Key Insights

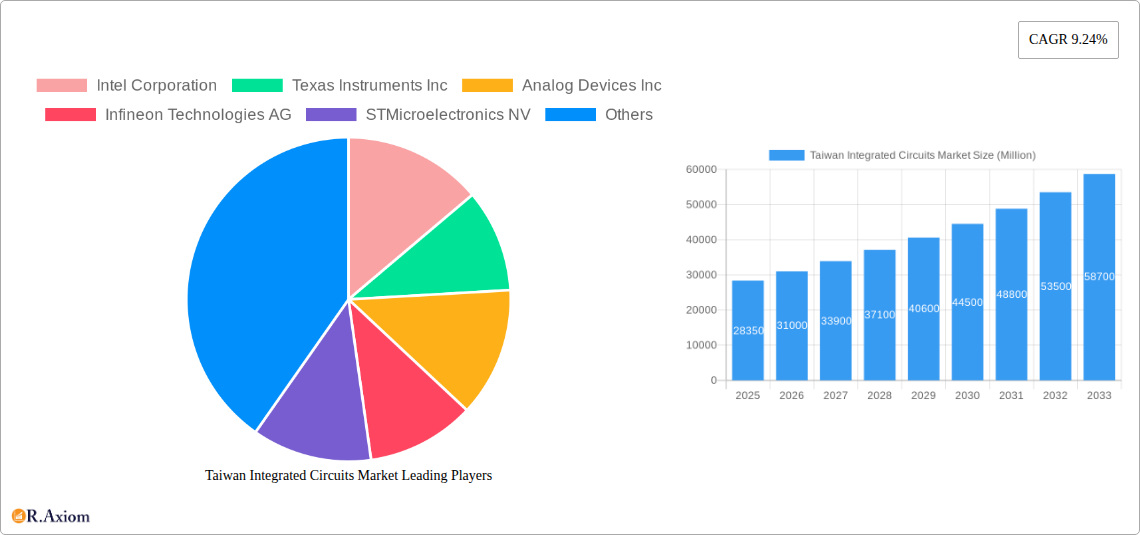

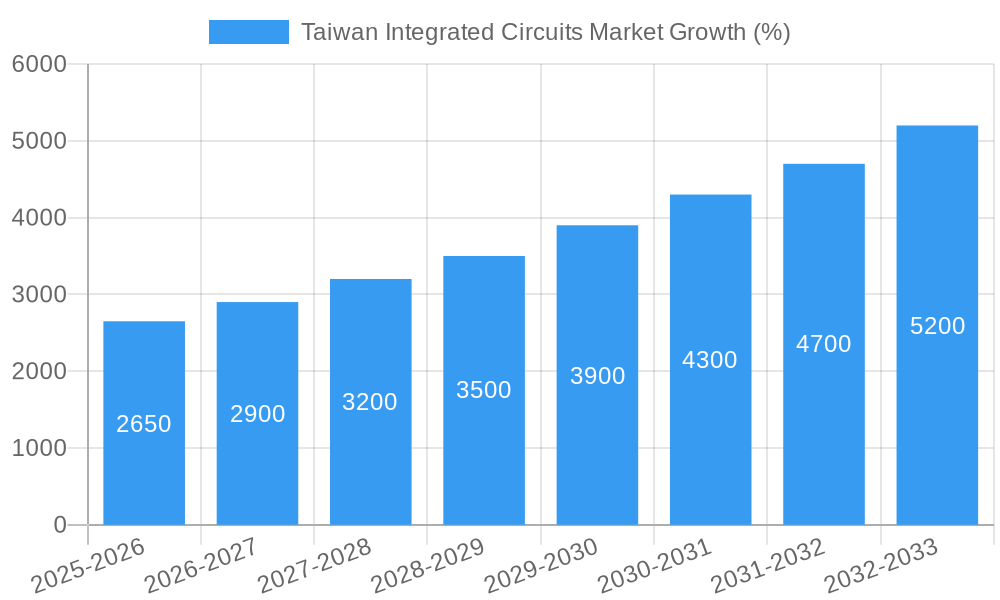

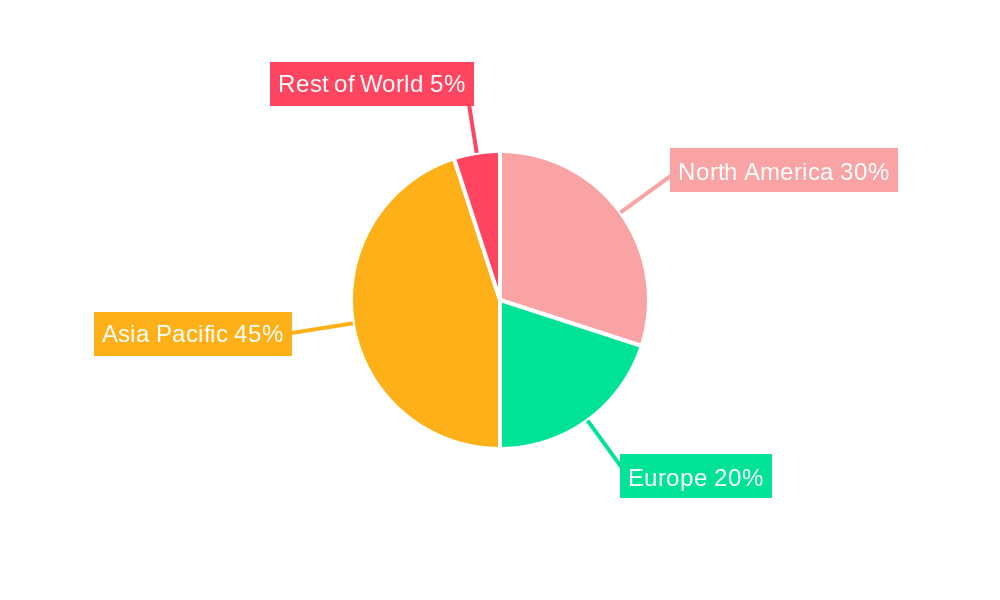

The Taiwan Integrated Circuits (IC) market, valued at $28.35 billion in 2025, is projected to experience robust growth, driven by increasing demand for high-performance computing, 5G infrastructure deployment, and the automotive electronics revolution. A Compound Annual Growth Rate (CAGR) of 9.24% from 2025 to 2033 indicates significant expansion, with the market expected to surpass $60 billion by 2033. This growth is fueled by continuous advancements in semiconductor technology, miniaturization trends, and the rising adoption of artificial intelligence (AI) and Internet of Things (IoT) devices. Key players like Intel, Texas Instruments, and TSMC (Taiwan Semiconductor Manufacturing Company – a major player implicitly included due to Taiwan's prominence in IC manufacturing) are strategically investing in research and development to maintain their competitive edge. The market is segmented by various IC types (e.g., memory, logic, analog), each exhibiting unique growth trajectories. While challenges exist, such as global geopolitical uncertainties and potential supply chain disruptions, the overall outlook for the Taiwan IC market remains positive due to strong domestic manufacturing capabilities and government support for the semiconductor industry.

The robust growth is further supported by Taiwan's established position as a global leader in semiconductor manufacturing, boasting advanced fabrication facilities and a highly skilled workforce. Government initiatives aimed at fostering innovation and attracting foreign investment are expected to further stimulate market expansion. However, potential restraints include increasing competition from other Asian economies, the cyclical nature of the semiconductor industry, and the need for continuous adaptation to evolving technological demands. Growth in specific segments, such as high-performance computing chips and automotive-grade ICs, will likely outpace the overall market average, driving further specialization and consolidation within the industry. The long-term forecast suggests sustained growth, positioning Taiwan as a pivotal player in the global semiconductor landscape for the foreseeable future.

Taiwan Integrated Circuits Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Taiwan Integrated Circuits (IC) market, covering the period from 2019 to 2033. It delves into market dynamics, competitive landscape, technological advancements, and future growth prospects, offering valuable insights for industry stakeholders. The report uses 2025 as its base year and provides detailed forecasts until 2033, leveraging historical data from 2019-2024. The report offers actionable intelligence, crucial for strategic decision-making within this dynamic sector.

Taiwan Integrated Circuits Market Market Concentration & Innovation

The Taiwan IC market exhibits a moderately concentrated landscape, dominated by a handful of global giants alongside several strong domestic players. Market share data for 2024 reveals that the top 5 players collectively hold approximately xx% of the market, indicating a competitive but not excessively monopolistic environment. Innovation is a key driver, fueled by substantial R&D investment from both established players and emerging startups. Government initiatives supporting semiconductor research and development further stimulate innovation within the Taiwanese IC sector.

Key Aspects:

- Market Concentration: Top 5 players hold approximately xx% market share (2024).

- Innovation Drivers: High R&D spending, government support, and a thriving ecosystem of startups.

- Regulatory Framework: Taiwan's proactive regulatory environment fosters fair competition and protects intellectual property.

- Product Substitutes: While limited direct substitutes exist, technological advancements and material innovations continuously challenge the market.

- End-User Trends: Growing demand for high-performance computing, automotive electronics, and 5G infrastructure significantly impact market dynamics.

- M&A Activity: Significant M&A activity, valued at approximately $xx Million in 2024, reflects industry consolidation and strategic expansion efforts.

Taiwan Integrated Circuits Market Industry Trends & Insights

The Taiwan IC market is characterized by strong growth, driven by robust global demand for advanced semiconductor technologies. The compound annual growth rate (CAGR) is projected to be xx% during the forecast period (2025-2033). Several factors contribute to this growth, including the increasing adoption of smartphones, IoT devices, and advanced driver-assistance systems (ADAS). Technological disruptions, such as the shift towards more energy-efficient designs and the integration of artificial intelligence (AI) capabilities, are reshaping the competitive landscape. Market penetration of advanced IC technologies, such as xx and xx, is experiencing significant growth, reflecting the adoption of cutting-edge technologies in various applications. Consumer preferences are increasingly focused on smaller, faster, and more energy-efficient devices, driving innovation in chip design and manufacturing.

Dominant Markets & Segments in Taiwan Integrated Circuits Market

The dominance within the Taiwan IC market is largely concentrated within the xx segment, fueled by strong local demand and the presence of major manufacturing facilities. This segment benefits significantly from government initiatives promoting technological advancement and infrastructure development. This dominance is further solidified by the concentration of key players within this specific sector.

- Key Drivers of Dominance (xx Segment):

- Favorable government policies supporting semiconductor manufacturing and R&D.

- Robust domestic demand driven by the growth of electronics manufacturing.

- Well-established supply chains and advanced manufacturing infrastructure.

- Concentration of leading IC manufacturers.

Taiwan Integrated Circuits Market Product Developments

Recent product developments in the Taiwan IC market demonstrate a clear trend toward miniaturization, increased processing power, and enhanced energy efficiency. New ICs are incorporating advanced functionalities like AI and machine learning capabilities, expanding their application in various sectors like automotive, healthcare, and consumer electronics. This focus on innovation directly translates to competitive advantages for companies capable of delivering cutting-edge technologies that meet evolving market demands.

Report Scope & Segmentation Analysis

This report segments the Taiwan IC market across several key parameters: by product type (e.g., microprocessors, memory chips, analog ICs, etc.), by application (e.g., consumer electronics, automotive, industrial, etc.), and by end-user (e.g., OEMs, distributors, etc.). Each segment's growth projections, market size, and competitive dynamics are thoroughly analyzed, offering a granular view of the market landscape. For instance, the xx segment is projected to experience the highest CAGR of xx% during the forecast period, while the xx segment is expected to maintain a steady growth rate, driven by its robust and established market share.

Key Drivers of Taiwan Integrated Circuits Market Growth

The growth of the Taiwan IC market is propelled by several key factors: the rising demand for consumer electronics and other applications globally, government initiatives boosting semiconductor manufacturing, substantial investments in R&D driving innovation, and the presence of a well-established ecosystem of supporting industries. These factors create a synergistic environment that propels growth across various segments of the market.

Challenges in the Taiwan Integrated Circuits Market Sector

The Taiwan IC market faces challenges including intense global competition, potential geopolitical risks affecting supply chains, dependence on specific raw materials, and the escalating cost of advanced manufacturing technologies. These challenges, if not effectively managed, could hinder market growth in the future. For instance, fluctuations in global demand can lead to significant market instability.

Emerging Opportunities in Taiwan Integrated Circuits Market

Emerging opportunities exist in the development of specialized ICs for AI, 5G, and automotive applications. The growth of the IoT sector also presents significant potential for expansion, as does the continued improvement of energy-efficient IC designs. These areas offer significant growth potential for market players.

Leading Players in the Taiwan Integrated Circuits Market Market

- Intel Corporation

- Texas Instruments Inc

- Analog Devices Inc

- Infineon Technologies AG

- STMicroelectronics NV

- NXP Semiconductors NV

- On Semiconductor Corporation

- Microchip Technology Inc

- Renesas Electronics Corporation

- Samsung Electronics Co Ltd

- SK Hynix Inc

Key Developments in Taiwan Integrated Circuits Market Industry

- December 2023: Asahi Kasei Microdevices Corporation (AKM) launched its AK7018 and AK7017 audio DSPs, enhancing in-car audio and voice experiences through collaboration with DSP Concepts, Inc. and the Audio Weaver platform.

- December 2023: Infineon introduced its PSoCEdge series microcontrollers, integrating Arm Cortex-M55 core with Helium DSP and Ethos U55 NPU for advanced AI operations.

Strategic Outlook for Taiwan Integrated Circuits Market Market

The Taiwan IC market is poised for sustained growth, driven by continuous technological advancements, increasing demand from diverse sectors, and government support for the industry. Focus on emerging technologies such as AI and 5G, along with strategic partnerships and investments in R&D, will be crucial for companies aiming to thrive in this competitive landscape. The market presents significant opportunities for companies that can adapt to changing market demands and deliver innovative solutions.

Taiwan Integrated Circuits Market Segmentation

-

1. Type

- 1.1. Analog IC

- 1.2. Logic IC

- 1.3. Memory

-

1.4. Micro

- 1.4.1. Microprocessors (MPU)

- 1.4.2. Microcontrollers (MCU)

-

2. End-user Industry

- 2.1. Consumer Electronics

- 2.2. Automotive

- 2.3. IT & Telecommunications

- 2.4. Manufacturing & Automation

- 2.5. Other En

Taiwan Integrated Circuits Market Segmentation By Geography

- 1. Taiwan

Taiwan Integrated Circuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.24% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Penetration of Smartphones

- 3.2.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.3. Market Restrains

- 3.3.1 Increasing Penetration of Smartphones

- 3.3.2 Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities

- 3.4. Market Trends

- 3.4.1. The Logic Segment is Anticipated to Hold a Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Taiwan Integrated Circuits Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog IC

- 5.1.2. Logic IC

- 5.1.3. Memory

- 5.1.4. Micro

- 5.1.4.1. Microprocessors (MPU)

- 5.1.4.2. Microcontrollers (MCU)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Automotive

- 5.2.3. IT & Telecommunications

- 5.2.4. Manufacturing & Automation

- 5.2.5. Other En

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Taiwan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Intel Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Texas Instruments Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Analog Devices Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Infineon Technologies AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 STMicroelectronics NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 NXP Semiconductors NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 On Semiconductor Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microchip Technology Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Renesas Electronics Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Samsung Electronics Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SK Hynix Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Intel Corporation

List of Figures

- Figure 1: Taiwan Integrated Circuits Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Taiwan Integrated Circuits Market Share (%) by Company 2024

List of Tables

- Table 1: Taiwan Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Taiwan Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Taiwan Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Taiwan Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Taiwan Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: Taiwan Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: Taiwan Integrated Circuits Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Taiwan Integrated Circuits Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Taiwan Integrated Circuits Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: Taiwan Integrated Circuits Market Volume Billion Forecast, by Type 2019 & 2032

- Table 11: Taiwan Integrated Circuits Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: Taiwan Integrated Circuits Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: Taiwan Integrated Circuits Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Taiwan Integrated Circuits Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Taiwan Integrated Circuits Market?

The projected CAGR is approximately 9.24%.

2. Which companies are prominent players in the Taiwan Integrated Circuits Market?

Key companies in the market include Intel Corporation, Texas Instruments Inc, Analog Devices Inc, Infineon Technologies AG, STMicroelectronics NV, NXP Semiconductors NV, On Semiconductor Corporation, Microchip Technology Inc, Renesas Electronics Corporation, Samsung Electronics Co Ltd, SK Hynix Inc.

3. What are the main segments of the Taiwan Integrated Circuits Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 28.35 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

6. What are the notable trends driving market growth?

The Logic Segment is Anticipated to Hold a Major Market Share.

7. Are there any restraints impacting market growth?

Increasing Penetration of Smartphones. Tablets and Consumer Electronics; Rising Capital Spending by Fabs to Increase Production Capacities.

8. Can you provide examples of recent developments in the market?

December 2023 - Asahi Kasei Microdevices Corporation unveiled its AK7018 and AK7017 audio DSPs with dual and single HiFi 4 CPUs, respectively, both pin-compatible. These new additions to the AK701x series aim to elevate the in-car audio and voice experience. In a strategic move, AKM collaborated with DSP Concepts, Inc., enabling the AK701x lineup to leverage the Audio Weaver platform. This collaboration fosters a versatile and expandable audio and voice application development environment and taps into the diverse array of 3rd party audio algorithms already available on Audio Weaver.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Taiwan Integrated Circuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Taiwan Integrated Circuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Taiwan Integrated Circuits Market?

To stay informed about further developments, trends, and reports in the Taiwan Integrated Circuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence