Key Insights

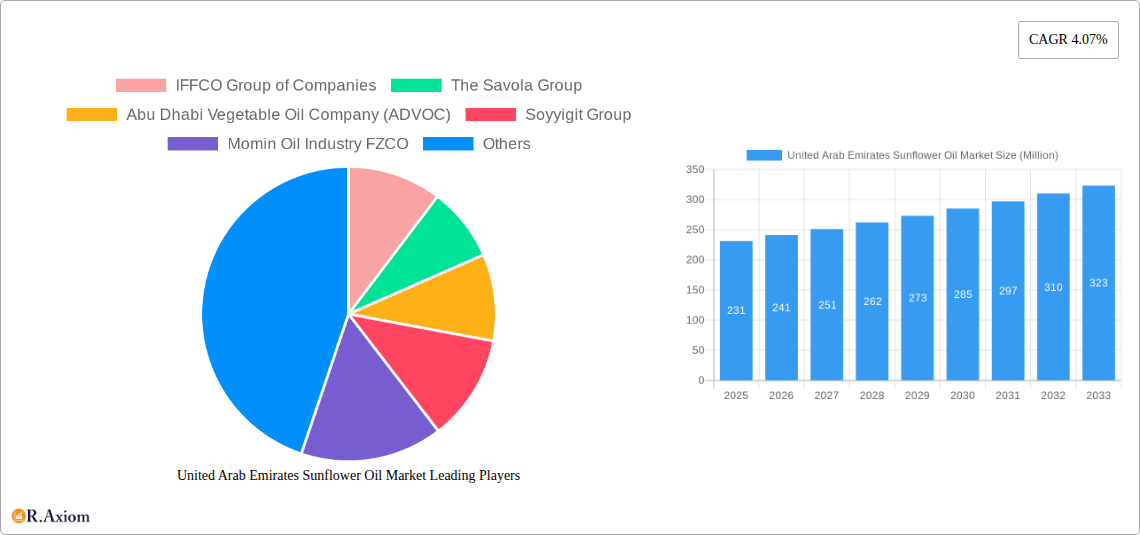

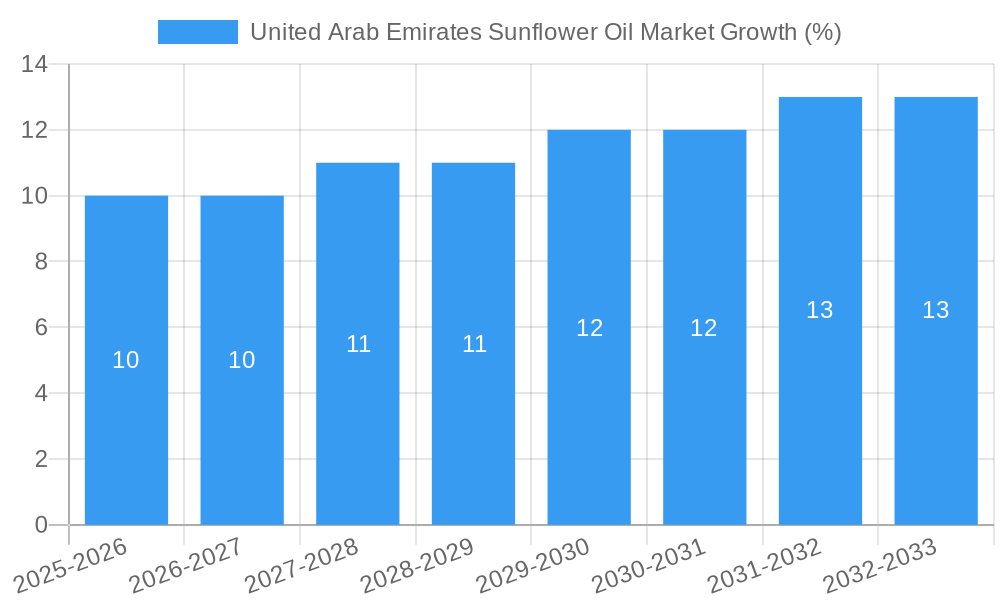

The United Arab Emirates (UAE) sunflower oil market, valued at $231 million in 2025, is projected to experience steady growth, driven by a compound annual growth rate (CAGR) of 4.07% from 2025 to 2033. This growth is fueled by several key factors. The increasing consumer preference for healthier cooking oils, coupled with the rising awareness of the health benefits associated with sunflower oil – its high linoleic acid content and relatively low saturated fat levels – is a significant driver. Furthermore, the UAE's robust food and beverage industry, encompassing a large number of restaurants, food processing facilities, and catering services, contributes significantly to the demand. The growing popularity of vegan and vegetarian diets also plays a role, as sunflower oil serves as a versatile and widely used cooking oil in these dietary contexts. The established presence of major international and regional players like IFFCO, Savola, and LuLu Group International, ensures a competitive landscape with continuous product innovation and wider distribution networks, further supporting market expansion.

However, the market's growth trajectory might be influenced by fluctuating global sunflower seed prices, which could impact the overall cost of production and subsequently the retail price of sunflower oil. Competition from other vegetable oils, such as olive oil and canola oil, also presents a challenge. To maintain market share, manufacturers will need to focus on product differentiation through initiatives such as introducing value-added products, emphasizing sustainability in sourcing and production, and enhancing brand marketing campaigns targeting health-conscious consumers. The future success of players in the UAE sunflower oil market hinges on their ability to adapt to evolving consumer preferences, manage cost fluctuations effectively, and capitalize on the expanding food service sector within the UAE.

United Arab Emirates Sunflower Oil Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the United Arab Emirates (UAE) sunflower oil market, offering invaluable insights for industry stakeholders, investors, and businesses seeking to navigate this dynamic sector. The report covers the period 2019-2033, with a focus on the base year 2025 and a forecast period spanning 2025-2033. Key market trends, competitive dynamics, and growth opportunities are meticulously examined, offering actionable intelligence for strategic decision-making.

United Arab Emirates Sunflower Oil Market Market Concentration & Innovation

The UAE sunflower oil market exhibits a moderately concentrated landscape, with several key players dominating market share. While precise market share figures for each company remain proprietary, major players like IFFCO Group of Companies, The Savola Group, and Abu Dhabi Vegetable Oil Company (ADVOC) hold significant positions. The market is witnessing increased innovation driven by consumer demand for healthier oils and private label growth within the retail sector (e.g., Lulu Group's expansion). Regulatory frameworks concerning food safety and labeling standards significantly influence market operations. Product substitution with other vegetable oils (e.g., olive oil, canola oil) poses a moderate competitive challenge, particularly within the premium segment. End-user trends lean towards convenience and value-added products, impacting packaging and product diversification. Mergers and acquisitions (M&A) activity, as illustrated by IHC Food Holding’s acquisition of a 75% stake in ADVOC in January 2022 for USD 24.7 Million, reflects strategic consolidation within the sector and highlights the ongoing quest for expansion and market dominance.

United Arab Emirates Sunflower Oil Market Industry Trends & Insights

The UAE sunflower oil market is experiencing steady growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors: a rising population, increasing disposable incomes leading to higher consumption of processed foods, and the growing preference for healthier cooking options amongst health-conscious consumers. Technological advancements in oil extraction and processing, coupled with efficient supply chains, continue to improve product quality and affordability. Consumer preferences show a growing inclination towards sustainably sourced and ethically produced sunflower oil, influencing supplier sourcing strategies. The competitive landscape is characterized by intense rivalry amongst both domestic and international players, resulting in price competitiveness and product differentiation strategies. Market penetration of private label brands such as Lulu's brand is gradually increasing, impacting the market share of established brands.

Dominant Markets & Segments in United Arab Emirates Sunflower Oil Market

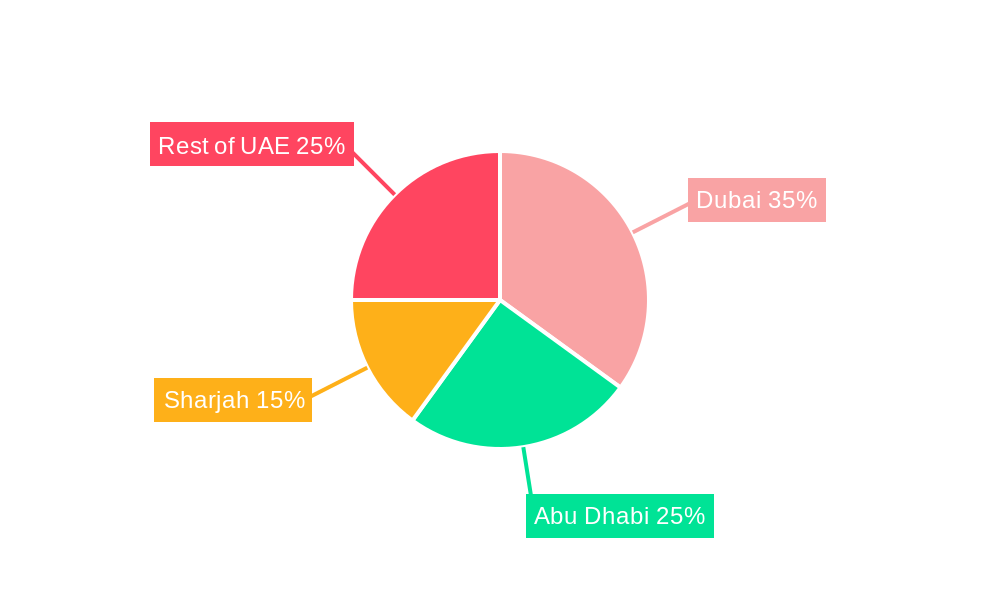

The UAE sunflower oil market shows robust performance across various regions, with urban centers demonstrating higher consumption rates due to higher population density and purchasing power. Key drivers for this dominance include established retail infrastructure, strong purchasing power of consumers, and greater accessibility to diverse food options.

- Economic Policies: Government initiatives promoting food security and agricultural development indirectly contribute to the market's growth.

- Infrastructure: The well-developed supply chain and distribution networks ensure efficient product delivery across the nation.

The market is segmented primarily by packaging type (bottles, pouches, cans), distribution channel (hypermarkets/supermarkets, traditional retailers, online retailers), and product type (refined, unrefined). The refined sunflower oil segment holds the largest market share due to its convenience and widespread availability. Hypermarkets and supermarkets dominate the distribution channels, catering to a broader consumer base.

United Arab Emirates Sunflower Oil Market Product Developments

Recent product innovations focus on enhancing product quality, convenience, and health benefits. Companies are introducing fortified sunflower oils enriched with essential vitamins and omega-3 fatty acids to cater to the growing health-conscious population. Packaging innovations focus on eco-friendly and convenient options, aligning with sustainability trends. These advancements aim to enhance the market appeal and competitiveness of sunflower oil against alternative cooking oils.

Report Scope & Segmentation Analysis

This report segments the UAE sunflower oil market based on several factors:

By Product Type: Refined and unrefined sunflower oil, each with distinct pricing and consumer preferences. The refined segment holds a significant majority of the market due to consumer preference. By Packaging: Bottles, pouches, and cans, reflecting variations in price points and consumer convenience. By Distribution Channel: Hypermarkets/supermarkets, traditional retailers (including smaller grocery stores), and online retailers. Hypermarkets currently hold the dominant market share. By Region: The report examines market performance across various Emirates, highlighting regional variations in consumption patterns and market dynamics.

Each segment is analyzed with respect to its growth projections, market size, and competitive landscape, providing a granular view of the market structure.

Key Drivers of United Arab Emirates Sunflower Oil Market Growth

The UAE sunflower oil market's growth is driven by several factors:

- Rising Population and Urbanization: Increasing population density, especially in urban areas, fuels demand for cooking oil.

- Growing Disposable Incomes: Higher purchasing power enables consumers to afford more processed foods and a variety of cooking oils.

- Health and Wellness Trends: Growing awareness of heart health is driving demand for healthier cooking oils, like sunflower oil, perceived as a healthier alternative to other oils.

- Government Initiatives: Policies related to food security and trade liberalization indirectly contribute to market growth.

Challenges in the United Arab Emirates Sunflower Oil Market Sector

The UAE sunflower oil market faces several challenges:

- Price Volatility: Fluctuations in global sunflower seed prices impact the cost of production and market stability.

- Competition: Intense competition from other vegetable oils and private label brands puts pressure on pricing and margins.

- Supply Chain Disruptions: Global events can create disruptions in the supply chain, impacting availability and prices.

- Health and Wellness Trends: Consumer shift towards healthier fats and new oils with specific health benefits.

Emerging Opportunities in United Arab Emirates Sunflower Oil Market

Emerging opportunities in the UAE sunflower oil market include:

- Premiumization: The growing demand for specialty and value-added sunflower oils offers a niche market for premium products.

- Sustainability: Consumers' increased preference for ethically sourced and sustainably produced oil presents opportunities for eco-friendly products and brands.

- Functional Foods: Enriched sunflower oils with added nutrients provide opportunities for health-conscious consumers.

- E-commerce Growth: The expansion of e-commerce platforms offers new avenues for distribution and market reach.

Leading Players in the United Arab Emirates Sunflower Oil Market Market

- IFFCO Group of Companies

- The Savola Group

- Abu Dhabi Vegetable Oil Company (ADVOC)

- Soyyigit Group

- Momin Oil Industry FZCO

- Eatco General Trading LLC (Family Harvest)

- ACG Alokozay Group of Companies

- AVES (Avesafya Oil)

- Avril Group

- LuLu Group International

Key Developments in United Arab Emirates Sunflower Oil Market Industry

- October 2023: LuLu Group opened its 24th hypermarket in Dubai Mall (72,000 sq ft), boosting Lulu-branded sunflower oil penetration.

- May 2023: Collaboration between DMT, Lulu Group International, and ADIO on a new community center in Al Rahbah, potentially increasing retail presence.

- January 2022: IHC Food Holding acquired a 75% stake in ADVOC for USD 24.7 Million, signifying market consolidation and expansion plans.

Strategic Outlook for United Arab Emirates Sunflower Oil Market Market

The UAE sunflower oil market holds significant growth potential driven by increasing consumption, expanding retail channels, and evolving consumer preferences. Strategic investments in sustainable sourcing, product innovation, and effective marketing strategies will be crucial for companies seeking to thrive in this competitive market. Focus on premiumization, health benefits, and convenient packaging will be critical for capturing market share and ensuring sustainable growth.

United Arab Emirates Sunflower Oil Market Segmentation

-

1. Type

- 1.1. Refined Deodorized

- 1.2. Unrefined

-

2. End User

- 2.1. Industrial

- 2.2. Foodservice

-

2.3. Retail/Household

-

2.3.1. Packaging Type

- 2.3.1.1. Cans

- 2.3.1.2. Bottles

-

2.3.1. Packaging Type

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retail Stores

United Arab Emirates Sunflower Oil Market Segmentation By Geography

- 1. United Arab Emirates

United Arab Emirates Sunflower Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.07% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth

- 3.3. Market Restrains

- 3.3.1. Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth

- 3.4. Market Trends

- 3.4.1. Rising Consumption of Refined Deodorized Sunflower Oil Supporting Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Arab Emirates Sunflower Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Refined Deodorized

- 5.1.2. Unrefined

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Industrial

- 5.2.2. Foodservice

- 5.2.3. Retail/Household

- 5.2.3.1. Packaging Type

- 5.2.3.1.1. Cans

- 5.2.3.1.2. Bottles

- 5.2.3.1. Packaging Type

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retail Stores

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IFFCO Group of Companies

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Savola Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Abu Dhabi Vegetable Oil Company (ADVOC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Soyyigit Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Momin Oil Industry FZCO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Eatco General Trading LLC (Family Harvest)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACG Alokozay Group of Companies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AVES (Avesafya Oil)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avril Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LuLu Group International*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IFFCO Group of Companies

List of Figures

- Figure 1: United Arab Emirates Sunflower Oil Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United Arab Emirates Sunflower Oil Market Share (%) by Company 2024

List of Tables

- Table 1: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Type 2019 & 2032

- Table 5: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by End User 2019 & 2032

- Table 6: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by End User 2019 & 2032

- Table 7: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 8: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 9: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Type 2019 & 2032

- Table 12: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Type 2019 & 2032

- Table 13: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by End User 2019 & 2032

- Table 14: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by End User 2019 & 2032

- Table 15: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 16: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Distribution Channel 2019 & 2032

- Table 17: United Arab Emirates Sunflower Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Arab Emirates Sunflower Oil Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Arab Emirates Sunflower Oil Market?

The projected CAGR is approximately 4.07%.

2. Which companies are prominent players in the United Arab Emirates Sunflower Oil Market?

Key companies in the market include IFFCO Group of Companies, The Savola Group, Abu Dhabi Vegetable Oil Company (ADVOC), Soyyigit Group, Momin Oil Industry FZCO, Eatco General Trading LLC (Family Harvest), ACG Alokozay Group of Companies, AVES (Avesafya Oil), Avril Group, LuLu Group International*List Not Exhaustive.

3. What are the main segments of the United Arab Emirates Sunflower Oil Market?

The market segments include Type, End User, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 231 Million as of 2022.

5. What are some drivers contributing to market growth?

Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth.

6. What are the notable trends driving market growth?

Rising Consumption of Refined Deodorized Sunflower Oil Supporting Market Growth.

7. Are there any restraints impacting market growth?

Augmented Tourism Supporting Foodservice Demand; Increasing Industrial Demand for Sunflower Oil Supporting Market Growth.

8. Can you provide examples of recent developments in the market?

October 2023: LuLu Group opened its hypermarket spread in a 72,000 sq. ft area in Dubai Mall, marking the company's 24th store in Dubai. The store offers primarily groceries, fresh food, fruits and vegetables, bakery, health and beauty, stationery, household, IT products, and fresh flowers, among others, resulting in an increasing penetration of Lulu-branded sunflower oil.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Arab Emirates Sunflower Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Arab Emirates Sunflower Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Arab Emirates Sunflower Oil Market?

To stay informed about further developments, trends, and reports in the United Arab Emirates Sunflower Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence