Key Insights

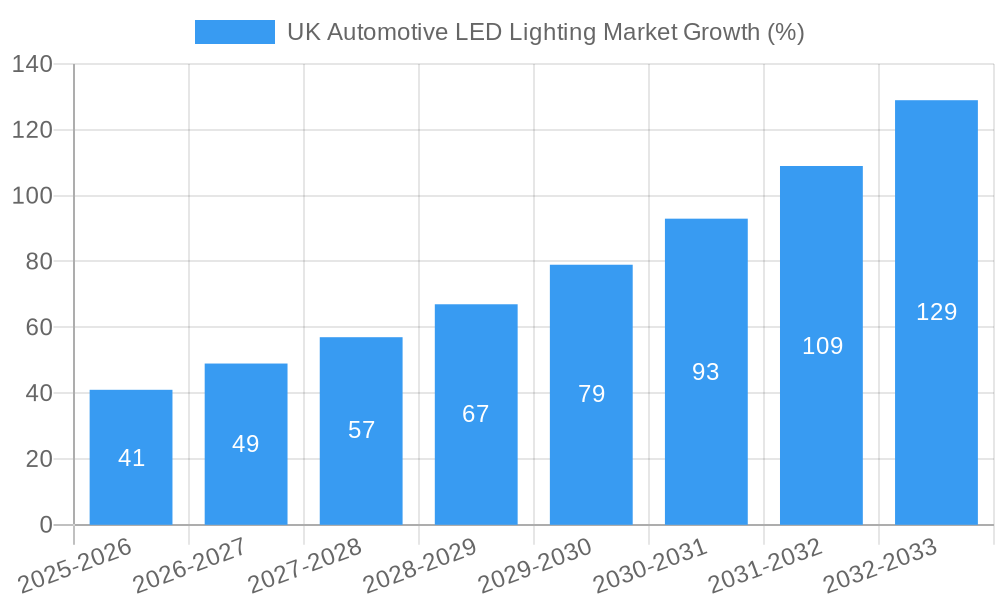

The UK automotive LED lighting market is experiencing robust growth, driven by increasing demand for enhanced safety features, improved fuel efficiency, and the aesthetic appeal of LED technology. The market, valued at approximately £X million in 2025 (assuming a market size "XX" represents a reasonable value in millions of pounds, which will be used consistently throughout this analysis based on this assumption), is projected to exhibit a Compound Annual Growth Rate (CAGR) of 16.42% from 2025 to 2033. This growth is fueled by several key factors. Firstly, stringent government regulations mandating advanced lighting systems in new vehicles are pushing adoption. Secondly, the rising consumer preference for advanced driver-assistance systems (ADAS) and superior visibility features contributes significantly to market expansion. Furthermore, the ongoing shift from traditional halogen and incandescent lighting to energy-efficient and longer-lasting LEDs further boosts market potential. The passenger car segment currently dominates the market, followed by commercial vehicles and two-wheelers. However, the two-wheeler segment is anticipated to showcase considerable growth owing to rising two-wheeler sales and the increasing adoption of LED lighting in this segment.

Within the automotive utility lighting segment, daytime running lights (DRLs), headlights, and tail lights are major contributors to market revenue. Despite the strong growth trajectory, challenges remain. High initial investment costs associated with LED technology can act as a barrier to entry for some manufacturers. Moreover, potential supply chain disruptions and fluctuations in raw material prices might impact market dynamics. Nevertheless, the long-term outlook for the UK automotive LED lighting market remains positive, driven by technological advancements, increasing regulatory compliance, and the continuous pursuit of enhanced vehicle safety and aesthetics. Leading players like OSRAM, HELLA, and Signify are strategically positioned to capitalize on these opportunities. The market’s expansion will be further fueled by the increasing integration of smart lighting technologies and connected car features, opening avenues for innovation and growth within the next decade.

UK Automotive LED Lighting Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the UK automotive LED lighting market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report dissects market trends, competitive dynamics, and future growth potential. The report leverages extensive data analysis and expert insights to deliver actionable intelligence across key market segments.

UK Automotive LED Lighting Market Concentration & Innovation

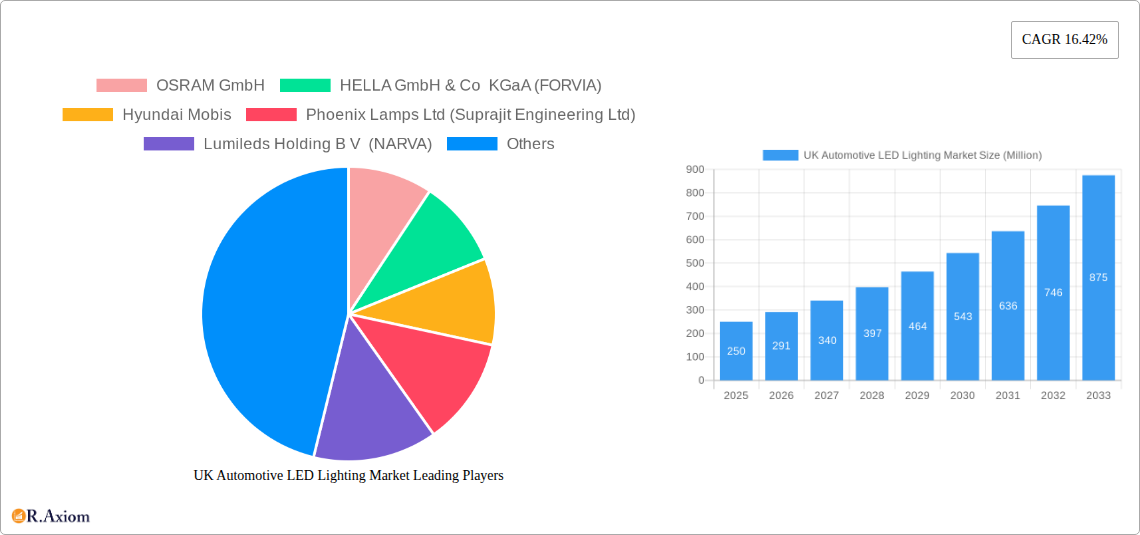

The UK automotive LED lighting market exhibits a moderately concentrated landscape, with a handful of global players holding significant market share. OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), and Signify (Philips) are prominent examples, collectively controlling an estimated xx% of the market in 2025. However, the market also accommodates several regional and specialized players, fostering competition and innovation.

Market Concentration Metrics (2025):

- Top 3 Players Market Share: xx%

- Top 5 Players Market Share: xx%

- Average Deal Value (M&A): £xx Million (2019-2024)

Innovation Drivers:

- Technological advancements: Miniaturization, improved energy efficiency, and advanced functionalities like adaptive headlights and laser lighting are driving innovation.

- Stringent regulations: EU regulations promoting enhanced vehicle safety and energy efficiency are pushing manufacturers to adopt LED technology.

- Consumer demand: Consumers increasingly prefer LED lighting for its aesthetic appeal, longevity, and superior illumination.

Regulatory Frameworks:

The UK automotive industry adheres to stringent safety and emission standards, influencing LED lighting adoption. These regulations mandate specific performance criteria for various lighting components.

Product Substitutes:

While LED lighting dominates, other technologies like halogen and Xenon exist, though their market share is shrinking due to LED's superior performance and cost-effectiveness over the lifecycle.

End-User Trends:

The increasing popularity of SUVs and electric vehicles directly boosts LED lighting demand due to their design integration and energy efficiency advantages.

M&A Activities: Consolidation through mergers and acquisitions has been moderate, with deal values ranging from £xx Million to £xx Million in recent years. These activities primarily aim to expand product portfolios and enhance market reach.

UK Automotive LED Lighting Market Industry Trends & Insights

The UK automotive LED lighting market is experiencing robust growth, driven by several factors. The CAGR during the forecast period (2025-2033) is projected to be xx%, reflecting increased vehicle production, rising consumer preference for advanced lighting features, and stringent safety regulations. Market penetration of LED lighting in new vehicles is already high, exceeding xx% in 2025, and is poised to reach near-saturation by 2033.

Technological disruptions, particularly in areas like adaptive driving beam (ADB) systems and laser lighting, will further propel market growth. Consumer preferences are shifting towards vehicles with sophisticated lighting systems, emphasizing safety, aesthetics, and advanced functionalities. The competitive landscape is dynamic, with both established players and new entrants vying for market share through product innovation and strategic partnerships. Price competition remains a significant factor, with price points influenced by the ongoing evolution of LED technology and component costs.

Dominant Markets & Segments in UK Automotive LED Lighting Market

The passenger car segment dominates the UK automotive LED lighting market, accounting for over xx% of total revenue in 2025. This dominance is fueled by the large volume of passenger car production and sales in the UK.

Dominant Segments (2025):

- Passenger Cars: This segment's dominance is driven by high production volumes and consumer preference for advanced lighting features.

- Headlights: Headlights represent a significant portion of the market due to their complexity and technological advancements.

- Daytime Running Lights (DRLs): The mandatory installation of DRLs in new vehicles significantly contributes to this segment’s growth.

Key Drivers:

- Economic growth: Economic stability and consumer spending contribute to vehicle sales and, consequently, LED lighting demand.

- Government incentives: Government policies supporting the adoption of fuel-efficient and eco-friendly vehicles indirectly influence LED lighting demand.

- Infrastructure development: Improved infrastructure facilitates smoother transportation of goods and components, affecting manufacturing and distribution.

UK Automotive LED Lighting Market Product Developments

Significant product innovations are reshaping the UK automotive LED lighting market. The shift towards adaptive driving beam (ADB) systems enhances safety and visibility, while the integration of laser lighting promises even brighter and more efficient illumination. These innovations are increasingly finding applications in high-end passenger cars and are gradually trickling down to mid-range and budget models. The competitive advantages stem from superior performance, enhanced safety features, and cost-effectiveness compared to traditional lighting solutions.

Report Scope & Segmentation Analysis

This report segments the UK automotive LED lighting market along two primary axes: Automotive Utility Lighting and Automotive Vehicle Lighting.

Automotive Utility Lighting: This segment comprises Daytime Running Lights (DRL), Directional Signal Lights, Headlights, Reverse Lights, Stop Lights, Tail Lights, and Others. Growth in this segment is projected at xx% CAGR during 2025-2033.

Automotive Vehicle Lighting: This segment is further categorized into 2 Wheelers, Commercial Vehicles, and Passenger Cars. The Passenger Car sub-segment exhibits the highest growth rate due to increased vehicle production and sales. Competitive dynamics in this area are defined by leading manufacturers' global expansion and technological competitiveness.

Key Drivers of UK Automotive LED Lighting Market Growth

The UK automotive LED lighting market's growth is primarily driven by:

- Technological advancements: The continuous development of more efficient and feature-rich LED lighting solutions attracts both manufacturers and consumers.

- Stringent safety regulations: Regulations mandating advanced lighting systems in new vehicles fuel market expansion.

- Growing demand for fuel efficiency: LED lighting contributes to improved fuel economy, making it attractive to environmentally conscious consumers.

Challenges in the UK Automotive LED Lighting Market Sector

The UK automotive LED lighting market faces challenges, including:

- Supply chain disruptions: Global supply chain issues can impact the availability and cost of LED components.

- Intense competition: The market's competitive nature puts pressure on profit margins.

- High initial investment costs: The upfront investment for adopting advanced LED lighting technologies can be substantial for smaller manufacturers.

Emerging Opportunities in UK Automotive LED Lighting Market

Emerging opportunities lie in:

- Smart lighting systems: The integration of intelligent features within LED lighting systems, for example, adaptive headlights and connected lighting.

- Electric vehicle adoption: The rise of electric vehicles directly boosts demand for energy-efficient LED lighting.

- Advanced driver-assistance systems (ADAS): ADAS functionalities that rely on advanced lighting technologies are creating new market segments.

Leading Players in the UK Automotive LED Lighting Market Market

- OSRAM GmbH

- HELLA GmbH & Co KGaA (FORVIA)

- Hyundai Mobis

- Phoenix Lamps Ltd (Suprajit Engineering Ltd)

- Lumileds Holding B V (NARVA)

- GRUPO ANTOLIN IRAUSA S A

- Marelli Holdings Co Ltd

- Stanley Electric Co Ltd

- Signify (Philips)

- KOITO MANUFACTURING CO LTD

Key Developments in UK Automotive LED Lighting Market Industry

- March 2023: HELLA expands its Black Magic auxiliary headlamp series with 32 new lightbars, including options for on-road and off-road applications. This expansion significantly broadens HELLA's product portfolio and market reach within the auxiliary lighting segment.

- March 2023: The launch of the New Generation of NARVA Range Performance Signaling Bulbs signifies an improvement in signaling bulb technology, offering enhanced visibility and quality. This can contribute to increased market share for NARVA and potentially increase adoption within the UK market.

- January 2023: HELLA's introduction of FlatLight technology into series production as a daytime running light represents a notable technological advancement. The successful transfer of this technology from rear combination lamps to front applications positions HELLA as an innovator and solidifies its position in the market.

Strategic Outlook for UK Automotive LED Lighting Market Market

The UK automotive LED lighting market is poised for continued growth, driven by technological innovation, stricter regulations, and increasing consumer demand for enhanced safety and aesthetic features. Opportunities exist in developing and deploying advanced lighting systems such as ADB and laser lighting, particularly in the rapidly expanding electric vehicle segment. Companies that successfully navigate supply chain complexities and adapt to evolving consumer preferences will be best positioned to capitalize on the market's long-term potential.

UK Automotive LED Lighting Market Segmentation

-

1. Automotive Utility Lighting

- 1.1. Daytime Running Lights (DRL)

- 1.2. Directional Signal Lights

- 1.3. Headlights

- 1.4. Reverse Light

- 1.5. Stop Light

- 1.6. Tail Light

- 1.7. Others

-

2. Automotive Vehicle Lighting

- 2.1. 2 Wheelers

- 2.2. Commercial Vehicles

- 2.3. Passenger Cars

UK Automotive LED Lighting Market Segmentation By Geography

- 1. United Kingdom

UK Automotive LED Lighting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment

- 3.3. Market Restrains

- 3.3.1. Security Issues Associated with Mobile Payments

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. UK Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 5.1.1. Daytime Running Lights (DRL)

- 5.1.2. Directional Signal Lights

- 5.1.3. Headlights

- 5.1.4. Reverse Light

- 5.1.5. Stop Light

- 5.1.6. Tail Light

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Automotive Vehicle Lighting

- 5.2.1. 2 Wheelers

- 5.2.2. Commercial Vehicles

- 5.2.3. Passenger Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Automotive Utility Lighting

- 6. England UK Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 7. Wales UK Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 8. Scotland UK Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 9. Northern UK Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 10. Ireland UK Automotive LED Lighting Market Analysis, Insights and Forecast, 2019-2031

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 OSRAM GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HELLA GmbH & Co KGaA (FORVIA)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Hyundai Mobis

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Phoenix Lamps Ltd (Suprajit Engineering Ltd)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Lumileds Holding B V (NARVA)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GRUPO ANTOLIN IRAUSA S A

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Marelli Holdings Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stanley Electric Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Signify (Philips)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 KOITO MANUFACTURING CO LTD

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 OSRAM GmbH

List of Figures

- Figure 1: UK Automotive LED Lighting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: UK Automotive LED Lighting Market Share (%) by Company 2024

List of Tables

- Table 1: UK Automotive LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: UK Automotive LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 3: UK Automotive LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 4: UK Automotive LED Lighting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: UK Automotive LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: England UK Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Wales UK Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Scotland UK Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Northern UK Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Ireland UK Automotive LED Lighting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: UK Automotive LED Lighting Market Revenue Million Forecast, by Automotive Utility Lighting 2019 & 2032

- Table 12: UK Automotive LED Lighting Market Revenue Million Forecast, by Automotive Vehicle Lighting 2019 & 2032

- Table 13: UK Automotive LED Lighting Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Automotive LED Lighting Market?

The projected CAGR is approximately 16.42%.

2. Which companies are prominent players in the UK Automotive LED Lighting Market?

Key companies in the market include OSRAM GmbH, HELLA GmbH & Co KGaA (FORVIA), Hyundai Mobis, Phoenix Lamps Ltd (Suprajit Engineering Ltd), Lumileds Holding B V (NARVA), GRUPO ANTOLIN IRAUSA S A, Marelli Holdings Co Ltd, Stanley Electric Co Ltd, Signify (Philips), KOITO MANUFACTURING CO LTD.

3. What are the main segments of the UK Automotive LED Lighting Market?

The market segments include Automotive Utility Lighting, Automotive Vehicle Lighting.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Internet Penetration and Growing M-commerce Market; Increasing Number of Loyality Benefits in Mobile Environment.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Security Issues Associated with Mobile Payments.

8. Can you provide examples of recent developments in the market?

March 2023: HELLA expands Black Magic auxiliary headlamp series with 32 new lightbars. Range expansion includes 14 lightbars with ECE approval for on-road use and 18 light-bars for off-road applicationsMarch 2023: The company offers the New Generation of NARVA Range Performance Signaling Bulbs which delivers crisp and vibrant positioning and interior lightsJanuary 2023: HELLA brings FlatLight technology into series production as a daytime running light for the first time. The lighting concept is successfully transferred from the rear combination lamp to an application in the front area; series production starts in 2025.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Automotive LED Lighting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Automotive LED Lighting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Automotive LED Lighting Market?

To stay informed about further developments, trends, and reports in the UK Automotive LED Lighting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence