Key Insights

The European data center construction market, valued at €13.24 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.36% from 2025 to 2033. This expansion is fueled by several key drivers. The burgeoning digital economy necessitates increased data storage and processing capabilities, driving demand for new and expanded data center facilities across various sectors. The increasing adoption of cloud computing, edge computing, and the Internet of Things (IoT) further intensifies this demand. Government initiatives promoting digital transformation and cybersecurity are also contributing to market growth. Furthermore, the rising adoption of advanced technologies like AI and machine learning within data centers is creating opportunities for specialized construction and infrastructure development. While regulatory hurdles and skilled labor shortages could pose some constraints, the overall market outlook remains positive, particularly in regions with strong digital infrastructure and supportive government policies. Germany, the UK, and France are expected to be leading markets due to their robust economies, established IT sectors, and significant investments in digital infrastructure. The market is segmented by end-user (Banking, Financial Services and Insurance, IT & Telecom, Government & Defense, Healthcare, and Others), infrastructure type (Electrical, Mechanical, General Construction), and tier level (Tier I-IV), offering opportunities for specialized contractors and service providers. Major players like Jacobs Solutions, Whiting-Turner, and others are strategically positioning themselves to capitalize on this growth trajectory.

The market segmentation provides a detailed picture of the diverse needs within the data center construction industry. The Banking, Financial Services and Insurance (BFSI) sector is a significant driver, requiring highly secure and resilient facilities. Similarly, the IT and Telecommunications sector's reliance on robust data infrastructure fuels strong demand. Government and Defense organizations are also major consumers, necessitating secure and compliant data centers. The infrastructure segment highlights the complexity of data center construction, encompassing electrical, mechanical, and general construction expertise. Finally, the tiered system reflects the varying levels of redundancy and resilience required, with Tier IV facilities representing the highest level of reliability and often attracting significant investment. The competitive landscape is defined by large, established construction firms known for their experience in large-scale projects, competing on factors like expertise, cost-effectiveness, and project execution capabilities.

United States Data Center Construction Market: A Comprehensive Report (2019-2033)

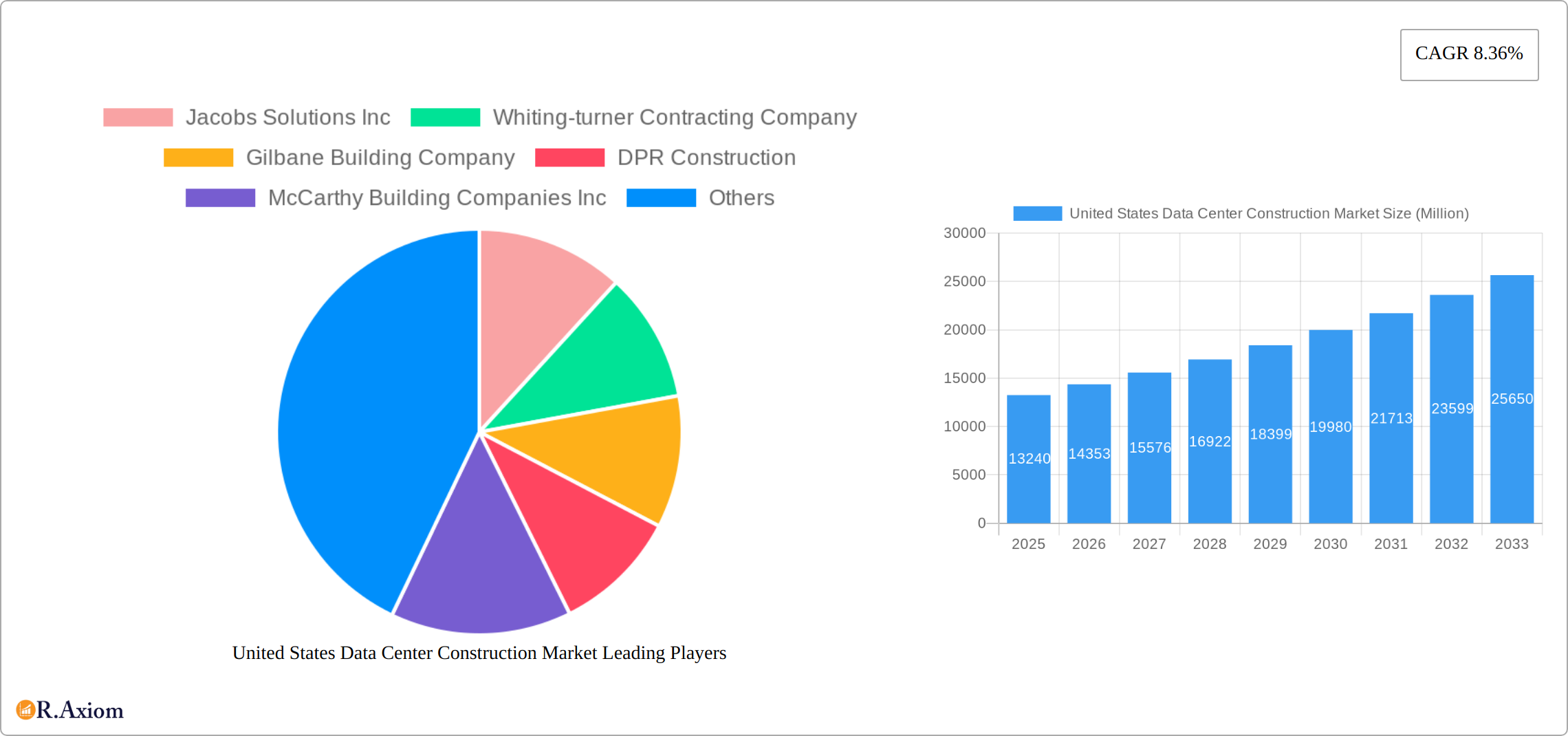

This comprehensive report provides a detailed analysis of the United States data center construction market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report covers market size, segmentation, growth drivers, challenges, and emerging opportunities, providing a 360-degree view of this dynamic sector. Key players such as Jacobs Solutions Inc, Whiting-Turner Contracting Company, Gilbane Building Company, DPR Construction, McCarthy Building Companies Inc, Hensel Phelps, Brasfield & Gorrie LL, Balfour Beatty US, AECOM, and Skanska USA are thoroughly analyzed.

United States Data Center Construction Market Concentration & Innovation

This section analyzes the competitive landscape of the US data center construction market, examining market concentration, innovation drivers, regulatory influences, and M&A activity. We delve into the market share held by leading players and assess the impact of mergers and acquisitions on market dynamics. The analysis includes an assessment of the influence of regulatory frameworks on innovation and competition. The substitution of traditional construction methods with newer, more efficient techniques is also evaluated. Finally, we examine prevailing end-user trends and their impact on market growth and segmentation. For example, the increasing adoption of cloud computing and the rise of edge data centers are analyzed for their influence on market demand and the strategies employed by leading companies. Metrics such as market share percentages and aggregated M&A deal values (in Millions of USD) are provided to quantify market concentration and dynamics. The section will also discuss the impact of evolving end-user demands on the market, such as the shift towards sustainable and energy-efficient data center designs. The total M&A deal value for the period is estimated to be xx Million.

United States Data Center Construction Market Industry Trends & Insights

The US data center construction market is experiencing robust growth, driven by a confluence of factors. This analysis delves into the key market trends, examining the Compound Annual Growth Rate (CAGR) and market penetration rates across various segments. We explore the escalating demand for data storage and processing power fueled by the digital transformation sweeping across industries, including the proliferation of cloud computing, big data analytics, the Internet of Things (IoT), and the increasing adoption of artificial intelligence (AI). The market's evolution is further shaped by technological advancements, such as the rise of modular and prefabricated construction, which enhance efficiency and sustainability. Growing concerns about environmental impact are also influencing the market, with a surge in demand for sustainable and environmentally friendly data center solutions. The competitive landscape is dynamic, characterized by evolving pricing strategies, technological innovations, and varying market entry barriers. We project a CAGR of xx% for the forecast period (2025-2033), with market penetration of Tier-IV data centers expected to reach xx% by 2033. This growth is unevenly distributed geographically, with certain regions experiencing faster expansion than others.

Dominant Markets & Segments in United States Data Center Construction Market

The US data center construction market is segmented by end-user sectors, infrastructure types, and tier classifications. This section provides a detailed analysis of each segment's market share and growth drivers, including economic policies, infrastructure development, regulatory changes, and technological advancements.

End-User Segments: The market is driven by diverse end-user sectors. While the IT and Telecommunications sector remains a dominant force, significant growth is also observed in Banking, Financial Services, and Insurance (BFSI); Government and Defense; and Healthcare. The analysis will detail the specific contributions of each sector, explaining the factors influencing their market share and growth trajectories. The "Other End Users" category encompasses a broad range of industries increasingly reliant on data center infrastructure.

- Banking, Financial Services, and Insurance

- IT and Telecommunications

- Government and Defense

- Healthcare

- Other End Users (e.g., Retail, Education, Energy)

Infrastructure Segments: The construction of data centers requires specialized infrastructure. This segment encompasses:

- Electrical Infrastructure (power distribution, UPS systems, etc.)

- Mechanical Infrastructure (HVAC, cooling systems, etc.)

- General Construction (civil works, building structures, etc.)

Tier Type Segments: Data centers are categorized by tiers reflecting their redundancy and fault tolerance. The market includes:

- Tier-I and -II (smaller, less resilient facilities)

- Tier-III (higher redundancy and fault tolerance)

- Tier-IV (highest levels of redundancy and uptime)

The report provides detailed market size projections for each segment throughout the forecast period, highlighting leading regions within the US driving market growth and the impact of government regulations and policies, such as incentives for sustainable construction, on market share.

United States Data Center Construction Market Product Developments

This section summarizes recent product innovations, applications, and their competitive advantages within the US data center construction market. We highlight the influence of technological advancements on market dynamics and assess the market fit of new product offerings. Emphasis is placed on emerging trends, such as sustainable building materials, improved energy efficiency solutions, and the integration of smart technologies into data center infrastructure, and their impact on the competitiveness of construction firms. The adoption of Building Information Modeling (BIM) and other digital construction methods is explored for its effect on project timelines and costs.

Report Scope & Segmentation Analysis

This report provides a detailed segmentation analysis of the United States data center construction market across various key parameters: End-user (Banking, Financial Services, and Insurance; IT and Telecommunications; Government and Defense; Healthcare; Other End Users), Infrastructure (Electrical Infrastructure; Mechanical Infrastructure; General Construction), and Tier Type (Tier-I and -II; Tier-III; Tier-IV). Each segment's growth projections, market sizes (in Millions of USD) for the historical period (2019-2024), base year (2025), and forecast period (2025-2033), and competitive dynamics are analyzed. Growth rates for individual segments are projected and compared to overall market growth to identify high-growth areas and potential opportunities.

Key Drivers of United States Data Center Construction Market Growth

The expansion of the US data center construction market is propelled by several key factors. The surging demand for data storage and processing capacity, driven by the rapid adoption of cloud computing, big data analytics, AI, and IoT, is a primary catalyst. Government initiatives promoting digital infrastructure development and investments in advanced technologies, alongside robust economic growth and rising digital literacy, further fuel market expansion. Technological advancements, such as energy-efficient cooling systems and innovative modular data center designs, contribute significantly to improving operational efficiency and reducing environmental impact. Furthermore, the increasing need for robust cybersecurity and disaster recovery solutions drives investment in modern, high-capacity data centers.

Challenges in the United States Data Center Construction Market Sector

Despite robust growth, the US data center construction market faces significant challenges. These include stringent regulatory compliance requirements, escalating environmental concerns leading to increased project costs and complexity, and supply chain disruptions causing material price volatility and impacting project timelines and profitability. Intense competition among construction firms, along with fluctuating demand, influence pricing strategies and profit margins. A persistent skilled labor shortage in the construction industry further exacerbates project challenges, potentially resulting in an estimated xx Million USD of lost revenue annually. Addressing these challenges requires proactive strategies from stakeholders across the industry.

Emerging Opportunities in United States Data Center Construction Market

Several emerging opportunities are shaping the future of the US data center construction market. The growing adoption of edge computing and the development of hyperscale data centers are creating significant demand for specialized construction expertise. The increasing focus on sustainable and green data centers presents opportunities for companies offering energy-efficient solutions and environmentally friendly construction materials. The expansion of 5G networks and the deployment of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), are driving further growth in data center construction. These opportunities offer significant potential for expansion and innovation within the industry.

Leading Players in the United States Data Center Construction Market Market

- Jacobs Solutions Inc (Jacobs Solutions Inc)

- Whiting-Turner Contracting Company (Whiting-Turner Contracting Company)

- Gilbane Building Company (Gilbane Building Company)

- DPR Construction (DPR Construction)

- McCarthy Building Companies Inc (McCarthy Building Companies Inc)

- Hensel Phelps (Hensel Phelps)

- Brasfield & Gorrie LL (Brasfield & Gorrie LL)

- Balfour Beatty US (Balfour Beatty US)

- AECOM (AECOM)

- Skanska USA (Skanska USA)

Key Developments in United States Data Center Construction Market Industry

- February 2024: Prime Data Centers' proposed USD 1.3 Billion data center complex in Caldwell County, Texas, underscores significant investment and heightened demand for construction services. This large-scale project highlights the continuing expansion of hyperscale data center deployments.

- November 2023: H5 Data Centres' expansion of its San Antonio edge data center, adding 340 cabinets and 1.5 MW of UPS capacity, demonstrates the ongoing growth of edge data center infrastructure, crucial for supporting low-latency applications and 5G networks.

- 2023: The deployment of infrastructure on a data center campus by five new telecommunications operators indicates a thriving network ecosystem and escalating demand for enhanced connectivity and bandwidth. This signals a broader trend of increased digital infrastructure investments.

Strategic Outlook for United States Data Center Construction Market Market

The US data center construction market exhibits strong growth potential driven by sustained demand for data storage and processing, technological advancements, and government initiatives. The ongoing digital transformation across various sectors will continue fueling demand for new data center construction and expansion projects. Companies focusing on sustainable construction practices, innovative technologies, and efficient project management will be well-positioned to capitalize on the market's future opportunities. The market is expected to see further consolidation through mergers and acquisitions as companies seek to expand their capabilities and market share.

United States Data Center Construction Market Segmentation

-

1. Infrastructure

-

1.1. Electrical Infrastructure

- 1.1.1. UPS Systems

- 1.1.2. Other Electrical Infrastructure

-

1.2. Mechanical Infrastructure

- 1.2.1. Cooling Systems

- 1.2.2. Racks

- 1.2.3. Other Mechanical Infrastructure

- 1.3. General Construction

-

1.1. Electrical Infrastructure

-

2. Tier Type

- 2.1. Tier-I and -II

- 2.2. Tier-III

- 2.3. Tier-IV

-

3. End User

- 3.1. Banking, Financial Services, and Insurance

- 3.2. IT and Telecommunications

- 3.3. Government and Defense

- 3.4. Healthcare

- 3.5. Other End Users

United States Data Center Construction Market Segmentation By Geography

- 1. United States

United States Data Center Construction Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 4.; Growing Cloud Applications

- 3.2.2 AI

- 3.2.3 and Big Data4.; Rising Adoption of Hyperscale Data Centers

- 3.3. Market Restrains

- 3.3.1. 4.; Increase in Real Estate Costs

- 3.4. Market Trends

- 3.4.1. UPS Systems to Lead the Electrical Infrastructure Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 5.1.1. Electrical Infrastructure

- 5.1.1.1. UPS Systems

- 5.1.1.2. Other Electrical Infrastructure

- 5.1.2. Mechanical Infrastructure

- 5.1.2.1. Cooling Systems

- 5.1.2.2. Racks

- 5.1.2.3. Other Mechanical Infrastructure

- 5.1.3. General Construction

- 5.1.1. Electrical Infrastructure

- 5.2. Market Analysis, Insights and Forecast - by Tier Type

- 5.2.1. Tier-I and -II

- 5.2.2. Tier-III

- 5.2.3. Tier-IV

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Banking, Financial Services, and Insurance

- 5.3.2. IT and Telecommunications

- 5.3.3. Government and Defense

- 5.3.4. Healthcare

- 5.3.5. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Infrastructure

- 6. Germany United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1. undefined

- 7. France United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1. undefined

- 8. United Kingdom United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1. undefined

- 9. Netherlands United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1. undefined

- 10. Ireland United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1. undefined

- 11. Switzerland United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Denmark United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Sweden United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. Italy United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. Poland United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. Norway United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1. undefined

- 17. Austria United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 17.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 17.1.1. undefined

- 18. Spain United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 18.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 18.1.1. undefined

- 19. Rest of Europe United States Data Center Construction Market Analysis, Insights and Forecast, 2019-2031

- 19.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 19.1.1. undefined

- 20. Competitive Analysis

- 20.1. Market Share Analysis 2024

- 20.2. Company Profiles

- 20.2.1 Jacobs Solutions Inc

- 20.2.1.1. Overview

- 20.2.1.2. Products

- 20.2.1.3. SWOT Analysis

- 20.2.1.4. Recent Developments

- 20.2.1.5. Financials (Based on Availability)

- 20.2.2 Whiting-turner Contracting Company

- 20.2.2.1. Overview

- 20.2.2.2. Products

- 20.2.2.3. SWOT Analysis

- 20.2.2.4. Recent Developments

- 20.2.2.5. Financials (Based on Availability)

- 20.2.3 Gilbane Building Company

- 20.2.3.1. Overview

- 20.2.3.2. Products

- 20.2.3.3. SWOT Analysis

- 20.2.3.4. Recent Developments

- 20.2.3.5. Financials (Based on Availability)

- 20.2.4 DPR Construction

- 20.2.4.1. Overview

- 20.2.4.2. Products

- 20.2.4.3. SWOT Analysis

- 20.2.4.4. Recent Developments

- 20.2.4.5. Financials (Based on Availability)

- 20.2.5 McCarthy Building Companies Inc

- 20.2.5.1. Overview

- 20.2.5.2. Products

- 20.2.5.3. SWOT Analysis

- 20.2.5.4. Recent Developments

- 20.2.5.5. Financials (Based on Availability)

- 20.2.6 Hensel Phelps

- 20.2.6.1. Overview

- 20.2.6.2. Products

- 20.2.6.3. SWOT Analysis

- 20.2.6.4. Recent Developments

- 20.2.6.5. Financials (Based on Availability)

- 20.2.7 Brasfield & Gorrie LL

- 20.2.7.1. Overview

- 20.2.7.2. Products

- 20.2.7.3. SWOT Analysis

- 20.2.7.4. Recent Developments

- 20.2.7.5. Financials (Based on Availability)

- 20.2.8 Balfour Beatty US

- 20.2.8.1. Overview

- 20.2.8.2. Products

- 20.2.8.3. SWOT Analysis

- 20.2.8.4. Recent Developments

- 20.2.8.5. Financials (Based on Availability)

- 20.2.9 AECOM

- 20.2.9.1. Overview

- 20.2.9.2. Products

- 20.2.9.3. SWOT Analysis

- 20.2.9.4. Recent Developments

- 20.2.9.5. Financials (Based on Availability)

- 20.2.10 Skanska USA

- 20.2.10.1. Overview

- 20.2.10.2. Products

- 20.2.10.3. SWOT Analysis

- 20.2.10.4. Recent Developments

- 20.2.10.5. Financials (Based on Availability)

- 20.2.1 Jacobs Solutions Inc

List of Figures

- Figure 1: United States Data Center Construction Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Data Center Construction Market Share (%) by Company 2024

List of Tables

- Table 1: United States Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United States Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 4: United States Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 5: United States Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 6: United States Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 7: United States Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: United States Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 9: United States Data Center Construction Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Data Center Construction Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 23: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 27: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 33: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 35: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 36: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 37: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 39: United States Data Center Construction Market Revenue Million Forecast, by Infrastructure 2019 & 2032

- Table 40: United States Data Center Construction Market Volume K Unit Forecast, by Infrastructure 2019 & 2032

- Table 41: United States Data Center Construction Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 42: United States Data Center Construction Market Volume K Unit Forecast, by Tier Type 2019 & 2032

- Table 43: United States Data Center Construction Market Revenue Million Forecast, by End User 2019 & 2032

- Table 44: United States Data Center Construction Market Volume K Unit Forecast, by End User 2019 & 2032

- Table 45: United States Data Center Construction Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United States Data Center Construction Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Data Center Construction Market?

The projected CAGR is approximately 8.36%.

2. Which companies are prominent players in the United States Data Center Construction Market?

Key companies in the market include Jacobs Solutions Inc, Whiting-turner Contracting Company, Gilbane Building Company, DPR Construction, McCarthy Building Companies Inc, Hensel Phelps, Brasfield & Gorrie LL, Balfour Beatty US, AECOM, Skanska USA.

3. What are the main segments of the United States Data Center Construction Market?

The market segments include Infrastructure, Tier Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.24 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Growing Cloud Applications. AI. and Big Data4.; Rising Adoption of Hyperscale Data Centers.

6. What are the notable trends driving market growth?

UPS Systems to Lead the Electrical Infrastructure Segment.

7. Are there any restraints impacting market growth?

4.; Increase in Real Estate Costs.

8. Can you provide examples of recent developments in the market?

In February 2024, in Caldwell County outside of Austin, Texas, Prime Data Centers proposed to construct a USD 1.3 billion data center complex. Such investments from the data center providers will create more demand for DC construction players in the near future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Data Center Construction Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Data Center Construction Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Data Center Construction Market?

To stay informed about further developments, trends, and reports in the United States Data Center Construction Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence