Key Insights

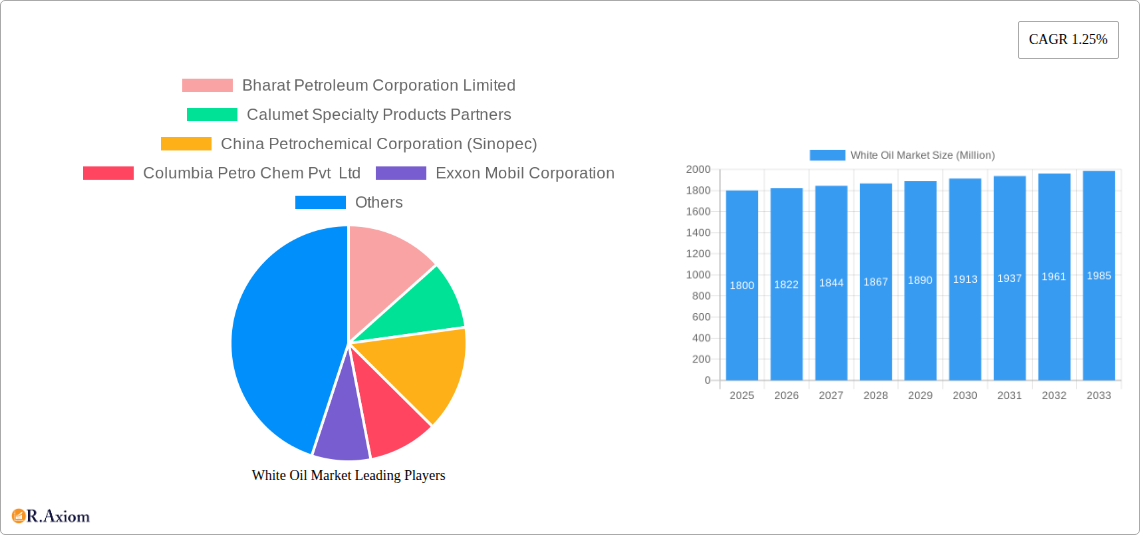

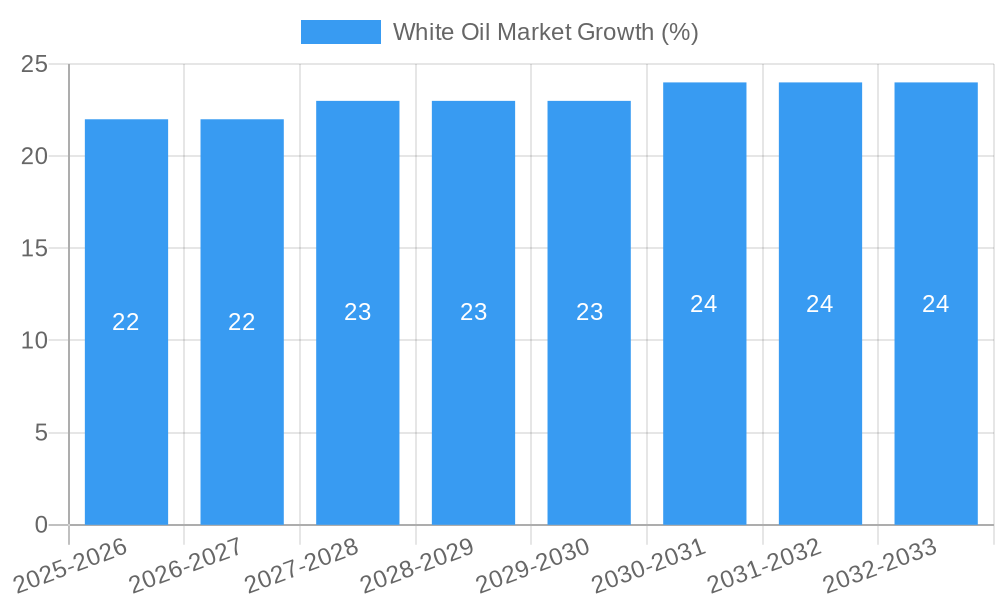

The white oil market, characterized by a steady growth trajectory, is projected to experience a Compound Annual Growth Rate (CAGR) of 1.25% from 2025 to 2033. While the precise market size in 2025 is unavailable, considering typical market sizes for specialized chemical segments and a CAGR of 1.25%, a reasonable estimation would place the 2025 market value in the range of $1.5 to $2 billion USD. This growth is fueled by increasing demand across various applications, primarily in the pharmaceutical, cosmetic, and food industries. The pharmaceutical sector's reliance on white oil as an excipient in drug formulations is a significant driver, along with its use as a lubricant and emollient in cosmetics and personal care products. Furthermore, the food industry utilizes white oil in specific food processing applications. However, the market faces constraints from stringent regulatory requirements regarding purity and safety standards, necessitating significant investments in advanced purification technologies. The competitive landscape includes both large multinational corporations like ExxonMobil and Shell, and smaller, specialized players like Savita Oil Technologies and Columbia Petro Chem. These companies are focusing on innovation in refining processes and product diversification to maintain a competitive edge.

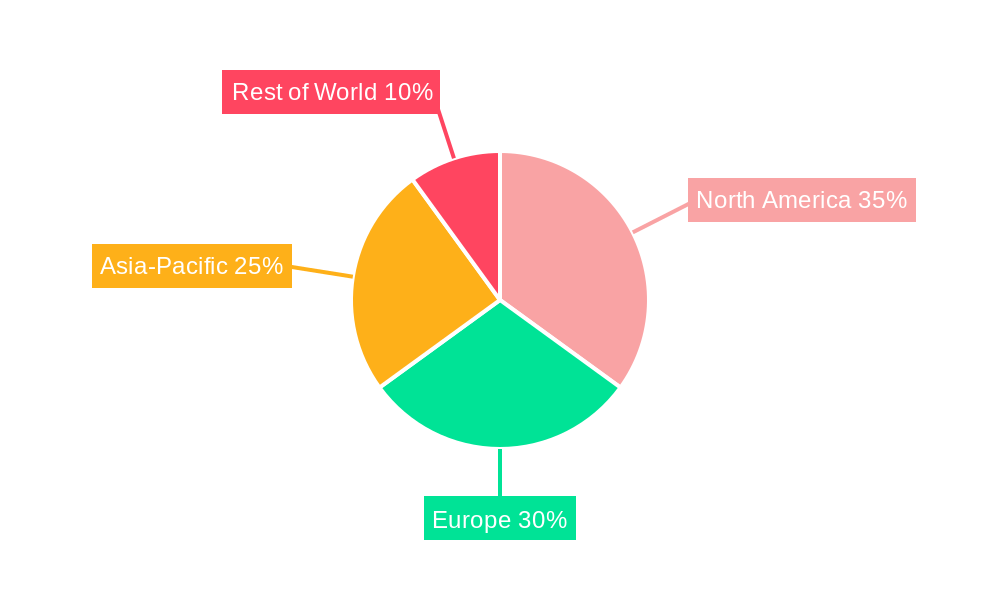

The global distribution of the market is likely geographically diverse, with North America, Europe, and Asia-Pacific representing significant regional markets. The growth in developing economies, particularly in Asia, is expected to contribute to overall market expansion, albeit at a moderate pace due to the relatively mature nature of the product and established supply chains. However, changing consumer preferences towards natural and organic products could pose a challenge to future growth, demanding the development of sustainable and eco-friendly white oil alternatives. The industry is also focusing on enhancing product quality and transparency to address consumer concerns about potential health and environmental impacts, thus fostering long-term market stability.

White Oil Market: A Comprehensive Report (2019-2033)

This detailed report provides a comprehensive analysis of the White Oil Market, offering actionable insights for industry stakeholders and investors. Covering the period from 2019 to 2033, with a focus on 2025, this study delves into market dynamics, competitive landscapes, and future growth prospects. The report leverages extensive primary and secondary research to provide accurate and reliable data, empowering informed decision-making.

White Oil Market Concentration & Innovation

The White Oil Market exhibits a moderately concentrated landscape, with several major players holding significant market share. While precise figures vary depending on the segment and region, key players like Exxon Mobil Corporation, Shell, and Sinopec collectively account for an estimated xx% of the global market. However, the market also features numerous smaller, specialized companies, particularly in regional markets.

Innovation Drivers: Key drivers include advancements in refining technologies leading to higher purity and specialized grades of white oil, as well as the development of sustainable and biodegradable alternatives. The demand for high-performance white oils in niche applications like pharmaceuticals and cosmetics further fuels innovation.

Regulatory Frameworks: Stringent regulations concerning purity, safety, and environmental impact significantly influence market dynamics. Compliance with these standards drives innovation and necessitates higher investment in R&D.

Product Substitutes: While few direct substitutes exist for white oil's unique properties in certain applications, the market faces indirect competition from synthetic alternatives in some segments. The emergence of bio-based white oils is also changing the competitive landscape.

End-User Trends: Growing demand in pharmaceuticals, cosmetics, and food processing industries, coupled with increasing focus on health and personal care, drive market expansion. The preference for natural and sustainable products also influences consumer demand.

M&A Activities: The industry has witnessed several notable mergers and acquisitions in recent years. For example, the April 2022 acquisition of Oxiteno SA by Indorama Ventures Public Company Limited (IVL) significantly reshaped the market landscape, particularly within the surfactant segment, demonstrating a value of xx Million. Other transactions, although potentially smaller in value, have also reshaped the competitive dynamics within certain regional markets or specific product segments. The total value of M&A activity within the period of 2019-2024 is estimated at xx Million.

White Oil Market Industry Trends & Insights

The global White Oil Market is experiencing steady growth, projected to reach xx Million by 2033, with a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by increasing demand from key end-use sectors, technological advancements leading to improved product quality, and the rise of emerging economies.

Market penetration is high in mature economies, but significant growth potential exists in developing countries. Technological disruptions are primarily focused on enhancing production efficiency, optimizing product quality, and developing eco-friendly alternatives. Consumer preferences increasingly lean towards products with high purity, sustainability, and safety certifications. The competitive dynamics are characterized by intense competition among major players, with a focus on product differentiation, cost optimization, and expansion into new markets. The shift towards sustainable production methods is creating new opportunities and posing challenges for existing players. The market is also witnessing a gradual shift towards specialized and customized white oil products, responding to the unique needs of individual industries.

Dominant Markets & Segments in White Oil Market

The Asia-Pacific region currently dominates the global White Oil Market, driven by robust economic growth, increasing industrialization, and rising consumer demand in countries like China and India.

- Key Drivers in Asia-Pacific:

- Rapid industrialization and urbanization.

- Growing demand from pharmaceutical, cosmetic, and food industries.

- Favorable government policies and investments in infrastructure.

- Expanding middle class with rising disposable incomes.

The dominance of Asia-Pacific stems from its large and rapidly growing population, coupled with significant industrial activity. The region's expanding middle class fuels demand for consumer goods, further boosting the market for white oil in related applications. Furthermore, favorable government policies and infrastructure development contribute to the region's economic dynamism, creating a supportive environment for the industry's growth. While other regions show potential for growth, Asia-Pacific's current scale and predicted trajectory maintain its position at the forefront of the White Oil market for the foreseeable future.

White Oil Market Product Developments

Recent product innovations focus on enhanced purity, improved viscosity profiles, and the development of specialized grades tailored to specific applications. Advances in refining technologies allow for greater precision in product specifications, catering to the stringent requirements of diverse industries. The development of bio-based white oils provides a sustainable alternative, further enhancing the product portfolio and appealing to environmentally conscious consumers. These innovations contribute to a competitive advantage by enhancing product performance, expanding market reach, and addressing growing sustainability concerns.

Report Scope & Segmentation Analysis

This report segments the White Oil Market based on several key parameters, including:

By Type: This segment categorizes white oil based on its purity level and viscosity. Each category shows varying market sizes and growth projections.

By Application: This segmentation considers various end-use applications, such as pharmaceuticals, cosmetics, food processing, and industrial lubricants. Each application exhibits distinct market dynamics and growth potential.

By Region: The report analyzes the market across major geographical regions, including North America, Europe, Asia-Pacific, and the rest of the world. Each region demonstrates unique market characteristics and competitive landscapes.

Key Drivers of White Oil Market Growth

The White Oil Market is propelled by several key factors:

- Growing demand from end-use industries: Pharmaceutical, cosmetic, and food processing industries rely heavily on white oil, driving market growth.

- Technological advancements: Innovations in refining technologies lead to higher-quality, specialized products.

- Expanding economies: Developing nations' economic growth drives industrial expansion and increased consumer spending.

Challenges in the White Oil Market Sector

The White Oil Market faces challenges including:

- Fluctuating crude oil prices: Raw material costs significantly influence production costs and profitability.

- Stringent environmental regulations: Meeting environmental standards adds to production costs and requires investment in cleaner technologies.

- Competition from substitutes: Bio-based and synthetic alternatives pose a challenge to traditional white oil producers.

Emerging Opportunities in White Oil Market

Emerging opportunities include:

- Growing demand for sustainable and bio-based products: The shift towards eco-friendly solutions opens avenues for sustainable white oil alternatives.

- Expansion into niche applications: Exploration of novel applications in emerging industries presents significant growth prospects.

- Technological advancements in refining and production: Increased efficiency and precision in production processes offer opportunities for cost optimization and product improvement.

Leading Players in the White Oil Market Market

- Bharat Petroleum Corporation Limited

- Calumet Specialty Products Partners

- China Petrochemical Corporation (Sinopec)

- Columbia Petro Chem Pvt Ltd

- Exxon Mobil Corporation

- H&R Group

- HF Sinclair Corporation

- Indorama Ventures Public Company Limited (Oxiteno)

- NYNAS AB

- RENKERT OIL

- Savita Oil Technologies Limited

- Seasol

- Shell

- List Not Exhaustive

Key Developments in White Oil Market Industry

- April 2022: Indorama Ventures Public Company Limited (IVL) acquired Oxiteno SA, expanding its presence in Latin America and the United States and establishing it as a leading surfactant producer. This significantly impacted market consolidation and competitive dynamics within the surfactant segment of the white oil industry.

Strategic Outlook for White Oil Market Market

The future of the White Oil Market is bright, driven by consistent growth in key end-use sectors, technological innovations, and expansion into new geographical markets. The focus on sustainability and the development of bio-based alternatives will play a crucial role in shaping the market landscape in the coming years. Companies that successfully adapt to changing consumer preferences, embrace technological advancements, and navigate regulatory hurdles will be well-positioned to capitalize on the market's growth potential.

White Oil Market Segmentation

-

1. Application

- 1.1. Plastics and Elastomers

- 1.2. Adhesives

- 1.3. Personal Care

- 1.4. Agriculture

- 1.5. Textile

- 1.6. Food and Beverage

- 1.7. Pharmaceutical

- 1.8. Metalworking Applications

- 1.9. Other Applications (Household Products)

-

2. Grade

- 2.1. Technical/Industrial Grade

- 2.2. Pharmaceutical Grade

-

3. Base Oil

- 3.1. Group I

- 3.2. Group II

- 3.3. Group III

- 3.4. Naphthenic

-

4. Viscosity

- 4.1. Low

- 4.2. Medium

- 4.3. High

White Oil Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East and Africa

White Oil Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 1.25% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Cosmetics and Personal Care Industry; Growing Pharmaceutical Industry

- 3.3. Market Restrains

- 3.3.1. Growing Demand from Cosmetics and Personal Care Industry; Growing Pharmaceutical Industry

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Personal Care Products Across the World

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global White Oil Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Plastics and Elastomers

- 5.1.2. Adhesives

- 5.1.3. Personal Care

- 5.1.4. Agriculture

- 5.1.5. Textile

- 5.1.6. Food and Beverage

- 5.1.7. Pharmaceutical

- 5.1.8. Metalworking Applications

- 5.1.9. Other Applications (Household Products)

- 5.2. Market Analysis, Insights and Forecast - by Grade

- 5.2.1. Technical/Industrial Grade

- 5.2.2. Pharmaceutical Grade

- 5.3. Market Analysis, Insights and Forecast - by Base Oil

- 5.3.1. Group I

- 5.3.2. Group II

- 5.3.3. Group III

- 5.3.4. Naphthenic

- 5.4. Market Analysis, Insights and Forecast - by Viscosity

- 5.4.1. Low

- 5.4.2. Medium

- 5.4.3. High

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.5.2. North America

- 5.5.3. Europe

- 5.5.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Asia Pacific White Oil Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Plastics and Elastomers

- 6.1.2. Adhesives

- 6.1.3. Personal Care

- 6.1.4. Agriculture

- 6.1.5. Textile

- 6.1.6. Food and Beverage

- 6.1.7. Pharmaceutical

- 6.1.8. Metalworking Applications

- 6.1.9. Other Applications (Household Products)

- 6.2. Market Analysis, Insights and Forecast - by Grade

- 6.2.1. Technical/Industrial Grade

- 6.2.2. Pharmaceutical Grade

- 6.3. Market Analysis, Insights and Forecast - by Base Oil

- 6.3.1. Group I

- 6.3.2. Group II

- 6.3.3. Group III

- 6.3.4. Naphthenic

- 6.4. Market Analysis, Insights and Forecast - by Viscosity

- 6.4.1. Low

- 6.4.2. Medium

- 6.4.3. High

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. North America White Oil Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Plastics and Elastomers

- 7.1.2. Adhesives

- 7.1.3. Personal Care

- 7.1.4. Agriculture

- 7.1.5. Textile

- 7.1.6. Food and Beverage

- 7.1.7. Pharmaceutical

- 7.1.8. Metalworking Applications

- 7.1.9. Other Applications (Household Products)

- 7.2. Market Analysis, Insights and Forecast - by Grade

- 7.2.1. Technical/Industrial Grade

- 7.2.2. Pharmaceutical Grade

- 7.3. Market Analysis, Insights and Forecast - by Base Oil

- 7.3.1. Group I

- 7.3.2. Group II

- 7.3.3. Group III

- 7.3.4. Naphthenic

- 7.4. Market Analysis, Insights and Forecast - by Viscosity

- 7.4.1. Low

- 7.4.2. Medium

- 7.4.3. High

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe White Oil Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Plastics and Elastomers

- 8.1.2. Adhesives

- 8.1.3. Personal Care

- 8.1.4. Agriculture

- 8.1.5. Textile

- 8.1.6. Food and Beverage

- 8.1.7. Pharmaceutical

- 8.1.8. Metalworking Applications

- 8.1.9. Other Applications (Household Products)

- 8.2. Market Analysis, Insights and Forecast - by Grade

- 8.2.1. Technical/Industrial Grade

- 8.2.2. Pharmaceutical Grade

- 8.3. Market Analysis, Insights and Forecast - by Base Oil

- 8.3.1. Group I

- 8.3.2. Group II

- 8.3.3. Group III

- 8.3.4. Naphthenic

- 8.4. Market Analysis, Insights and Forecast - by Viscosity

- 8.4.1. Low

- 8.4.2. Medium

- 8.4.3. High

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World White Oil Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Plastics and Elastomers

- 9.1.2. Adhesives

- 9.1.3. Personal Care

- 9.1.4. Agriculture

- 9.1.5. Textile

- 9.1.6. Food and Beverage

- 9.1.7. Pharmaceutical

- 9.1.8. Metalworking Applications

- 9.1.9. Other Applications (Household Products)

- 9.2. Market Analysis, Insights and Forecast - by Grade

- 9.2.1. Technical/Industrial Grade

- 9.2.2. Pharmaceutical Grade

- 9.3. Market Analysis, Insights and Forecast - by Base Oil

- 9.3.1. Group I

- 9.3.2. Group II

- 9.3.3. Group III

- 9.3.4. Naphthenic

- 9.4. Market Analysis, Insights and Forecast - by Viscosity

- 9.4.1. Low

- 9.4.2. Medium

- 9.4.3. High

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bharat Petroleum Corporation Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Calumet Specialty Products Partners

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 China Petrochemical Corporation (Sinopec)

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Columbia Petro Chem Pvt Ltd

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Exxon Mobil Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 H&R Group

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 HF Sinclair Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Indorama Ventures Public Company Limited (Oxiteno)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 NYNAS AB

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 RENKERT OIL

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Savita Oil Technologies Limited

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Seasol

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Shell*List Not Exhaustive

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.1 Bharat Petroleum Corporation Limited

List of Figures

- Figure 1: Global White Oil Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Asia Pacific White Oil Market Revenue (Million), by Application 2024 & 2032

- Figure 3: Asia Pacific White Oil Market Revenue Share (%), by Application 2024 & 2032

- Figure 4: Asia Pacific White Oil Market Revenue (Million), by Grade 2024 & 2032

- Figure 5: Asia Pacific White Oil Market Revenue Share (%), by Grade 2024 & 2032

- Figure 6: Asia Pacific White Oil Market Revenue (Million), by Base Oil 2024 & 2032

- Figure 7: Asia Pacific White Oil Market Revenue Share (%), by Base Oil 2024 & 2032

- Figure 8: Asia Pacific White Oil Market Revenue (Million), by Viscosity 2024 & 2032

- Figure 9: Asia Pacific White Oil Market Revenue Share (%), by Viscosity 2024 & 2032

- Figure 10: Asia Pacific White Oil Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Asia Pacific White Oil Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America White Oil Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America White Oil Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America White Oil Market Revenue (Million), by Grade 2024 & 2032

- Figure 15: North America White Oil Market Revenue Share (%), by Grade 2024 & 2032

- Figure 16: North America White Oil Market Revenue (Million), by Base Oil 2024 & 2032

- Figure 17: North America White Oil Market Revenue Share (%), by Base Oil 2024 & 2032

- Figure 18: North America White Oil Market Revenue (Million), by Viscosity 2024 & 2032

- Figure 19: North America White Oil Market Revenue Share (%), by Viscosity 2024 & 2032

- Figure 20: North America White Oil Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America White Oil Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe White Oil Market Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe White Oil Market Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe White Oil Market Revenue (Million), by Grade 2024 & 2032

- Figure 25: Europe White Oil Market Revenue Share (%), by Grade 2024 & 2032

- Figure 26: Europe White Oil Market Revenue (Million), by Base Oil 2024 & 2032

- Figure 27: Europe White Oil Market Revenue Share (%), by Base Oil 2024 & 2032

- Figure 28: Europe White Oil Market Revenue (Million), by Viscosity 2024 & 2032

- Figure 29: Europe White Oil Market Revenue Share (%), by Viscosity 2024 & 2032

- Figure 30: Europe White Oil Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe White Oil Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Rest of the World White Oil Market Revenue (Million), by Application 2024 & 2032

- Figure 33: Rest of the World White Oil Market Revenue Share (%), by Application 2024 & 2032

- Figure 34: Rest of the World White Oil Market Revenue (Million), by Grade 2024 & 2032

- Figure 35: Rest of the World White Oil Market Revenue Share (%), by Grade 2024 & 2032

- Figure 36: Rest of the World White Oil Market Revenue (Million), by Base Oil 2024 & 2032

- Figure 37: Rest of the World White Oil Market Revenue Share (%), by Base Oil 2024 & 2032

- Figure 38: Rest of the World White Oil Market Revenue (Million), by Viscosity 2024 & 2032

- Figure 39: Rest of the World White Oil Market Revenue Share (%), by Viscosity 2024 & 2032

- Figure 40: Rest of the World White Oil Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World White Oil Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global White Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global White Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global White Oil Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 4: Global White Oil Market Revenue Million Forecast, by Base Oil 2019 & 2032

- Table 5: Global White Oil Market Revenue Million Forecast, by Viscosity 2019 & 2032

- Table 6: Global White Oil Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global White Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: Global White Oil Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 9: Global White Oil Market Revenue Million Forecast, by Base Oil 2019 & 2032

- Table 10: Global White Oil Market Revenue Million Forecast, by Viscosity 2019 & 2032

- Table 11: Global White Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: China White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: India White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Asia Pacific White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global White Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global White Oil Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 18: Global White Oil Market Revenue Million Forecast, by Base Oil 2019 & 2032

- Table 19: Global White Oil Market Revenue Million Forecast, by Viscosity 2019 & 2032

- Table 20: Global White Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: United States White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Canada White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of North America White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global White Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global White Oil Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 26: Global White Oil Market Revenue Million Forecast, by Base Oil 2019 & 2032

- Table 27: Global White Oil Market Revenue Million Forecast, by Viscosity 2019 & 2032

- Table 28: Global White Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: Germany White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Kingdom White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Italy White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Rest of Europe White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Global White Oil Market Revenue Million Forecast, by Application 2019 & 2032

- Table 34: Global White Oil Market Revenue Million Forecast, by Grade 2019 & 2032

- Table 35: Global White Oil Market Revenue Million Forecast, by Base Oil 2019 & 2032

- Table 36: Global White Oil Market Revenue Million Forecast, by Viscosity 2019 & 2032

- Table 37: Global White Oil Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: South America White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Middle East and Africa White Oil Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the White Oil Market?

The projected CAGR is approximately 1.25%.

2. Which companies are prominent players in the White Oil Market?

Key companies in the market include Bharat Petroleum Corporation Limited, Calumet Specialty Products Partners, China Petrochemical Corporation (Sinopec), Columbia Petro Chem Pvt Ltd, Exxon Mobil Corporation, H&R Group, HF Sinclair Corporation, Indorama Ventures Public Company Limited (Oxiteno), NYNAS AB, RENKERT OIL, Savita Oil Technologies Limited, Seasol, Shell*List Not Exhaustive.

3. What are the main segments of the White Oil Market?

The market segments include Application, Grade, Base Oil, Viscosity.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Cosmetics and Personal Care Industry; Growing Pharmaceutical Industry.

6. What are the notable trends driving market growth?

Increasing Demand from Personal Care Products Across the World.

7. Are there any restraints impacting market growth?

Growing Demand from Cosmetics and Personal Care Industry; Growing Pharmaceutical Industry.

8. Can you provide examples of recent developments in the market?

April 2022: Indorama Ventures Public Company Limited (IVL) announced the completion of the acquisition of Oxiteno SA. Through the acquisition, IVL broadens its development profile into lucrative markets in Latin America and the United States. It established itself as the continent's top producer of surfactants with additional opportunities to improve in Europe and Asia.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "White Oil Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the White Oil Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the White Oil Market?

To stay informed about further developments, trends, and reports in the White Oil Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence