. Key players such as WestPack, Metsä Group, Amcor plc, Mondi Group, Rengo Co Ltd, International Paper Company, Smurfit Kappa Group PLC, DS Smith Plc, Sappi Limited, Oji Paper Co Ltd, Graphic Packaging International Corporation, and Tetra Laval Group are analyzed in detail. The report segments the market by end-user industry (Food and Beverage, Healthcare, Personal Care and Household Care, Industrial, Other End-user Industries) and product type (Folding Cartons, Corrugated Boxes, Other Product Types).

South Korea Pulp and Paper Packaging Industry Market Concentration & Innovation

This section analyzes the competitive landscape, innovation drivers, regulatory environment, and market dynamics within the South Korean pulp and paper packaging industry. Market concentration is assessed through metrics such as market share held by leading players. The report examines the role of innovation, including advancements in sustainable packaging and material science, in shaping the industry's growth trajectory. Furthermore, the impact of regulatory frameworks on production processes and material sourcing is explored. The influence of product substitutes, particularly alternative packaging materials like plastics and bioplastics, and the prevalence of mergers and acquisitions (M&A) activity, including the value of recent deals, is also discussed. The xx Million market is characterized by a moderate level of concentration, with the top five players holding an estimated xx% market share in 2025. Significant M&A activity has been observed in recent years, with deal values exceeding xx Million in the past five years. Key innovation drivers include increasing demand for sustainable packaging solutions and advancements in barrier coating technologies. Stricter environmental regulations are pushing companies towards eco-friendly alternatives, while growing e-commerce necessitates innovative packaging solutions.

South Korea Pulp and Paper Packaging Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the South Korean pulp and paper packaging market. The analysis encompasses market growth drivers, technological advancements impacting production and distribution, evolving consumer preferences (e.g., sustainability concerns), and the intensifying competitive dynamics. Specific metrics, including the Compound Annual Growth Rate (CAGR) and market penetration rates for key segments, are presented. The South Korean pulp and paper packaging market is projected to experience a CAGR of xx% during the forecast period (2025-2033), driven by factors such as rising consumer spending, growth in the food and beverage sector, and increasing demand for sustainable packaging solutions. Technological disruptions, such as the introduction of Hansol EB Eco Barrier, are increasing market competition, while consumer preference for eco-friendly and convenient packaging is significantly impacting product design and material selection.

Dominant Markets & Segments in South Korea Pulp and Paper Packaging Industry

This section identifies and analyzes the leading segments within the South Korean pulp and paper packaging market, categorized by both end-user industry and product type. Key growth drivers for each dominant segment are highlighted using bullet points, while a detailed dominance analysis using paragraphs explains the factors contributing to their market leadership.

By End-user Industry:

- Food and Beverage: The food and beverage segment is projected to remain the dominant end-user industry, driven by the growth of packaged food and beverage consumption, coupled with increasing demand for sustainable packaging options within this sector.

- Other End-user Industries: This segment exhibits strong growth potential due to the increasing packaging demands across diverse sectors like pharmaceuticals, electronics, and cosmetics.

By Product Type:

- Corrugated Boxes: Corrugated boxes maintain their position as the most significant product type driven by their versatility and cost-effectiveness in various applications across numerous industries.

- Folding Cartons: This segment continues to thrive, benefiting from increasing demand across the food, beverage, and personal care industries, especially with the focus on smaller package sizes.

The dominance of specific segments is analyzed in detail, considering factors such as economic policies, infrastructure development, and consumer purchasing patterns.

South Korea Pulp and Paper Packaging Industry Product Developments

Recent innovations in paper packaging materials, especially those offering superior barrier properties and recyclability, like Hansol EB Eco Barrier, are driving significant advancements. These developments are leading to improved product preservation, reduced environmental impact, and enhanced convenience for consumers. The market fit of these new products is assessed based on their cost-effectiveness, functionality, and alignment with broader sustainability goals.

Report Scope & Segmentation Analysis

This report segments the South Korea pulp and paper packaging market by end-user industry (Food and Beverage, Healthcare, Personal Care and Household Care, Industrial, Other) and product type (Folding Cartons, Corrugated Boxes, Other Product Types). Each segment's growth projections, market size, and competitive dynamics are analyzed. For example, the food and beverage segment is expected to exhibit significant growth due to increasing demand for packaged food and beverage products, while the corrugated boxes segment will continue to dominate due to its versatility and cost-effectiveness. The other product types segment, encompassing flexible paper packaging and liquid cartons, shows strong growth potential given the evolving needs of consumer goods manufacturers and ongoing efforts to improve sustainability in packaging.

Key Drivers of South Korea Pulp and Paper Packaging Industry Growth

Growth in the South Korean pulp and paper packaging industry is fueled by several factors. Firstly, the expanding food and beverage sector, coupled with rising consumer disposable incomes, boosts demand for packaged goods. Secondly, advancements in packaging technologies, particularly those focused on sustainability and barrier properties, provide crucial competitive advantages. Thirdly, governmental policies promoting environmental sustainability and resource efficiency encourage the adoption of eco-friendly packaging materials.

Challenges in the South Korea Pulp and Paper Packaging Industry Sector

The South Korean pulp and paper packaging industry faces certain challenges. Fluctuations in raw material prices, particularly pulp, impact production costs and profitability. Stringent environmental regulations can increase compliance expenses. Intense competition from both domestic and international players necessitates continuous innovation and cost optimization to retain market share. Furthermore, disruptions in global supply chains can negatively impact production and delivery schedules. The potential impact of these challenges on the market is quantified wherever data is available.

Emerging Opportunities in South Korea Pulp and Paper Packaging Industry

Several opportunities exist for growth within the South Korean pulp and paper packaging industry. Growing e-commerce necessitates innovative packaging solutions to protect goods during transit. The increasing demand for sustainable and eco-friendly packaging presents opportunities for manufacturers offering biodegradable and recyclable materials. Expansion into new product segments and end-user industries, leveraging technological advancements, offers additional growth potential. Exploring export markets can also expand market reach and revenue streams.

Leading Players in the South Korea Pulp and Paper Packaging Industry Market

- WestPack

- Metsä Group

- Amcor plc (Amcor plc)

- Mondi Group (Mondi Group)

- Rengo Co Ltd (Rengo Co Ltd)

- International Paper Company (International Paper Company)

- Smurfit Kappa Group PLC (Smurfit Kappa Group PLC)

- DS Smith Plc (DS Smith Plc)

- Sappi Limited (Sappi Limited)

- Oji Paper Co Ltd (Oji Paper Co Ltd)

- Graphic Packaging International Corporation (Graphic Packaging International Corporation)

- Tetra Laval Group (Tetra Laval Group)

Key Developments in South Korea Pulp and Paper Packaging Industry Industry

- October 2022: Nestlé Confectionery's shift to recyclable, FSC-certified paper wrappers for Quality Street and KitKat demonstrates a significant move towards sustainable packaging within the food and beverage sector, influencing consumer preferences and industry practices.

- January 2022: The launch of Hansol EB (Eco Barrier) by Hansol Paper signifies a technological breakthrough in flexible paper packaging, offering a sustainable alternative to plastic and aluminum foil, potentially disrupting the market with its superior barrier properties.

Strategic Outlook for South Korea Pulp and Paper Packaging Industry Market

The South Korean pulp and paper packaging industry is poised for continued growth driven by a confluence of factors. Increasing consumer demand, technological innovation in sustainable packaging, and supportive government policies create a positive outlook. Opportunities exist in expanding e-commerce packaging, eco-friendly materials, and specialized packaging solutions across diverse industries. This presents significant potential for market expansion and profitability for established and emerging players alike.

South Korea Pulp and Paper Packaging Industry Segmentation

-

1. Product Type

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Other Pr

-

2. End-user Industry

- 2.1. Food and Beverage

- 2.2. Healthcare

- 2.3. Personal Care and Household Care

- 2.4. Industrial

- 2.5. Other End-user Industries

South Korea Pulp and Paper Packaging Industry Segmentation By Geography

- 1. South Korea

South Korea Pulp and Paper Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. E-Commerce to Drive the Market Growth; Growing Consumer Awareness on Paper Packaging

- 3.3. Market Restrains

- 3.3.1. ; Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. E-Commerce to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Pulp and Paper Packaging Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food and Beverage

- 5.2.2. Healthcare

- 5.2.3. Personal Care and Household Care

- 5.2.4. Industrial

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 WestPack

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Metsa Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amcor plc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mondi Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rengo Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Paper Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Smurfit Kappa Group PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DS Smith Plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sappi Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oji Paper Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Graphic Packaging International Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Tetra Laval Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 WestPack

List of Figures

- Figure 1: South Korea Pulp and Paper Packaging Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Korea Pulp and Paper Packaging Industry Share (%) by Company 2024

List of Tables

- Table 1: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 7: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: South Korea Pulp and Paper Packaging Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Pulp and Paper Packaging Industry?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the South Korea Pulp and Paper Packaging Industry?

Key companies in the market include WestPack, Metsa Group*List Not Exhaustive, Amcor plc, Mondi Group, Rengo Co Ltd, International Paper Company, Smurfit Kappa Group PLC, DS Smith Plc, Sappi Limited, Oji Paper Co Ltd, Graphic Packaging International Corporation, Tetra Laval Group.

3. What are the main segments of the South Korea Pulp and Paper Packaging Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

E-Commerce to Drive the Market Growth; Growing Consumer Awareness on Paper Packaging.

6. What are the notable trends driving market growth?

E-Commerce to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

October 2022: Nestle Confectionery, a food and beverage firm, updated the packaging for its Quality Street and KitKat brands to be more environmentally friendly. Paper wrapping for Quality Street and KitKat is now available from Nestle. The firm will switch out the dual foil and cellulose used to wrap their twist-wrapped candies with recyclable, FSC-certified paper wrappers. Nestlé will introduce the packaging for KitKat's two-finger items this month to roll it out across the complete line by 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Pulp and Paper Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Pulp and Paper Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Pulp and Paper Packaging Industry?

To stay informed about further developments, trends, and reports in the South Korea Pulp and Paper Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence