Key Insights

The global sperm bank market, valued at approximately $5.8 billion in 2025, is projected to grow at a compound annual growth rate (CAGR) of 5.1% from 2025 to 2033. Key drivers for this expansion include rising global infertility rates and advancements in assisted reproductive technologies (ART) such as in-vitro fertilization (IVF). Increased awareness of fertility preservation, particularly among cancer patients and individuals undergoing vasectomy, further fuels market demand. The growing prevalence of single parenthood and same-sex couple families also contributes to the increasing reliance on sperm banking services. The market is segmented by service (sperm storage, semen analysis, genetic counseling), donor type (known, anonymous, other), and end-user (pre-vasectomy patients, cancer patients, others). North America and Europe currently dominate market share due to higher ART adoption and acceptance of sperm donation. However, the Asia Pacific region is anticipated to experience substantial growth driven by increasing disposable incomes and rising awareness of fertility treatments in developing economies.

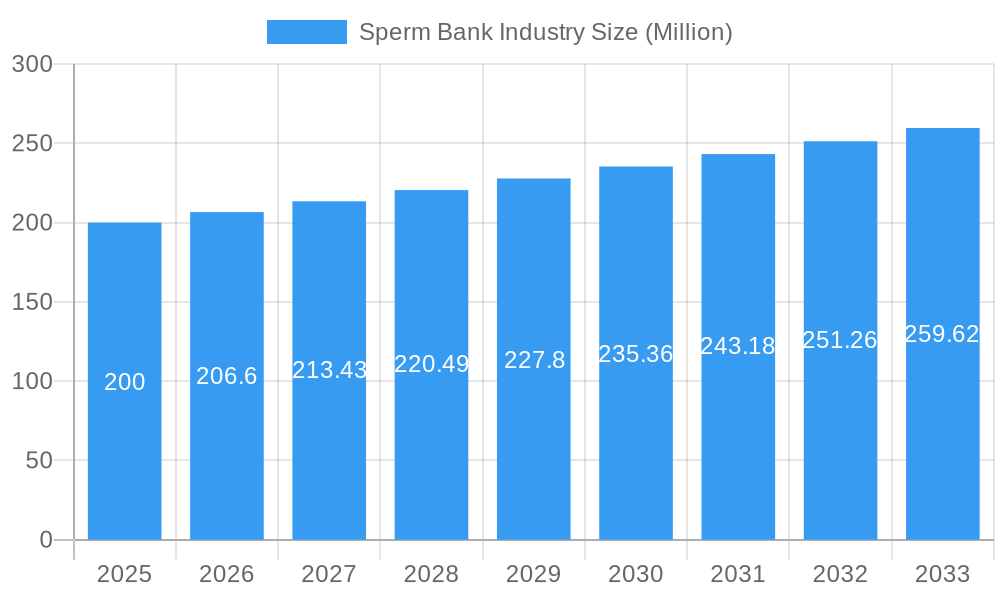

Sperm Bank Industry Market Size (In Billion)

Despite challenges such as stringent regulations, ethical considerations regarding donor anonymity, and the cost of ART procedures, the industry is bolstered by technological innovations in sperm preservation and genetic screening. The market's future remains positive, propelled by increasing demand and ongoing advancements in ART. Intense competition exists among established players like Fairfax Cryobank, CRYOS International, and New England Cryogenic Centre. Niche players focusing on specific segments, such as known donor programs or specialized genetic screening, are also gaining traction. The growing adoption of online platforms for sperm donor selection and recruitment is further shaping the industry landscape.

Sperm Bank Industry Company Market Share

Sperm Bank Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the global sperm bank industry, offering valuable insights for stakeholders including investors, industry professionals, and researchers. Covering the period from 2019 to 2033, with a focus on 2025, this report meticulously examines market trends, competitive landscapes, and future growth potential. The study period encompasses historical data (2019-2024), the base year (2025), and a detailed forecast (2025-2033). The report segments the market by service type (Sperm Storage, Semen Analysis, Genetic Consultant), donor type (Known Donor, Anonymous Donor, Other Donors), and end-user (Pre-vasectomy Patient, Cancer Patient, Other End Users), providing a granular understanding of market dynamics across various segments. The total market size is predicted to reach xx Million by 2033.

Sperm Bank Industry Market Concentration & Innovation

The sperm bank industry exhibits a moderately concentrated market structure, with a few major players holding significant market share. While precise market share data for each company is proprietary, CRYOS INTERNATIONAL INC and Fairfax Cryobank Inc are understood to be among the leading players, commanding a substantial portion of the global market. However, the presence of numerous regional and smaller players introduces a level of competition.

Market innovation is driven by several factors, including advancements in cryopreservation techniques, genetic screening technologies, and the increasing adoption of digital platforms for service delivery. Stringent regulatory frameworks governing sperm donation and storage vary across geographical regions, impacting market dynamics and creating regional variations in market concentration. The industry faces minimal direct product substitution, although alternative reproductive technologies such as in-vitro fertilization (IVF) represent indirect competition. End-user trends indicate a growing demand for known donor options and increased transparency around donor profiles.

Mergers and acquisitions (M&A) activity has been noticeable, with recent deals reflecting a push towards consolidation and technological integration. For example, Ro’s acquisition of Dadi in 2022 demonstrates the integration of technology and established sperm banking services. The total value of M&A deals within the last 5 years is estimated at xx Million.

- Key Market Players: CRYOS INTERNATIONAL INC, Fairfax Cryobank Inc, and others.

- Innovation Drivers: Technological advancements in cryopreservation, genetic screening, and digital platforms.

- Regulatory Landscape: Varies significantly across regions, influencing market access and competition.

- M&A Activity: Significant consolidation activity observed, with deal values totaling an estimated xx Million in the past five years.

Sperm Bank Industry Industry Trends & Insights

The sperm bank industry is experiencing robust growth, driven by several factors. The increasing prevalence of infertility, coupled with rising awareness of assisted reproductive technologies (ART), is a primary driver. Technological advancements, such as improved cryopreservation techniques and genetic screening methods, are enhancing the quality and safety of services, further fueling market expansion. Changing societal attitudes towards family planning and reproductive choices are also contributing to increased demand. The rising disposable incomes, particularly in developing economies, coupled with improved access to healthcare, are positively influencing market growth.

Consumer preferences are shifting towards known donor options and personalized services, pushing companies to enhance transparency and customization. The competitive landscape is dynamic, with established players expanding their service offerings and new entrants leveraging technological advancements. The Compound Annual Growth Rate (CAGR) for the industry is projected to be xx% during the forecast period (2025-2033). Market penetration remains relatively low in some regions, indicating significant untapped potential.

Dominant Markets & Segments in Sperm Bank Industry

The North American market currently holds the largest share of the global sperm bank industry, driven by high adoption rates of ART, strong regulatory support, and well-established industry players. Europe and Asia Pacific regions are also witnessing significant growth.

- Leading Region: North America

- Key Drivers (North America): High prevalence of infertility, strong regulatory frameworks supporting ART, well-established healthcare infrastructure, high disposable incomes.

- Leading Service Segment: Sperm Storage (accounts for the largest revenue share)

- Key Drivers (Sperm Storage): Long-term preservation needs, increasing demand for fertility treatments.

- Leading Donor Segment: Anonymous Donors (due to the concerns of privacy and donor identification)

- Key Drivers (Anonymous Donors): Preference for anonymity amongst clients, along with legal and ethical considerations in several jurisdictions.

- Leading End-User Segment: Pre-vasectomy patients (due to the increasing number of vasectomy procedures undertaken)

- Key Drivers (Pre-vasectomy patients): Increased awareness about fertility preservation options prior to vasectomy.

Other segments, like Semen Analysis and Genetic Consultant services are experiencing rapid growth, fueled by the increasing demand for comprehensive fertility assessments and genetic screening. The demand for known donors is growing in certain markets with changing cultural preferences.

Sperm Bank Industry Product Developments

Recent product innovations focus on improving cryopreservation techniques to enhance sperm viability and longevity. Advancements in genetic screening technologies enable the identification of genetic disorders, providing clients with more informed choices. The integration of digital platforms for online consultations, ordering, and tracking services is enhancing convenience and accessibility. The market is seeing the rise of at-home testing kits, which simplify the sperm testing process, further improving client convenience.

Report Scope & Segmentation Analysis

Service: This report segments the industry by services offered: Sperm Storage (growing steadily due to increasing demand for fertility treatments and preservation options), Semen Analysis (experiencing growth as awareness about fertility testing grows), and Genetic Consultant (growing due to enhanced genetic screening technology and increased demand for risk assessments).

Donor: The report also categorizes the industry based on donor types: Known Donor (growing in popularity due to a desire for more information and connection with donors), Anonymous Donor (still represents a major segment of the market), and Other Donors (this category covers specialized cases such as third-party donation, representing a smaller but significant portion of the market).

End User: The report considers diverse end-user segments including Pre-vasectomy Patient (growing demand driven by increasing vasectomy procedures), Cancer Patient (a critical segment requiring fertility preservation options), and Other End Users (which includes individuals using services for reasons not outlined in the other categories). Each segment's growth trajectory and competitive dynamics are thoroughly examined.

Key Drivers of Sperm Bank Industry Growth

The sperm bank industry's growth is propelled by several factors. Rising infertility rates globally are a key driver. Technological advancements such as improved cryopreservation and genetic testing methods contribute significantly to industry growth. Increased awareness of fertility preservation options among pre-vasectomy patients and cancer patients fuels demand. Furthermore, supportive regulatory environments and improving access to healthcare in many regions are significant contributors.

Challenges in the Sperm Bank Industry Sector

The sperm bank industry faces challenges, including stringent regulatory environments that vary geographically, imposing barriers to market entry and operations. Supply chain issues relating to the availability of qualified donors and maintaining high-quality cryopreservation materials can impact service delivery. Competition is intense, with both established players and new entrants vying for market share, placing pressure on pricing and profitability. Ethical concerns related to donor anonymity and genetic screening also represent ongoing challenges.

Emerging Opportunities in Sperm Bank Industry

Emerging opportunities exist in expanding services into new geographic markets with low market penetration. Technological advancements offer opportunities to improve existing services (e.g., faster, more accurate genetic screening). The growing demand for personalized services and increased transparency are also promising avenues for growth. The industry can explore partnerships with fertility clinics and healthcare providers to expand reach and service offerings.

Leading Players in the Sperm Bank Industry Market

- Fairfax Cryobank Inc

- CRYOS INTERNATIONAL INC

- New England Cryogenic Centre

- London Sperm Bank

- European Sperm Bank

- Indian Spermtech

- CALIFORNIA CRYOBANK

- Xytex Corporation

- Androcryos

Key Developments in Sperm Bank Industry Industry

- July 2021: India IVF Clinic launched a do-it-yourself semen testing kit in Delhi NCR. This signifies a move towards convenient at-home testing solutions.

- March 2022: Ro acquired Dadi, integrating sperm testing, analysis, and storage into its direct-to-patient healthcare platform. This highlights a trend of integrating technology into sperm banking services.

- May 2022: Legacy raised USD 25 Million in Series B funding, signaling significant investment in the digital fertility clinic space and indicating a push toward expansion and technological advancements in sperm banking services.

Strategic Outlook for Sperm Bank Industry Market

The sperm bank industry is poised for continued growth, driven by technological advancements, increasing infertility rates, and evolving societal attitudes. Future growth will be shaped by innovations in cryopreservation, genetic screening, and digital health technologies. Expanding into underserved markets and offering personalized services will be key strategic imperatives for industry players. The industry is expected to experience a period of continued consolidation and expansion, with significant opportunities for growth and innovation in the coming years.

Sperm Bank Industry Segmentation

-

1. Service

- 1.1. Sperm Storage

- 1.2. Seman Analysis

- 1.3. Genetic Consultant

-

2. Donor

- 2.1. Known Donor

- 2.2. Anonymous Donor

- 2.3. Other Donors

-

3. End User

- 3.1. Pre-vasectomy Patient

- 3.2. Cancer Patient

- 3.3. Other End Users

Sperm Bank Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Sperm Bank Industry Regional Market Share

Geographic Coverage of Sperm Bank Industry

Sperm Bank Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Acceptance of the LGBT Community; Prevalence of Poor Fertility; Advancement in Cryopreservation

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Among People; Low Availability of Sperm Banks

- 3.4. Market Trends

- 3.4.1. Semen Analysis Segment is Expected to Hold a Major Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sperm Bank Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Sperm Storage

- 5.1.2. Seman Analysis

- 5.1.3. Genetic Consultant

- 5.2. Market Analysis, Insights and Forecast - by Donor

- 5.2.1. Known Donor

- 5.2.2. Anonymous Donor

- 5.2.3. Other Donors

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Pre-vasectomy Patient

- 5.3.2. Cancer Patient

- 5.3.3. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Sperm Bank Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Sperm Storage

- 6.1.2. Seman Analysis

- 6.1.3. Genetic Consultant

- 6.2. Market Analysis, Insights and Forecast - by Donor

- 6.2.1. Known Donor

- 6.2.2. Anonymous Donor

- 6.2.3. Other Donors

- 6.3. Market Analysis, Insights and Forecast - by End User

- 6.3.1. Pre-vasectomy Patient

- 6.3.2. Cancer Patient

- 6.3.3. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Sperm Bank Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Sperm Storage

- 7.1.2. Seman Analysis

- 7.1.3. Genetic Consultant

- 7.2. Market Analysis, Insights and Forecast - by Donor

- 7.2.1. Known Donor

- 7.2.2. Anonymous Donor

- 7.2.3. Other Donors

- 7.3. Market Analysis, Insights and Forecast - by End User

- 7.3.1. Pre-vasectomy Patient

- 7.3.2. Cancer Patient

- 7.3.3. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Sperm Bank Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Sperm Storage

- 8.1.2. Seman Analysis

- 8.1.3. Genetic Consultant

- 8.2. Market Analysis, Insights and Forecast - by Donor

- 8.2.1. Known Donor

- 8.2.2. Anonymous Donor

- 8.2.3. Other Donors

- 8.3. Market Analysis, Insights and Forecast - by End User

- 8.3.1. Pre-vasectomy Patient

- 8.3.2. Cancer Patient

- 8.3.3. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Middle East and Africa Sperm Bank Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Sperm Storage

- 9.1.2. Seman Analysis

- 9.1.3. Genetic Consultant

- 9.2. Market Analysis, Insights and Forecast - by Donor

- 9.2.1. Known Donor

- 9.2.2. Anonymous Donor

- 9.2.3. Other Donors

- 9.3. Market Analysis, Insights and Forecast - by End User

- 9.3.1. Pre-vasectomy Patient

- 9.3.2. Cancer Patient

- 9.3.3. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. South America Sperm Bank Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Sperm Storage

- 10.1.2. Seman Analysis

- 10.1.3. Genetic Consultant

- 10.2. Market Analysis, Insights and Forecast - by Donor

- 10.2.1. Known Donor

- 10.2.2. Anonymous Donor

- 10.2.3. Other Donors

- 10.3. Market Analysis, Insights and Forecast - by End User

- 10.3.1. Pre-vasectomy Patient

- 10.3.2. Cancer Patient

- 10.3.3. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Fiarfax Cryobank Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 CRYOS INTERNATIONAL INC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 New England Cryogenic Centre

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 London Sperm Bank

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 European Sperm Bank

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Indian Spermtech

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CALIFORNIA CRYOBANK

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xytex Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Androcryos

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Fiarfax Cryobank Inc

List of Figures

- Figure 1: Global Sperm Bank Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Sperm Bank Industry Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Sperm Bank Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Sperm Bank Industry Revenue (billion), by Donor 2025 & 2033

- Figure 5: North America Sperm Bank Industry Revenue Share (%), by Donor 2025 & 2033

- Figure 6: North America Sperm Bank Industry Revenue (billion), by End User 2025 & 2033

- Figure 7: North America Sperm Bank Industry Revenue Share (%), by End User 2025 & 2033

- Figure 8: North America Sperm Bank Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Sperm Bank Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Sperm Bank Industry Revenue (billion), by Service 2025 & 2033

- Figure 11: Europe Sperm Bank Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Sperm Bank Industry Revenue (billion), by Donor 2025 & 2033

- Figure 13: Europe Sperm Bank Industry Revenue Share (%), by Donor 2025 & 2033

- Figure 14: Europe Sperm Bank Industry Revenue (billion), by End User 2025 & 2033

- Figure 15: Europe Sperm Bank Industry Revenue Share (%), by End User 2025 & 2033

- Figure 16: Europe Sperm Bank Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Sperm Bank Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Sperm Bank Industry Revenue (billion), by Service 2025 & 2033

- Figure 19: Asia Pacific Sperm Bank Industry Revenue Share (%), by Service 2025 & 2033

- Figure 20: Asia Pacific Sperm Bank Industry Revenue (billion), by Donor 2025 & 2033

- Figure 21: Asia Pacific Sperm Bank Industry Revenue Share (%), by Donor 2025 & 2033

- Figure 22: Asia Pacific Sperm Bank Industry Revenue (billion), by End User 2025 & 2033

- Figure 23: Asia Pacific Sperm Bank Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Asia Pacific Sperm Bank Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Sperm Bank Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Sperm Bank Industry Revenue (billion), by Service 2025 & 2033

- Figure 27: Middle East and Africa Sperm Bank Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Middle East and Africa Sperm Bank Industry Revenue (billion), by Donor 2025 & 2033

- Figure 29: Middle East and Africa Sperm Bank Industry Revenue Share (%), by Donor 2025 & 2033

- Figure 30: Middle East and Africa Sperm Bank Industry Revenue (billion), by End User 2025 & 2033

- Figure 31: Middle East and Africa Sperm Bank Industry Revenue Share (%), by End User 2025 & 2033

- Figure 32: Middle East and Africa Sperm Bank Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East and Africa Sperm Bank Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Sperm Bank Industry Revenue (billion), by Service 2025 & 2033

- Figure 35: South America Sperm Bank Industry Revenue Share (%), by Service 2025 & 2033

- Figure 36: South America Sperm Bank Industry Revenue (billion), by Donor 2025 & 2033

- Figure 37: South America Sperm Bank Industry Revenue Share (%), by Donor 2025 & 2033

- Figure 38: South America Sperm Bank Industry Revenue (billion), by End User 2025 & 2033

- Figure 39: South America Sperm Bank Industry Revenue Share (%), by End User 2025 & 2033

- Figure 40: South America Sperm Bank Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: South America Sperm Bank Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sperm Bank Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Sperm Bank Industry Revenue billion Forecast, by Donor 2020 & 2033

- Table 3: Global Sperm Bank Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Global Sperm Bank Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Sperm Bank Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global Sperm Bank Industry Revenue billion Forecast, by Donor 2020 & 2033

- Table 7: Global Sperm Bank Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 8: Global Sperm Bank Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Sperm Bank Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 13: Global Sperm Bank Industry Revenue billion Forecast, by Donor 2020 & 2033

- Table 14: Global Sperm Bank Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Sperm Bank Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: United Kingdom Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Germany Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: France Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Spain Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Rest of Europe Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Sperm Bank Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 23: Global Sperm Bank Industry Revenue billion Forecast, by Donor 2020 & 2033

- Table 24: Global Sperm Bank Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 25: Global Sperm Bank Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: China Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Japan Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: India Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Australia Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Korea Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Asia Pacific Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Sperm Bank Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 33: Global Sperm Bank Industry Revenue billion Forecast, by Donor 2020 & 2033

- Table 34: Global Sperm Bank Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 35: Global Sperm Bank Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: GCC Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Africa Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of Middle East and Africa Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Sperm Bank Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 40: Global Sperm Bank Industry Revenue billion Forecast, by Donor 2020 & 2033

- Table 41: Global Sperm Bank Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 42: Global Sperm Bank Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Brazil Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Argentina Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Rest of South America Sperm Bank Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sperm Bank Industry?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Sperm Bank Industry?

Key companies in the market include Fiarfax Cryobank Inc, CRYOS INTERNATIONAL INC, New England Cryogenic Centre, London Sperm Bank, European Sperm Bank, Indian Spermtech, CALIFORNIA CRYOBANK, Xytex Corporation, Androcryos.

3. What are the main segments of the Sperm Bank Industry?

The market segments include Service, Donor, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Acceptance of the LGBT Community; Prevalence of Poor Fertility; Advancement in Cryopreservation.

6. What are the notable trends driving market growth?

Semen Analysis Segment is Expected to Hold a Major Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Lack of Awareness Among People; Low Availability of Sperm Banks.

8. Can you provide examples of recent developments in the market?

In May 2022, Legacy, a digital fertility clinic for people with sperm, raised a USD 25M Series B funding round led by Bain Capital Ventures with participation from FirstMark Capital, Section 32, TQ Ventures, and Valor Equity Partners. With this latest funding round, Legacy intends to quadruple its staff and expand its services beyond sperm testing, freezing, and fertility assistance. The company also plans to launch Legacy Labs: physical labs that allow customers to receive same-day, at-home service.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sperm Bank Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sperm Bank Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sperm Bank Industry?

To stay informed about further developments, trends, and reports in the Sperm Bank Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence