Key Insights

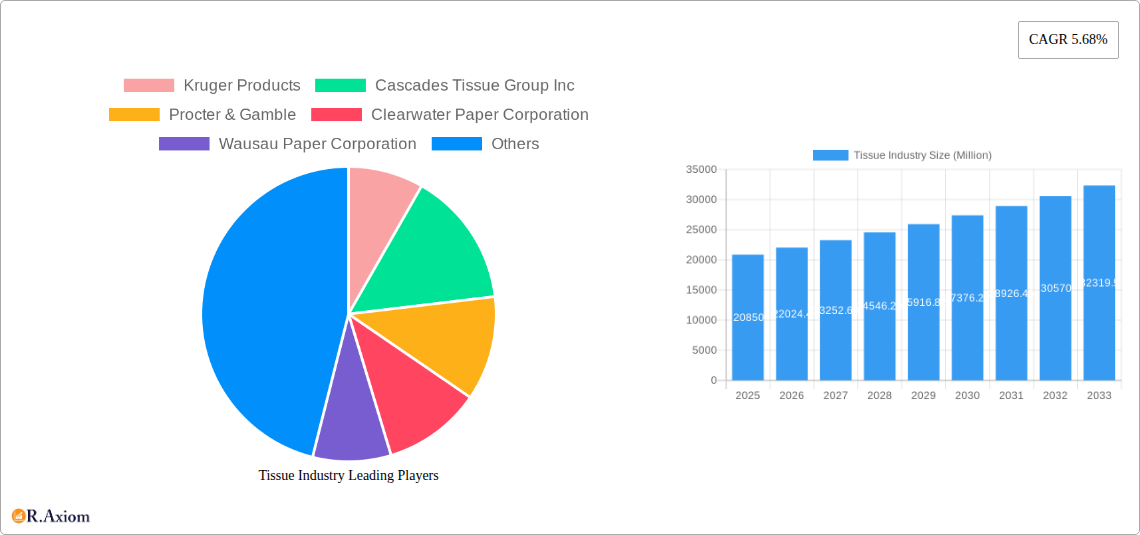

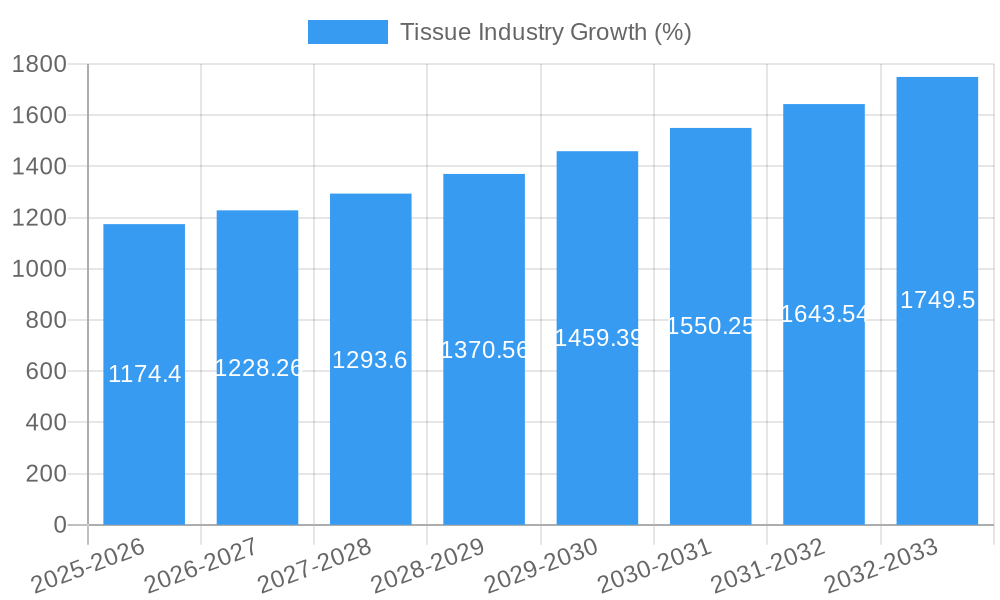

The global tissue paper market, valued at $20.85 billion in 2025, is projected to experience robust growth, driven by several key factors. Rising disposable incomes, particularly in developing economies, are fueling increased consumption of tissue products like toilet paper, paper towels, and facial tissues. Simultaneously, heightened awareness of hygiene and sanitation, amplified by recent global health concerns, is significantly boosting demand. Product innovation, such as the introduction of eco-friendly and sustainable tissue options made from recycled materials or bamboo, is attracting environmentally conscious consumers and shaping market trends. The market is segmented by raw material (BSK, BHK, HYP, etc.), product type (bathroom tissue, paper towels, etc.), and distribution channel (at-home, away-from-home). Key players like Procter & Gamble, Kimberly-Clark, and Essity are leveraging their strong brand recognition and extensive distribution networks to maintain market share. However, fluctuating raw material prices, particularly pulp costs, pose a significant challenge, impacting profitability and potentially influencing pricing strategies. Furthermore, growing environmental concerns related to deforestation and water usage in pulp production are prompting manufacturers to adopt sustainable practices and invest in innovative, environmentally responsible solutions.

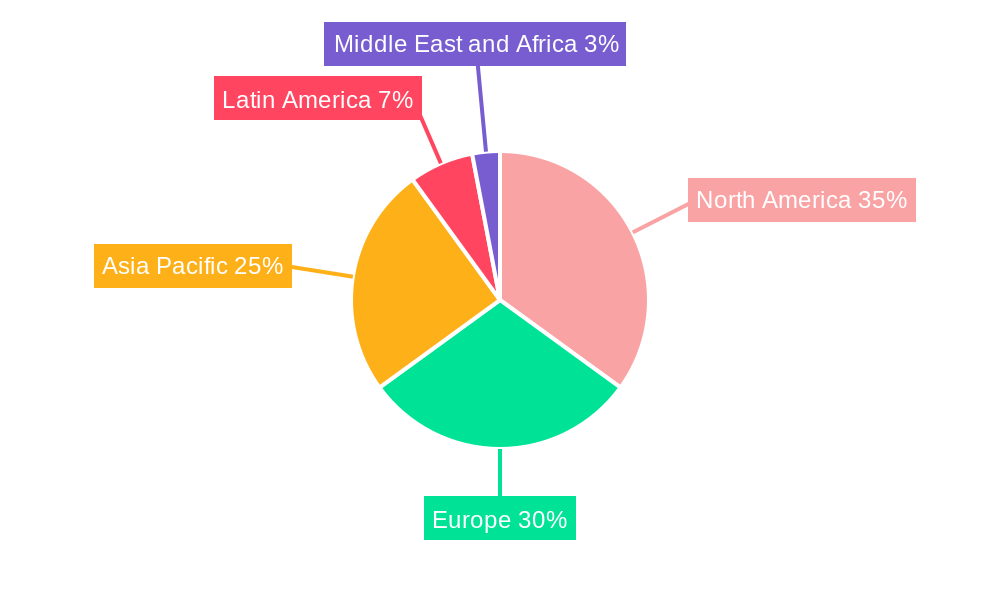

The market's geographical distribution reveals a varied landscape. North America and Europe currently hold substantial market share due to high per capita consumption and established market infrastructure. However, the Asia-Pacific region is poised for significant growth, fueled by rapid economic development and increasing urbanization. Latin America and the Middle East and Africa also present substantial, albeit less mature, market opportunities. The forecast period of 2025-2033 suggests continued expansion, with a projected CAGR of 5.68%, indicating a considerable market potential for established players and new entrants alike. This growth is expected to be driven by continuous product diversification, improved distribution channels, and a persistent focus on sustainable and eco-friendly tissue options. The competitive landscape remains dynamic, with companies focused on innovation, brand building, and efficient supply chain management to gain a competitive edge.

This comprehensive report provides an in-depth analysis of the global tissue industry, offering valuable insights for stakeholders across the value chain. Covering the period 2019-2033, with a focus on 2025, this report examines market dynamics, key players, and emerging trends to provide a clear strategic outlook. The study period is 2019-2033, with 2025 as the base and estimated year, and 2025-2033 as the forecast period. The historical period covered is 2019-2024. Market values are expressed in Millions.

Tissue Industry Market Concentration & Innovation

This section analyzes the competitive landscape of the tissue industry, evaluating market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and mergers & acquisitions (M&A) activities. The global tissue market exhibits moderate concentration, with several large players holding significant market share. However, the presence of numerous smaller regional players contributes to a dynamic competitive landscape.

- Market Share: Kimberly-Clark Corporation and Procter & Gamble hold a combined xx% market share, highlighting their dominant position. Other major players like Essity and Cascades Tissue Group Inc. also command significant portions of the market (xx%). However, regional players collectively contribute a substantial xx% to the total market, indicating significant competition at both global and regional levels.

- Innovation Drivers: Sustainability initiatives, particularly around recyclable and sustainable raw materials, are driving significant innovation. This includes the development of alternative fiber sources and advanced manufacturing processes to reduce environmental impact. Consumer demand for premium and specialized tissue products is another key driver, leading to product diversification and improved quality.

- Regulatory Frameworks: Stringent environmental regulations regarding waste management and sustainable sourcing significantly influence industry practices and investment decisions. These regulations promote the adoption of eco-friendly technologies and sustainable sourcing practices.

- M&A Activities: The tissue industry has seen a moderate level of M&A activity in recent years, with deal values totaling approximately $xx Million. These deals primarily focused on expanding geographical reach, product portfolio diversification, and enhancing vertical integration. For example, a major transaction involved the acquisition of a smaller regional player by a large multinational, increasing market share and regional presence.

- Product Substitutes: While traditional tissue products dominate, alternative products like reusable cloths and bamboo-based tissues are emerging as substitutes. However, their market penetration remains relatively low.

Tissue Industry Industry Trends & Insights

This section delves into the key trends and insights shaping the tissue industry. The market exhibits a steady growth trajectory driven by increasing disposable incomes, changing lifestyles, and rising hygiene awareness across the globe. However, raw material price volatility and fluctuations in energy costs pose challenges.

The global tissue market is projected to grow at a CAGR of xx% during the forecast period (2025-2033), driven primarily by strong demand in developing economies. Market penetration of premium tissue products, particularly in developed countries, remains high. Technological advancements in manufacturing processes are boosting efficiency and production volumes. Shifting consumer preferences towards eco-friendly and sustainable products necessitate sustainable sourcing practices and the development of biodegradable or compostable products. Intense competition among established players and the entry of new players in niche segments create a dynamic marketplace. The increasing adoption of e-commerce also impacts distribution channels and necessitates innovations in packaging.

Dominant Markets & Segments in Tissue Industry

This section identifies the dominant regions, countries, and segments within the tissue industry.

By Raw Material:

- Bleached Softwood Kraft Pulp (BSK): Remains the dominant raw material due to its superior strength and softness characteristics. Key drivers include its established use and availability.

- Birch Hardwood Kraft Pulp (BHK): A significant segment offering a balance of cost-effectiveness and quality. This market's growth is fuelled by expanding production capacities and increasing demand from tissue manufacturers.

- High Yield Pulp (HYP): Used as a cost-effective component in tissue production.

- Other Raw Materials: Includes recycled fibers and other alternative raw materials, witnessing increased demand due to sustainability concerns and regulatory pressure.

By Product Type:

- Bathroom Tissue: The largest segment, characterized by high consumption rates globally, driven by hygiene awareness and convenience.

- Paper Towels: A significant segment with strong demand in both household and commercial settings, supported by convenience and hygiene needs.

- Facial Tissues: A substantial segment driven by health and hygiene awareness, with growth spurred by specialized and premium products.

- Paper Napkins: A consistently performing segment driven by household usage and food service industries.

- Specialty and Wrapping Tissue: A niche segment with a moderate growth outlook, driven by increasing demand for specialized packaging in retail and e-commerce sectors.

By Type:

- At Home: This segment constitutes the largest portion of the market due to the increasing use of tissue products for hygiene and daily living in households across the globe.

- Away from Home: This market segment witnesses stable growth, driven by the increasing demand for tissue products in commercial settings like offices, public restrooms, and hotels.

North America and Europe represent the most significant regional markets, driven by high per capita consumption and established infrastructure. However, Asia-Pacific is experiencing rapid growth due to increasing urbanization, rising disposable incomes, and heightened awareness of hygiene.

Tissue Industry Product Developments

Recent product innovations have focused on enhancing product quality, sustainability, and functionality. These include the introduction of recycled content tissues, biodegradable products, and specialized tissue formulations for specific applications like sensitive skin or industrial uses. Key advancements involve improving softness, strength, and absorbency through modifications to the pulping process and incorporating advanced technologies in manufacturing. Furthermore, advancements in packaging design improve logistics and reduce environmental impact.

Report Scope & Segmentation Analysis

This report segments the tissue industry by raw material (BSK, BHK, HYP, Other), product type (Bathroom Tissue, Paper Napkins, Paper Towels, Facial Tissues, Specialty and Wrapping Tissue), and type (At Home, Away from Home). Each segment's growth projections, market size, and competitive dynamics are analyzed. Growth is projected to be strongest in the Away from Home segment, driven by economic growth and increased public hygiene consciousness. The BSK segment dominates the raw material sector. The market is fragmented, with several large and small players competing across these segments.

Key Drivers of Tissue Industry Growth

Several factors fuel the growth of the tissue industry. Increasing disposable incomes globally, particularly in developing economies, drive higher consumption. Enhanced hygiene awareness, especially in developing nations, supports the adoption of tissue products. Continuous product innovation to improve softness, absorbency, and sustainability further drives market expansion. The growth of e-commerce and food delivery services increases demand for packaging tissues.

Challenges in the Tissue Industry Sector

The tissue industry faces several challenges. Fluctuations in raw material prices, particularly pulp, influence production costs and profitability. Stringent environmental regulations related to waste management and sustainable forestry practices necessitate ongoing investments in compliant technologies. Intense competition among established players and the entrance of new players increase pressure on margins. Supply chain disruptions, exacerbated by global events, can disrupt production and distribution.

Emerging Opportunities in Tissue Industry

Emerging opportunities exist in the tissue industry. The growing demand for sustainable and eco-friendly products creates significant opportunities for the development and adoption of recycled, biodegradable, and compostable tissues. Expanding into new, high-growth markets, particularly in developing regions, offers significant potential. Developing advanced manufacturing processes to enhance production efficiency and reduce costs presents further opportunity. Technological innovations, like improved packaging solutions and automation of manufacturing processes, offer advantages in terms of efficiency and environmental impact.

Leading Players in the Tissue Industry Market

- Kruger Products

- Cascades Tissue Group Inc

- Procter & Gamble

- Clearwater Paper Corporation

- Wausau Paper Corporation

- Essity

- Asia Pulp and Paper (APP)

- Sofidel Group

- Georgia Pacific LLC

- Kimberly-Clark Corporation

- SCA (Svenska Cellulosa Aktiebolaget)

Key Developments in Tissue Industry Industry

- January 2022: Crown Paper Mill (CPM) planned to construct a tissue mill with an annual production capacity of 60,000 MT in Saudi Arabia. This signifies expansion into a high-growth market.

- October 2022: Sealed Air launched its ready-to-roll paper wrapping systems, addressing increasing demand for sustainable e-commerce packaging. This highlights innovation in packaging solutions to meet the evolving needs of online retailers.

Strategic Outlook for Tissue Industry Market

The tissue industry is poised for continued growth, driven by increasing consumer demand, product innovation, and expansion into new markets. Opportunities abound in developing sustainable products, improving manufacturing efficiency, and leveraging technological advancements to meet the evolving needs of a global market. Further M&A activity is anticipated, leading to greater industry consolidation and the emergence of stronger global players. The focus on sustainability and eco-friendly solutions will continue to define the industry's strategic direction.

Tissue Industry Segmentation

-

1. Raw Material

- 1.1. Bleached Softwood Kraft Pulp (BSK)

- 1.2. Birch Hardwood Kraft Pulp (BHK)

- 1.3. High Yield Pulp (HYP)

- 1.4. Other Raw Materials

-

2. Product Type

- 2.1. Bathroom Tissue

- 2.2. Paper Napkins

- 2.3. Paper Towels

- 2.4. Facial Tissues

- 2.5. Speciality and Wrapping Tissue

-

3. Type

- 3.1. At Home

- 3.2. Away from Home

Tissue Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Tissue Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.68% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Spending on Hygiene; Technological Developments in Manufacturing Processes

- 3.3. Market Restrains

- 3.3.1. ; Alternative Forms of Packaging

- 3.4. Market Trends

- 3.4.1. Bathroom Tissue Expected to Witness a High Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Bleached Softwood Kraft Pulp (BSK)

- 5.1.2. Birch Hardwood Kraft Pulp (BHK)

- 5.1.3. High Yield Pulp (HYP)

- 5.1.4. Other Raw Materials

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Bathroom Tissue

- 5.2.2. Paper Napkins

- 5.2.3. Paper Towels

- 5.2.4. Facial Tissues

- 5.2.5. Speciality and Wrapping Tissue

- 5.3. Market Analysis, Insights and Forecast - by Type

- 5.3.1. At Home

- 5.3.2. Away from Home

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. North America Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Bleached Softwood Kraft Pulp (BSK)

- 6.1.2. Birch Hardwood Kraft Pulp (BHK)

- 6.1.3. High Yield Pulp (HYP)

- 6.1.4. Other Raw Materials

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Bathroom Tissue

- 6.2.2. Paper Napkins

- 6.2.3. Paper Towels

- 6.2.4. Facial Tissues

- 6.2.5. Speciality and Wrapping Tissue

- 6.3. Market Analysis, Insights and Forecast - by Type

- 6.3.1. At Home

- 6.3.2. Away from Home

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. Europe Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Bleached Softwood Kraft Pulp (BSK)

- 7.1.2. Birch Hardwood Kraft Pulp (BHK)

- 7.1.3. High Yield Pulp (HYP)

- 7.1.4. Other Raw Materials

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Bathroom Tissue

- 7.2.2. Paper Napkins

- 7.2.3. Paper Towels

- 7.2.4. Facial Tissues

- 7.2.5. Speciality and Wrapping Tissue

- 7.3. Market Analysis, Insights and Forecast - by Type

- 7.3.1. At Home

- 7.3.2. Away from Home

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Asia Pacific Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Bleached Softwood Kraft Pulp (BSK)

- 8.1.2. Birch Hardwood Kraft Pulp (BHK)

- 8.1.3. High Yield Pulp (HYP)

- 8.1.4. Other Raw Materials

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Bathroom Tissue

- 8.2.2. Paper Napkins

- 8.2.3. Paper Towels

- 8.2.4. Facial Tissues

- 8.2.5. Speciality and Wrapping Tissue

- 8.3. Market Analysis, Insights and Forecast - by Type

- 8.3.1. At Home

- 8.3.2. Away from Home

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. Latin America Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Bleached Softwood Kraft Pulp (BSK)

- 9.1.2. Birch Hardwood Kraft Pulp (BHK)

- 9.1.3. High Yield Pulp (HYP)

- 9.1.4. Other Raw Materials

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Bathroom Tissue

- 9.2.2. Paper Napkins

- 9.2.3. Paper Towels

- 9.2.4. Facial Tissues

- 9.2.5. Speciality and Wrapping Tissue

- 9.3. Market Analysis, Insights and Forecast - by Type

- 9.3.1. At Home

- 9.3.2. Away from Home

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. Middle East and Africa Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Bleached Softwood Kraft Pulp (BSK)

- 10.1.2. Birch Hardwood Kraft Pulp (BHK)

- 10.1.3. High Yield Pulp (HYP)

- 10.1.4. Other Raw Materials

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Bathroom Tissue

- 10.2.2. Paper Napkins

- 10.2.3. Paper Towels

- 10.2.4. Facial Tissues

- 10.2.5. Speciality and Wrapping Tissue

- 10.3. Market Analysis, Insights and Forecast - by Type

- 10.3.1. At Home

- 10.3.2. Away from Home

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. North America Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Tissue Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Kruger Products

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Cascades Tissue Group Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Procter & Gamble

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Clearwater Paper Corporation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Wausau Paper Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Essity*List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Asia Pulp and Paper (APP)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Sofidel Group

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Georgia Pacific LLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Kimberly-Clark Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 SCA (Svenska Cellulosa Aktiebolaget)

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Kruger Products

List of Figures

- Figure 1: Global Tissue Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Tissue Industry Revenue (Million), by Raw Material 2024 & 2032

- Figure 13: North America Tissue Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 14: North America Tissue Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 15: North America Tissue Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 16: North America Tissue Industry Revenue (Million), by Type 2024 & 2032

- Figure 17: North America Tissue Industry Revenue Share (%), by Type 2024 & 2032

- Figure 18: North America Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Tissue Industry Revenue (Million), by Raw Material 2024 & 2032

- Figure 21: Europe Tissue Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 22: Europe Tissue Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 23: Europe Tissue Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 24: Europe Tissue Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Europe Tissue Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Europe Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific Tissue Industry Revenue (Million), by Raw Material 2024 & 2032

- Figure 29: Asia Pacific Tissue Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 30: Asia Pacific Tissue Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 31: Asia Pacific Tissue Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Asia Pacific Tissue Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Pacific Tissue Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Pacific Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Asia Pacific Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Latin America Tissue Industry Revenue (Million), by Raw Material 2024 & 2032

- Figure 37: Latin America Tissue Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 38: Latin America Tissue Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 39: Latin America Tissue Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 40: Latin America Tissue Industry Revenue (Million), by Type 2024 & 2032

- Figure 41: Latin America Tissue Industry Revenue Share (%), by Type 2024 & 2032

- Figure 42: Latin America Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Latin America Tissue Industry Revenue Share (%), by Country 2024 & 2032

- Figure 44: Middle East and Africa Tissue Industry Revenue (Million), by Raw Material 2024 & 2032

- Figure 45: Middle East and Africa Tissue Industry Revenue Share (%), by Raw Material 2024 & 2032

- Figure 46: Middle East and Africa Tissue Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 47: Middle East and Africa Tissue Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 48: Middle East and Africa Tissue Industry Revenue (Million), by Type 2024 & 2032

- Figure 49: Middle East and Africa Tissue Industry Revenue Share (%), by Type 2024 & 2032

- Figure 50: Middle East and Africa Tissue Industry Revenue (Million), by Country 2024 & 2032

- Figure 51: Middle East and Africa Tissue Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Tissue Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Tissue Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 3: Global Tissue Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: Global Tissue Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 5: Global Tissue Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Tissue Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Tissue Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Tissue Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Tissue Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Tissue Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Tissue Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 17: Global Tissue Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 18: Global Tissue Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Tissue Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 21: Global Tissue Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 22: Global Tissue Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 23: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Tissue Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 25: Global Tissue Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 26: Global Tissue Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 27: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Tissue Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 29: Global Tissue Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 30: Global Tissue Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Tissue Industry Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 33: Global Tissue Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 34: Global Tissue Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global Tissue Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Tissue Industry?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the Tissue Industry?

Key companies in the market include Kruger Products, Cascades Tissue Group Inc, Procter & Gamble, Clearwater Paper Corporation, Wausau Paper Corporation, Essity*List Not Exhaustive, Asia Pulp and Paper (APP), Sofidel Group, Georgia Pacific LLC, Kimberly-Clark Corporation, SCA (Svenska Cellulosa Aktiebolaget).

3. What are the main segments of the Tissue Industry?

The market segments include Raw Material, Product Type, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.85 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Spending on Hygiene; Technological Developments in Manufacturing Processes.

6. What are the notable trends driving market growth?

Bathroom Tissue Expected to Witness a High Growth Rate.

7. Are there any restraints impacting market growth?

; Alternative Forms of Packaging.

8. Can you provide examples of recent developments in the market?

October 2022 - Sealed Air launched its first ready-to-roll paper wrapping systems to streamline packaging supply for low- and medium-volume e-commerce retailers and fulfillment companies. According to Sealed Air, the QuikWrap Nano and QuikWrap M systems require minimal assembly and do not need electricity or excessive maintenance. Each can produce double layers of FSC-certified honeycomb paper and interleaf tissue paper, which are claimed to be 100% kerbside recyclable and are expected to provide enhanced protection for the products they package.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Tissue Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Tissue Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Tissue Industry?

To stay informed about further developments, trends, and reports in the Tissue Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence