Key Insights

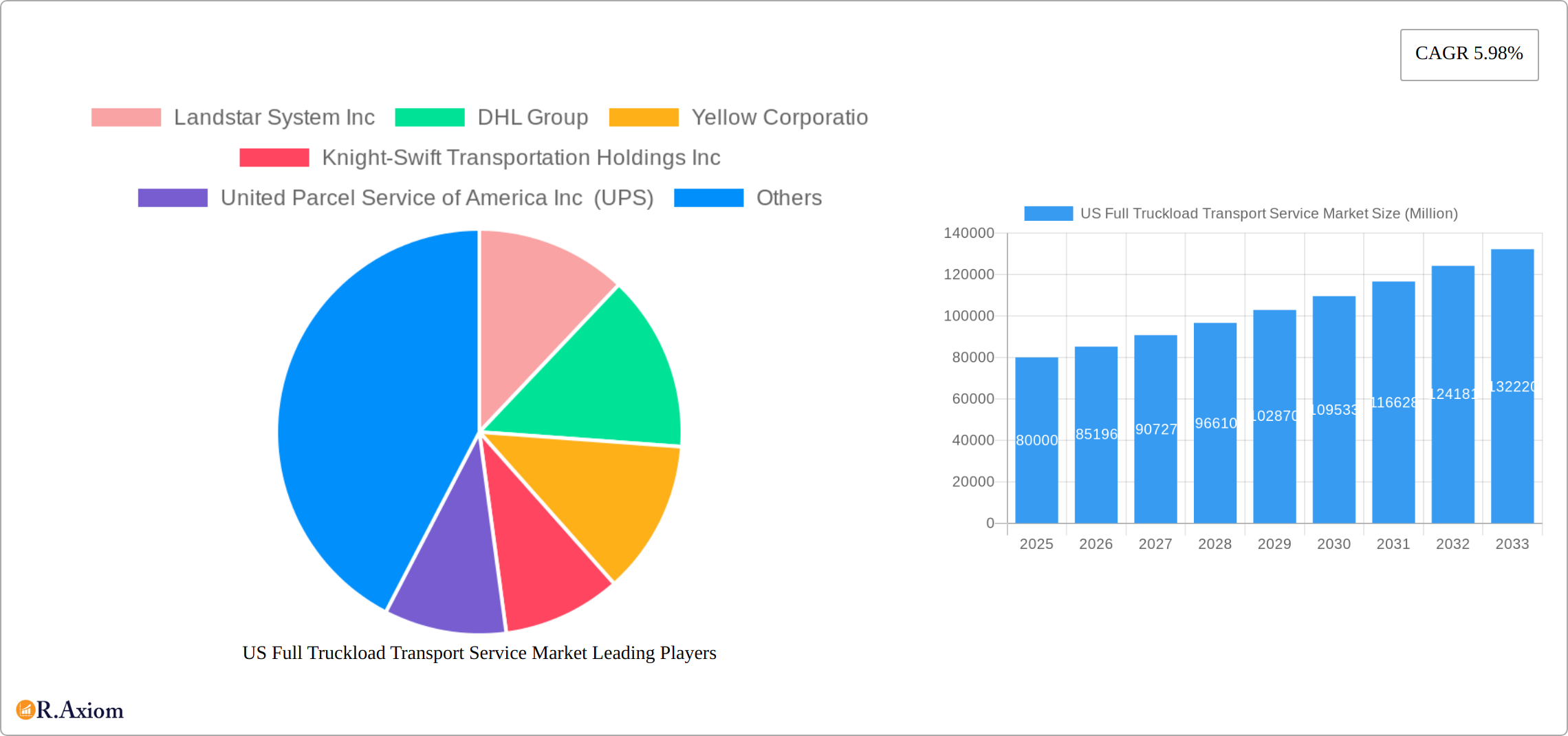

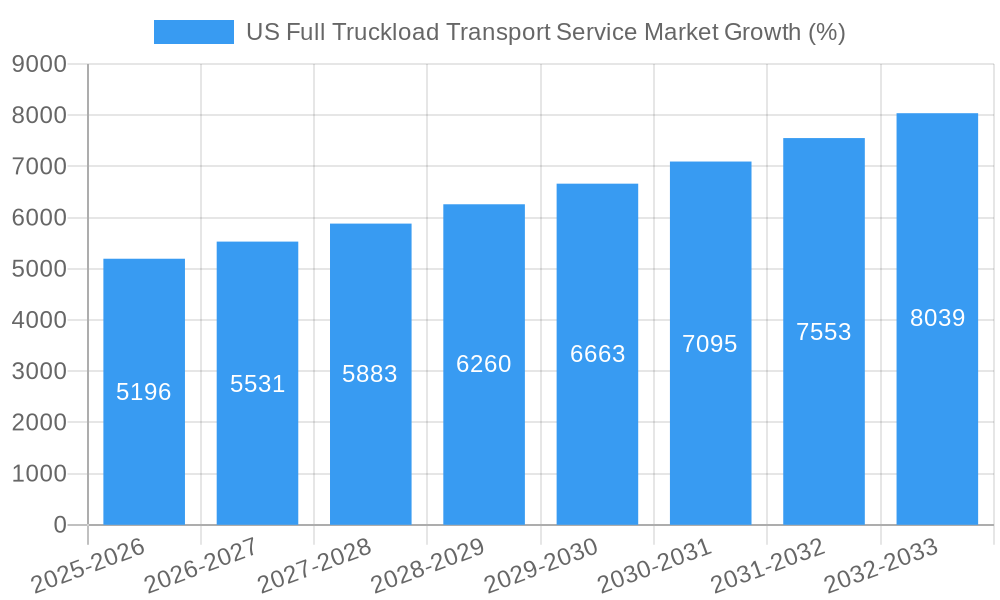

The US full truckload (FTL) transportation services market is a substantial sector, exhibiting robust growth driven by a burgeoning e-commerce landscape, increasing manufacturing output, and the ongoing expansion of the logistics industry. The market's compound annual growth rate (CAGR) of 5.98% from 2019 to 2024 suggests a significant upward trajectory, projected to continue through 2033. Key drivers include the rising demand for efficient and reliable transportation solutions across various end-user industries, such as manufacturing, retail, and oil and gas. The growth is further fueled by technological advancements in fleet management, route optimization, and supply chain visibility, leading to improved efficiency and cost reductions for carriers. While potential restraints include fluctuating fuel prices and driver shortages, the overall market outlook remains positive due to sustained economic activity and the ongoing need for efficient freight movement. The segmentation of the market by end-user industry and destination (domestic vs. international) highlights diverse growth opportunities across different sectors and geographical regions. The dominance of major players like UPS, FedEx, and other large logistics companies indicates a competitive landscape, characterized by strategic alliances, technological investments, and a focus on improving service quality and customer experience. Regional variations in market share are expected, reflecting differences in economic activity and infrastructure development across the United States.

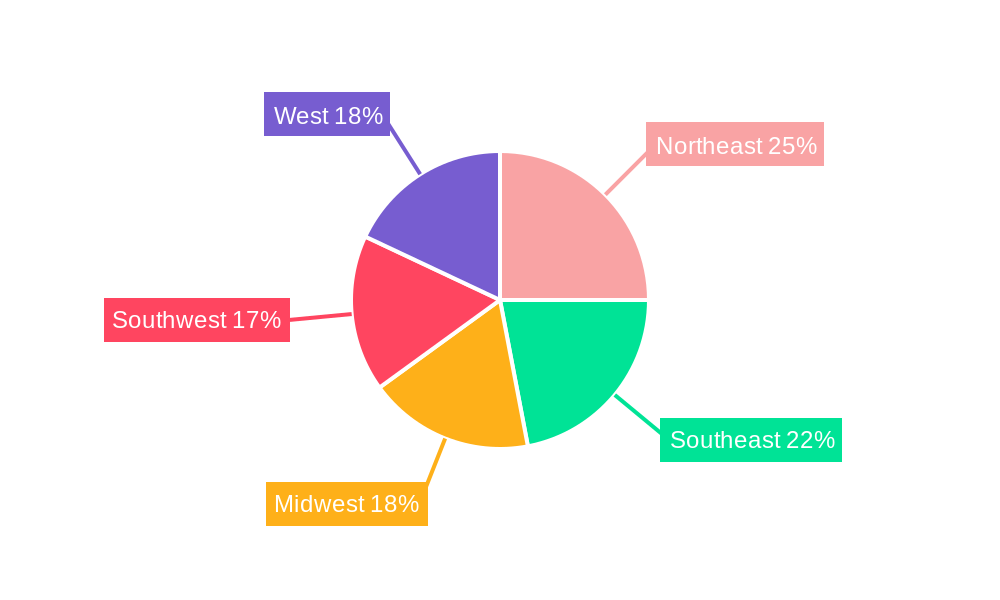

The Northeast, Southeast, and West regions likely hold significant market share, driven by higher population density and industrial activity. However, growth in the Midwest and Southwest may outpace other regions due to robust manufacturing and logistics infrastructure development. Future growth will depend on the continued expansion of e-commerce, infrastructure improvements, technological innovation within the industry, and successful mitigation of challenges such as driver shortages and fuel cost volatility. The market's resilience and continued expansion point towards significant investment opportunities and promising prospects for both established players and emerging companies. Careful consideration of regional variations and technological advancements will be crucial for success in this competitive and dynamic market.

This in-depth report provides a comprehensive analysis of the US Full Truckload Transport Service Market, covering market size, segmentation, key players, industry trends, and future growth prospects from 2019 to 2033. The report leverages extensive primary and secondary research to deliver actionable insights for industry stakeholders, investors, and strategic decision-makers. With a focus on data-driven analysis and expert commentary, this report offers a crucial resource for navigating the complexities and opportunities within this dynamic sector.

US Full Truckload Transport Service Market Market Concentration & Innovation

The US full truckload transport service market exhibits a moderately concentrated structure, with a few major players holding significant market share. However, a substantial number of smaller, regional carriers also contribute to the overall market volume. The market share of the top five players is estimated at xx%, reflecting both the presence of large national carriers and the fragmented nature of the industry. Innovation is driven by technological advancements, including telematics, route optimization software, and autonomous vehicle development. These innovations aim to enhance efficiency, reduce operational costs, and improve delivery times. Stringent regulatory frameworks, including safety regulations and environmental standards, influence operational practices and investment decisions. Product substitutes, such as intermodal transportation and less-than-truckload (LTL) shipping, exert competitive pressure. However, the full truckload segment continues to dominate for high-volume, long-haul shipments. End-user trends, particularly in e-commerce and the demand for faster delivery, fuel market growth. Mergers and acquisitions (M&A) activity is prevalent, with deal values exceeding xx Million in recent years, reflecting consolidation efforts and strategic expansion by leading players.

- Market Share: Top 5 players: xx%

- M&A Deal Value (2019-2024): xx Million

- Key Innovation Drivers: Telematics, Route Optimization Software, Autonomous Vehicles

- Regulatory Influence: Safety Regulations, Environmental Standards

US Full Truckload Transport Service Market Industry Trends & Insights

The US full truckload transport service market is experiencing robust growth, driven by a surge in e-commerce, the expansion of manufacturing activities, and increasing demand for efficient logistics solutions. The Compound Annual Growth Rate (CAGR) during the historical period (2019-2024) was estimated at xx%, and this growth is expected to continue into the forecast period (2025-2033), albeit at a slightly moderated pace (projected CAGR of xx%). Technological disruptions are profoundly impacting the industry, with the adoption of digital freight matching platforms, advanced analytics, and driver assistance systems enhancing operational efficiency. Consumer preferences towards faster delivery and improved tracking capabilities are pushing the industry towards innovative solutions. Competitive dynamics are shaped by pricing strategies, service offerings, and technological capabilities. Market penetration of advanced technologies remains relatively low, suggesting significant potential for future growth. The fluctuating cost of fuel and driver shortages remain major challenges impacting profitability and service reliability.

Dominant Markets & Segments in US Full Truckload Transport Service Market

The manufacturing sector constitutes the largest end-user industry for full truckload transport services, driven by high-volume shipments of raw materials and finished goods. The domestic transportation segment accounts for the majority of market volume. However, the international segment is witnessing increasing growth due to the expansion of global trade and the rise of cross-border e-commerce. The growth of the wholesale and retail trade sector is also a major driver for this market.

- Leading End-User Industry: Manufacturing

- Dominant Destination: Domestic

- Key Drivers:

- Manufacturing: Increased production, supply chain expansion

- Wholesale & Retail Trade: E-commerce growth, faster delivery needs

- Domestic: Established infrastructure, cost-effectiveness

- International: Growth of global trade, cross-border e-commerce

The dominance of these segments is fueled by several factors. The manufacturing sector relies heavily on efficient and reliable transportation for raw materials and finished goods, resulting in substantial demand for full truckload services. Similarly, the robust growth of e-commerce necessitates faster and more reliable delivery options, further driving the demand within the wholesale and retail trade segment. The domestic market's established infrastructure and cost-effectiveness make it the more accessible choice compared to international transport. While the international segment is still growing, cost and regulatory complexities pose some challenges.

US Full Truckload Transport Service Market Product Developments

Recent product innovations in the full truckload transport service market focus on enhancing efficiency and optimizing delivery routes through the use of advanced technologies like telematics, route optimization software, and AI-powered load matching platforms. These innovations aim to improve fuel efficiency, reduce transit times, and enhance overall operational efficiency. Companies are increasingly integrating digital platforms to facilitate seamless communication and real-time tracking, creating a more transparent and responsive logistics network. The market fit for these developments is strong, driven by growing consumer demand for faster and more reliable delivery services, along with the pressure on companies to reduce operational costs.

Report Scope & Segmentation Analysis

This report segments the US full truckload transport service market by end-user industry (Agriculture, Fishing, and Forestry; Construction; Manufacturing; Oil and Gas; Mining and Quarrying; Wholesale and Retail Trade; Others) and destination (Domestic; International). Each segment's market size, growth projections, and competitive dynamics are thoroughly analyzed. The manufacturing segment holds the largest market share, followed by wholesale and retail trade. The domestic market segment dominates in terms of volume, driven by robust domestic economic activity and well-established transportation infrastructure. The international segment is experiencing faster growth, driven by expanding cross-border trade.

Key Drivers of US Full Truckload Transport Service Market Growth

The US full truckload transport service market is fueled by several key factors. The robust growth of e-commerce and the consequent demand for faster and more reliable deliveries are major contributors. Technological advancements, such as telematics, route optimization software, and improved fleet management systems, significantly increase efficiency and reduce costs. Government initiatives to improve infrastructure and facilitate smoother logistics operations also stimulate market growth. Favorable economic conditions that drive manufacturing activity and industrial production further fuel this market expansion.

Challenges in the US Full Truckload Transport Service Market Sector

The industry faces significant challenges, including driver shortages, fluctuating fuel prices, and intense competition. These factors directly impact operational costs and profitability. Stringent regulatory compliance requirements add to operational complexities. Supply chain disruptions and capacity constraints, especially during peak seasons, can impact service reliability and lead to increased costs for shippers. These challenges necessitate strategic approaches to mitigate risks and ensure the efficient and reliable delivery of goods.

Emerging Opportunities in US Full Truckload Transport Service Market

Emerging opportunities in the market include the increasing adoption of autonomous vehicles, the development of more efficient and sustainable transportation solutions, and the expanding use of data analytics and AI for route optimization and predictive maintenance. Growth in e-commerce continues to drive demand for faster and more efficient delivery options, creating opportunities for specialized services. Expansion into new geographic markets and the development of innovative solutions to address the driver shortage represent significant opportunities.

Leading Players in the US Full Truckload Transport Service Market Market

- Landstar System Inc

- DHL Group

- Yellow Corporation

- Knight-Swift Transportation Holdings Inc

- United Parcel Service of America Inc (UPS)

- Werner Enterprises

- C H Robinson

- ArcBest®

- J B Hunt Transport Inc

- Ryder Systems

Key Developments in US Full Truckload Transport Service Market Industry

- September 2023: UPS acquired MNX Global Logistics, strengthening its healthcare logistics capabilities. This acquisition enhances UPS's position in the time-critical logistics market, particularly for temperature-sensitive goods.

- October 2023: Ryder Systems expanded its multiclient warehouse network, adding a significant distribution center. This expansion increases Ryder's capacity to handle consumer packaged goods, reflecting the growth in e-commerce and related logistics demands.

- February 2024: C.H. Robinson launched new AI-powered appointment scheduling technology. This technology significantly improves efficiency by automating appointment scheduling for pickups and deliveries, enhancing operational speed and reducing delays.

Strategic Outlook for US Full Truckload Transport Service Market Market

The US full truckload transport service market is poised for continued growth, driven by sustained e-commerce expansion, technological advancements, and improving infrastructure. Opportunities exist in specialized services, such as temperature-controlled transport and expedited delivery, catering to the evolving needs of various industries. Companies that effectively leverage technology, optimize their operations, and adapt to changing regulatory landscapes are expected to experience significant success in this dynamic and competitive market. The focus on sustainability and the adoption of green technologies will also play a crucial role in shaping the future of the industry.

US Full Truckload Transport Service Market Segmentation

-

1. End User Industry

- 1.1. Agriculture, Fishing, and Forestry

- 1.2. Construction

- 1.3. Manufacturing

- 1.4. Oil and Gas, Mining and Quarrying

- 1.5. Wholesale and Retail Trade

- 1.6. Others

-

2. Destination

- 2.1. Domestic

- 2.2. International

US Full Truckload Transport Service Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Full Truckload Transport Service Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.98% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing trade relations; Increased demand for perishable goods

- 3.3. Market Restrains

- 3.3.1. Cargo theft; High cost of maintainig

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 5.1.1. Agriculture, Fishing, and Forestry

- 5.1.2. Construction

- 5.1.3. Manufacturing

- 5.1.4. Oil and Gas, Mining and Quarrying

- 5.1.5. Wholesale and Retail Trade

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Destination

- 5.2.1. Domestic

- 5.2.2. International

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End User Industry

- 6. North America US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 6.1.1. Agriculture, Fishing, and Forestry

- 6.1.2. Construction

- 6.1.3. Manufacturing

- 6.1.4. Oil and Gas, Mining and Quarrying

- 6.1.5. Wholesale and Retail Trade

- 6.1.6. Others

- 6.2. Market Analysis, Insights and Forecast - by Destination

- 6.2.1. Domestic

- 6.2.2. International

- 6.1. Market Analysis, Insights and Forecast - by End User Industry

- 7. South America US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 7.1.1. Agriculture, Fishing, and Forestry

- 7.1.2. Construction

- 7.1.3. Manufacturing

- 7.1.4. Oil and Gas, Mining and Quarrying

- 7.1.5. Wholesale and Retail Trade

- 7.1.6. Others

- 7.2. Market Analysis, Insights and Forecast - by Destination

- 7.2.1. Domestic

- 7.2.2. International

- 7.1. Market Analysis, Insights and Forecast - by End User Industry

- 8. Europe US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 8.1.1. Agriculture, Fishing, and Forestry

- 8.1.2. Construction

- 8.1.3. Manufacturing

- 8.1.4. Oil and Gas, Mining and Quarrying

- 8.1.5. Wholesale and Retail Trade

- 8.1.6. Others

- 8.2. Market Analysis, Insights and Forecast - by Destination

- 8.2.1. Domestic

- 8.2.2. International

- 8.1. Market Analysis, Insights and Forecast - by End User Industry

- 9. Middle East & Africa US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 9.1.1. Agriculture, Fishing, and Forestry

- 9.1.2. Construction

- 9.1.3. Manufacturing

- 9.1.4. Oil and Gas, Mining and Quarrying

- 9.1.5. Wholesale and Retail Trade

- 9.1.6. Others

- 9.2. Market Analysis, Insights and Forecast - by Destination

- 9.2.1. Domestic

- 9.2.2. International

- 9.1. Market Analysis, Insights and Forecast - by End User Industry

- 10. Asia Pacific US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 10.1.1. Agriculture, Fishing, and Forestry

- 10.1.2. Construction

- 10.1.3. Manufacturing

- 10.1.4. Oil and Gas, Mining and Quarrying

- 10.1.5. Wholesale and Retail Trade

- 10.1.6. Others

- 10.2. Market Analysis, Insights and Forecast - by Destination

- 10.2.1. Domestic

- 10.2.2. International

- 10.1. Market Analysis, Insights and Forecast - by End User Industry

- 11. Northeast US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 15. West US Full Truckload Transport Service Market Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Landstar System Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 DHL Group

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Yellow Corporatio

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Knight-Swift Transportation Holdings Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 United Parcel Service of America Inc (UPS)

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Werner Enterprises

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 C H Robinson

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 ArcBest®

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 J B Hunt Transport Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Ryder Systems

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Landstar System Inc

List of Figures

- Figure 1: Global US Full Truckload Transport Service Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 5: North America US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 6: North America US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 7: North America US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 8: North America US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 9: North America US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 11: South America US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 12: South America US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 13: South America US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 14: South America US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 15: South America US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 17: Europe US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 18: Europe US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 19: Europe US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 20: Europe US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 21: Europe US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Middle East & Africa US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 23: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 24: Middle East & Africa US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 25: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 26: Middle East & Africa US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East & Africa US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Asia Pacific US Full Truckload Transport Service Market Revenue (Million), by End User Industry 2024 & 2032

- Figure 29: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by End User Industry 2024 & 2032

- Figure 30: Asia Pacific US Full Truckload Transport Service Market Revenue (Million), by Destination 2024 & 2032

- Figure 31: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by Destination 2024 & 2032

- Figure 32: Asia Pacific US Full Truckload Transport Service Market Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific US Full Truckload Transport Service Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 3: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 4: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Northeast US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Southeast US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Midwest US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Southwest US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: West US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 12: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 13: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Canada US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 18: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 19: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Brazil US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Argentina US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of South America US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 24: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 25: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Kingdom US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Germany US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: France US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Italy US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Spain US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Russia US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Benelux US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Nordics US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Rest of Europe US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 36: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 37: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global US Full Truckload Transport Service Market Revenue Million Forecast, by End User Industry 2019 & 2032

- Table 45: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Destination 2019 & 2032

- Table 46: Global US Full Truckload Transport Service Market Revenue Million Forecast, by Country 2019 & 2032

- Table 47: China US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Japan US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: ASEAN US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Oceania US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Rest of Asia Pacific US Full Truckload Transport Service Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Full Truckload Transport Service Market?

The projected CAGR is approximately 5.98%.

2. Which companies are prominent players in the US Full Truckload Transport Service Market?

Key companies in the market include Landstar System Inc, DHL Group, Yellow Corporatio, Knight-Swift Transportation Holdings Inc, United Parcel Service of America Inc (UPS), Werner Enterprises, C H Robinson, ArcBest®, J B Hunt Transport Inc, Ryder Systems.

3. What are the main segments of the US Full Truckload Transport Service Market?

The market segments include End User Industry, Destination.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing trade relations; Increased demand for perishable goods.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Cargo theft; High cost of maintainig.

8. Can you provide examples of recent developments in the market?

February 2024: C.H. Robinson has developed a new technology that creates a major efficiency in freight shipping: removing the work of scheduling an appointment at the place where a load needs to be picked up and scheduling another appointment where the load needs to be delivered. The technology also uses artificial intelligence to determine the optimal appointment, based on transit-time data from C.H. Robinson’s millions of shipments across 300,000 shipping lanes.October 2023: Ryder Systems continues to expand its multiclient warehouse network, adding a 400,000-square-foot distribution center in Aurora, Ill. The newly built facility is the latest addition to a now six-building campus totaling 2.4 million square feet, primarily serving shippers of consumer packaged goods (CPG), including food and beverage, food ingredients, health and beauty, household products, and general retail merchandise.September 2023: UPS has entered into an agreement to acquire MNX Global Logistics (MNX), a global time-critical logistics provider. MNX’s capabilities in radio-pharmaceuticals and temperature-controlled logistics will help UPS’ healthcare segment and clinical trial logistics subsidiary Marken meet the growing demand for these services. The transaction is expected to close by the end of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Full Truckload Transport Service Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Full Truckload Transport Service Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Full Truckload Transport Service Market?

To stay informed about further developments, trends, and reports in the US Full Truckload Transport Service Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence