Key Insights

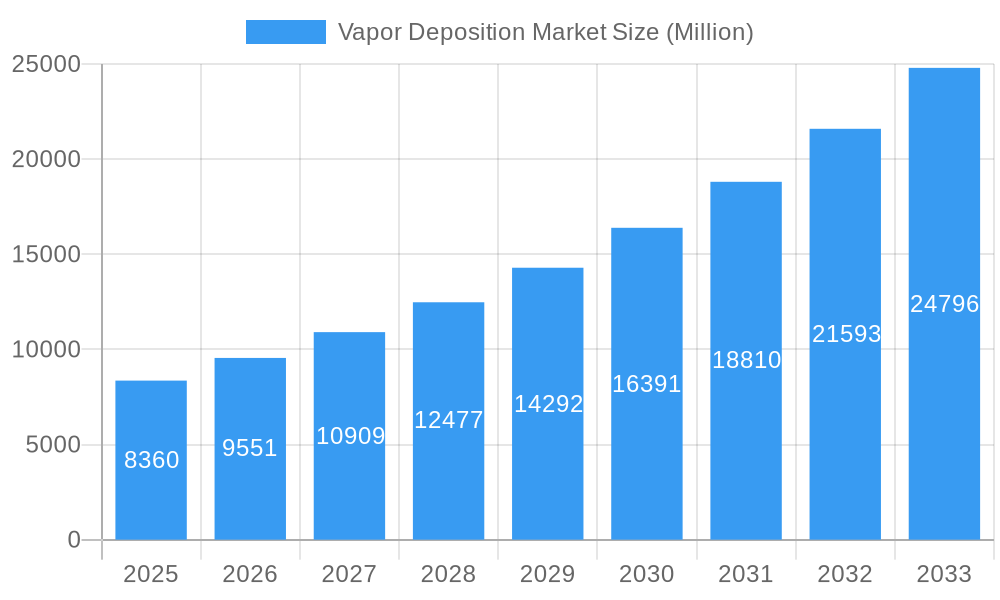

The global Vapor Deposition Market is projected to experience substantial growth, reaching an estimated $8.36 billion in 2025 and expanding at a robust Compound Annual Growth Rate (CAGR) of 14.25% through 2033. This significant expansion is propelled by several key drivers, primarily the escalating demand for advanced semiconductor devices and the burgeoning adoption of thin-film technologies across diverse industries. The electronics sector, with its insatiable need for high-performance components, stands as a major beneficiary, fueling the adoption of CVD (Chemical Vapor Deposition) and PVD (Physical Vapor Deposition) techniques for manufacturing integrated circuits, displays, and memory. Furthermore, the increasing focus on renewable energy sources is driving demand for vapor deposition in solar panel manufacturing, enhancing their efficiency and durability. The cutting tools industry is also witnessing a surge in the application of vapor-deposited coatings to improve wear resistance and lifespan. Emerging applications in medical devices, where biocompatible and specialized coatings are crucial, further contribute to the market's upward trajectory.

Vapor Deposition Market Market Size (In Billion)

The market's growth is further supported by ongoing technological advancements in deposition processes, enabling greater precision, speed, and material versatility. Innovations in equipment design and material science are continuously pushing the boundaries of what vapor deposition can achieve, leading to the development of novel functionalities and improved product performance. While the market is characterized by strong growth, certain restraints, such as the high initial investment costs for sophisticated equipment and the complex technical expertise required for operation, may pose challenges for smaller players. However, the relentless pursuit of miniaturization, enhanced performance, and energy efficiency in electronic devices, coupled with the expanding scope of applications in areas like aerospace and automotive, are expected to more than offset these limitations, ensuring a dynamic and flourishing market landscape. The competitive landscape features a blend of established multinational corporations and specialized regional players, all vying for market share through continuous innovation and strategic partnerships.

Vapor Deposition Market Company Market Share

This in-depth report provides an exhaustive analysis of the global vapor deposition market, offering critical insights for stakeholders across the electronics, solar, automotive, and medical device industries. Covering the study period of 2019–2033, with a base year and estimated year of 2025, and a detailed forecast period of 2025–2033, this research delves into the market's current landscape, historical performance (2019–2024), and future trajectory. We explore the dominance of CVD equipment and CVD materials, alongside key applications such as electronics, solar panels, cutting tools, and medical devices. With an estimated market size projected to reach $XX billion by 2033, driven by a CAGR of XX%, this report is an indispensable resource for understanding market concentration, innovation, industry trends, dominant segments, product developments, growth drivers, challenges, emerging opportunities, leading players, and key industry developments shaping the vapor deposition market.

Vapor Deposition Market Market Concentration & Innovation

The vapor deposition market exhibits moderate to high concentration, with a significant share held by leading players. Innovation is a primary driver, fueled by the relentless demand for advanced materials and coatings with enhanced performance characteristics. Key innovation areas include the development of novel precursor materials for improved deposition rates and film quality, advanced reactor designs for higher throughput and uniformity, and sophisticated process control for precision applications. Regulatory frameworks, particularly concerning environmental impact and material safety, are increasingly influencing R&D and market entry strategies. Product substitutes, while present in some niche applications, generally fall short of the superior performance offered by advanced vapor deposition techniques. End-user trends, such as the miniaturization of electronic components, the demand for higher efficiency solar cells, and the need for durable and biocompatible coatings in medical devices, are continuously pushing the boundaries of innovation. Mergers and acquisitions (M&A) activity is also a significant factor, with strategic deals valued in the billions of dollars aimed at consolidating market share, acquiring cutting-edge technologies, and expanding geographical reach. For instance, the acquisition of Epiluvac AB by Veeco Instruments Inc. in February 2023 highlights the strategic importance of advanced epitaxy systems for the burgeoning electric vehicle market.

Vapor Deposition Market Industry Trends & Insights

The vapor deposition market is experiencing robust growth, propelled by several interconnected industry trends and insights. The escalating demand for high-performance semiconductor devices, driven by advancements in artificial intelligence, 5G technology, and the Internet of Things (IoT), is a primary growth engine. This translates directly into increased demand for sophisticated CVD equipment and specialized CVD materials essential for fabricating advanced microchips. Furthermore, the global push towards renewable energy sources is significantly boosting the solar panel segment, where vapor deposition techniques are crucial for creating efficient photovoltaic layers. The automotive industry's rapid transition to electric vehicles (EVs) is another powerful catalyst, with vapor deposition playing a vital role in enhancing the performance and durability of EV components, particularly silicon carbide (SiC) power devices. The medical device sector also presents substantial growth opportunities, driven by the need for biocompatible, wear-resistant, and antimicrobial coatings on implants, surgical instruments, and diagnostic equipment. The market is witnessing a continuous technological disruption, with ongoing research into atomic layer deposition (ALD) and plasma-enhanced chemical vapor deposition (PECVD) to achieve atomic-level precision and novel material properties. Consumer preferences are increasingly leaning towards products with longer lifespans, improved functionality, and enhanced aesthetic appeal, all of which can be achieved through advanced vapor deposition coatings. The competitive dynamics are characterized by intense innovation, strategic partnerships, and a focus on developing cost-effective and scalable deposition solutions. The vapor deposition market is projected to grow at a CAGR of XX% during the forecast period, with market penetration deepening across diverse industrial applications.

Dominant Markets & Segments in Vapor Deposition Market

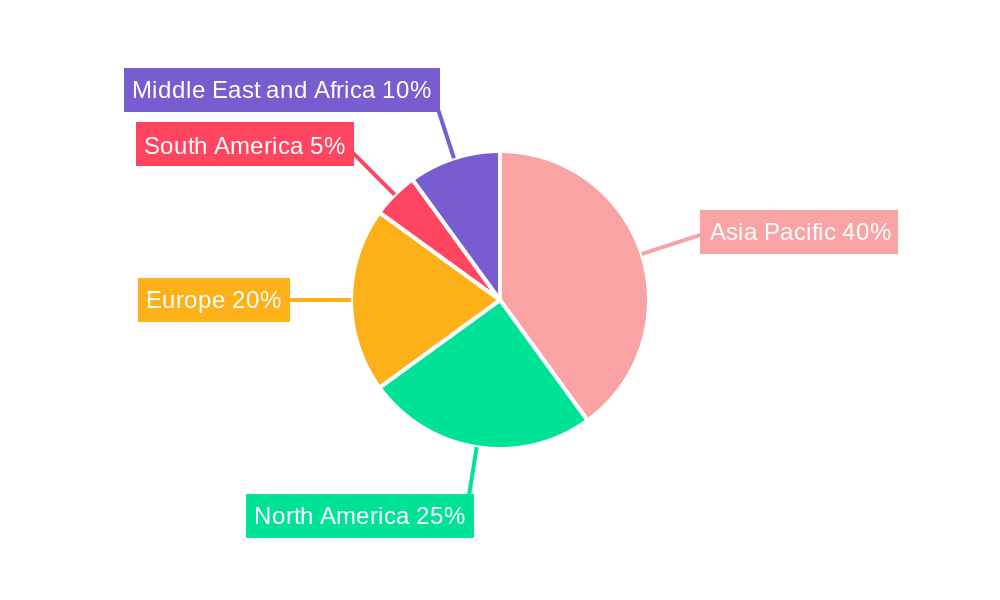

The vapor deposition market is characterized by the dominance of specific regions and segments. North America and Asia Pacific are the leading geographical markets, driven by strong manufacturing bases in electronics and semiconductors, coupled with substantial investments in renewable energy and advanced materials research. Within Asia Pacific, China, South Korea, and Japan are pivotal contributors, housing major semiconductor fabrication plants and solar panel manufacturers. Economically, supportive government policies, R&D incentives, and a well-developed industrial infrastructure in these regions foster market expansion.

- CVD Equipment Segment: This segment holds a dominant position due to the foundational role of CVD equipment in enabling advanced manufacturing processes. The increasing complexity of semiconductor devices and the growing scale of solar panel production necessitate sophisticated and high-throughput CVD systems. Technological advancements in reactor design, process control, and automation are key drivers of dominance.

- CVD Materials Segment: The development and availability of high-purity and specialized precursor materials are critical for achieving desired film properties. The CVD materials segment's growth is intrinsically linked to innovation in precursor chemistry and the demand for advanced thin films.

- Electronics Application Segment: This remains the largest and most dominant application segment. The insatiable demand for smaller, faster, and more powerful electronic devices, from smartphones and computers to advanced AI processors, fuels the widespread adoption of vapor deposition for critical layers like dielectrics, interconnects, and passivation.

- Solar Panel Application Segment: With the global imperative for clean energy, the solar panel application segment is experiencing significant growth. Vapor deposition techniques are crucial for depositing absorber layers, anti-reflective coatings, and conductive layers that enhance the efficiency and durability of photovoltaic modules. Government subsidies and falling manufacturing costs further bolster this segment's dominance.

- Cutting Tools Application Segment: The demand for high-performance cutting tools with enhanced hardness, wear resistance, and reduced friction drives the adoption of vapor deposition for applying hard coatings like titanium nitride (TiN) and diamond-like carbon (DLC).

- Medical Devices Application Segment: The medical devices segment is a high-value growth area. Vapor deposition is used to apply biocompatible coatings to implants, antimicrobial surfaces to surgical instruments, and low-friction coatings to catheters, ensuring patient safety and improving device performance.

Vapor Deposition Market Product Developments

Product developments in the vapor deposition market are primarily focused on enhancing precision, efficiency, and material capabilities. Companies are innovating in areas such as lower-temperature deposition processes for temperature-sensitive substrates, multi-layer deposition for complex device architectures, and the development of novel precursor chemistries for depositing advanced materials like transition metal dichalcogenides (TMDs) and high-k dielectrics. The integration of AI and machine learning into deposition equipment for real-time process optimization and predictive maintenance is another significant trend, offering competitive advantages through improved yield and reduced downtime.

Report Scope & Segmentation Analysis

This report meticulously segments the vapor deposition market to provide granular insights. The Category segmentation includes CVD Equipment and CVD Materials. The Application segmentation covers Electronics, Solar Panel, Cutting Tools, Medical Devices, and Other Applications. Each segment is analyzed for its market size, growth projections, and competitive dynamics. For instance, the Electronics segment, valued at $XX billion in 2025, is projected to grow at a CAGR of XX% to reach $XX billion by 2033, driven by semiconductor advancements. The CVD Equipment segment is expected to witness substantial growth as manufacturers invest in next-generation tools to meet evolving technological demands.

Key Drivers of Vapor Deposition Market Growth

Several key drivers are fueling the expansion of the vapor deposition market. Technologically, the relentless miniaturization of electronic components and the demand for higher device performance necessitate increasingly sophisticated thin-film deposition techniques. Economically, supportive government initiatives for renewable energy (e.g., solar panel subsidies) and the growing adoption of electric vehicles are creating significant demand. Regulatory factors, such as stricter environmental standards, are also pushing the development of cleaner and more efficient deposition processes. The increasing complexity of materials science, requiring precise control over atomic-level structures, further underscores the importance of advanced vapor deposition methods.

Challenges in the Vapor Deposition Market Sector

Despite its robust growth, the vapor deposition market faces several challenges. High initial capital investment for advanced CVD equipment can be a barrier for smaller players. The stringent purity requirements for precursor materials and the complex supply chains associated with their production can lead to supply disruptions and cost volatility. Intense competition and the need for continuous innovation to keep pace with rapidly evolving end-user demands also pose significant challenges. Furthermore, navigating diverse and evolving global regulatory landscapes, particularly concerning environmental compliance and material sourcing, requires significant strategic attention.

Emerging Opportunities in Vapor Deposition Market

Emerging opportunities in the vapor deposition market are diverse and promising. The growing demand for advanced packaging solutions in the electronics industry presents a significant avenue for growth. The expansion of the quantum computing sector requires highly specialized and precise thin-film deposition capabilities. The increasing use of vapor deposition in additive manufacturing (3D printing) for creating functional components with tailored surface properties is another burgeoning opportunity. Furthermore, the development of new applications in aerospace, defense, and energy storage technologies, such as next-generation batteries, will further diversify and expand the market.

Leading Players in the Vapor Deposition Market Market

- IHI Ionbond AG

- Plasma-Therm

- CVD Equipment Corporation

- Applied Materials Inc

- ADEKA CORPORATION

- ASM International

- OC Oerlikon Management AG

- LAM RESEARCH CORPORATION

- Oxford Instruments

- Tokyo Electron Limited

- Dynavac

- Mustang Vacuum Systems

- Veeco Instruments Inc

- ULVAC Inc

- Aixtron

Key Developments in Vapor Deposition Market Industry

- February 2023: Veeco Instruments Inc. announced the acquisition of Epiluvac AB, a manufacturer of chemical vapor deposition (CVD) epitaxy systems, strengthening its position in advanced silicon carbide (SiC) applications for the electric vehicle market.

- April 2022: Applied Materials introduced the Stensar Advanced Patterning Film for EUV, deposited using its Precision CVD system, offering superior control over EUV hardmask layers for enhanced pattern transfer uniformity in semiconductor manufacturing.

Strategic Outlook for Vapor Deposition Market Market

The strategic outlook for the vapor deposition market is highly positive, characterized by sustained innovation and expanding applications. Continued investment in R&D for next-generation deposition technologies, such as atomic layer deposition (ALD) and novel PECVD techniques, will be crucial for maintaining a competitive edge. Strategic collaborations and partnerships between equipment manufacturers, material suppliers, and end-users will facilitate faster product development and market penetration. The increasing demand from emerging sectors like electric vehicles, renewable energy, and advanced electronics will serve as significant growth catalysts. Companies that can offer scalable, cost-effective, and high-performance vapor deposition solutions, while adapting to evolving regulatory and sustainability demands, are poised for significant success in the coming years.

Vapor Deposition Market Segmentation

-

1. Category

- 1.1. CVD Equipment

- 1.2. CVD Materials

-

2. Application

- 2.1. Electronics

- 2.2. Solar panel

- 2.3. Cutting Tools

- 2.4. Medical Devices

- 2.5. Other Applications

Vapor Deposition Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Vapor Deposition Market Regional Market Share

Geographic Coverage of Vapor Deposition Market

Vapor Deposition Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand in Microelectronics Application; Use of High-performance Films in Solar Panels

- 3.3. Market Restrains

- 3.3.1. High Capital Investment for Technology; Regulations regarding Emission of F-gases

- 3.4. Market Trends

- 3.4.1. Increasing Demand from the Electronics Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Vapor Deposition Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Category

- 5.1.1. CVD Equipment

- 5.1.2. CVD Materials

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Electronics

- 5.2.2. Solar panel

- 5.2.3. Cutting Tools

- 5.2.4. Medical Devices

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Category

- 6. Asia Pacific Vapor Deposition Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Category

- 6.1.1. CVD Equipment

- 6.1.2. CVD Materials

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Electronics

- 6.2.2. Solar panel

- 6.2.3. Cutting Tools

- 6.2.4. Medical Devices

- 6.2.5. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Category

- 7. North America Vapor Deposition Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Category

- 7.1.1. CVD Equipment

- 7.1.2. CVD Materials

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Electronics

- 7.2.2. Solar panel

- 7.2.3. Cutting Tools

- 7.2.4. Medical Devices

- 7.2.5. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Category

- 8. Europe Vapor Deposition Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Category

- 8.1.1. CVD Equipment

- 8.1.2. CVD Materials

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Electronics

- 8.2.2. Solar panel

- 8.2.3. Cutting Tools

- 8.2.4. Medical Devices

- 8.2.5. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Category

- 9. South America Vapor Deposition Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Category

- 9.1.1. CVD Equipment

- 9.1.2. CVD Materials

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Electronics

- 9.2.2. Solar panel

- 9.2.3. Cutting Tools

- 9.2.4. Medical Devices

- 9.2.5. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Category

- 10. Middle East and Africa Vapor Deposition Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Category

- 10.1.1. CVD Equipment

- 10.1.2. CVD Materials

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Electronics

- 10.2.2. Solar panel

- 10.2.3. Cutting Tools

- 10.2.4. Medical Devices

- 10.2.5. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IHI Ionbond AG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Plasma-Therm

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CVD Equipment Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Applied Materials Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 ADEKA CORPORATION

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ASM International

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 OC Oerlikon Management AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LAM RESEARCH CORPORATION

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oxford Instruments

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tokyo Electron Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dynavac

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Mustang Vacuum Systems

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Veeco Instruments Inc *List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ULVAC Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Aixtron

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 IHI Ionbond AG

List of Figures

- Figure 1: Global Vapor Deposition Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Vapor Deposition Market Revenue (undefined), by Category 2025 & 2033

- Figure 3: Asia Pacific Vapor Deposition Market Revenue Share (%), by Category 2025 & 2033

- Figure 4: Asia Pacific Vapor Deposition Market Revenue (undefined), by Application 2025 & 2033

- Figure 5: Asia Pacific Vapor Deposition Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Vapor Deposition Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: Asia Pacific Vapor Deposition Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America Vapor Deposition Market Revenue (undefined), by Category 2025 & 2033

- Figure 9: North America Vapor Deposition Market Revenue Share (%), by Category 2025 & 2033

- Figure 10: North America Vapor Deposition Market Revenue (undefined), by Application 2025 & 2033

- Figure 11: North America Vapor Deposition Market Revenue Share (%), by Application 2025 & 2033

- Figure 12: North America Vapor Deposition Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Vapor Deposition Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Vapor Deposition Market Revenue (undefined), by Category 2025 & 2033

- Figure 15: Europe Vapor Deposition Market Revenue Share (%), by Category 2025 & 2033

- Figure 16: Europe Vapor Deposition Market Revenue (undefined), by Application 2025 & 2033

- Figure 17: Europe Vapor Deposition Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Vapor Deposition Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Vapor Deposition Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Vapor Deposition Market Revenue (undefined), by Category 2025 & 2033

- Figure 21: South America Vapor Deposition Market Revenue Share (%), by Category 2025 & 2033

- Figure 22: South America Vapor Deposition Market Revenue (undefined), by Application 2025 & 2033

- Figure 23: South America Vapor Deposition Market Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Vapor Deposition Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Vapor Deposition Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Vapor Deposition Market Revenue (undefined), by Category 2025 & 2033

- Figure 27: Middle East and Africa Vapor Deposition Market Revenue Share (%), by Category 2025 & 2033

- Figure 28: Middle East and Africa Vapor Deposition Market Revenue (undefined), by Application 2025 & 2033

- Figure 29: Middle East and Africa Vapor Deposition Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Vapor Deposition Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Middle East and Africa Vapor Deposition Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Vapor Deposition Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 2: Global Vapor Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global Vapor Deposition Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Vapor Deposition Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 5: Global Vapor Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Global Vapor Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: India Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Japan Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: South Korea Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: ASEAN Countries Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Global Vapor Deposition Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 14: Global Vapor Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global Vapor Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: United States Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Canada Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Vapor Deposition Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 20: Global Vapor Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 21: Global Vapor Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Germany Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: United Kingdom Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Italy Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: France Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Spain Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Vapor Deposition Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 29: Global Vapor Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 30: Global Vapor Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Brazil Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Argentina Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Rest of South America Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Global Vapor Deposition Market Revenue undefined Forecast, by Category 2020 & 2033

- Table 35: Global Vapor Deposition Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Global Vapor Deposition Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Saudi Arabia Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: South Africa Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa Vapor Deposition Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Vapor Deposition Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Vapor Deposition Market?

Key companies in the market include IHI Ionbond AG, Plasma-Therm, CVD Equipment Corporation, Applied Materials Inc, ADEKA CORPORATION, ASM International, OC Oerlikon Management AG, LAM RESEARCH CORPORATION, Oxford Instruments, Tokyo Electron Limited, Dynavac, Mustang Vacuum Systems, Veeco Instruments Inc *List Not Exhaustive, ULVAC Inc, Aixtron.

3. What are the main segments of the Vapor Deposition Market?

The market segments include Category, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand in Microelectronics Application; Use of High-performance Films in Solar Panels.

6. What are the notable trends driving market growth?

Increasing Demand from the Electronics Industry.

7. Are there any restraints impacting market growth?

High Capital Investment for Technology; Regulations regarding Emission of F-gases.

8. Can you provide examples of recent developments in the market?

February 2023: Veeco Instruments Inc. announced that on January 31, 2023, it acquired Epiluvac AB, a privately held manufacturer of chemical vapor deposition (CVD) epitaxy systems that enable advanced silicon carbide (SiC) applications in the electric vehicle market. Epiluvac's technology platform combined with Veeco's global go-to-market capabilities create a significant long-term growth driver for Veeco.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Vapor Deposition Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Vapor Deposition Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Vapor Deposition Market?

To stay informed about further developments, trends, and reports in the Vapor Deposition Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence