Key Insights

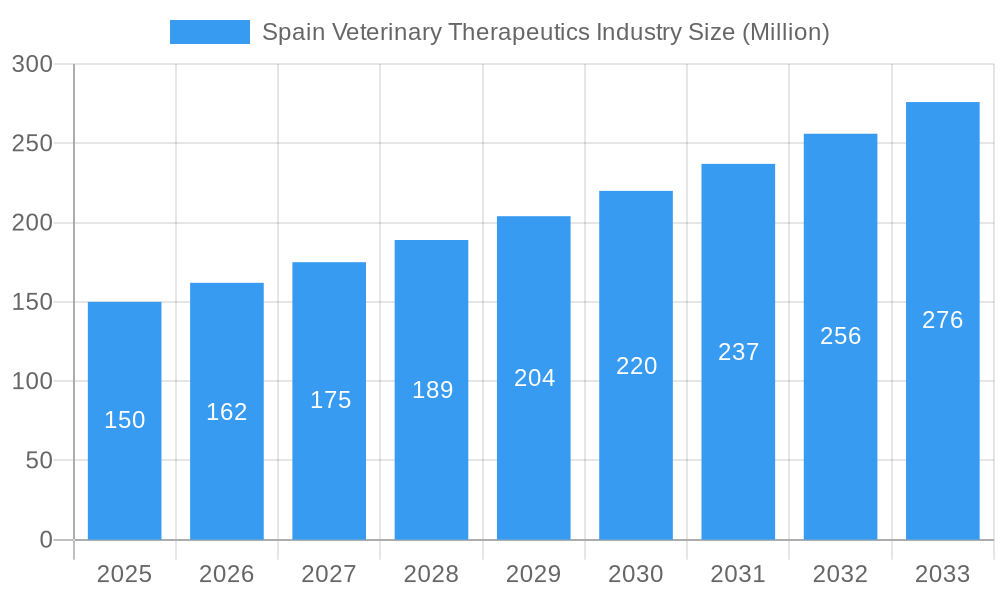

The Spain veterinary therapeutics market is projected to grow from an estimated 250 million in 2025 to achieve a Compound Annual Growth Rate (CAGR) of 7.1% through 2033. Key growth drivers include rising pet ownership, increasing pet humanization, and significant advancements in veterinary diagnostics and therapeutics. Growing owner awareness of preventative care also fuels demand for veterinary products. The market is segmented by product type (therapeutics, diagnostics) and animal type, with dogs and cats dominating, followed by horses, ruminants, swine, and poultry. Key competitors include multinational corporations such as Zoetis Inc., Boehringer Ingelheim International GmbH, and MSD Animal Health, alongside regional players like BioVet SA and Bioiberica S.A.U.

Spain Veterinary Therapeutics Industry Market Size (In Million)

Challenges to market growth include economic fluctuations impacting veterinary spending, stringent regulatory approval processes for new drugs, and susceptibility to livestock sector volatility. Nevertheless, sustained growth in pet ownership, enhanced pet health awareness, and ongoing technological innovations in veterinary therapeutics indicate a positive market trajectory. The companion animal segment is expected to remain dominant, while the livestock sector will likely see moderate expansion driven by demand for efficient animal production.

Spain Veterinary Therapeutics Industry Company Market Share

This report offers a comprehensive analysis of the Spain veterinary therapeutics industry, detailing market size, growth drivers, key players, and future projections from 2019 to 2033, with 2025 as the base year. The study provides actionable insights for manufacturers, distributors, investors, and regulatory bodies. The market is segmented by product (therapeutics, other therapeutics, diagnostics) and animal type (dogs and cats, horses, ruminants, swine, poultry, other animals). The market size was 250 million in the base year, 2025.

Spain Veterinary Therapeutics Industry Market Concentration & Innovation

The Spanish veterinary therapeutics market exhibits a moderately concentrated landscape, with key players like Zoetis Inc, MSD Animal Health, and Boehringer Ingelheim International GmbH holding significant market share. However, smaller, specialized companies like BioVet SA and Bioiberica S A U also contribute meaningfully, particularly in niche segments. The estimated market share of the top 3 players in 2025 is approximately XX%.

Innovation is driven by several factors:

- Growing pet ownership: Increased pet humanization fuels demand for advanced therapies and diagnostics.

- Technological advancements: Development of novel therapeutics and diagnostic tools, including biologics and point-of-care diagnostics.

- Regulatory changes: Evolving regulations impacting product approval and market access.

- Increased investment in R&D: Major players are continuously investing in research and development to bring innovative products to the market.

Mergers and acquisitions (M&A) activity has been moderate. Notable recent deals include VetPartners' acquisition of Spanish veterinary practices in January 2022, indicating consolidation trends within the industry. The estimated total value of M&A deals in the last 5 years is XX Million. Product substitution is influenced by price, efficacy, and ease of administration, with generic alternatives posing a competitive threat to branded products.

Spain Veterinary Therapeutics Industry Industry Trends & Insights

The Spanish veterinary therapeutics market is experiencing robust growth, driven by factors such as increasing pet ownership, rising veterinary healthcare expenditure, and enhanced animal welfare awareness. The Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033) is projected at XX%, with market penetration expected to reach XX% by 2033.

Technological disruptions, specifically the adoption of digital technologies in veterinary practice management and diagnostics, are significantly impacting the industry. Consumer preferences are shifting towards premium, specialized products with improved efficacy and safety profiles. Competitive dynamics are characterized by intense competition among multinational corporations and smaller, specialized companies, leading to continuous product innovation and pricing pressures.

Dominant Markets & Segments in Spain Veterinary Therapeutics Industry

Dominant Segments:

- By Animal Type: Dogs and cats constitute the largest segment, driven by high pet ownership and increased spending on pet healthcare.

- By Product: Therapeutics dominates, reflecting a high demand for treatment of various diseases and conditions.

Key Drivers of Segment Dominance:

- Dogs and Cats: High pet ownership rates, rising disposable incomes, and increased humanization of pets.

- Therapeutics: Prevalence of various animal diseases and increasing demand for effective treatments.

Regional Dominance: While data on specific regional dominance within Spain is limited, we can infer that densely populated urban areas likely exhibit higher market concentration due to higher pet ownership and greater access to veterinary services.

Spain Veterinary Therapeutics Industry Product Developments

Recent product innovations focus on targeted therapies, improved drug delivery systems, and advanced diagnostic tools. The market is witnessing a rise in biologics, personalized medicine approaches, and point-of-care diagnostic devices. These advancements are enhancing treatment efficacy, improving animal welfare, and streamlining veterinary practice workflows. Companies are emphasizing the safety and efficacy of their products to gain competitive advantages.

Report Scope & Segmentation Analysis

By Product:

- Therapeutics: This segment includes pharmaceuticals for treating various animal diseases. Growth is projected at XX% CAGR during the forecast period, driven by the increasing prevalence of animal diseases and advancements in therapeutic approaches. The market is moderately competitive.

- Other Therapeutics: This segment encompasses nutritional supplements, herbal remedies, and other therapeutic agents. The segment is expected to experience a CAGR of XX% owing to rising consumer preference for complementary therapies. The market is less concentrated than the Therapeutics segment.

- Diagnostics: This segment comprises various diagnostic tools and tests. Growth is driven by the increasing need for accurate and timely diagnosis, resulting in a projected CAGR of XX%. The market is moderately competitive, with both established and emerging players.

By Animal Type: The report provides detailed analysis of market size, growth projections, and competitive dynamics for each animal type, including dogs and cats, horses, ruminants, swine, poultry, and other animals. The dominance of companion animals (dogs and cats) in the market is analyzed.

Key Drivers of Spain Veterinary Therapeutics Industry Growth

Key growth drivers include:

- Rising pet ownership: The increasing humanization of pets is leading to higher veterinary spending.

- Growing awareness of animal health and welfare: This encourages pet owners to seek professional veterinary care.

- Advancements in veterinary therapeutics and diagnostics: Innovation leads to more effective treatments and diagnostic capabilities.

- Favorable government regulations: Supportive regulatory frameworks promote market growth.

Challenges in the Spain Veterinary Therapeutics Industry Sector

Challenges include:

- High cost of innovative therapeutics: Limited access to expensive treatments can restrict market growth. The impact is estimated to be XX% reduction in market reach for certain high-cost drugs.

- Stringent regulatory requirements: Complex approval processes can delay product launches.

- Competition from generic drugs: Price competition impacts profitability for branded drug manufacturers.

- Supply chain disruptions: Global supply chain vulnerabilities can impact product availability.

Emerging Opportunities in Spain Veterinary Therapeutics Industry

Emerging opportunities include:

- Growth of the companion animal segment: Focus on premium products and specialized services for companion animals.

- Technological advancements: Application of artificial intelligence and big data in diagnostics and therapeutics.

- Increased demand for preventive healthcare: Proactive approaches to animal health offer significant growth potential.

Leading Players in the Spain Veterinary Therapeutics Industry Market

- Ceva Animal Health Inc

- Boehringer Ingelheim International GmbH

- Bayer Healthcare

- BioVet SA

- MSD Animal Health

- SUPER'S DIANA S L

- LABORATORIOS EURISKO

- Bioiberica S A U

- S P Veterinaria

- Zoetis Inc

Key Developments in Spain Veterinary Therapeutics Industry Industry

- May 2022: TheraVet signs an exclusive distribution agreement with Nuzoa for BIOCERA-VET in Spain, expanding market access for osteoarticular disease treatments.

- January 2022: VetPartners acquires its first veterinary practices in Spain, signifying increased industry consolidation.

Strategic Outlook for Spain Veterinary Therapeutics Industry Market

The Spanish veterinary therapeutics market exhibits strong growth potential, fueled by increasing pet ownership, rising veterinary spending, and ongoing technological advancements. Opportunities lie in developing innovative products, leveraging digital technologies, and expanding into underserved markets. The market is expected to experience continued consolidation, with larger players potentially acquiring smaller companies to expand their product portfolios and market share. Focus on preventative care and personalized medicine will be crucial for future success.

Spain Veterinary Therapeutics Industry Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti-infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

Spain Veterinary Therapeutics Industry Segmentation By Geography

- 1. Spain

Spain Veterinary Therapeutics Industry Regional Market Share

Geographic Coverage of Spain Veterinary Therapeutics Industry

Spain Veterinary Therapeutics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Pollution Related to Allergens; Increasing Dog Ownership

- 3.3. Market Restrains

- 3.3.1. Lack of Veterinarians and Shortage of Skilled Farm Workers; Increasing Cost of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. Vaccines Segment is Expected to Witness Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Veterinary Therapeutics Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti-infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ceva Animal Health Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Boehringer Ingelheim International GmbH

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bayer Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BioVet SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MSD Animal Health

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUPER'S DIANA S L

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LABORATORIOS EURISKO

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bioiberica S A U

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 S P Veterinaria

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zoetis Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ceva Animal Health Inc

List of Figures

- Figure 1: Spain Veterinary Therapeutics Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Spain Veterinary Therapeutics Industry Share (%) by Company 2025

List of Tables

- Table 1: Spain Veterinary Therapeutics Industry Revenue million Forecast, by Product 2020 & 2033

- Table 2: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Spain Veterinary Therapeutics Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 4: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 5: Spain Veterinary Therapeutics Industry Revenue million Forecast, by Region 2020 & 2033

- Table 6: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Spain Veterinary Therapeutics Industry Revenue million Forecast, by Product 2020 & 2033

- Table 8: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Spain Veterinary Therapeutics Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 10: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 11: Spain Veterinary Therapeutics Industry Revenue million Forecast, by Country 2020 & 2033

- Table 12: Spain Veterinary Therapeutics Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Veterinary Therapeutics Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Spain Veterinary Therapeutics Industry?

Key companies in the market include Ceva Animal Health Inc, Boehringer Ingelheim International GmbH, Bayer Healthcare, BioVet SA, MSD Animal Health, SUPER'S DIANA S L, LABORATORIOS EURISKO, Bioiberica S A U, S P Veterinaria, Zoetis Inc.

3. What are the main segments of the Spain Veterinary Therapeutics Industry?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 250 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Pollution Related to Allergens; Increasing Dog Ownership.

6. What are the notable trends driving market growth?

Vaccines Segment is Expected to Witness Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Veterinarians and Shortage of Skilled Farm Workers; Increasing Cost of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

In May 2022, TheraVet, a pioneer in the treatment of osteoarticular diseases in pets, announced the signing of an exclusive distribution agreement with Nuzoa, a leading Spanish company in the distribution of veterinary products and services. This agreement will allow the distribution of the BIOCERA-VET product line in Spain.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Veterinary Therapeutics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Veterinary Therapeutics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Veterinary Therapeutics Industry?

To stay informed about further developments, trends, and reports in the Spain Veterinary Therapeutics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence