Key Insights

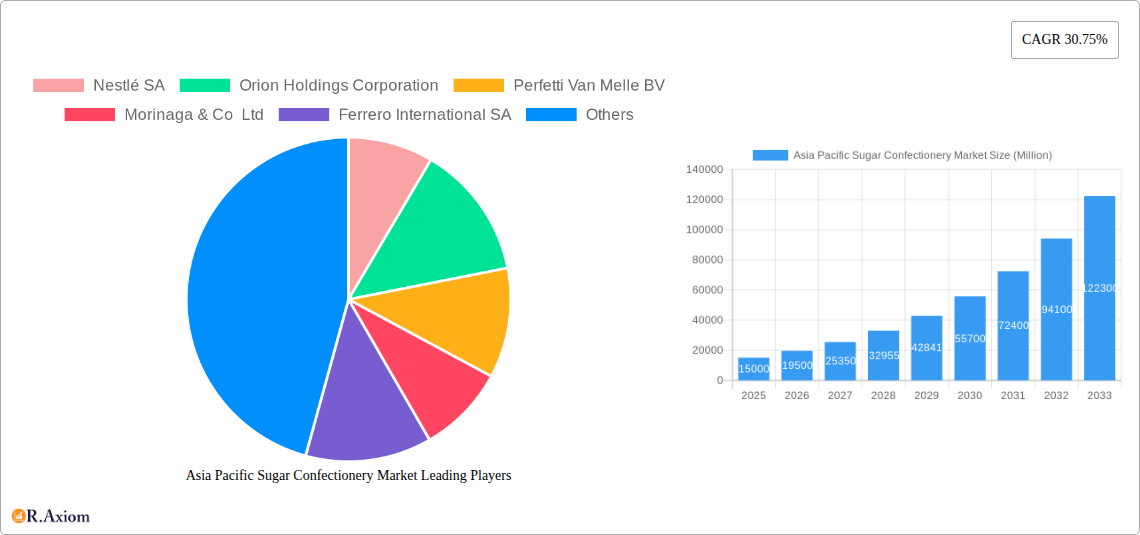

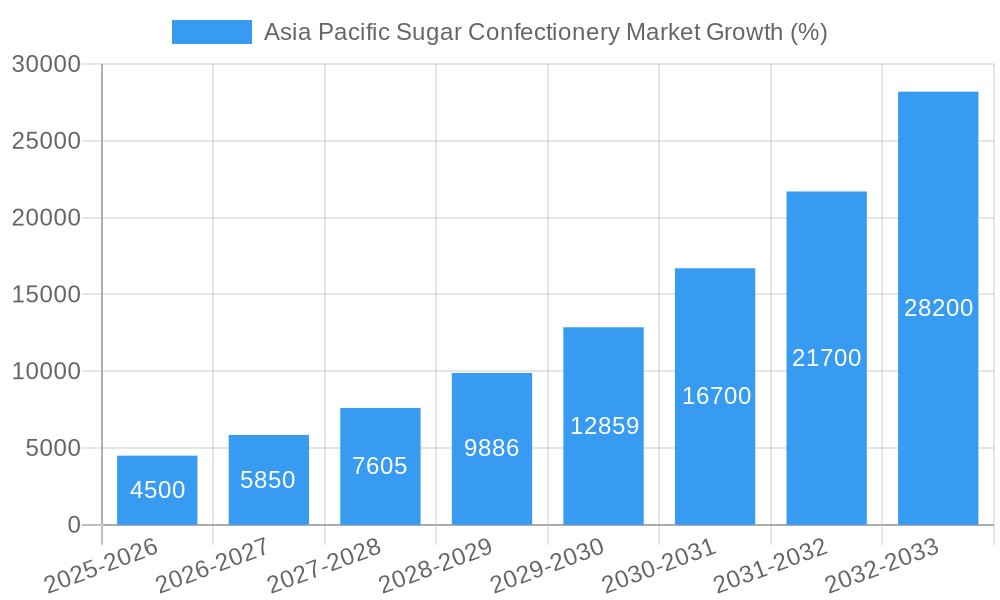

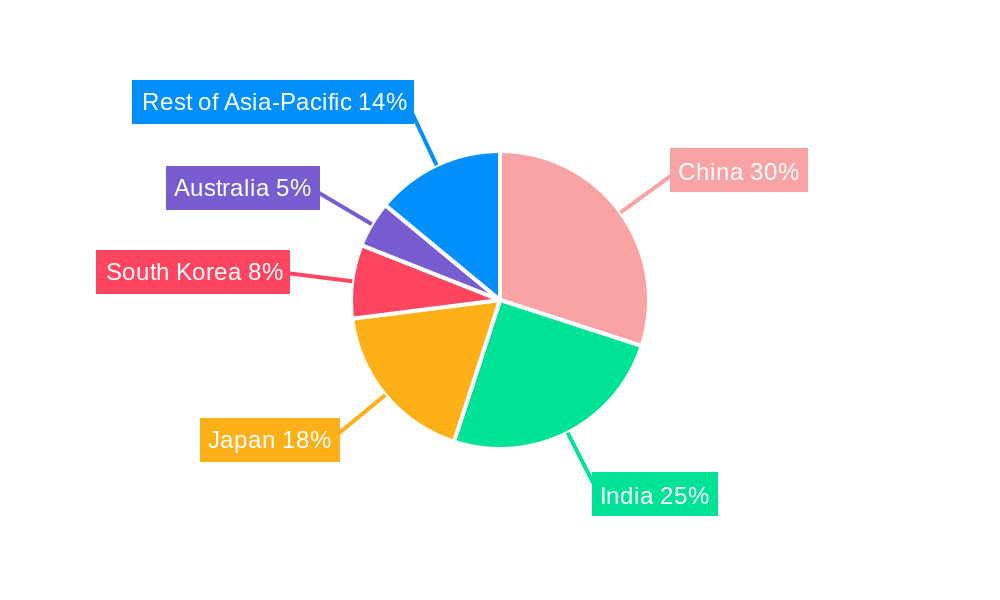

The Asia-Pacific sugar confectionery market is experiencing robust growth, driven by rising disposable incomes, increasing urbanization, and a growing preference for convenient and indulgent snacks. A CAGR of 30.75% from 2019 to 2024 indicates a significant expansion, projected to continue through 2033. Key segments contributing to this growth include gummies and jellies, which are gaining popularity due to their appealing texture and variety of flavors. The convenience store distribution channel is a major driver, offering easy access to a wide range of sugar confectionery products. However, growing health concerns surrounding sugar consumption and increasing awareness of the link between sugar and various health issues pose significant restraints. This is partially offset by the rise of healthier options within the confectionery segment, such as sugar-reduced or naturally sweetened products, a trend that manufacturers are actively addressing to maintain market share. Major players like Nestlé, Mars, and Mondelez are strategically investing in product innovation, marketing, and expanding their distribution networks to capitalize on this expanding market. Regional variations within the Asia-Pacific region exist, with China, India, and Japan anticipated to lead the growth trajectory due to their large populations and evolving consumer preferences. The market is characterized by a diverse range of product offerings, from hard candies and lollipops to more complex confectionery items like toffees and nougats. Future growth will likely depend on the successful navigation of health concerns through innovative product development and targeted marketing strategies.

The competitive landscape is highly fragmented, with both multinational corporations and local players vying for market share. Successful companies are those that effectively cater to evolving consumer demands, focusing on product differentiation, unique flavors, and convenient packaging. Furthermore, the increasing adoption of e-commerce is transforming the distribution landscape, opening new avenues for growth and creating opportunities for both established and emerging players. The ongoing expansion of organized retail across the Asia-Pacific region is also contributing to the overall market expansion. While the high CAGR indicates a promising outlook, sustained growth will hinge upon the ability of manufacturers to address consumer health concerns and adapt to changing market dynamics effectively, embracing innovative strategies in product development, marketing, and distribution.

Asia Pacific Sugar Confectionery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the Asia Pacific sugar confectionery market, covering the period 2019-2033. It offers invaluable insights into market dynamics, key players, emerging trends, and future growth prospects. The report segments the market by confectionery variant, distribution channel, and country, providing granular data for informed decision-making. With a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for businesses operating within or seeking to enter this dynamic market. The report uses Million as the unit for all values.

Asia Pacific Sugar Confectionery Market Market Concentration & Innovation

The Asia Pacific sugar confectionery market is characterized by a moderately concentrated landscape, with several multinational giants and regional players vying for market share. Key players such as Nestlé SA, Mars Incorporated, and Mondelēz International Inc. hold significant portions of the market, though their precise market shares fluctuate based on product performance and strategic initiatives. The market exhibits a high degree of innovation, driven by evolving consumer preferences and technological advancements. The introduction of new flavors, healthier ingredients, and innovative packaging designs are key drivers of market growth. Regulatory frameworks concerning sugar content and labeling are increasingly influencing product formulation and marketing strategies. Product substitutes, such as sugar-free or low-sugar alternatives, present a growing challenge, but also offer an avenue for innovation. The market shows a trend towards premiumization, with consumers increasingly willing to pay for higher-quality, specialized products. Mergers and acquisitions (M&A) activity remains robust, with deal values reaching xx Million in the past year, primarily driven by a desire to expand product portfolios, geographic reach, and brand dominance.

- Market Leaders: Nestlé SA, Mars Incorporated, Mondelēz International Inc.

- Innovation Drivers: New flavors, healthier ingredients, innovative packaging.

- Regulatory Influences: Sugar content regulations, labeling requirements.

- M&A Activity: Deal values approximately xx Million in the past year.

Asia Pacific Sugar Confectionery Market Industry Trends & Insights

The Asia Pacific sugar confectionery market is experiencing robust growth, projected to achieve a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several factors, including rising disposable incomes, a growing young population with a penchant for sweet treats, and the increasing adoption of modern retail channels. Technological advancements in production processes and distribution networks have also contributed significantly. However, changing consumer preferences, with a growing focus on health and wellness, pose a challenge. The market is seeing increased demand for sugar-free and low-sugar confectionery, driving innovation in alternative sweeteners and product formulations. Competitive dynamics are intense, with companies engaging in aggressive marketing, product diversification, and strategic partnerships to gain a competitive edge. Market penetration of online retail channels is steadily increasing, though traditional retail outlets like convenience stores and supermarkets/hypermarkets remain dominant.

Dominant Markets & Segments in Asia Pacific Sugar Confectionery Market

The Asia Pacific sugar confectionery market exhibits significant variations across countries and product segments. China and India represent the largest national markets, driven by vast populations and rising consumer spending. However, Japan and South Korea demonstrate higher per capita consumption rates.

- Leading Country: China & India (Market Size: xx Million)

- Leading Segment (Confectionery Variant): Gummies and Jellies (Market Size: xx Million), driven by their appealing texture and versatility.

- Leading Segment (Distribution Channel): Supermarket/Hypermarket (Market Size: xx Million), due to wide availability and established distribution networks.

Key Drivers:

- China & India: Rapid economic growth, expanding middle class, rising disposable incomes.

- Japan & South Korea: High per capita consumption, established confectionery culture.

- Gummies & Jellies: Appealing texture, wide range of flavors and formats.

- Supermarket/Hypermarket: Established infrastructure, wide product availability.

Asia Pacific Sugar Confectionery Market Product Developments

Recent product developments reflect a focus on healthier options, innovative flavors, and convenient packaging. Sugar-free and low-sugar alternatives are gaining traction, while companies are also exploring new flavor profiles and formats to cater to evolving consumer preferences. Technological advancements, such as improved production processes and sustainable packaging, are enhancing efficiency and reducing environmental impact. Companies are also leveraging digital marketing to reach younger demographics and enhance brand loyalty.

Report Scope & Segmentation Analysis

This report provides a comprehensive analysis of the Asia Pacific sugar confectionery market, segmented by:

Confectionery Variant: Hard Candy, Lollipops, Mints, Pastilles, Gummies and Jellies, Toffees and Nougats, Others. Each segment exhibits unique growth trajectories influenced by consumer preferences and competitive dynamics. Gummies and jellies, for instance, show high growth potential due to their appeal to various age groups.

Distribution Channel: Convenience Store, Online Retail Store, Supermarket/Hypermarket, Others. The online retail segment is showing strong growth, but traditional channels remain dominant. Supermarkets and hypermarkets benefit from high-volume sales and established distribution networks.

Country: Australia, China, India, Indonesia, Japan, Malaysia, New Zealand, South Korea, Rest of Asia-Pacific. Each country displays unique market characteristics based on economic development, consumer habits, and regulatory frameworks. China and India, being the largest markets, are crucial for overall market growth.

Each segment is analyzed in terms of market size, growth projections, and competitive dynamics.

Key Drivers of Asia Pacific Sugar Confectionery Market Growth

Several factors contribute to the growth of the Asia Pacific sugar confectionery market: increasing disposable incomes and a growing middle class, especially in emerging economies, are fueling demand. The young demographic, with a higher propensity for confectionery consumption, further drives growth. Innovation in product offerings, with new flavors, healthier options, and convenient formats, expands market appeal. Finally, the expansion of retail channels and efficient distribution networks enhances accessibility and market reach.

Challenges in the Asia Pacific Sugar Confectionery Market Sector

The market faces significant challenges, including increasing health consciousness leading to reduced sugar consumption. Government regulations aimed at curbing sugar intake and promoting healthier diets could impact sales. Supply chain disruptions, particularly in times of economic uncertainty, can lead to production delays and cost increases. Intense competition among established and emerging players leads to price wars and impacts profit margins. The fluctuating price of raw materials, including sugar, poses a threat to production costs and profitability.

Emerging Opportunities in Asia Pacific Sugar Confectionery Market

Emerging opportunities exist in the production and marketing of sugar-free and low-sugar confectionery items. The expanding online retail channel offers new avenues for market penetration and reaching a wider consumer base. Innovation in packaging, using sustainable and eco-friendly materials, aligns with growing consumer demands for environmentally conscious products. Furthermore, tapping into specific niche markets, such as organic or artisanal confectionery, can create new revenue streams.

Leading Players in the Asia Pacific Sugar Confectionery Market Market

- Nestlé SA

- Orion Holdings Corporation

- Perfetti Van Melle BV

- Morinaga & Co Ltd

- Ferrero International SA

- The Bazooka Companies Inc

- Mars Incorporated

- Lotte Corporation

- The Hershey Company

- Mondelēz International Inc

- Meiji Holdings Company Ltd

Key Developments in Asia Pacific Sugar Confectionery Market Industry

- June 2023: Tic Tac launched a new spearmint flavor variant in India, targeting diverse consumption occasions.

- April 2023: Tic Tac (Ferrero India) launched a digital influencer campaign, "TicTacLife," in collaboration with Yashraj Mukhate.

- March 2023: Hershey's introduced Hershey's Kisses’ Milklicious candies with a creamy milk chocolate filling.

Strategic Outlook for Asia Pacific Sugar Confectionery Market Market

The Asia Pacific sugar confectionery market presents significant growth potential in the coming years. Companies that adapt to evolving consumer preferences, particularly the demand for healthier options, will be best positioned for success. Strategic investments in research and development, coupled with innovative marketing strategies, will be crucial for maintaining a competitive edge. Expansion into online retail channels and leveraging digital marketing will further enhance market penetration and brand awareness. The market will continue to see a trend towards premiumization and specialization, catering to specific consumer needs and preferences.

Asia Pacific Sugar Confectionery Market Segmentation

-

1. Confectionery Variant

- 1.1. Hard Candy

- 1.2. Lollipops

- 1.3. Mints

- 1.4. Pastilles, Gummies, and Jellies

- 1.5. Toffees and Nougats

- 1.6. Others

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Asia Pacific Sugar Confectionery Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Sugar Confectionery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 30.75% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with the Freeze-Drying Technology

- 3.4. Market Trends

- 3.4.1 China and India collectively accounted for more than 50% of the market share due to the large population of children

- 3.4.2 which is the major consumer group of sugar confectionery

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Hard Candy

- 5.1.2. Lollipops

- 5.1.3. Mints

- 5.1.4. Pastilles, Gummies, and Jellies

- 5.1.5. Toffees and Nougats

- 5.1.6. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. China Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia Pacific Sugar Confectionery Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Nestlé SA

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Orion Holdings Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Perfetti Van Melle BV

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Morinaga & Co Ltd

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Ferrero International SA

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 The Bazooka Companies Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Mars Incorporated

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Lotte Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 The Hershey Compan

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mondelēz International Inc

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Meiji Holdings Company Ltd

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.1 Nestlé SA

List of Figures

- Figure 1: Asia Pacific Sugar Confectionery Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia Pacific Sugar Confectionery Market Share (%) by Company 2024

List of Tables

- Table 1: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 3: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Confectionery Variant 2019 & 2032

- Table 14: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 15: Asia Pacific Sugar Confectionery Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: India Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: New Zealand Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Indonesia Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Malaysia Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Singapore Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Thailand Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Vietnam Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Philippines Asia Pacific Sugar Confectionery Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Sugar Confectionery Market?

The projected CAGR is approximately 30.75%.

2. Which companies are prominent players in the Asia Pacific Sugar Confectionery Market?

Key companies in the market include Nestlé SA, Orion Holdings Corporation, Perfetti Van Melle BV, Morinaga & Co Ltd, Ferrero International SA, The Bazooka Companies Inc, Mars Incorporated, Lotte Corporation, The Hershey Compan, Mondelēz International Inc, Meiji Holdings Company Ltd.

3. What are the main segments of the Asia Pacific Sugar Confectionery Market?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Popularization of Adventure Sports and Expedition; Suitability of the Freeze-Dried Technique for Heat Sensitive Food Products.

6. What are the notable trends driving market growth?

China and India collectively accounted for more than 50% of the market share due to the large population of children. which is the major consumer group of sugar confectionery.

7. Are there any restraints impacting market growth?

High Cost Associated with the Freeze-Drying Technology.

8. Can you provide examples of recent developments in the market?

June 2023: Tic Tac launched a new spearmint flavor variant in India. The introduction of this refreshing and strong mint variant is aimed at meeting the longstanding demand for a flavor that can be enjoyed in diverse moments throughout the day, such as after meals, workouts, and before important meetings.April 2023: Tic Tac, the confectionery brand of Ferrero India, announced the launch of its latest Digital Influencer campaign, TicTacLife, in a musical collaboration with the internet sensation Yashraj Mukhate.March 2023: Hershey's introduced new Hershey's Kisses’ Milklicious candies, featuring a creamy chocolate milk filling packed into the delicious center of a rich, milk chocolate Hershey's Kisses candy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Sugar Confectionery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Sugar Confectionery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Sugar Confectionery Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Sugar Confectionery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence