Key Insights

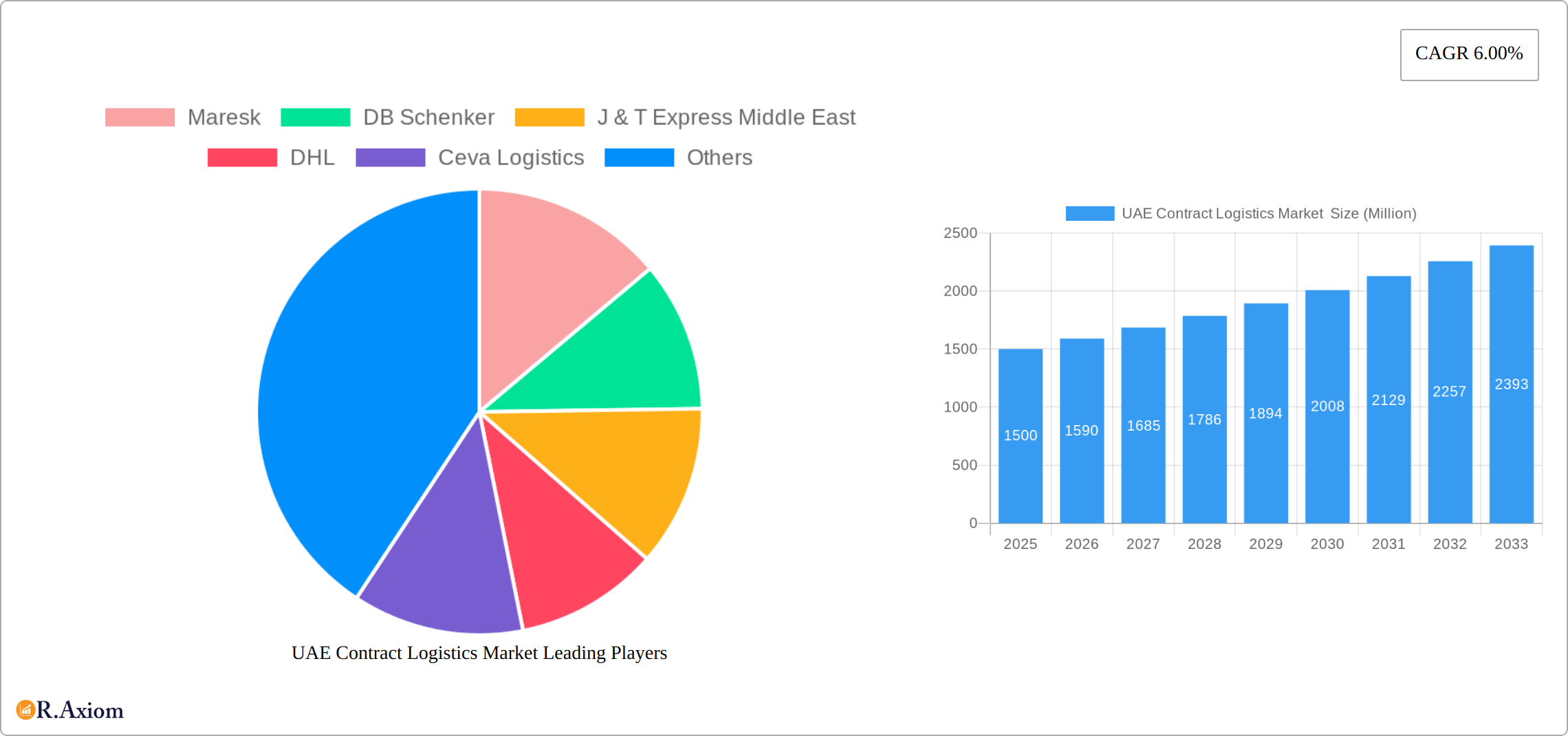

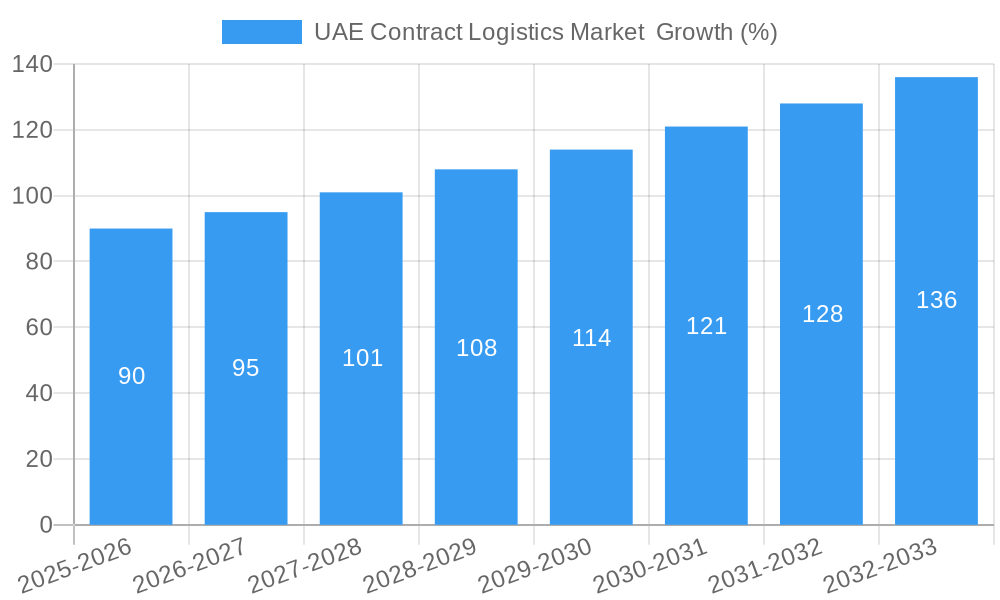

The UAE contract logistics market, valued at approximately $X million in 2025 (assuming a logical extrapolation based on the provided 2019-2024 data and 6% CAGR), is experiencing robust growth, projected to reach $Y million by 2033. This expansion is fueled by several key factors. The UAE's strategic geographic location as a global trade hub, coupled with its advanced infrastructure and supportive government policies, significantly contributes to the market's dynamism. The burgeoning e-commerce sector within the UAE and the increasing demand for efficient supply chain solutions across diverse industries—including manufacturing, automotive, consumer goods, retail, high-tech, and healthcare—are major drivers. Furthermore, a growing focus on technological advancements within logistics, such as automation and data analytics, is enhancing operational efficiency and attracting significant investments. Outsourcing trends are prevalent, particularly amongst SMEs seeking scalability and cost optimization, further stimulating market expansion.

However, challenges remain. Fluctuating fuel prices and geopolitical uncertainties can impact transportation costs and overall market stability. Competition amongst established players like Maersk, DB Schenker, DHL, and others, while driving innovation, also necessitates continuous strategic adaptation. Despite these restraints, the UAE's commitment to economic diversification and its focus on developing a world-class logistics infrastructure promise continued, albeit potentially moderated, growth for the contract logistics sector throughout the forecast period (2025-2033). The market segmentation reveals significant opportunities across various end-user industries, each presenting unique logistical requirements and growth potentials.

UAE Contract Logistics Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UAE contract logistics market, offering valuable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The market is segmented by type (insourced and outsourced) and end-user (Manufacturing and Automotive, Consumer Goods and Retail, High-tech, Healthcare and Pharmaceuticals, and Other End Users). Key players such as Maersk, DB Schenker, DHL, and others are analyzed for their market share and strategic initiatives. The report's findings are based on rigorous research and analysis, providing actionable intelligence to inform strategic decision-making. The total market value in 2025 is estimated at xx Million, with projections extending to 2033.

UAE Contract Logistics Market Concentration & Innovation

The UAE contract logistics market exhibits a moderately concentrated landscape, with a few major global players holding significant market share. Maersk, DB Schenker, DHL, and Agility Logistics Pvt Ltd are among the dominant players, leveraging their extensive networks and technological capabilities. Market share data for 2025 shows DHL holding approximately xx% share, followed by Maersk at xx%, DB Schenker at xx%, and Agility at xx%. The remaining share is distributed among regional and smaller players.

Innovation is a key driver, with companies investing heavily in technological advancements such as automation, AI-powered logistics solutions, and blockchain technology for enhanced transparency and efficiency. The regulatory framework, while generally supportive of business growth, faces ongoing evolution to adapt to the rapid technological changes in the industry. Product substitution is relatively limited, with the core offering remaining centered around efficient and reliable logistics solutions. End-user trends indicate a growing preference for integrated and customized contract logistics solutions, tailored to specific industry needs.

M&A activity has been moderate in recent years, with several smaller acquisitions aimed at expanding geographic reach or acquiring specialized capabilities. The total value of M&A deals in the last five years is estimated to be around xx Million. These deals highlight a trend towards consolidation and the expansion of service offerings within the market.

UAE Contract Logistics Market Industry Trends & Insights

The UAE contract logistics market is experiencing robust growth, driven by several key factors. The expanding e-commerce sector, the rise of omnichannel retail, and the continued growth of manufacturing and industrial activities are all contributing to the increased demand for efficient and reliable logistics solutions. The market is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is further fueled by investments in infrastructure development, such as improved port facilities and transportation networks, and the government's focus on promoting the ease of doing business.

Technological disruptions are reshaping the industry landscape. The adoption of advanced technologies such as AI, machine learning, and IoT is enabling greater automation, optimization of supply chains, and enhanced real-time visibility. Consumer preferences are shifting towards faster delivery times, increased transparency, and personalized services, pushing logistics providers to adapt and innovate. Competitive dynamics are characterized by a mix of both cooperation and competition, with leading players forming strategic alliances while simultaneously vying for market share. Market penetration of advanced technologies like AI in logistics is projected to reach approximately xx% by 2033.

Dominant Markets & Segments in UAE Contract Logistics Market

The UAE's contract logistics market is dominated by the major urban centers, particularly Dubai and Abu Dhabi. These areas offer a large pool of potential clients, well-established infrastructure, and access to key transportation routes.

- By Type: The Outsourced segment holds the larger market share, reflecting the increasing preference among businesses to outsource logistics functions to focus on core competencies.

- By End User: The Consumer Goods and Retail sector is a significant driver of growth, followed closely by the Manufacturing and Automotive sector. The growth of e-commerce and the expansion of retail chains are significant contributors to the dominance of the Consumer Goods and Retail segment. Key drivers for this include the robust consumer spending in the UAE, the burgeoning e-commerce sector, and the focus on efficient supply chains to meet rising consumer demand. The Manufacturing and Automotive sector's growth is propelled by the government’s initiatives to diversify the economy and attract foreign investment in these sectors.

Economic policies promoting diversification, the robust growth of the e-commerce industry, and investments in infrastructure development significantly contribute to the overall dominance of these segments.

UAE Contract Logistics Market Product Developments

Recent product developments are focused on enhancing efficiency, transparency, and sustainability. This includes the integration of AI-powered platforms for real-time tracking, predictive analytics, and automated warehousing systems. The development of specialized solutions catering to specific industry needs (e.g., temperature-controlled transport for pharmaceuticals) is another key trend. The adoption of these innovations reflects a market-driven demand for optimized logistics solutions, ultimately increasing operational efficiencies and reducing overall costs for end-users.

Report Scope & Segmentation Analysis

This report provides a detailed analysis of the UAE contract logistics market segmented by type and end-user.

By Type:

- Insourced: This segment involves businesses managing their logistics operations in-house. It is projected to experience moderate growth, driven by larger companies with established internal logistics capabilities.

- Outsourced: This segment represents the majority of the market, with a strong growth projection due to the increasing preference for specialized logistics providers offering efficiency and scalability.

By End-User:

- Manufacturing and Automotive: This segment demonstrates robust growth due to expanding industrial activities and automotive production in the UAE.

- Consumer Goods and Retail: This is the largest segment, reflecting the significant impact of e-commerce and omnichannel retail on logistics demand.

- High-tech: This segment is experiencing growth driven by the increasing demand for efficient and secure handling of sensitive technology products.

- Healthcare and Pharmaceuticals: This segment is characterized by stringent regulatory requirements and a focus on temperature-controlled logistics solutions.

- Other End-Users: This segment comprises various industries with varying logistics requirements.

Key Drivers of UAE Contract Logistics Market Growth

The UAE's contract logistics market growth is propelled by several factors. Firstly, the booming e-commerce industry necessitates efficient last-mile delivery solutions, driving demand for contract logistics services. Secondly, government initiatives aimed at infrastructure development, such as improved port facilities and road networks, further enhance logistics efficiency and attract foreign investment. Finally, the increasing adoption of advanced technologies like AI and automation streamlines operations and boosts the overall market efficiency.

Challenges in the UAE Contract Logistics Market Sector

The UAE contract logistics market faces challenges including high labor costs, fierce competition among established players, and navigating evolving regulatory requirements. Supply chain disruptions, particularly those caused by global events, can significantly impact operational efficiency and profitability. These factors could potentially result in increased costs and delays, impacting overall market growth. The quantifiable impact varies, but recent disruptions have shown potential for a xx% decrease in efficiency in specific sectors.

Emerging Opportunities in UAE Contract Logistics Market

Emerging opportunities lie in expanding into specialized logistics niches, such as temperature-controlled transport for pharmaceuticals or high-value goods. The growth of e-commerce also presents opportunities in last-mile delivery optimization and the integration of new technologies such as drones and autonomous vehicles. Further growth is expected from sustainable logistics solutions that cater to the growing focus on environmentally friendly operations.

Leading Players in the UAE Contract Logistics Market Market

- Maersk

- DB Schenker

- J & T Express Middle East

- DHL

- Ceva Logistics

- Yusen Logistics Co Ltd

- Agility Logistics Pvt Ltd

- Aramex

- GAC

- Hellmann Worldwide Logistics GmbH & Co KG

- Mac World Logistic LLC

- DSV

- RAK Logistics

- Al-futtaim Logistics

Key Developments in UAE Contract Logistics Market Industry

- November 2022: DSV launched a 14,000 square-meter logistics facility in Bahrain, expanding its warehousing capacity and contract logistics solutions. This development enhances DSV's regional presence and strengthens its capabilities in the fast-moving consumer goods sector.

- March 2023: Aramco and DHL Supply Chain announced a joint venture for a new procurement and logistics hub in Saudi Arabia, focusing on sustainable and integrated supply chain solutions. While not directly in the UAE, this signals a broader regional trend and potential future expansion into the UAE market.

Strategic Outlook for UAE Contract Logistics Market Market

The UAE contract logistics market presents significant growth potential driven by continuous expansion in e-commerce, the government’s push towards infrastructure development, and the ongoing adoption of innovative technologies. The market's future success hinges on companies' ability to adapt to changing consumer demands, embrace sustainable practices, and leverage technological advancements to enhance efficiency and create greater transparency throughout the supply chain. This presents significant opportunities for both established players and new entrants seeking to establish a strong foothold within this rapidly evolving market.

UAE Contract Logistics Market Segmentation

-

1. Type

- 1.1. Insourced

- 1.2. Outsourced

-

2. End User

- 2.1. Manufacturing and Automotive

- 2.2. Consumer Goods and Retail

- 2.3. High-tech

- 2.4. Healthcare and Pharmaceuticals

- 2.5. Other End Users

UAE Contract Logistics Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UAE Contract Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise In E commerce; Increase Demand for Efficient and Cost Effective Supply Chain

- 3.3. Market Restrains

- 3.3.1. Limited Visible of Shipments; Increasing Transportation

- 3.4. Market Trends

- 3.4.1. Growth in E-commerce Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UAE Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Insourced

- 5.1.2. Outsourced

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Manufacturing and Automotive

- 5.2.2. Consumer Goods and Retail

- 5.2.3. High-tech

- 5.2.4. Healthcare and Pharmaceuticals

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America UAE Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Insourced

- 6.1.2. Outsourced

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Manufacturing and Automotive

- 6.2.2. Consumer Goods and Retail

- 6.2.3. High-tech

- 6.2.4. Healthcare and Pharmaceuticals

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America UAE Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Insourced

- 7.1.2. Outsourced

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Manufacturing and Automotive

- 7.2.2. Consumer Goods and Retail

- 7.2.3. High-tech

- 7.2.4. Healthcare and Pharmaceuticals

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe UAE Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Insourced

- 8.1.2. Outsourced

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Manufacturing and Automotive

- 8.2.2. Consumer Goods and Retail

- 8.2.3. High-tech

- 8.2.4. Healthcare and Pharmaceuticals

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa UAE Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Insourced

- 9.1.2. Outsourced

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Manufacturing and Automotive

- 9.2.2. Consumer Goods and Retail

- 9.2.3. High-tech

- 9.2.4. Healthcare and Pharmaceuticals

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific UAE Contract Logistics Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Insourced

- 10.1.2. Outsourced

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Manufacturing and Automotive

- 10.2.2. Consumer Goods and Retail

- 10.2.3. High-tech

- 10.2.4. Healthcare and Pharmaceuticals

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Maresk

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DB Schenker

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 J & T Express Middle East

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DHL

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Ceva Logistics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Yusen Logistics Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Agility Logistics Pvt Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Arame

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 GAC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hellmann Worldwide Logistics GmbH & Co KG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Mac World Logistic LLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 DSV

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 RAK Logistics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Al-futtaim Logistics

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Maresk

List of Figures

- Figure 1: Global UAE Contract Logistics Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: UAE UAE Contract Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 3: UAE UAE Contract Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America UAE Contract Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 5: North America UAE Contract Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America UAE Contract Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 7: North America UAE Contract Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 8: North America UAE Contract Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America UAE Contract Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America UAE Contract Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 11: South America UAE Contract Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America UAE Contract Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 13: South America UAE Contract Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 14: South America UAE Contract Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America UAE Contract Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe UAE Contract Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 17: Europe UAE Contract Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe UAE Contract Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 19: Europe UAE Contract Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 20: Europe UAE Contract Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe UAE Contract Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa UAE Contract Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Middle East & Africa UAE Contract Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa UAE Contract Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 25: Middle East & Africa UAE Contract Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 26: Middle East & Africa UAE Contract Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa UAE Contract Logistics Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific UAE Contract Logistics Market Revenue (Million), by Type 2024 & 2032

- Figure 29: Asia Pacific UAE Contract Logistics Market Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific UAE Contract Logistics Market Revenue (Million), by End User 2024 & 2032

- Figure 31: Asia Pacific UAE Contract Logistics Market Revenue Share (%), by End User 2024 & 2032

- Figure 32: Asia Pacific UAE Contract Logistics Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific UAE Contract Logistics Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global UAE Contract Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global UAE Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global UAE Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global UAE Contract Logistics Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global UAE Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Global UAE Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 7: Global UAE Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global UAE Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Mexico UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global UAE Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: Global UAE Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: Global UAE Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: Brazil UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Argentina UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of South America UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global UAE Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global UAE Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 20: Global UAE Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United Kingdom UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: France UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Italy UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Spain UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Russia UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Benelux UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Nordics UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of Europe UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global UAE Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global UAE Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 32: Global UAE Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Turkey UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Israel UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: GCC UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: North Africa UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: South Africa UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Middle East & Africa UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global UAE Contract Logistics Market Revenue Million Forecast, by Type 2019 & 2032

- Table 40: Global UAE Contract Logistics Market Revenue Million Forecast, by End User 2019 & 2032

- Table 41: Global UAE Contract Logistics Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: China UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: India UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Japan UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: South Korea UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: ASEAN UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Oceania UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Asia Pacific UAE Contract Logistics Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UAE Contract Logistics Market ?

The projected CAGR is approximately 6.00%.

2. Which companies are prominent players in the UAE Contract Logistics Market ?

Key companies in the market include Maresk, DB Schenker, J & T Express Middle East, DHL, Ceva Logistics, Yusen Logistics Co Ltd, Agility Logistics Pvt Ltd, Arame, GAC, Hellmann Worldwide Logistics GmbH & Co KG, Mac World Logistic LLC, DSV, RAK Logistics, Al-futtaim Logistics.

3. What are the main segments of the UAE Contract Logistics Market ?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise In E commerce; Increase Demand for Efficient and Cost Effective Supply Chain.

6. What are the notable trends driving market growth?

Growth in E-commerce Driving the Market.

7. Are there any restraints impacting market growth?

Limited Visible of Shipments; Increasing Transportation.

8. Can you provide examples of recent developments in the market?

March 2023: To improve supply chain sustainability and efficiency, Aramco and contract logistics provider DHL Supply Chain have inked a shareholders' agreement for a new procurement and logistics hub in Saudi Arabia. The joint venture will offer complete integrated procurement and supply chain services to businesses in the industrial, energy, chemical, and petrochemical sectors once it becomes operational in 2025. The new center will concentrate on the Kingdom first, with aspirations to spread throughout the MENA region. The joint venture aims to implement supply chain, transportation, and warehousing solutions that are more environmentally friendly as well as industry best practices in procurement and supply chain management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UAE Contract Logistics Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UAE Contract Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UAE Contract Logistics Market ?

To stay informed about further developments, trends, and reports in the UAE Contract Logistics Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence