Key Insights

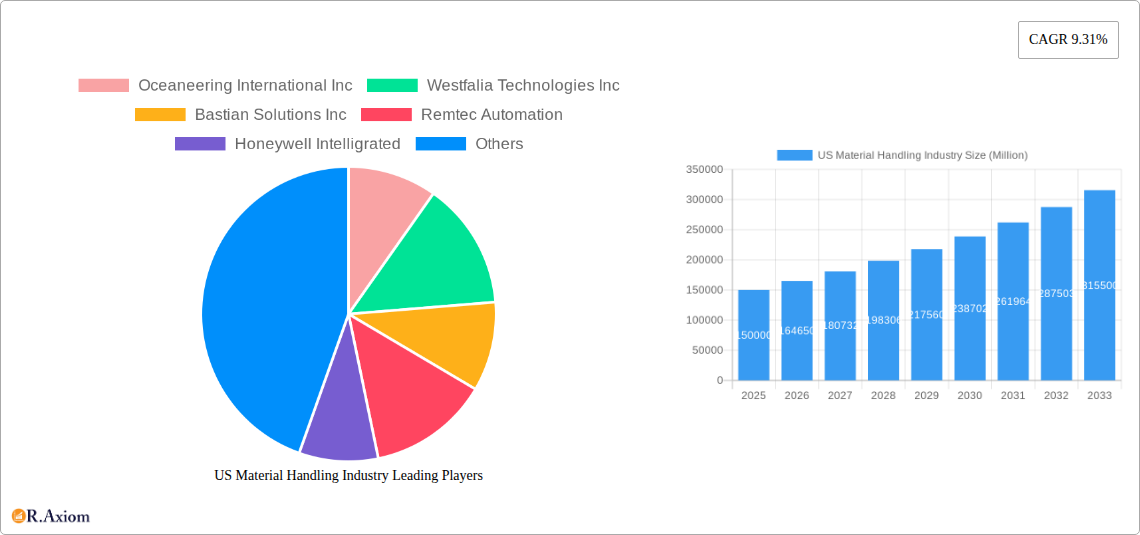

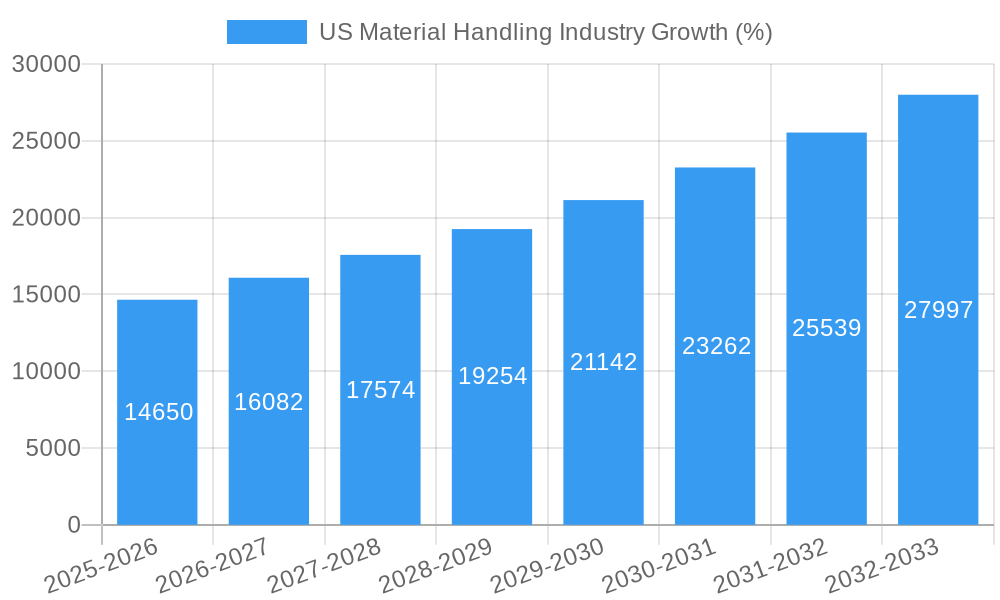

The US material handling industry, a vital component of the nation's supply chain, is experiencing robust growth, fueled by the increasing demand for efficient logistics and automation across various sectors. With a market size exceeding $XX million in 2025 (assuming a logical extrapolation based on the provided CAGR of 9.31% and unspecified 2019-2024 data), the industry is projected to maintain a healthy growth trajectory throughout the forecast period (2025-2033). Key drivers include the burgeoning e-commerce sector necessitating faster delivery times, the rising adoption of automation technologies like Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) to improve warehouse efficiency, and a growing focus on supply chain resilience and optimization in the face of global disruptions. Significant growth is observed across segments, particularly in automated storage and retrieval systems (ASRS), automated conveyors, and robotic sortation systems within warehousing and distribution centers, automotive, and e-commerce logistics. The increasing complexity of supply chains and the need for real-time visibility are driving the demand for sophisticated software and services to manage and optimize material handling operations.

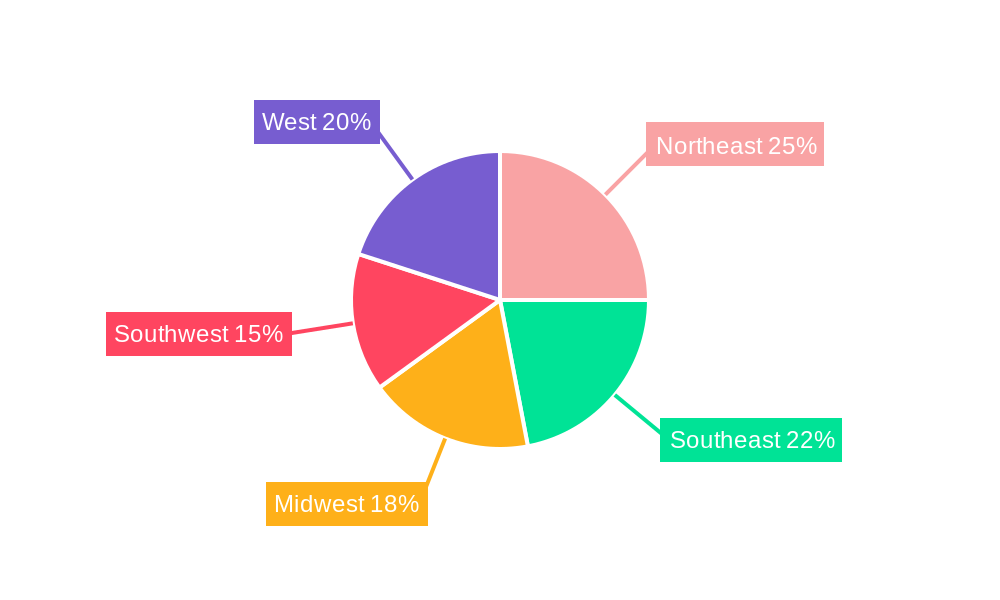

While the market enjoys considerable momentum, certain restraints persist. These include the high initial investment costs associated with automation technologies, the need for skilled labor to operate and maintain these systems, and concerns regarding the integration of new technologies with existing infrastructure. Nevertheless, ongoing technological advancements, coupled with government initiatives promoting automation and digitalization in logistics, are expected to mitigate these challenges. The regional distribution of the market is likely to reflect the established industrial hubs, with significant activity concentrated in the Northeast, Southeast, and West, given their concentration of major distribution centers and manufacturing facilities. Leading players like Oceaneering International Inc, Westfalia Technologies Inc, and Honeywell Intelligrated are poised to benefit from this growth, actively investing in innovation and expanding their market share through strategic partnerships and acquisitions. The diverse segments within the industry present multiple opportunities for both established players and new entrants.

US Material Handling Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the US Material Handling Industry, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a base year of 2025, this report forecasts market trends, identifies key players, and explores emerging opportunities within this dynamic sector. The US Material Handling market is projected to reach xx Million by 2033, exhibiting a robust CAGR of xx% during the forecast period (2025-2033).

US Material Handling Industry Market Concentration & Innovation

The US material handling industry is characterized by a moderately concentrated market with several large players holding significant market share. However, the presence of numerous smaller, specialized firms fosters innovation and competition. Key players like Honeywell Intelligrated, Daifuku Co Ltd, and Vanderlande Industries B.V. dominate certain segments, while others like Bastian Solutions Inc and Remtec Automation focus on niche applications. Market share data for 2024 reveals that the top 5 companies hold approximately xx% of the market, while the remaining share is distributed amongst a larger number of competitors.

Innovation is driven by the increasing demand for automation, efficiency, and data-driven solutions. Regulatory frameworks, such as those concerning workplace safety and environmental compliance, influence product development and adoption. Substitutes, such as improved manual handling techniques or alternative transportation methods, exert some pressure, but the overall demand for efficient material handling remains robust. End-user trends towards lean manufacturing, supply chain optimization, and e-commerce fulfillment are powerful drivers of market growth.

Mergers and acquisitions (M&A) play a significant role in shaping the industry landscape. Recent years have witnessed several notable transactions, such as the January 2021 acquisition of Lauyans & Co. Inc. by W. M. Kelley Co. Inc., consolidating expertise in overhead conveyor systems. The total value of M&A deals in the industry during 2019-2024 is estimated at xx Million, indicating a high level of consolidation and strategic investment.

- Key Metrics:

- Top 5 companies market share: xx% (2024)

- Total M&A deal value (2019-2024): xx Million

US Material Handling Industry Industry Trends & Insights

The US material handling industry is experiencing significant transformation fueled by technological advancements and evolving end-user needs. Key trends include the rising adoption of automation technologies like Autonomous Mobile Robots (AMRs), Automated Guided Vehicles (AGVs), and sophisticated warehouse management systems (WMS). These technologies promise enhanced efficiency, reduced labor costs, and improved accuracy in material handling processes. The market is witnessing a shift from traditional manual handling methods to automated systems, driven by labor shortages, rising labor costs, and the need for faster order fulfillment. This trend is particularly pronounced in e-commerce and logistics sectors.

Consumer preferences are increasingly focused on speed, accuracy, and transparency in supply chains. E-commerce growth is driving demand for faster delivery times, prompting companies to adopt automation and optimize their warehouse operations. Competitive dynamics are intense, with companies constantly striving to differentiate themselves through innovative product offerings, superior customer service, and strategic partnerships. The market is characterized by both intense competition among established players and the emergence of new entrants offering disruptive technologies. The industry's CAGR for the historical period (2019-2024) is estimated at xx%, demonstrating consistent growth driven by the factors mentioned above. Market penetration of automated systems is steadily increasing, particularly in large-scale distribution centers and manufacturing facilities.

Dominant Markets & Segments in US Material Handling Industry

The US material handling market exhibits robust growth across various segments, with certain areas showing particularly strong dominance. The retail/warehousing/distribution centers/logistics centers segment represents the largest end-user vertical, driven by the explosive growth of e-commerce and the need for efficient order fulfillment. Within equipment types, Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) are experiencing the fastest growth, reflecting the industry's ongoing automation trend. The software segment is also experiencing rapid expansion as businesses invest in advanced warehouse management systems (WMS) and other software solutions to optimize their operations. In terms of product types, Hardware dominates, followed by Services.

- Key Drivers:

- Retail/Warehousing/Distribution Centers/Logistic Centers: E-commerce boom, demand for faster delivery.

- AGVs and AMRs: Automation trend, labor cost reduction.

- Software: Need for data-driven optimization, efficient warehouse management.

- Hardware: Foundation for all material handling systems.

The dominance of these segments stems from several factors:

- Economic policies: Government initiatives promoting infrastructure development and automation.

- Infrastructure: Expansion of logistics networks and transportation systems.

- Technological advancements: Development of innovative and cost-effective solutions.

US Material Handling Industry Product Developments

Recent product innovations focus on enhanced automation, improved safety features, and increased data analytics capabilities. Examples include advanced robotics for palletizing and sortation, intelligent conveyor systems with real-time tracking, and cloud-based warehouse management systems. These developments enable companies to optimize their operations, improve efficiency, and reduce operational costs. The market fit for these innovations is strong, as companies seek to gain a competitive edge through improved logistics and supply chain management.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the US material handling market, segmented by product type (hardware, software, services), equipment type (AGV, AMR, ASRS, conveyor systems, palletizers, sortation systems), and end-user vertical (airport, automotive, food and beverage, retail/warehousing/distribution centers, general manufacturing, pharmaceuticals, post and parcel, other). Each segment's growth projections, market size, and competitive dynamics are analyzed in detail. The report considers the historical period (2019-2024), the base year (2025), and the forecast period (2025-2033) to provide a holistic view of market trends. Growth rates vary across segments, with automated systems and software solutions generally outpacing traditional hardware. Competitive dynamics are shaped by factors such as technological innovation, pricing strategies, and customer service.

Key Drivers of US Material Handling Industry Growth

The growth of the US material handling industry is driven by several factors, including:

- Technological advancements: Automation, robotics, AI, and IoT are transforming the industry. Examples include the rise of AMRs and the integration of WMS systems.

- Economic growth: Increased industrial output and e-commerce expansion fuel demand for efficient material handling solutions.

- Regulatory changes: Compliance requirements and safety standards drive the adoption of advanced technologies.

Challenges in the US Material Handling Industry Sector

The US material handling industry faces several challenges:

- Supply chain disruptions: Global events and logistics bottlenecks can impact the availability of components and materials.

- High capital expenditure: Investing in advanced automation technologies requires significant upfront investment.

- Skill gaps: A shortage of skilled labor capable of operating and maintaining sophisticated equipment.

Emerging Opportunities in US Material Handling Industry

Several emerging opportunities exist within the US material handling industry:

- Growth of e-commerce: Continued expansion creates demand for efficient last-mile delivery and warehouse automation.

- Development of advanced robotics: Further automation capabilities improve speed, accuracy, and efficiency.

- Integration of data analytics: Provides insights into process optimization and supply chain management.

Leading Players in the US Material Handling Industry Market

- Oceaneering International Inc

- Westfalia Technologies Inc

- Bastian Solutions Inc

- Remtec Automation

- Honeywell Intelligrated

- Daifuku Co Ltd

- Vanderlande Industries B V

- Siggins Company

- Kion Group AG

- Dorner Manufacturing Corporation

- Aethon Inc

- DMW&H

- Cornerstone Automation Systems LLC

Key Developments in US Material Handling Industry Industry

- February 2021: Urban Outfitters Inc. partners with TGW to implement an automated fulfillment center solution using TGW's FlashPick system. This highlights the growing adoption of automated solutions in the retail sector.

- January 2021: W. M. Kelley Co. Inc. acquires Lauyans & Co. Inc., strengthening its position in overhead conveyor systems. This demonstrates the ongoing consolidation within the industry.

Strategic Outlook for US Material Handling Industry Market

The US material handling industry is poised for continued growth driven by technological innovation, e-commerce expansion, and the ongoing need for efficient supply chain management. Future opportunities lie in the development and adoption of advanced robotics, AI-powered solutions, and data-driven optimization techniques. Companies that can adapt to changing market demands and embrace innovation will be well-positioned for success in this dynamic sector.

US Material Handling Industry Segmentation

-

1. Product Type

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Equipment Type

-

2.1. Automated Guided Vehicle (AGV)

- 2.1.1. Automated Forklift

- 2.1.2. Automated Tow/Tractor/Tug

- 2.1.3. Unit Load

- 2.1.4. Assembly Line

- 2.1.5. Special Purpose

- 2.2. Autonomous Mobile Robots (AMR)

- 2.3. Laser Guided Vehicle

-

2.4. Automated Storage and Retrieval System (ASRS)

- 2.4.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 2.4.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 2.4.3. Vertical Lift Module

-

2.5. Automated Conveyor

- 2.5.1. Belt

- 2.5.2. Roller

- 2.5.3. Pallet

- 2.5.4. Overhead

-

2.6. Palletizer

- 2.6.1. Conventional (High Level + Low Level)

- 2.6.2. Robotic

- 2.7. Sortation System

-

2.1. Automated Guided Vehicle (AGV)

-

3. End-user Vertical

- 3.1. Airport

- 3.2. Automotive

- 3.3. Food and Beverage

- 3.4. Retail/W

- 3.5. General Manufacturing

- 3.6. Pharmaceuticals

- 3.7. Post and Parcel

- 3.8. Other End-Users

US Material Handling Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

US Material Handling Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Manufacturing Complexity and Technology Availability; Increasing Demand for Improving Order Accuracy and SKU Proliferation; Emergence of Smart City Logistics and Wide Adoption of Robotics in Warehouse Applications

- 3.3. Market Restrains

- 3.3.1. Gap in Supply Chain Skills and Workforce Shortage; High initial costs

- 3.4. Market Trends

- 3.4.1. Autonomous Mobile Robots (AMR) is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Equipment Type

- 5.2.1. Automated Guided Vehicle (AGV)

- 5.2.1.1. Automated Forklift

- 5.2.1.2. Automated Tow/Tractor/Tug

- 5.2.1.3. Unit Load

- 5.2.1.4. Assembly Line

- 5.2.1.5. Special Purpose

- 5.2.2. Autonomous Mobile Robots (AMR)

- 5.2.3. Laser Guided Vehicle

- 5.2.4. Automated Storage and Retrieval System (ASRS)

- 5.2.4.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.4.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.4.3. Vertical Lift Module

- 5.2.5. Automated Conveyor

- 5.2.5.1. Belt

- 5.2.5.2. Roller

- 5.2.5.3. Pallet

- 5.2.5.4. Overhead

- 5.2.6. Palletizer

- 5.2.6.1. Conventional (High Level + Low Level)

- 5.2.6.2. Robotic

- 5.2.7. Sortation System

- 5.2.1. Automated Guided Vehicle (AGV)

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. Airport

- 5.3.2. Automotive

- 5.3.3. Food and Beverage

- 5.3.4. Retail/W

- 5.3.5. General Manufacturing

- 5.3.6. Pharmaceuticals

- 5.3.7. Post and Parcel

- 5.3.8. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Equipment Type

- 6.2.1. Automated Guided Vehicle (AGV)

- 6.2.1.1. Automated Forklift

- 6.2.1.2. Automated Tow/Tractor/Tug

- 6.2.1.3. Unit Load

- 6.2.1.4. Assembly Line

- 6.2.1.5. Special Purpose

- 6.2.2. Autonomous Mobile Robots (AMR)

- 6.2.3. Laser Guided Vehicle

- 6.2.4. Automated Storage and Retrieval System (ASRS)

- 6.2.4.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 6.2.4.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 6.2.4.3. Vertical Lift Module

- 6.2.5. Automated Conveyor

- 6.2.5.1. Belt

- 6.2.5.2. Roller

- 6.2.5.3. Pallet

- 6.2.5.4. Overhead

- 6.2.6. Palletizer

- 6.2.6.1. Conventional (High Level + Low Level)

- 6.2.6.2. Robotic

- 6.2.7. Sortation System

- 6.2.1. Automated Guided Vehicle (AGV)

- 6.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.3.1. Airport

- 6.3.2. Automotive

- 6.3.3. Food and Beverage

- 6.3.4. Retail/W

- 6.3.5. General Manufacturing

- 6.3.6. Pharmaceuticals

- 6.3.7. Post and Parcel

- 6.3.8. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Equipment Type

- 7.2.1. Automated Guided Vehicle (AGV)

- 7.2.1.1. Automated Forklift

- 7.2.1.2. Automated Tow/Tractor/Tug

- 7.2.1.3. Unit Load

- 7.2.1.4. Assembly Line

- 7.2.1.5. Special Purpose

- 7.2.2. Autonomous Mobile Robots (AMR)

- 7.2.3. Laser Guided Vehicle

- 7.2.4. Automated Storage and Retrieval System (ASRS)

- 7.2.4.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 7.2.4.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 7.2.4.3. Vertical Lift Module

- 7.2.5. Automated Conveyor

- 7.2.5.1. Belt

- 7.2.5.2. Roller

- 7.2.5.3. Pallet

- 7.2.5.4. Overhead

- 7.2.6. Palletizer

- 7.2.6.1. Conventional (High Level + Low Level)

- 7.2.6.2. Robotic

- 7.2.7. Sortation System

- 7.2.1. Automated Guided Vehicle (AGV)

- 7.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.3.1. Airport

- 7.3.2. Automotive

- 7.3.3. Food and Beverage

- 7.3.4. Retail/W

- 7.3.5. General Manufacturing

- 7.3.6. Pharmaceuticals

- 7.3.7. Post and Parcel

- 7.3.8. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Equipment Type

- 8.2.1. Automated Guided Vehicle (AGV)

- 8.2.1.1. Automated Forklift

- 8.2.1.2. Automated Tow/Tractor/Tug

- 8.2.1.3. Unit Load

- 8.2.1.4. Assembly Line

- 8.2.1.5. Special Purpose

- 8.2.2. Autonomous Mobile Robots (AMR)

- 8.2.3. Laser Guided Vehicle

- 8.2.4. Automated Storage and Retrieval System (ASRS)

- 8.2.4.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 8.2.4.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 8.2.4.3. Vertical Lift Module

- 8.2.5. Automated Conveyor

- 8.2.5.1. Belt

- 8.2.5.2. Roller

- 8.2.5.3. Pallet

- 8.2.5.4. Overhead

- 8.2.6. Palletizer

- 8.2.6.1. Conventional (High Level + Low Level)

- 8.2.6.2. Robotic

- 8.2.7. Sortation System

- 8.2.1. Automated Guided Vehicle (AGV)

- 8.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.3.1. Airport

- 8.3.2. Automotive

- 8.3.3. Food and Beverage

- 8.3.4. Retail/W

- 8.3.5. General Manufacturing

- 8.3.6. Pharmaceuticals

- 8.3.7. Post and Parcel

- 8.3.8. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Equipment Type

- 9.2.1. Automated Guided Vehicle (AGV)

- 9.2.1.1. Automated Forklift

- 9.2.1.2. Automated Tow/Tractor/Tug

- 9.2.1.3. Unit Load

- 9.2.1.4. Assembly Line

- 9.2.1.5. Special Purpose

- 9.2.2. Autonomous Mobile Robots (AMR)

- 9.2.3. Laser Guided Vehicle

- 9.2.4. Automated Storage and Retrieval System (ASRS)

- 9.2.4.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 9.2.4.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 9.2.4.3. Vertical Lift Module

- 9.2.5. Automated Conveyor

- 9.2.5.1. Belt

- 9.2.5.2. Roller

- 9.2.5.3. Pallet

- 9.2.5.4. Overhead

- 9.2.6. Palletizer

- 9.2.6.1. Conventional (High Level + Low Level)

- 9.2.6.2. Robotic

- 9.2.7. Sortation System

- 9.2.1. Automated Guided Vehicle (AGV)

- 9.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.3.1. Airport

- 9.3.2. Automotive

- 9.3.3. Food and Beverage

- 9.3.4. Retail/W

- 9.3.5. General Manufacturing

- 9.3.6. Pharmaceuticals

- 9.3.7. Post and Parcel

- 9.3.8. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Equipment Type

- 10.2.1. Automated Guided Vehicle (AGV)

- 10.2.1.1. Automated Forklift

- 10.2.1.2. Automated Tow/Tractor/Tug

- 10.2.1.3. Unit Load

- 10.2.1.4. Assembly Line

- 10.2.1.5. Special Purpose

- 10.2.2. Autonomous Mobile Robots (AMR)

- 10.2.3. Laser Guided Vehicle

- 10.2.4. Automated Storage and Retrieval System (ASRS)

- 10.2.4.1. Fixed Aisle (Stacker Crane + Shuttle System)

- 10.2.4.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 10.2.4.3. Vertical Lift Module

- 10.2.5. Automated Conveyor

- 10.2.5.1. Belt

- 10.2.5.2. Roller

- 10.2.5.3. Pallet

- 10.2.5.4. Overhead

- 10.2.6. Palletizer

- 10.2.6.1. Conventional (High Level + Low Level)

- 10.2.6.2. Robotic

- 10.2.7. Sortation System

- 10.2.1. Automated Guided Vehicle (AGV)

- 10.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.3.1. Airport

- 10.3.2. Automotive

- 10.3.3. Food and Beverage

- 10.3.4. Retail/W

- 10.3.5. General Manufacturing

- 10.3.6. Pharmaceuticals

- 10.3.7. Post and Parcel

- 10.3.8. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Northeast US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 12. Southeast US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 13. Midwest US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 14. Southwest US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 15. West US Material Handling Industry Analysis, Insights and Forecast, 2019-2031

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Oceaneering International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Westfalia Technologies Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bastian Solutions Inc

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Remtec Automation

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Honeywell Intelligrated

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Daifuku Co Ltd

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Vanderlande Industries B V *List Not Exhaustive

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Siggins Company

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Kion Group AG

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Dorner Manufacturing Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Aethon Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 DMW&H

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Cornerstone Automation Systems LLC

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Oceaneering International Inc

List of Figures

- Figure 1: Global US Material Handling Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: United states US Material Handling Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: United states US Material Handling Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America US Material Handling Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 5: North America US Material Handling Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 6: North America US Material Handling Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 7: North America US Material Handling Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 8: North America US Material Handling Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 9: North America US Material Handling Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 10: North America US Material Handling Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: North America US Material Handling Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America US Material Handling Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 13: South America US Material Handling Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: South America US Material Handling Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 15: South America US Material Handling Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 16: South America US Material Handling Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 17: South America US Material Handling Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 18: South America US Material Handling Industry Revenue (Million), by Country 2024 & 2032

- Figure 19: South America US Material Handling Industry Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe US Material Handling Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 21: Europe US Material Handling Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 22: Europe US Material Handling Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 23: Europe US Material Handling Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 24: Europe US Material Handling Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 25: Europe US Material Handling Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 26: Europe US Material Handling Industry Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe US Material Handling Industry Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa US Material Handling Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 29: Middle East & Africa US Material Handling Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 30: Middle East & Africa US Material Handling Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 31: Middle East & Africa US Material Handling Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 32: Middle East & Africa US Material Handling Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Middle East & Africa US Material Handling Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Middle East & Africa US Material Handling Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa US Material Handling Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific US Material Handling Industry Revenue (Million), by Product Type 2024 & 2032

- Figure 37: Asia Pacific US Material Handling Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: Asia Pacific US Material Handling Industry Revenue (Million), by Equipment Type 2024 & 2032

- Figure 39: Asia Pacific US Material Handling Industry Revenue Share (%), by Equipment Type 2024 & 2032

- Figure 40: Asia Pacific US Material Handling Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 41: Asia Pacific US Material Handling Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 42: Asia Pacific US Material Handling Industry Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific US Material Handling Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global US Material Handling Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global US Material Handling Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Global US Material Handling Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 4: Global US Material Handling Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Global US Material Handling Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global US Material Handling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Northeast US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Southeast US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Midwest US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Southwest US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global US Material Handling Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 13: Global US Material Handling Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 14: Global US Material Handling Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 15: Global US Material Handling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Canada US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Global US Material Handling Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: Global US Material Handling Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 21: Global US Material Handling Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 22: Global US Material Handling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Brazil US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Argentina US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global US Material Handling Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 27: Global US Material Handling Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 28: Global US Material Handling Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global US Material Handling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 30: United Kingdom US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Germany US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: France US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Italy US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Spain US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Russia US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Benelux US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Nordics US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Europe US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Global US Material Handling Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 40: Global US Material Handling Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 41: Global US Material Handling Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 42: Global US Material Handling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Turkey US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Israel US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: GCC US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: North Africa US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: South Africa US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Middle East & Africa US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global US Material Handling Industry Revenue Million Forecast, by Product Type 2019 & 2032

- Table 50: Global US Material Handling Industry Revenue Million Forecast, by Equipment Type 2019 & 2032

- Table 51: Global US Material Handling Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 52: Global US Material Handling Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: China US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: India US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: South Korea US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: ASEAN US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Oceania US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Rest of Asia Pacific US Material Handling Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the US Material Handling Industry?

The projected CAGR is approximately 9.31%.

2. Which companies are prominent players in the US Material Handling Industry?

Key companies in the market include Oceaneering International Inc, Westfalia Technologies Inc, Bastian Solutions Inc, Remtec Automation, Honeywell Intelligrated, Daifuku Co Ltd, Vanderlande Industries B V *List Not Exhaustive, Siggins Company, Kion Group AG, Dorner Manufacturing Corporation, Aethon Inc, DMW&H, Cornerstone Automation Systems LLC.

3. What are the main segments of the US Material Handling Industry?

The market segments include Product Type, Equipment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Manufacturing Complexity and Technology Availability; Increasing Demand for Improving Order Accuracy and SKU Proliferation; Emergence of Smart City Logistics and Wide Adoption of Robotics in Warehouse Applications.

6. What are the notable trends driving market growth?

Autonomous Mobile Robots (AMR) is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Gap in Supply Chain Skills and Workforce Shortage; High initial costs.

8. Can you provide examples of recent developments in the market?

February 2021- Urban Outfitters Inc. (URBN), one of the providers of lifestyle products and services companies, that operates a portfolio of global consumer brands comprised of Anthropologie, BHLDN, Free People, Terrain, Urban Outfitters, Nuuly, and a Food and Beverage division partnered with TGW to design and implement an automation solution for a new fulfillment center in Kansas City, in the US. The company's FlashPick system is provided as a solution as the product picks orders fully automatically and ensures the next phase of picking is being addressed.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "US Material Handling Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the US Material Handling Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the US Material Handling Industry?

To stay informed about further developments, trends, and reports in the US Material Handling Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence