Key Insights

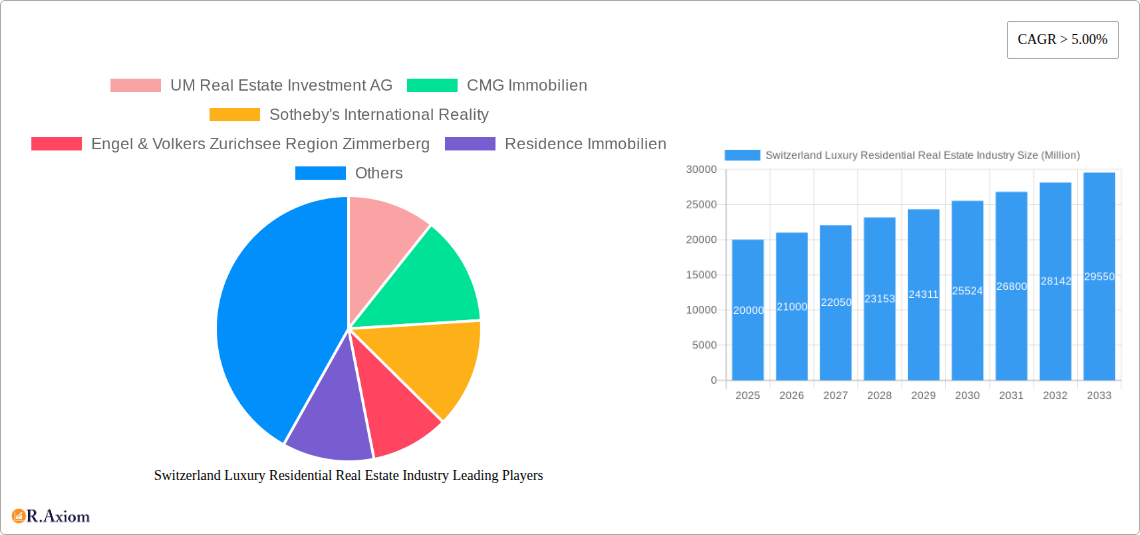

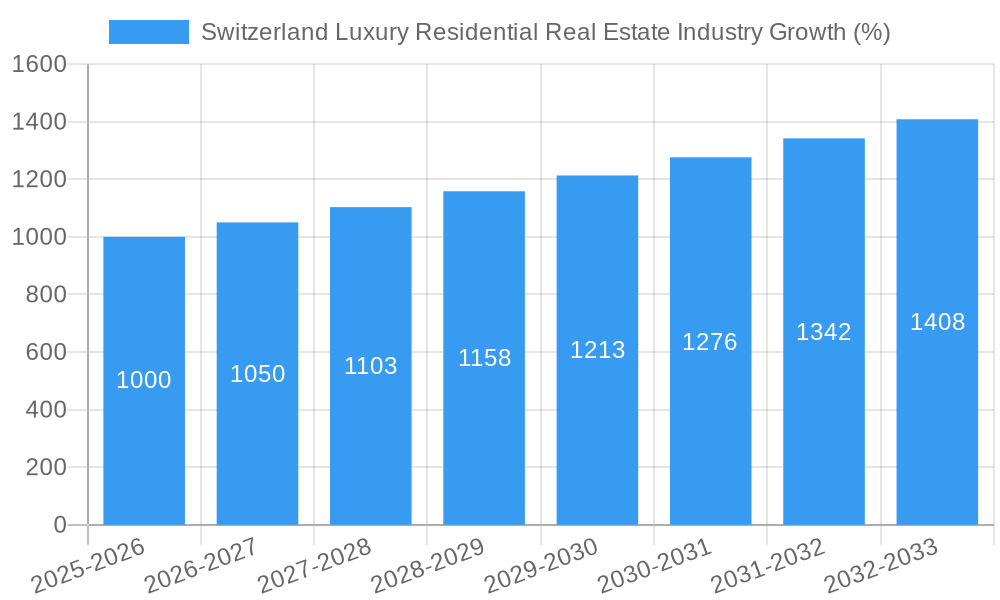

The Switzerland luxury residential real estate market, valued at approximately CHF 20 billion in 2025, exhibits robust growth potential, projected to expand at a CAGR exceeding 5% from 2025 to 2033. This growth is fueled by several key drivers. Firstly, Switzerland's enduring appeal as a global safe haven for investment, combined with its political and economic stability, attracts high-net-worth individuals seeking secure and prestigious properties. Secondly, a limited supply of luxury properties, particularly in prime locations like Zurich, Geneva, and Bern, further elevates prices and sustains market demand. The increasing influx of wealthy international buyers, drawn to Switzerland's high quality of life, exceptional infrastructure, and renowned educational institutions, also significantly contributes to market dynamism. Finally, a growing preference for larger, more luxurious homes amidst a post-pandemic shift towards prioritizing living space and proximity to nature is shaping market preferences towards villas and landed houses. While construction costs and stringent regulations pose potential restraints, the overall market outlook remains positive, driven by strong underlying fundamentals.

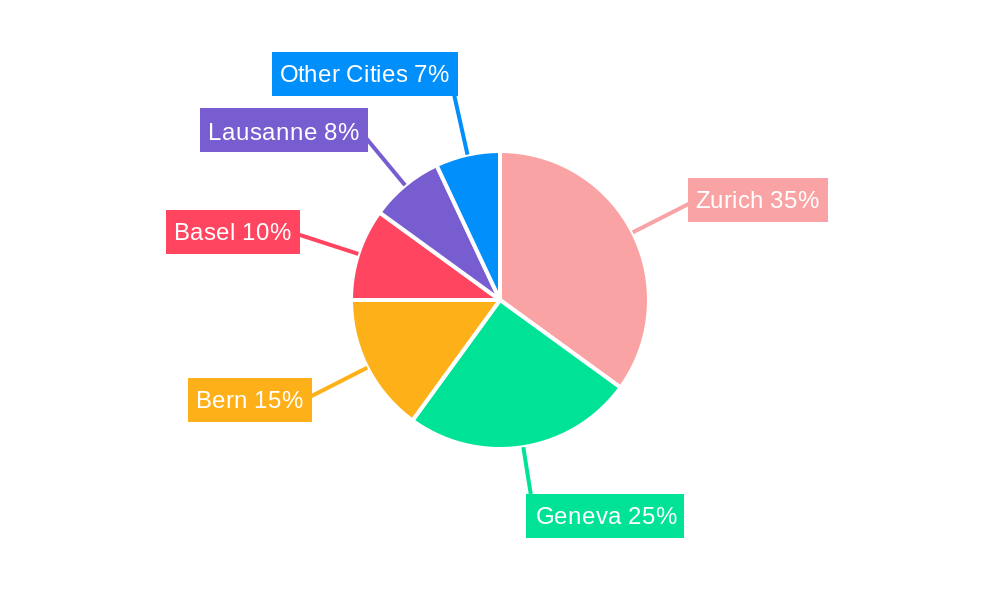

The market segmentation reveals distinct preferences. Villas and landed houses consistently command higher price points compared to apartments and condominiums, reflecting the discerning tastes of luxury buyers. Geographically, Zurich, Geneva, and Bern capture the lion's share of the market, owing to their established reputations as financial and cultural hubs. However, other cities like Basel and Lausanne are also experiencing growth, albeit at a slower pace, driven by their own unique characteristics and increasing attractiveness to high-net-worth individuals. Leading players in this market include established firms such as UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Realty, and Engel & Volkers, leveraging their extensive networks and expertise in luxury property sales and management to cater to sophisticated clientele. The market is likely to witness further consolidation and innovation as technology and changing buyer preferences continue to evolve.

This comprehensive report provides an in-depth analysis of the Switzerland luxury residential real estate industry, covering the period 2019-2033. It offers actionable insights for investors, developers, and industry stakeholders, focusing on market trends, leading players, and future growth opportunities. The report utilizes data from the historical period (2019-2024), with the base year set at 2025 and a forecast period spanning 2025-2033. The market size for all values will be expressed in Millions.

Switzerland Luxury Residential Real Estate Industry Market Concentration & Innovation

The Swiss luxury residential real estate market exhibits moderate concentration, with a few dominant players and a number of smaller, specialized firms. Market share data for 2024 indicates that the top five firms account for approximately xx% of the total market value, while the remaining share is dispersed among numerous smaller players. Innovation is driven by technological advancements in property marketing, virtual tours, and data analytics; a growing focus on sustainability and energy efficiency; and evolving consumer preferences towards smart homes and bespoke design. Regulatory frameworks, while generally stable, influence market access and development practices. Product substitutes, such as luxury vacation rentals, exert some pressure on the market.

- Market Concentration: Top 5 players hold xx% market share (2024).

- Innovation Drivers: Technological advancements, sustainability focus, evolving consumer preferences.

- Regulatory Framework: Stable but influential on development and access.

- M&A Activity: Significant M&A activity recorded between 2019-2024 totalled approximately xx Million, with the largest deal valuing xx Million. The average deal value was approximately xx Million.

- End-User Trends: Increasing demand for sustainable, technology-integrated luxury properties.

Switzerland Luxury Residential Real Estate Industry Industry Trends & Insights

The Swiss luxury residential real estate market is characterized by strong demand, fueled by a robust economy, high net worth individuals, and a stable political environment. The market experienced a CAGR of xx% during the historical period (2019-2024), and a projected CAGR of xx% is anticipated during the forecast period (2025-2033). Technological disruptions, such as the rise of proptech platforms and virtual reality property viewings, are changing how properties are marketed and sold, increasing market penetration and efficiency. Consumer preferences are shifting towards sustainable, eco-friendly homes, smart home technology, and properties offering exceptional amenities and lifestyle experiences. Competitive dynamics are shaped by both established players and emerging firms, leading to innovation in property development and marketing strategies. Market penetration of smart home technology in luxury properties is projected to reach xx% by 2033.

Dominant Markets & Segments in Switzerland Luxury Residential Real Estate Industry

Zurich remains the dominant market for luxury residential real estate in Switzerland, driven by strong economic activity, a highly developed infrastructure, and a large concentration of high-net-worth individuals. Geneva and Basel also represent significant markets, while Lausanne and Bern show steady growth. Within segments, villas and landed houses command higher prices and contribute a larger share of the overall market value compared to apartments and condominiums.

By Cities:

- Zurich: Dominant market due to strong economy, infrastructure, and high net-worth population. Growth driven by high demand and limited supply.

- Geneva: Strong market fueled by international organizations and high-net-worth individuals.

- Basel: Significant market with steady growth.

- Lausanne: Growing market with increasing attractiveness to high-net-worth individuals.

- Bern: Steady growth driven by governmental employment and a pleasant living environment.

- Other Cities: Show consistent yet slower growth compared to the major cities.

By Type:

- Villas and Landed Houses: Higher price points and larger market share compared to apartments/condominiums. Demand driven by desire for privacy, space, and land.

- Apartments and Condominiums: Offer a more urban living experience and cater to a diverse range of buyers, from young professionals to retired couples.

Switzerland Luxury Residential Real Estate Industry Product Developments

Product innovation focuses on sustainable design, smart home technology integration, and personalized luxury experiences. Developers are increasingly incorporating features such as renewable energy sources, advanced security systems, and bespoke design elements to cater to the sophisticated preferences of high-net-worth buyers. The market fit is strong for properties that emphasize wellness, convenience, and environmental responsibility. The integration of technology enhances the value proposition, enabling remote management, energy efficiency, and an improved quality of life for residents.

Report Scope & Segmentation Analysis

This report segments the Swiss luxury residential real estate market by property type (villas and landed houses; apartments and condominiums) and by city (Zurich, Geneva, Basel, Lausanne, Bern, other cities). Each segment's growth projection, market size, and competitive dynamics are detailed in the full report. The projected growth for villas and landed houses is xx% CAGR between 2025-2033, while apartments and condominiums are expected to exhibit a xx% CAGR over the same period. Zurich is projected to maintain its dominance, with a projected market size of xx Million in 2033.

Key Drivers of Switzerland Luxury Residential Real Estate Industry Growth

Several key factors are driving growth in the Swiss luxury residential real estate industry: a strong and stable economy, a large population of high-net-worth individuals, attractive tax policies, political stability, a highly developed infrastructure, increasing demand for high-quality housing, and a limited supply of luxury properties in prime locations. The increasing demand for sustainable and technologically advanced properties further fuels the growth.

Challenges in the Switzerland Luxury Residential Real Estate Industry Sector

Challenges include stringent building regulations, high construction costs, limited land availability in prime locations, and competition from other luxury real estate markets. Regulatory hurdles can slow down development projects, contributing to constrained supply. The scarcity of land in desirable areas necessitates higher prices, impacting affordability. Competition from established players and new entrants also shapes market dynamics. These factors collectively affect overall market expansion and pricing.

Emerging Opportunities in Switzerland Luxury Residential Real Estate Industry

Emerging opportunities lie in the growing demand for sustainable and smart homes, the expansion of the luxury rental market, and the increasing popularity of second homes in popular resort areas. The rising adoption of proptech solutions offers further avenues for growth. Developments focusing on wellness and holistic living experiences present significant opportunities to attract high-net-worth buyers seeking more than just a house, but a lifestyle upgrade.

Leading Players in the Switzerland Luxury Residential Real Estate Industry Market

- UM Real Estate Investment AG

- CMG Immobilien

- Sotheby's International Realty

- Engel & Volkers Zurichsee Region Zimmerberg

- Residence Immobilien

- Honeywell Immobilier

- SJS ImmoArch AG

- Swiss Capital Property

- Luxury places SA

- La Roche Residential

Key Developments in Switzerland Luxury Residential Real Estate Industry Industry

- January 2022: Engel & Volkers Zurichsee Region Zimmerberg expanded to over 50 locations in Switzerland, increasing market presence and local affinity.

- March 2023: Honeywell Immobilier partnered with Watershed Organization Trust (WOTR) focusing on soil and water conservation, aligning with growing sustainability concerns.

Strategic Outlook for Switzerland Luxury Residential Real Estate Industry Market

The Swiss luxury residential real estate market is poised for continued growth, driven by sustained economic strength, ongoing demand from high-net-worth individuals, and the increasing appeal of Switzerland as a desirable place to live and invest. Focus on sustainability, technological integration, and bespoke luxury experiences will define the future of the market, presenting opportunities for forward-thinking developers and investors to capture market share. The market is expected to see further consolidation, with strategic mergers and acquisitions shaping the landscape of the industry.

Switzerland Luxury Residential Real Estate Industry Segmentation

-

1. Type

- 1.1. Villas and Landed Houses

- 1.2. Apartments and Condominiums

-

2. Cities

- 2.1. Bern

- 2.2. Zurich

- 2.3. Geneva

- 2.4. Basel

- 2.5. Lausanne

- 2.6. Other Cities

Switzerland Luxury Residential Real Estate Industry Segmentation By Geography

- 1. Switzerland

Switzerland Luxury Residential Real Estate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material

- 3.3. Market Restrains

- 3.3.1. 4.; High cost of purchasing the equipment for development and manufacturing of various construction material

- 3.4. Market Trends

- 3.4.1. Existing Home Sales Witnessing Strong Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Switzerland Luxury Residential Real Estate Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Villas and Landed Houses

- 5.1.2. Apartments and Condominiums

- 5.2. Market Analysis, Insights and Forecast - by Cities

- 5.2.1. Bern

- 5.2.2. Zurich

- 5.2.3. Geneva

- 5.2.4. Basel

- 5.2.5. Lausanne

- 5.2.6. Other Cities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Switzerland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 UM Real Estate Investment AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CMG Immobilien

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sotheby's International Reality

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Engel & Volkers Zurichsee Region Zimmerberg

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Residence Immobilien

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Honeywell Immobilier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SJS ImmoArch AG**List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Swiss Capital Property

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luxury places SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 La Roche Residential

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 UM Real Estate Investment AG

List of Figures

- Figure 1: Switzerland Luxury Residential Real Estate Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Switzerland Luxury Residential Real Estate Industry Share (%) by Company 2024

List of Tables

- Table 1: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 4: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Cities 2019 & 2032

- Table 8: Switzerland Luxury Residential Real Estate Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Switzerland Luxury Residential Real Estate Industry?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the Switzerland Luxury Residential Real Estate Industry?

Key companies in the market include UM Real Estate Investment AG, CMG Immobilien, Sotheby's International Reality, Engel & Volkers Zurichsee Region Zimmerberg, Residence Immobilien, Honeywell Immobilier, SJS ImmoArch AG**List Not Exhaustive, Swiss Capital Property, Luxury places SA, La Roche Residential.

3. What are the main segments of the Switzerland Luxury Residential Real Estate Industry?

The market segments include Type, Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Increasing demand for green construction to reduce carbon footprint4.; Introduction of technology for manufactruing the of building construction material.

6. What are the notable trends driving market growth?

Existing Home Sales Witnessing Strong Growth.

7. Are there any restraints impacting market growth?

4.; High cost of purchasing the equipment for development and manufacturing of various construction material.

8. Can you provide examples of recent developments in the market?

March 2023: Honeywell Immobilier recently entered into a partnership with Watershed Organization Trust (WOTR) to focus on soil and water conservation in rural ecosystems. WOTR is involved in restoring rural water bodies, boosting the water table and helping farmers and women with livelihood opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Switzerland Luxury Residential Real Estate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Switzerland Luxury Residential Real Estate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Switzerland Luxury Residential Real Estate Industry?

To stay informed about further developments, trends, and reports in the Switzerland Luxury Residential Real Estate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence