Key Insights

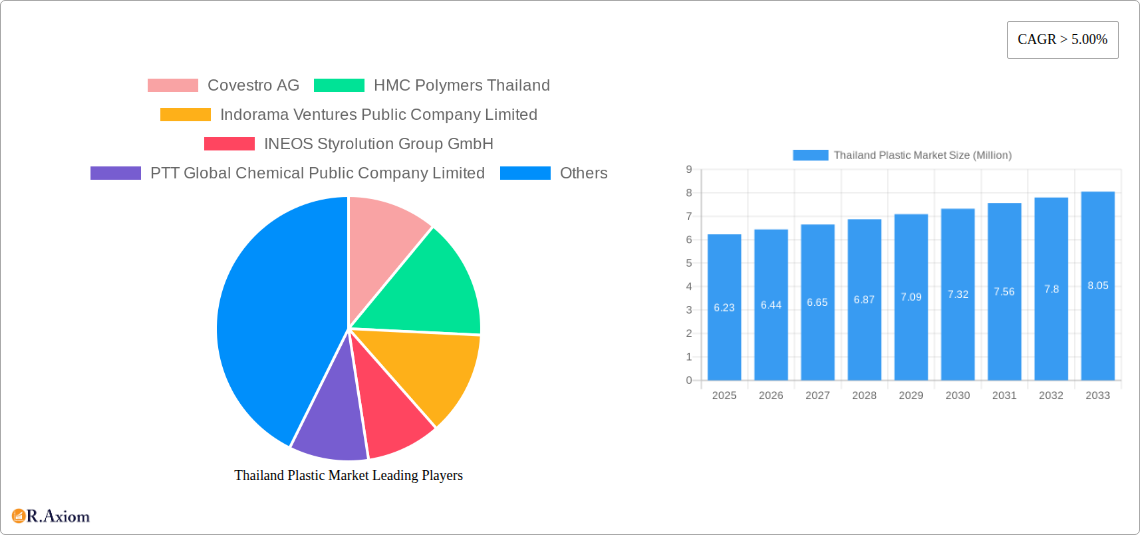

The Thailand plastic market is poised for significant growth, projected to reach $6.23 million in 2025 with a Compound Annual Growth Rate (CAGR) of 3.43% through 2033. This expansion is primarily fueled by robust demand across key application sectors, notably packaging, which continues to be a dominant consumer of plastic materials due to the growth of the food and beverage, healthcare, and e-commerce industries in Thailand. The building and construction sector also presents substantial opportunities, driven by ongoing infrastructure development and a rising demand for housing. Furthermore, the automotive industry's increasing adoption of lightweight and high-performance plastics for fuel efficiency and design flexibility will further propel market expansion. Engineering plastics, in particular, are expected to witness elevated demand as manufacturers seek advanced materials with superior mechanical properties, chemical resistance, and thermal stability for sophisticated applications.

Thailand Plastic Market Market Size (In Million)

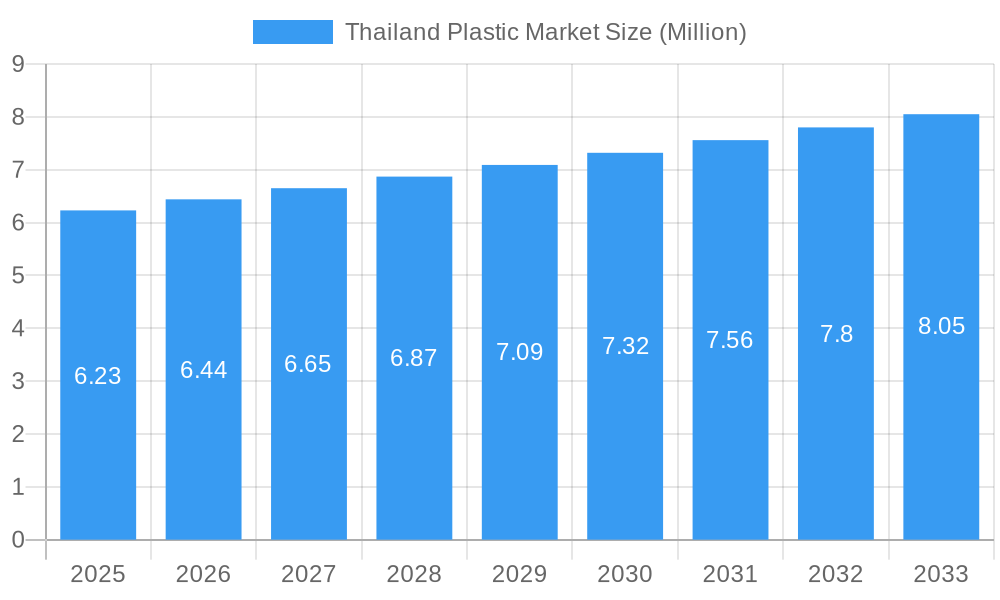

While the market is driven by these strong application demands and the increasing prevalence of advanced plastic types, it also faces certain restraints that warrant attention. The growing global and local emphasis on sustainability and environmental regulations is prompting a shift towards bioplastics and recycled plastics, which may impact the demand for traditional plastics in the long run. However, the inherent cost-effectiveness and versatility of traditional plastics will ensure their continued relevance, especially in price-sensitive applications. The market is characterized by a competitive landscape with major players like Covestro AG, Indorama Ventures, and SCG Chemicals actively engaged in innovation and capacity expansion to cater to evolving market needs. The strategic focus on developing value-added products and sustainable solutions will be crucial for sustained growth and market leadership in the coming years.

Thailand Plastic Market Company Market Share

This in-depth report provides a thorough analysis of the Thailand Plastic Market, encompassing historical data from 2019 to 2024 and an extensive forecast from 2025 to 2033. Leveraging granular segmentation by plastic type, application, and key industry developments, this report offers strategic insights for stakeholders navigating the dynamic Thai plastics landscape. The Thailand plastic market size is projected for significant growth, driven by robust industrial expansion and increasing demand across various sectors. With a base year of 2025 and an estimated year of 2025, the forecast period from 2025 to 2033 will reveal critical trends in Thai plastic consumption, Thailand plastic production, and Thailand plastic industry outlook. This analysis is crucial for understanding the future of plastics in Thailand and identifying lucrative investment opportunities within the Southeast Asian plastic market.

Thailand Plastic Market Market Concentration & Innovation

The Thailand plastic market exhibits a moderate level of concentration, with a few dominant players holding significant market share. Key innovators driving growth include companies like Indorama Ventures Public Company Limited and SCG Chemicals Co Ltd, which consistently invest in research and development to enhance product performance and sustainability. The regulatory framework in Thailand is increasingly focused on environmental sustainability, influencing innovation towards bioplastics and recycled plastics. Product substitutes, such as traditional materials like paper and glass, are gaining traction in specific applications, prompting plastic manufacturers to focus on advanced functionalities and cost-effectiveness. End-user trends lean towards lighter, more durable, and eco-friendly plastic solutions, particularly in the packaging and automotive sectors. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and expansion, with past deals valued in the hundreds of millions of dollars, enhancing market reach and technological capabilities. For instance, a hypothetical M&A event involving a major engineering plastics producer could boost the market share of advanced polymers by an estimated 5% within a year.

Thailand Plastic Market Industry Trends & Insights

The Thailand plastic market is poised for substantial expansion, driven by a confluence of robust economic growth, burgeoning manufacturing sectors, and evolving consumer preferences. The projected Compound Annual Growth Rate (CAGR) for the Thailand plastic industry is estimated at approximately 6.5% over the forecast period. This growth is underpinned by escalating demand from the packaging sector, which accounts for an estimated 40% of the total market penetration, followed by the electrical and electronics sector at approximately 20%. Technological advancements are a significant disruptor, with a rising focus on high-performance polymers, advanced recycling technologies, and the development of biodegradable and compostable alternatives. Consumer preferences are increasingly aligning with sustainability, pushing for reduced plastic waste and the adoption of circular economy principles. Companies are responding by investing in R&D for eco-friendly plastic solutions, leading to the introduction of new product lines with enhanced recyclability and lower environmental impact. Competitive dynamics are characterized by fierce competition among both domestic and international players, necessitating strategic differentiation through product quality, innovation, and efficient supply chain management. The Thailand plastic market value is anticipated to reach over USD 15,000 million by 2033.

Dominant Markets & Segments in Thailand Plastic Market

The Thailand Plastic Market is segmented by type and application, with distinct areas demonstrating significant dominance and growth potential.

Dominant Segments by Type:

- Traditional Plastics: This segment, comprising Polyethylene (PE), Polypropylene (PP), Polystyrene (PS), and Polyvinyl Chloride (PVC), continues to be the largest contributor to the market. Polypropylene, in particular, is experiencing robust growth, driven by its widespread application in packaging, automotive components, and consumer goods. The economic policies supporting manufacturing industries and infrastructure development act as key drivers for the sustained demand in this segment.

- Engineering Plastics: This segment, including Polyethylene Terephthalate (PET), Polyamides, Polycarbonates, Styrene Copolymers (ABS and SAN), Polybutylene Terephthalate (PBT), Polymethyl Methacrylate (PMMA), and Other Engineering Plastics, is a significant growth engine. The automotive and electrical & electronics industries are primary consumers, demanding high-performance materials for lightweighting and enhanced durability. Investments in advanced manufacturing and a growing emphasis on product innovation fuel the dominance of engineering plastics.

- Bioplastics: While currently a smaller segment, bioplastics are witnessing rapid growth due to increasing environmental consciousness and supportive government initiatives promoting sustainable alternatives. The market penetration of bioplastics is expected to surge as production costs decrease and consumer acceptance broadens.

Dominant Segments by Application:

- Packaging: This sector remains the most significant application, accounting for approximately 40% of the total market. The growth is propelled by Thailand's expanding food and beverage industry, e-commerce growth, and increasing demand for flexible and rigid packaging solutions. Government initiatives promoting food safety and consumer product standards further bolster this segment.

- Electrical and Electronics: This application segment is a strong contender, driven by Thailand's robust electronics manufacturing base and the growing demand for consumer electronics and components. The need for high-performance, heat-resistant, and electrically insulating plastics makes engineering plastics crucial in this sector.

- Automotive and Transportation: With Thailand being a major automotive manufacturing hub in Southeast Asia, this segment is a key driver of plastic demand. Lightweighting trends and the increasing use of plastic components for fuel efficiency and enhanced design continue to fuel growth.

- Building and Construction: The ongoing infrastructure development projects and the booming real estate sector contribute significantly to the demand for plastics in construction applications like pipes, profiles, and insulation.

Thailand Plastic Market Product Developments

Product developments in the Thailand Plastic Market are increasingly focused on sustainability, performance enhancement, and specialized applications. Manufacturers are innovating with advanced polymer grades offering improved mechanical properties, thermal resistance, and chemical inertness. The push towards a circular economy is driving the development of recycled content plastics and bio-based alternatives. For instance, the introduction of novel biodegradable polymers derived from renewable resources offers promising alternatives for single-use packaging. Furthermore, advancements in compounding and additive technologies are enabling the creation of plastics with specific functionalities, such as antimicrobial properties or enhanced UV resistance, catering to niche market demands and providing a competitive advantage.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Thailand Plastic Market across key segmentation dimensions.

- By Type: The market is segmented into Traditional Plastics (Polyethylene, Polypropylene, Polystyrene, Polyvinyl Chloride), Engineering Plastics (Polyethylene Terephthalate (PET), Polyamides, Polycarbonates, Styrene Copolymers (ABS and SAN), Polybutylene Terephthalate (PBT), Polymethyl Methacrylate (PMMA), Other Engineering Plastics), and Bioplastics. Traditional plastics are expected to maintain their dominance due to cost-effectiveness and widespread use. However, engineering plastics are projected to exhibit higher growth rates, driven by demand from high-value applications. Bioplastics represent a rapidly expanding, albeit smaller, segment with significant future potential.

- By Application: The market is further segmented into Packaging, Electrical and Electronics, Building and Construction, Automotive and Transportation, Furniture and Bedding, and Other Applications. The packaging segment is projected to remain the largest, with continuous innovation in flexible and rigid solutions. The automotive and electrical & electronics sectors are anticipated to show strong growth due to Thailand's manufacturing prowess and the demand for advanced materials.

Key Drivers of Thailand Plastic Market Growth

Several factors are propelling the growth of the Thailand Plastic Market:

- Economic Growth and Industrial Expansion: Thailand's robust economic growth fuels demand across key sectors like manufacturing, automotive, and packaging.

- Government Initiatives and Supportive Policies: Favorable government policies promoting industrial development, infrastructure projects, and sustainable practices encourage investment and innovation in the plastics sector.

- Rising Consumer Demand: An expanding middle class with increasing disposable income drives demand for consumer goods, packaging, and durables, all of which heavily rely on plastic materials.

- Technological Advancements: Innovations in polymer science, processing technologies, and the development of high-performance and sustainable plastics are creating new market opportunities and enhancing product competitiveness.

- Foreign Direct Investment: Thailand's attractive investment climate attracts foreign companies, leading to capacity expansion and technology transfer within the plastics industry.

Challenges in the Thailand Plastic Market Sector

Despite the promising outlook, the Thailand Plastic Market faces several challenges:

- Environmental Regulations and Waste Management: Stringent environmental regulations concerning plastic waste management and pollution control pose compliance challenges and necessitate significant investment in sustainable solutions and recycling infrastructure.

- Raw Material Price Volatility: Fluctuations in the prices of crude oil and its derivatives, key feedstocks for plastic production, can impact manufacturing costs and profit margins.

- Competition from Substitutes: The increasing availability and adoption of alternative materials, such as paper, glass, and metal, in certain applications can limit market expansion.

- Supply Chain Disruptions: Global supply chain vulnerabilities, as evidenced by recent events, can affect the availability and cost of raw materials and finished products.

- Skilled Labor Shortage: A lack of adequately skilled personnel in advanced manufacturing processes and polymer engineering can hinder technological adoption and production efficiency.

Emerging Opportunities in Thailand Plastic Market

The Thailand Plastic Market presents numerous emerging opportunities:

- Growth in Bioplastics and Sustainable Plastics: The increasing global and domestic focus on sustainability opens vast opportunities for biodegradable, compostable, and recycled plastics.

- Demand for High-Performance Engineering Plastics: The automotive, aerospace, and electronics sectors' continuous need for lightweight, durable, and high-performance materials creates significant demand for advanced engineering plastics.

- Expansion of E-commerce Packaging: The booming e-commerce sector drives demand for innovative and secure packaging solutions, including specialized films and containers.

- Circular Economy Initiatives: Investment in advanced recycling technologies, chemical recycling, and closed-loop systems offers substantial growth potential for companies focusing on circular economy principles.

- Smart and Functional Plastics: The development of "smart" plastics with embedded functionalities, such as sensors or self-healing capabilities, presents niche market opportunities in advanced applications.

Leading Players in the Thailand Plastic Market Market

- Covestro AG

- HMC Polymers Thailand

- Indorama Ventures Public Company Limited

- INEOS Styrolution Group GmbH

- PTT Global Chemical Public Company Limited

- SCG Chemicals Co Ltd

- Thai Plastic Industries Co Ltd

Key Developments in Thailand Plastic Market Industry

- December 2022: HMC Polymers announced the inauguration of its fourth polypropylene production line (PP4 plant) in Map Ta Phut Industrial Estate, Rayong Province, Thailand. This expansion, with an investment exceeding THB 8,000 million (USD 244.13 million), significantly boosts the company's polypropylene production capacity from 810,000 tons per annum to 1,060,000 tons per annum, reinforcing its leadership in the Southeast Asian PP resin market.

- October 2022: HMC Polymers launched the "PP Reborn" platform, a comprehensive initiative for managing PP plastics and other plastic types in Thailand. This platform aims to enhance knowledge and understanding of plastic sorting activities and facilitate the collection of orphaned plastic waste, integrating it back into the production system in alignment with circular economy principles.

Strategic Outlook for Thailand Plastic Market Market

The strategic outlook for the Thailand Plastic Market is overwhelmingly positive, driven by ongoing industrial diversification, government support for sustainable practices, and a growing appetite for advanced materials. Continued investment in the development and adoption of bioplastics and recycled plastics will be paramount for long-term success. Furthermore, the expansion of engineering plastics for high-growth sectors like automotive and electronics will offer substantial opportunities. Companies that prioritize innovation in product development, focus on circular economy solutions, and strategically align with the evolving consumer and regulatory landscape will be best positioned to capitalize on the projected market expansion and secure a significant share in this dynamic Southeast Asian plastic market.

Thailand Plastic Market Segmentation

-

1. Type

-

1.1. Traditional Plastics

- 1.1.1. Polyethylene

- 1.1.2. Polypropylene

- 1.1.3. Polystyrene

- 1.1.4. Polyvinyl Chloride

-

1.2. Engineering Plastics

- 1.2.1. Polyethylene Terephthalate (PET)

- 1.2.2. Polyamides

- 1.2.3. Polycarbonates

- 1.2.4. Styrene Copolymers (ABS and SAN)

- 1.2.5. Polybutylene Terephthalate (PBT)

- 1.2.6. Polymethyl Methacrylate (PMMA)

- 1.2.7. Other Engineering Plastics

- 1.3. Bioplastics

-

1.1. Traditional Plastics

-

2. Application

- 2.1. Packaging

- 2.2. Electrical and Electronics

- 2.3. Building and Construction

- 2.4. Automotive and Transportation

- 2.5. Furniture and Bedding

- 2.6. Other Applications

Thailand Plastic Market Segmentation By Geography

- 1. Thailand

Thailand Plastic Market Regional Market Share

Geographic Coverage of Thailand Plastic Market

Thailand Plastic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.35% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Thailand Plastic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Traditional Plastics

- 5.1.1.1. Polyethylene

- 5.1.1.2. Polypropylene

- 5.1.1.3. Polystyrene

- 5.1.1.4. Polyvinyl Chloride

- 5.1.2. Engineering Plastics

- 5.1.2.1. Polyethylene Terephthalate (PET)

- 5.1.2.2. Polyamides

- 5.1.2.3. Polycarbonates

- 5.1.2.4. Styrene Copolymers (ABS and SAN)

- 5.1.2.5. Polybutylene Terephthalate (PBT)

- 5.1.2.6. Polymethyl Methacrylate (PMMA)

- 5.1.2.7. Other Engineering Plastics

- 5.1.3. Bioplastics

- 5.1.1. Traditional Plastics

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Packaging

- 5.2.2. Electrical and Electronics

- 5.2.3. Building and Construction

- 5.2.4. Automotive and Transportation

- 5.2.5. Furniture and Bedding

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Thailand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Covestro AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 HMC Polymers Thailand

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Indorama Ventures Public Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 INEOS Styrolution Group GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PTT Global Chemical Public Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SCG Chemicals Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thai Plastic Industries Co Ltd*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Covestro AG

List of Figures

- Figure 1: Thailand Plastic Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Thailand Plastic Market Share (%) by Company 2025

List of Tables

- Table 1: Thailand Plastic Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Thailand Plastic Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Thailand Plastic Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Thailand Plastic Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Thailand Plastic Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Thailand Plastic Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Thailand Plastic Market?

The projected CAGR is approximately 11.35%.

2. Which companies are prominent players in the Thailand Plastic Market?

Key companies in the market include Covestro AG, HMC Polymers Thailand, Indorama Ventures Public Company Limited, INEOS Styrolution Group GmbH, PTT Global Chemical Public Company Limited, SCG Chemicals Co Ltd, Thai Plastic Industries Co Ltd*List Not Exhaustive.

3. What are the main segments of the Thailand Plastic Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Plastics in Building and Construction; Rising Demand from Food and Beverage Packaging.

8. Can you provide examples of recent developments in the market?

December 2022: the Thailand-based major producer and distributor of polypropylene or PP resin company, named HMC Polymers company limited or HMC Polymers, announced to open of the fourth production line of the polypropylene plant (PP4 plant) in Map Ta Phut Industrial Estate, Rayong Province, Thailand, with an investment of over THB 8,000 million (USD 244.13 million). This new plant will help the company reinforce its leadership in the PP resin industry in the Southeast Asian region. The 4th production facility of HMC Polymers will increase the company's production capacity from 810,000 tons per annum to 1,060,000 tons per annum.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Thailand Plastic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Thailand Plastic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Thailand Plastic Market?

To stay informed about further developments, trends, and reports in the Thailand Plastic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence