Key Insights

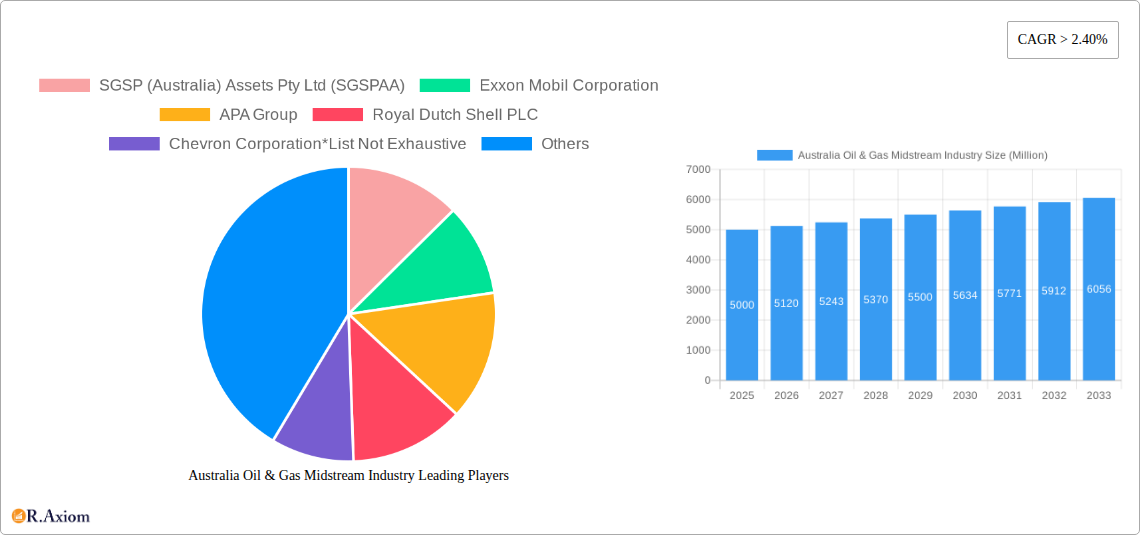

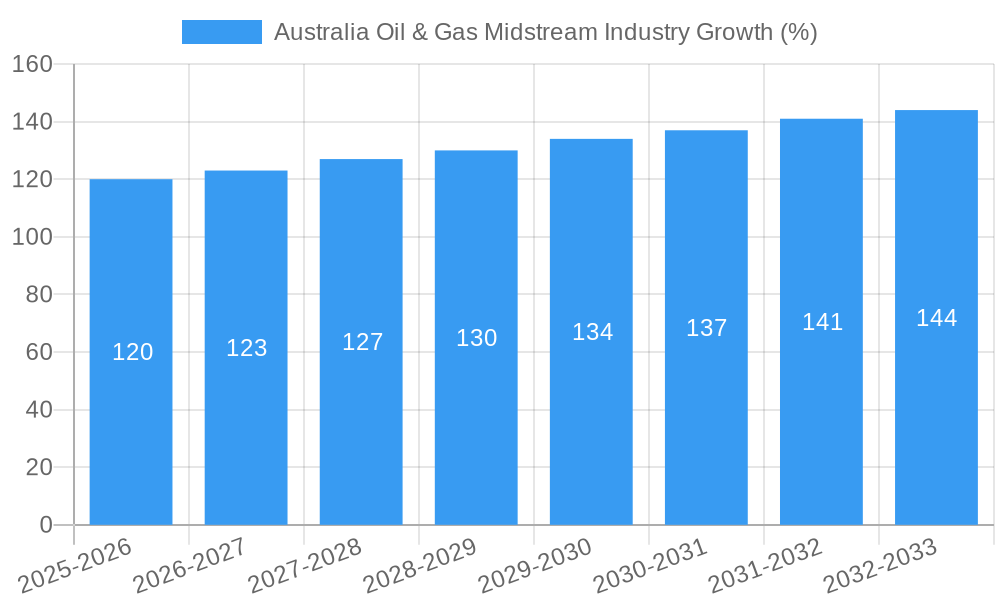

The Australian oil and gas midstream sector, encompassing transportation, storage, and LNG terminals, is experiencing robust growth, projected to maintain a CAGR exceeding 2.40% from 2025 to 2033. The market size in 2025 is estimated to be substantial, driven by several key factors. Increased domestic demand for energy, coupled with Australia's significant role as a global LNG exporter, fuels substantial investment in infrastructure development. Numerous projects are either underway or planned across the transportation (pipelines), storage (facilities expansion and new builds), and LNG terminal segments. This expansion caters to both the growing domestic market and the burgeoning international demand for Australian LNG. Key players such as SGSP (Australia) Assets Pty Ltd, ExxonMobil, APA Group, Shell, and Chevron are strategically positioned to capitalize on this growth, driving competition and innovation within the sector. However, regulatory hurdles, environmental concerns related to emissions, and potential fluctuations in global energy prices present challenges that could influence the sector's trajectory in the coming years.

The forecast period (2025-2033) anticipates continued expansion, albeit with potential variations based on global economic conditions and policy changes. The existing infrastructure, while significant, requires continuous upgrades and expansions to support the increasing energy demands and project pipelines. The success of the Australian oil and gas midstream sector hinges on the effective management of these factors – balancing growth with sustainability and navigating potential regulatory changes. The ongoing development of new projects and the strategic investments by major players will be crucial in determining the overall market size and growth within the forecast period. The sector's resilience and adaptability will be critical in navigating the evolving energy landscape and capitalizing on future growth opportunities.

Australia Oil & Gas Midstream Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Australian oil & gas midstream industry, covering the period from 2019 to 2033. It delves into market dynamics, key players, emerging trends, and future growth prospects, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. The report utilizes a robust methodology, incorporating extensive primary and secondary research to provide accurate and reliable market data. The base year for this analysis is 2025, with forecasts extending to 2033.

Australia Oil & Gas Midstream Industry Market Concentration & Innovation

This section analyzes the competitive landscape of Australia's oil and gas midstream sector, examining market concentration, innovation drivers, regulatory influences, and M&A activities. The study period covers 2019-2033, with a focus on the 2025 estimated year and forecast period of 2025-2033.

The Australian midstream oil and gas market exhibits a moderately concentrated structure, with a few major players holding significant market share. Companies like Exxon Mobil Corporation, APA Group, Royal Dutch Shell PLC, and Chevron Corporation dominate various segments. SGSP (Australia) Assets Pty Ltd (SGSPAA) also plays a notable role. Precise market share data for 2025 is currently being finalized (xx%) but indicates a trend of consolidation through mergers and acquisitions (M&A).

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for 2025 is estimated at xx, suggesting a moderately concentrated market.

- M&A Activity: The total value of M&A deals in the Australian midstream sector from 2019 to 2024 is estimated at $xx Million. Several significant transactions have reshaped the competitive landscape, leading to increased market concentration.

- Innovation Drivers: Technological advancements in pipeline management, automation, and data analytics are driving innovation. Regulatory pressures related to emissions reduction are also stimulating the adoption of cleaner technologies and practices.

- Regulatory Framework: The Australian government's policies on energy security and emissions reduction significantly impact the industry, influencing investment decisions and operational practices.

- Product Substitutes: The emergence of renewable energy sources presents a potential long-term threat to the dominance of fossil fuels, although the transition is expected to be gradual.

- End-User Trends: Growing energy demand, particularly in the Asia-Pacific region, is driving investment in midstream infrastructure to support the export of Australian oil and gas resources.

Australia Oil & Gas Midstream Industry Industry Trends & Insights

This section explores key trends and insights shaping the Australian oil and gas midstream industry. The analysis considers market growth drivers, technological disruptions, and competitive dynamics to provide a comprehensive understanding of the sector's evolution. The CAGR for the forecast period (2025-2033) is projected at xx%. Market penetration of new technologies is expected to increase steadily, reaching xx% by 2033.

The Australian midstream oil and gas market is experiencing robust growth driven by several factors. Increased domestic and international demand for energy, particularly LNG, is a key driver. Government support for infrastructure development, coupled with technological advancements enhancing operational efficiency and safety, contribute significantly to growth. The industry faces ongoing challenges from fluctuating commodity prices and the global transition to lower-carbon energy sources. However, the strategic importance of natural gas as a transition fuel is expected to sustain demand and investments in the midstream sector for the foreseeable future. Competitive pressures remain significant, with ongoing consolidation and strategic alliances shaping the market landscape.

Dominant Markets & Segments in Australia Oil & Gas Midstream Industry

This section identifies the leading regions, countries, or segments within the Australian oil and gas midstream industry. Key drivers of dominance are analyzed using both bullet points and detailed paragraphs.

Dominant Segment: The transportation segment, specifically LNG terminals and pipelines, is the dominant segment in the Australian midstream market. This is due to Australia's significant LNG export capacity and the extensive pipeline network connecting production sites to processing facilities and ports.

Key Drivers of Dominance:

- Abundant Resources: Australia possesses significant reserves of natural gas, supporting substantial LNG exports and domestic consumption.

- Export-Oriented Economy: The focus on LNG exports necessitates a robust midstream infrastructure, primarily LNG terminals and pipelines.

- Government Support: Australian government policies have facilitated investments in infrastructure projects, particularly in the LNG sector.

- Strategic Location: Australia's geographic proximity to key Asian markets provides a significant competitive advantage in the LNG market.

Dominance Analysis: The dominance of the transportation segment is expected to continue throughout the forecast period, primarily driven by increasing LNG exports. However, the growth of other segments like storage facilities may also contribute to the overall market expansion. Furthermore, specific regions within Australia, particularly Western Australia, are likely to continue holding significant importance due to their concentration of LNG production and export facilities.

Australia Oil & Gas Midstream Industry Product Developments

Recent product innovations focus on enhancing pipeline efficiency and safety through advanced monitoring systems and leak detection technologies. The integration of data analytics is improving operational efficiency and predictive maintenance. This emphasis on technological sophistication is crucial in maintaining competitiveness and ensuring environmental compliance. The industry is also focusing on developing infrastructure to support the growth of renewable gas, contributing to a more sustainable energy landscape.

Report Scope & Segmentation Analysis

This report segments the Australian oil & gas midstream market based on three primary sectors: Transportation, Storage, and LNG Terminals. Each sector is further subdivided into Existing Infrastructure, Projects in Pipeline, and Upcoming Projects. Each segment's growth projections, market sizes (in Million dollars), and competitive dynamics are analyzed.

Transportation: This segment encompasses pipelines, trucking, and rail networks transporting oil and gas. Market size in 2025 is estimated at $xx Million, projected to grow to $xx Million by 2033. Competition is intense among pipeline operators.

Storage: This covers underground storage facilities and above-ground tanks. The 2025 market size is estimated at $xx Million, with projected growth to $xx Million by 2033. Competition is influenced by facility location and capacity.

LNG Terminals: This segment focuses on liquefaction and regasification facilities. The 2025 market size is estimated at $xx Million, with a projected growth to $xx Million by 2033. Competition is dominated by a few major players with significant export capacity.

Key Drivers of Australia Oil & Gas Midstream Industry Growth

Several factors are driving the growth of Australia's oil & gas midstream sector. Increased domestic and international demand for natural gas, particularly LNG, is a major catalyst. Government support for infrastructure development, including substantial investment in pipelines and LNG export terminals, is another significant factor. Technological advancements improving efficiency and safety within the industry further contribute to growth. Finally, Australia’s strategic location, facilitating efficient export to key Asian markets, plays a crucial role in the industry's continued expansion.

Challenges in the Australia Oil & Gas Midstream Industry Sector

The Australian midstream oil and gas industry faces several challenges, including regulatory hurdles related to environmental protection and emissions reduction, which can increase operational costs and impact project timelines. Fluctuations in commodity prices represent a significant risk, impacting profitability and investment decisions. Furthermore, growing competition from renewable energy sources and the global push towards decarbonization pose long-term challenges to the industry's growth. These combined challenges require strategic adaptation and innovation to ensure long-term sustainability and competitiveness.

Emerging Opportunities in Australia Oil & Gas Midstream Industry

The Australian midstream industry presents several emerging opportunities. The growing adoption of renewable gas, including hydrogen and biomethane, opens new avenues for infrastructure development and investment. Advancements in carbon capture and storage technologies offer avenues for reducing emissions and improving environmental performance. Finally, the expanding demand for energy in the Asia-Pacific region creates significant potential for further infrastructure expansion and increased export capacity.

Leading Players in the Australia Oil & Gas Midstream Industry Market

- SGSP (Australia) Assets Pty Ltd (SGSPAA)

- Exxon Mobil Corporation

- APA Group

- Royal Dutch Shell PLC

- Chevron Corporation

- List Not Exhaustive

Key Developments in Australia Oil & Gas Midstream Industry Industry

- 2022 Q4: APA Group announces a significant investment in pipeline expansion to support growing LNG exports.

- 2023 Q1: Chevron Corporation completes a major upgrade to its LNG processing facility, boosting export capacity.

- 2023 Q2: New regulations on methane emissions come into effect, impacting operational practices across the industry.

- Further key developments to be added upon report finalization.

Strategic Outlook for Australia Oil & Gas Midstream Industry Market

The Australian oil & gas midstream sector is poised for continued growth, driven by strong export demand and ongoing investment in infrastructure. While facing challenges related to emissions reduction and competition from renewable energy, the industry is adapting by investing in new technologies and pursuing diversification strategies. The strategic importance of natural gas as a transition fuel, combined with ongoing government support, ensures a positive outlook for the midstream sector in the coming years. The market's future trajectory will be significantly shaped by the pace of the global energy transition and government policies related to emissions reduction and energy security.

Australia Oil & Gas Midstream Industry Segmentation

-

1. Sector

-

1.1. Transportation

-

1.1.1. Overview

- 1.1.1.1. Existing Infrastructure

- 1.1.1.2. Projects in Pipeline

- 1.1.1.3. Upcoming Projects

-

1.1.1. Overview

- 1.2. Storage

- 1.3. LNG Terminals

-

1.1. Transportation

Australia Oil & Gas Midstream Industry Segmentation By Geography

- 1. Australia

Australia Oil & Gas Midstream Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rising Environmental Concerns and Energy Security in the Country4.; Increasing Focus on Renewable Energy

- 3.3. Market Restrains

- 3.3.1. 4.; Availability of Abundance Natural Fossil Fuel Reserves

- 3.4. Market Trends

- 3.4.1. Pipeline Sector to Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Oil & Gas Midstream Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Transportation

- 5.1.1.1. Overview

- 5.1.1.1.1. Existing Infrastructure

- 5.1.1.1.2. Projects in Pipeline

- 5.1.1.1.3. Upcoming Projects

- 5.1.1.1. Overview

- 5.1.2. Storage

- 5.1.3. LNG Terminals

- 5.1.1. Transportation

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 SGSP (Australia) Assets Pty Ltd (SGSPAA)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Exxon Mobil Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 APA Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Royal Dutch Shell PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chevron Corporation*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.1 SGSP (Australia) Assets Pty Ltd (SGSPAA)

List of Figures

- Figure 1: Australia Oil & Gas Midstream Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Australia Oil & Gas Midstream Industry Share (%) by Company 2024

List of Tables

- Table 1: Australia Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Australia Oil & Gas Midstream Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 3: Australia Oil & Gas Midstream Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Australia Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Australia Oil & Gas Midstream Industry Revenue Million Forecast, by Sector 2019 & 2032

- Table 6: Australia Oil & Gas Midstream Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Oil & Gas Midstream Industry?

The projected CAGR is approximately > 2.40%.

2. Which companies are prominent players in the Australia Oil & Gas Midstream Industry?

Key companies in the market include SGSP (Australia) Assets Pty Ltd (SGSPAA), Exxon Mobil Corporation, APA Group, Royal Dutch Shell PLC, Chevron Corporation*List Not Exhaustive.

3. What are the main segments of the Australia Oil & Gas Midstream Industry?

The market segments include Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rising Environmental Concerns and Energy Security in the Country4.; Increasing Focus on Renewable Energy.

6. What are the notable trends driving market growth?

Pipeline Sector to Witness Growth.

7. Are there any restraints impacting market growth?

4.; Availability of Abundance Natural Fossil Fuel Reserves.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Oil & Gas Midstream Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Oil & Gas Midstream Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Oil & Gas Midstream Industry?

To stay informed about further developments, trends, and reports in the Australia Oil & Gas Midstream Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence