Key Insights

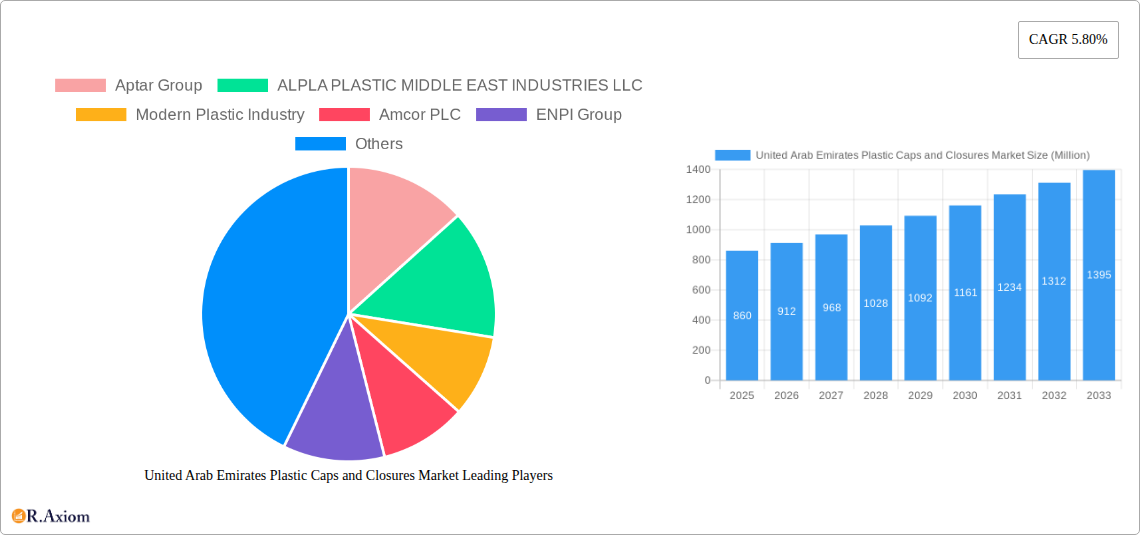

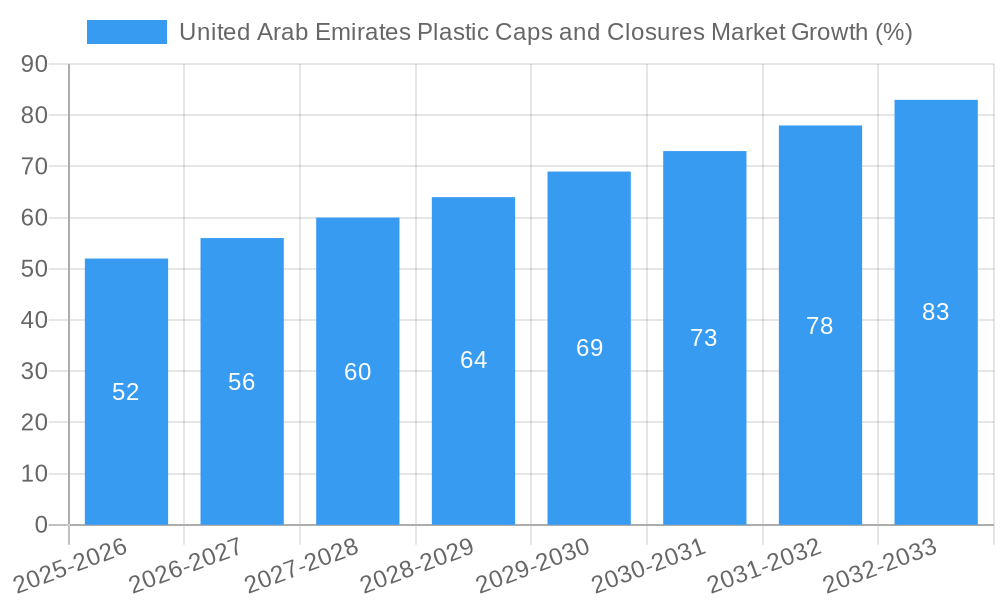

The United Arab Emirates (UAE) plastic caps and closures market, valued at $0.86 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.80% from 2025 to 2033. This expansion is fueled by several key factors. The flourishing food and beverage industry in the UAE, coupled with increasing demand for packaged goods, necessitates a significant supply of plastic caps and closures. Furthermore, the UAE's strategic location as a regional hub for trade and distribution facilitates market growth. The rising adoption of sustainable and innovative packaging solutions, including lightweight and recyclable materials, presents opportunities for manufacturers to cater to environmentally conscious consumers. However, fluctuating oil prices – a significant input cost in plastic production – and growing concerns regarding plastic waste management pose challenges to sustained market expansion. Competitive pressures from both domestic and international players also influence pricing and market share dynamics.

The market segmentation, while not explicitly detailed, can be reasonably inferred to include various types of caps and closures (e.g., screw caps, flip-top caps, tamper-evident closures) and applications across diverse industries like food and beverage, pharmaceuticals, cosmetics, and chemicals. Leading players like Aptar Group, ALPLA, Amcor, and others are strategically investing in advanced technologies and capacity expansion to cater to the rising demand. The future growth trajectory of the UAE plastic caps and closures market hinges on effectively addressing environmental concerns and maintaining a competitive landscape while continuing to innovate and meet the evolving needs of consumers and businesses.

This detailed report provides a comprehensive analysis of the United Arab Emirates (UAE) plastic caps and closures market, offering valuable insights for industry stakeholders, investors, and businesses seeking to enter or expand within this dynamic sector. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. Market size is expressed in Millions (USD).

United Arab Emirates Plastic Caps and Closures Market Market Concentration & Innovation

The UAE plastic caps and closures market exhibits a moderately concentrated landscape, with a handful of major players holding significant market share. Aptar Group, ALPLA PLASTIC MIDDLE EAST INDUSTRIES LLC, Amcor PLC, and Bericap Middle East FZE are key players, each leveraging their established brand reputation and extensive distribution networks. However, the market also features several smaller, regional players such as Modern Plastic Industry, ENPI Group, Polycos Plastic Industries, Alamir Plastic Industries, and Emirates Plastic Industries Factor, which compete primarily on price and localized service. Market share data for 2024 indicates that the top 5 players hold approximately xx% of the market, with the remaining share distributed among smaller players.

Innovation in the sector is driven by increasing consumer demand for sustainable and eco-friendly packaging solutions. This is pushing manufacturers to develop recyclable, lightweight, and biodegradable caps and closures. Regulatory frameworks, particularly those focusing on waste reduction and environmental protection, are also shaping innovation. The rising adoption of advanced materials, such as post-consumer recycled (PCR) plastics, and improved closure designs contribute to increased efficiency and sustainability. Mergers and acquisitions (M&A) activity, such as Aptar's acquisition of a majority stake in Gulf Closures, further consolidate market share and introduce new technologies and capabilities. The value of M&A deals in the sector over the past five years is estimated at xx Million.

- Key Market Concentration Metrics: Top 5 players' market share (xx%), Average deal value (xx Million).

- Innovation Drivers: Sustainability regulations, consumer preference for eco-friendly packaging, technological advancements in materials and design.

- Regulatory Framework: Focus on waste reduction, recyclability standards.

- Product Substitutes: Limited substitutes, with the primary alternatives being alternative packaging materials (e.g., metal, glass).

- End-User Trends: Growing demand from the food and beverage, pharmaceutical, and personal care sectors.

United Arab Emirates Plastic Caps and Closures Market Industry Trends & Insights

The UAE plastic caps and closures market is experiencing robust growth, driven by a burgeoning food and beverage industry, expanding pharmaceutical sector, and increasing per capita consumption. The market witnessed a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million by 2033. Market penetration for sustainable caps and closures is increasing steadily, driven by both consumer and regulatory pressures. This is reflected in increased adoption of recyclable and compostable materials. Technological disruptions, such as the adoption of advanced manufacturing techniques like injection molding and automation, are enhancing efficiency and production capacity. Competitive dynamics remain intense, with established players focusing on innovation, strategic partnerships, and acquisitions to maintain their market position. The increasing focus on sustainable packaging is driving the adoption of lightweighting technologies, enabling reduced plastic usage and transportation costs. Consumer preferences are shifting toward convenient and tamper-evident closures, increasing demand for innovative designs.

Dominant Markets & Segments in United Arab Emirates Plastic Caps and Closures Market

The UAE's food and beverage sector represents the dominant segment within the plastic caps and closures market, accounting for approximately xx% of total market value in 2024. This is fueled by the country's robust economic growth, high population density, and increasing consumer demand for packaged food and beverages.

- Key Drivers of Food and Beverage Segment Dominance:

- High per capita consumption of packaged foods and beverages.

- Significant growth in the food and beverage manufacturing sector.

- Favorable government policies supporting the food and beverage industry.

- Expanding retail sector and supermarket chains.

The pharmaceutical and personal care segments are also experiencing substantial growth, driven by increased healthcare expenditure and rising demand for cosmetics and personal care products. The geographic distribution of demand is largely concentrated in urban areas due to high population density and higher consumption patterns. The market is regionally well-diversified, with strong presence in major cities like Dubai, Abu Dhabi, and Sharjah.

United Arab Emirates Plastic Caps and Closures Market Product Developments

Recent product innovations focus on enhanced sustainability, improved functionality, and enhanced consumer experience. Manufacturers are introducing caps and closures made from recycled materials, incorporating lightweight designs to reduce plastic usage, and developing tamper-evident closures for enhanced product security. These developments align with the growing consumer preference for sustainable and environmentally responsible packaging solutions. Technological advancements in materials science and manufacturing processes enable the production of more durable, lightweight, and aesthetically pleasing caps and closures. The market is witnessing a trend toward increasing customization and personalization of closures to meet specific brand requirements.

Report Scope & Segmentation Analysis

This report segments the UAE plastic caps and closures market based on material type (e.g., HDPE, PP, PET), application (e.g., food and beverage, pharmaceuticals, personal care), and closure type (e.g., screw caps, snap caps, flip-top caps). Each segment's growth projection, market size, and competitive dynamics are analyzed in detail. For instance, the HDPE segment is expected to witness substantial growth owing to its cost-effectiveness and recyclability. The food and beverage application segment holds the largest market share, driven by the high consumption of packaged goods.

Key Drivers of United Arab Emirates Plastic Caps and Closures Market Growth

Several factors fuel the growth of the UAE plastic caps and closures market:

- Economic Growth: The UAE's robust economic growth and rising disposable incomes boost demand for packaged goods.

- Tourism: The thriving tourism sector contributes to increased consumption of packaged food and beverages.

- Population Growth: The growing population, particularly in urban centers, fuels demand for various packaged products.

- Government Initiatives: Government support for the manufacturing sector and initiatives aimed at promoting sustainability.

Challenges in the United Arab Emirates Plastic Caps and Closures Market Sector

The market faces challenges such as fluctuations in raw material prices, intense competition, and stringent environmental regulations. Supply chain disruptions can also impact production and availability. The increasing emphasis on sustainability poses both challenges and opportunities, requiring manufacturers to invest in eco-friendly materials and processes. The competitive landscape necessitates continuous innovation and cost optimization to maintain market share.

Emerging Opportunities in United Arab Emirates Plastic Caps and Closures Market

Emerging opportunities include a growing focus on sustainable packaging solutions, increasing demand for innovative closure designs, and the potential for expansion into new market segments like the medical and industrial sectors. The adoption of smart packaging technologies and the rising demand for customized packaging solutions present further opportunities for market growth.

Leading Players in the United Arab Emirates Plastic Caps and Closures Market Market

- Aptar Group

- ALPLA PLASTIC MIDDLE EAST INDUSTRIES LLC

- Modern Plastic Industry

- Amcor PLC

- ENPI Group

- Polycos Plastic Industries

- Bericap Middle East FZE (BERICAP Holding GmbH)

- Alamir Plastic Industries

- Emirates Plastic Industries Factor

Key Developments in United Arab Emirates Plastic Caps and Closures Market Industry

- December 2023: Aptar Closures inaugurated Gulf Closures, a Bahrain-based beverage closures manufacturer, following its acquisition of a majority stake in March 2023. This expands Aptar's regional presence and strengthens its service capabilities.

- October 2023: Borouge signed an MOU with Tadweer to explore polymer recycling, potentially boosting demand for recyclable plastic caps and closures.

Strategic Outlook for United Arab Emirates Plastic Caps and Closures Market Market

The UAE plastic caps and closures market is poised for continued growth, driven by favorable economic conditions, rising consumer demand, and an increasing focus on sustainability. Opportunities exist for companies to capitalize on the rising demand for eco-friendly packaging solutions and innovative closure designs. Strategic partnerships, investments in R&D, and expansion into new market segments will be crucial for success in this dynamic market.

United Arab Emirates Plastic Caps and Closures Market Segmentation

-

1. Resin

- 1.1. Polyethylene (PE)

- 1.2. Polyethylene Terephthalate (PET)

- 1.3. Polypropylene (PP)

- 1.4. Other Pl

-

2. Product Type

- 2.1. Threaded

- 2.2. Dispensing

- 2.3. Unthreaded

- 2.4. Child-resistant

-

3. End-user Industry

- 3.1. Food

-

3.2. Beverage

- 3.2.1. Bottled Water

- 3.2.2. Carbonated Soft Drinks

- 3.2.3. Alcoholic Beverages

- 3.2.4. Juices and Energy Drinks

- 3.2.5. Other Beverages

- 3.3. Personal Care and Cosmetics

- 3.4. Household Chemicals

- 3.5. Other End-user Industries

United Arab Emirates Plastic Caps and Closures Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Plastic Caps and Closures Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.80% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Demand For Recyclable Caps and Closures

- 3.2.2 and Increase in Shelf Life of the Products

- 3.3. Market Restrains

- 3.3.1 Demand For Recyclable Caps and Closures

- 3.3.2 and Increase in Shelf Life of the Products

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) To Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Plastic Caps and Closures Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 5.1.1. Polyethylene (PE)

- 5.1.2. Polyethylene Terephthalate (PET)

- 5.1.3. Polypropylene (PP)

- 5.1.4. Other Pl

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Threaded

- 5.2.2. Dispensing

- 5.2.3. Unthreaded

- 5.2.4. Child-resistant

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.2.1. Bottled Water

- 5.3.2.2. Carbonated Soft Drinks

- 5.3.2.3. Alcoholic Beverages

- 5.3.2.4. Juices and Energy Drinks

- 5.3.2.5. Other Beverages

- 5.3.3. Personal Care and Cosmetics

- 5.3.4. Household Chemicals

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Resin

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Aptar Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ALPLA PLASTIC MIDDLE EAST INDUSTRIES LLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Modern Plastic Industry

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ENPI Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Polycos Plastic Industries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bericap Middle East FZE (BERICAP Holding GmbH)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alamir Plastic Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Emirates Plastic Industries Factor

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Aptar Group

List of Figures

- Figure 1: United Arab Emirates Plastic Caps and Closures Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Plastic Caps and Closures Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 4: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2019 & 2032

- Table 5: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 6: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 7: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 8: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 9: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by Resin 2019 & 2032

- Table 12: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by Resin 2019 & 2032

- Table 13: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 14: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by Product Type 2019 & 2032

- Table 15: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 16: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 17: United Arab Emirates Plastic Caps and Closures Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Arab Emirates Plastic Caps and Closures Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Plastic Caps and Closures Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the United Arab Emirates Plastic Caps and Closures Market?

Key companies in the market include Aptar Group, ALPLA PLASTIC MIDDLE EAST INDUSTRIES LLC, Modern Plastic Industry, Amcor PLC, ENPI Group, Polycos Plastic Industries, Bericap Middle East FZE (BERICAP Holding GmbH), Alamir Plastic Industries, Emirates Plastic Industries Factor.

3. What are the main segments of the United Arab Emirates Plastic Caps and Closures Market?

The market segments include Resin, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand For Recyclable Caps and Closures. and Increase in Shelf Life of the Products.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) To Witness Growth.

7. Are there any restraints impacting market growth?

Demand For Recyclable Caps and Closures. and Increase in Shelf Life of the Products.

8. Can you provide examples of recent developments in the market?

December 2023: Aptar Closures marked a significant moment with the inauguration of Gulf Closures, a Bahrain-based beverage closures manufacturer. This move followed Aptar's acquisition of a majority stake in Gulf Closures in March 2023. The acquisition merged Aptar's worldwide business strengths and integrated Gulf Closures' specialized manufacturing, regional reach, and seasoned workforce. This strategic alignment aimed to enhance service for Aptar's current Middle Eastern clientele, explore fresh market avenues, and solidify Aptar's foothold in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Plastic Caps and Closures Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Plastic Caps and Closures Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Plastic Caps and Closures Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Plastic Caps and Closures Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence