Key Insights

The global Veterinary CT Scanner market is projected for substantial growth, with a forecasted market size of 449.71 million by 2025, and an expected Compound Annual Growth Rate (CAGR) of 7.15% from 2025 to 2033. This expansion is driven by rising pet ownership and increased owner awareness of advanced diagnostic imaging for companion animals, addressing conditions like neurological disorders, oncology, and cardiology. Investments in veterinary healthcare infrastructure and technological advancements in portable and cost-effective CT scanners also contribute significantly. The growing prevalence of complex medical conditions in livestock, necessitating sophisticated diagnostic tools for disease management and food safety, further fuels this market's upward trend.

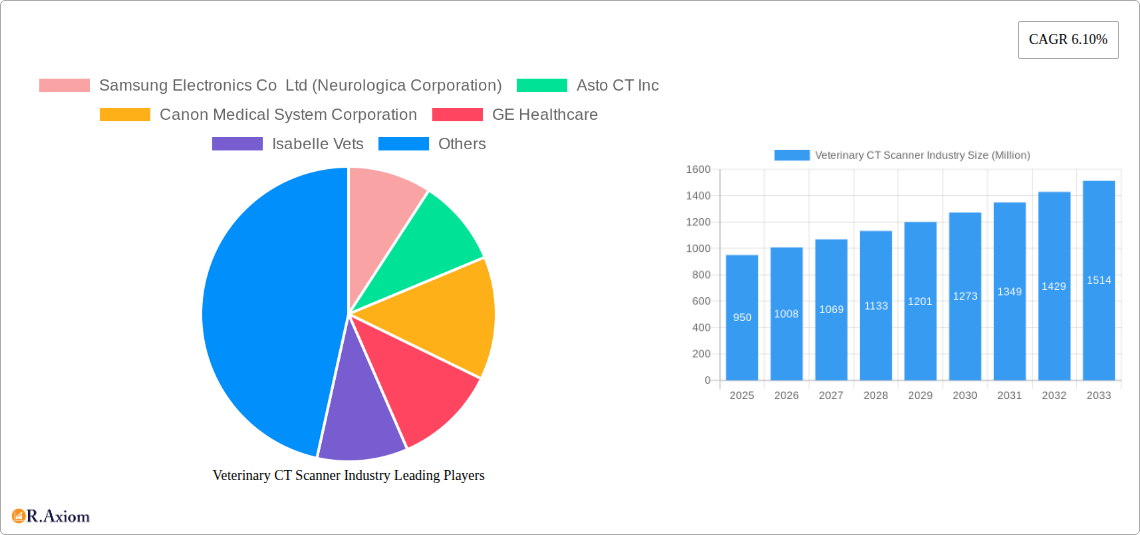

Veterinary CT Scanner Industry Market Size (In Million)

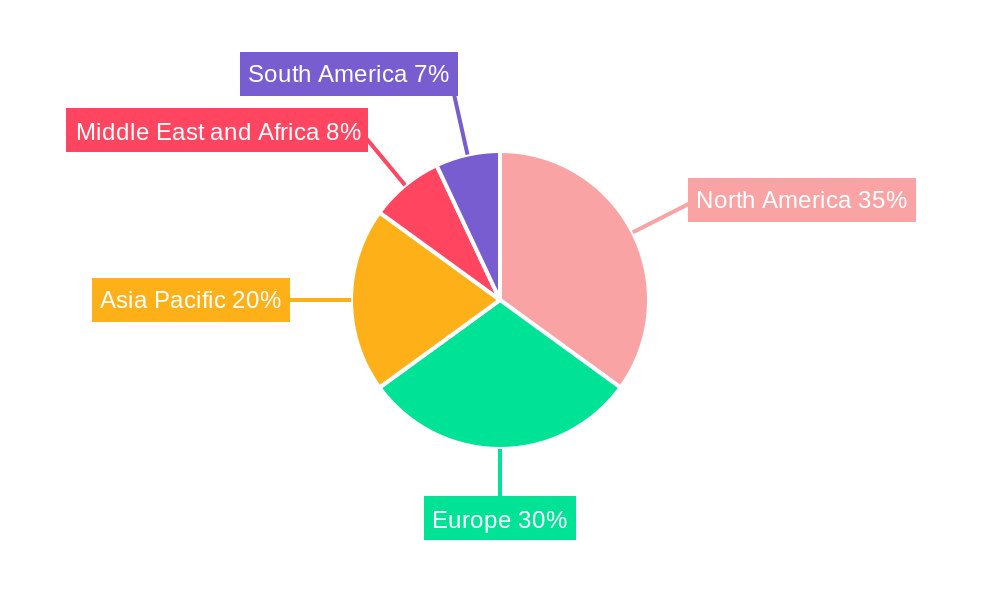

Key market segments show varied growth. The "Stationary Multi-slice CT Scanner" segment is expected to retain its leading position due to advanced capabilities crucial for specialized veterinary practices and research. Conversely, the "Portable CT Scanner" segment is anticipated to experience the fastest growth, offering versatile on-site diagnostics for farms, emergency clinics, and remote locations. Companion animals, especially dogs and cats, constitute the largest animal type segment, aligning with increased pet healthcare expenditure. Neurology and Oncology are prominent application segments, reflecting advancements in veterinary medicine. Geographically, North America and Europe will likely remain dominant markets, supported by high pet care spending and established veterinary systems. However, the Asia Pacific region is poised for the most rapid growth, propelled by a growing middle class, increased pet adoption, and expanding veterinary services and infrastructure.

Veterinary CT Scanner Industry Company Market Share

This report offers an in-depth analysis of the global Veterinary CT Scanner industry, providing critical insights into market dynamics, growth drivers, emerging opportunities, and competitive landscapes. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this comprehensive study equips stakeholders with actionable intelligence for strategic decision-making. Optimized with high-traffic keywords such as "veterinary CT scanner market," "animal imaging technology," "companion animal diagnostics," and "livestock health solutions," this report aims to maximize search visibility and engage key industry players.

Veterinary CT Scanner Industry Market Concentration & Innovation

The Veterinary CT Scanner Industry exhibits a moderate to high level of market concentration, driven by significant capital investment requirements and the specialized nature of advanced imaging technology for animal health. Key players like GE Healthcare, Siemens Healthineers, and Canon Medical System Corporation dominate market share, holding an estimated collective share of over 70%. Innovation in this sector is primarily fueled by advancements in digital imaging, artificial intelligence for image analysis, and miniaturization of CT scanner technology. Regulatory frameworks, such as those overseen by the FDA for medical devices, play a crucial role in ensuring product safety and efficacy, influencing product development timelines and market entry strategies. Product substitutes, while limited in direct competition with CT, include MRI and ultrasound, but CT scanners offer distinct advantages in speed and resolution for certain diagnostic applications. End-user trends reflect a growing demand for advanced diagnostic capabilities in veterinary hospitals, driven by increasing pet ownership and a willingness to invest in specialized animal care. Mergers and acquisition (M&A) activities are sporadic but significant, often involving established medical imaging companies acquiring niche veterinary imaging firms to expand their portfolios. For instance, an estimated XX Million in M&A deal values were observed in the historical period.

Veterinary CT Scanner Industry Industry Trends & Insights

The global Veterinary CT Scanner Industry is poised for substantial growth, with an estimated Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period. This upward trajectory is underpinned by several key market growth drivers. The increasing pet humanization trend worldwide is a significant factor, leading pet owners to demand higher standards of veterinary care, including access to advanced diagnostic tools like CT scanners. This has translated into a substantial increase in the market penetration of veterinary imaging equipment. Furthermore, the rising prevalence of chronic diseases and complex medical conditions in both companion animals and livestock necessitates sophisticated diagnostic modalities. Technological disruptions are continuously shaping the industry; innovations in detector technology, radiation dose reduction techniques, and AI-powered image processing are enhancing diagnostic accuracy, improving patient safety, and reducing scan times. These advancements contribute to increased efficiency in veterinary practices. Consumer preferences are evolving, with a growing demand for minimally invasive diagnostic procedures and faster turnaround times for results, all of which CT scanners can facilitate. Competitive dynamics are characterized by intense R&D efforts among major players to offer more compact, cost-effective, and user-friendly CT solutions tailored for veterinary use. The expanding veterinary workforce and the continuous need for specialized training in advanced imaging techniques also contribute to sustained market expansion. The market penetration of CT scanners in developed nations stands at an estimated 35%, with significant room for growth in emerging economies.

Dominant Markets & Segments in Veterinary CT Scanner Industry

The global Veterinary CT Scanner Industry is dominated by North America, particularly the United States, which accounts for an estimated 38% of the global market share. This dominance is driven by a confluence of factors including a high pet ownership rate, a strong economy that supports discretionary spending on pet healthcare, the presence of leading veterinary teaching hospitals and research institutes, and a proactive regulatory environment that encourages the adoption of advanced medical technologies.

Product Type:

- Stationary Multi-slice CT Scanners represent the largest segment within product types, holding an estimated 75% of the market share. This is attributed to their superior image quality, advanced diagnostic capabilities, and suitability for comprehensive evaluations in specialized veterinary settings.

- Key Drivers: High diagnostic accuracy, ability to perform complex scans (e.g., cardiac imaging, detailed oncology staging), established presence in referral hospitals.

- Portable CT Scanners are experiencing rapid growth, projected to capture an increasing market share, driven by their flexibility and utility in emergency situations and remote veterinary care.

- Key Drivers: Mobility for on-farm diagnostics, use in emergency and critical care units, lower initial investment compared to fixed systems.

Animal Type:

- Companion Animals represent the dominant segment, accounting for approximately 82% of the market. The increasing humanization of pets, coupled with the rising pet healthcare expenditure, fuels the demand for advanced diagnostics for dogs, cats, and other domestic pets.

- Key Drivers: High discretionary spending on pet health, prevalence of age-related diseases in pets, owner willingness to invest in life-saving treatments.

- Livestock Animals form a significant and growing segment, driven by the need for efficient disease detection and management in large-scale animal farming for food security.

- Key Drivers: Economic impact of animal diseases, demand for rapid and accurate disease diagnosis in herds, government initiatives for animal health surveillance.

Application:

- Neurology applications hold a substantial market share, estimated at 30%, due to the prevalence of neurological disorders in animals and the critical role of CT in diagnosing conditions like brain tumors, spinal injuries, and disc herniations.

- Key Drivers: Complex anatomical structures of the brain and spinal cord, need for detailed imaging for surgical planning.

- Oncology applications are also a major driver, with an estimated market share of 25%, as CT scanners are essential for tumor detection, staging, treatment planning (radiation therapy), and monitoring treatment response.

- Key Drivers: Early detection of cancers, precise localization of tumors, assessment of metastasis.

- Cardiology and Gastroenterology are rapidly growing application areas, reflecting the increasing sophistication of veterinary medicine.

End-User:

- Veterinary Hospitals are the largest end-user segment, constituting an estimated 70% of the market. This is due to their direct need for advanced diagnostic imaging to provide comprehensive patient care.

- Key Drivers: Centralized facilities for advanced diagnostics, patient volume, demand for comprehensive care services.

- Research Institutes represent a smaller but important segment, utilizing CT scanners for preclinical studies, drug development, and basic scientific research in animal models.

- Key Drivers: Need for high-resolution imaging in scientific experiments, validation of research findings.

Veterinary CT Scanner Industry Product Developments

Product innovations in the Veterinary CT Scanner Industry are focused on enhancing diagnostic capabilities, improving patient safety, and increasing operational efficiency. Recent developments include the integration of AI algorithms for automated image segmentation and anomaly detection, reducing interpretation time and improving accuracy. Advanced detector technologies are enabling lower radiation doses while maintaining excellent image resolution, crucial for repeated scans and sensitive animal patients. Furthermore, manufacturers are developing more compact and portable CT scanner designs to broaden accessibility, particularly for mobile veterinary services and smaller clinics. The emphasis is on providing comprehensive solutions that integrate seamlessly with existing veterinary information systems, offering superior image quality for neurological, oncological, and orthopedic applications, thereby providing a competitive edge.

Report Scope & Segmentation Analysis

This report meticulously analyzes the Veterinary CT Scanner Industry across several key segmentations. The Product Type segmentation includes Stationary Multi-slice CT Scanners and Portable CT Scanners, with projections indicating steady growth for both, albeit with portable units exhibiting a higher growth rate. The Animal Type segmentation covers Companion Animals, Livestock Animals, and Other Animal Types, with companion animals currently dominating due to higher per-animal healthcare spending, though livestock is expected to see significant expansion driven by food security concerns. The Application segmentation delves into Neurology, Oncology, Cardiology, Nephrology, Gastroenterology, and Other Applications, with neurology and oncology leading due to the complexity of these conditions. The End-User segmentation comprises Veterinary Hospitals and Research Institutes, with veterinary hospitals representing the primary market due to direct patient care needs. Each segment is analyzed for market size, growth projections, and competitive dynamics.

Key Drivers of Veterinary CT Scanner Industry Growth

The growth of the Veterinary CT Scanner Industry is propelled by several interconnected factors. Technologically, advancements in imaging resolution, AI-powered diagnostics, and radiation dose reduction are making CT scans more accessible and effective. Economically, the increasing disposable income in developed nations and the growing trend of pet humanization are leading to higher expenditure on animal healthcare, including advanced diagnostics. Regulatory frameworks, while sometimes a hurdle, also foster growth by ensuring safety and efficacy, building trust among end-users. The rising incidence of chronic diseases and injuries in animals necessitates sophisticated diagnostic tools like CT scanners. Furthermore, the expansion of veterinary education and specialized training programs ensures a skilled workforce capable of operating and interpreting these advanced imaging systems.

Challenges in the Veterinary CT Scanner Industry Sector

Despite the positive outlook, the Veterinary CT Scanner Industry faces several challenges. High initial investment costs for state-of-the-art CT scanners can be a significant barrier, especially for smaller veterinary practices and in developing regions, with entry-level systems costing upwards of XX Million. Regulatory hurdles related to device approval and radiation safety protocols can lead to extended time-to-market for new products. Supply chain disruptions, particularly for specialized components, can impact manufacturing and delivery timelines, leading to potential delays and increased costs. Intense competition among established players and the emergence of new technologies also put pressure on pricing and innovation cycles. Furthermore, the availability of skilled veterinary professionals trained in advanced imaging interpretation remains a critical concern for widespread adoption.

Emerging Opportunities in Veterinary CT Scanner Industry

Emerging opportunities within the Veterinary CT Scanner Industry are abundant and poised to shape future market dynamics. The increasing demand for mobile veterinary imaging solutions presents a significant opportunity for portable CT scanner manufacturers. The integration of artificial intelligence and machine learning for automated image analysis offers a pathway to enhance diagnostic accuracy and efficiency, creating value-added services. Expanding into emerging markets in Asia and Latin America, where veterinary healthcare infrastructure is rapidly developing, represents a substantial growth avenue. The development of cost-effective, compact CT scanners designed specifically for general veterinary practices rather than solely referral centers can unlock new market segments. Furthermore, strategic partnerships between CT scanner manufacturers and veterinary software providers can facilitate seamless data integration and workflow optimization, enhancing the overall value proposition for end-users.

Leading Players in the Veterinary CT Scanner Industry Market

- GE Healthcare

- Siemens Healthineers

- Canon Medical System Corporation

- Samsung Electronics Co Ltd (Neurologica Corporation)

- Asto CT Inc

- Isabelle Vets

- Animage LLC

- GNI ApS

- Epica Animal Health

Key Developments in Veterinary CT Scanner Industry Industry

- September 2022: A Fort Lauderdale, Florida-based referral hospital recently upgraded its treatment capabilities by installing a state-of-the-art Toshiba Aquilion 16 CT scanner, ensuring top-notch care for our beloved pets.

- April 2022: Improve International, a renowned global provider of veterinary continuing professional development (CPD), introduced an innovative online program in computed tomography (CT). This program presents a pathway for individuals to attain a general practitioner certificate (GPCert), which is accredited and conferred by the esteemed International School of Veterinary Postgraduate Studies.

Strategic Outlook for Veterinary CT Scanner Industry Market

The strategic outlook for the Veterinary CT Scanner Industry is exceptionally robust, driven by a confluence of increasing pet healthcare expenditure, advancements in diagnostic imaging technology, and a growing understanding of the critical role of CT in animal health. The persistent trend of pet humanization will continue to fuel demand for sophisticated diagnostic tools, particularly in companion animal segments. Innovations in AI-driven imaging and portable CT scanner development are poised to democratize access to advanced diagnostics, expanding the market reach. Strategic collaborations between technology providers, veterinary institutions, and animal health organizations will be crucial for fostering innovation and driving adoption. The industry's future lies in offering integrated solutions that enhance diagnostic accuracy, improve patient outcomes, and provide a strong return on investment for veterinary professionals, positioning the market for sustained growth in the coming decade.

Veterinary CT Scanner Industry Segmentation

-

1. Product Type

- 1.1. Stationary Multi-slice CT Scanner

- 1.2. Portable CT Scanner

-

2. Animal Type

- 2.1. Companion Animal

- 2.2. Livestock Animal

- 2.3. Other Animal Types

-

3. Application

- 3.1. Neurology

- 3.2. Oncology

- 3.3. Cardiology

- 3.4. Nephrology

- 3.5. Gastroenterology

- 3.6. Other Applications

-

4. End-User

- 4.1. Veterinary Hospitals

- 4.2. Research Institutes

- 4.3. Other End-Users

Veterinary CT Scanner Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Veterinary CT Scanner Industry Regional Market Share

Geographic Coverage of Veterinary CT Scanner Industry

Veterinary CT Scanner Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Pet Ownership and Animal Health Expenditure; Rising Prevalence of Animal Diseases and Injuries

- 3.3. Market Restrains

- 3.3.1. High Cost of CT Imaging Devices; Low Animal Health Awareness in Emerging Markets

- 3.4. Market Trends

- 3.4.1. Companion Animals Segment is Expected to Hold a Significant Market Share During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary CT Scanner Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Stationary Multi-slice CT Scanner

- 5.1.2. Portable CT Scanner

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Companion Animal

- 5.2.2. Livestock Animal

- 5.2.3. Other Animal Types

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Neurology

- 5.3.2. Oncology

- 5.3.3. Cardiology

- 5.3.4. Nephrology

- 5.3.5. Gastroenterology

- 5.3.6. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End-User

- 5.4.1. Veterinary Hospitals

- 5.4.2. Research Institutes

- 5.4.3. Other End-Users

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East and Africa

- 5.5.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Veterinary CT Scanner Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Stationary Multi-slice CT Scanner

- 6.1.2. Portable CT Scanner

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Companion Animal

- 6.2.2. Livestock Animal

- 6.2.3. Other Animal Types

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Neurology

- 6.3.2. Oncology

- 6.3.3. Cardiology

- 6.3.4. Nephrology

- 6.3.5. Gastroenterology

- 6.3.6. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End-User

- 6.4.1. Veterinary Hospitals

- 6.4.2. Research Institutes

- 6.4.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Veterinary CT Scanner Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Stationary Multi-slice CT Scanner

- 7.1.2. Portable CT Scanner

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Companion Animal

- 7.2.2. Livestock Animal

- 7.2.3. Other Animal Types

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Neurology

- 7.3.2. Oncology

- 7.3.3. Cardiology

- 7.3.4. Nephrology

- 7.3.5. Gastroenterology

- 7.3.6. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End-User

- 7.4.1. Veterinary Hospitals

- 7.4.2. Research Institutes

- 7.4.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Veterinary CT Scanner Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Stationary Multi-slice CT Scanner

- 8.1.2. Portable CT Scanner

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Companion Animal

- 8.2.2. Livestock Animal

- 8.2.3. Other Animal Types

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Neurology

- 8.3.2. Oncology

- 8.3.3. Cardiology

- 8.3.4. Nephrology

- 8.3.5. Gastroenterology

- 8.3.6. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End-User

- 8.4.1. Veterinary Hospitals

- 8.4.2. Research Institutes

- 8.4.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Veterinary CT Scanner Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Stationary Multi-slice CT Scanner

- 9.1.2. Portable CT Scanner

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Companion Animal

- 9.2.2. Livestock Animal

- 9.2.3. Other Animal Types

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Neurology

- 9.3.2. Oncology

- 9.3.3. Cardiology

- 9.3.4. Nephrology

- 9.3.5. Gastroenterology

- 9.3.6. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End-User

- 9.4.1. Veterinary Hospitals

- 9.4.2. Research Institutes

- 9.4.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Veterinary CT Scanner Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Stationary Multi-slice CT Scanner

- 10.1.2. Portable CT Scanner

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Companion Animal

- 10.2.2. Livestock Animal

- 10.2.3. Other Animal Types

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Neurology

- 10.3.2. Oncology

- 10.3.3. Cardiology

- 10.3.4. Nephrology

- 10.3.5. Gastroenterology

- 10.3.6. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End-User

- 10.4.1. Veterinary Hospitals

- 10.4.2. Research Institutes

- 10.4.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Samsung Electronics Co Ltd (Neurologica Corporation)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Asto CT Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Canon Medical System Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GE Healthcare

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Isabelle Vets

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Animage LLC

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 GNI ApS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Siemens Healthineers

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Epica Animal Health

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Samsung Electronics Co Ltd (Neurologica Corporation)

List of Figures

- Figure 1: Global Veterinary CT Scanner Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global Veterinary CT Scanner Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Veterinary CT Scanner Industry Revenue (million), by Product Type 2025 & 2033

- Figure 4: North America Veterinary CT Scanner Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Veterinary CT Scanner Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Veterinary CT Scanner Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Veterinary CT Scanner Industry Revenue (million), by Animal Type 2025 & 2033

- Figure 8: North America Veterinary CT Scanner Industry Volume (K Unit), by Animal Type 2025 & 2033

- Figure 9: North America Veterinary CT Scanner Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 10: North America Veterinary CT Scanner Industry Volume Share (%), by Animal Type 2025 & 2033

- Figure 11: North America Veterinary CT Scanner Industry Revenue (million), by Application 2025 & 2033

- Figure 12: North America Veterinary CT Scanner Industry Volume (K Unit), by Application 2025 & 2033

- Figure 13: North America Veterinary CT Scanner Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Veterinary CT Scanner Industry Volume Share (%), by Application 2025 & 2033

- Figure 15: North America Veterinary CT Scanner Industry Revenue (million), by End-User 2025 & 2033

- Figure 16: North America Veterinary CT Scanner Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 17: North America Veterinary CT Scanner Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: North America Veterinary CT Scanner Industry Volume Share (%), by End-User 2025 & 2033

- Figure 19: North America Veterinary CT Scanner Industry Revenue (million), by Country 2025 & 2033

- Figure 20: North America Veterinary CT Scanner Industry Volume (K Unit), by Country 2025 & 2033

- Figure 21: North America Veterinary CT Scanner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 22: North America Veterinary CT Scanner Industry Volume Share (%), by Country 2025 & 2033

- Figure 23: Europe Veterinary CT Scanner Industry Revenue (million), by Product Type 2025 & 2033

- Figure 24: Europe Veterinary CT Scanner Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 25: Europe Veterinary CT Scanner Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 26: Europe Veterinary CT Scanner Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 27: Europe Veterinary CT Scanner Industry Revenue (million), by Animal Type 2025 & 2033

- Figure 28: Europe Veterinary CT Scanner Industry Volume (K Unit), by Animal Type 2025 & 2033

- Figure 29: Europe Veterinary CT Scanner Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Europe Veterinary CT Scanner Industry Volume Share (%), by Animal Type 2025 & 2033

- Figure 31: Europe Veterinary CT Scanner Industry Revenue (million), by Application 2025 & 2033

- Figure 32: Europe Veterinary CT Scanner Industry Volume (K Unit), by Application 2025 & 2033

- Figure 33: Europe Veterinary CT Scanner Industry Revenue Share (%), by Application 2025 & 2033

- Figure 34: Europe Veterinary CT Scanner Industry Volume Share (%), by Application 2025 & 2033

- Figure 35: Europe Veterinary CT Scanner Industry Revenue (million), by End-User 2025 & 2033

- Figure 36: Europe Veterinary CT Scanner Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 37: Europe Veterinary CT Scanner Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 38: Europe Veterinary CT Scanner Industry Volume Share (%), by End-User 2025 & 2033

- Figure 39: Europe Veterinary CT Scanner Industry Revenue (million), by Country 2025 & 2033

- Figure 40: Europe Veterinary CT Scanner Industry Volume (K Unit), by Country 2025 & 2033

- Figure 41: Europe Veterinary CT Scanner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Europe Veterinary CT Scanner Industry Volume Share (%), by Country 2025 & 2033

- Figure 43: Asia Pacific Veterinary CT Scanner Industry Revenue (million), by Product Type 2025 & 2033

- Figure 44: Asia Pacific Veterinary CT Scanner Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 45: Asia Pacific Veterinary CT Scanner Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 46: Asia Pacific Veterinary CT Scanner Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 47: Asia Pacific Veterinary CT Scanner Industry Revenue (million), by Animal Type 2025 & 2033

- Figure 48: Asia Pacific Veterinary CT Scanner Industry Volume (K Unit), by Animal Type 2025 & 2033

- Figure 49: Asia Pacific Veterinary CT Scanner Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 50: Asia Pacific Veterinary CT Scanner Industry Volume Share (%), by Animal Type 2025 & 2033

- Figure 51: Asia Pacific Veterinary CT Scanner Industry Revenue (million), by Application 2025 & 2033

- Figure 52: Asia Pacific Veterinary CT Scanner Industry Volume (K Unit), by Application 2025 & 2033

- Figure 53: Asia Pacific Veterinary CT Scanner Industry Revenue Share (%), by Application 2025 & 2033

- Figure 54: Asia Pacific Veterinary CT Scanner Industry Volume Share (%), by Application 2025 & 2033

- Figure 55: Asia Pacific Veterinary CT Scanner Industry Revenue (million), by End-User 2025 & 2033

- Figure 56: Asia Pacific Veterinary CT Scanner Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 57: Asia Pacific Veterinary CT Scanner Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 58: Asia Pacific Veterinary CT Scanner Industry Volume Share (%), by End-User 2025 & 2033

- Figure 59: Asia Pacific Veterinary CT Scanner Industry Revenue (million), by Country 2025 & 2033

- Figure 60: Asia Pacific Veterinary CT Scanner Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: Asia Pacific Veterinary CT Scanner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Veterinary CT Scanner Industry Volume Share (%), by Country 2025 & 2033

- Figure 63: Middle East and Africa Veterinary CT Scanner Industry Revenue (million), by Product Type 2025 & 2033

- Figure 64: Middle East and Africa Veterinary CT Scanner Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 65: Middle East and Africa Veterinary CT Scanner Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 66: Middle East and Africa Veterinary CT Scanner Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 67: Middle East and Africa Veterinary CT Scanner Industry Revenue (million), by Animal Type 2025 & 2033

- Figure 68: Middle East and Africa Veterinary CT Scanner Industry Volume (K Unit), by Animal Type 2025 & 2033

- Figure 69: Middle East and Africa Veterinary CT Scanner Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 70: Middle East and Africa Veterinary CT Scanner Industry Volume Share (%), by Animal Type 2025 & 2033

- Figure 71: Middle East and Africa Veterinary CT Scanner Industry Revenue (million), by Application 2025 & 2033

- Figure 72: Middle East and Africa Veterinary CT Scanner Industry Volume (K Unit), by Application 2025 & 2033

- Figure 73: Middle East and Africa Veterinary CT Scanner Industry Revenue Share (%), by Application 2025 & 2033

- Figure 74: Middle East and Africa Veterinary CT Scanner Industry Volume Share (%), by Application 2025 & 2033

- Figure 75: Middle East and Africa Veterinary CT Scanner Industry Revenue (million), by End-User 2025 & 2033

- Figure 76: Middle East and Africa Veterinary CT Scanner Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 77: Middle East and Africa Veterinary CT Scanner Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 78: Middle East and Africa Veterinary CT Scanner Industry Volume Share (%), by End-User 2025 & 2033

- Figure 79: Middle East and Africa Veterinary CT Scanner Industry Revenue (million), by Country 2025 & 2033

- Figure 80: Middle East and Africa Veterinary CT Scanner Industry Volume (K Unit), by Country 2025 & 2033

- Figure 81: Middle East and Africa Veterinary CT Scanner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 82: Middle East and Africa Veterinary CT Scanner Industry Volume Share (%), by Country 2025 & 2033

- Figure 83: South America Veterinary CT Scanner Industry Revenue (million), by Product Type 2025 & 2033

- Figure 84: South America Veterinary CT Scanner Industry Volume (K Unit), by Product Type 2025 & 2033

- Figure 85: South America Veterinary CT Scanner Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 86: South America Veterinary CT Scanner Industry Volume Share (%), by Product Type 2025 & 2033

- Figure 87: South America Veterinary CT Scanner Industry Revenue (million), by Animal Type 2025 & 2033

- Figure 88: South America Veterinary CT Scanner Industry Volume (K Unit), by Animal Type 2025 & 2033

- Figure 89: South America Veterinary CT Scanner Industry Revenue Share (%), by Animal Type 2025 & 2033

- Figure 90: South America Veterinary CT Scanner Industry Volume Share (%), by Animal Type 2025 & 2033

- Figure 91: South America Veterinary CT Scanner Industry Revenue (million), by Application 2025 & 2033

- Figure 92: South America Veterinary CT Scanner Industry Volume (K Unit), by Application 2025 & 2033

- Figure 93: South America Veterinary CT Scanner Industry Revenue Share (%), by Application 2025 & 2033

- Figure 94: South America Veterinary CT Scanner Industry Volume Share (%), by Application 2025 & 2033

- Figure 95: South America Veterinary CT Scanner Industry Revenue (million), by End-User 2025 & 2033

- Figure 96: South America Veterinary CT Scanner Industry Volume (K Unit), by End-User 2025 & 2033

- Figure 97: South America Veterinary CT Scanner Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 98: South America Veterinary CT Scanner Industry Volume Share (%), by End-User 2025 & 2033

- Figure 99: South America Veterinary CT Scanner Industry Revenue (million), by Country 2025 & 2033

- Figure 100: South America Veterinary CT Scanner Industry Volume (K Unit), by Country 2025 & 2033

- Figure 101: South America Veterinary CT Scanner Industry Revenue Share (%), by Country 2025 & 2033

- Figure 102: South America Veterinary CT Scanner Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary CT Scanner Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Veterinary CT Scanner Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 4: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 5: Global Veterinary CT Scanner Industry Revenue million Forecast, by Application 2020 & 2033

- Table 6: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 7: Global Veterinary CT Scanner Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 8: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 9: Global Veterinary CT Scanner Industry Revenue million Forecast, by Region 2020 & 2033

- Table 10: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global Veterinary CT Scanner Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 12: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 13: Global Veterinary CT Scanner Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 14: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 15: Global Veterinary CT Scanner Industry Revenue million Forecast, by Application 2020 & 2033

- Table 16: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 17: Global Veterinary CT Scanner Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 18: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 19: Global Veterinary CT Scanner Industry Revenue million Forecast, by Country 2020 & 2033

- Table 20: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: United States Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: United States Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Canada Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Canada Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Mexico Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Global Veterinary CT Scanner Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 28: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 29: Global Veterinary CT Scanner Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 30: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 31: Global Veterinary CT Scanner Industry Revenue million Forecast, by Application 2020 & 2033

- Table 32: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: Global Veterinary CT Scanner Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 34: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 35: Global Veterinary CT Scanner Industry Revenue million Forecast, by Country 2020 & 2033

- Table 36: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 37: Germany Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: Germany Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: United Kingdom Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: United Kingdom Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: France Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: France Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Italy Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Italy Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Spain Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Spain Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Rest of Europe Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Europe Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Global Veterinary CT Scanner Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 50: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 51: Global Veterinary CT Scanner Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 52: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 53: Global Veterinary CT Scanner Industry Revenue million Forecast, by Application 2020 & 2033

- Table 54: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 55: Global Veterinary CT Scanner Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 56: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 57: Global Veterinary CT Scanner Industry Revenue million Forecast, by Country 2020 & 2033

- Table 58: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 59: China Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 60: China Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Japan Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Japan Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: India Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: India Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Australia Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: Australia Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: South Korea Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 68: South Korea Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: Rest of Asia Pacific Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Asia Pacific Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Global Veterinary CT Scanner Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 72: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 73: Global Veterinary CT Scanner Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 74: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 75: Global Veterinary CT Scanner Industry Revenue million Forecast, by Application 2020 & 2033

- Table 76: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 77: Global Veterinary CT Scanner Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 78: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 79: Global Veterinary CT Scanner Industry Revenue million Forecast, by Country 2020 & 2033

- Table 80: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 81: GCC Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: GCC Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: South Africa Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 84: South Africa Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 85: Rest of Middle East and Africa Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 86: Rest of Middle East and Africa Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 87: Global Veterinary CT Scanner Industry Revenue million Forecast, by Product Type 2020 & 2033

- Table 88: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 89: Global Veterinary CT Scanner Industry Revenue million Forecast, by Animal Type 2020 & 2033

- Table 90: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Animal Type 2020 & 2033

- Table 91: Global Veterinary CT Scanner Industry Revenue million Forecast, by Application 2020 & 2033

- Table 92: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Application 2020 & 2033

- Table 93: Global Veterinary CT Scanner Industry Revenue million Forecast, by End-User 2020 & 2033

- Table 94: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by End-User 2020 & 2033

- Table 95: Global Veterinary CT Scanner Industry Revenue million Forecast, by Country 2020 & 2033

- Table 96: Global Veterinary CT Scanner Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 97: Brazil Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 98: Brazil Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: Argentina Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 100: Argentina Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Rest of South America Veterinary CT Scanner Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 102: Rest of South America Veterinary CT Scanner Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary CT Scanner Industry?

The projected CAGR is approximately 7.15%.

2. Which companies are prominent players in the Veterinary CT Scanner Industry?

Key companies in the market include Samsung Electronics Co Ltd (Neurologica Corporation), Asto CT Inc, Canon Medical System Corporation, GE Healthcare, Isabelle Vets, Animage LLC, GNI ApS, Siemens Healthineers, Epica Animal Health.

3. What are the main segments of the Veterinary CT Scanner Industry?

The market segments include Product Type, Animal Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 449.71 million as of 2022.

5. What are some drivers contributing to market growth?

Increased Pet Ownership and Animal Health Expenditure; Rising Prevalence of Animal Diseases and Injuries.

6. What are the notable trends driving market growth?

Companion Animals Segment is Expected to Hold a Significant Market Share During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of CT Imaging Devices; Low Animal Health Awareness in Emerging Markets.

8. Can you provide examples of recent developments in the market?

September 2022: A Fort Lauderdale, Florida-based referral hospital recently upgraded its treatment capabilities by installing a state-of-the-art Toshiba Aquilion 16 CT scanner, ensuring top-notch care for our beloved pets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary CT Scanner Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary CT Scanner Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary CT Scanner Industry?

To stay informed about further developments, trends, and reports in the Veterinary CT Scanner Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence